ID: PMRREP32516| 191 Pages | 31 Oct 2025 | Format: PDF, Excel, PPT* | Healthcare

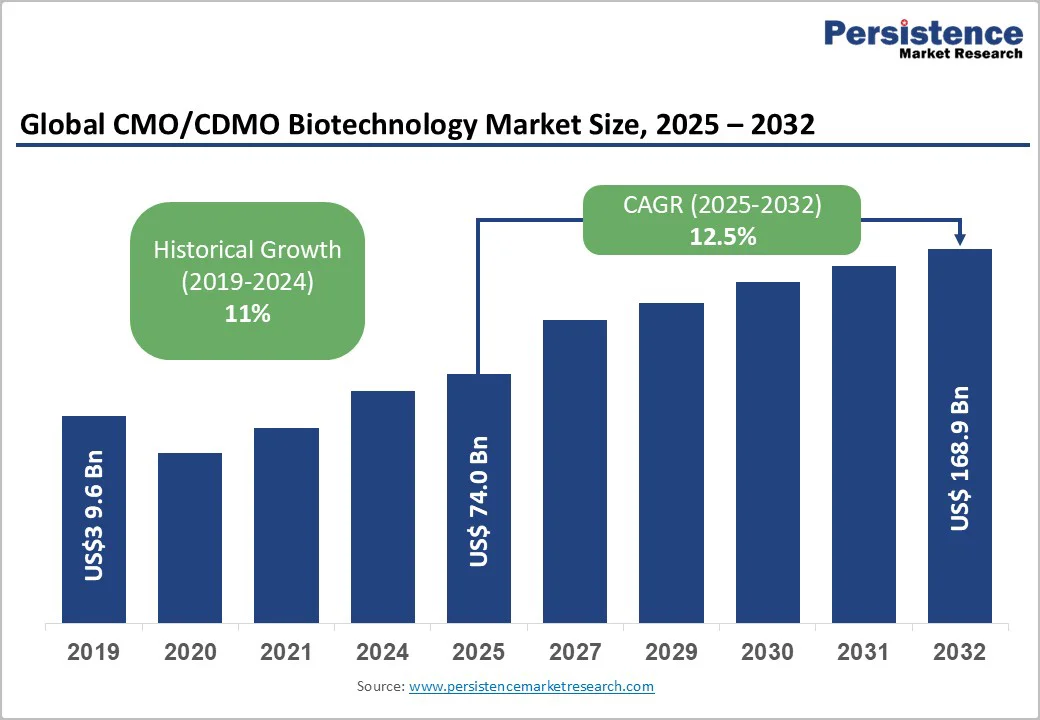

The global CMO/CDMO biotechnology market size is likely to be valued at US$74.0 Billion in 2025, and is estimated to reach US$168.9 Billion by 2032, growing at a CAGR of 12.5% during the forecast period 2025 - 2032, driven by the increasing reliance of pharmaceutical and biopharmaceutical companies on outsourcing for innovative biologics and advanced therapeutic production.

The rising demand for cost-efficient, scalable biomanufacturing amid increasing approvals of biologics, biosimilars, and gene therapies will also drive market growth. Advances in single-use bioreactors and integrated development services accelerate outsourcing, enhancing speed-to-market and efficiency. Regulatory support and CDMO capacity expansion further position CMOs as key partners in drug lifecycle management.

| Key Insights | Details |

|---|---|

| CMO/CDMO Biotechnology Market Size (2025E) | US$74.0 Bn |

| Market Value Forecast (2032F) | US$168.9 Bn |

| Projected Growth (CAGR 2025 to 2032) | 12.5% |

| Historical Market Growth (CAGR 2019 to 2024) | 11% |

The expanding pipeline of complex biologics, including monoclonal antibodies (mAbs), recombinant proteins, and cell & gene therapies (CGT), is a fundamental determinant for the market growth. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have approved an increasing number of biologics and biosimilars over the last few years, signaling heightened outsourcing needs for development and manufacturing capacity. Advanced expression systems and disposable bioreactors enhance process flexibility, enabling scalable, contamination-reducing manufacture at lower costs. The sustained dependence of biopharma companies on CDMOs is reinforced by their consistently rising yearly R&D expenditure, emphasizing the adoption of external expertise to accelerate market delivery and mitigate investment risk associated with in-house manufacturing complexities.

Stringent regulatory compliance across multiple jurisdictions remains a significant barrier, creating structural complexity and elevated costs for CDMOs. Adherence to GMP standards, coupled with varying regional mandates for process validation, documentation, and quality assurance, imposes operational burdens. Non-compliance risks include fines, recalls, and potential contract loss, impacting revenue predictability. For example, delays caused by Investigational New Drug (IND) or New Drug Application (NDA) approvals can extend project timelines by several months, causing considerable cost upheavals.

Moreover, overly strict regulatory inspections necessitate continuous capital infusion in upgrading facilities, staff training, and certification renewals. Such obstacles challenge mid-sized and emerging CDMOs disproportionately, limiting their scaling capabilities. Consequently, regulatory complexity acts as a demand bottleneck while encouraging market consolidation among established service providers with compliant infrastructure and robust quality systems.

The digital transformation of bioprocessing and manufacturing represents a compelling untapped opportunity within the market, driven by advances in Industry 4.0 technologies, including Artificial Intelligence (AI), machine learning, Internet of Things (IoT), and big data analytics. These technologies are enabling smart biomanufacturing environments characterized by real-time monitoring, predictive maintenance, and process optimization, which significantly increase operational efficiency, reduce batch failures, and improve product quality consistency. Digital twin platforms and cloud-based process analytics further facilitate remote supervision and scalability of complex biologics production.

This digital shift is especially relevant for advanced therapies where process variability and customization demands are high. Pharmaceutical companies increasingly seek CDMOs capable of integrating digital bioprocessing for faster, data-driven decisions aligned with regulatory compliance mandates such as the FDA’s Process Analytical Technology (PAT) framework. This convergence fosters new service models, including continuous manufacturing as a service, boosted by digital oversight. Early investments in digital infrastructure and workforce upskilling thus position players for sustainable long-term growth and differentiation in a crowded outsourcing landscape.

Standalone services are set to dominate with an estimated 60% of the CMO/CDMO biotechnology market share in 2025, aided by a growing demand for specialized solutions such as cell-line development, analytical testing, and fill-finish services. Pharmaceutical companies frequently prefer outsourcing discrete high-skill or capital-intensive services rather than fully integrated manufacturing, especially in early-stage development or for clinical trial material production. This preference allows flexibility in vendor selection and reduces exposure to single-source dependencies.

However, as market dynamics shift, integrated development and manufacturing services are forecasted to grow at an accelerated CAGR between 2025 and 2032. This strong upward trajectory is propelled by pharmaceutical companies’ increasing inclination for outsourcing comprehensive drug development lifecycles, from early discovery through commercial-scale manufacturing, to streamline regulatory submissions, reduce timeline inefficiencies, and leverage economies of scale. Mid-size CDMOs with modular, technology-flexible platforms are capitalizing on this trend as sponsors seek partners capable of agile response to clinical pipeline fluctuations and personalized medicines.

