ID: PMRREP18409| 200 Pages | 24 Dec 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

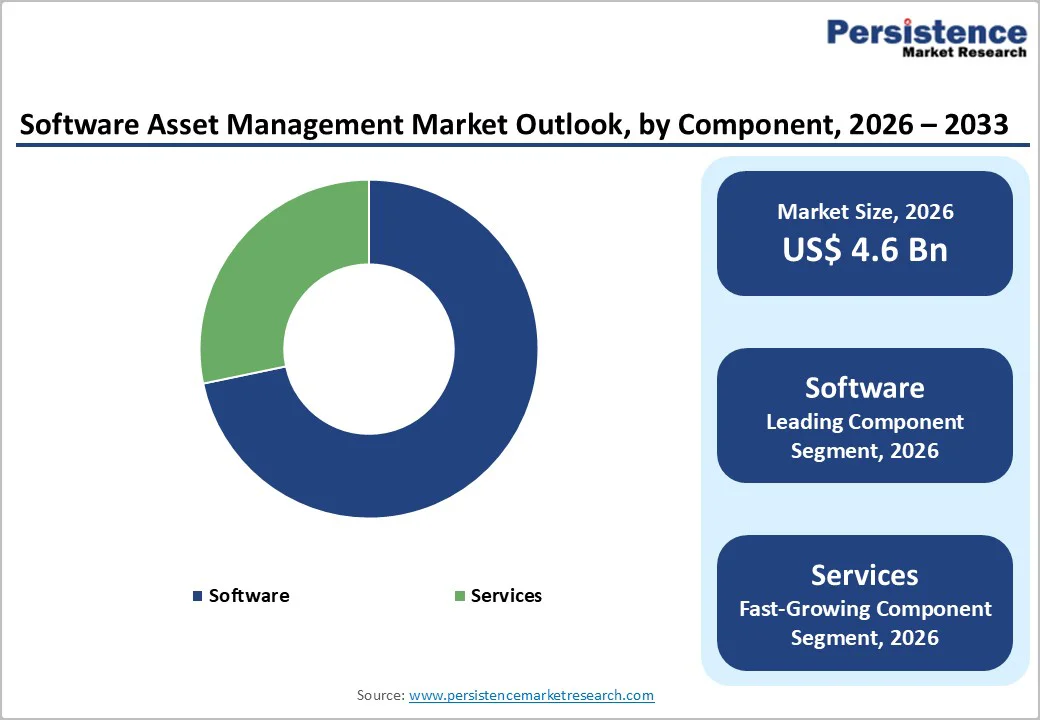

The global software asset management market size is valued at US$ 4.6 billion in 2026 and is projected to reach US$ 10.4 billion by 2033, growing at a CAGR of 12.4% between 2026 and 2033.

Rapid enterprise digitization, the shift to cloud and SaaS-based delivery, and intensifying software audit and compliance pressures are some prominent factors propelling the software asset management market growth.

| Key Insights | Details |

|---|---|

| Global Software Asset Management Market Size (2026E) | US$ 4.6 Bn |

| Market Value Forecast (2033F) | US$ 10.4 Bn |

| Projected Growth CAGR (2026 - 2033) | 12.4% |

| Historical Market Growth (2020 - 2025) | 9.8% |

The global software asset management (SAM) market is increasingly driven by the rapid rise in software complexity, widespread cloud adoption, and an intensified corporate focus on reducing software waste and optimizing IT spend. As enterprises embrace hybrid and multi-cloud ecosystems, software environments have become more fragmented, consisting of subscription-based SaaS platforms, cloud-native applications, legacy on-premise systems, and emerging microservices architectures. This diversity not only complicates license visibility but also elevates the risk of over-provisioning and redundant purchases. Organizations are under pressure to control the growing software costs as cloud expenditure becomes one of the largest components of IT budgets.

CFOs and CIOs face mounting expectations to eliminate shelfware, remove unused subscriptions, and maximize the value of existing digital investments. SAM tools enable automated discovery, usage tracking, metering, and rightsizing across complex environments, helping businesses align software consumption with actual needs. Furthermore, the shift toward FinOps and cost-governance frameworks underscores the importance of real-time insights into utilization patterns and contract terms. Collectively, these factors are pushing enterprises to adopt sophisticated SAM platforms capable of managing lifecycle efficiency, ensuring financial discipline, and supporting cloud-first transformation strategies.

