ID: PMRREP2832| 185 Pages | 17 Jul 2025 | Format: PDF, Excel, PPT* | Healthcare

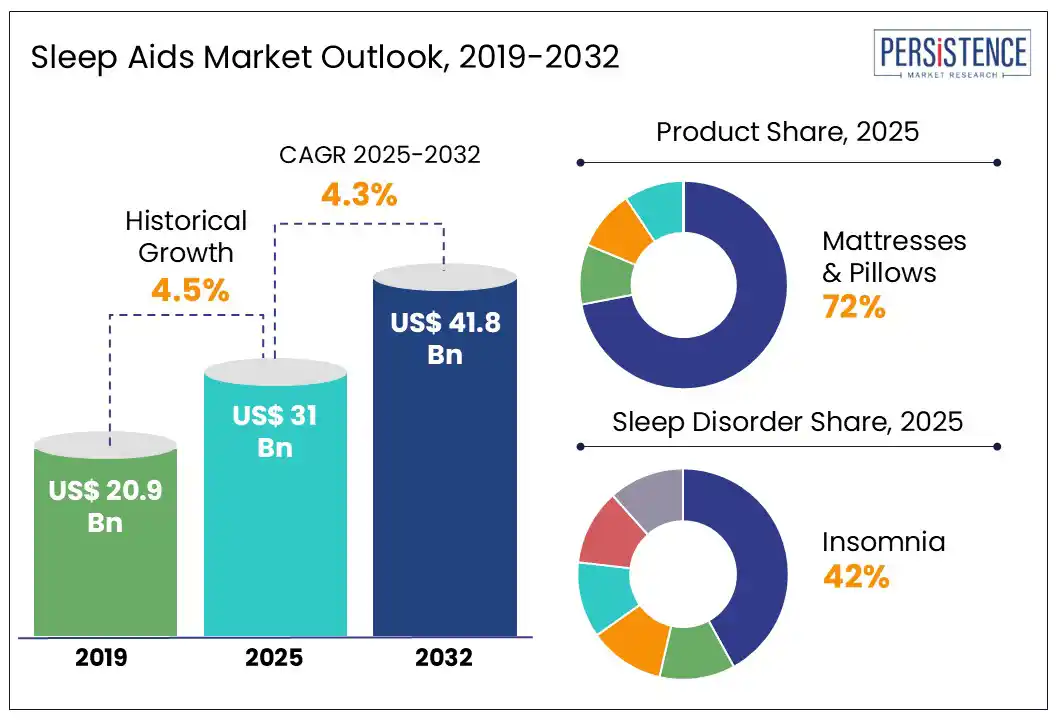

The global sleep aids market size is likely to be valued at US$31 Bn in 2025 and is estimated to reach US$41.8 Bn in 2032, growing at a CAGR of 4.3% during the forecast period 2025 - 2032.

Modern lifestyles, marked by stress, irregular schedules, and stimulants, contribute to poor sleep. Sleep aids such as prescription medications, over-the-counter drugs, and dietary supplements are commonly used to manage sleep disorders including insomnia. Prescription drugs are FDA-approved and often effective but may cause side effects or dependency. OTC aids, usually antihistamines, are widely available but not recommended for long-term use. Natural supplements such as melatonin are popular but less regulated and lack strong clinical evidence.

The sleep aids market growth is driven by increasing prevalence of sleep disorders due to rising stress levels, rising incidence of sleep apnea, restless leg syndrome, and obesity and the growing awareness of the importance of sleep for overall health.

While sleep aids can help with short-term sleep issues, they carry risks such as next-day drowsiness, confusion, abnormal behavior, and drug interactions, especially for older adults, pregnant individuals, and children. The bedding industry also plays a growing role in sleeping aid solutions.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Sleep Aids Market Size (2025E) |

US$ 31 Bn |

|

Market Value Forecast (2032F) |

US$ 41.8 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.5% |

Sleep disorders disrupt normal sleep patterns, impacting the overall health and quality of life. Causes can be genetic, environmental, psychological, and physiological. Insomnia is linked to sleep apnea, obesity, and circadian disorders. According to a National Library of Medicine study, insomnia affects ~30–35% of adults globally at some point, with 6–15% meeting clinical criteria. Women and older adults are more prone. As per a 2024 Science Direct study, 14.7% of people in Canada used prescription sleep medications, 28.7% used over-the-counter or natural sleep aids, and 9.7% used alcohol to help them sleep.

