ID: PMRREP33097| 200 Pages | 9 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

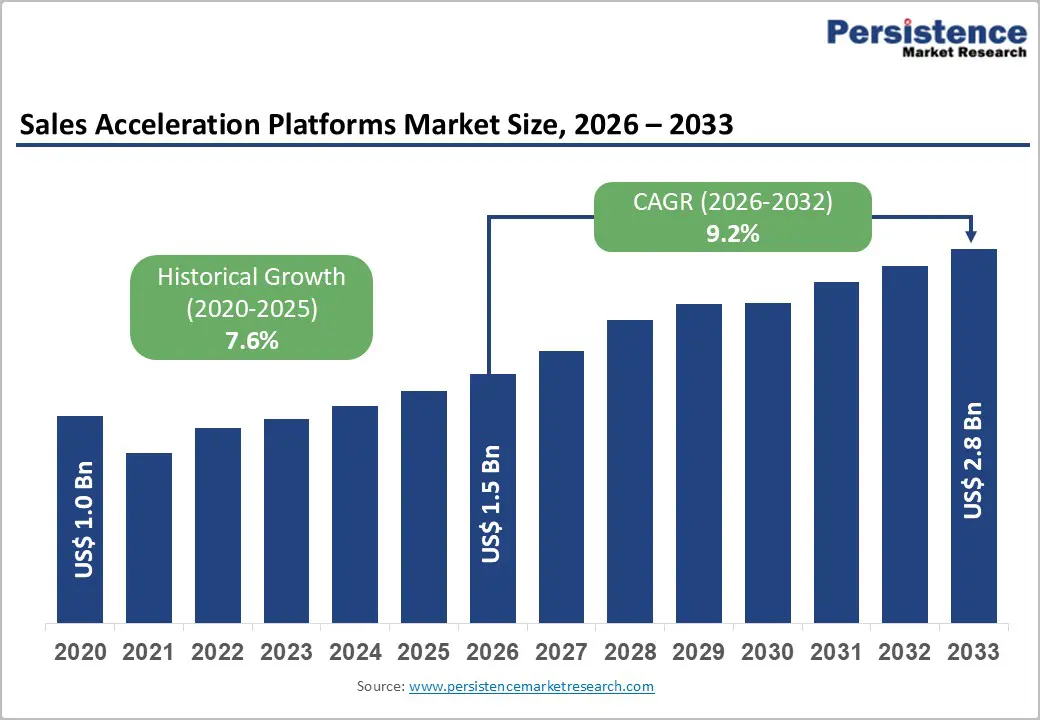

The global sales acceleration platforms market size is likely to be valued at US$ 1.5 billion in 2026 and is projected to reach US$ 2.8 billion by 2033, growing at a CAGR of 9.2% between 2026 and 2033.

The market is experiencing robust expansion driven by accelerating adoption of cloud-based SaaS solutions, rising demand for AI-powered sales engagement tools, and the rapid digital transformation of sales processes across enterprises globally.

| Key Insights | Details |

|---|---|

| Sales Acceleration Platform Market Size (2026E) | US$ 1.5 Bn |

| Market Value Forecast (2033F) | US$ 2.8 Bn |

| Projected Growth CAGR(2026 - 2033) | 9.2% |

| Historical Market Growth (2020 - 2025) | 7.6% |

The widespread shift toward remote and hybrid work models has fundamentally transformed sales team management requirements, driving substantial adoption of sales acceleration platforms designed to coordinate geographically dispersed sales professionals. According to industry data, approximately 39% of companies now operate fully remote environments, while 23% maintain hybrid work arrangements, creating unprecedented demand for integrated digital platforms enabling seamless coordination, real-time performance tracking, and synchronized customer engagement across time zones and locations.

Sales acceleration platforms address critical operational gaps by centralizing customer communications, automating administrative workflows, and providing unified dashboards for pipeline visibility, enabling sales managers to maintain team productivity and performance metrics despite physical separation. Companies implementing these solutions report substantial improvements in sales cycle acceleration, with teams completing complex sales processes up to 50% faster than traditional methods, while reducing reliance on physical office infrastructure and enabling access to talent pools unconstrained by geographic limitations.