The rising frequency and intensity of software vendor audits, which expose organizations to significant financial, legal, and operational risks is another key driver of the global SAM market. Major vendors, such as Microsoft, Oracle, IBM, SAP, and Adobe, are increasingly leveraging audits as a strategic revenue-recovery mechanism, particularly as the shift to subscription models reduces traditional licensing income. These audits often uncover instances of accidental over-deployment, misinterpretation of complex licensing rules, indirect access usage, and shadow IT installations, resulting in heavy penalties and unexpected true-up costs. In addition, governments worldwide are tightening compliance regulations related to digital assets, cybersecurity, and intellectual property protection, making the use of unlicensed or pirated software a substantial liability.

Non-compliance can lead not only to monetary fines but also reputational damage and operational disruptions. As organizations expand globally, ensuring adherence across subsidiaries and distributed teams becomes even more challenging. SAM solutions help mitigate these risks by providing continuous license monitoring, automated reconciliation, audit-ready documentation, and proactive compliance alerts. By ensuring accurate entitlement management and eliminating unauthorized installations, SAM platforms empower enterprises to avoid audit exposure, streamline governance, and maintain a defensible compliance posture in increasingly regulated digital environments.

SAM adoption is hindered by the intricacy of modern licensing schemes and heterogeneous environments. Vendors increasingly use per-user, per-core, concurrent, subscription-based, and consumption-based metrics, often with cloud-specific Bring-Your-Own-License (BYOL) provisions and regional usage restrictions. As organizations adopt multi-cloud and hybrid architectures, entitlement data resides across disparate ITSM, CMDB, procurement, and cloud-management tools, making it hard to reconcile a single “effective license position.” ISO/IEC 19770-1:2017 explicitly highlights the need for integrated processes spanning change management, data reconciliation, and license control, yet many enterprises lack the process maturity and tooling to meet this standard, slowing SAM program rollout and limiting value realization.

Small and medium enterprises (SMEs) frequently underestimate both compliance risk and savings potential from SAM. Studies by BSA show unlicensed software usage rates above 50% in many emerging economies, especially in Asia Pacific, indicating that SMEs often rely on informal or poorly documented licensing practices. Budget constraints and competing priorities make investments in dedicated SAM tools, specialized staff, and integrations with existing ERP or ITSM platforms difficult to justify. The result is reactive license management driven by audit events rather than proactive optimization. This adoption gap in the SME segment, despite rapidly growing cloud and SaaS usage, acts as a structural restraint on overall market penetration.

Accelerating convergence of SAM, SaaS Management Platforms (SMPs), and FinOps practices as enterprises transition toward cloud-first operating models is one of the major opportunities for the global Software Asset Management market. Organizations are increasingly seeking unified solutions that provide a single source of truth for software usage, entitlements, spend analytics, and cloud consumption across IaaS, PaaS, and SaaS environments. As cloud budgets grow, often becoming one of the largest and fastest-rising segments of IT expenditure, CIOs and CFOs are prioritizing stronger governance, financial accountability, and real-time optimization of digital investments. This convergence enables SAM vendors to move beyond traditional license compliance and expand into continuous cost optimization, vendor negotiation intelligence, contract lifecycle management, and cloud financial governance.

Integrated SAM-FinOps-SMP platforms support cross-functional collaboration between IT, procurement, finance, and security teams, strengthening decision-making and reducing waste. Enterprises adopting such integrated models can better align software consumption with business objectives, eliminate redundancy across cloud subscriptions, and strategically plan renewals. As multi-cloud ecosystems and SaaS sprawl intensify, the demand for unified platforms that merge operational, financial, and contractual oversight will create substantial market expansion opportunities for SAM providers.

AI and automation present one of the most transformative opportunities for the Software Asset Management market, enabling enterprises to manage highly complex and dynamic IT estates with greater speed, accuracy, and intelligence. Modern SAM environments must track thousands of applications deployed across hybrid clouds, virtual machines, containers, remote devices, and SaaS platforms. AI-driven discovery tools can autonomously identify software assets, classify usage patterns, detect anomalies, and predict compliance risks with minimal human intervention. Similarly, machine learning models can enhance predictive analytics for contract renewals, vendor audits, and consumption forecasting, helping organizations negotiate smarter and optimize budgets.

Automated license reconciliation, remediation workflows, and policy enforcement significantly reduce operational overhead and eliminate manual errors associated with traditional SAM processes. As IT footprints expand through digital transformation, mergers, and distributed workforces, AI-powered SAM solutions enable enterprises to maintain constant visibility, improve compliance health, and proactively mitigate cost leakages. Vendors integrating automation with natural language processing, recommendation engines, and intelligent orchestration stand to capture strong market demand, as enterprises increasingly favor advanced, self-optimizing platforms capable of managing software lifecycles at scale.

