ID: PMRREP35431| 199 Pages | 19 Jun 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

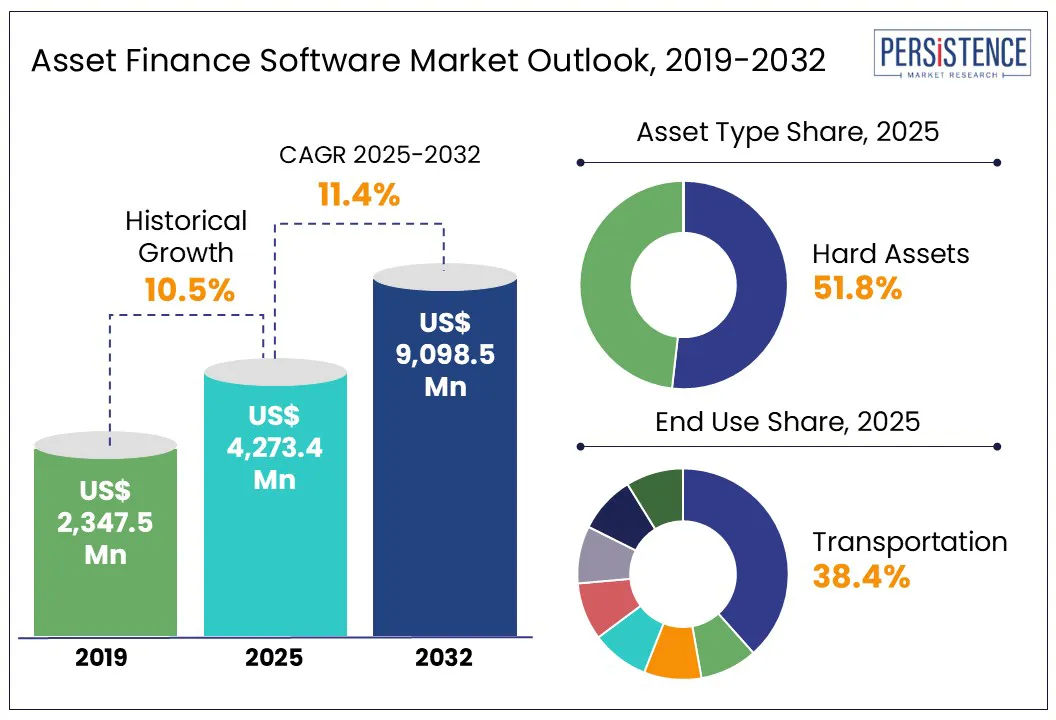

According to Persistence Market Research, the global asset finance software market size is predicted to reach US$ 9,098.5 Mn in 2032 from US$ 4,273.4 Mn in 2025. It will likely witness a CAGR of around 11.4% in the forecast period between 2025 and 2032.

Asset finance has become a technology-backed strategy, reshaping how businesses acquire, manage, and optimize their assets. In a world increasingly dominated by subscription models, usage-based billing, and Equipment-as-a-Service (EaaS), asset finance software has emerged as the backbone of this transformation. These software solutions enable financial institutions and enterprises to unlock new revenue streams, enhance decision-making, and reduce risk.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Asset Finance Software Market Size (2025E) |

US$ 4,273.4 Mn |

|

Market Value Forecast (2032F) |

US$ 9,098.5 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

11.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

10.5% |

The surge of subscription-based business models, mainly across technology, equipment, and automotive sectors, is propelling a fundamental shift in how assets are financed, tracked, and managed. Conventional lease or loan structures are increasingly replaced by usage-based, flexible financial arrangements, which require a different set of features from asset finance software. These models demand real-time asset usage tracking, dynamic pricing, contract modifications, and continuous billing- none of which legacy finance systems were built to handle. Hence, key players are shifting toward next-generation asset finance platforms with integrated digital asset management to help support complex recurring revenue workflows.

The automotive industry, for example, has been adopting car subscription services on a large scale. Porsche’s Porsche Drive and Volvo’s Care by Volvo have extended at a fast pace, with subscriptions predicted to make up a significant share of new vehicle access models by 2030. As per a new study, mobility subscription services are poised to account for 20% of new car revenues in mature markets by the end of the decade. This trend is also seen in heavy equipment financing, where OEMs and dealers are moving toward pay-per-use models, prompting a high dependence on asset finance software solutions that integrate telematics and predictive maintenance.

