ID: PMRREP32541| 278 Pages | 31 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

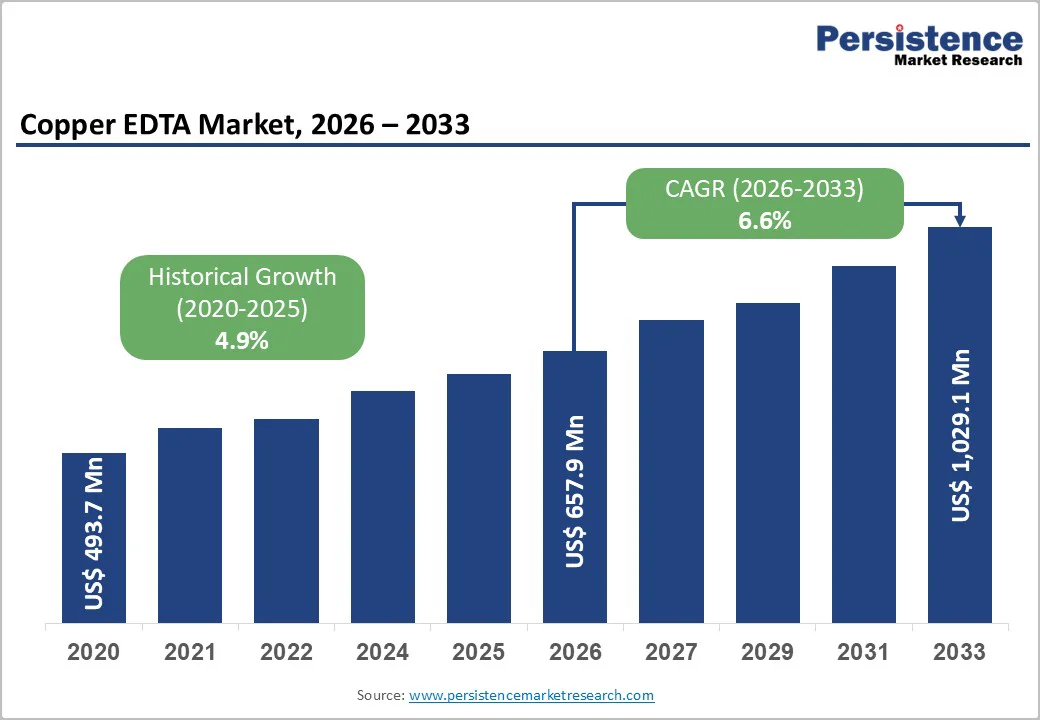

The global Copper EDTA market size is supposed to be valued at US$ 657.9 Mn in 2026 and is projected to reach US$ 1,029.1 Mn by 2033, growing at a CAGR of 6.6% between 2026 and 2033.

The expansion of the copper EDTA market is primarily driven by heightened awareness of micronutrient deficiencies in agricultural soils, particularly in the Asia-Pacific and Latin America, where prolonged intensive farming has depleted essential soil reserves. The rapid adoption of precision agriculture and drip irrigation systems that favor chelated formulations for optimized nutrient delivery, and the reinforcement of regulatory frameworks promoting sustainable agricultural practices. Furthermore, the anticipated surge in global copper demand, combined with copper’s pivotal role in renewable energy infrastructure and electric vehicle manufacturing, has significantly elevated its strategic importance. This dynamic indirectly strengthens the market for copper-based micronutrient supplements. Collectively, these converging drivers position the Copper EDTA market for robust and sustained growth throughout the forecast period.

| Key Insights | Details |

|---|---|

|

Copper EDTA Size (2026E) |

US$ 657.9 Mn |

|

Market Value Forecast (2033F) |

US$ 1,029.1 Mn |

|

Projected Growth CAGR (2026-2033) |

6.6% |

|

Historical Market Growth (2020-2025) |

4.9% |

Copper deficiency is increasingly prevalent in global agricultural systems, particularly in sandy soils, peat soils with high organic matter, and alkaline soils where copper availability is severely limited. Studies, including those by the University of Minnesota, indicate that approximately 19% of topsoil samples in Canada exhibit copper deficiency, with wheat, barley, and oats being most affected.

