ID: PMRREP35429| 199 Pages | 5 Nov 2025 | Format: PDF, Excel, PPT* | Healthcare

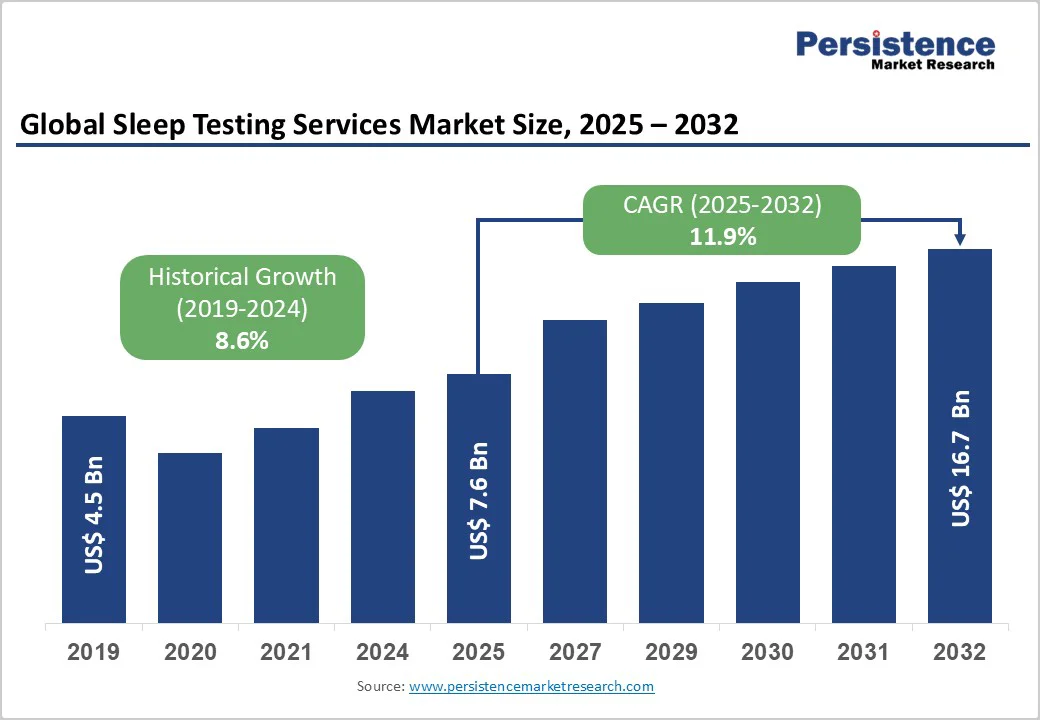

The global sleep testing services market size is likely to be valued US$ 7.6 billion in 2025 and is projected to reach US$ 16.7 billion by 2032, growing at a CAGR of 11.9% during the forecast period from 2025 to 2032. Sleep testing services involve the clinical evaluation and monitoring of sleep patterns to diagnose disorders such as obstructive sleep apnea (OSA), insomnia, restless leg syndrome (RLS), and others. Growing public awareness, increased diagnosis rates of sleep disorders, and rising health concerns linked to poor sleep are driving the market growth.

| Key Insights | Details |

|---|---|

|

Sleep Testing Services Market Size (2025E) |

US$ 7.6 Bn |

|

Market Value Forecast (2032F) |

US$ 16.7 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

11.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

8.6% |

The sleep testing services market is experiencing robust growth driven by widespread changes in sleep behaviour, fuelled by modern lifestyles, digital overstimulation, and elevated stress levels. Conditions such as OSA, RLS, insomnia, and circadian rhythm disorders are being diagnosed at an unprecedented rate, prompting greater health awareness and proactive clinical engagement.

According to American Journal of Epidemiology, 2023, the estimated prevalence rates of obstructive sleep apnea have increased substantially over the last two decades. Globally, OSA affects nearly 936 million adults aged between 30 and 69 (NIH, 2025).

Additionally, circadian rhythm imbalances and irregular sleep-wake patterns are becoming increasingly common, often triggered by stress, inconsistent daily routines, and social obligations. According to a study, which analyzed data from over 170,000 individuals through the U.S. National Health Interview Survey, approximately 8% of all deaths may be linked to poor sleep patterns (World Economic Forum, 2023).

With sleep now recognized as integral to mental, metabolic, and cardiovascular health, healthcare systems are expanding access through policy support and insurance coverage. These converging trends are firmly positioning sleep diagnostics as a cornerstone of preventive healthcare.

