ID: PMRREP3280| 186 Pages | 8 Sep 2025 | Format: PDF, Excel, PPT* | Semiconductor Electronics

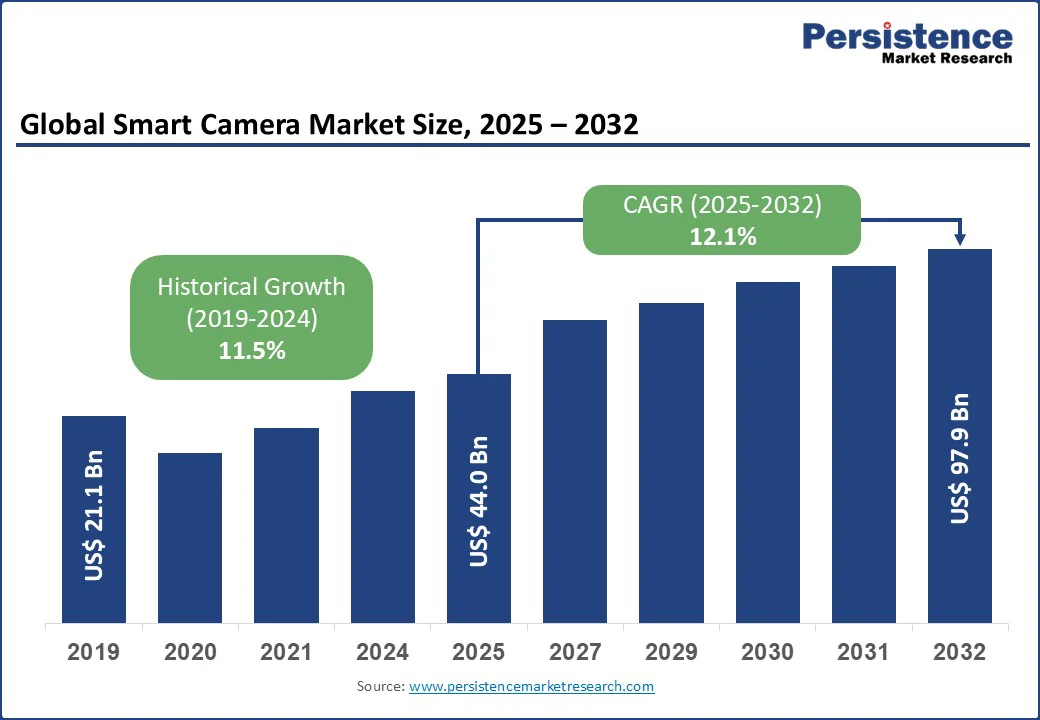

The global smart camera market size is likely to be valued at US$ 44.0 Bn in 2025, with a anticipated value of US$ 97.9 Bn by 2032, growing at a CAGR of 12.1% during the forecast period 2025 to 2032.

Key Industry Highlights:

| Global Market Attribute | Key Insights |

|---|---|

| Smart Camera Market Size (2025E) | US$ 44.0 Bn |

| Market Value Forecast (2032F) | US$ 97.9 Bn |

| Projected Growth (CAGR 2025 to 2032) | 12.1% |

| Historical Growth (CAGR 2019 to 2024) | 11.5% |

The market is experiencing robust growth, driven by advancements in artificial intelligence (AI), Internet of Things (IoT), and increasing demand for advanced security and automation solutions.

Smart cameras, equipped with image sensors, processors, and connectivity features such as Wi-Fi and 5G, serve as standalone vision systems capable of real-time monitoring, analytics, and decision-making. Moreover, growing applications in security and surveillance, industrial automation, and smart home ecosystems, aligning with global smart camera market trends.

The smart camera market growth is propelled by the increasing need for advanced security, automation, and AI-powered technologies across multiple sectors. Global spending on security solutions is projected to reach US$ 232 billion by 2027, with smart cameras playing a pivotal role due to their AI-driven features such as facial recognition and real-time analytics. The rise in crime, including 44% of Americans reporting package theft in 2025, drives demand for smart cameras in residential and commercial settings.

Advancements in CMOS image sensors, offering superior image quality and low-light performance, support market growth. The proliferation of IoT and 5G networks enables seamless connectivity, enhancing remote monitoring and integration with smart ecosystems such as Amazon Alexa and Google Assistant.

Smart city initiatives, particularly in the Asia Pacific, with China investing over US$ 150 Bn annually, drive demand for smart cameras in traffic management and public safety. Industrial automation, with the global machine vision market projected to reach US$ 18.7 Bn by 2028, further accelerates adoption in manufacturing for quality control and fault detection, aligning with smart camera market trends.

The smart camera market faces significant challenges due to high production costs and privacy concerns. Developing advanced smart cameras with AI, high-resolution sensors, and processors requires substantial R&D investments, with high-end models costing over US$ 1,000 per units. The reliance on expensive components such as lenses and processors, with lens prices rising by 15% from 2021 to 2023 due to supply chain constraints, limits affordability in price-sensitive markets. Privacy concerns surrounding AI-powered facial recognition and data storage are significant, with 46 countries facing regulatory scrutiny for AI surveillance technologies.

The EU’s General Data Protection Regulation (GDPR), impacting 15 Mn smart camera users in Europe, increases compliance costs for manufacturers, affecting scalability. Cybersecurity risks associated with cloud-based storage and IoT connectivity further deter adoption in regions with limited digital infrastructure, such as parts of Latin America and Africa, impacting smart camera market trends.

The smart camera market offers substantial growth opportunities through the expansion of smart home ecosystems and industrial automation. The global smart home market is projected to grow at a CAGR of 8.25% through 2025, driving demand for smart cameras with features such as motion detection and cloud storage.

The residential segment, particularly smart indoor cameras, fueled by consumer demand for remote monitoring. In industrial applications, smart cameras are critical for machine vision, with the global industrial automation market expected to reach US$ 395 Bn by 2029.

Emerging markets in Asia Pacific, particularly India and China, offer untapped potential due to smart city investments of US$ 28 Bn in India by 2025. Advancements in AI and edge computing, reducing latency by up to 40%, enhance real-time analytics capabilities. Partnerships with IoT platforms and cloud providers, such as Hikvision’s collaboration with Genetec, further boost market potential, aligning with smart camera market trends.

Image sensors hold a 30% market share in 2025, driven by advancements in CMOS technology, which offers superior image quality, low power consumption, and cost-effectiveness. The CMOS sensor market supports applications in security and industrial automation. Their ability to perform in low-light conditions makes them ideal for smart camera market trends.

Processors are the fastest-growing component, fueled by demand for AI and machine learning capabilities, enabling features such as facial recognition and object detection. These processors enhance computational speed and enable real-time decision-making, which is essential for applications in industries such as automotive, electronics, healthcare, and security.

