ID: PMRREP2986| 199 Pages | 28 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

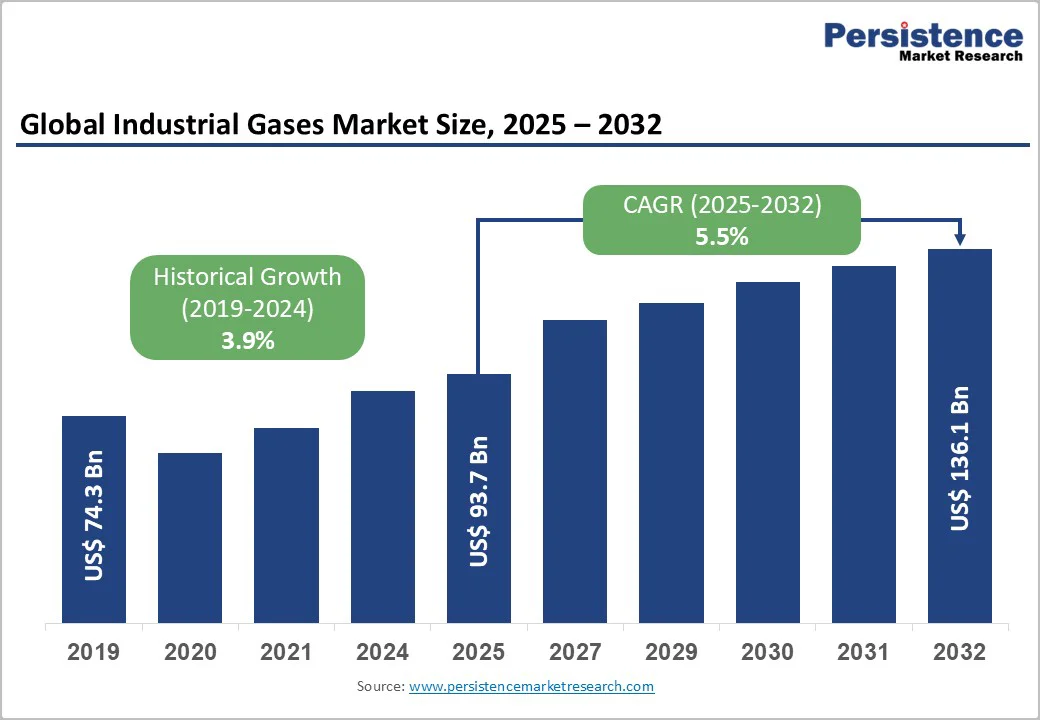

The global industrial gases market size is valued at US$93.7 billion in 2025 and is projected to reach US$136.1 billion, growing at a CAGR of 5.5% between 2025 and 2032.

The industrial gases sector is experiencing robust expansion driven by accelerating demand from manufacturing, healthcare, and energy worldwide. Rising industrialization across the Asia Pacific, particularly in China and India, coupled with the global transition toward clean energy solutions, is the primary catalyst for market growth.

The increasing adoption of green hydrogen technologies, supported by substantial government investments and regulatory frameworks promoting sustainability, significantly enhances the sector's growth trajectory.

| Key Insights | Details |

|---|---|

| Industrial Gases Market Size (2025E) | US$93.7 billion |

| Market Value Forecast (2032F) | US$136.1 billion |

| Projected Growth CAGR (2025 - 2032) | 5.5% |

| Historical Market Growth (2019 - 2024) | 3.9% |

Emerging economies, particularly across the Asia Pacific, drive substantial demand for industrial gases through unprecedented manufacturing expansion. China's steel production, which exceeds 1 billion tons annually and accounts for 55% of global output, demands massive quantities of oxygen, nitrogen, and argon for steelmaking. India's steel sector, projected to grow at 9% annually through 2030 according to the Ministry of Steel, further amplifies regional gas consumption.

The "Make in India" campaign has spurred domestic industrial gas production, reducing import dependence while supporting local manufacturing ecosystems. Vietnam, Indonesia, and other Southeast Asian nations witness rapid infrastructure development and electronics manufacturing growth, creating sustained demand for high-purity specialty gases.

This industrial expansion directly translates into proportional increases in oxygen consumption for oxy-fuel cutting, nitrogen for inert-gas shielding, and argon for advanced welding applications. The construction of specialized metals production facilities and the rise of automotive component manufacturing in these regions consolidate industrial gases as essential inputs for maintaining competitive manufacturing capabilities and achieving production efficiency targets.

