ID: PMRREP24766| 196 Pages | 20 Oct 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

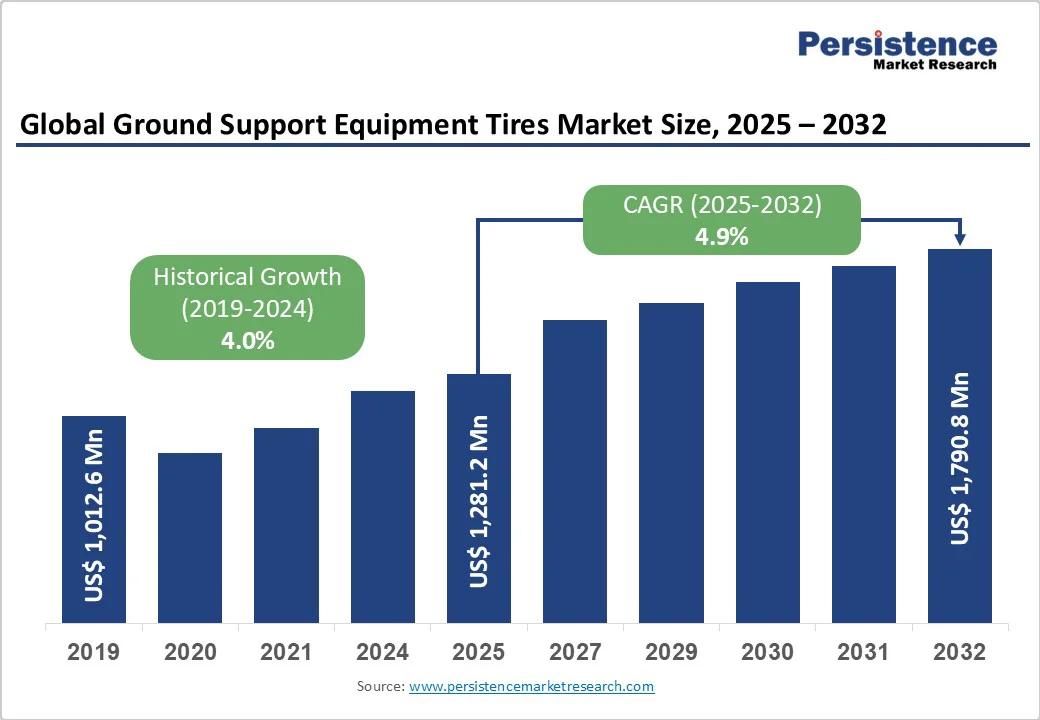

The global ground support equipment tires market size is likely to be valued at US$1,281.2 Million in 2025 and is expected to reach US$1,790.8 Million by 2032, growing at a CAGR of 4.9% during the forecast period from 2025 to 2032, the surging global air passenger traffic, which reached over 4.7 billion passengers in 2024 according to the International Air Transport Association (IATA), necessitating expanded ground handling operations and frequent tire replacements for durability.

The push for sustainable aviation practices is accelerating the adoption of advanced tire technologies such as foam-filled variants, reducing downtime and enhancing efficiency amid rising cargo volumes projected to grow by 5% annually through 2030, by the International Civil Aviation Organization (ICAO). These factors collectively bolster market expansion by improving operational reliability at busy airports worldwide.

| Key Insights | Details |

|---|---|

|

Ground Support Equipment Tires Market Size (2025E) |

US$1,281.2 Mn |

|

Market Value Forecast (2032F) |

US$1,790.8 Mn |

|

Projected Growth CAGR (2025-2032) |

4.9% |

|

Historical Market Growth (2019-2024) |

4.0% |

The relentless increase in global air travel is a pivotal driver for the ground support equipment tires market, as higher passenger and cargo volumes demand more robust ground handling fleets. According to IATA, air passenger numbers are expected to double to 8.2 billion by 2037, directly correlating with a 15-20% rise in ground support equipment usage at major hubs. This escalation requires tires that withstand heavy loads and frequent operations, boosting replacement cycles and new installations.

For instance, new airport constructions in emerging regions, supported by investments exceeding US$1 Trillion globally as per ICAO reports, further amplify tire demand by integrating modern equipment. Consequently, manufacturers are innovating puncture-resistant designs, ensuring seamless operations and reducing turnaround times, which positively impacts market revenue through sustained procurement.

Technological innovations in tire construction, such as enhanced rubber compounds and low-rolling-resistance profiles, are significantly propelling market growth by addressing operational challenges in high-stress airport environments. Data from the Federal Aviation Administration (FAA) indicates that advanced tires can extend lifespan by up to 30%, minimizing maintenance costs that account for 10-15% of ground handling expenses.

These advancements are in line with broader trends in the ground support equipment market, where sensor-equipped tires enable real-time monitoring to prevent failures during critical operations such as baggage towing. As airports prioritize fuel efficiency and safety, the adoption of such tires rises, evidenced by a 25% increase in orders for foam-filled variants reported in industry journals, fostering long-term market expansion.

Fluctuations in raw material costs, particularly natural rubber and synthetic compounds, pose a significant barrier to the ground support equipment tires market by inflating production expenses and squeezing margins for manufacturers. Rubber prices surged by 20% in 2024 due to supply chain disruptions from weather events in key producing regions, including Southeast Asia, as noted by the Association of Natural Rubber Producing Countries (ANRPC).

This volatility discourages investments in R&D for specialized tires, leading to supply shortages during peak demand periods at international airports. Ultimately, higher costs are passed to end-users, potentially slowing fleet upgrades and constraining overall market accessibility for smaller operators.

Regulatory compliance requirements for tire disposal and emissions are hindering market progress by increasing operational burdens on airport authorities and equipment providers. The European Union Aviation Safety Agency (EASA) mandates recycled content in tires, raising compliance costs by 15-20% as per recent audits, while similar FAA standards in the U.S. enforce rigorous testing that delays product launches. These rules limit the use of traditional materials, complicating supply chains and reducing flexibility for rapid scaling in response to air traffic growth. As a result, smaller players struggle to meet standards, fragmenting the market and impeding widespread adoption of new tire solutions.

The transition to electric Ground Support Equipment (GSE) presents a lucrative opportunity for tire manufacturers, as these vehicles require specialized, low-friction tires to optimize battery life and reduce environmental impact. With IATA forecasting that 50% of GSE at major airports will be electric by 2030, the demand for eco-friendly tires could surge by 40%, driven by policies such as the EU Green Deal mandating zero-emission operations.

Recent developments, such as airport trials in Amsterdam demonstrating 25% energy savings with advanced foam-filled tires, highlight potential for partnerships with OEMs. This shift not only opens revenue streams through customized products but also aligns with global sustainability goals, positioning companies to capture emerging segments in cargo and passenger services.

Rapid airport development in high-growth regions such as Asia Pacific offers substantial opportunities, fueled by rising air connectivity and urbanization. The ICAO data shows over 200 new airports planned in China and India by 2030, potentially increasing tire demand by 35% through integrated GSE fleets for the Aircraft Tractor Market.

Recent developments show that India’s GMR Group is investing US$2 Billion in terminal expansion projects, with a focus on enhancing infrastructure, including the use of durable tires for baggage handling and pushback operations.

