- Executive Summary

- Global IoT Analytics Market Snapshot 2026 and 2033

- Market Opportunity Assessment, 2026-2033, US$ Bn

- Key Market Trends

- Industry Developments and Key Market Events

- Demand Side and Supply Side Analysis

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definitions

- Value Chain Analysis

- Macro-Economic Factors

- Global GDP Outlook

- Global IT Spending Overview

- Global Energy & Utilities Industry Overview

- Forecast Factors – Relevance and Impact

- COVID-19 Impact Assessment

- PESTLE Analysis

- Porter's Five Forces Analysis

- Geopolitical Tensions: Market Impact

- Regulatory and Technology Landscape

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Trends

- Price Trend Analysis, 2020 – 2033

- Region-wise Price Analysis

- Price by Segments

- Price Impact Factors

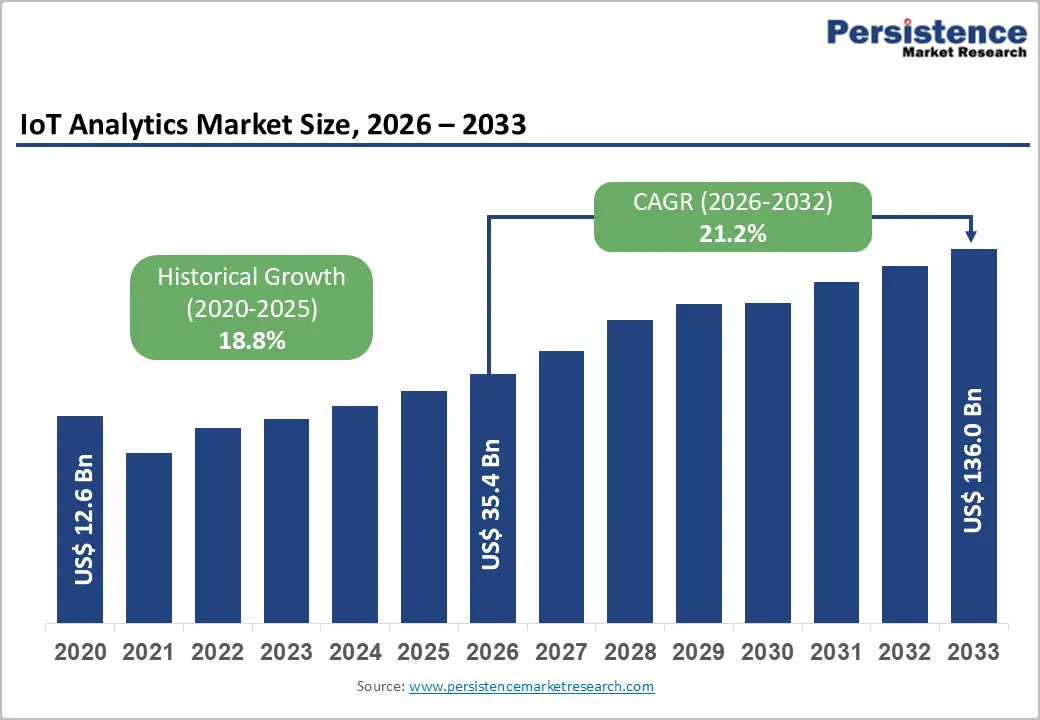

