ID: PMRREP21124| 198 Pages | 29 Oct 2025 | Format: PDF, Excel, PPT* | Food and Beverages

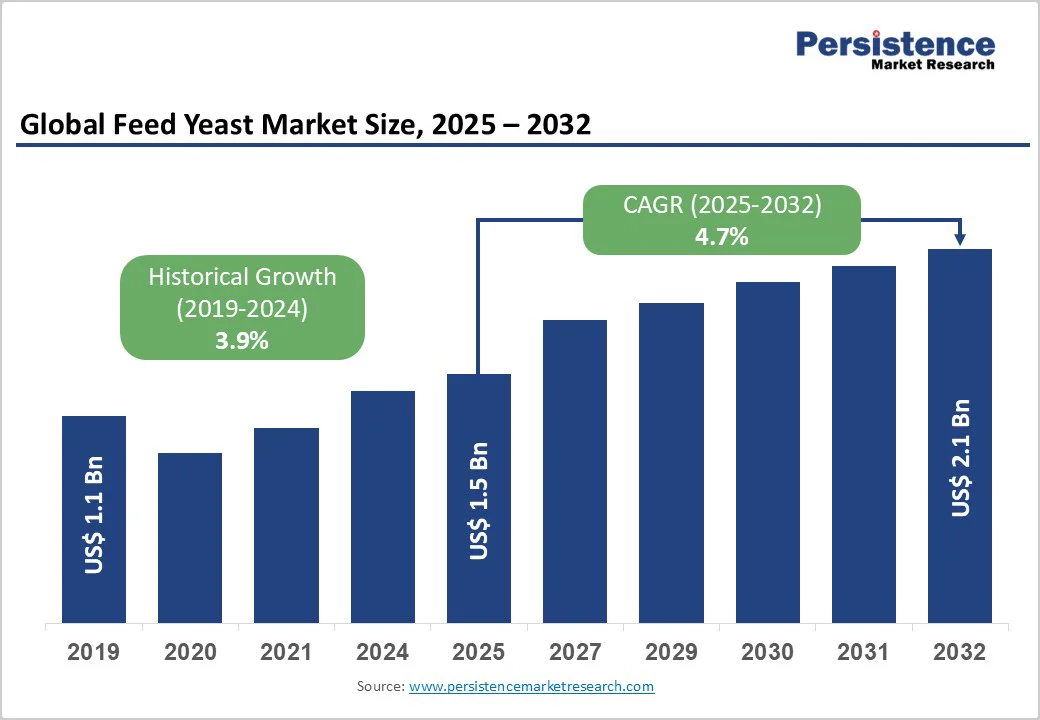

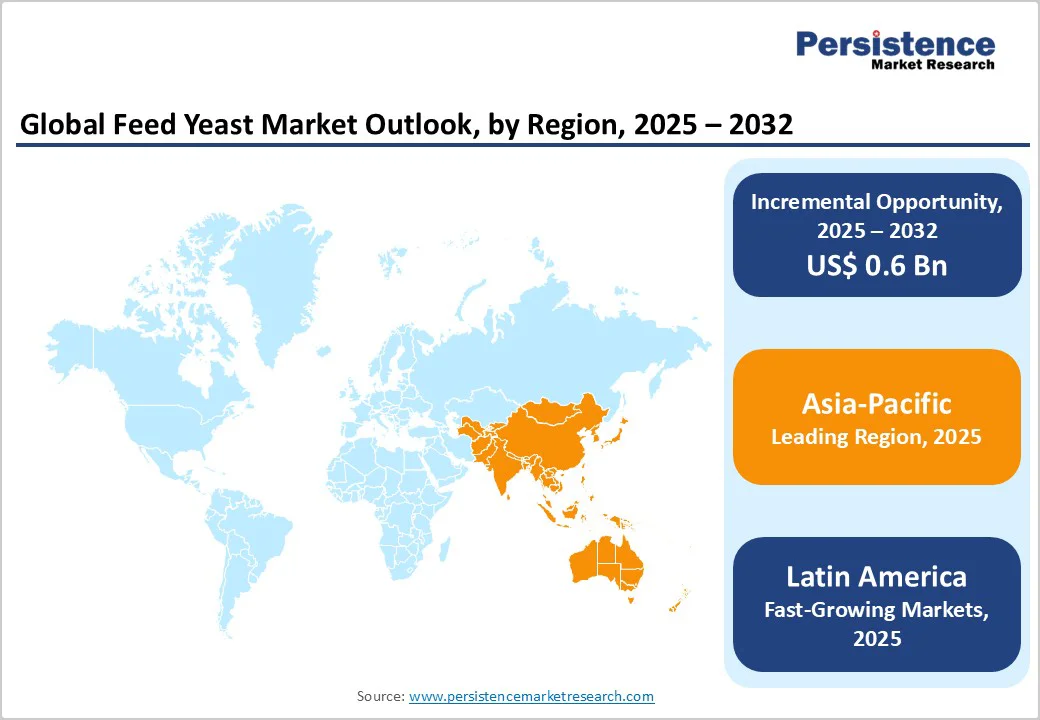

The global feed yeast market size is likely to value US$ 1.5 billion in 2025 and is projected to reach US$ 2.1 billion by 2032, growing at a CAGR of 5.1% during the forecast period from 2025 to 2032. The global feed yeast market is steadily growing, driven by demand for natural, functional feed additives that boost livestock health and productivity. North America leads with advanced animal husbandry, followed by Europe with strong organic and sustainable feed initiatives. Asia Pacific is the fastest-growing region, fueled by expanding poultry, swine, and aquaculture sectors and rising probiotic yeast adoption.

| Key Insights | Details |

|---|---|

|

Global Feed Yeast Market Size (2025E) |

US$ 1.5 Bn |

|

Market Value Forecast (2032F) |

US$ 2.1 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.3% |

Enhanced animal health and immunity are pivotal drivers in the growing demand for feed yeast supplements. Yeast products, particularly those derived from Saccharomyces cerevisiae, are rich in bioactive compounds such as β-glucans and mannan-oligosaccharides, which play a crucial role in modulating immune responses in livestock. For instance, supplementation with yeast cell wall products has been shown to stimulate immune system and cytokine production in young swine, enhancing their disease resistance. Similarly, yeast culture supplementation has demonstrated positive effects on performance and overall benefits to animal health in various species. These bioactive components not only bolster the immune system but also contribute to improved gut health, leading to better nutrient absorption and overall animal well-being. As a result, the inclusion of yeast derivatives in animal feed formulations is increasingly recognized as a sustainable and effective strategy to enhance animal health and productivity.

The feed yeast market faces significant competition from alternative feed additives, particularly probiotics and enzymes, which are gaining popularity due to their proven benefits in enhancing animal health and performance. Probiotics, such as Lactobacillus and Bifidobacterium strains, are increasingly used in livestock diets to improve gut health, enhance digestion, and boost immunity. Studies have shown that probiotic supplementation can positively alter the gut microbiota, reduce pathogen shedding, and improve overall animal health.

Similarly, feed enzymes such as phytases, proteases, and xylanases are utilized to break down complex feed components, improving nutrient digestibility and feed efficiency. Research indicates that the addition of feed enzymes can promote growth and efficiency of nutrient utilization in single-stomached animals, such as swine and poultry. These alternatives not only enhance animal health but also align with the growing demand for sustainable and antibiotic-free livestock production, posing a challenge to the feed yeast market.

Functional yeast derivatives are gaining prominence in India's feed industry due to their nutritional and health benefits. The Department of Animal Husbandry and Dairying (DAHD) highlights that the livestock sector contributes 30.23% to agricultural Gross Value Added (GVA) and 5.5% to the national economy, underscoring the significance of animal nutrition in India's economic landscape. Functional yeast derivatives, including yeast autolysates and hydrolysates, are utilized to enhance gut health, immunity, and overall productivity in livestock.

The Department of Biotechnology (DBT) reports that India's bio-economy has expanded eightfold from $10 billion to $80 billion over eight years, with the number of biotech startups increasing from 50 to 5,300, indicating a robust environment for biotechnological innovations. This growth is reflected in the feed industry, where the adoption of functional yeast derivatives is on the rise, driven by advancements in biotechnology and a focus on sustainable animal nutrition.

