ID: PMRREP4922| 199 Pages | 22 Dec 2025 | Format: PDF, Excel, PPT* | Consumer Goods

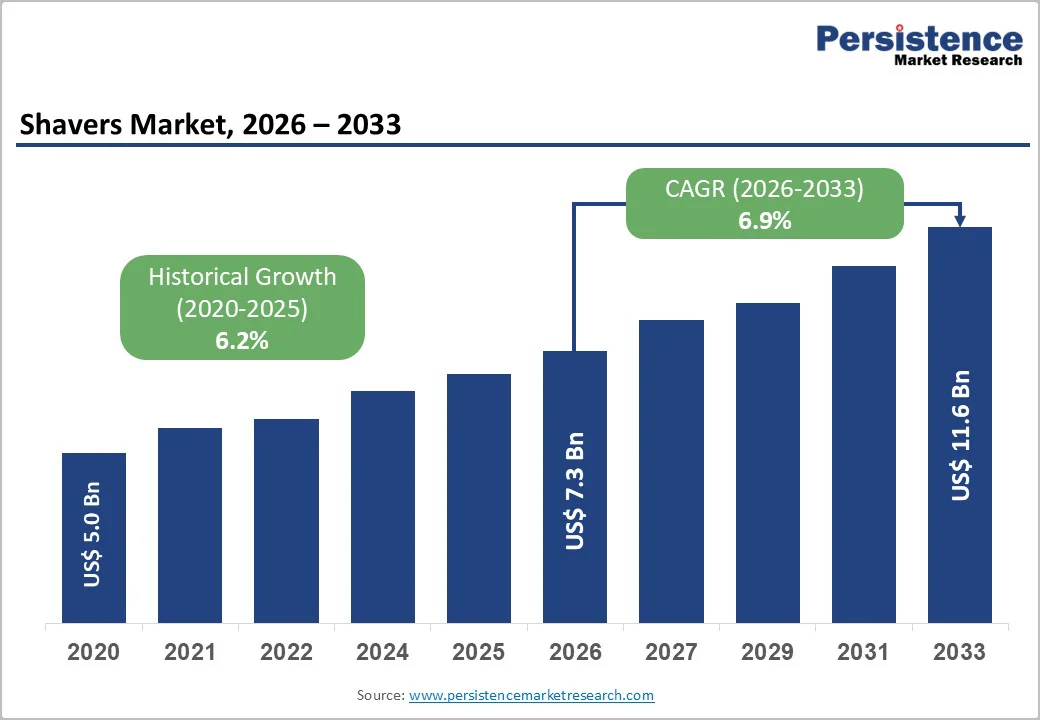

The global shavers market size is expected to be valued at US$ 7.3 billion in 2026 and is projected to reach US$ 11.6 billion by 2033, growing at a CAGR of 6.9% between 2026 and 2033.

The rise in adoption of personal grooming across demographics, rapid penetration of electric shavers, and premiumization trends in both men’s and women’s grooming drive demand for shavers. Increasing urbanization and higher disposable incomes are driving consumers toward durable, feature-rich grooming devices.

| Key Insights | Details |

|---|---|

| Shavers Market Size (2026E) | US$ 7.3 Billion |

| Market Value Forecast (2033F) | US$ 11. 6 Billion |

| Projected Growth CAGR (2026 - 2033) | 6.9% |

| Historical Market Growth (2020 - 2025) | 6.2% |

Growing grooming awareness among both men and women is emerging as a major growth catalyst in the global shavers market. As personal hygiene, professional image, and even social-media presence become more entwined, consumers increasingly view facial and body grooming as essential, not optional. This is especially true for urban Millennials and Gen Z, who treat grooming as part of their self-expression and frequently invest in electric clippers, trimmers, and shaving kits.

The rise of organized retail and online marketplaces further amplifies this trend as consumers can easily explore, compare, and repurchase blades, cartridges, and grooming accessories. Philips India reported a more than 75% growth in its “premium grooming” segment in 2025, highlighting a strong rising demand for higher-end grooming products.