- Global IoT Analytics Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

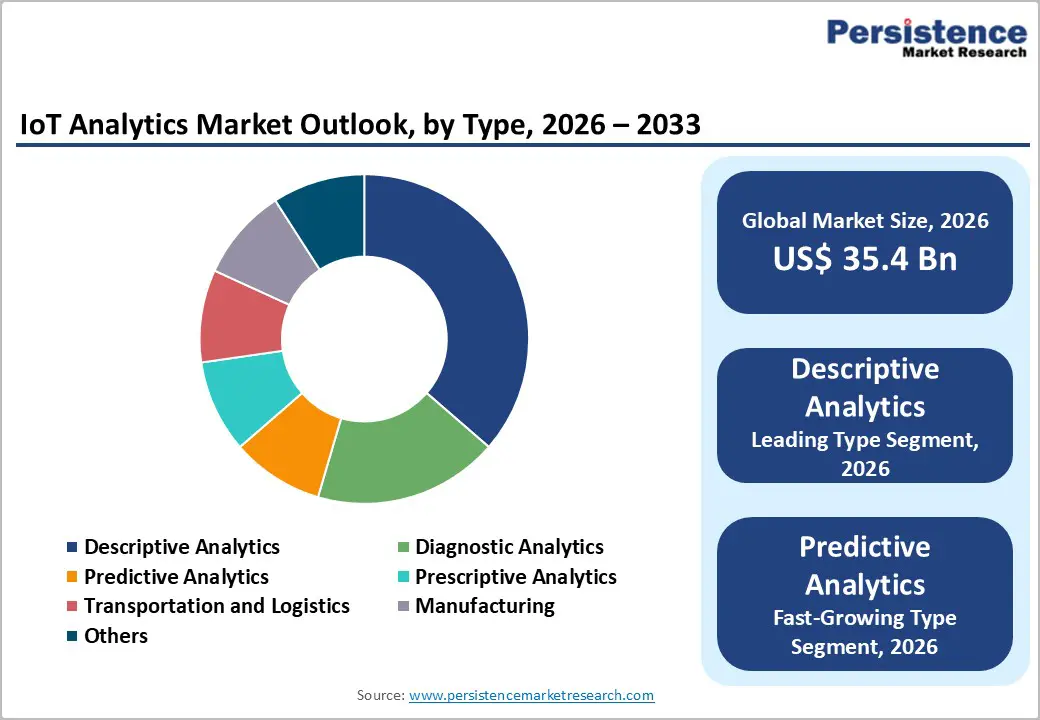

- Global IoT Analytics Market Outlook: Type

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by Type , 2020-2025

- Current Market Size (US$ Bn) Forecast, by Type , 2026-2033

- Descriptive Analytics

- Diagnostic Analytics

- Predictive Analytics

- Prescriptive Analytics

- Market Attractiveness Analysis: Type

- Global IoT Analytics Market Outlook: Component

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by Component, 2020-2025

- Current Market Size (US$ Bn) Forecast, by Component, 2026-2033

- Solution

- Services

- Market Attractiveness Analysis: Component

- Global IoT Analytics Market Outlook: Deployment Mode

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by Deployment Mode, 2020-2025

