ID: PMRREP33175| 210 Pages | 20 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

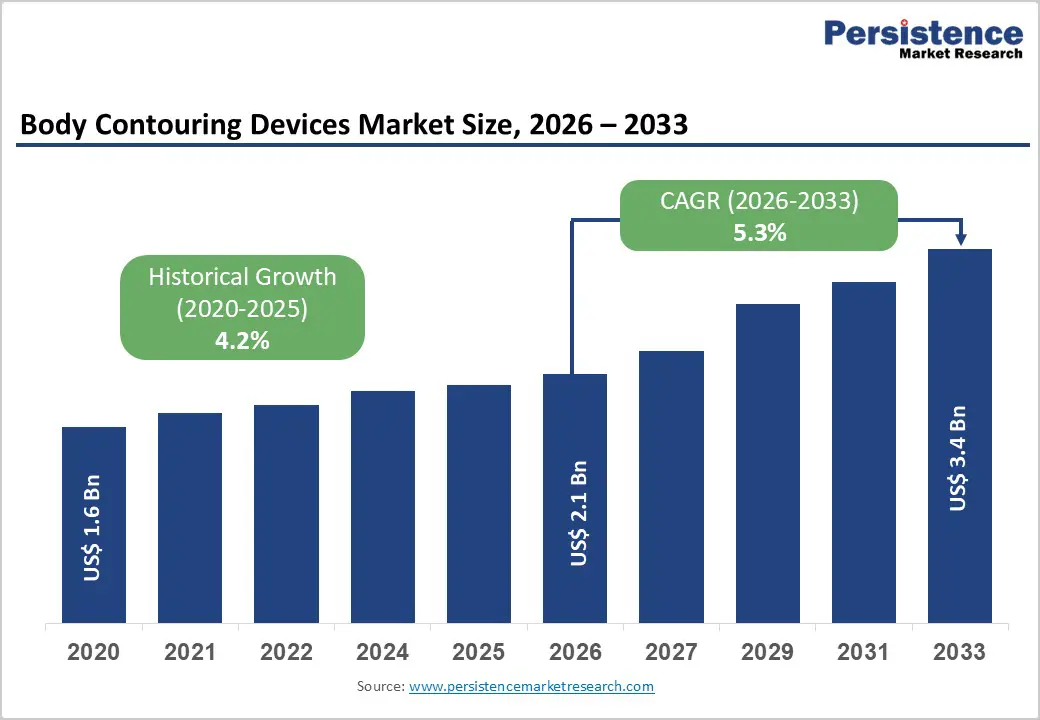

The global body contouring devices market size is estimated to grow from US$ 2.1 Bn in 2026 to US$ 3.4 Bn by 2033. The market is projected to grow at a CAGR of 5.3% from 2026 to 2033.

Global demand for body contouring devices is increasing steadily, driven by rising aesthetic awareness, growing prevalence of obesity and overweight conditions, and increasing preference for non-invasive and minimally invasive cosmetic procedures. Sedentary lifestyles, poor dietary habits, and aging populations are expanding the target population seeking fat reduction, skin tightening, and body sculpting solutions. Body contouring devices are widely used across hospitals, specialty aesthetic clinics, and ambulatory settings to deliver targeted fat reduction, skin firming, and body toning with minimal downtime and reduced procedural risk. Growing emphasis on physical appearance, wellness, and preventive aesthetics is further accelerating adoption among both male and female consumers.

The expansion of medical aesthetics chains, medical spas, and private clinics, along with rising medical tourism, is driving global market growth. Technological advancements—including cryolipolysis, radiofrequency, ultrasound, laser-based systems, and AI-enabled platforms—are improving treatment precision, safety, and workflow efficiency. Additionally, expanding healthcare infrastructure in emerging markets and rising investments in aesthetic medicine are reinforcing long-term demand for body contouring devices worldwide.

| Key Insights | Details |

|---|---|

|

Body Contouring Devices Market Size (2026E) |

US$ 2.1 Bn |

|

Market Value Forecast (2033F) |

US$ 3.4 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

5.3% |

|

Historical Market Growth (CAGR 2020 to 2025) |

4.2% |

Growth is primarily driven by increasing global demand for non-invasive and minimally invasive aesthetic procedures that offer visible body shaping results with minimal downtime and lower procedural risk. Rising prevalence of overweight and obesity, driven by sedentary lifestyles, poor dietary habits, and urbanization, has significantly expanded the target population seeking fat reduction and body sculpting solutions. At the same time, growing body image awareness, social media influence, and acceptance of aesthetic treatments among both men and women are accelerating procedure volumes.

