ID: PMRREP26182| 192 Pages | 5 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

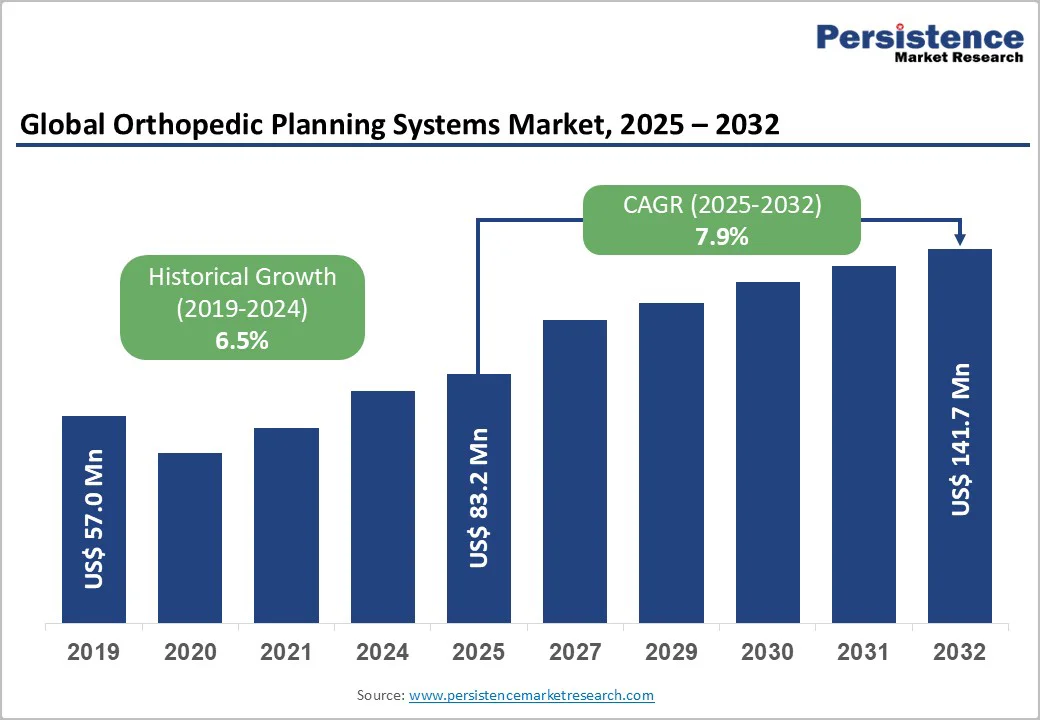

The global orthopedic planning systems market size is valued at US$ 83.2 million in 2025 and projected to reach US$ 141.7 million by 2032. The market is projected to record a CAGR of 7.9% during the forecast period from 2025 to 2032.

Orthopaedic planning systems, as the name suggests, include 3D printed modelling of the physical parts of a patient’s body. These systems play an important role in preoperative preparation for a surgical procedure, in which a 3D insert or a patient-specific prosthesis is created and inserted during orthopedic surgery.

The creation of patient-specific implants using 3D printing innovation avoids the uneasiness that arises from size mismatch and variations in a person's life structure.

| Key Insights | Details |

|---|---|

| Orthopedic Planning Systems Market Size (2025E) | US$ 83.2 Mn |

| Market Value Forecast (2032F) | US$ 141.7 Mn |

| Projected Growth (CAGR 2025 to 2032) | 7.9% |

| Historical Market Growth (CAGR 2019 to 2024) | 6.5% |

Advances in 3D pre-surgical planning technology are emerging as a key driver for the orthopedic planning systems market. Digital planning solutions, including 3D modeling, simulation, and virtual templating, enable surgeons to customize prostheses and implants to each patient’s anatomy accurately.

This precision reduces intraoperative errors, shortens operation times, and minimizes postoperative complications, resulting in faster patient recovery and improved surgical outcomes. Medical literature indicates that over 60% of orthopedic procedures now increasingly incorporate digital planning tools, a trend expected to strengthen as awareness of precision medicine grows.

The rising prevalence of degenerative musculoskeletal disorders, such as osteoarthritis, rheumatoid arthritis, and osteoporosis-related fractures, is driving demand for orthopedic interventions globally. Additionally, aging populations and a surge in sports- and trauma-related injuries are contributing to higher volumes of joint replacement and orthopedic oncology surgeries.

