ID: PMRREP2802| 84 Pages | 8 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

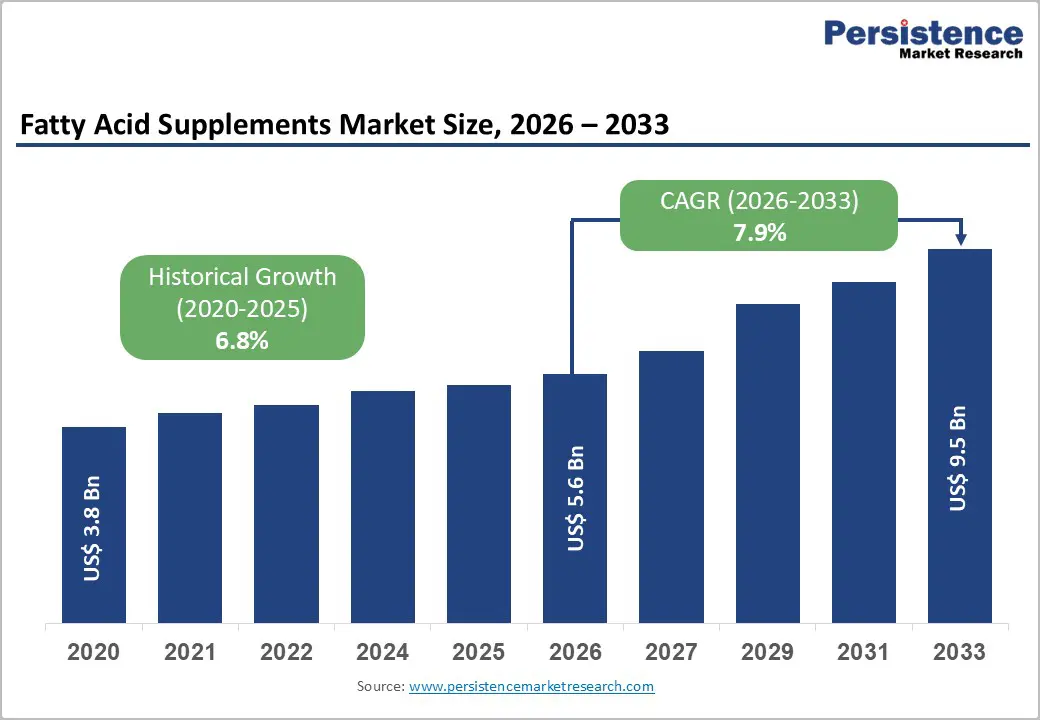

The global Fatty Acid Supplements market size is expected to be valued at US$ 5.6 billion in 2026 and projected to reach US$ 9.5 billion by 2033, growing at a CAGR of 7.9% between 2026 and 2033.

Shifting health priorities, digital retail expansion, and innovation in formulation are redefining how fatty acid supplements are produced, positioned, and consumed worldwide. The market is increasingly shaped by preventive wellness behaviors, sustainability expectations, and science-led product differentiation across regions

| Key Insights | Details |

|---|---|

| Fatty Acid Supplements Market Size (2026E) | US$ 5.6 Bn |

| Market Value Forecast (2033F) | US$ 9.5 Bn |

| Projected Growth (CAGR 2026 to 2033) | 7.9% |

| Historical Market Growth (CAGR 2020 to 2025) | 6.8% |

A quiet shift toward long-term wellness is reshaping supplement choices as consumers prioritize prevention over treatment. Fatty acid supplements benefit strongly from this mindset due to their established role in supporting cardiovascular balance, lipid management, and metabolic health. Awareness around lifestyle-linked conditions pushes individuals to adopt daily nutrition routines that support heart function from an early age. Omega-rich formulations are increasingly viewed as foundational wellness tools rather than condition-specific aids.

This driver gains momentum through medical advice, digital health content, and self-tracking culture that emphasizes proactive care. Aging populations seek joint and cognitive support, while younger consumers focus on endurance and circulatory health. Fatty acids fit seamlessly into these goals because they are easy to consume and align with clean nutrition habits. As preventive health becomes a lifestyle priority, the sustained demand for fatty acid supplementation continues to expand globally.

Environmental awareness is reshaping how consumers and regulators view marine-sourced ingredients. Fatty acid supplements face growing scrutiny linked to overfishing, ecosystem imbalance, and resource depletion. Concerns over fish stock sustainability influence purchasing decisions, particularly among environmentally conscious buyers. Brands relying on traditional marine oils encounter pressure to justify sourcing practices and traceability. This scrutiny raises reputational risks and complicates supply planning.

The restraint deepens as advocacy groups and policymakers demand responsible harvesting and transparent supply chains. Limited access to certified raw materials can constrain production scalability and raise costs. Smaller manufacturers struggle to secure sustainable inputs without eroding margins. As environmental accountability becomes non-negotiable, sustainability challenges remain a structural constraint that suppliers must actively address to maintain market credibility.

Fresh thinking around how supplements are consumed is unlocking new growth paths for fatty acid brands. Innovative delivery formats like gummies, chewables, and emulsions address long-standing issues related to taste, swallowing difficulty, and absorption. These formats attract younger consumers and lifestyle-focused buyers who prefer convenient, enjoyable supplementation experiences. Improved bioavailability through emulsified systems further enhances perceived value.

For startups, alternative formats create clear differentiation without competing purely on ingredient sourcing. Established players leverage delivery innovation to refresh mature portfolios and expand usage occasions. Functional gummies and ready-to-mix emulsions fit seamlessly into daily routines, increasing compliance. As consumer expectations evolve toward convenience and sensory appeal, delivery innovation emerges as a high-impact opportunity across both premium and mass-market fatty acid supplements.

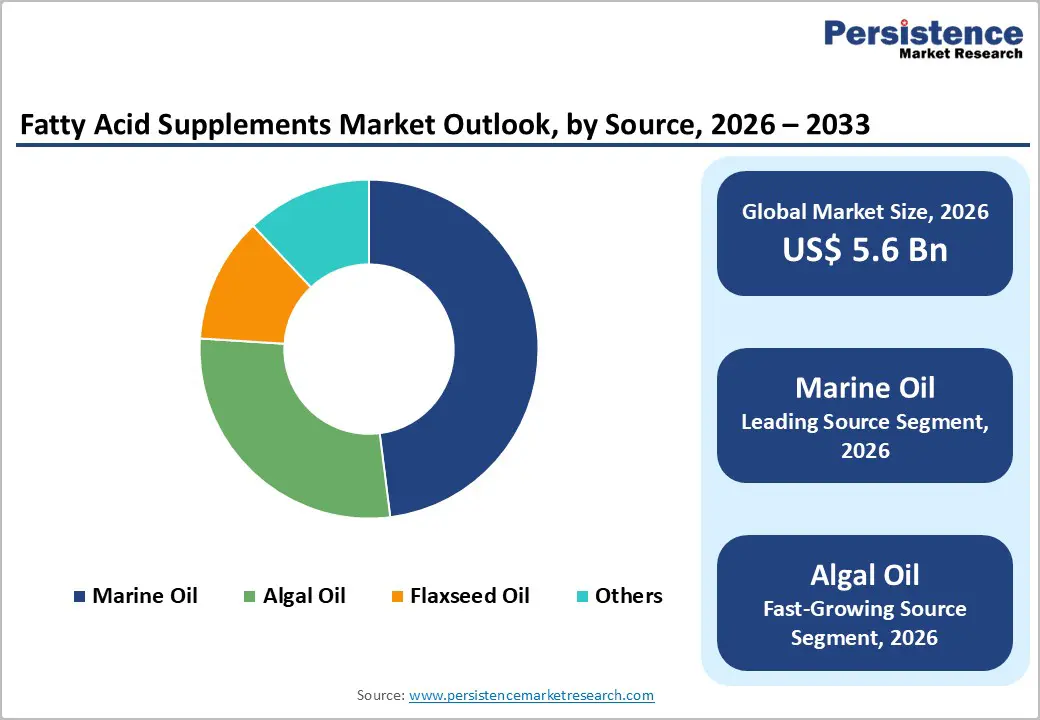

Marine Oil holds approx. 47% market share as of 2025, reflecting its deep-rooted credibility in fatty acid nutrition. Fish-derived oils remain widely trusted for their natural concentration of essential omega compounds with proven bioavailability. Long-standing consumer familiarity and clinical usage reinforce preference for marine sources across heart, brain, and joint health applications.

Dominance is further supported by established supply chains and standardized refining technologies that ensure consistent quality. Marine oils integrate easily into capsules, liquids, and functional foods, offering formulation flexibility. Healthcare professionals frequently recommend marine-based fatty acids, strengthening consumer confidence. Despite emerging alternatives, marine oil continues to anchor the market due to efficacy perception, legacy usage, and strong alignment with preventive health routines worldwide.

Online Retail is projected to grow at a CAGR of 9.6% during the forecast period as digital purchasing reshapes supplement consumption. Consumers increasingly favor direct access to product information, reviews, and subscription options when buying fatty acid supplements. Online platforms allow easy comparison of formulations, dosages, and sourcing claims, supporting informed decision-making. Convenience and discreet home delivery further strengthen adoption.

Growth accelerates through brand-owned websites and curated wellness platforms offering personalized bundles and auto-replenishment. Online channels enable rapid launch of niche formulations without reliance on physical shelf space. Educational content and influencer-driven awareness build trust and engagement. As digital health ecosystems expand, online retail becomes a critical growth engine for fatty acid supplements, especially among tech-savvy and repeat-purchase consumers.