Symptoms include stunted growth, reduced chlorophyll synthesis, weakened disease resistance, and heightened vulnerability to pathogens such as ergot fungus, leading to significant yield losses. To mitigate these challenges, farmers are adopting EDTA-chelated copper formulations, which remain soluble and bioavailable under adverse soil pH conditions. This trend is especially pronounced in Asia-Pacific nations like India and China, where decades of intensive farming have depleted soil copper reserves, necessitating targeted micronutrient interventions.

The global horticultural sector is the fastest-growing application segment for Copper EDTA, accounting for nearly 33% of overall demand, driven by the high nutrient requirements of greenhouse vegetables, fruit crops, and specialty ornamental plants. Advanced precision agriculture practices, such as soil analysis, crop monitoring, and optimized nutrient scheduling, facilitate accurate application of chelated copper formulations, minimizing waste and enhancing nutrient uptake efficiency.

Yara International ASA has introduced its YaraVita PROCOTE technology, enabling micronutrient coating on granular fertilizers to ensure uniform nutrient distribution and improved crop vigor. Additionally, the increasing adoption of drip irrigation and fertigation systems across Asia-Pacific countries, including Vietnam, Thailand, and Indonesia, supports the effective use of water-soluble Copper EDTA. These systems deliver chelates directly to root zones, improving absorption while reducing environmental losses through leaching or runoff.

EDTA compounds exhibit environmental persistence, prompting regulatory scrutiny, particularly in Europe, where stringent water-quality standards and soil-protection directives restrict application rates. Current European Union regulations cap copper fungicide use at 4 kg Cu/hectare/year in vineyard soils, with projections suggesting minimal long-term impact on predicted no-effect concentrations. Nevertheless, environmental advocacy groups and proponents of sustainable agriculture have expressed concerns about EDTA’s potential leaching into groundwater and its limited biodegradability under certain soil conditions.

These factors are driving pressure for stricter regulations and encouraging substitution with alternative chelating agents such as GLDA or IDS/IDHA compounds. Consequently, regulatory uncertainty combined with rising consumer demand for environmentally responsible agricultural inputs creates significant barriers to market growth and necessitates substantial R&D investment in next-generation, biodegradable chelating solutions.

The Copper EDTA market remains highly susceptible to fluctuations in copper prices, which surged by 50% in 2025 to exceed US$12,000 per metric ton. Supply disruptions in major mining regions, including Indonesia, the Democratic Republic of Congo, and Chile, primarily drove this escalation. Concurrently, rising demand from renewable energy projects, electric vehicle manufacturing, and data center expansion has intensified cost pressures, directly impacting micronutrient formulation producers.

Furthermore, EDTA synthesis involves complex chemical processes and specialized raw materials, with production concentrated among a limited number of regional suppliers, heightening exposure to geopolitical risks and tariff-related trade barriers. Persistent structural shortages in primary copper mining, coupled with the absence of significant new deposits and protracted development timelines for new projects, indicate sustained price volatility that could constrain market growth for cost-sensitive agricultural sectors.

Government-led soil health programs, notably India’s National Mission on Natural Farming and Digital Agriculture Mission, are driving the systematic adoption of micronutrient-enriched fertilizers, including EDTA-chelated formulations. The Nutrient-Based Subsidy framework, coupled with subsidy rationalization policies favoring balanced fertilization over conventional urea, is influencing farmers to shift toward specialty micronutrient products, with the micronutrient fertilizer market projected to grow at a CAGR of 6.49% through 2030.