Expansion of hospital networks and ambulatory surgical centers equipped with advanced planning software in regions such as North America and Asia Pacific further supports adoption. Collectively, technological advancements in preoperative planning and the increasing need for orthopedic care are fueling sustained growth in the orthopedic planning systems market.

Computer-assisted Orthopedic Surgery (CAOS) is an innovative approach that utilizes robotic devices to help surgeons by creating virtual images of substitute joints, thereby increasing accuracy during surgical procedures.

CAOS utilizes real pictures of the joint obtained from X-rays/fluoroscopy, ultrasound, or CT scans, and makes virtual pictures of the affected joint. Specialists use PC-generated data and images to precisely and reproducibly reconstruct joints and limbs.

Although beneficial, these systems come at a very high cost, thereby increasing the overall cost of a surgical procedure, which may be why patients opt out, and can be a significant restraining market factor over the forecast period.

Additionally, the high cost of 3D printing materials further restrains the growth of demand for orthopedic planning equipment. 3D printing technologies are used to develop patient-specific model organs from patient medical imaging. These models utilize materials such as aluminum AlSi7Mg0.6 and stainless steel 316L, utilized in SLM and DMLS innovations, which can cost many dollars per kilo/pound.

The cost of 3D printing materials generally goes higher depending on how specialized or valuable the material is, especially after adding material cost with additional system completion and coordination costs. This high cost, along with the high cost of online 3D printing services, may hamper growth in the orthopedic planning systems market over the forecast period.

The coming years are set to offer several lucrative opportunities for manufacturers of orthopedic planning systems worldwide. Availability of orthopedic software, such as cloud-based solutions and their use in mobile platforms, will drive demand for orthopedic planning systems.

The ability to share information easily and securely is a critical parameter for improving product demand and sales. Advancements in software, especially mobiles and the Internet of Things (IoT) device,s will help in rapid development and innovation, thereby responding to the demands placed by rapidly evolving new technologies in healthcare IT systems.

Cloud services also enable easy remote access to applications and data via the Internet, using wireless and wired systems. There has been constant innovation and advancement happening in digital platforms in the healthcare sector. This has benefited many surgical procedures, enabling them to be carried out efficiently.

Even healthcare professionals are constantly learning to develop new techniques and approaches to shift from traditional methods to technological methods in delivering health services. Cloud-based services and technologies have brought in hassle-free applications for healthcare, such as maintaining electronic medical records, a patient portal, data analytics, and telemedicine.