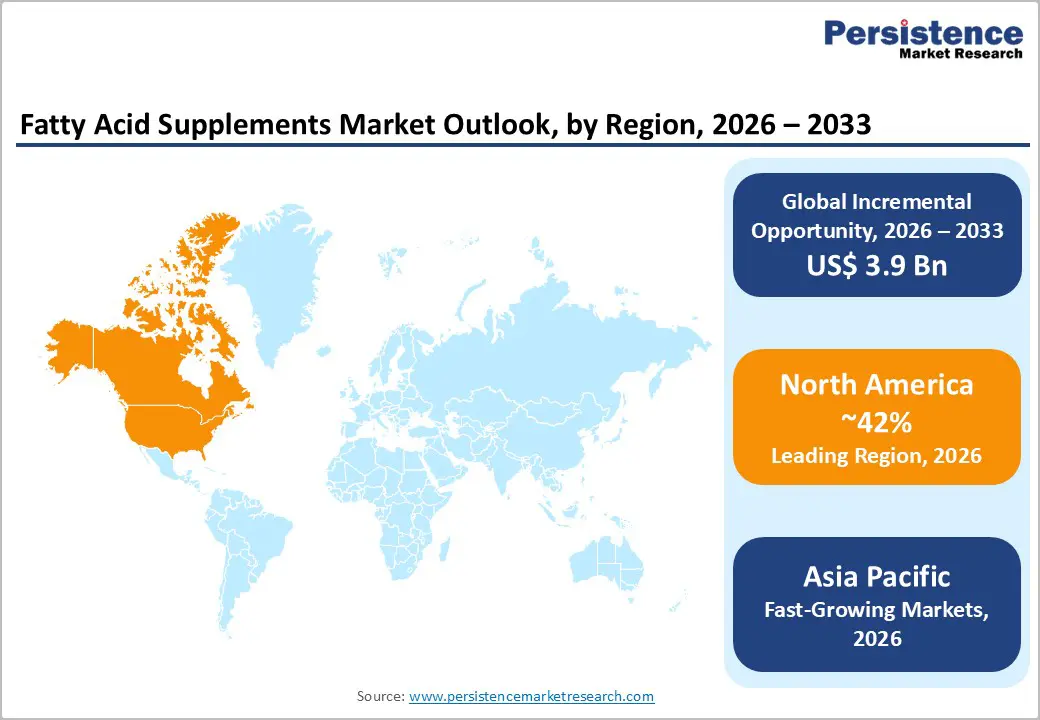

North America holds approximately 42% market share in the global Fatty Acid Supplements Market, driven by strong wellness awareness and supplement adoption. In the U.S., consumers increasingly integrate fatty acids into daily routines for heart, cognitive, and joint support. Demand rises for high-purity, traceable products aligned with preventive healthcare habits. Functional nutrition and physician-guided supplementation influence purchasing behavior.

Canada mirrors this trend with emphasis on quality assurance, clean labeling, and sustainability-linked sourcing. Retailers highlight science-backed formulations and dosage clarity. Growth of subscription models and practitioner-recommended brands strengthens market maturity. Across North America, innovation focuses on absorption efficiency and convenience formats, positioning the region as a stable, premium-driven market for fatty acid supplements.

Asia Pacific Fatty Acid Supplements Market is expected to grow at a CAGR of 9.4% as health awareness expands rapidly. In India, rising lifestyle-related health concerns increase interest in heart and metabolic support supplements. Urban consumers adopt omega products through pharmacies and digital platforms.

China shows strong momentum through preventive nutrition culture and growing trust in imported supplements. Japan emphasizes purity, precise dosing, and functional benefits, aligning fatty acids with healthy aging. South Korea integrates fatty acid supplements into beauty-from-within and cognitive wellness trends. Across the region, education-driven marketing and rising disposable incomes accelerate adoption. Diverse consumption habits and evolving retail channels position Asia Pacific as a dynamic growth region for fatty acid supplements

The global Fatty Acid Supplements Market is moderately consolidated, combining multinational ingredient leaders with agile niche brands. Leading companies emphasize clean label sourcing, transparency, and third-party certifications to build trust. Sustainability commitments increasingly shape sourcing strategies and brand narratives.

Competition centers on product innovation, delivery format advancement, and formulation differentiation. Companies invest in regulatory compliance to navigate varying regional standards. Emerging players leverage focused positioning and digital reach, while established firms expand portfolios through science-backed upgrades. Government oversight on labeling and quality continues influencing competitive strategy. Success increasingly depends on balancing efficacy, ethical sourcing, and consumer education in a tightly regulated global environment.

The global Fatty Acid Supplements market is expected to reach around US$ 5.6 billion in 2026.

Rising consumer focus on preventive health and heart wellness is a key demand driver in the Fatty Acid Supplements market.

North America leads the Fatty Acid Supplements market with about 42% share in 2025.

Innovation in delivery formats such as gummies and emulsions is the key opportunity in the market.

Key players include DSM-Firmenich, BASF SE, Croda International Plc, ADM, Evonik Industries AG, Corbion NV, and others

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Source

By End Use

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author