Sleep ability declines with age, and the National Sleep Foundation recommends minimum sleep durations for all age groups. Sleep disorders negatively impact the quality of life by causing daytime fatigue, cognitive impairment, mood disturbances, reduced productivity, and increased risk of chronic health conditions. Approximately 50–60% of the elderly suffer from sleep disorders including sleep apnea, restless legs syndrome, and REM sleep behavior disorder. Chronic sleep deprivation in older adults is linked to increased risks of neurodegenerative diseases such as Alzheimer’s and Parkinson’s. Sleep disturbance is a core symptom of the menopausal transition.

The sleep aids, specifically sleep medications, face significant restraints due to the associated side effects and dependency risks. Prescription drugs, such as benzodiazepines, Z-drugs, and antihistamines, can lead to tolerance, dependence, and withdrawal symptoms, with studies indicating that 20–50% of long-term users may experience withdrawal and 3–5% may become dependent. These drugs are also associated with cognitive impairments, including memory loss, reduced attention, and psychomotor slowing. The next-day drowsiness, dizziness, dry mouth, stomach discomfort, vivid dreams or nightmares and impaired coordination increase the risk of falls, motor vehicle accidents, and confusion.

Z-drugs have been linked to sleepwalking or eating while unconscious. Long-term use has also been associated with increased risks of mortality, cancer, and respiratory issues. Regulatory agencies such as the FDA and the American Geriatrics Society now recommend limiting these medications to short-term use, further restricting market growth. These concerns are contributing to a transition toward non-pharmacological treatments such as cognitive behavioral therapy for insomnia (CBT-i).

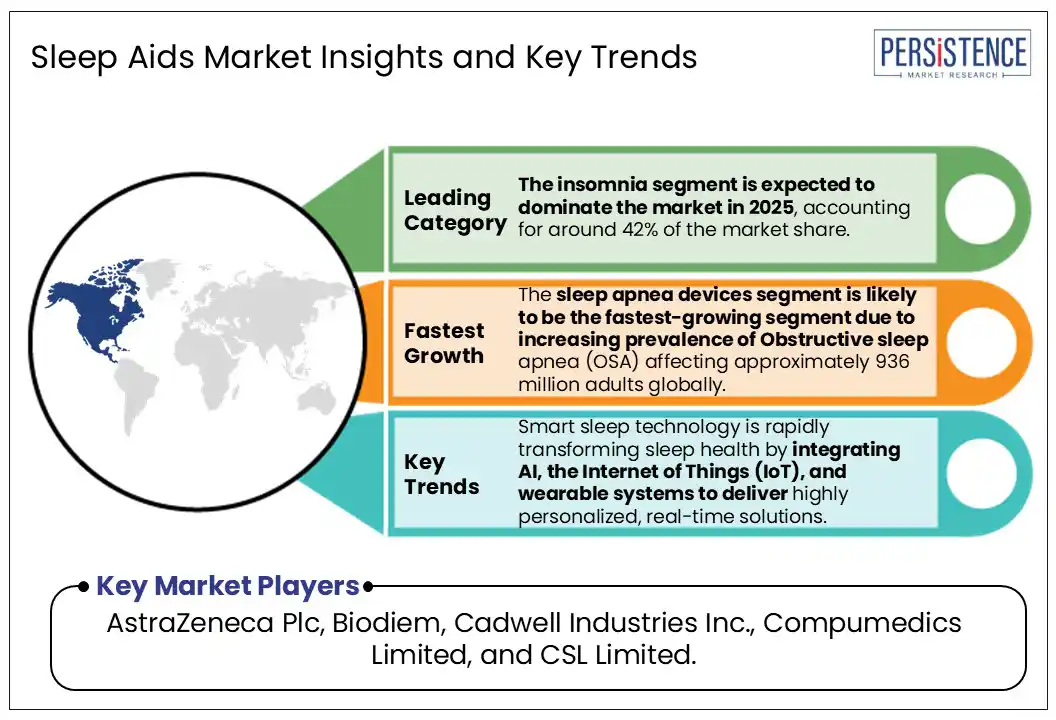

Smart sleep technology is rapidly transforming sleep health by integrating AI, the Internet of Things (IoT), and wearable systems to deliver highly personalized and real-time solutions. Advanced wearables such as Apollo Neuro’s SmartVibes use predictive AI to gently prevent mid-sleep wake-ups by calming the nervous system, while devices such as Masimo W1 Sport’s Sleep Halo track sleep stages and oxygen levels through machine learning and continuous pulse oximetry. Neurofeedback-based tools such as the Bia Smart Sleep Mask monitor brain waves and use audio stimuli to guide users into deep sleep. Contact-free sensors embedded in pillows and mattresses will gather sleep metrics without physical discomfort, offering real-time insights and making dynamic recommendations. These technologies enable sleep tracking, snore detection, oxygen saturation monitoring, and sleep stage analysis.

AI-enhanced beds and mattresses are transforming the sleep aids market. Products such as the DeRUCCI T11 Pro and QREM AI Smart Mattress use adaptive air chambers and AIoT algorithms to adjust support, regulate temperature, and detect the underlying health issues. The OptimizeME Smart Mattress has bio-AI-driven real-time incline control to counteract obstructive sleep apnea by adjusting posture while sleeping. CES-recognized innovations such as the ERA Smart Layer allow traditional beds to be retrofitted with AI capabilities for spinal alignment and pressure relief.

By product, the mattresses & pillows segment is expected to dominate the market with approximately 72% market share during the forecast period. Pillows and mattresses are leading as they directly impact the physical comfort and sleep posture. Unlike temporary aids such as medication or wearables, these products continuously support the body over the night, thereby reducing discomfort, pain, and pressure points that can disturb sleep. Smart mattresses and sleep monitors incorporate advanced sensors and AI algorithms to monitor sleep metrics including body movement, heart rate, and breathing patterns. Key features such as adjustable firmness, temperature regulation, built-in massage, and contactless biometric sensors further improve comfort and restfulness. Leading players including Sleep Number, Eight Sleep, Tempur Sealy International, Serta Simmons Bedding, Casper, and The Sleep Company are heavily investing in AI integration and IoT.

The sleep apnea devices segment is likely to be the fastest-growing segment over the forecast period. Obstructive sleep apnea (OSA) is a prevalent sleep disorder affecting approximately 936 million adults globally. A study conducted by Charles University in Prague found that OSA significantly increases mortality risks in diabetics. Sleep apnea treatments focus on keeping the airway open during sleep. Common sleep apnea devices include Continuous Positive Airway Pressure (CPAP) machines, BiPAP machines, oral appliances, and nasal EPAP devices. The CPAP machine delivers steady air through a mask to prevent airway collapse. Leading CPAP machine manufacturers include ResMed, Philips Respironics, Fisher & Paykel Healthcare, and Drive DeVilbiss Healthcare. Oral appliances such as mandibular advancement devices (MADs) and tongue-retaining devices, hypoglossal nerve stimulation (an implantable device that activates tongue muscles to keep the airway open), are also other devices.

By sleep disorder, the insomnia segment is expected to dominate the market in 2025, accounting for around 42% of the market share. Insomnia affects roughly 10–30% of adults at any given time, with about 6% suffering from chronic insomnia. Insomnia causes daytime fatigue, mood disturbances, impaired concentration, obesity, diabetes, cardiovascular disease, and depression. Causes include stress, anxiety, poor sleep habits, substance use, certain medications, and environmental disruptions. Older people, female gender, and individuals with irregular work shifts are prone to insomnia. Maintaining a consistent sleep schedule, a comfortable sleep environment, limiting stimulants and screen time before bed, and regular physical activity may reduce insomnia. People also adopt cognitive behavioral therapy for insomnia (CBT-I). Recent advances include FDA-approved drugs such as daridorexant and lemborexant that promote natural sleep without next-day grogginess.

The sleep apnea segment is projected to be the fastest-growing in the sleep aids market, driven by both rising global prevalence and innovative treatment advancements. Sleep apnea is a potentially serious sleep disorder in which breathing repeatedly stops and starts. Treatment options for OSA have advanced beyond traditional CPAP machines to include more personalized and less invasive solutions. FDA-approved tirzepatide, a GLP-1 receptor agonist, has shown a 63% reduction in apnea-hypopnea index by supporting weight loss. Inspire® Upper Airway Stimulation offers implantable and mask-free alternatives. eXciteOSA® and Oral Pressure Therapy (OPT) provide daytime and non-invasive treatment options. The epilepsy medication sulthiame has shown promise in improving oxygen levels and reducing apneic events.

North America is likely to dominate the market, accounting for a market share of 46% in 2025. The growing number of older adults, who are more susceptible to sleep disturbances, is contributing to increased demand for sleep aids. Consumers are increasingly seeking herbal supplements and non-prescription sleep aids, such as valerian root, chamomile, and melatonin, due to concerns over side effects and dependency. With high disposable incomes, consumers are willing to invest in premium sleep health solutions. Online platforms are becoming the preferred shopping channel for sleep aids. Supportive FDA approvals for digital therapeutics (Sleepio) and reimbursement for sleep-related treatments encourage both investment and adoption. Higher rates of obesity and diabetes in Mexico are contributing to the prevalence of OSA, boosting the CPAP demand.

The U.S. is experiencing significant market growth within North America. The CDC reports that about one in three adults in the U.S. not sleeping regularly. The FDA approved daridorexant (Quviviq) and lemborexant (Dayvigo) as safer alternatives to traditional sleep medications. The U.S. is experiencing significant growth in smart sleep technology with AI-powered mattresses (Sleep Number, Eight Sleep), sleep trackers, neuromodulation wearables, and digital CBT-I apps.

Asia Pacific is estimated to witness fastest-growth over the forecast period. Increasing urbanization, digital health adoption, and a rising focus on personalized sleep solutions in countries including China, India, Japan, and South Korea are major drivers. Pharmaceutical treatments for insomnia (benzodiazepines) and orexin-receptor antagonists (lemborexant and daridorexant) and non-pharmacological (CBT-I apps and OTC herbal remedies) are highly popular in the region., The sleep-tech device sector is expanding, with wearable trackers from brands such as Xiaomi and Huawei, specialized headbands and rings, and smart beds. Factors such as work stress, long commutes, extensive screen time, and environmental issues such as noise, light pollution, and rising nighttime temperatures contribute to deteriorating sleep quality. Over 20% of Japanese working adults suffer from insomnia, while South Koreans face high insomnia rates linked to mental health pressures and cultural stressors.

China's sleep aids market is experiencing significant growth, driven by increasing awareness of sleep disorders, advancements in sleep technology, and evolving consumer preferences. This expansion is fueled by a rising middle class, greater disposable income, and a liking for natural & herbal sleep aids. According to 2025 China Daily, around 60 million individuals in China suffer from sleep-related issues, including chronic insomnia and occasional disturbances. Melatonin supplements are popular in China and can be purchased over-the-counter in pharmacies and online platforms such as Taobao. Companies such as Xilinmen investing in R&D to create advanced sleep solutions, including smart mattresses and other sleep-related products.

Europe is likely to experience steady growth over the forecast period. There is a growing preference for natural and herbal sleep aids, with products containing ingredients such as chamomile, lavender, and valerian root. The Somnox 3 Sleep Robot Pillow, introduced in 2024, integrated AI-enhanced breathing guidance and soothing sounds, offering a non-medical sleep aid. Many European countries place a strong emphasis on work-life balance and overall well-being, driving individuals to seek solutions that enhance sleep quality and contribute to a healthier lifestyle. GDPR and MDR/IVDR regulations present hurdles for AI/medical sleep devices, though they also ensure quality and patient safety. The European Academy of Neurology is running a multi-country study (2023–2025) on socioeconomic and health burdens of insomnia and daytime sleepiness.

The market in Germany is witnessing significant growth within Europe. Wearables, under-mattress monitors, and smart mattresses / pillows are gaining traction in Germany, with players including Philips and Fitbit. Aging population, increasing stress levels, and a strong preference for natural and herbal sleep aids also act as major drivers. Germany features exclusive innovations such as Beurer’s SleepLine devices, and SleepHero’s anti-snoring products, reflecting the country’s emphasis on holistic sleep solutions. Germany's advanced healthcare infrastructure and regulatory environment further contribute to consumer trust and market expansion.

The global sleep aids market is highly competitive with global and domestic players offering a wide range of products and competing for a higher market share. Companies are investing in R&D and adopting growth strategies such as product innovations, strategic partnerships, and acquisitions.

The global market is projected to be valued at US$ 31 bn in 2025.

Market growth is driven by increasing prevalence of sleep disorders due to rising stress levels, growing incidence of sleep apnea, restless leg syndrome, and obesity, along with the rising awareness of the importance of sleep for overall health.

The market is poised to witness a CAGR of 4.3% from 2025 to 2032.

Smart sleep technology is rapidly transforming sleep health by integrating AI, the Internet of Things (IoT), and wearable systems to deliver highly personalized and real-time solutions.

Major players in the Global Sleep Aids Market include AstraZeneca Plc, Biodiem, Cadwell Industries Inc., Compumedics Limited, and CSL Limited.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product

By Sleep Disorder

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author