Technological advancements in energy-based systems such as cryolipolysis, radiofrequency, ultrasound, and laser platforms have improved treatment efficacy, safety, and patient comfort, increasing clinician and consumer confidence. Modern devices enable targeted fat reduction, skin tightening, and muscle toning with predictable outcomes, supporting repeat treatments and combination therapies. Expansion of specialty aesthetic clinics, medical spas, and outpatient centers has improved accessibility, while flexible financing options and promotional packages are lowering adoption barriers. Additionally, increasing disposable incomes and medical aesthetics tourism in several regions are supporting demand. Continuous product innovation, shorter treatment times, and broader application versatility are collectively driving sustained growth momentum.

The market faces notable restraints related to the high upfront cost of advanced body contouring systems, particularly energy-based and multi-platform devices. These costs can limit adoption among small clinics, independent practitioners, and facilities in price-sensitive regions. Beyond initial acquisition, ongoing expenses associated with device maintenance, consumables, software upgrades, and service contracts increase total cost of ownership.

Limited availability of trained and certified aesthetic professionals also constrains market expansion. Many advanced systems require specialized training to ensure safe operation and optimal treatment outcomes, and inconsistent training standards across regions can lead to underutilization or variability in results. In emerging markets, lack of awareness, affordability concerns, and limited access to aesthetic infrastructure further restrict adoption. Regulatory requirements for medical device approval, clinical validation, and post-market surveillance can extend product launch timelines and increase compliance costs for manufacturers. Additionally, patient concerns regarding treatment efficacy, variability of results, and the need for multiple sessions may impact conversion rates. Collectively, these factors can slow penetration, particularly in developing regions and smaller healthcare settings.

Significant growth opportunities are emerging from expanding aesthetic awareness and healthcare infrastructure development in emerging economies. Rapid urbanization, rising disposable incomes, and increasing acceptance of cosmetic procedures across Asia Pacific, Latin America, and the Middle East are creating strong untapped demand for body contouring solutions. Expansion of private aesthetic clinics, medical spas, and dermatology centers is improving access and driving procedural volumes.

Technological advancements focused on automation, real-time monitoring, and AI-assisted treatment customization are enhancing clinical efficiency and outcomes, making devices more attractive to high-volume providers. Development of compact, user-friendly systems with reduced operator dependency supports adoption in smaller clinics. Growing interest in combination treatment platforms that address fat reduction, skin tightening, and muscle toning within a single system is further expanding revenue potential. Additionally, increasing medical tourism, particularly for aesthetic procedures, is strengthening demand in cost-competitive regions. Strategic partnerships between device manufacturers, clinic chains, and training institutions are improving skill availability and standardization of care. As aesthetics increasingly aligns with wellness and preventive care, body contouring devices are well-positioned for long-term growth.

Non-invasive devices are projected to dominate the global body contouring devices market in 2026, accounting for a revenue share of 62.5%. Their leadership is primarily driven by strong patient preference for procedures that avoid surgery, anesthesia, and extended recovery periods. Technologies such as cryolipolysis, radiofrequency, ultrasound, and laser-based systems enable effective fat reduction and skin tightening with minimal discomfort and low complication risk. These devices are widely adopted across aesthetic clinics and outpatient settings due to simplified operation, lower procedural costs, and the ability to treat multiple body areas. Increasing demand for lunchtime procedures, repeat sessions, and combination treatments further strengthens adoption. Additionally, continuous innovation focused on treatment precision, safety profiles, and improved clinical outcomes supports sustained market dominance. Rising awareness of body aesthetics, growing obesity rates, and expanding availability of non-invasive solutions in emerging markets are expected to reinforce leadership through the forecast period.