The global energy transition toward decarbonization and the integration of renewable energy create transformative opportunities for industrial gas suppliers. The International Energy Agency projects global investment in clean hydrogen technologies will increase by 70% in 2025, approaching ~$8 billion despite project cancellations. India's National Green Hydrogen Mission targets annual production capacity of around 5 MMT by 2032, supported by 125 GW of dedicated renewable energy capacity and investments.

Reliance Industries plans INR75,000 crore investments in green hydrogen production over the coming years, with a 1 GW facility in Jamnagar targeting operational status by 2025. Government hydrogen subsidies, tax incentives, and infrastructure development support across North America, Europe, and the Asia Pacific fundamentally reshape the industrial gases market composition.

Hydrogen's zero-carbon emissions profile and compatibility with fuel cell technologies for transportation and power generation establish it as the fastest-growing gas segment, with a projected CAGR of 11.5% through 2032.

The integration of electrolyzer-based hydrogen production systems with existing gas supply networks creates substantial infrastructure investment requirements and operational opportunities for established market leaders while supporting emerging market entrants focused on green hydrogen solutions.

Industrial gas manufacturers navigate complex regulatory frameworks governing production, storage, transportation, and environmental impact management, creating significant operational barriers.

The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) enforce strict purity standards that require specialized equipment and rigorous quality control processes, substantially increasing manufacturing costs. Hazardous materials handling regulations, including the International Maritime Dangerous Goods (IMDG) code and Department of Transportation (DOT) rules, impose logistical constraints and reduce supply chain flexibility.

Compliance infrastructure requirements, encompassing monitoring systems, safe storage facilities, protective equipment, and worker training programs, represent substantial capital investments beyond core production capabilities. Small and medium-sized enterprises encounter particular difficulty in meeting compliance costs, reducing their competitive market participation, and limiting their innovation capacity.

Regulatory violations result in substantial penalties, product recalls, or permanent operational shutdowns, creating significant downside risks that constrain market entry and expansion initiatives. The layered compliance structure across different jurisdictions and applications creates operational complexity requiring specialized management expertise and continuous monitoring systems.

Industrial gas production and distribution infrastructure demands substantial capital investments, creating significant barriers to market participation and geographic expansion. On-site air separation units, cryogenic storage systems, pipeline networks, and distribution logistics require multi-million-dollar capital commitments with extended payback periods.

Large industrial gas suppliers, including Linde and Air Liquide, annually maintain capital expenditure programs to expand and maintain production capacity. Liquefaction technologies, compression equipment, and specialized transportation infrastructure impose substantial costs, particularly for smaller market participants lacking economies of scale.

Geographic expansion into emerging markets requires infrastructure development in regions with limited existing industrial gas networks, compounding capital requirements. Energy costs for production and liquefaction processes represent significant ongoing operational expenses, creating vulnerability to energy price volatility and regulatory changes.

These capital-intensive characteristics consolidate market leadership among established players with substantial financial resources, limiting competitive entry and constraining market fragmentation.

Carbon capture, utilization, and storage technologies create substantial new demand streams for industrial gases, particularly nitrogen for inerting and oxygen for oxidation processes. The European Union's stringent emissions regulations and climate objectives are driving the development of carbon capture projects across the manufacturing and power generation sectors.

Global carbon capture projects under development collectively exceed around 1.1 million tons per year of planned output, requiring associated oxygen, nitrogen, and specialty gases for supporting systems. This emerging application domain positions industrial gases as critical enablers of climate objectives, attracting government support, regulatory incentives, and private-sector investment.

Companies developing integrated low-carbon solutions that combine hydrogen production with carbon capture differentiate themselves while accessing premium pricing opportunities.

The International Energy Agency projects carbon capture and storage capacity will expand substantially through 2032, creating sustained demand growth for supporting industrial gas supplies. Strategic positioning within CCS infrastructure development offers industrial gas suppliers opportunities to establish long-term customer relationships and participate in high-growth emerging applications.

On-site gas generation systems reduce logistics costs, enhance supply chain security, and align with decarbonization objectives while creating new market opportunities for equipment suppliers and service providers. Pipeline-based on-site tonnage supply accounts for 40% of the current market share, with cryogenic tanks and liquid dewars growing at a 6.1% CAGR driven by increased adoption.