- Current Market Size (US$ Bn) Forecast, by Deployment Mode, 2026-2033

- On-premise

- Cloud-based

- Market Attractiveness Analysis: Deployment Mode

- Global IoT Analytics Market Outlook: Application

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by Application , 2020-2025

- Current Market Size (US$ Bn) Forecast, by Application , 2026-2033

- Energy Management

- Predictive Maintenance

- Asset Management

- Inventory Management

- Remote Monitoring

- Others

- Market Attractiveness Analysis: Application

- Global IoT Analytics Market Outlook: End Use

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by End Use, 2020-2025

- Current Market Size (US$ Bn) Forecast, by End Use, 2026-2033

- Manufacturing

- Energy & Utilities

- IT & Telecom

- Healthcare & Life Sciences

- Transportation & Logistics

- Retail & E-commerce

- Others

- Market Attractiveness Analysis: End Use

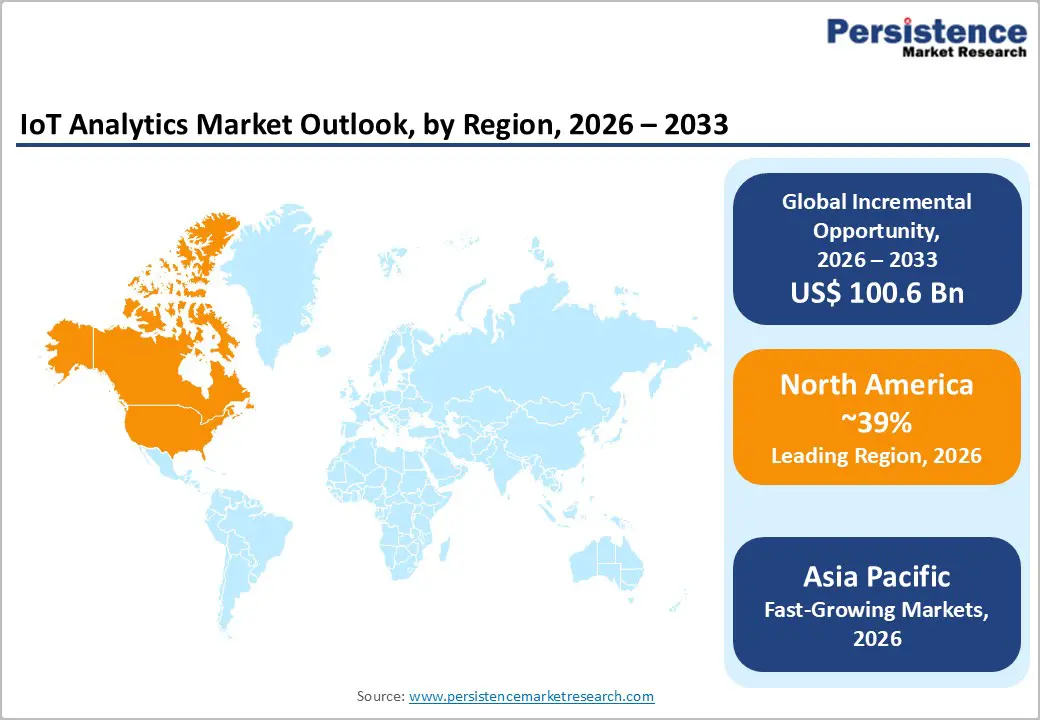

- Global IoT Analytics Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Bn) Analysis by Region, 2020-2025

- Current Market Size (US$ Bn) Forecast, by Region, 2026-2033

- North America

- Europe

- East Asia

- South Asia & Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America IoT Analytics Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- North America Market Size (US$ Bn) Forecast, by Country, 2026-2033

- U.S.

- Canada

- North America Market Size (US$ Bn) Forecast, by Type , 2026-2033

- Descriptive Analytics

- Diagnostic Analytics

- Predictive Analytics

- Prescriptive Analytics

- North America Market Size (US$ Bn) Forecast, by Component, 2026-2033

- Solution

- Services

- North America Market Size (US$ Bn) Forecast, by Deployment Mode, 2026-2033

- On-premise

- Cloud-based

- North America Market Size (US$ Bn) Forecast, by Application , 2026-2033

- Energy Management

- Predictive Maintenance

- Asset Management

- Inventory Management

- Remote Monitoring

- Others

- North America Market Size (US$ Bn) Forecast, by End Use, 2026-2033

- Manufacturing

- Energy & Utilities

- IT & Telecom

- Healthcare & Life Sciences

- Transportation & Logistics

- Retail & E-commerce

- Others

- Europe IoT Analytics Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- Europe Market Size (US$ Bn) Forecast, by Country, 2026-2033

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- Rest of Europe

- Europe Market Size (US$ Bn) Forecast, by Type , 2026-2033

- Descriptive Analytics

- Diagnostic Analytics

- Predictive Analytics

- Prescriptive Analytics

- Europe Market Size (US$ Bn) Forecast, by Component, 2026-2033

- Solution

- Services

- Europe Market Size (US$ Bn) Forecast, by Deployment Mode, 2026-2033

- On-premise

- Cloud-based

- Europe Market Size (US$ Bn) Forecast, by Application , 2026-2033

- Energy Management

- Predictive Maintenance

- Asset Management

- Inventory Management

- Remote Monitoring

- Others

- Europe Market Size (US$ Bn) Forecast, by End Use, 2026-2033

- Manufacturing

- Energy & Utilities

- IT & Telecom

- Healthcare & Life Sciences

- Transportation & Logistics

- Retail & E-commerce

- Others

- East Asia IoT Analytics Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- East Asia Market Size (US$ Bn) Forecast, by Country, 2026-2033