The software segment is the clear revenue leader in component terms, accounting for about 74% of global software asset management revenues in 2024. This dominance reflects the centrality of capabilities such as license management, audit and compliance management, software discovery, optimization & metering, contract management, and configuration management to enterprises’ IT governance strategies. As organizations migrate to SaaS and hybrid environments, they require platforms that automatically normalize application data, map entitlements to installations, and surface optimization opportunities across thousands of titles.

Integrations with ERP, ITSM, identity, and cloud cost-management tools have further entrenched solution-centric SAM architectures. While managed and professional services are growing rapidly, particularly for assessments and program design, they remain layered on top of a software-driven control plane, reinforcing the leadership of the solutions segment.

Cloud deployment has emerged as the leading deployment model in software asset management, consistently reported as holding the largest share of new SAM deployments and installed base revenues in recent years. Enterprises are shifting from on-premises tools to cloud-hosted SAM platforms to gain elastic scalability, lower upfront capital costs, and easier global rollout. Cloud-based SAM also enables real-time data collection from distributed endpoints, automated updates, and faster delivery of new analytics features. While highly regulated industries still maintain on-premises deployments for specific compliance reasons, the long-term growth trajectory clearly favors cloud-native SAM, particularly for managing complex SaaS subscription estates and multi-cloud contracts.

By organization size, large enterprises dominate the software asset management market, generating more than 74% of global revenues in 2024. These organizations run extensive portfolios of commercial and custom software across multiple business units and geographies, with annual software and cloud budgets often reaching hundreds of millions of US$. Flexera’s research indicates that such enterprises face high audit exposure, around 50% experienced at least one audit from major vendors such as Microsoft in a three-year period, and can incur audit penalties exceeding US$ 5-10 million if their license positions are not well controlled. To mitigate these risks and reclaim the 20-30% of spend lost to unused or mis-configured software, large enterprises are investing in enterprise-grade SAM platforms, global license centers of excellence, and integrations with FinOps and security teams, keeping this segment firmly in the lead.

Across industry verticals, manufacturing is widely recognized as one of the most prominent adopters and currently dominates SAM spending. Manufacturers rely heavily on a mix of ERP, PLM, MES, industrial automation, and engineering design software, much of it licensed on high-value, complex terms. As global supply chains digitize and Industry 4.0 initiatives connect factories via IoT, the number of software instances, edge devices, and embedded licenses has exploded, elevating both compliance risks and optimization opportunities.

Manufacturers also face stringent safety and quality regulations, making unlicensed or unpatched software a material operational risk. SAM solutions that can reconcile usage across plants, central engineering teams, and global business units, and that integrate with enterprise asset management (EAM) and maintenance systems, are therefore seeing strong traction in this vertical, with similar patterns emerging in BFSI, IT & telecom, and healthcare.