Persistent regional deficiencies in zinc, copper, iron, and boron across India’s diverse agroecological zones underscore the strategic importance of government-supported Copper EDTA distribution initiatives. BASF SE’s recent introduction of Trilon G, a GLDA-based sustainable chelating agent, and Sokalan CP 301 dispersant in April 2025 reflects industry commitment to environmentally compliant, government-approved solutions. These developments present significant opportunities for manufacturers offering cost-effective, regulatory-compliant products tailored to local soil and crop requirements.

The rapid expansion of global data centers and renewable energy infrastructure has created unprecedented demand for copper, resulting in a structurally tight market and sustained high prices. While this poses challenges for micronutrient manufacturers, it simultaneously underscores the strategic importance of efficient copper utilization in agriculture through chelated formulations. Farmers facing rising input costs are increasingly adopting Copper EDTA for its superior bioavailability, enabling reduced application rates and improved agronomic performance compared to non-chelated alternatives.

Concurrently, investments in regional copper processing infrastructure, particularly in Asia-Pacific nations such as Indonesia and India, are enhancing local production capacity for chelated micronutrients, reducing dependence on imports, and strengthening supply chain resilience. This convergence of global scarcity and regional capacity expansion creates opportunities for manufacturers to differentiate products and command premium pricing for sustainable, high-performance formulations.

The powder form segment represents the leading category in the Copper EDTA market, accounting for nearly 58% of the total share due to its superior stability, extended shelf life, and ease of handling across diverse application methods. Powdered Copper EDTA offers significantly lower transportation costs compared to liquid formulations, making it highly suitable for regions with developing logistics infrastructure, such as South and Southeast Asia. Industrial users, including water treatment facilities, pharmaceutical manufacturers, and large-scale agricultural enterprises, favor powdered variants for precise dosing, simplified blending, and reduced storage requirements.

Furthermore, powder formulations integrate seamlessly with granular NPK fertilizers through advanced coating technologies such as YaraVita PROCOTE, ensuring uniform nutrient distribution and enhanced crop compatibility. While liquid formulations are gaining traction in precision agriculture, the powder segment’s cost-effectiveness and versatility secure its dominant position throughout the forecast period.

The Above 12% copper content segment dominates the Copper EDTA market, accounting for nearly 64% of the total share, primarily due to commercial agricultural producers’ preference for concentrated formulations that maximize cost-efficiency per application. Products containing 12–15% elemental copper, such as Copper EDTA 15% and specialized 14% variants, command premium pricing while delivering superior agronomic performance through enhanced nutrient density. High-copper-content formulations reduce application volumes, significantly lowering labor and equipment costs, particularly in large-scale farming operations across North America, Europe, and developed Asia-Pacific regions.

Furthermore, pharmaceutical and nutraceutical manufacturers favor these formulations for animal feed supplements and human nutrition, as concentrated copper delivery minimizes bulk and improves portability. Conversely, the Below 12% segment, including 10–12% copper products, remains relevant in price-sensitive markets and organic farming, though adoption is limited by lower nutrient density and regulatory constraints.