- China

- Japan

- South Korea

- East Asia Market Size (US$ Bn) Forecast, by Type , 2026-2033

- Descriptive Analytics

- Diagnostic Analytics

- Predictive Analytics

- Prescriptive Analytics

- East Asia Market Size (US$ Bn) Forecast, by Component, 2026-2033

- Solution

- Services

- East Asia Market Size (US$ Bn) Forecast, by Deployment Mode, 2026-2033

- On-premise

- Cloud-based

- East Asia Market Size (US$ Bn) Forecast, by Application , 2026-2033

- Energy Management

- Predictive Maintenance

- Asset Management

- Inventory Management

- Remote Monitoring

- Others

- East Asia Market Size (US$ Bn) Forecast, by End Use, 2026-2033

- Manufacturing

- Energy & Utilities

- IT & Telecom

- Healthcare & Life Sciences

- Transportation & Logistics

- Retail & E-commerce

- Others

- South Asia & Oceania IoT Analytics Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Country, 2026-2033

- India

- Southeast Asia

- ANZ

- Rest of SAO

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Type , 2026-2033

- Descriptive Analytics

- Diagnostic Analytics

- Predictive Analytics

- Prescriptive Analytics

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Component, 2026-2033

- Solution

- Services

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Deployment Mode, 2026-2033

- On-premise

- Cloud-based

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Application , 2026-2033

- Energy Management

- Predictive Maintenance

- Asset Management

- Inventory Management

- Remote Monitoring

- Others

- South Asia & Oceania Market Size (US$ Bn) Forecast, by End Use, 2026-2033

- Manufacturing

- Energy & Utilities

- IT & Telecom

- Healthcare & Life Sciences

- Transportation & Logistics

- Retail & E-commerce

- Others

- Latin America IoT Analytics Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- Latin America Market Size (US$ Bn) Forecast, by Country, 2026-2033

- Brazil

- Mexico

- Rest of LATAM

- Latin America Market Size (US$ Bn) Forecast, by Type , 2026-2033

- Descriptive Analytics

- Diagnostic Analytics

- Predictive Analytics

- Prescriptive Analytics

- Latin America Market Size (US$ Bn) Forecast, by Component, 2026-2033

- Solution

- Services

- Latin America Market Size (US$ Bn) Forecast, by Deployment Mode, 2026-2033

- On-premise

- Cloud-based

- Latin America Market Size (US$ Bn) Forecast, by Application , 2026-2033

- Energy Management

- Predictive Maintenance

- Asset Management

- Inventory Management

- Remote Monitoring

- Others

- Latin America Market Size (US$ Bn) Forecast, by End Use, 2026-2033

- Manufacturing

- Energy & Utilities

- IT & Telecom

- Healthcare & Life Sciences

- Transportation & Logistics

- Retail & E-commerce

- Others

- Middle East & Africa IoT Analytics Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- Middle East & Africa Market Size (US$ Bn) Forecast, by Country, 2026-2033

- GCC Countries

- South Africa

- Northern Africa

- Rest of MEA

- Middle East & Africa Market Size (US$ Bn) Forecast, by Type , 2026-2033

- Descriptive Analytics

- Diagnostic Analytics

- Predictive Analytics

- Prescriptive Analytics

- Middle East & Africa Market Size (US$ Bn) Forecast, by Component, 2026-2033

- Solution

- Services

- Middle East & Africa Market Size (US$ Bn) Forecast, by Deployment Mode, 2026-2033

- On-premise

- Cloud-based

- Middle East & Africa Market Size (US$ Bn) Forecast, by Application , 2026-2033

- Energy Management

- Predictive Maintenance

- Asset Management

- Inventory Management

- Remote Monitoring

- Others

- Middle East & Africa Market Size (US$ Bn) Forecast, by End Use, 2026-2033

- Manufacturing

- Energy & Utilities

- IT & Telecom

- Healthcare & Life Sciences

- Transportation & Logistics

- Retail & E-commerce

- Others

- Competition Landscape

- Market Share Analysis, 2025

- Market Structure

- Competition Intensity Mapping

- Competition Dashboard

- Company Profiles

- Accenture

- Company Overview

- Product Portfolio/Offerings

- Key Financials

- SWOT Analysis

- Company Strategy and Key Developments

- Aeris

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- Google (Alphabet Inc.)

- OpenText Web

- Microsoft

- Oracle

- PTC

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- Software AG

- Accenture

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment