ID: PMRREP26881| 183 Pages | 18 Nov 2025 | Format: PDF, Excel, PPT* | Healthcare

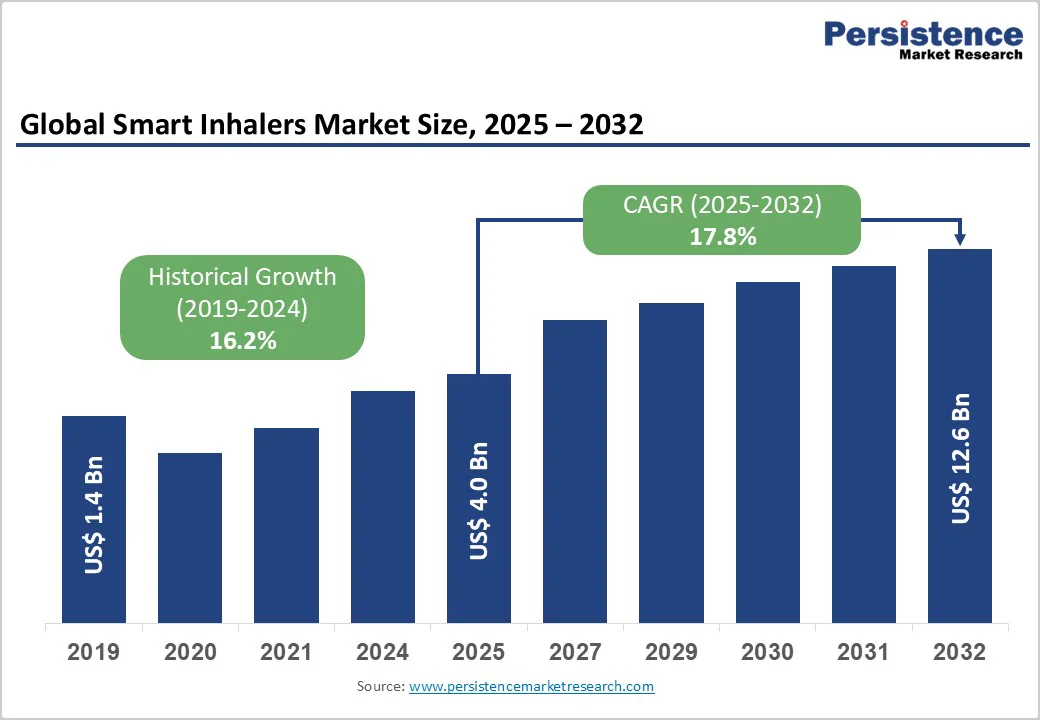

The global smart inhalers market size is likely to value at US$ 4.0 billion in 2025 and is projected to reach US$ 12.6 billion at a CAGR of 17.8% during the forecast period from 2025 to 2032.

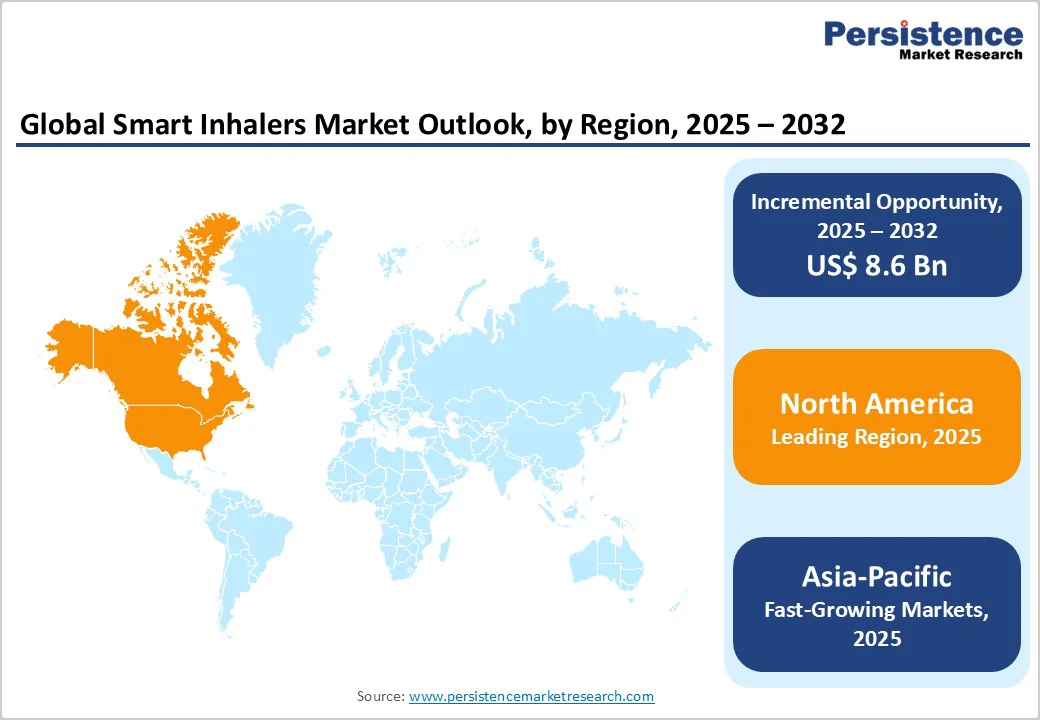

The global smart inhalers market is growing steadily, driven by the rising prevalence of asthma and COPD, increasing adoption of digital health tools, and demand for connected drug-delivery systems. North America leads due to advanced healthcare infrastructure, while Europe and the Asia Pacific exhibit rapid adoption supported by telehealth expansion and patient adherence programs.

