ID: PMRREP36002| 200 Pages | 7 Jan 2026 | Format: PDF, Excel, PPT* | Packaging

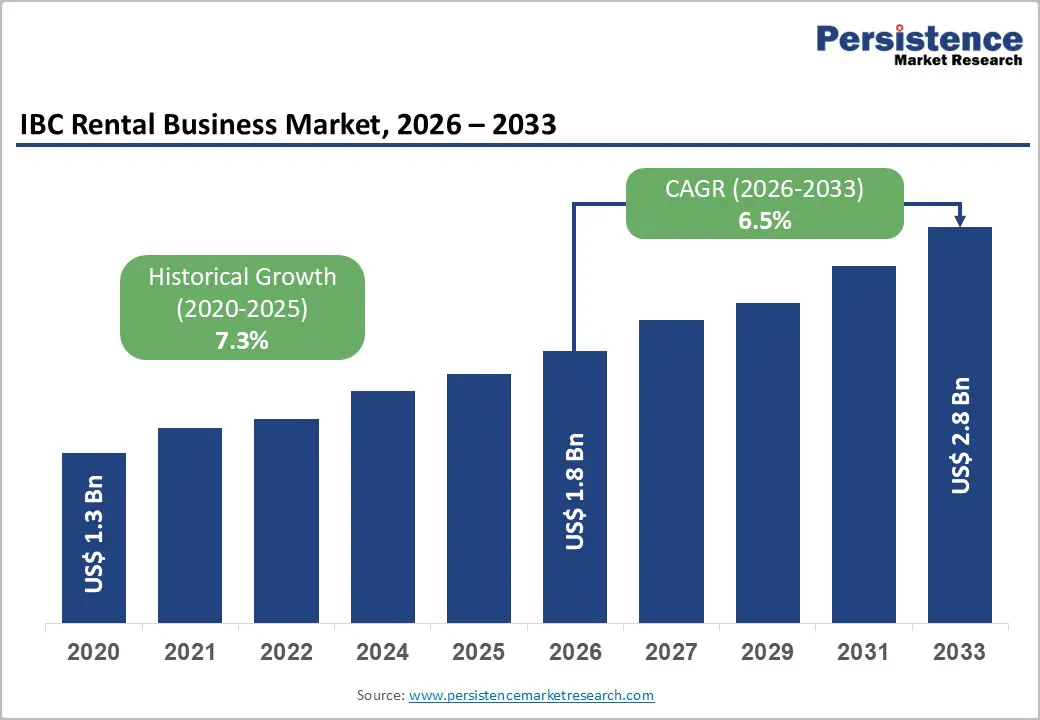

The global IBC rental business market size is likely to be valued at US$1.8 billion in 2026 and is expected to reach US$2.8 billion by 2033, growing at a CAGR of 6.5% between 2026 and 2033, driven by rising demand from the chemicals and food & beverage industries, increasing regulatory pressure supporting circular and reusable packaging systems, and a growing preference for rental and fleet-based container models to reduce capital expenditure.

The market structure increasingly favors integrated service providers that offer rental, reconditioning, and logistics as a unified solution. Strategically, investments in asset tracking, high-throughput reconditioning capacity, and compliance-ready IBC portfolios are becoming critical for securing long-term contracts with regulated end-users.

| Key Insights | Details |

|---|---|

| IBC Rental Business Market Size (2026E) | US$1.8 Bn |

| Market Value Forecast (2033F) | US$2.8 Bn |

| Projected Growth (CAGR 2026 to 2033) | 6.5% |

| Historical Market Growth (CAGR 2020 to 2025) | 7.3% |

Governments and regulatory authorities are increasingly enforcing packaging policies that prioritize reusability, recyclability, and waste reduction. In Europe, binding packaging and waste regulations mandate the use of reusable industrial packaging solutions over the medium term, with phased implementation. These policies significantly enhance the economic viability of rental and pooled IBC fleets, designed for repeated use within controlled logistics systems.

As compliance requirements tighten, industrial buyers are increasingly seeking rental providers capable of delivering documented reconditioning cycles, traceable asset histories, and verified recycled-content compliance. This shift is accelerating the transition away from single-use ownership models toward professionally managed rental fleets, particularly in highly regulated regions such as the European Union.

