ID: PMRREP19342| 200 Pages | 19 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

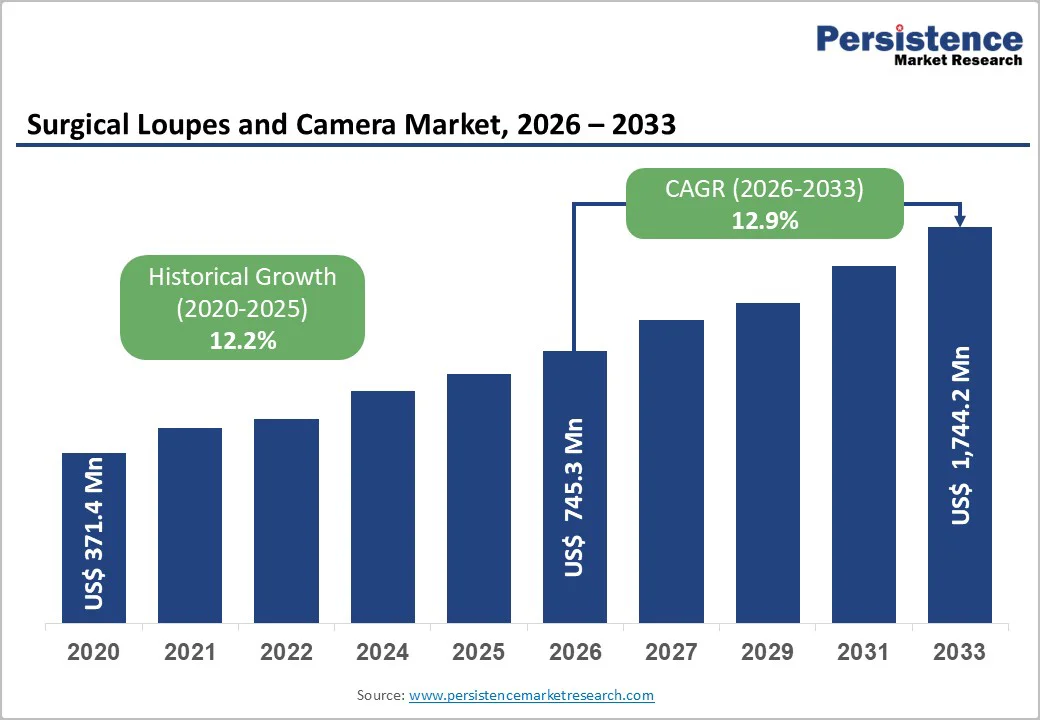

The global surgical loupes and camera market size is estimated to grow from US$ 745.3 million in 2026 and projected to reach US$ 1,744.2 million by 2033 growing at a CAGR of 12.9% during the forecast period from 2026 to 2033.

With the rise in surgical demand for sharper visualization, ergonomic comfort, and real-time documentation, loupes are shifting from basic optical aids to high-precision, lightweight systems that reduce fatigue during long procedures. At the same time, surgical cameras are becoming compact, wireless, and 4K-enabled, allowing surgeons to record, stream, and train with unprecedented clarity.

Growing use in dentistry, plastic surgery, and microsurgical specialties is expanding adoption, while integration of loupe-mounted cameras is creating a single, hands-free imaging platform. Rising focus on tele-surgical training, workflow efficiency, and infection-control-friendly designs is reshaping market innovation and purchasing trends.

| Key Insights | Details |

|---|---|

| Surgical Loupes and Camera Market Size (2026E) | US$ 745.3 Mn |

| Market Value Forecast (2033F) | US$ 1,744.2 Mn |

| Projected Growth (CAGR 2026 to 2033) | 12.9% |

| Historical Market Growth (CAGR 2020 to 2024) | 12.2% |

The rising focus on surgeon musculoskeletal health has become a powerful driver in the Surgical Loupes and Camera Market. Surgeons frequently experience chronic neck, shoulder, and upper-back strain due to long hours spent leaning forward during delicate procedures. This has heightened awareness around posture-related injuries, prompting hospitals and clinics to integrate ergonomics into procurement decisions.

Modern lightweight loupes with optimized weight distribution, adjustable declination angles, and customizable frame geometry significantly reduce cervical flexion and muscular fatigue. Many institutions now consider ergonomic assessments mandatory before purchasing visualization tools.

As burnout and injury-related downtime gain attention, surgeons increasingly prioritize devices that protect long-term physical well-being, making ergonomic loupes a central investment to improve comfort, precision, and career longevity.