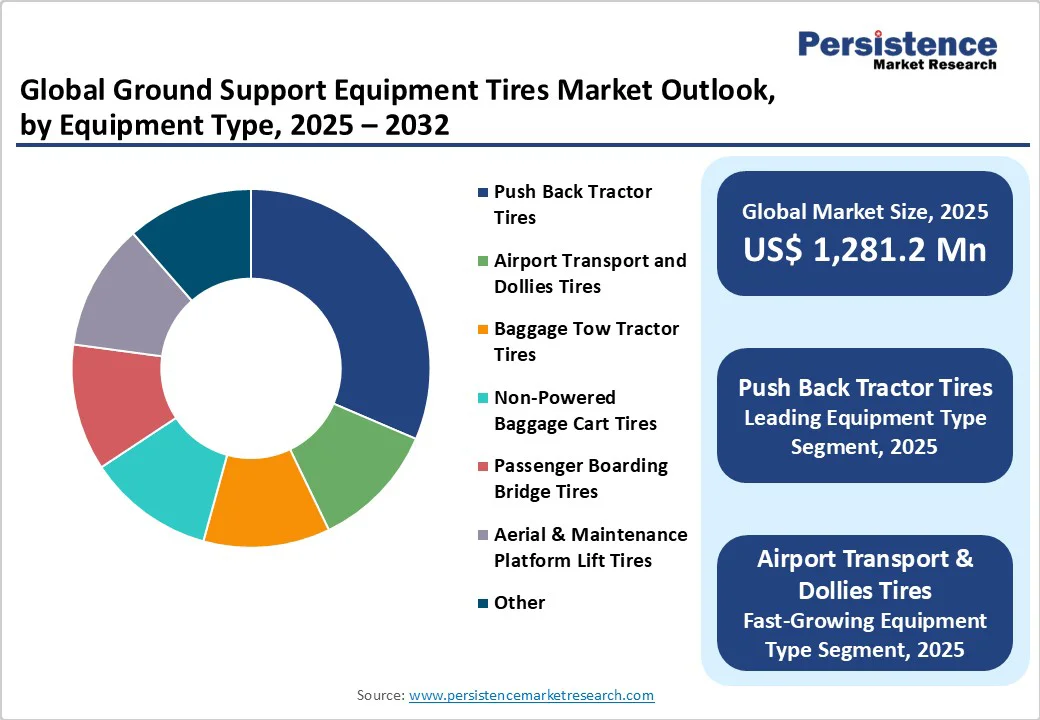

Among equipment types, push back tractor tires lead the market with approximately 28% market share, attributed to their critical role in efficient aircraft maneuvering at congested gates. These tires endure extreme loads up to 100 tons per vehicle, as per the FAA operational guidelines, ensuring minimal slippage on tarmac surfaces during towing.

High replacement frequency, driven by daily usage in commercial hubs, supports dominance, with statistics from airport logs showing 20% higher wear rates compared to lighter equipment such as dollies. This segment's reliance on robust, traction-enhanced designs underscores its leadership, bolstered by innovations in the broader aircraft tractor market.

Solid rubber tires dominate the product type category with a 42% share in the ground support equipment tires market, owing to their superior puncture resistance and low maintenance in harsh airport conditions. Engineered without air chambers, they eliminate flat risks, vital for non-stop operations, as evidenced by IATA reports noting a 15% reduction in downtime incidents. Durability against debris and chemicals, tested to withstand 50,000 km lifespans per ISO standards, justifies preference over air-filled alternatives. Their cost-effectiveness in high-traffic scenarios further cements leadership, aligning with efficiency demands in ground handling.

Commercial airports command an 82% share in the end-user segment of the market, driven by their vast scale and continuous operations serving civilian aviation. Handling over 90% of global flights as per IATA, these facilities require tires optimized for high-volume cargo and passenger handling, with wear data from major hubs such as Heathrow revealing annual replacements exceeding 10,000 units. Regulatory adherence to FAA and EASA safety norms ensures priority for durable solutions, outpacing military needs in procurement volume. This dominance reflects the sector's economic scale and infrastructure investments.