This accelerates recurring demand, and the growth of men’s post-shave products shows that grooming ecosystems are evolving together, reinforcing steady adoption of shavers.

Continuous innovation in shaver technology is fueling market expansion, as consumers increasingly shift from traditional razors to advanced electric and foil shavers. Leading devices now come with features like multi-directional heads, skin-sensitive pressure sensors, precision blades, and long-lasting lithium-ion batteries that offer superior comfort and performance.

Many models are waterproof or support wet & dry usage, enabling customers to shave in the shower with gels or foam, a big plus for busy lifestyles.

Ergonomic grips, low-noise motors, and attachments for trimming body or facial hair make these shavers more versatile. In July 2024, Remington announced the Remington Balder Pro Head Shaver as its #1 head-shaver in the U.S., citing advanced features like 5 dual-track heads, multidirectional pivot & flex-contour technology that maintain close skin contact for a smooth, comfortable shave, even on two-day stubble.

Its 100% waterproof design and rechargeable lithium-ion battery offer cordless convenience, aligning with the broader trend toward comfort-oriented shavers. These design and technology enhancements support premium pricing, drive brand loyalty, and help manufacturers differentiate in a crowded market.

Despite its strong potential, the shaver market faces material headwinds. One of the biggest obstacles is the high upfront cost of premium electric shavers compared to disposables or safety razors. In many price-sensitive markets, consumers classify electric devices as discretionary spend, delaying upgrades or sticking to cheaper options.

Recurring costs such as replacement foils, cutters, or proprietary cartridges increase the total cost of ownership, which can be a deterrent. This is compounded in lower-income or rural markets where the perception of electric shavers as a “luxury” limits penetration. These cost dynamics continue to restrain a faster shift from traditional wet shaving to advanced electric solutions.

Environmental sustainability is emerging as a structural constraint on the shaver market. The widespread use of disposable razors and non-recyclable cartridges contributes significantly to plastic waste, which is increasingly drawing scrutiny from eco-conscious consumers and regulators.

In response, brands are being pressured to adopt more sustainable designs, using metal or bio-based materials, enabling recycling programs, or offering take-back schemes. While this shift presents innovation opportunities, it also raises costs; redesigning products and implementing responsible end-of-life programs require capital investment. For companies heavily dependent on high-volume disposable sales, the transition can disrupt traditional business models.

One of the most promising opportunities in the market is the rapid rise of women’s and unisex grooming, a segment that was historically underserved but is now expanding quickly due to growing interest in skin-friendly, painless grooming solutions.

Demand for bikini trimmers, body shavers, and facial hair removal devices is increasing as consumers embrace self-care, body positivity, and grooming as part of everyday lifestyle routines, moving beyond traditional depilatory products. Brands are strengthening their reach with unisex designs that feature neutral aesthetics and adaptable attachments, enabling broader appeal while reducing SKU complexity.

In October 2025, Philips introduced the OneBlade Intimate, a unisex, skin-safe grooming device specifically designed for sensitive areas, highlighting the accelerating adoption of gender-inclusive grooming tools. Continuous innovation in blade geometry, protective guards, and moisturizing strips for delicate zones is helping companies tap into new revenue opportunities while cultivating long-term loyalty among female users and first-time buyers.

The accelerating shift toward e-commerce and direct-to-consumer (D2C) models is creating exceptional growth opportunities for global shaver brands. Online marketplaces and brand-owned websites significantly enhance product visibility, allowing consumers to compare features, prices, skin-compatibility, and sustainability attributes with greater ease.

These channels also enable brands to adopt profitable subscription-based models for replenishing blades, cartridges, lubricating strips, and grooming liquids. The integrated “razor + refill + post-care” ecosystem, popularized by brands such as Dollar Shave Club and Harry’s, has proven highly successful in building predictable, recurring revenue streams.

For emerging or niche brands, D2C platforms reduce entry barriers and make it easier to differentiate using premium design, hypoallergenic materials, eco-friendly formulations, or dermatology-backed grooming solutions.

Additionally, curated bundles that pair devices with shaving gels, pre-shave oils, exfoliants, or aftershave balms strengthen customer loyalty and increase average order value. As consumers prioritize convenience and personalization, D2C and digital retail channels are becoming essential drivers of long-term customer engagement in the grooming market.

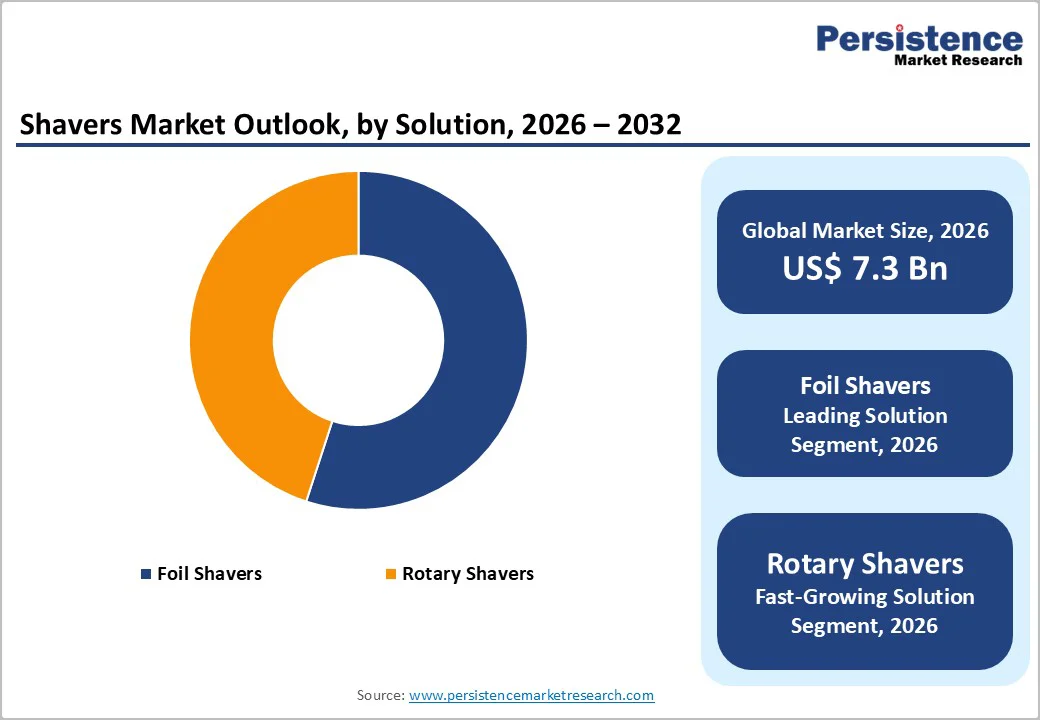

Within product type, rotary shavers and foil shavers form the core of the electric shaver category, with foil models often holding a slightly higher share in markets where precision and close shaving are preferred.

Foil shavers make up around 55% of electric shaver value in mature economies, driven by strong demand from daily users and professionals. Ongoing innovations in thin-foil materials, multi-foil heads, and wet-dry compatibility help leading brands maintain strong customer loyalty and premium positioning.

By power source, cordless shavers lead the market, contributing an estimated 65% or more of global electric shaver sales due to their convenience and portability. Modern lithium-ion batteries offer longer runtime, quick charging, and improved durability, making cordless models the preferred choice for most households and frequent travelers.

Corded shavers still appeal to barbershops and value-focused buyers because of their stable power supply and affordability. However, falling battery costs and the rise of features like USB-C charging and wireless charging docks continue to shift consumer preference strongly toward cordless technology.

Online retail has become the fastest-growing and, in many markets, the dominant distribution channel for shavers and grooming appliances. Online platforms contributing 40-50% of category sales due to ease of comparison, customer reviews, discounts, and subscription options.

As brands expand partnerships with e-commerce leaders and invest in direct-to-consumer websites, online sales are expected to exceed 50% of total volumes in several major markets. While supermarkets, pharmacies, and specialty stores still matter for trial and impulse purchases, the strongest and most consistent growth continues to come from digital channels.

By end-user, men remain the dominant segment, accounting for roughly 70% of global shaver demand because of long-standing habits linked to facial shaving and beard maintenance. Growth in the men’s grooming category, particularly skincare and beard care products, further boosts repeat purchases of shavers and accessories.

At the same time, the women’s segment is expanding quickly as more women adopt electric trimmers and body shavers designed for sensitive areas. Over the forecast period, women’s share is expected to rise steadily, making unisex designs and female-focused innovations important for future market differentiation.

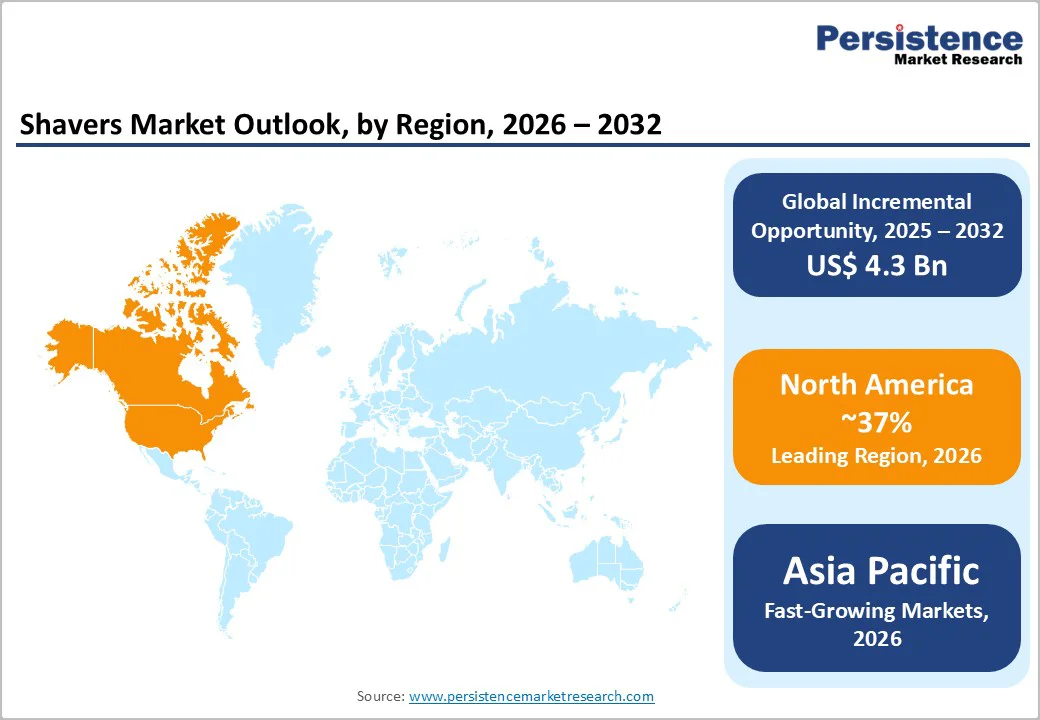

North America continues to be one of the most established and profitable regions in the global shavers market. The United States leads the region in both market size and product innovation, supported by high disposable income, strong grooming culture, and the wide presence of major brands such as The Procter & Gamble Company (Gillette), Koninklijke Philips N.V., Panasonic Corporation, and Edgewell Personal Care.

Consumers are increasingly choosing premium electric shavers with features like multi-directional blades, skin-protection technology, and app-based performance tracking, showing a shift toward more advanced grooming habits.

The region’s growth is also influenced by regulatory standards that focus on safety, energy efficiency, and consumer transparency. Subscription-based purchase models for blades and grooming kits, popularized by Harry’s Inc. and Dollar Shave Club, continue to drive recurring sales and customer retention, supported by 2024 company press releases.