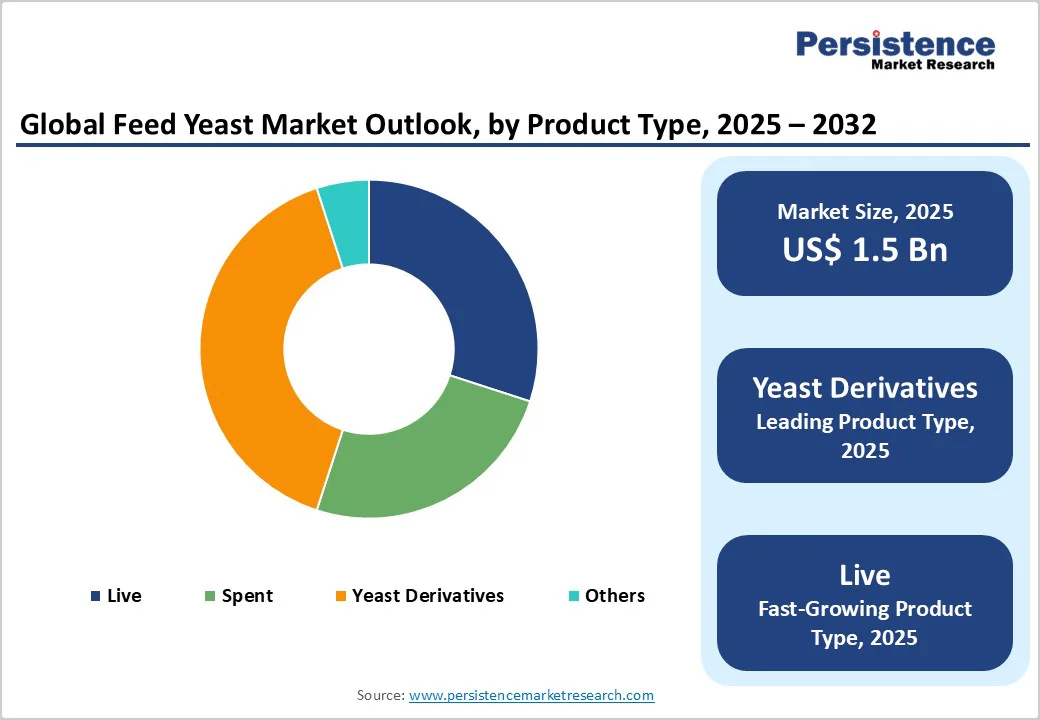

Yeast Derivatives dominates with a 39.4% share in 2025 due to their proven efficacy in enhancing livestock health and productivity. The Department of Animal Husbandry and Dairying (DAHD) emphasizes the importance of feed additives in improving animal nutrition and performance. Functional yeast derivatives, such as yeast autolysates and hydrolysates, are rich in bioactive compounds that support gut health, boost immunity, and improve feed conversion ratios. These benefits align with the government's focus on sustainable and efficient livestock management practices.

Additionally, the Department of Biotechnology (DBT) reports significant growth in India's bio-economy, with the number of biotech startups increasing from 50 to 5,300 over eight years, indicating a favorable environment for biotechnological innovations. This growth fosters the development and adoption of yeast-based feed additives, reinforcing their dominance.

Poultry dominates the feed yeast market due to its substantial contribution to meat production and consumption. In 2020, poultry meat accounted for nearly 40% of global meat production, with production increasing from 9 million tonnes in 1961 to 133 million tonnes in 2020. This growth is attributed to factors such as rising global population, urbanization, and increased purchasing power, leading to higher demand for poultry products. Additionally, poultry is raised by approximately 80% of rural households in developing countries, highlighting its accessibility and importance in global food systems. The integration of yeast derivatives in poultry feed enhances gut health, improves feed conversion ratios, and boosts overall productivity, making them a preferred choice for poultry producers seeking to meet the rising global demand for poultry products.

The North American market dominates the global market with a 33.4% share in 2025, due to its advanced agricultural infrastructure and large-scale livestock production. The United States, for instance, is a major producer of yeast, with industrial-scale operations utilizing technologies that differ from those traditionally used in tropical climates, allowing for greater control over fermentation processes. This technological edge enables efficient production of yeast derivatives, which are crucial for enhancing animal nutrition.

The U.S. corn ethanol industry generates millions of tons of nutritional co-products annually, including high-protein, low-fiber yeast-based feeds, further bolstering the availability of feed yeast. These factors, combined with a well-established feed industry and strong regulatory frameworks, position North America at the forefront of the feed yeast market.

Europe is an important region in the feed yeast market due to its robust agricultural systems, stringent regulatory frameworks, and emphasis on sustainable practices. The European Union (EU) is a significant producer of yeast, with industrial-scale operations utilizing technologies that differ from those traditionally used in tropical climates, allowing for greater control over fermentation processes. This technological edge enables efficient production of yeast derivatives, which are crucial for enhancing animal nutrition.

The EU's livestock sector is substantial, producing millions of tonnes of meat annually, which drives the demand for high-quality feed additives like yeast derivatives. The integration of yeast derivatives in animal feed enhances gut health, improves feed conversion ratios, and boosts overall productivity, aligning with the EU's focus on sustainable and efficient livestock management practices. These factors collectively position Europe at the forefront of the feed yeast market.

Asia-Pacific is the fastest-growing region in the feed yeast market, driven by rapid industrialization, increasing livestock production, and a shift towards sustainable animal nutrition. The region accounts for over 90% of global aquaculture output, highlighting its dominance in fish farming. Countries like China, India, and Vietnam are major producers of yeast derivatives, with China's Angel Yeast Co., Ltd. producing 26,000 tons annually, making it a global leader in yeast production.

The regional governments in Asia Pacific are investing in alternative proteins, including fermentation-based solutions, to meet the growing demand for animal feed and address food security challenges. This combination of production capacity, government support, and market demand positions Asia-Pacific as a key player in the global feed yeast market.

The global feed yeast market is growing as producers adopt advanced extraction, blending, and value-addition techniques. Focus on purity, stability, and aroma, alongside organic and specialty segments, enhances competitiveness. Sustainable cultivation, strategic collaborations, and traceable supply chains boost consumption in livestock, poultry, aquaculture, and pet feed, supporting sustained market expansion worldwide.

The global feed yeast market is projected to be valued at US$ 1.5 Bn in 2025.

Rising livestock production, demand for sustainable nutrition, gut health benefits, and increased adoption of yeast derivatives drive global feed yeast growth.

The global feed yeast market is poised to witness a CAGR of 5.1% between 2025 and 2032.

Opportunities include functional yeast derivatives, organic feed, aquaculture expansion, sustainable livestock practices, emerging markets, and technological advancements in extraction and formulation.

Major players in the global are Alltech Inc., Diamond V (Cargill, Incorporated), Lallemand Animal Nutrition, Inc., Archer Daniels Midland Company, ABF Ingredients, Lesaffre, and Others.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Livestock

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author