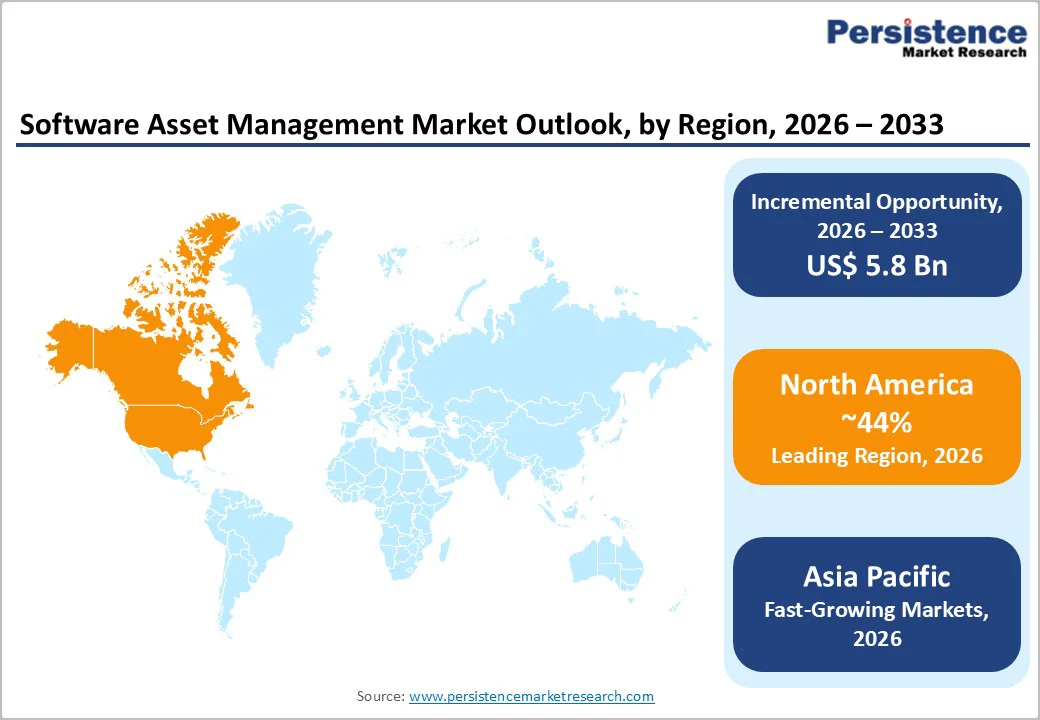

North America remains the dominant regional market for Software Asset Management, representing nearly 44% of global SAM revenues by 2026 due to its highly digitalized enterprise ecosystem and stringent compliance environment. The region hosts a large concentration of technology-intensive industries, such as BFSI, healthcare, telecom, IT services, and advanced manufacturing, that maintain vast and complex software portfolios across hybrid and multi-cloud infrastructures. As these organizations rapidly scale SaaS adoption, containerized workloads, and cloud-native applications, the need for real-time visibility, rightsizing, and cost governance becomes increasingly critical.

Europe represents a substantial share of the global software asset management market, driven by rigorous data-protection and privacy regulation, most notably the EU General Data Protection Regulation (GDPR). GDPR’s requirements for lawful processing, data minimization, and security by design have pushed organizations in Germany, the U.K., France, Spain, and other EU economies to gain much tighter control over software inventories, access rights, and patch levels, core outcomes of a mature SAM program.

European organizations are also early adopters of formal standards such as ISO/IEC 19770-1, which provides a structured framework for IT asset management processes, aligning SAM with broader management system standards and corporate governance requirements.

Asia Pacific is the fastest-growing regional market for software asset management, underpinned by rapid digital transformation in China, Japan, India, and key ASEAN economies. The region has a very high density of SMEs, often over 95% of registered businesses in many countries, rapidly adopting cloud and SaaS but often lacking formal SAM processes.

Historical BSA surveys show unlicensed software rates around 61% in Asia-Pacific, significantly higher than in North America or Western Europe, creating both compliance risk and a large upside for disciplined license governance. As governments roll out national digital-economy programs and tighten cybersecurity laws, enterprises are turning to SAM tools to ensure that mission-critical software is properly licensed, updated, and secured.

The global software asset management market is moderately fragmented, with a mix of global platform vendors and specialized regional providers. Leading players such as IBM Corporation, Flexera, Snow Software, ServiceNow, USU Software AG, Ivanti, Matrix42, Certero, Belarc, Inc., and Eracent offer comprehensive suites covering discovery, license management, optimization, and compliance analytics. Competition increasingly centers on depth of software-recognition libraries, automation of complex licensing rules, multi-cloud coverage, and the ability to integrate with ITSM, CMDB, FinOps, and security tooling.

Market leaders are also pursuing acquisitions and partnerships, such as IFS-Copperleaf, Freshworks Inc.-Device42, and Softchoice’s SAM+ launch, to strengthen AI-driven analytics, infrastructure discovery, and managed SAM services. Differentiators now include cross-portfolio visibility, predictive optimization, and support for emerging use cases like BYOD, edge computing, and SaaS governance.

The global software asset management market is estimated at around US$ 4.6 billion in 2026 and is projected to reach approximately US$ 10.4 billion by 2033, reflecting a robust CAGR of about 12.4% over 2026 - 2033.

Key demand drivers include escalating software and cloud spending, rising SaaS adoption, and heightened audit and regulatory pressures from vendors and frameworks like GDPR and ISO/IEC 19770, compelling enterprises to formalize SAM.

By component, software solutions dominate with roughly 74% share of global revenues, thanks to their central role in license management, discovery, optimization, and compliance.

North America is the leading region, accounting for about 44% of global SAM revenues in 2026, underpinned by extensive cloud and SaaS adoption, stringent sectoral regulations, and strong enforcement by organizations.

The most attractive opportunity lies in converged AI-enabled platforms that unify SAM, SaaS management, and FinOps, enabling continuous cost optimization, automated compliance, and predictive license planning across hybrid multi-cloud estates.

Key players include major platform and solution providers such as IBM Corporation, Flexera, Snow Software, ServiceNow Inc., USU Software AG, Ivanti, Matrix42 GmbH, Certero, Belarc, Inc., Eracent, Scalable Software, Inc., InvGate, and several others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Component

By Deployment

By Organization Size

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author