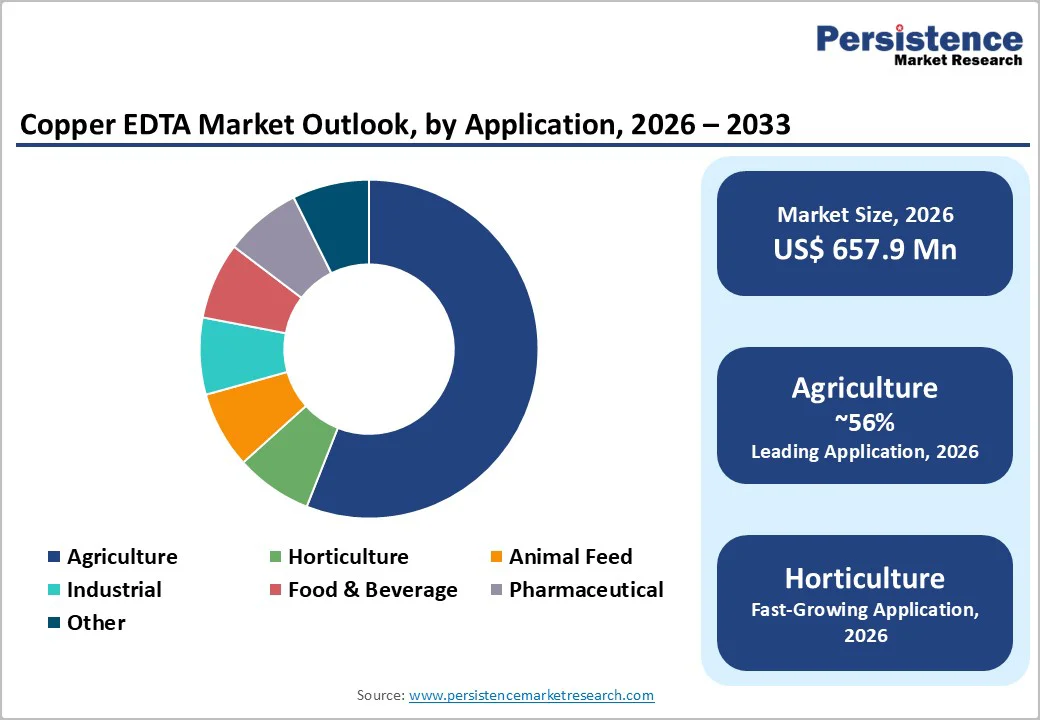

The Agriculture segment holds the dominant position in the Copper EDTA market, accounting for nearly 56% of the application-based share. This leadership is driven by widespread copper deficiencies in major crop-producing regions and increasing farmer awareness of micronutrient optimization. Key crops such as wheat, barley, rice, corn, and cotton, which account for over 70% of global grain output, exhibit significant copper responsiveness, with deficiency-related yield losses estimated at 15–25% in regional studies.

The Horticulture segment is the fastest-growing category, fueled by high micronutrient requirements in fruit, vegetable, and ornamental crops. Animal Feed applications account for approximately 8% of the market, leveraging Copper EDTA to enhance bioavailability in livestock and poultry nutrition. Industrial, Food & Beverage, and Pharmaceutical, offering niche growth opportunities through specialized applications.