Strong R&D spending and a competitive D2C ecosystem further boost innovation in sustainability, user experience, and value-added services such as personalization and extended warranties.

Europe remains a significant and mature market for shavers, with Germany, the U.K., France, and Spain contributing the largest shares. Consumers place strong emphasis on product quality, comfort, and long-term durability. This trend supports steady demand for premium foil shavers, rotary shavers, and high-performance cartridge systems.

European shoppers are also highly aware of sustainability issues, prompting companies such as Société BIC SA and Super-Max Limited to introduce products with recyclable materials and reduced-plastic packaging.

The region benefits from EU-wide regulatory harmonization, which enforces strict product safety and environmental standards, ensuring transparency and reliability.

E-commerce and omnichannel distribution are well-developed across Europe, enabling customers to compare product features such as blade life, ergonomic design, and noise levels before purchasing. Aging demographics in many European countries continue to support demand for gentle, easy-to-use shavers that cater to sensitive skin and senior users.

Asia Pacific is currently the fastest-growing region in the global shavers market. Countries such as China, Japan, India, and leading ASEAN economies are driving substantial growth.

2024 Asia Pacific grooming industry studies indicate that rising urbanization, a growing middle class, and higher spending on personal care products are fueling demand for both basic and advanced grooming devices. Consumers in China and Japan are particularly receptive to high-tech grooming equipment, boosting sales of premium electric shavers and multifunction grooming kits.

In India and Southeast Asia, traditional razors still hold high penetration; however, a rapid shift among younger urban consumers toward electric and premium cartridge systems. The region is also a major manufacturing base for branded and OEM shavers, offering cost advantages and fast production flexibility.

Local and regional brands compete strongly with global leaders by offering affordable, locally tailored grooming tools such as compact beard and body trimmers. The rise of e-commerce and quick-commerce platforms, continues to accelerate online sales. Social media influencers and regional celebrities also significantly impact consumer purchasing behavior across the foil shavers and grooming devices categories.

The global shavers market is moderately consolidated at the top, featuring strong international players alongside agile regional and niche brands. Leading companies such as Panasonic Corporation, Société BIC SA, The Procter & Gamble Company, Koninklijke Philips N.V., and Edgewell Personal Care command significant market shares through broad portfolios, global distribution networks, and consistent marketing investments.

Competition is focused on technological innovation, product differentiation for specific use cases, and sustainability credentials. Emerging business models center on D2C channels, subscription services, and data-driven personalization, while collaborations with salons, barbers, and influencers help strengthen brand authenticity and consumer engagement across regions.

The global shavers market is valued at US$ 7.3 Billion in 2025 and is projected to reach US$ 11.6 Billion by 2032, registering a CAGR of 6.9% during 2026 - 2033.

Key demand drivers include rising grooming awareness among men and women, rapid adoption of electric shavers, premiumization in features such as skin protection and wet-dry use, and the strong growth of online retail and subscription-based distribution models.

Among product types, Foil Shavers and other electric models hold a majority value share in many mature markets, while Cordless shavers lead by power source owing to superior convenience, travel-friendliness, and improvements in rechargeable battery technology.

North America is the leading region in terms of value, with North America benefiting from high grooming expenditure and a strong digital ecosystem.

Major opportunities include targeting women’s grooming and full-body shaving with specialized electric shavers, and bundling devices with skincare and after-care products, leveraging trends seen in the high-growth Men’s Post-Shave Market and broader personal care appliances sectors.

Key players include Panasonic Corporation, Société BIC SA, The Procter & Gamble Company, Koninklijke Philips N.V., Edgewell Personal Care, Conair Corporation, Remington Products Co. LLC, Helen of Troy Limited, Harry’s Inc., Dollar Shave Club, Wahl Clipper Corporation, and other regional and niche brands.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Power Source

By Distribution Chanel

By End-user

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author