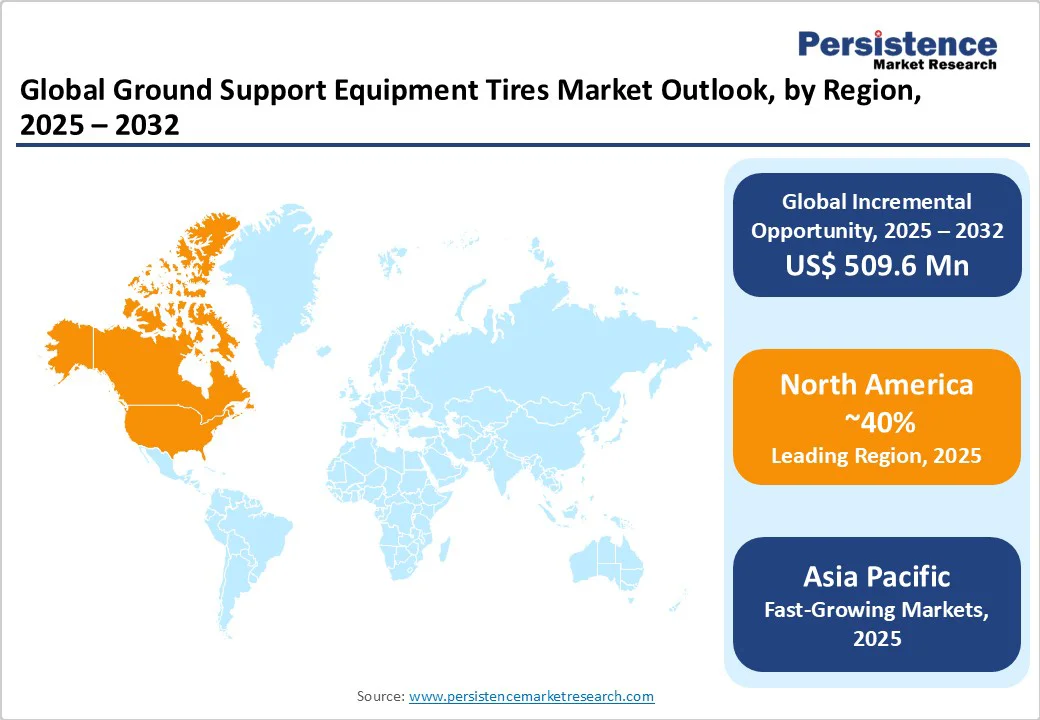

North America leads the market due to its mature aviation ecosystem and robust infrastructure investments. The U.S., home to over 5,000 airports under FAA oversight, drives demand through expansions at hubs such as Atlanta Hartsfield-Jackson, the world's busiest, where tire innovations enhance safety amid 1.2 billion passengers annually. Regulatory frameworks emphasize tire performance standards, fostering an innovation hub with companies testing low-emission variants.

Recent developments underscore this leadership, such as Los Angeles International Airport's 2025 initiative for sustainable GSE, integrating advanced tires to cut operational emissions by 20%. This aligns with U.S. Department of Transportation goals for efficient ground handling, positioning the region for sustained growth.

Europe's ground support equipment tires market thrives on harmonized regulations and strong performance in key nations such as Germany, the U.K., France, and Spain. EASA directives ensure uniform safety across the European Union, promoting tires with recycled content, as seen in Frankfurt Airport's adoption, reducing waste by 15% in 2024. Germany's manufacturing prowess, via firms such as Trelleborg AB, supports exports, while the U.K.'s post-Brexit focus on efficiency boosts tire upgrades at Heathrow.

France and Spain emphasize green aviation, with Paris Charles de Gaulle trials of foam-filled tires improving traction on wet runways, per Eurocontrol reports. Regulatory alignment facilitates cross-border procurement, enhancing market stability and innovation in passenger services.

Asia Pacific exhibits explosive growth in the market, led by China, Japan, India, and ASEAN nations' infrastructure boom. China's 14th Five-Year Plan targets 450 civil airports by 2025, driving tire demand for new GSE fleets, with Beijing Capital handling 100 million passengers yearly. India's UDAN scheme expands regional connectivity, necessitating durable tires for diverse terrains.

Manufacturing advantages in Japan and ASEAN lower costs, as Tokyo Haneda's 2024 upgrades incorporate high-load tires for cargo surges. This dynamic supports 6-7% annual growth, outpacing global averages through cost efficiencies and rising air freight.

The global ground support equipment tires market exhibits a moderately consolidated structure, with top players such as Michelin and Continental AG holding over 50% combined share through extensive portfolios and global distribution.

Strategies focus on R&D for sustainable materials, such as bio-based rubber, and expansions via acquisitions to penetrate emerging markets. Key differentiators include Michelin’s sensor-integrated tires for predictive maintenance and Trelleborg’s custom treads for traction. Emerging models emphasize leasing and aftermarket services, reducing capex for airports while promoting circular economy practices.

The ground support equipment tires market is projected to reach US$1,790.8 Million by 2032, growing from US$1,281.2 Mn in 2025 to a 4.9% CAGR.

Surging air traffic and technological advancements in tire durability drive demand, with IATA forecasting 8.2 billion passengers by 2037, boosting GSE fleet expansions.

Push Back Tractor Tires lead with 28% share, essential for aircraft towing and supported by high-load requirements at major airports.

North America leads due to FAA regulations and infrastructure at hubs such as Atlanta, handling 40% of global traffic.

Electric GSE transition offers opportunities, with 50% electrification by 2030 per IATA, demanding sustainable tire innovations.

Leading players include Michelin, Continental AG, and Trelleborg AB.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Equipment Type

By Product Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author