End-use industries such as chemicals, food & beverage, pharmaceuticals, and agrochemicals face sustained pressure to optimize working capital while maintaining operational flexibility. Renting IBCs allows companies to convert capital expenditure into operating expenditure, minimize idle container inventory, and shift maintenance and cleaning risks to specialized providers.

Rental models also reduce the total cost of ownership by lowering downtime, improving container availability, and eliminating the need for in-house reconditioning infrastructure. Industries characterized by high SKU diversity, frequent batch changes, and short production cycles increasingly adopt rental IBC solutions. As a result, provider differentiation now centers on fleet optimization, dynamic allocation capabilities, and compliance documentation rather than container ownership alone.

Pharmaceutical and food manufacturers operate under stringent hygiene, traceability, and validation requirements, making professionally managed IBC rental fleets increasingly attractive. These industries require food-grade or pharmaceutical-grade containers supported by documented cleaning protocols, traceable usage histories, and validated logistics.

Technological advancements such as aseptic liners and improved container evacuation systems have expanded the suitability of rented IBCs for high-value and sensitive liquid products. Growth in contract manufacturing and outsourcing further amplifies demand, as producers favor rental solutions that reduce contamination risk and regulatory exposure. Providers investing in validated cleaning processes and advanced liner technologies are well-positioned to capture premium contracts in these segments.

IBC rental operations require substantial upfront investment in container fleets, automated cleaning systems, inspection infrastructure, and logistics networks. Profitability depends heavily on achieving high fleet utilization and sufficient rotation cycles. Low utilization rates or contamination incidents that require container disposal can significantly reduce asset returns. Industry benchmarks suggest that fleets operating below optimal utilization levels may experience margin erosion of 8-12 percentage points. These capital requirements present entry barriers for new market participants, who must secure long-term contracts or partnerships to justify investment and shorten payback periods.

Managing pooled IBC fleets across multiple industries and jurisdictions involves compliance with a wide range of regulations governing hazardous goods transport, chemical safety, food-contact materials, and waste handling. Non-compliance can result in fines, shipment delays, product recalls, and reputational damage. In highly regulated markets, packaging non-compliance can force the premature withdrawal of entire container pools, increasing direct costs and lifecycle expenses. The need to maintain compliance across chemicals, food, and pharmaceutical applications adds operational complexity and requires continuous monitoring, documentation, and process validation.

Regulatory mandates supporting reusability create strong opportunities for rental providers to offer end-to-end reusable packaging services. These services include container leasing, collection, automated reconditioning, compliance documentation, and reporting. In Europe, even modest penetration of reusable rental solutions into existing disposable IBC demand could generate a multi-hundred-million-dollar incremental opportunity by 2028, based on the region’s share of the global market. Providers that invest early in regional reconditioning hubs, digital traceability systems, and contractual guarantees on rotation counts can establish defensible positions as compliance partners rather than commodity suppliers.

Digital asset tracking, usage analytics, and validated cleaning documentation enable rental providers to move beyond basic leasing into higher-margin service offerings. Telemetry systems that monitor container location, condition, and usage history enhance fleet utilization while reducing administrative burden for customers. Premium add-on services such as validated aseptic liners and compliance reporting can increase revenue per IBC by 15-30% compared with base rental fees. Bundling these capabilities into subscription-style service packages creates recurring revenue streams and strengthens long-term customer relationships, particularly in pharmaceutical and food-processing segments.