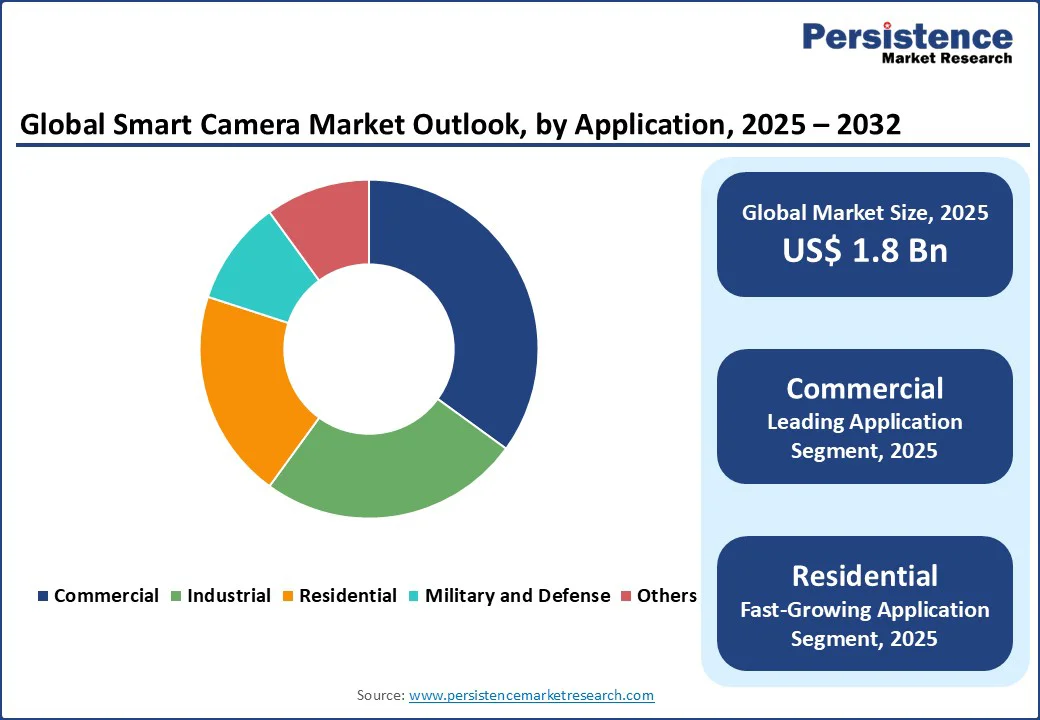

The commercial application is the leading application in the smart camera market, holding the largest share due to its wide deployment across offices, retail stores, hotels, hospitals, and educational institutions. Businesses in these environments rely heavily on smart surveillance for theft prevention, employee and customer safety, and compliance with regulatory standards.

Residential applications are the fastest-growing, fueled by smart home ecosystems and consumer demand for remote monitoring. The growth of affordable, plug-and-play wireless cameras with features such as mobile app connectivity, cloud storage, facial recognition, and two-way audio is making advanced surveillance accessible to a wider consumer base.

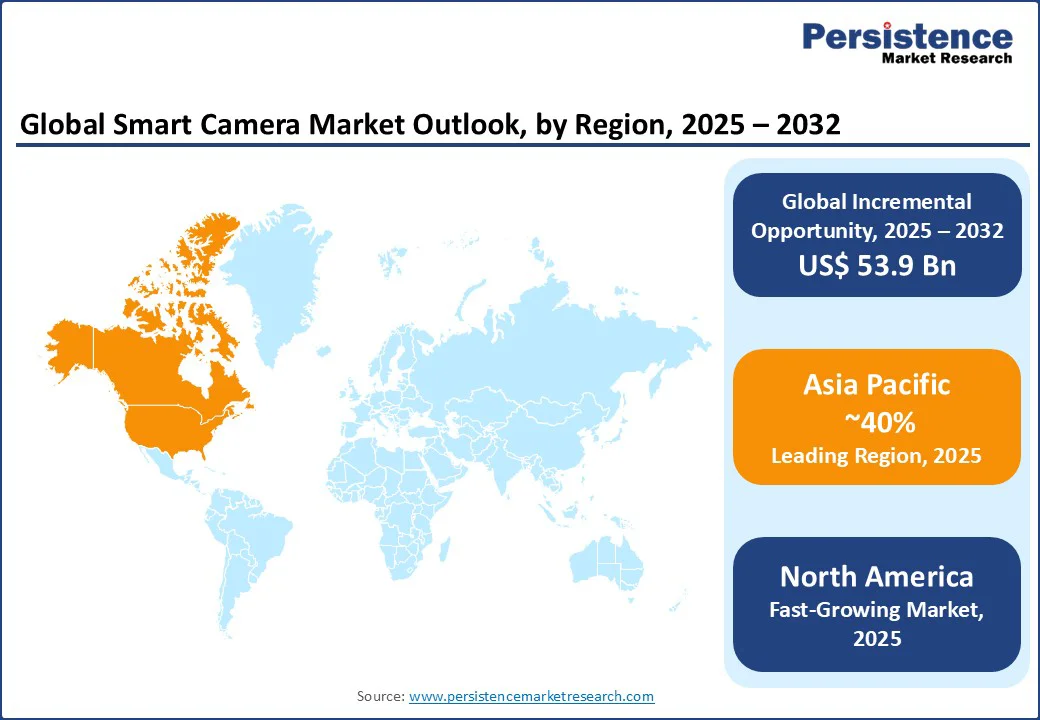

North America is the fastest-growing region, holds a 30% global market share in 2025, led by the U.S., which dominates due to its advanced technological infrastructure and high demand for smart security solutions. The U.S. market benefits from R&D investments exceeding US$ 60 Bn annually in AI and IoT technologies.

