ID: PMRREP35467| 195 Pages | 7 Jul 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

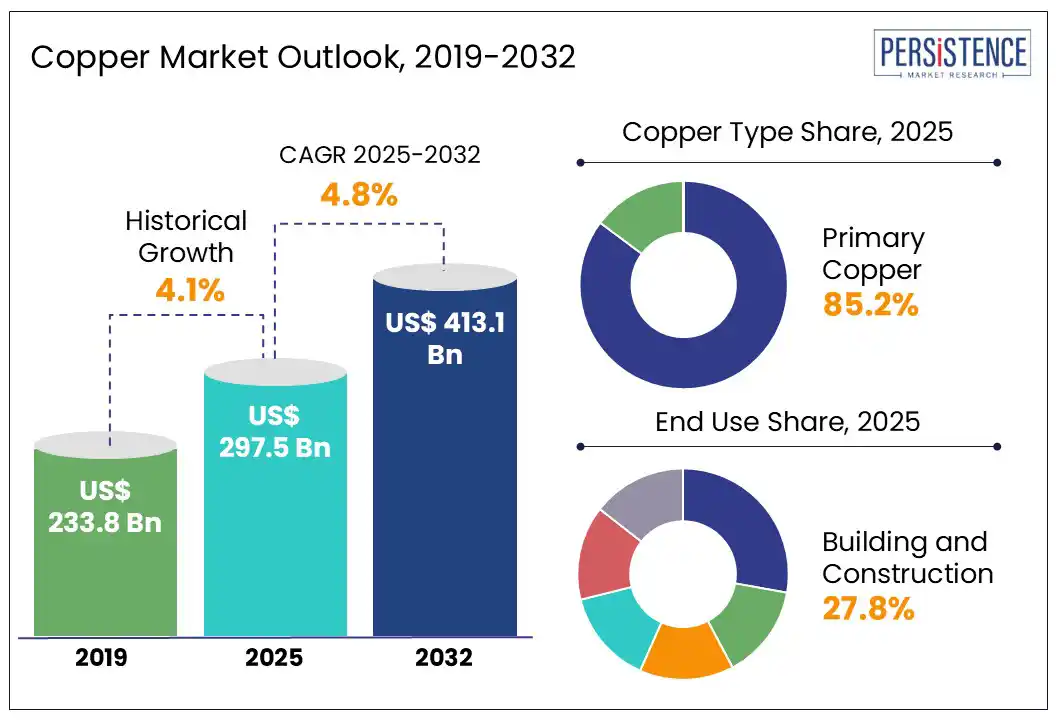

The copper market size is likely to be valued at US$ 297.5 Bn in 2025 and is estimated to reach US$ 413.1 Bn in 2032, growing at a CAGR of 4.8% during the forecast period 2025-2032.

Once considered just another industrial metal, copper has rapidly emerged as a key enabler of the world’s transition to clean systems, reveals a Persistence Market Research report. Copper’s conductivity, durability, and versatility have made it indispensable in both aging infrastructure and next-generation technologies. As global climate targets intensify and digitization skyrockets, demand for the metal is outpacing historical trends. It is hence propelling geopolitical competition, innovation in recycling, and a race to secure sustainable supply chains.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Copper Market Size (2025E) |

US$ 297.5 Bn |

|

Market Value Forecast (2032F) |

US$ 413.1 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.1% |

The shift toward electric mobility is significantly spurring the copper market growth owing to the metal’s key function in EV powertrains, electrodeposited copper foil, batteries, inverters, and charging infrastructure. The global EV market is booming, with more than 14 Mn units sold in 2023 alone. The International Energy Agency (IEA) estimates that this number could exceed 45 Mn units annually by 2030. This trajectory is anticipated to fuel additional copper demand of over 4 Mn tons per year by the end of the decade.

Beyond vehicles, the rollout of EV charging infrastructure is another significant demand driver. Fast-charging (DC) stations require approximately 25 to 30 kg of copper per unit, including cabling, internal wiring, and transformers. With India, Germany, and the U.S. each targeting over 100,000 new public chargers by 2030, the copper required just for charging infrastructure is envisioned to surpass 600,000 tons cumulatively over the next five years.

Environmental concerns surrounding copper mining are increasingly acting as a constraint on supply expansion. These are directly affecting demand by tightening availability and raising costs. One of the key issues is the high water and energy intensity of copper extraction and processing. Chile, for example, is facing severe water stress due to prolonged droughts in the Atacama region. In 2024, Codelco announced a temporary production cut at its Radomiro Tomic and Chuquicamata mines, stating water scarcity and the rising costs of sourcing desalinated water. These supply limitations make end users hesitant to commit to large-scale copper-intensive projects at volatile price points.