Data privacy and security concerns are predicted to hinder asset finance software market growth in the foreseeable future. As these platforms increasingly move to the cloud and integrate with third-party ecosystems, companies worry about exposure to cyber threats, non-compliance with regulations, and unauthorized data access. These concerns are mainly evident in Europe, where regulatory scrutiny has intensified. The European Union’s Digital Operational Resilience Act (DORA), for example, mandates strict ICT risk management across financial entities.

A 2024 online survey revealed that nearly 62% of financial service executives identified cybersecurity and data privacy as the most prominent risk in adopting new digital platforms. For small-scale banks and independent leasing firms, this has resulted in implementation delays or an increasing preference for on-premise solutions, which lack the agility of modern cloud-based systems. High-profile data breaches, including the MOVEit file transfer hack in 2023 that affected various financial institutions, have further spurred caution.

Medical equipment manufacturers are increasingly embracing financing partnerships and embedded finance models to bolster sales in a capital-constrained healthcare environment. This will likely create a high demand for asset finance software that support these complex arrangements. With diagnostic centers and hospitals under pressure to manage cash flow and avoid large upfront expenditures, manufacturers offer pay-per-use, leasing, and subscription-based equipment models. Siemens Healthineers and GE HealthCare, for instance, have launched equipment-as-a-service offerings that enable customers to pay based on outcomes or usage rather than buying machines outright.

The shift is specifically visible in markets, including Brazil and India, where private clinics and hospitals face high demand but limited liquidity. Manufacturing companies in these markets are forming alliances with finance companies and fintechs to manage and underwrite these deals. They are gradually shifting toward asset finance platforms that provide end-to-end asset lifecycle tracking, compliance, and flexibility. Vendors, including LTi Technology Solutions and Odessa, are now targeting healthcare-specific use cases, delivering integrations with hospital management systems.

In terms of asset type, the market is bifurcated into hard assets and soft assets. Out of these, hard assets are likely to remain at the forefront with around 51.8% of the asset finance software market share in 2025 due to their ability to provide tangible collateral, predictable depreciation, and easy risk assessment, making them suitable for structured finance. These assets have well-established secondary markets, thereby enabling lenders to repossess and resell them in case of default. This built-in recovery mechanism helps reduce the credit risk, which is essential for lenders operating at scale.

Soft assets are also gaining momentum owing to the digital transformation of industries and the surging dependence on intangible resources, including intellectual property and IT infrastructure. As companies shift toward digital ecosystems and cloud-based operations, the requirement of financing these assets is rising. In the IT and telecommunication sector, for instance, enterprise buyers are now financing end-to-end digital setups such as cybersecurity solutions, asset integrity management, and data center services.

Based on end-use, the market is segregated into transportation, IT and related services, construction, agriculture, medical equipment, banks, and industrial/manufacturing equipment. Among these, the transportation segment is predicted to account for a share of approximately 38.4% in 2025, backed by the industry’s high capital intensity, asset mobility, and dependency on structured financing to support fleet expansion. Commercial vehicles, rail, ships, and aircraft assets represent large-ticket investments with predictable lifecycles, making these ideal candidates for financing models, including hire purchase and software asset management integration.

Agriculture, on the other hand, is predicted to showcase a steady growth rate through 2032 due to the sector’s rising mechanization, seasonal cash flow constraints, and high equipment costs, pushing demand for flexible financing. Agri-businesses and farmers often rely on financed assets, including drones, irrigation systems, combine harvesters, and tractors, which are now equipped with precision farming technologies. Asset finance software plays a key role in enabling equipment vendors, cooperatives, and agri-financiers to manage these asset-heavy transactions efficiently.