Artificial intelligence integration within sales acceleration platforms represents a transformative growth catalyst, enabling sales teams to leverage machine learning algorithms for lead scoring, predictive forecasting, and autonomous engagement automation. Research demonstrates that organizations using AI-powered sales tools achieve measurable performance improvements: 75% of companies using predictive analytics report significant sales performance gains, while those implementing AI-driven personalization strategies achieve average sales conversion increases of 30% compared to traditional engagement methods.

Leading platforms, including Salesforce with Einstein AI, Outreach, and SalesLoft, are embedding sophisticated machine learning capabilities, enabling teams to analyze customer behavior patterns, recommend optimal engagement sequences, and identify high-probability scenarios for deal closure with unprecedented accuracy. McKinsey research validates these gains, documenting that organizations investing in AI across sales processes achieve 13-15% revenue growth and 10-20% improvements in sales return-on-investment, compelling widespread platform adoption among enterprises seeking competitive advantage through data-driven sales excellence.

Despite strong market opportunities, adoption barriers persist as organizations face substantial implementation complexity and escalating total cost of ownership associated with sales acceleration platform deployment. Integration projects frequently require external consulting services to connect sales acceleration platforms with existing ERP systems, financial management applications, and customer service infrastructure, often inflating project costs and extending deployment timelines beyond initial budgets.

Small and medium-sized enterprises face particular challenges, as upfront services and customization expenses frequently rival annual license fees, creating significant procurement friction that impedes adoption even among organizations eager to implement sales automation. Extended renewal cycles and compressed deal sizes reflect procurement teams' heightened scrutiny of payback periods, while implementation timelines stretching from months to years create financial uncertainty that deters investment, particularly among resource-constrained mid-market organizations evaluating platform alternatives.

The rapid integration of artificial intelligence (AI) and advanced analytics into sales acceleration platforms represents a major growth opportunity for the global market. Sales organizations are increasingly shifting from intuition-led selling to data-driven decision-making, creating strong demand for platforms that can analyze large volumes of customer interaction data, pipeline activity, and historical deal outcomes to deliver predictive insights. AI-powered features such as predictive lead scoring, deal risk identification, next-best-action recommendations, and real-time sales coaching are enabling sales teams to prioritize high-probability opportunities and shorten sales cycles.

As enterprises face rising customer acquisition costs and longer buying journeys, especially in B2B environments, the ability to improve win rates and forecast accuracy has become a strategic imperative. Sales acceleration platforms are uniquely positioned to capitalize on this shift by embedding machine learning models into everyday sales workflows, including email engagement, call analysis, meeting intelligence, and CRM interactions. The growing adoption of conversation intelligence, where AI analyzes voice, video, and text interactions to extract buyer intent, objections, and sentiment, further strengthens platform value.

Generative AI capabilities are opening new avenues, such as automated email drafting, personalized sales messaging at scale, and dynamic content recommendations aligned to buyer personas. This transformation not only increases platform stickiness and subscription value but also enables vendors to upsell premium AI modules, driving higher average revenue per user and long-term market expansion.

The increasing digitalization of small and medium-sized enterprises (SMEs), particularly in emerging markets, presents a significant untapped opportunity for the global sales acceleration platform market. Historically, advanced sales acceleration and analytics tools were primarily adopted by large enterprises due to high costs, complex implementations, and limited scalability. The rise of cloud-based, subscription-driven software-as-a-service (SaaS) models has dramatically lowered entry barriers, making sophisticated sales acceleration capabilities accessible to smaller organizations.

SMEs are under growing pressure to compete with digitally mature players, improve sales productivity with limited resources, and manage omnichannel customer engagement, challenges that sales acceleration platforms are well-suited to address. In fast-growing regions such as Asia-Pacific, Latin America, the Middle East, and Africa, expanding startup ecosystems, growing B2B services sectors, and increasing internet and smartphone penetration are accelerating demand for modern sales tools. Sales acceleration platforms that offer modular pricing, rapid deployment, mobile-first interfaces, and native integrations with popular CRM and communication tools can gain strong traction in these markets.

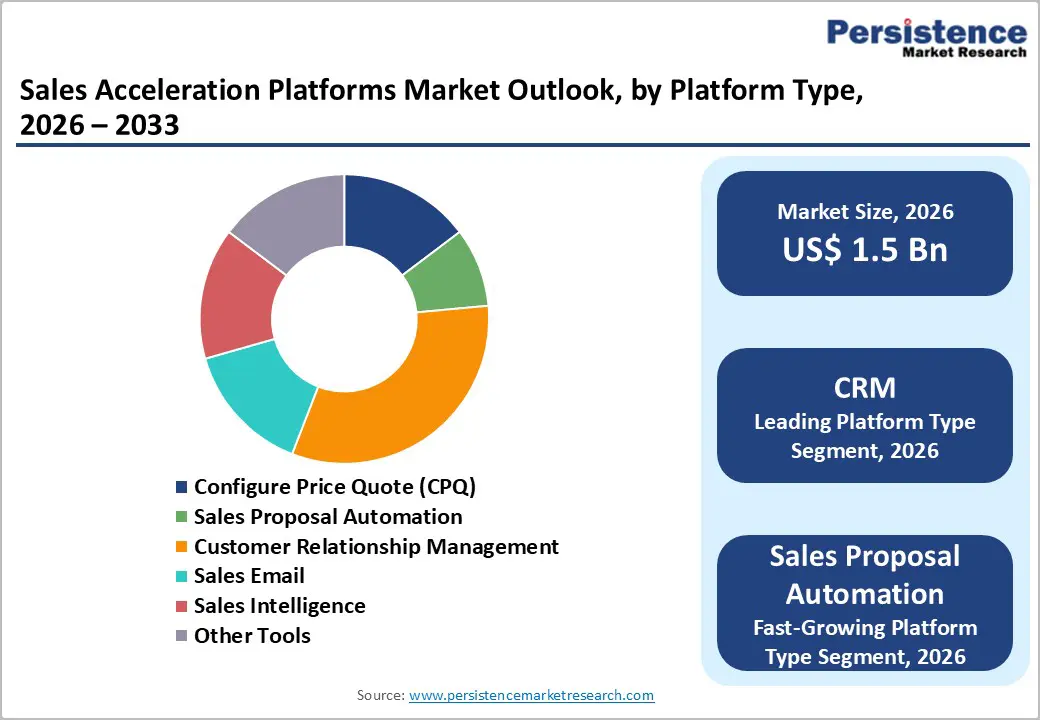

Customer relationship management (CRM) systems represent the dominant platform type, capturing approximately 38% market share and maintaining market leadership through comprehensive integration capabilities that connect sales, marketing, and customer service functions within a unified ecosystem. CRM platforms' sustained leadership reflects their foundational role in sales operations, providing customer data repositories, pipeline management capabilities, and activity-tracking functionality that sales-acceleration features depend on for effective implementation.

The CRM segment's strength is further reinforced by major vendors' substantial R&D investments: Salesforce announced enhanced Einstein AI capabilities, HubSpot expanded artificial intelligence features across marketing and sales functions, and Microsoft integrated Dynamics 365 with Azure AI services, ensuring continued innovation and competitive functionality across platform offerings.

Cloud-based SaaS deployment holds a dominant market position, with approximately 72.6% market share, driven by enterprises' compelling requirements for real-time data synchronization, API integrations supporting omnichannel sales operations, and scalable infrastructure to accommodate global sales team expansion. Cloud-based deployment reduces capital expenditure requirements, eliminates IT maintenance burdens, and enables rapid feature deployment and security updates, compelling even organizations with on-premise technology preferences to adopt cloud-based sales acceleration solutions.

The on-premise segment, while declining in relative market share, remains relevant in highly regulated industries, including military contractors, aerospace manufacturers, and government agencies prioritizing data sovereignty and requiring isolated infrastructure, creating a sustainable niche opportunity for vendors supporting on-premise or hybrid deployment models alongside mainstream cloud offerings.

Large enterprises maintain market revenue dominance, accounting for 58.3% of 2026 software market sales spending, reflecting their substantial budgets, complex sales process requirements, and strategic imperative to optimize sales effectiveness across global organizations. Large enterprises' purchasing sophistication extends implementation timelines, creates multi-year commitment requirements with contractual service-level guarantees, and frequently requires comprehensive customization to address unique industry-specific sales processes, thereby supporting vendor revenue growth through premium pricing strategies. The SME market segment is experiencing a 12.4% CAGR, significantly exceeding enterprise spending growth rates, demonstrating market bifurcation and creating distinct growth trajectories and business model requirements within single product categories.

Information Technology & IT-enabled Services captures approximately 29% market share as the leading vertical segment, reflecting IT service providers' advanced technology adoption capabilities, competitive pressure to optimize sales efficiency, and the requirement to manage complex solution sales involving multiple decision-makers and extended evaluation cycles.

Retail & E-commerce exhibits the fastest growth trajectory, expanding at 9.5% CAGR, fueled by omnichannel sales requirements, dynamic pricing optimization, and personalized customer engagement necessitated by competitive market dynamics and consumer expectations for tailored shopping experiences.

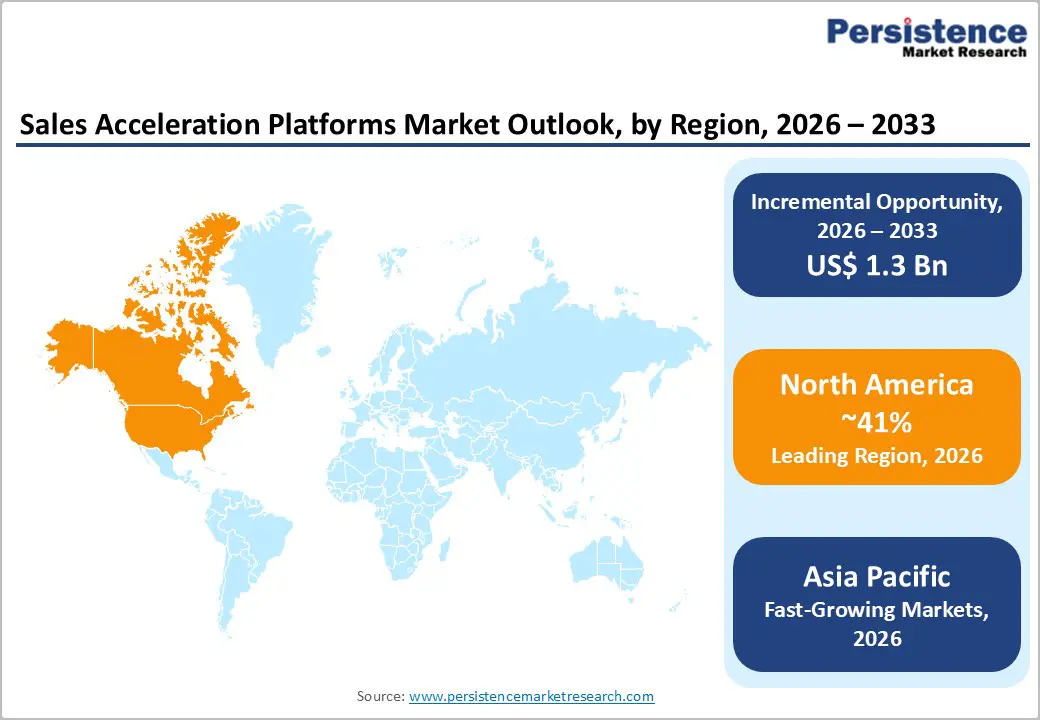

North America maintains a dominant regional position with 38.1% global revenue share, supported by mature enterprise adoption, a robust SaaS ecosystem, and the presence of leading technology companies requiring sophisticated sales infrastructure. The United States is a major contributor to the growth of the North American market, driven by widespread adoption of cloud-based solutions and enterprise implementations of AI-powered sales engagement capabilities across Fortune 500 organizations and mid-market technology companies.

North American organizations are pioneering advanced artificial intelligence integration within sales operations, with companies implementing Outreach, SalesLoft, and Salesforce reporting a 15% increase in qualified pipeline and substantial improvements in sales forecasting accuracy through machine learning algorithms that analyze customer engagement patterns. Regulatory frameworks that support business innovation, favorable tax policies that encourage technology investment, and a highly competitive business environment that compels organizations to adopt productivity-enhancing tools combine to support continued North American market leadership.