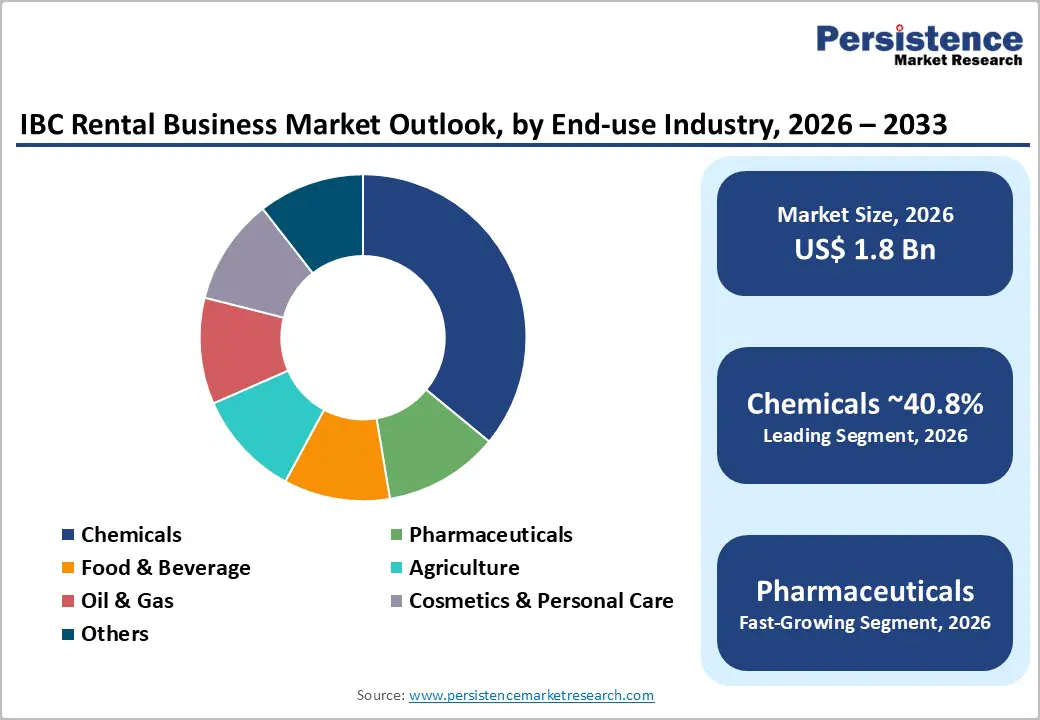

Chemicals are expected to account for 40.8% of revenue, the largest end-use segment due to high-volume liquid transport requirements, frequent batch changes, and strict handling standards. Chemical producers require durable, hazardous-goods-capable containers supported by traceable reconditioning and certification. Rental models allow chemical companies to manage seasonal demand fluctuations and regulatory complexity without tying up capital in container ownership. The segment’s dominance reflects both volume demand and the need for premium services related to safety and compliance.

Pharmaceuticals are the fastest-growing, driven by compliance-intensive manufacturing requirements. Pharmaceutical manufacturers increasingly adopt rental IBCs to support small-batch production, biologics manufacturing, and contract manufacturing models. Demand is driven by strict hygiene requirements, regulatory scrutiny, and the need for validated cleaning and traceability. Rental providers offering aseptic liners, documented cleaning cycles, and regulatory inspection support capture higher per-unit revenue and experience growth rates exceeding the overall market.

Chemical storage is expected to account for 45.7% of revenue share, as it dominates the market due to the efficiency of containers in handling bulk liquids at standardized volumes. Rental fleets designed for chemical storage emphasize robust frames, secure valves, and documented cleaning to enable repeated use. For distributors and formulators, rental models reduce capital investment and improve logistics flexibility, particularly when supported by regional pooling strategies that minimize empty-container movements.

Food & beverage storage is expected to steadily gain share over the forecast period, emerging as the fastest-growing application as processors increasingly rely on rented food-grade IBCs to manage seasonal production cycles and reduce contamination risk. Demand growth is the strongest among co-packers and ingredient suppliers requiring rapid turnaround and validated hygiene. Advances in aseptic liners and automated sanitation processes support wider adoption by reducing cross-contamination risks and meeting audit requirements.

Market growth in North America is supported by a robust chemicals industry, a technologically advanced food-processing sector, and a growing pharmaceutical manufacturing base. The U.S. leads regional demand due to its concentration of bulk chemical producers, specialty formulators, and contract manufacturing organizations, while Canada and Mexico contribute with agrochemicals, industrial intermediates, and export-driven food ingredients. The region’s well-established logistics infrastructure and widespread use of standardized bulk packaging drive continued adoption of rental models. Key growth factors include the ongoing transition from capital-intensive container ownership to operational-cost-based rental solutions, rising hygiene and traceability standards, and the adoption of digital fleet management technologies. Regulatory oversight by agencies such as the U.S. Food and Drug Administration (FDA) and the Environmental Protection Agency (EPA) increases compliance costs for container ownership, making rental providers that offer validated cleaning, certification, and documentation more attractive. As a result, chemical and food manufacturers are increasingly outsourcing the management of container lifecycles.