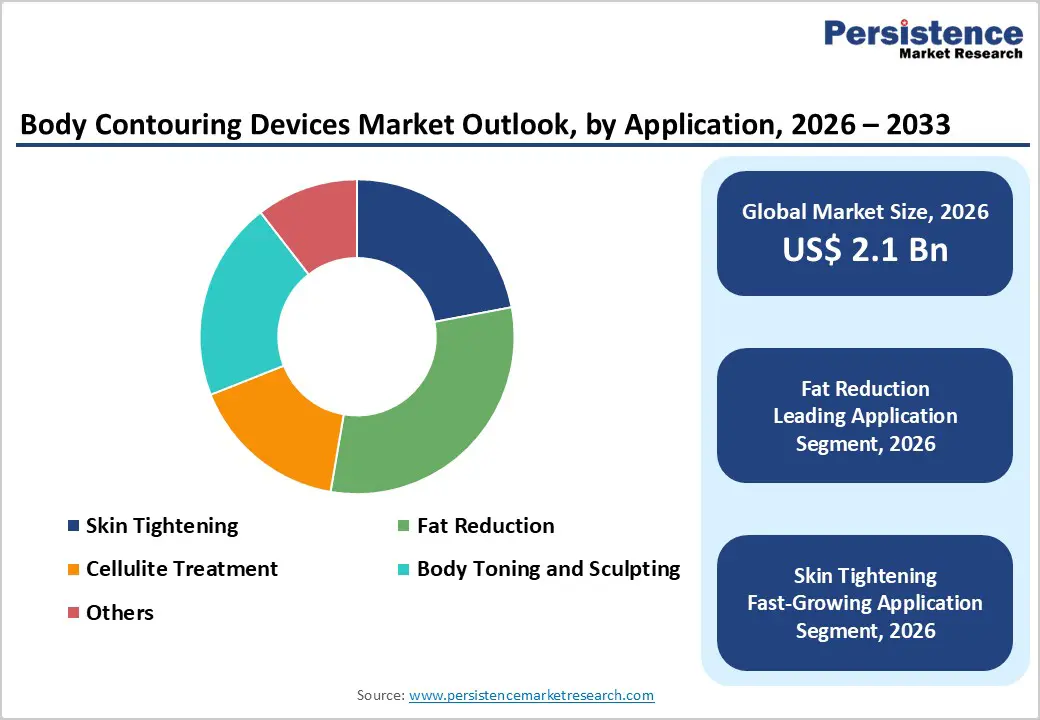

The fat reduction segment is expected to dominate the global body contouring devices market in 2026, capturing a revenue share of 30.7%. This leadership is driven by the increasing global prevalence of overweight and obesity, coupled with growing consumer inclination toward non-surgical body fat management solutions. Fat reduction procedures represent the highest-volume aesthetic treatments, particularly targeting the abdomen, flanks, thighs, and arms. Non-invasive modalities such as cryolipolysis and focused ultrasound are widely preferred due to proven efficacy, safety, and minimal downtime. Rising aesthetic consciousness among both male and female populations, supported by social media influence and wellness trends, continues to boost demand. Additionally, expanding availability of customized treatment protocols and combination therapies enhances clinical outcomes. As lifestyle-related weight gain remains a persistent global challenge, fat reduction is expected to retain its position as the leading application area.

Specialty clinics are projected to dominate the global body contouring devices market in 2026, accounting for a revenue share of 41.0%. This dominance is attributed to high patient footfall, specialized aesthetic expertise, and focused service offerings tailored specifically to cosmetic and body contouring procedures. Specialty clinics are often early adopters of advanced body contouring technologies, enabling them to offer a wide range of non-invasive and minimally invasive treatments. Availability of trained aesthetic practitioners, personalized treatment plans, and shorter appointment cycles enhances patient satisfaction and repeat visits. Additionally, these clinics benefit from flexible pricing models and strong brand visibility through digital marketing. Growing medical aesthetics chains and franchise models further support expansion. While hospitals and ambulatory centers contribute significantly, specialty clinics remain the primary revenue generators due to procedural volume, operational efficiency, and dedicated aesthetic infrastructure.