Despite growing awareness, the sleep testing services market faces major restraints due to widespread underdiagnosis and workforce shortages. Symptom overlap between sleep disorders and conditions like depression, anxiety, and thyroid dysfunction often leads to misdiagnosis or delayed referrals. Primary care physicians often lack training in sleep medicine, causing sleep issues to be overlooked or misattributed.

According to the American Academy of Sleep Medicine 2025, Obstructive sleep apnea (OSA) affects nearly 30 million Americans, yet approximately 80% of these cases remain undiagnosed. Untreated OSA increases risks of cardiovascular disease, stroke, diabetes, and depression, while costing the U.S. $149.6 billion annually due to higher healthcare use, accidents, and lost productivity.

Simultaneously, a critical shortage of certified sleep technologists limits diagnostic capacity, creating long wait times and restricting service scalability. Workforce shortages in sleep centers cause long appointment delays, worsening health outcomes, and reduced productivity for patients with sleep disorders.

According to recent studies, the United States currently has around 10,250 certified sleep technologists and around 3,616 valid sleep medicine certificate holders (American board of Internal Medicine, 2025), while an estimated 50 to 70 million Americans suffer from sleep disorders. This stark imbalance highlights a critical shortage of qualified professionals relative to the growing demand for diagnostic services.

Fragmented care pathways and limited cross-specialty collaboration further compound these barriers. Without stronger clinical integration and targeted workforce investment, the sleep diagnostics industry is anticipated to struggle to meet its rising demand potential.

The sleep testing services market is poised for transformation through scalable, tech-enabled models like Home Sleep Testing (HST) and Subscription-Based Sleep Health as a Service (SHaaS). Advances in HST technology-such as AI integration, real-time data analytics, and telemedicine compatibility-are making at-home diagnostics more accurate, accessible, and cost-effective.

In December 2024, EnsoData partnered with BodiMetrics to streamline the patient care pathway—from initial home sleep testing to longitudinal sleep monitoring—by integrating EnsoSleep’s FDA-cleared PPG software (SaMD) into BodiMetrics’ FDA-cleared circul pro™ smart ring.

In April 2025, Blackstone Medical Services (BMS), partnered with EnsoData, an innovator in AI health tech solutions, to enhance accessibility for diagnosis and treatment for the millions of patients living with undiagnosed sleep apnea.

Additionally, SHaaS offers consumers a proactive, long-term care model with bundled services, from wearable monitoring to virtual consultations. These innovations support early detection, enhance patient engagement, and improve treatment adherence, especially for chronic conditions like sleep apnea.

With growing digital health adoption and value-based care becoming a priority, these models offer sustainable growth avenues. Together, they redefine sleep diagnostics as more continuous, personalized, and user-centric-creating vast opportunities for providers, insurers, and tech innovators alike.