Strict environmental regulations and permitting delays are also contributing to project cancellations and deferrals. ESG-conscious investors and governments are scrutinizing copper’s carbon footprint. It is especially evident in open-pit mining regions where biodiversity loss and tailings mismanagement are common. Such environmental concerns are not only stalling projects but also transforming procurement strategies in terms of copper coils.

The global push for clean energy sources to meet climate targets is creating sustained demand for copper due to its role in renewable power systems and grid modernization. Solar and wind power installations use up to 5 times more copper per megawatt than traditional fossil-fuel generation. For instance, a single onshore wind turbine requires around 4 tons of copper, while offshore turbines can use 8 to 10 tons. This is primarily evident in nacelle wiring, generator windings, and subsea transmission lines.

Grid expansion and reinforcement are another copper-intensive opportunity tied to clean energy. As countries integrate variable renewable sources, the demand for high-capacity grids has surged. China’s State Grid Corporation, for instance, is accelerating deployment of ultra-high voltage networks. These require copper for substations and conductor systems at unprecedented scale.

Based on copper type, the market is bifurcated into primary and secondary. Among these, primary copper will likely account for approximately 85.2% of share in 2025 due to its key role in the electrification and decarbonization of global economies. The surging production of EVs is a significant driver. EVs typically use around 83?kg of copper, nearly four times the 23?kg in internal combustion vehicles. With global EV sales skyrocketing every year, this translates into millions of tons of additional copper demand annually, particularly for components such as flexible copper foil.

Secondary copper, on the other hand, is speculated to exhibit considerable growth through 2032 amid its important role in offsetting supply constraints of primary copper. With rising concerns over the environmental and energy costs of primary copper mining, manufacturers and governments are actively shifting toward recycled copper. This shift is particularly relevant in the European Union, where the revised Critical Raw Materials Act mandates high recycling quotas and prioritizes domestic processing of end-of-life materials.

In terms of end use, the market is divided into industrial equipment, transport, infrastructure, building and construction, and consumer and general products. Out of these, building and construction is projected to hold around 27.8% of the copper market share in 2025 owing to its superior performance in electrical conductivity, corrosion resistance, and antimicrobial properties. Green building standards and energy efficiency regulations are further reinforcing demand. The LEED and BREEAM certifications now often require the use of durable, recyclable, and energy-efficient materials, including copper magnet wires, thereby spurring demand.

Infrastructure is gaining impetus due to copper’s ability to enable high-capacity electricity transmission, renewable energy integration, and digital connectivity across large-scale public systems. As countries race to decarbonize and modernize their grids, copper’s superior electrical conductivity and reliability under high-load conditions make it ideal. According to the International Copper Association, a kilometer of high-voltage underground cable can contain more than 2.5 tons of copper. Global grid expansion plans are further predicted to consume over 20 Mn tons of copper by 2030.

In North America, the market is undergoing a strategic resurgence because of the accelerating demand from EVs, renewable energy projects, and grid modernization efforts. The U.S. copper market is poised to remain at the forefront owing to the presence of significant mines such as Morenci (Freeport-McMoRan) and Resolution (a joint venture between Rio Tinto and BHP). These are central to meeting the domestic demand. Development at Resolution, however, has faced prolonged delays due to environmental and tribal land concerns, pointing to surging regulatory hurdles in the U.S.

The Inflation Reduction Act (IRA) passed in 2022 has significantly influenced copper investments in the U.S. by offering tax credits for domestically sourced materials used in clean energy and EVs. It has propelled renewed exploration and brownfield expansion projects across Nevada, Utah, and Montana. Canada remains a key contributor, particularly in British Columbia, which hosts large-scale mining operations such as Teck Resources’ Highland Valley Copper. Teck recently announced plans to invest over CAD 800 Mn in extending the mine life and bolstering production efficiency through autonomous haul systems.

In the Middle East and Africa, copper is increasingly positioned as a strategic asset, with the Democratic Republic of Congo (DRC) and Zambia in leading positions. The DRC has become a focal point for global mining investments, with China-based projects dominating the landscape. China’s CMOC Group ramped up production at the Tenke Fungurume mine in 2024 after resolving a prolonged ownership dispute. This helped the company in producing more than 360,000 tons of copper and 30,000 tons of cobalt the same year.