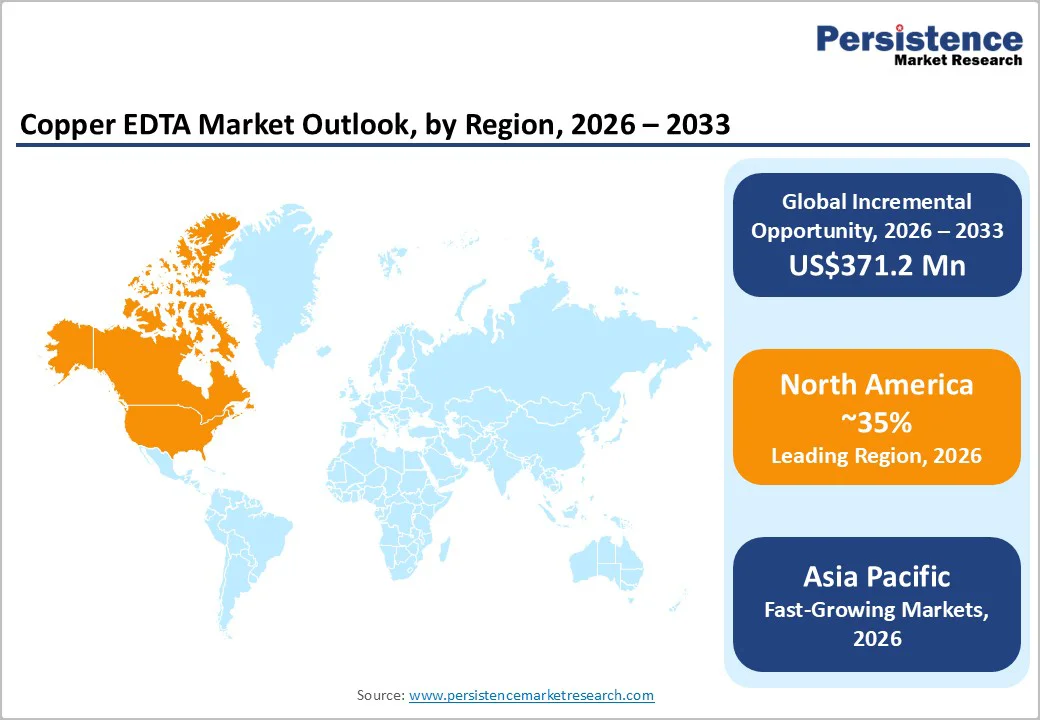

North America holds a leading position in the global copper EDTA market, accounting for nearly 35% of the total share. This dominance is supported by advanced agricultural infrastructure, widespread adoption of precision farming technologies, and stringent regulatory frameworks promoting environmental stewardship in nutrient management. In the U.S., copper deficiencies are prevalent in the Midwestern grain belts and on High Plains sandy loam soils, prompting the systematic integration of chelated micronutrients into crop management practices.

Similarly, Canadian regions such as Central Alberta exhibit 19% copper deficiency in topsoil, driving consistent demand for chelated formulations among grain and oilseed producers. The market benefits from robust distribution networks, direct farmer-to-manufacturer engagement, and strong R&D capabilities led by major agrochemical corporations. Additionally, infrastructure investments and renewable energy initiatives are expected to boost copper demand, indirectly supporting micronutrient adoption.

Europe accounts for nearly 28% of the global Copper EDTA market, with strong demand concentrated in Germany, France, Spain, and the United Kingdom. The region operates under stringent agricultural regulations, including the EU’s Integrated Plant Protection Directive and soil protection frameworks, which limit overall copper use and favor chelated formulations as efficient, environmentally compliant alternatives. Vineyard areas in Spain, France, and Italy represent key application zones, where restrictions on the annual use of copper fungicides have accelerated the adoption of EDTA-chelated micronutrients.

The market is transitioning toward sustainable solutions, such as GLDA-based and biodegradable chelating agents, exemplified by BASF SE’s launch of Trilon G in 2025. Germany leads innovation in precision agriculture and digital soil monitoring, while consumer preference for eco-friendly inputs supports premium pricing. Despite moderate growth compared to Asia-Pacific, Europe maintains resilience at a 4.5% CAGR through 2033.

Asia Pacific is the fastest-growing regional market for Copper EDTA, projected to expand at a CAGR of about 8.2% through 2033. China leads the region, accounting for 33.3% of fertilizer sales, driven by extensive agricultural acreage for rice, wheat, and specialty crops. Decades of intensive farming have caused severe soil degradation in areas such as the Yangtze River Delta and North China Plain, creating widespread micronutrient deficiencies and necessitating chelated formulations.

India, growing at 6.49% CAGR, benefits from subsidy reforms and Soil Health Card initiatives to promote micronutrient adoption among smallholders. Southeast Asian nations, including Indonesia, Vietnam, Thailand, and the Philippines, show robust growth at 9.5% CAGR, fueled by export-oriented horticulture. Regional manufacturers are expanding production capacity and developing localized products to strengthen supply chain resilience and reduce dependence on imports.

The copper EDTA market demonstrates moderate consolidation, with the top five manufacturers, BASF SE, Yara International ASA, Haifa Group, AkzoNobel N.V., and Dow Chemical Company, collectively accounting for nearly 55% of global market share. A competitive middle tier comprises 20 regional producers and specialty chemical manufacturers, while a fragmented base of small-scale suppliers primarily serves developing agricultural markets. Competitive strategies emphasize product innovation, particularly the development of biodegradable chelating agents and environmentally compliant formulations, alongside supply chain reliability, technical agronomic support, and expanded distribution networks. BASF SE maintains a market share exceeding 20% through integrated global production facilities, comprehensive chelate portfolios, and strategic expansions in China, supported by continuous innovation in sustainable technologies. Yara International ASA differentiates through advanced micronutrient coating solutions, such as YaraVita PROCOTE, that enhance nutrient efficiency and compatibility with precision agriculture systems.