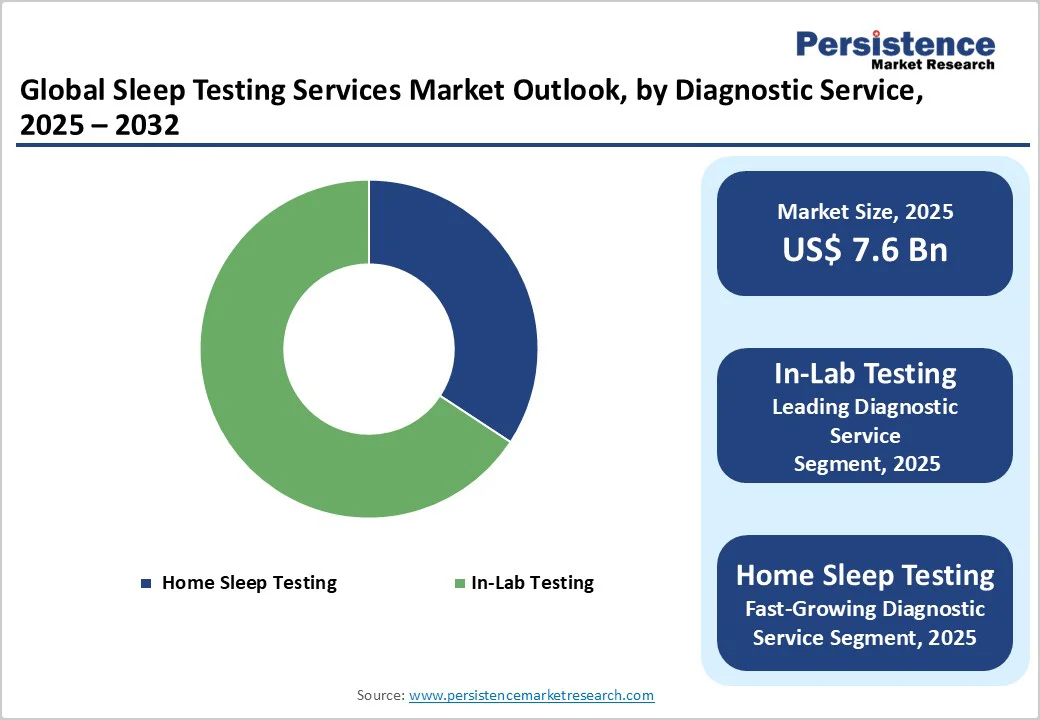

In-lab testing segment is projected to hold a revenue share of over 65% in 2025 within the global sleep testing services market 2025. In-lab tests such as polysomnography (PSA) are considered the gold standard for diagnosing sleep disorders such as OSA and insomnia. These tests offer detailed data on brain activity, breathing, and heart rate. Growing need for precise diagnostics, particularly in complex cases, drives the demand for in-lab testing services, ensuring their continued dominance in the market.

Home sleep testing (HST) is projected to grow at a CAGR of 13.9% over the forecast period. HSTs are increasingly being accepted as a reliable alternative to in-lab testing due to their convenience, affordability, and flexibility to diagnose sleep disorders at home. This growing demand presents significant opportunities for sleep testing service providers to expand their reach and services.

The obstructive sleep apnea (OSA) segment is expected to dominate the indication category in 2025, with 44.8% of the global sleep testing services market share. The segment’s dominance is owed to the high prevalence of OSA compared to other sleep disorders, growing awareness, increasing diagnostic testing, and a strong clinical focus. Recent meta-analyses estimate the global prevalence of OSA to range from 9% to 38% in adults.

OSA requires comprehensive test procedures to accurately monitor multiple physiological parameters and confirm OSA severity, ruling out other sleep disorders, such as insomnia, RLS, circadian rhythm sleeping disorders, narcolepsy, rapid eye movement (REM) sleep disorders, periodic limb movement disorders (PLMB) or bruxism. Compared to other sleep disorders, OSA has more definitive diagnostic criteria and treatment protocols, making it one of the dominants as well as the most rapidly expanding segments in clinical settings.

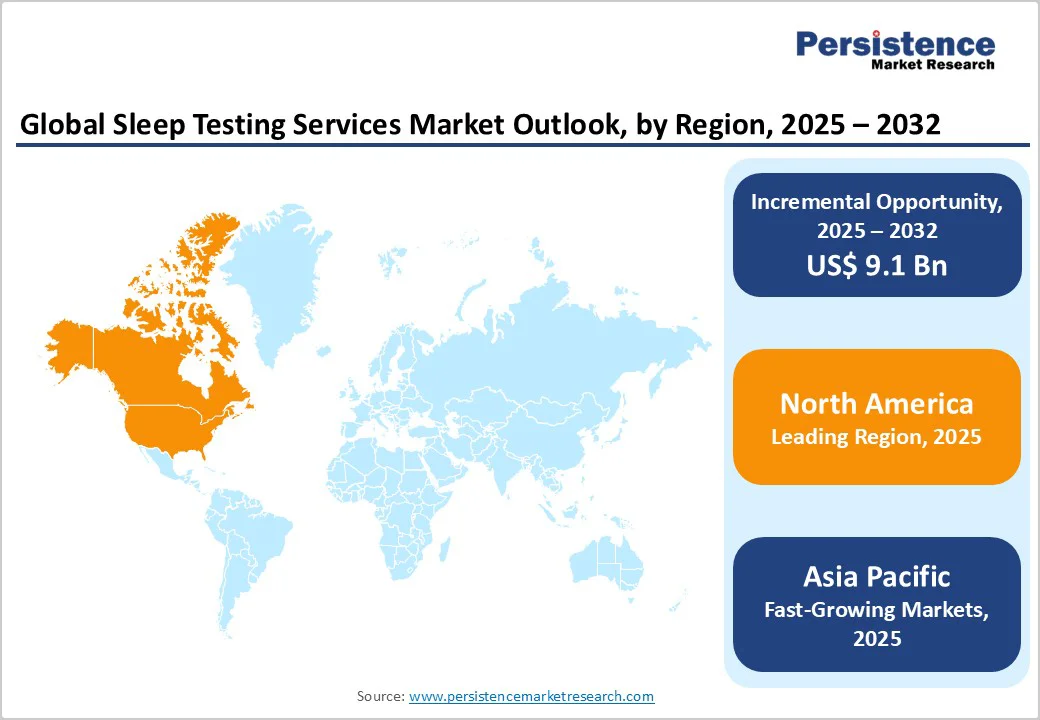

North America is anticipated to hold 36.6% of the global share in 2025, driven by the high prevalence of sleep disorders and the increasing adoption of diagnostic technologies.