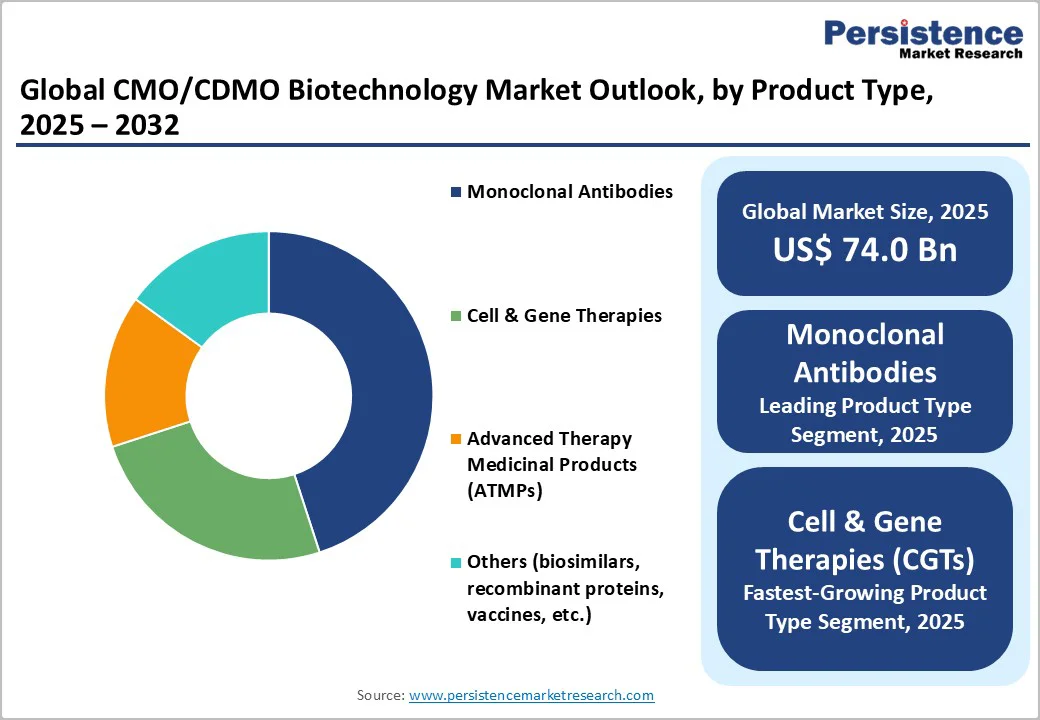

Monoclonal antibodies are slated to secure the leading position with an estimated 45% market share in 2025, due to their clinical maturity, broad therapeutic applications across oncology, autoimmune disorders, and inflammation, and operational scalability in contract manufacturing. Their robust demand sustains large-volume outsourcing, benefiting from standardized production platforms and well-established regulatory pathways.

In contrast, cell and gene therapies (CGTs) represent the fastest-growing product category with a projected CAGR exceeding 15% through 2032. The explosive growth of this segment is fueled by breakthrough approvals of CAR-T therapies and viral vector-based gene therapies, alongside rising investments in personalized medicine and rare disease treatments. CGTs necessitate specialized facilities with advanced viral vector manufacturing capabilities, single-use bioreactor systems, and stringent cold chain logistics, creating high entry barriers but lucrative opportunities for CDMOs expanding these platforms.

Large scale/Commercial manufacturing is likely to capture the lion’s share of outsourcing contracts at an estimated 65% in 2025, reflecting the need for large batch productions and cost efficiencies for mature biologics and biosimilars. Large-scale CDMOs benefit from economies of scale, infrastructure investments, and long-term client contracts, enabling robust revenue and capacity utilization.

The small-scale/pilot production segment is expected to register the highest CAGR from 2025 to 2032, on account of a speedily increasing number of early-phase clinical trials and personalized medicine manufacturing demand. Flexible, modular, single-use bioprocessing technologies allow CDMOs to offer nimble, cost-effective production runs tailored to smaller patient populations or bespoke therapies. Investments in pilot-scale capacity also attract biopharma startups seeking to outsource early clinical batch manufacturing, contributing to market fragmentation and expansion at the lower end of the capacity spectrum.