Europe demonstrates the fastest regional growth trajectory among mature markets, driven by GDPR compliance requirements compelling organizations to adopt data privacy-preserving sales engagement solutions, increasing digitalization across financial services and manufacturing sectors, and government digital transformation initiatives supporting software adoption. Germany and the United Kingdom lead European adoption, with Germany supporting the web-based deployment segment, capturing 15.8% regional share and a 6.0% CAGR, reflecting preference for on-premise flexibility and data localization capabilities that address regulatory requirements.

European regulation, including GDPR, the directive on the accessibility of websites and mobile applications, and emerging AI Act provisions, are compelling vendors to develop privacy-preserving, explainable artificial intelligence capabilities demonstrating compliance with stringent European regulatory requirements. This regulatory environment creates distinct European market dynamics requiring specialized product configurations and compliance certifications, supporting the growth of vendors demonstrating exceptional regulatory expertise and creating barriers to entry for vendors unable to navigate European regulatory complexity.

Asia Pacific exhibits the fastest absolute growth rate, with a 12.1% CAGR through 2033, driven by rapid digital transformation initiatives across emerging markets, the explosive growth of FinTech ecosystems, and expanding e-commerce adoption, which create demand for sophisticated sales engagement capabilities. China, India, Japan, and South Korea lead regional adoption, with India demonstrating particularly strong growth momentum, supported by 89% of sales teams using or experimenting with AI, government digital infrastructure investment, and a growing startup ecosystem that requires sales acceleration capabilities, enabling resource-constrained organizations to compete with established market incumbents.

Asia Pacific BFSI digital transformation presents a particular opportunity, with institutions across India, China, Singapore, and Hong Kong investing substantially in open banking APIs, fintech partnerships, and customer engagement modernization, requiring integrated sales acceleration capabilities to address complex financial product selling. The region's young demographic with strong technology affinity, mobile-first digital commerce adoption, and rapidly expanding middle-class consumer base creates sustained demand for advanced sales solutions enabling personalized customer engagement at scale across distributed sales organizations.

The sales acceleration platforms market exhibits moderate consolidation, with leading vendors including Salesforce, HubSpot, Microsoft Corporation, Outreach Corporation, and SalesLoft Inc. collectively controlling approximately 55-60% of global deployment footprint, indicating competitive concentration around top-tier providers offering comprehensive platform ecosystems.

Emerging competitive dynamics increasingly favor vendors offering AI-native architectures, with specialists such as Clari Inc. and ZoomInfo Technologies gaining market share through focused innovation in revenue intelligence and deal management capabilities, challenging traditional CRM vendors with superior functionality that addresses specific sales leaders' requirements.

Differentiation increasingly focuses on AI sophistication, industry-specific vertical solutions, integration depth with complementary business applications, and the ability to balance feature richness with user experience simplicity, attracting diverse customer segments. Market consolidation trends, including Apttus' acquisition by Syntellect and Upload Software's expansion through strategic partnerships, reflect ongoing industry consolidation, with larger vendors acquiring specialized capabilities and customer bases to strengthen their competitive positioning.

The global sales acceleration platforms market is projected to expand from US$ 1.5 billion in 2026 to US$ 2.8 billion by 2033, representing substantial growth opportunity.

Remote workforce management, artificial intelligence integration enabling predictive analytics and autonomous engagement automation, digital transformation initiatives across enterprises, and critical operational requirements for distributed sales team coordination represent primary market growth catalysts.

Customer Relationship Management (CRM) systems maintain dominant market position with approximately 38% share, reflecting their foundational importance in integrating sales, marketing, and customer service functions.

North America maintains dominant regional position with 41% global market share, driven by mature enterprise adoption, presence of technology innovation leaders, and SaaS ecosystem development.

Small and Medium-sized Enterprises (SMEs) represent the most substantial market opportunity, driven by product-led growth strategies and cloud-based deployment options dramatically reducing implementation barriers and democratizing access to enterprise-grade sales capabilities.

Salesforce, HubSpot Inc., Outreach Corporation, SalesLoft Inc., ZoomInfo Technologies Inc., Clari Inc., and Microsoft Corporation maintain dominant competitive positions through extensive customer bases, substantial R&D investments in artificial intelligence capabilities, and strategic expansion into emerging verticals and geographic markets.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Platform Type

By Deployment Mode

By Organization Size

By Industrys

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author