| Key Insights | Details |

|---|---|

| Global Smart Inhalers Market Size (2025E) | US$ 4.0 Bn |

| Market Value Forecast (2032F) | US$ 12.6 Bn |

| Projected Growth (CAGR 2025 to 2032) | 17.8% |

| Historical Market Growth (CAGR 2019 to 2024) | 16.2% |

Healthcare professionals are increasingly recommending smart inhaler technologies because they offer objective monitoring of inhaler use, adherence, and technique, key issues in respiratory care. Studies indicate that up to 70-90 % of inhaler users have faulty technique or inconsistent use, reducing drug delivery by as much as 60-90%.

In a qualitative study, clinicians identified smart inhaler sensors as tools that enable real-time feedback and guided self-management, improving patient-clinician collaboration.

Recent guideline updates also reflect this shift: for example, the Global Initiative for Asthma (GINA) and the National Asthma Education and Prevention Program (NAEPP) now recommend a single?maintenance?and?reliever therapy (SMART) inhaler approach for moderate-to-severe asthma, simplifying regimens and reducing exacerbations.

Consequently, the smart inhaler market is gaining traction as clinicians look to integrate device-based adherence and monitoring solutions into routine care.

Smart inhaler devices routinely collect detailed inhaler-usage records, inhalation flow measurements, location/environment data, and even biometric signals, all of which are classed as personal health information under laws such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. and General Data Protection Regulation (GDPR) in Europe.

One qualitative study found that only 67% of medical mHealth apps included a privacy policy and just 55% complied with their own stated policies, indicating significant gaps in transparency and trust.

Because smart inhalers represent connected medical-device systems and involve cloud data transmission, patients and prescribers worry about unauthorized access, unclear data ownership, the resale of anonymised data and potential insurance or employment discrimination based on health-data profiles.

These concerns slow adoption, reduce willingness to pay for the technology, and require device makers and providers to invest heavily in cybersecurity and compliance, raising cost and complexity in the market.

The increasing integration of telehealth and remote monitoring into respiratory care represents a major opportunity for the smart inhaler market. Remote patient monitoring (RPM) technologies linked with smart inhalers enable real-time adherence tracking, inhaler technique feedback and timely intervention by clinicians.

For example, one study showed mean controller inhaler adherence rose to ~80% in the intervention group versus ~46% in the control among children with asthma using electronic monitors plus weekly feedback. A systematic review of remote monitoring in asthma (n = 19 studies) found slower declines in maintenance inhaler adherence and reduced reliever use in monitored groups.

As such, connected inhaler systems embedded in telehealth platforms can support personalized management of respiratory disease, offer data to clinicians remotely, and thereby expand the use case for smart inhalers beyond traditional dispensing, opening new pathways for reimbursement, care integration, and disease management models.

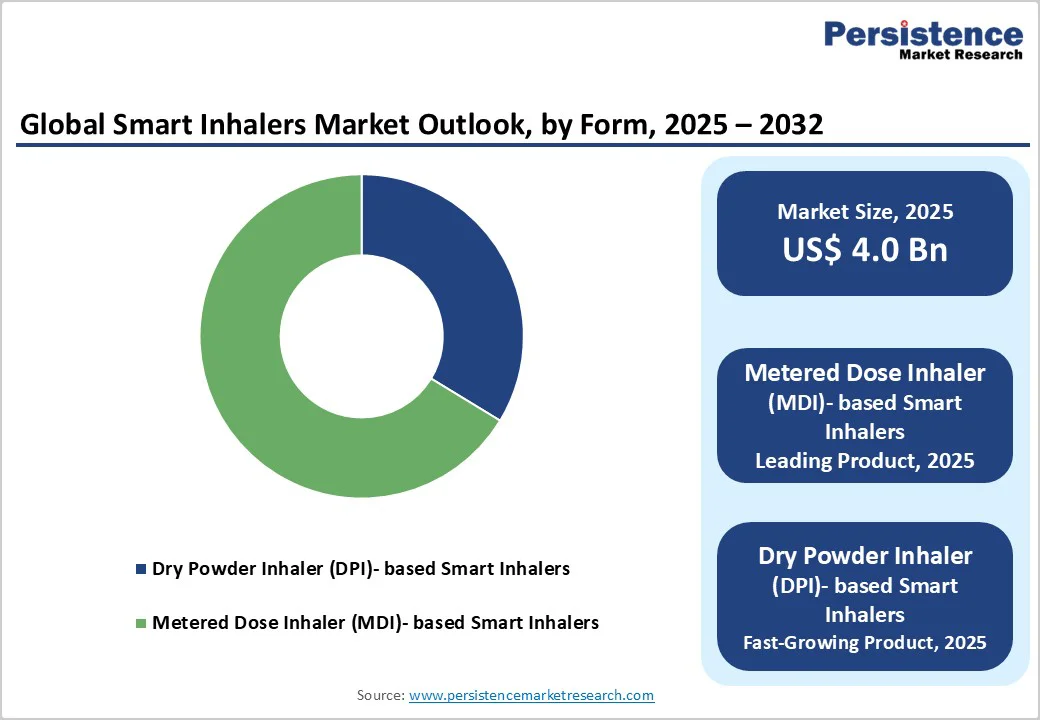

The dominance of metered-dose inhaler (MDI)-based smart inhalers in the market reflects their entrenched usage and infrastructure, with a 66.3% share in 2025. For example, in a US Medicare analysis of 10.5 million older adults, MDIs accounted for 51% of all inhaler dispensations, compared with 45.3% for dry-powder inhalers (DPIs).

Similarly, global manufacturing data suggest around 690-800 million HFC-MDIs were produced annually in earlier years, well above DPI volumes. Since smart inhaler tech (sensors, connectivity) is most easily retrofitted into existing familiar MDI platforms, and health systems and payers already distribute MDIs widely, manufacturers favor MDIs for smart-device integration.

This gives them a structural advantage, leading MDIs to capture the largest share of smart inhaler product deployments.

The chronic obstructive pulmonary disease (COPD) segment dominates the smart inhalers market lies in its substantial burden and treatment demands. In the United States, COPD affects approximately 3.8% of adults aged 18+ and was ranked the fifth leading cause of death in 2023, accounting for 141,733 deaths.

The disease also carries enormous economic weight: among adults aged 45+, COPD costs about US$24 billion annually in medical expenses. Because COPD often requires regular inhaled therapies, frequent monitoring of dose usage, and management of exacerbations, healthcare providers regard connected inhaler systems as especially useful.

This entrenched therapy burden and chronic-care model favour the adoption of smart inhalers in the COPD space over less resource-intensive indications like mild asthma.

Europe dominates the global market with 35.6% share in 2025, due to its advanced healthcare infrastructure, high burden of respiratory disease, and early adoption of digital health technologies. In the U.S. alone, about 25 million people have asthma and over 16 million have COPD, according to the Centers for Disease Control and Prevention (CDC, 2023).

The U.S. Food and Drug Administration (FDA) has also cleared multiple connected inhaler systems, including Teva’s Digihaler line and Propeller Health sensors, enabling large-scale clinical use. Combined with widespread broadband access, over 92% of U.S. adults own a smartphone, per Pew Research Center (2023). The region’s digital readiness supports the integration of telehealth and smart monitoring devices, making North America the clear leader in smart inhaler adoption.

The growth of the smart inhalers market in the Asia Pacific region is driven by the rising burden of chronic respiratory diseases and the expansion of digital health infrastructure. For instance, in the World Health Organization South-East Asia Region, chronic respiratory diseases (CRDs) represented about 12% of all deaths in 2021, with approximately 1.56 million deaths COPD accounting for ~1.24 million and asthma ~254,834.

In addition, a modelling study covering 12 Asia Pacific countries estimated COPD prevalence at ~6.3% of adults aged 30+ (~56.6 million cases) in the region. Moreover, smartphone and mobile internet penetration are accelerating: the region had over 1.5 billion mobile internet users in 2024, paving the way for connected health devices. Combined, these factors create fertile demand and infrastructure for smart inhaler adoption across the Asia Pacific.

The European region is vital for the smart inhalers market because of its high burden of respiratory disease and strong infrastructure for digital health adoption. In Europe, more than 36 million people live with Chronic Obstructive Pulmonary Disease (COPD), and the condition accounts for roughly 6% of all health-care spending in the EU.

Similarly, asthma affects about 6.7% of adults in the big five European countries (France, Germany, Italy, Spain, UK). Importantly, studies show that even when patients receive therapy, many still remain uncontrolled, pointing to the need for improved monitoring and adherence tools. These facts, combined with well-developed healthcare systems and regulatory frameworks, make Europe a key and strategic region for introducing and scaling smart inhaler solutions.

The global smart inhalers market is expanding as healthcare systems embrace digital monitoring, data-driven adherence tools, and connected respiratory care. Leading companies focus on sensor integration, connectivity, and real-time data tracking, while emerging players develop cost-effective devices. Rising asthma and COPD prevalence and telehealth adoption continue to drive steady global growth.

The global smart inhalers market is projected to be valued at US$ 4.0 Bn in 2025.

Rising asthma and COPD prevalence, digital health adoption, and improved patient adherence through connected inhaler technologies drive the market.

The global smart inhalers market is poised to witness a CAGR of 17.8% between 2025 and 2032.

Integration with telehealth, AI-driven monitoring, expansion in emerging markets, and development of cost-effective, user-friendly smart inhalers create opportunities.

OPKO Health, Inc., AstraZeneca plc, GlaxoSmithKline Plc., Propeller Health, Aptar Pharma, Novartis AG, and Others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn; Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product

By Indication

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author