Infection-control challenges are becoming a major restraint as modern loupes often include add-on headlights, cameras, protective shields, and battery modules. Each additional attachment introduces crevices and contact surfaces that can harbor contaminants, increasing the risk of microbial transfer during high-volume procedures.

Proper sterilization requires disassembly, specialized wipes, and drying protocols, which significantly lengthen turnaround times between surgeries. Some accessories cannot withstand autoclaving, forcing clinicians to rely on manual cleaning methods that vary in effectiveness. Hospitals face higher compliance pressures, and staff must follow strict SOPs to avoid lapses. This added complexity discourages routine use of multi-component loupe systems.

The development of lightweight composite optics presents a powerful growth avenue for the surgical loupes market. Carbon-composite frames, paired with advanced polymer lenses, significantly reduce overall device weight without compromising optical clarity.

This directly addresses one of the biggest surgeon pain points: neck strain and musculoskeletal fatigue during long procedures. Ultra-light designs improve posture, enhance comfort, and enable sustained accuracy in microsurgery, dentistry, and plastic surgery. As surgeons increasingly seek ergonomic solutions, hospitals and clinics are likely to prioritize these upgraded models for staff well-being and performance.

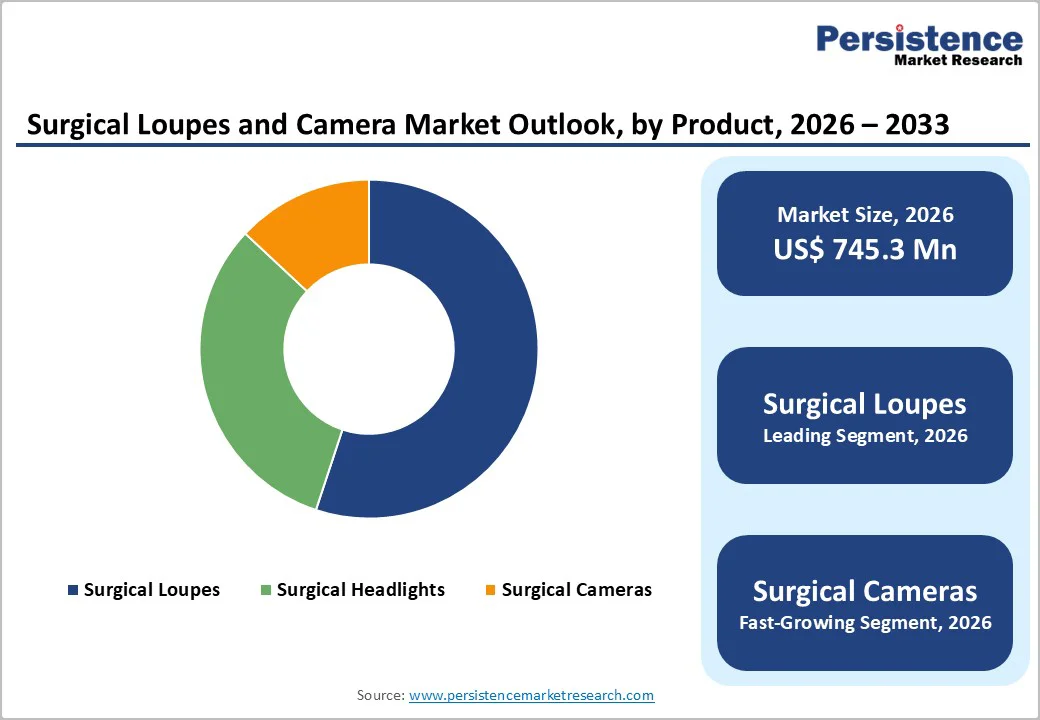

Surgical loupes lead the market because they are the most universally required visualization tool across dental, surgical, and microsurgical specialties. Unlike headlights and cameras, loupes are essential for basic magnification, posture correction, and precision during nearly all routine and advanced procedures.

Their comparatively lower cost, frequent replacement needs, and widespread adoption in dental schools and residency programs further drive high unit volumes. Surgeons also prefer owning personal loupes tailored to their working distance and magnification preferences, creating a continuous replacement and upgrade cycle.

Dental clinics hold the highest share because loupes are considered essential tools for precision in restorative, endodontic, periodontal, and cosmetic procedures. Dentists rely heavily on magnification for everyday clinical work, making adoption nearly universal compared to hospitals or ASCs, where usage varies by specialty.

Dental schools increasingly mandate loupe training, creating early familiarity and long-term dependency. Moreover, dentists typically purchase their own personalized loupes and upgrade them regularly for better ergonomics, magnification, and integrated lighting or camera features.