Smart home adoption is significant, with 41% of U.S. households owning smart cameras in 2025, driving residential applications. The U.S. Department of Homeland Security’s focus on AI-driven surveillance, with annual spending of US$ 7 Bn, boosts demand for smart cameras in public safety and military applications.

Companies such as Honeywell Security and FLIR Systems lead innovations in military and defense applications, particularly in border security and defense systems. Canada contributes through smart city initiatives, with investments of US$ 3 Bon in smart infrastructure by 2025.

The rise of e-commerce enhances access to smart camera systems for residential and commercial applications. Emerging trends include AI-powered traffic management systems and smart retail analytics, with companies such as Avigilon (Motorola Solutions) developing cameras for retail loss prevention, aligning with smart camera market trends.

Europe holds a 25% global market share in 2025, led by Germany, the UK, and France. Germany dominates due to its advanced manufacturing sector, with Bosch Security Systems investing US$ 500 Mn annually in smart camera technologies for machine vision and quality control. The UK focuses on public safety, with smart cameras deployed in 70% of urban surveillance systems, supported by government spending of US$ 2 Bn on security infrastructure.

France leads in commercial applications, with smart cameras in retail growing at a CAGR of 10%, driven by demand for customer analytics. The EU’s General Data Protection Regulation (GDPR) ensures data privacy, boosting consumer trust while increasing compliance costs.

Companies such as Axis Communications and Panasonic i-PRO Sensing Solutions lead with AI-driven solutions, supported by e-commerce distribution. Emerging trends include smart cameras for autonomous vehicles and smart retail, with Germany pioneering automotive applications, aligning with smart camera market trends.

Asia Pacific is the leading region, with a 40% global market share in 2025, led by China, Japan, and India. China’s smart city investments, exceeding US$ 150 Bn annually, drive demand for smart cameras in traffic management and public safety, with 600 Mn surveillance cameras deployed by 2025.

Japan’s focus on industrial automation, with a machine vision market valued at US$ 4 Bn in 2025, boosts smart camera adoption in manufacturing. India’s smart city mission, with US$ 28 Bn in investments, supports urban surveillance and commercial applications, with smart cameras used in 100 smart cities by 2025.

Companies such as Hikvision Digital Technology and Dahua Technology dominate with cost-effective, AI-powered cameras, supported by e-commerce platforms and regional trade agreements. Emerging trends include smart cameras for healthcare monitoring and smart agriculture, with Japan leading in healthcare applications, positioning Asia Pacific as a hub for smart camera market trends.

The global smart camera market is highly competitive, with a mix of global giants, tech-driven enterprises, and agile consumer-focused brands shaping its growth. Leading players such as Hikvision and Dahua Technology dominate large-scale surveillance with AI-enabled analytics, while Axis Communications, Bosch, Honeywell, and Sony focus on enterprise-grade solutions that integrate seamlessly with broader security systems.

In the residential and smart home space, companies such as Ring (Amazon), Nest (Google), Arlo, Eufy, and Wyze drive adoption through affordable, user-friendly devices that connect easily with home automation ecosystems. The competitive landscape is defined by continuous innovation in AI, machine learning, edge computing, and 5G connectivity, enabling features such as real-time facial recognition, motion detection, and cloud integration.

The smart camera market is projected to reach US$ 44.0 Bn in 2025, driven by demand for AI-powered security solutions.

Rising demand for security, industrial automation, and AI-driven analytics fuels smart camera market growth.

The smart camera market grows at a CAGR of 12.1% from 2025 to 2032, reaching US$ 97.9 Bn by 2032.

Expansion in smart homes, industrial automation, and smart city initiatives drives smart camera market growth.

Key players include Honeywell Security, Axis Communications, Hikvision, Dahua, and Panasonic i-PRO.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

| Customization and Pricing | Available upon request |

By Component

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author