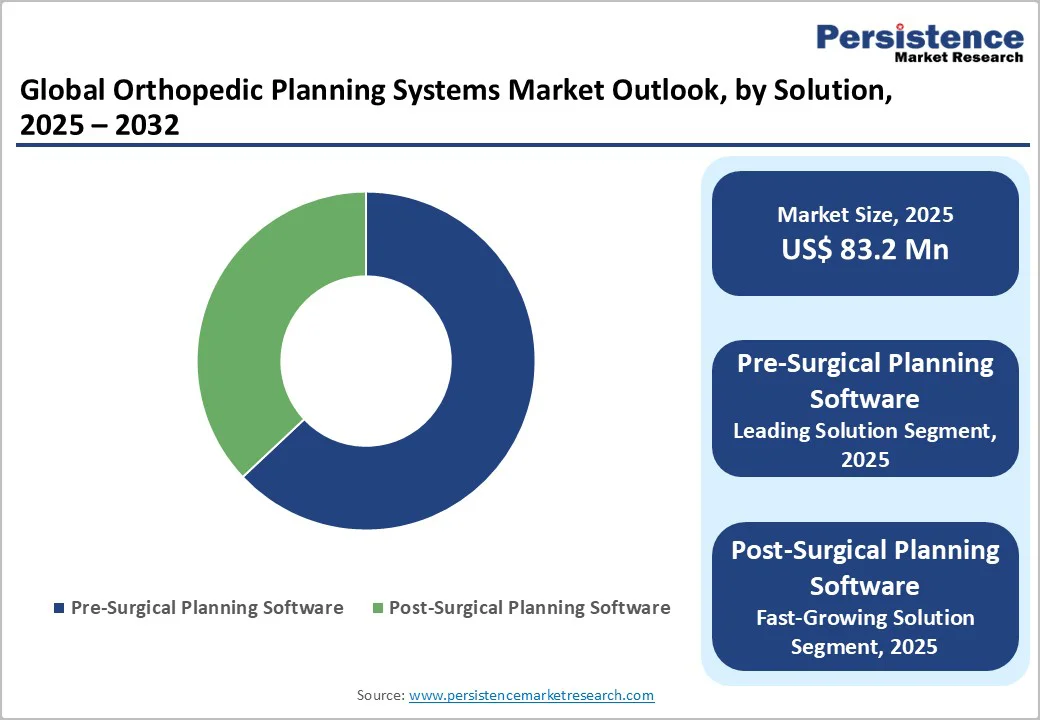

Pre-surgical planning software holds a dominant position in the global orthopedic planning systems market, accounting for approximately 63% of the solution segment in 2024. Its leadership is attributed to its essential role in guiding surgeons through complex procedures, enabling precise evaluation of anatomical structures and preoperative customization of implants.

Advanced 3D modeling and simulation tools enhance surgical accuracy, reduce intraoperative risks, and improve patient outcomes. Hospitals, trauma centers, and specialized orthopedic facilities are increasingly integrating pre-surgical planning software into their standard workflows to streamline procedure planning, optimize implant selection, and facilitate communication among surgical teams.

In contrast, post-surgical planning software is emerging as the fastest-growing segment. These solutions enable monitoring of patient recovery, assessment of implant positioning, and analysis of functional outcomes.

Integration with imaging systems and electronic health records supports data-driven postoperative care, improving rehabilitation protocols and long-term patient management. Rising emphasis on personalized follow-up and outcome tracking is driving rapid adoption of post-surgical planning solutions, creating new growth opportunities for market players.

Joint replacement continues to dominate the orthopedic planning systems market, capturing the largest share due to the high prevalence of hip, knee, and shoulder replacement procedures globally.

The increasing incidence of osteoarthritis, rheumatoid arthritis, and trauma-related joint damage is driving demand for precise preoperative planning to ensure accurate implant positioning, alignment, and long-term durability. Advanced orthopedic planning software enables surgeons to simulate procedures, select optimal implant sizes, and customize surgical approaches for individual patients, reducing intraoperative errors and improving clinical outcomes.

The growing trend toward minimally invasive and patient-specific joint replacement procedures further supports the adoption of digital planning tools. Hospitals, orthopedic centers, and ambulatory surgical facilities are increasingly investing in software solutions that integrate with imaging systems and navigation technologies, enhancing surgical efficiency.

Rising awareness of the benefits of preoperative planning among clinicians and patients is also fueling demand, making joint replacement the leading application segment and a critical driver of growth in the global orthopedic planning systems market.