Recent studies indicate that nearly 70 million U.S. individuals are affected by sleep disorders yearly. National Sleep Foundation’s 2025 Sleep in America Poll reported six out of ten Americans not getting enough sleep, while four in 10 adults struggle to fall asleep at least three nights per week. The increasing collaboration between medical device companies and research institutes plays a pivotal role in advancing the U.S. sleep testing services market.

For instance, in April 2025, Samsung Electronics Co., Ltd. partnered with Stanford Medicine to enhance solutions leveraging the OSA detection feature on the Galaxy Watch. Similarly, in March 2025, researchers at the Icahn School of Medicine, U.S., developed an AI model called patch foundational transformer for sleep (PFTSleep) to analyze brain waves, muscle activity, heart rate, and breathing to classify sleep stages more accurately and support future clinical diagnostics.

These advancements highlight the growing emphasis on technological innovation to address the nation’s sleep health crisis and improve long-term patient outcomes.

Europe market is estimated to generate a significant share of 23.6% in 2025 due to the strong presence of national sleep societies and government-supported awareness campaigns promoting increased diagnosis rates of sleep-related conditions. Untreated sleep apnea alone contributes to over €120 billion in annual healthcare and societal costs, highlighting the need for action.

Public education efforts, such as those by The Sleep Charity in the UK, are increasing recognition of sleep health and encouraging timely diagnosis and treatment. Parallelly, in March 2025, the European Sleep Research Society (ESRS) launched Sleep Awareness Month across Europe, promoting sleep health, supporting World Sleep Day activities, and highlighting the importance of sleep hygiene in children and adolescents.

At the policy level, EU initiatives like the Healthier Together program and the 2023 Mental Health Strategy provide frameworks to integrate sleep disorders into broader non-communicable disease (NCD) and mental health policies. With growing collaboration across stakeholders, Europe is well-positioned in sleep health innovation and service accessibility.

Asia Pacific market for sleep testing services is estimated to grow by 13.8% during the forecast period due to increasing healthcare investments and expanding diagnostic labs in countries such as China, South Korea, and India. Additionally, the rising prevalence of chronic diseases and growing demand for early disease detection are also fuelling market expansion.

Recent studies indicate a high prevalence of sleep disorders in Indian adults, with 37.4% affected by OSA, and 25.7% experiencing insomnia. Furthermore, an alarming 93% of the population experiences some form of sleep disorder or deprivation.

Launch of state-of-the-art “Sleep Lab” by Calcutta Medical Research Institute (CMRI) on World Sleep Day, March 2024, in Eastern India, highlights a growing focus on diagnosing and treating sleep disorders, particularly OSA and Sleep Disordered Breathing (SDB), among the Indian population.

Furthermore, CMRI’s initiative represents a vital step in strengthening regional sleep health infrastructure and improving patient outcomes through early detection and intervention, thus driving India's sleep testing services market.

Additionally, the Asia Pacific market is witnessing rapid growth in sleep testing, driven by innovative at-home diagnostics and digital health solutions. Recently in October 2025, Smartee Denti-Technology launched a clear aligner device called Smartee Sleep Aligner, to help manage obstructive sleep apnoea hypopnoea syndrome (OSAHS) and primary snoring (PS).

Earlier in 2024 June, Korea approved Soomirang, an abdominal-worn device for at-home sleep apnea detection via a smartphone app, while Beacon Biosignals partnered with Takeda in April to enhance at-home sleep monitoring for clinical trials using AI-powered EEG technology. These innovations are driving greater accessibility and precision in managing sleep health across the region.

The global sleep diagnostic services market is characterized by intense competition, driven by continuous innovation and strategic collaborations. Key players are focusing on developing advanced diagnostic technologies and expanding their geographic reach. Partnerships with healthcare providers and research institutions are enhancing product offerings and service quality.

The global sleep testing services market is projected to value at US$ 7.6 billion in 2025.

The growing prevalence of sleep disorders, increased awareness of sleep health, and advancements in diagnostic technologies drive the global market.

The global sleep testing services market is poised to witness a CAGR of 11.9% between 2025 and 2032.

Rising home-based diagnostics, AI-driven analysis, and increasing awareness of sleep disorders present lucrative opportunities.

Major service providers are active globally, including Circle Health Group, Koninklijke Philips N.V., ResMed, Sleep Dynamics, and others.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Diagnostic Services:

By Indication:

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author