From a competitive standpoint, SCHUTZ Container Systems, Mauser Packaging Solutions, and Greif maintain extensive IBC service and reconditioning networks across the U.S. These players continue to invest in IoT-enabled tracking systems that allow customers to monitor container location, usage cycles, and cleaning history in real time. In parallel, Hoover Ferguson has strengthened its intermediate bulk container rental and reconditioning capabilities to support chemical and energy-adjacent customers requiring certified hazardous-material handling. Investment activity in North America focuses on expanding reconditioning capacity, upgrading wash lines to food- and pharma-grade standards, and forming partnerships with third-party logistics providers to improve turnaround times. Strategically, market participants gain an advantage by targeting high-margin regulated segments such as specialty chemicals, pharmaceuticals, and food ingredients, while optimizing fleet utilization across regional pooling networks.

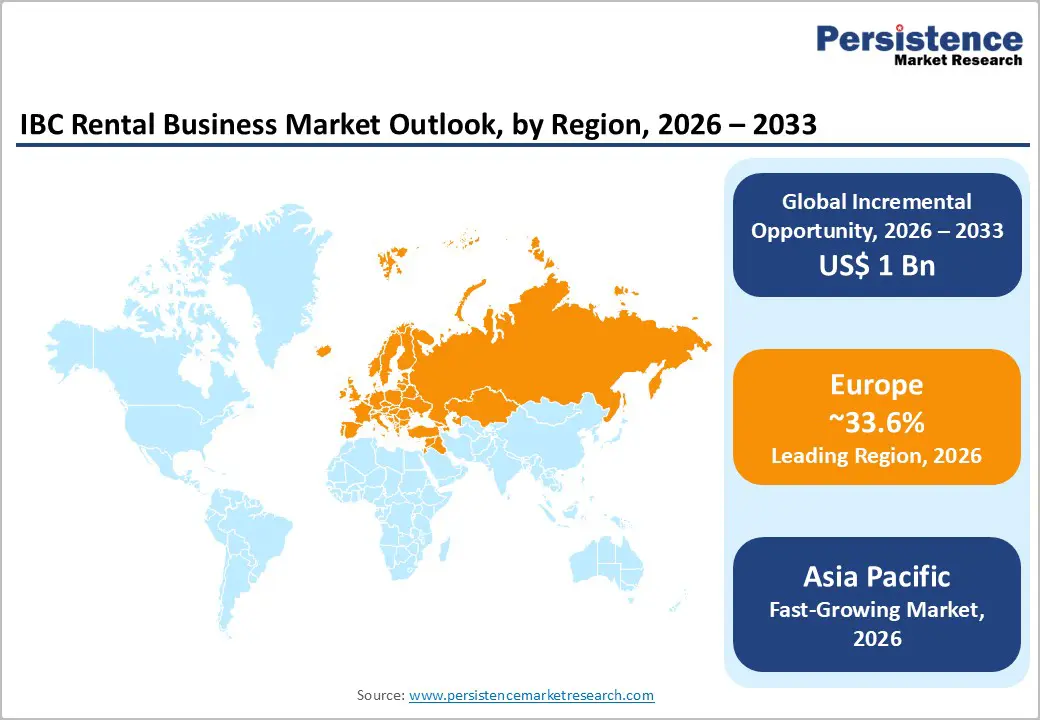

Europe is projected to hold the largest regional share of the market at approximately 33.6%, driven by dense manufacturing clusters, cross-border trade intensity, and early adoption of circular economy and reusable packaging regulations. Germany, the U.K., France, and Spain represent core demand centers, supported by strong chemical processing, pharmaceutical manufacturing, and food and beverage production. The region’s emphasis on sustainability and waste reduction structurally favors rental and pooling models over single-owner container systems. Regulatory frameworks such as the EU Packaging and Packaging Waste Directive and national-level waste reduction mandates actively encourage the use of reusable transport packaging. These binding requirements accelerate the adoption of rented and pooled IBCs, particularly among multinational chemical and pharmaceutical producers operating across multiple EU member states. Harmonized regulations enable cross-border fleet deployment, which benefits providers with pan-European logistics networks and standardized compliance protocols.