The economic advantages of on-site generation, including reduced trucking emissions, minimized power transmission losses, and enhanced operational control, are driving the adoption of acceleration across large manufacturing facilities. Linde's 2024 announcement of 59 long-term agreements to build and operate 64 small on-site nitrogen and oxygen plants demonstrates strong market momentum toward distributed generation models.

Digital automation, artificial intelligence integration, and real-time monitoring systems enhance on-site unit operational efficiency and predictive maintenance capabilities, creating convergence between industrial gases and digital technology sectors.

This digitalization trend creates opportunities for software development, system integration, and managed services businesses, complementing traditional gas supply operations. Strategic partnerships between industrial gas companies and digital technology providers establish hybrid business models combining asset ownership, operational expertise, and software capabilities.

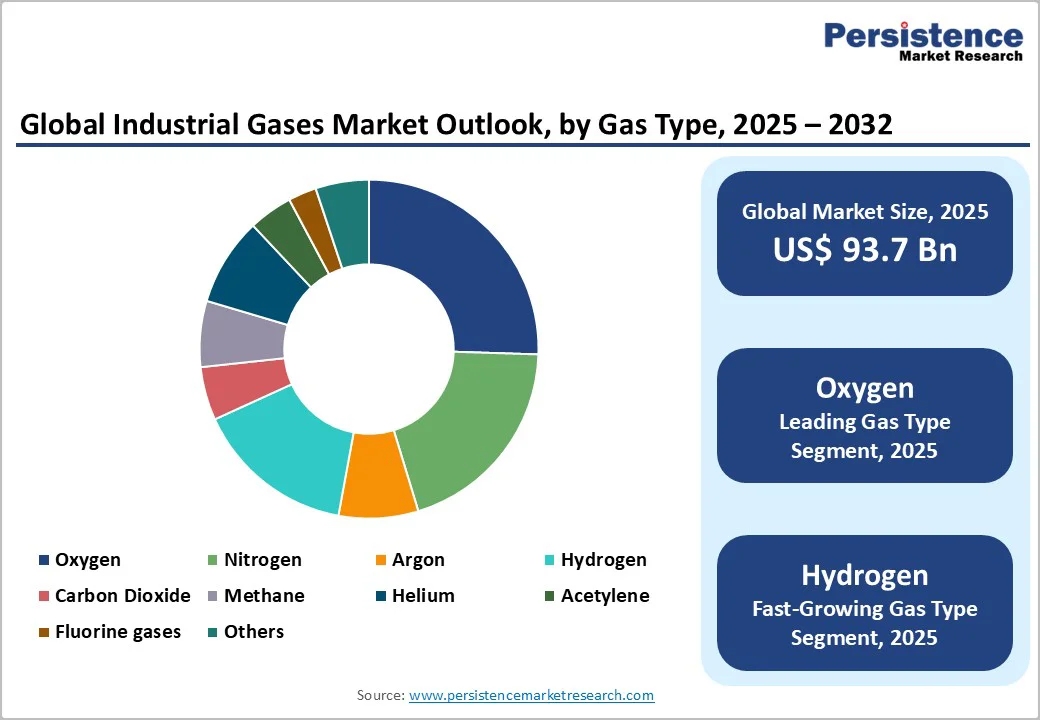

Oxygen maintains a dominant market position with approximately 26% share, driven primarily by steel manufacturing applications where oxygen facilitates oxy-fuel combustion processes and combustion enhancement in steelmaking furnaces. The steel industry's global expansion, particularly in Asia Pacific, directly correlates with growth in oxygen consumption.

Beyond steelmaking, oxygen applications span metal fabrication, chemical processing, medical applications, and environmental remediation, creating diversified demand sources. Healthcare oxygen demand remains elevated at baseline across hospitals, clinics, and home healthcare services, with post-pandemic emphasis on emergency preparedness and maintaining inventory levels.

Hydrogen gas emerges as the fastest-growing segment, with a 11.5% CAGR through 2032, driven by green hydrogen energy transition initiatives and the commercialization of fuel cell technology.