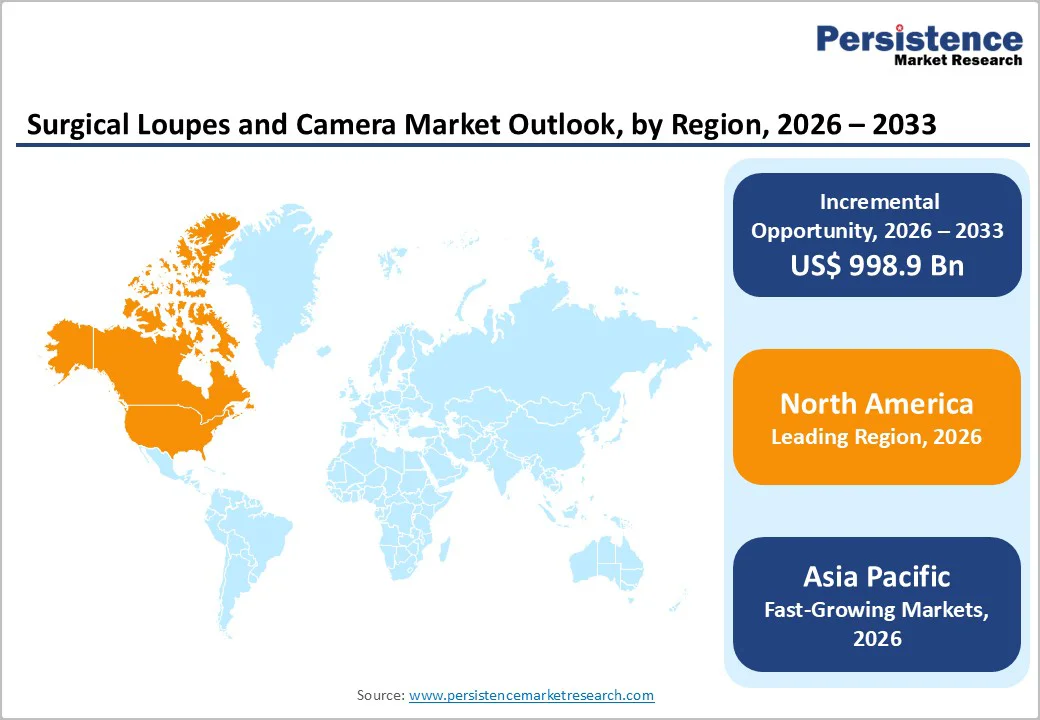

North America leads the Surgical Loupes and Camera Market due to high adoption of advanced surgical visualization tools, strong healthcare infrastructure, and emphasis on precision procedures. The U.S., in particular, drives demand with widespread use of loupes in dentistry, microsurgery, and plastic surgery, supported by mandatory loupe training in dental schools and residency programs.

Surgeons increasingly prefer lightweight, ergonomic loupes and integrated 4K cameras for documentation, teaching, and tele-mentoring. Rising hospital investments in advanced imaging and telemedicine, combined with a growing preference for premium, high-resolution devices, reinforce North America’s leadership, making it the largest and most technologically advanced regional market.

Asia Pacific surgical loupes and camera market is rapidly emerging, driven by rising surgical procedure volumes, expanding dental and specialty clinics, and improving healthcare infrastructure. Countries such as India, China, and Japan are witnessing growing adoption of loupes and camera systems for dentistry, plastic surgery, and microsurgery.

Increasing awareness of ergonomic benefits, technological advancements such as lightweight frames and integrated cameras, and cost-effective solutions are accelerating market penetration. Additionally, training institutes and teaching hospitals are investing in loupe-mounted cameras for remote mentoring and telemedicine. Competitive pricing and expanding distributor networks further support growth, positioning Asia Pacific as a high-potential emerging market.

The surgical loupes and camera market is highly competitive, dominated by global and regional players offering a mix of optical and digital solutions.

Key companies compete on innovation, ergonomic design, magnification quality, integrated camera features, and pricing. Market differentiation increasingly relies on lightweight materials, 4K resolution cameras, wireless connectivity, and telemedicine compatibility. Strategic partnerships with hospitals, dental chains, and training institutes are common to expand adoption.

The global surgical loupes and camera market is projected to be valued at US$ 745.3 Mn in 2026.

Increasing volume of minimally invasive surgeries, dental restorations, and microsurgeries fuels loupe and camera demand.

The global market is poised to witness a CAGR of 12.9% between 2026 and 2033.

Carbon-composite frames and polymer lenses reduce fatigue, appealing to surgeons with long procedure hours.

Carl-Zeiss-Stiftung, Rose Micro Solutions, ErgonoptiX, North-southern Electronics Limited, and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2024 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Modality

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author