Leading players, including SCHUTZ, Mauser Packaging Solutions, Greif, and Werit, continue to expand and modernize European reconditioning operations. SCHUTZ’s long-established Ticket Service network allows customers to return IBCs across multiple countries, improving fleet circulation and reducing empty-container transport. Mauser’s integration of reconditioning assets across Western and Southern Europe supports consistent cleaning standards and faster redeployment, strengthening its position in regulated end-use industries. Consolidation remains a defining trend, with larger providers acquiring or integrating regional reconditioning facilities to gain scale efficiencies and extend service coverage. Strategic priorities increasingly center on digital traceability systems, the expansion of a stainless steel IBC fleet for pharmaceutical and specialty chemical applications, and last-mile collection partnerships. These initiatives help maintain high utilization rates while meeting Europe’s stringent compliance and sustainability expectations.

Asia Pacific is likely to be the fastest-growing regional market for IBC rental services, driven by rapid industrialization, expanding chemical output, and strong growth in contract manufacturing. China and India account for a substantial share of regional volume demand due to large-scale chemical, agrochemical, and food-processing industries, while Japan and ASEAN countries support higher-value applications in pharmaceuticals, specialty chemicals, electronics chemicals, and food ingredients.

Export-oriented production further accelerates demand for standardized, reusable bulk packaging solutions. Growth is reinforced by manufacturing cost advantages, increasing participation in global supply chains, and gradual alignment with international hygiene, safety, and transport standards. Multinational chemical and pharmaceutical companies operating in the Asia Pacific increasingly apply the same container compliance requirements used in Europe and North America, which strengthens demand for rental providers capable of delivering validated cleaning, inspection, and documentation services.

Global players such as SCHUTZ, Mauser Packaging Solutions, and Greif have expanded their presence across China, India, and Southeast Asia through localized reconditioning hubs and service depots. These investments reduce container turnaround times and lower logistics costs, making rental models more competitive versus ownership. At the same time, regional providers are scaling cost-efficient plastic IBC rental fleets to serve volume-driven applications in the chemicals and agriculture industries.

Investment trends emphasize the development of localized logistics networks, automation in reconditioning operations, and the selective deployment of stainless steel IBCs for pharmaceutical and specialty chemical customers. Providers that successfully balance high-volume, price-sensitive demand with compliance-focused premium services are best positioned to capture long-term growth in Asia Pacific, particularly as regulatory enforcement and export quality standards continue to tighten.

The global IBC rental business market features a mixed structure combining global manufacturers with integrated rental and reconditioning services and regional specialists focused on leasing and logistics. Market concentration varies by region, with higher consolidation in Europe and greater fragmentation in Asia Pacific. Leading players control large fleet pools and reconditioning networks, enabling them to secure enterprise-level contracts, while smaller firms serve regional or niche applications.

Key developments include regulatory enforcement accelerating the adoption of reusable packaging, expansion of regional reconditioning capacity through acquisitions, and product innovation focused on aseptic and high-hygiene applications. Continued investments in digital fleet management and strategic partnerships between rental providers and cleaning specialists further enhance service efficiency and scalability. Market leaders emphasize vertical integration, premium product differentiation, digital asset tracking, and geographic expansion. Competitive advantage increasingly depends on compliance assurance, fleet utilization efficiency, and value-added services rather than container ownership alone.

The global IBC rental business market size is expected to be US$1.8 billion in 2026.

By 2033, the IBC rental business market value is projected to reach US$2.8 billion.

Key trends include increased adoption of pooled IBC systems, rising demand for validated cleaning and traceability, expansion of food- and pharma-grade rental fleets, integration of digital tracking and IoT-enabled fleet management, and growing alignment with circular economy and reusable packaging regulations, particularly in Europe.

The chemicals end-use industry is the leading segment, accounting for 40.8% market share, driven by high-volume liquid handling needs, frequent batch changes, and strict safety and compliance requirements that favor rental over ownership.

The IBC rental business market is projected to grow at a CAGR of 6.5% between 2026 and 2033.

Major players include SCHUTZ GmbH & Co. KGaA, Mauser Packaging Solutions, Greif, Inc., Hoover Ferguson Group, and Werit Kunststoffwerke W. Schneider GmbH & Co. KG.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By End-use Industry

By Application

By Material Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author