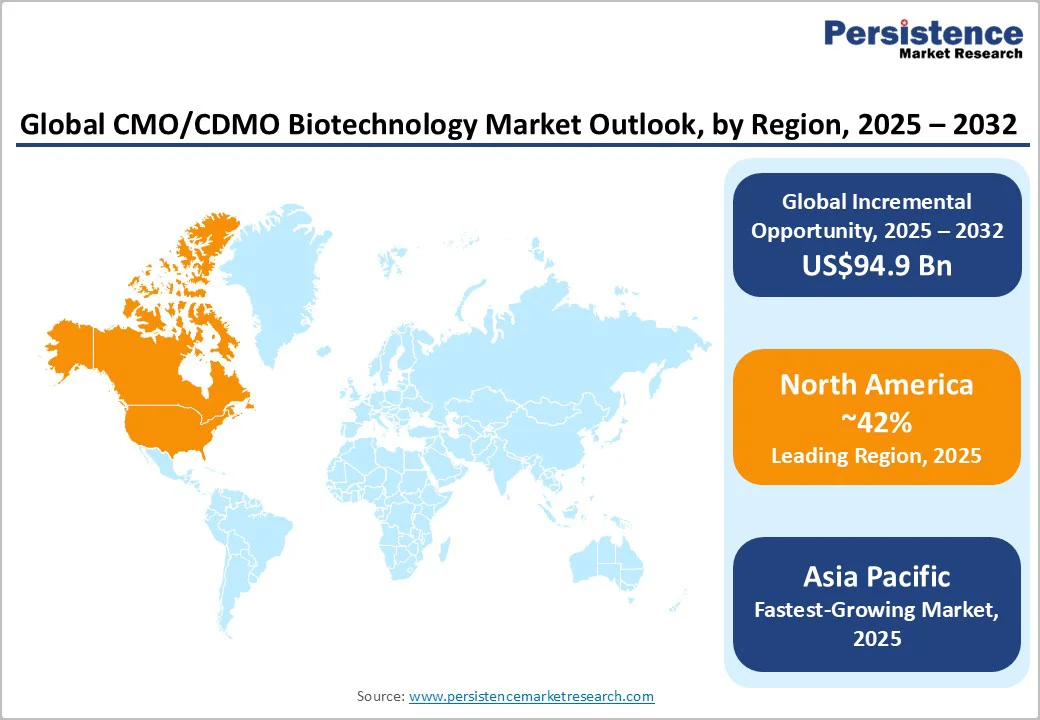

North America is anticipated to lead with an estimated 42% of the CMO/CDMO biotechnology market share in 2025, driven by the United States’ dominant biopharma landscape. The robust CAGR of the regional market is stimulated by a steady growth of the healthcare innovation ecosystem, regulatory modernization from the FDA, and dense concentration of large biotech hubs, including Boston, San Francisco, and San Diego. The FDA’s expedited regulatory pathways, adaptive trial designs, and digital inspection initiatives lower barriers for contract manufacturing integration.

CDMOs in North America benefit from early adoption of advanced bioprocess technologies, digital biomanufacturing, and comprehensive quality systems to meet stringent regulatory expectations. Strategic investments focus on capacity expansions and digitization, while M&A activity remains robust as larger CDMOs consolidate expertise and facilities. However, rising labor and operational costs pose challenges, encouraging pharmaceutical companies to diversify supply chains and invest selectively in onshore capacity.

Europe is set to command approximately 25% of the market share in 2025, with Germany, the U.K., France, and Spain as major contributors. The regional market is fueled by regulatory harmonization led by the EMA that facilitates cross-border clinical trial conduct and manufacturing service deployment. European CDMOs emphasize quality assurance, GMP compliance, and high-value specialized services, particularly in gene editing and biosimilars manufacturing niches. Investment trends reveal growing commitments to digital transformation, automation, and bioprocess intensification technologies, supported by EU funding programs such as Horizon Europe.

The regulatory landscape, while rigorous, is providing clearer guidance on advanced therapy medicinal products (ATMPs), enhancing the adoption of outsourcing solutions. The competitive environment features a mix of historical contract manufacturers and innovative biotech-focused CDMOs expanding through strategic partnerships. Market maturation encourages integration of sustainability initiatives, green manufacturing, and digital traceability to align with EU policy objectives.

Asia Pacific is slated to emerge as the fastest-growing regional market with a projected CAGR of 14% through 2032. The CMO/CDMO biotechnology market growth here is predominantly concentrated in China, India, South Korea, and an expanding ASEAN footprint, leveraging competitive labor costs, government incentives, including tax holidays and streamlined approval processes, and expanded investment in enabling infrastructure. China’s biotech ecosystem has experienced a tripling of biopharma R&D expenditure since 2020, with foreign and domestic CDMOs increasing manufacturing capacity and capabilities, including viral vector and single-use systems.

India’s evolving regulatory framework and vast clinical trial patient pool attract global sponsors outsourcing both clinical supplies and commercial biologics manufacturing. South Korea’s established manufacturing expertise, underscored by Samsung Biologics and Celltrion expansions, anchors the regional market. Regulatory reforms to harmonize standards and increase approval speed are further enhancing Asia Pacific’s competitive positioning. The region is increasingly attracting cross-border collaborations and strategic investments, supporting its evolution as a critical global CDMO hub.

The global CMO/CDMO biotechnology market is moderately consolidated, with the top 10 players holding about 58% share. Key leaders such as Lonza, Thermo Fisher Scientific, Samsung Biologics, Boehringer Ingelheim, and AGC Biologics leverage extensive service portfolios and global reach to deliver end-to-end biomanufacturing solutions. Smaller CDMOs focus on niche therapies and flexible partnerships, driving innovation. Active M&A continues to shape the market, enabling capacity expansion, service diversification, and broader geographic reach. This balance of scale and specialization underpins sustainable growth across the biopharma outsourcing ecosystem.

The CMO/CDMO biotechnology market is projected to reach US$74.0 Billion in 2025.

The increasing reliance of pharmaceutical and biopharmaceutical companies on outsourcing for innovative biologics and advanced therapeutic production is driving the market.

The CMO/CDMO biotechnology market is poised to witness a CAGR of 12.5% from 2025 to 2032.

An escalating demand for cost-effective, scalable manufacturing solutions for novel biologics, biosimilars, and gene therapies, technological advancements such as single-use bioreactors, and capacity expansion investment by CDMOs are key market opportunities.

Lonza Group AG, Thermo Fisher Scientific, and Samsung Biologics are some of the key players in the CMO/CDMO biotechnology market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Service Type

By Product Type

By Scale of Operation

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author