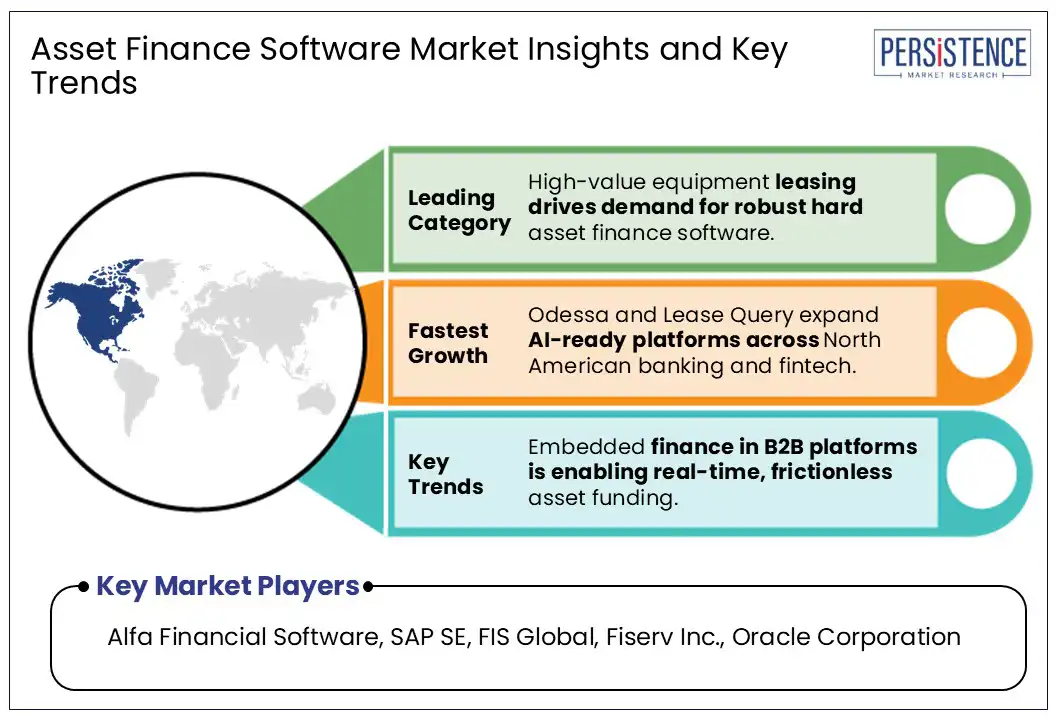

In 2025, North America is estimated to hold a share of nearly 38.1% because of a high penetration rate of asset finance software among Tier 1 banks and captive finance providers. The U.S. asset finance software market is currently experiencing steady growth, owing to high demand for efficient asset management across various industries. Key players such as Odessa Technologies, Fidelity National Information Services (FIS), and Oracle Corporation are at the forefront of the market.

They are investing in innovative technologies, including machine learning and AI to improve customer experience, automate routine tasks, and enhance decision-making processes. Despite the country’s technological prowess, challenges continue to persist, specifically concerning the integration of new software with legacy systems. For example, in a recently conducted survey, a U.S.-based equipment finance company reported a 22% drop in transaction processing efficiency during the initial quarter post-integration. It was primarily due to underutilized automation features and retraining gaps.

Europe’s market is characterized by evolving financing models, technological innovation, and regulatory pressures that are pushing demand across various industries. The implementation of IFRS 16 lease accounting standards in 2019 continues to accelerate domestic lessees and lessors toward automated software solutions to ensure compliance and accurate lease reporting. This regulatory push has augmented investments in platforms capable of handling complex lease portfolios and integrated financial reporting.

The rise of green financing is also influencing the regional market. EU sustainability directives and carbon emission norms have encouraged financiers to prioritize renewable energy equipment and Electric Vehicles (EVs) in their asset portfolios. Leasing of EV fleets increased by nearly 23% in 2023 across the EU, necessitating asset finance software capable of handling government subsidy tracking, lifecycle emissions reporting, and battery leasing contracts.

Asia Pacific is experiencing considerable growth due to evolving financing models, regulatory changes, and digital transformation across multiple industries. China will likely maintain its dominance in the region with the government's push for financial modernization. The integration of cloud-based solutions and invoice automation software is gaining traction in the country, creating new opportunities.

In India, growth is being driven by its booming fintech sector. The country is also showcasing a rise in customized solutions for microfinance and tractor leasing, thereby addressing the unique requirements of its diverse economy. Start-ups, including CashFlo, are at the forefront, providing customized solutions for GST compliance, asset performance management, and supply chain finance. These companies are focusing on simplifying asset financing processes for small- and medium-sized enterprises across India.

The global asset finance software market contains several well-established enterprise vendors and emerging fintech firms. Renowned companies are focusing on providing integrated, comprehensive platforms that serve banks, leasing companies, and financial institutions with complex requirements. These companies emphasize end-to-end automation, regulatory compliance, and scalability, making them ideal for multinational operations. Specialized providers are striving to strengthen their presence by focusing on industry-specific and innovative features developed for asset finance, leasing, and equipment finance firms.

The market is projected to reach US$ 4,273.4 Mn in 2025.

Increasing demand for automated lease management and rising preference for subscription-based models are the key market drivers.

The market is poised to witness a CAGR of 11.4% from 2025 to 2032.

Surging financing in electric vehicles and increasing integration with IoT are the key market opportunities.

Alfa Financial Software, SAP SE, and FIS Global are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Asset Type

By Deployment

By Enterprise Size

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author