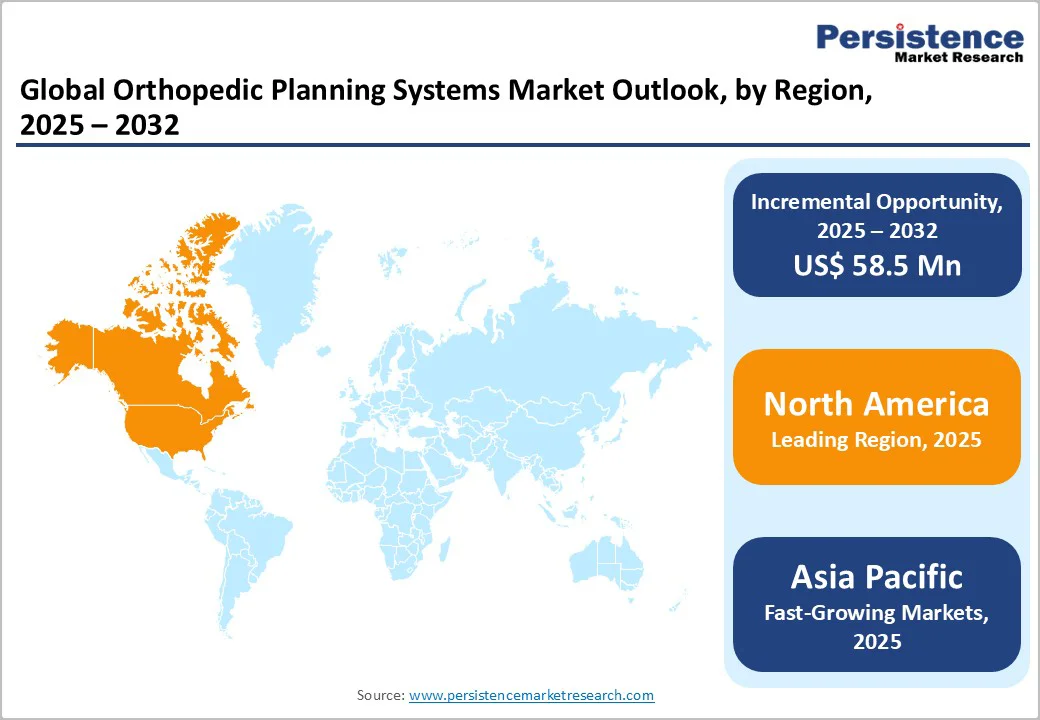

North America leads the orthopedic planning systems market, with the U.S. accounting for approximately 93% of the regional share. This dominance is driven by high healthcare expenditure, widespread digital infrastructure, and early adoption of advanced technologies in surgical care.

The integration of artificial intelligence (AI) and robotics in orthopedic procedures is a key growth factor, enabling surgeons to predict patient outcomes, optimize implant positioning, and enhance surgical precision. These technologies support personalized treatment planning, reduce intraoperative errors, and improve postoperative recovery.

Favorable regulatory frameworks from the U.S. Food and Drug Administration (FDA) and supportive reimbursement policies further accelerate the adoption of AI- and robot-assisted planning systems. Collaborations between healthcare providers, technology developers, and research institutions are fostering continuous innovation, allowing orthopedic planning software to evolve rapidly with improved usability and analytics.

Additionally, increasing awareness of precision medicine and digital surgery tools among hospitals, trauma centers, and ambulatory surgical facilities is driving further market expansion, reinforcing North America’s position as a global leader in adoption of orthopedic planning systems.

Asia Pacific is the fastest-growing region in the orthopedic planning systems market, driven by rising healthcare investments in China, India, Japan, and ASEAN countries. The region is seeing increased adoption of digital health solutions as hospitals and surgical centers aim to improve precision in orthopedic procedures.

The rising prevalence of lifestyle-related musculoskeletal disorders, including osteoarthritis, rheumatoid arthritis, and sports injuries, is contributing to higher demand for pre-surgical planning tools.

Local manufacturing capabilities and cost-effective production provide affordable access to advanced orthopedic planning systems, encouraging adoption in both urban and emerging healthcare markets. Government initiatives to strengthen trauma care infrastructure, expand hospital networks, and improve access to orthopedic services further support market growth.

Additionally, training programs and awareness campaigns on the benefits of digital preoperative planning are enhancing acceptance among clinicians. Collectively, these factors create a favorable environment for orthopedic planning system deployment, positioning the Asia Pacific as a high-growth market with significant expansion potential over the forecast period.

The global orthopedic planning systems market is moderately concentrated with a few key players dominating global revenue shares. Leading companies including Formus Labs Ltd, EOS imaging, Brainlab AG, Sectra AB, Stryker, Materialise, Zimmer Biomet, and Corin Group focus on innovation-driven growth strategies emphasizing cloud-based software, AI integration, and user-friendly interfaces.

Strategic partnerships with hospitals and technology providers, enhanced R&D investments, and geographic expansion are the main competitive approaches. Emerging business models involve subscription-based licensing and continuous software upgrades, reflecting a shift towards service-oriented offerings.

The global orthopedic planning systems market is projected to be valued at US$ 83.2 Mn in 2025.

Key drivers include advances in 3D pre-surgical planning technologies enhancing surgical outcomes and rising prevalence of musculoskeletal diseases increasing orthopedic surgeries.

The global orthopedic planning systems market is poised to witness a CAGR of 7.9% between 2025 and 2032.

Growing adoption of AI and cloud-based orthopedic planning software enabling real-time collaboration and integration with robotic surgery presents significant growth potential.

Leading companies include Formus Labs Ltd, EOS imaging, Brainlab AG, Sectra AB, Stryker, Materialise, Zimmer Biomet, and Corin Group.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn and Volume (if Available) |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Solution

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author