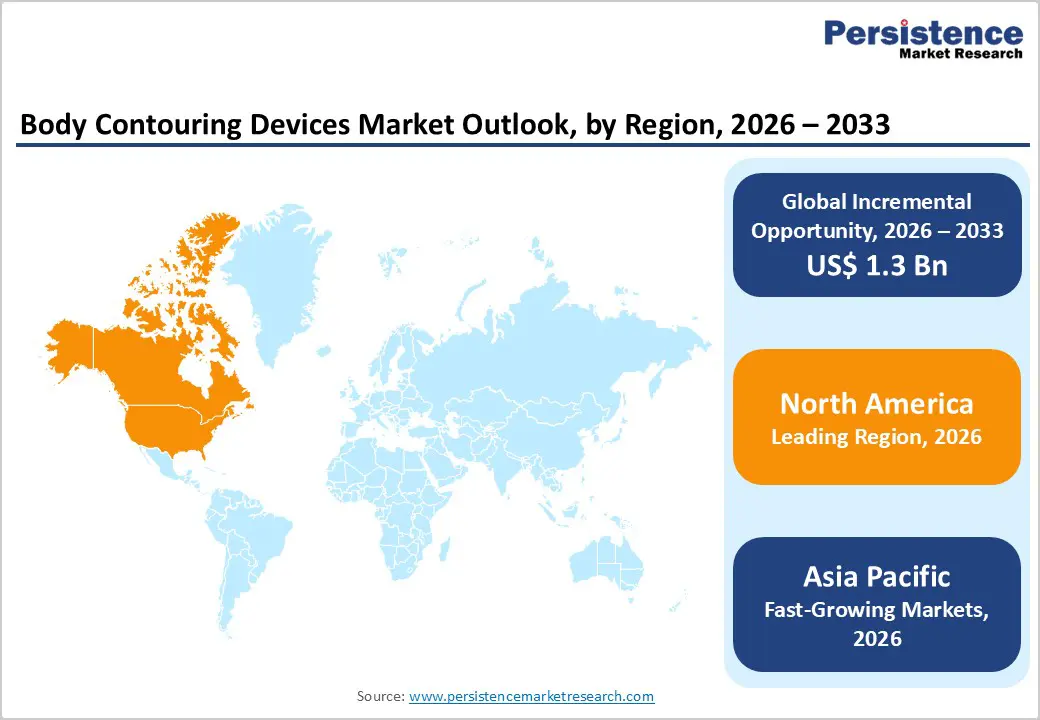

North America is expected to dominate the global body contouring devices market with a value share of 47.3% in 2026, led primarily by the United States. The region benefits from a mature medical aesthetics ecosystem, high consumer awareness regarding body image, and strong acceptance of cosmetic procedures. A high prevalence of obesity and sedentary lifestyles has significantly increased demand for fat reduction and body sculpting solutions. Additionally, North America has a strong concentration of leading manufacturers, aesthetic clinics, and certified practitioners, ensuring rapid adoption of advanced technologies.

Favorable reimbursement scenarios for select procedures, widespread availability of financing options, and strong purchasing power further support market growth. Continuous product innovation, early adoption of next-generation non-invasive devices, and frequent equipment upgrades contribute to sustained demand. The growing male aesthetics segment and increasing preference for preventive and maintenance-based treatments are expected to reinforce North America’s leadership throughout the forecast period.

The Europe body contouring devices market is expected to grow steadily, supported by strong regulatory frameworks, high clinical standards, and increasing demand for aesthetic procedures across countries such as Germany, the U.K., France, Italy, and Spain. The region benefits from a well-established private healthcare sector and growing acceptance of non-invasive cosmetic treatments among aging and middle-aged populations. Rising focus on appearance, wellness, and anti-aging solutions is driving adoption of skin tightening and fat reduction devices.

European clinics emphasize safety, efficacy, and compliance with stringent medical device regulations, supporting demand for high-quality body contouring systems. Expansion of private aesthetic clinics and medical spas, along with increasing availability of trained practitioners, is strengthening market penetration. Additionally, medical tourism in Southern and Eastern Europe is contributing to procedural volumes. As preventive aesthetics gain momentum, Europe is expected to maintain consistent long-term growth.

The Asia Pacific body contouring devices market is expected to register a relatively higher CAGR of around 7.2% between 2026 and 2033, driven by rapid urbanization, expanding middle-class populations, and increasing awareness of aesthetic treatments. Countries such as China, India, Japan, South Korea, and Australia are witnessing rising demand for non-invasive body shaping procedures due to changing lifestyle patterns, obesity growth, and strong influence of beauty standards. Expansion of private aesthetic clinics, dermatology centers, and medical spas is significantly increasing device adoption. Improving affordability, availability of cost-effective systems, and entry of regional manufacturers are enhancing market accessibility.

Government initiatives supporting healthcare infrastructure development and growing medical tourism further contribute to growth. With rising disposable incomes and increasing acceptance of cosmetic procedures among younger demographics, Asia Pacific is expected to emerge as the fastest-growing regional market.

The global body contouring devices market is highly competitive, with strong participation from companies such as Cynosure Lutronic, AbbVie Inc., Merz Pharma, Solta Medical Inc., and InMode Ltd. These players leverage extensive global distribution networks, strong brand equity, and diversified aesthetics-focused product portfolios to address the rising demand for effective, safe, and minimally invasive body shaping solutions.

Their offerings emphasize advanced energy-based technologies, treatment precision, patient comfort, reduced downtime, and compatibility across multiple applications such as fat reduction, skin tightening, and body sculpting. Continuous technological innovation, regulatory compliance, clinical efficacy, product reliability, and adherence to international quality and manufacturing standards remain critical for sustaining competitive positioning in the global body contouring devices market.

The global body contouring devices market is projected to be valued at US$ 2.1 Bn in 2026.

Rising demand for non-invasive aesthetic procedures, driven by growing body-image awareness, obesity prevalence, and continuous technological advancements in contouring devices.

The global body contouring devices market is poised to witness a CAGR of 5.3% between 2026 and 2033.

Rapid expansion potential in emerging economies due to increasing disposable incomes, medical aesthetics adoption, and growth of specialty aesthetic clinics.

Cynosure Lutronic, AbbVie Inc., Merz Pharma, Solta Medical Inc., and InMode Ltd are some of the key players in the body contouring devices market.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn Volume (in units) If Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product

By Application

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author