Government hydrogen subsidies and renewable energy integration create sustained production incentives, while fuel cell commercialization across heavy-duty transportation, maritime shipping, and aviation expands end-use applications. Industrial hydrogen production capacity expansions, including green hydrogen projects and electrolyzer manufacturing facilities, establish supply chain infrastructure supporting market growth acceleration.

Chemical manufacturing and petroleum refining applications account for 20% of the market, consuming substantial quantities of hydrogen, nitrogen, oxygen, and specialty gases for catalytic processes, synthesis reactions, and fuel production.

U.S. refiners sourced 68% of their hydrogen externally in 2024, up from 53% a decade earlier, indicating accelerating outsourcing trends that expand merchant gas supply pools. Hydrogen hydro-treating requirements remain elevated due to stricter fuel sulfur content regulations and variations in crude oil quality.

Healthcare applications are projected to achieve a 7% CAGR through 2032, supported by an aging population, rising surgical procedure volumes, and hospital infrastructure expansion.

Emerging markets are demonstrating accelerating healthcare investment, particularly in India and Southeast Asian nations, as they develop modern hospital networks. Medical oxygen, nitrous oxide, and specialty gases sustain consistent baseline demand, while expanding medical device manufacturing increases high-purity gas requirements.

Pipeline supply and on-site tonnage generation account for 40% market share, providing cost-effective, reliable delivery to large industrial customers requiring consistent high-volume supplies. This supply mode dominates for major manufacturing facilities, particularly steelmakers and chemical refineries. On-site generation advantages, including reduced logistics costs and enhanced supply security, drive accelerated adoption.

Cryogenic tanks and liquid dewar distribution are projected to grow at a 6.1% CAGR through 2032, supporting smaller industrial customers, healthcare facilities, and distributed manufacturing operations lacking on-site generation infrastructure. This supply mode's flexibility enables market penetration across diverse customer segments while supporting emerging applications requiring specialty gas supplies.

North America holds 21% global market share with a projected 4.5% CAGR through 2032. The United States dominates regional performance, with a prominent market share growing at a 3.9% CAGR. Healthcare is the largest segment, commanding approximately 23.6% market share, driven by an aging population, respiratory disease prevalence, and advanced surgical requirements.

The aerospace, automotive, and electronics industries consume substantial volumes of industrial gas for welding, cutting, and specialty applications. The region's robust regulatory environment, advanced healthcare infrastructure, and technological innovation ecosystem position North America as a mature market with premium pricing.

North America's clean energy initiatives, particularly hydrogen production projects and carbon capture installations, create growth opportunities exceeding baseline industrial demand. Government support for renewable energy infrastructure and the development of the hydrogen economy attracts substantial private-sector investment.

The region's well-developed distribution infrastructure and regulatory certainty enable efficient market operations, positioning North America as a stable, high-margin market for established industrial gas suppliers. Strategic partnerships with renewable energy developers and clean energy technology companies enhance competitive positioning and establish market differentiation.