Zambia is also regaining momentum after years of policy instability. Under its new mining reforms, the government of Zambia aims to triple copper output to 3 Mn tons by 2032, signaling a policy shift toward investor-friendly terms and public-private partnerships. Other countries such as Namibia and Botswana are emerging as exploration hotspots. Sandfire Resources’ Motheo copper mine in Botswana commenced commercial production in mid-2024. It is anticipated to yield 30,000 tons every year.

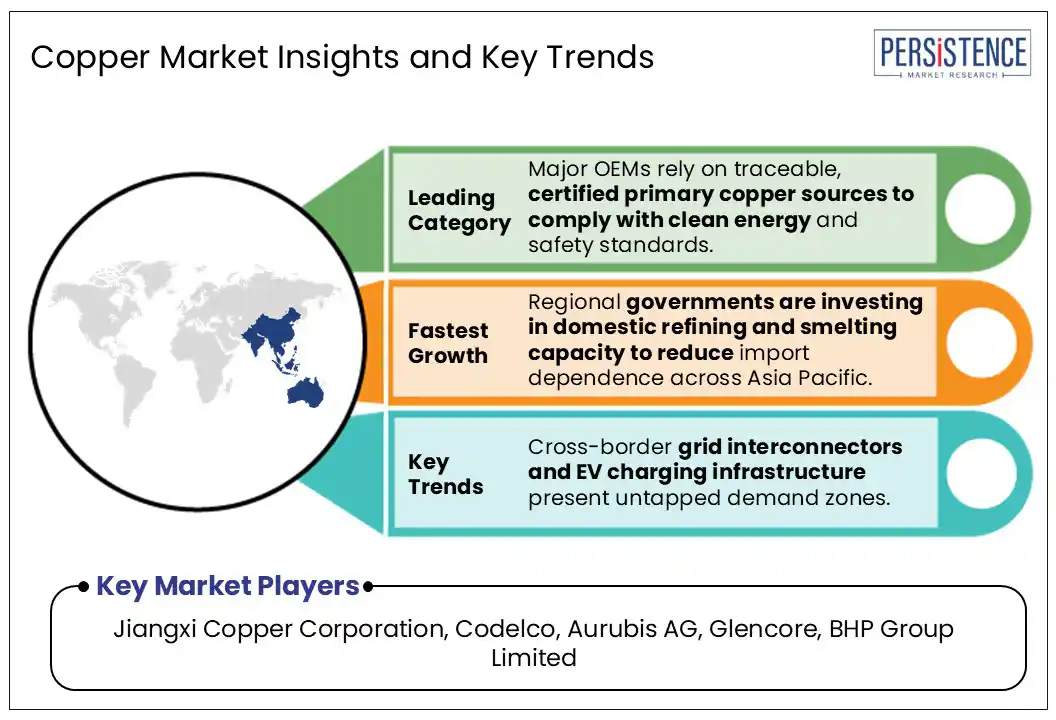

Asia Pacific is predicted to account for nearly 75.3% of share in 2025 due to China’s position as one of the most significant consumers and refiners of copper worldwide. Domestic production, however, continues to lag behind industrial demand. As per various sources, the country produces around 1.8 to 1.9 Mn metric tons of mined copper domestically, but it should emphasize refining and imports over 13 Mn metric tons to cater to its rising downstream demand. Local players are extending overseas stakes and refining operations to gain a competitive edge.

Indonesia is rapidly transforming into a copper processing hub. Following its 2023 export ban on unprocessed copper concentrate, the government has fast-tracked downstream infrastructure. Freeport Indonesia, for example, launched its new US$ 3.7 Bn copper smelter in Gresik, East Java, which is capable of refining 1.7 Mn tons of concentrate annually. India, while not a significant copper miner, has exhibited surging demand due to renewable energy and power transmission projects.

The copper market is characterized by high concentration at the peak, with a handful of mining giants controlling a significant share of global production. Key players such as Codelco, Glencore, BHP, and Freeport-McMoRan dominate in terms of both mining output and reserves. Codelco remains one of the world's most prominent producers due to Chile’s extensive deposits, particularly the Chuquicamata and El Teniente mines. There is increasing investment competition for resource-rich regions, especially in Africa. Zambia and the Democratic Republic of Congo are attracting China-based companies as they aim to secure mining rights.

The market is projected to reach US$ 297.5 Bn in 2025.

Surging transport electrification programs and integration of automation in mining are the key market drivers.

The market is poised to witness a CAGR of 4.8% from 2025 to 2032.

Government investments in domestic refining capacity and increasing smart city initiatives are the key market opportunities.

Jiangxi Copper Corporation, Codelco, and Aurubis AG are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Copper Type

By Product Type

By End Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author