BASF SE (Ludwigshafen, Germany) represents the global market leader through vertically integrated production capabilities, comprehensive EDTA-chelate product portfolios encompassing copper, iron, zinc, and manganese chelates, substantial R&D investment in sustainable chelating agent development, and strategic positioning in high-growth Asia Pacific markets through major capital investments in China and Southeast Asia production facilities. The company's Agricultural Solutions segment generated €3.2 billion revenues in 2023, with chelated micronutrient products commanding premium pricing justified by superior product quality, regulatory compliance, and technical agronomic support.

Yara International ASA (Oslo, Norway) operates as a global agronomic solutions provider with a substantial market presence in the Copper EDTA segment through its YaraVita foliar micronutrient product line and its proprietary PROCOTE micronutrient coating technology, which enables the precision application of chelated nutrients to granular fertilizers. The company's competitive advantages encompass global distribution networks spanning 160 countries, technical agronomic expertise provision to farmers and agricultural distributors, and continuous innovation in product formulations tailored to regional soil conditions and crop requirements across diverse agroecological zones.

Haifa Group (Haifa, Israel) maintains a significant global market presence through integrated production facilities, specialized expertise in chelated micronutrient formulation chemistry, and strategic geographic positioning in Middle Eastern and North African agricultural markets. The company's planned investment of approximately US$350 million in specialty fertilizer production infrastructure reflects management's commitment to expanding regional production capacity, enhancing product portfolio depth, and capturing growth opportunities in emerging agricultural markets that require sophisticated micronutrient management solutions.

The global Copper EDTA market is projected to reach US$ 1,029.1 Mn by 2033, growing from US$ 657.9 Mn in 2026 at a CAGR of 6.6%, driven by expanding agricultural micronutrient deficiencies and horticultural sector growth across developing nations.

The market is primarily driven by escalating copper deficiencies in agricultural soils, affecting approximately 19% of arable land in developed regions, growing adoption of precision agriculture and drip irrigation systems, expanding horticultural production in the Asia Pacific, and government-sponsored soil health initiatives, particularly in India and China, promoting micronutrient-fortified fertilizer applications.

The Agriculture segment commands approximately 56% market share, with particular strength in cereal, wheat, and field crop production where copper deficiency-induced yield losses quantifiable at 15-25% necessitate systematic preventive micronutrient applications, while the Horticulture segment emerges as the fastest-growing category expanding at 9.5% CAGR.

North America currently maintains the dominant regional position with approximately 35% global market share, underpinned by sophisticated agricultural infrastructure, precision agriculture technology adoption, and regulatory frameworks mandating environmental stewardship, though Asia Pacific is projected to capture 37% share by 2033 through high-growth agricultural markets.

The primary market opportunity lies in developing biodegradable, environmentally compliant chelating agent alternatives, including GLDA-based and IDS/IDHA formulations capable of addressing environmental persistence concerns associated with conventional EDTA compounds while maintaining equivalent agronomic efficacy, thereby capturing premium market segments demanding sustainable agricultural inputs aligned with evolving regulatory standards.

Leading market participants include BASF SE, Yara International ASA, Haifa Group, AkzoNobel N.V., Dow Chemical Company, and regional manufacturers, including Shijiazhuang Tuhong Biotech Co., Ltd., Lemandou, and Van Iperen International, expanding production capacity and geographic presence.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 – 2025 |

|

Forecast Period |

2026 – 2033 |

|

Market Analysis Units |

Value: US$ Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author