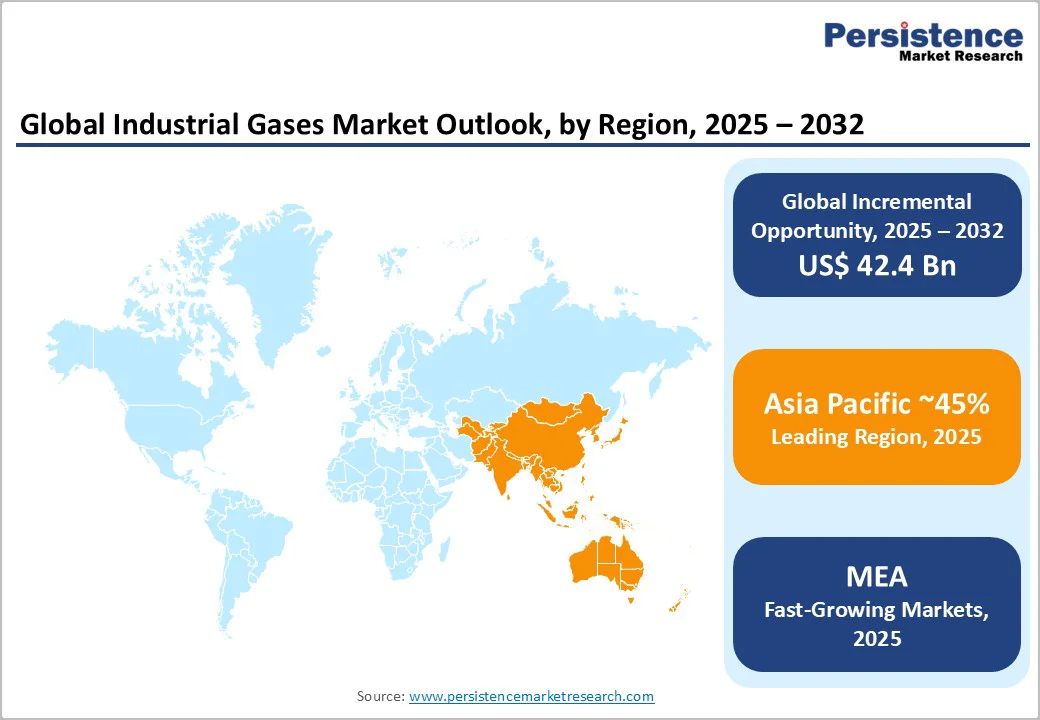

Asia Pacific dominates the global industrial gases market with a 45% share, driven by rapid industrialization, manufacturing expansion, and healthcare infrastructure development. China commands 45.5% of the regional market share, supported by massive steel production (exceeding 1 billion tons annually), semiconductor manufacturing growth, and government sustainability initiatives.

India represents a significant growth opportunity, with industrial demand expanding at 7 to 8% annually through manufacturing sector expansion and healthcare infrastructure investment. Japan and South Korea contribute significant volumes through advanced electronics manufacturing and chemical production requirements.

China's commitment to clean energy development, including renewable hydrogen initiatives and the expansion of electric vehicle infrastructure, creates sustained growth in industrial gas demand independent of cyclical manufacturing patterns. India's "Make in India" campaign and the National Green Hydrogen Mission establish policy frameworks that support long-term demand acceleration.

The region's rapid urbanization, rising healthcare spending, and infrastructure development projects create favorable structural demand drivers. Key market players, including Linde and Air Liquide, maintain substantial production capacity investments across the Asia Pacific, reflecting strategic recognition of the region's long-term growth significance.

The Middle East industrial gases market is projected to grow at a 7.3% CAGR through 2032, while the combined Middle East & Africa region accounts for around 8% of the global market share. The GCC countries dominate the regional performance in the Middle East & Africa, with over 60% market share, supported by healthcare expansion, petrochemical investment, and technology park development.

The Kingdom of Saudi Arabia (KSA) leads with 39% market share, driven by concentrated petrochemical clusters in Jubail and Yanbu, Vision 2030 diversification initiatives, and rising semiconductor fabrication activity. The UAE maintains strong regional performance through ongoing growth in healthcare infrastructure, advanced manufacturing, and industrial gas distribution.

Qatar’s North Field LNG and petrochemical projects continue to drive demand for hydrogen, nitrogen, and specialty gases across the energy and industrial sectors.

The global industrial gases market is moderately consolidated, led by major global suppliers with strong technological expertise and extensive geographic reach. Linde plc, Air Liquide, and Air Products and Chemicals dominate global operations through advanced production capabilities and diversified portfolios across atmospheric and specialty gases.

Their scale, infrastructure, and capital intensity create substantial entry barriers, reinforcing market stability. Meanwhile, regional leaders such as Messer, INOX-Air Products, and Iwatani sustain strong local positions through tailored operations and customer-focused strategies, ensuring competitive balance across both commodity and specialty gas segments.

The global industrial gases market was valued at US$ 93.7 Billion in 2025 and is projected to reach US$ 136.1 Billion by 2032.

The industrial gases market is driven by rapid industrialization and manufacturing expansion in emerging countries, accelerating global energy transition with green hydrogen investment supported by government incentives, and expanding healthcare demand across emerging markets.

The industrial gases market is projected to grow at a 5.5% CAGR during the forecast period.

Key market opportunities include accelerating carbon capture and storage technology deployment, semiconductor and advanced electronics manufacturing expansion, on-site gas generation systems, green hydrogen commercialization, and healthcare infrastructure expansion in emerging markets.

The key global market players are Linde plc, Air Liquide, Air Products and Chemicals, Airgas Inc., Messer SE, Praxair Technology, Taiyo Nippon Sanso Corporation, and Air Water Inc.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Gas Type

By Application

By Supply Mode

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author