ID: PMRREP35255| 180 Pages | 4 Sep 2025 | Format: PDF, Excel, PPT* | Consumer Goods

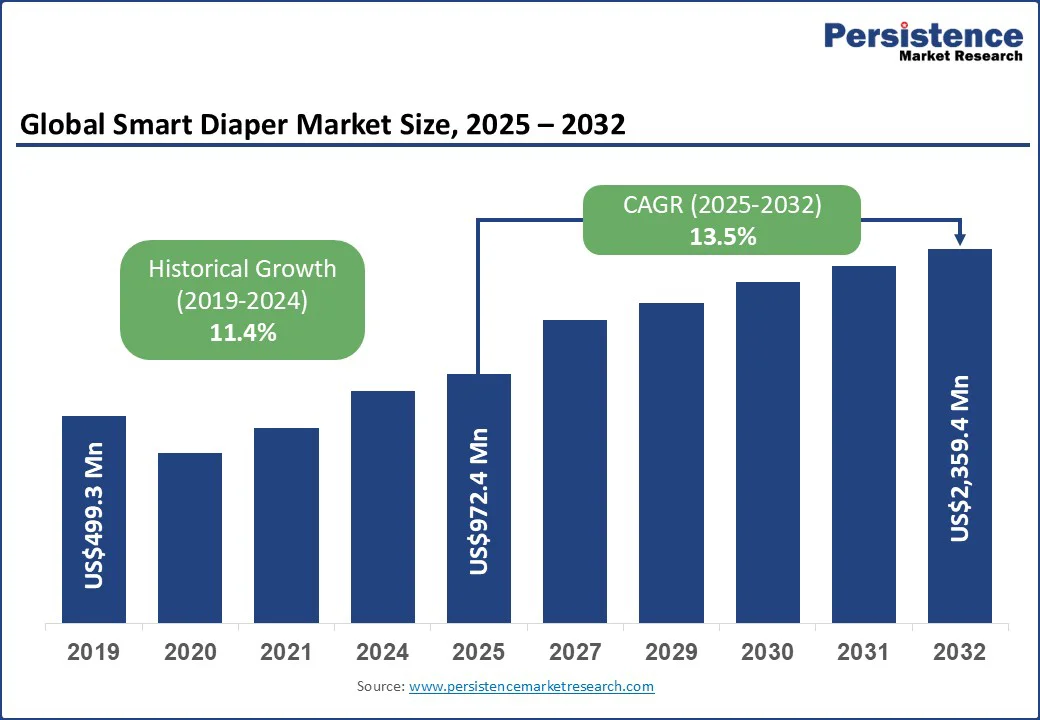

The global smart diaper market size is likely to be valued at US$972.4 Mn in 2025 and is expected to reach US$2,359.4 Mn by 2032, growing at a CAGR of 13.5% during the forecast period from 2025 to 2032.

The market growth is driven by the adoption of technology-enabled baby and geriatric care solutions and increased awareness of skin health and prevention of diaper dermatitis. The integration of mobile applications, caregiver notification systems, and cloud-based monitoring platforms enables real-time tracking, optimizes workflow efficiency in care facilities, and enhances hygiene management for both infants and the geriatric population.

Smart diapers integrate disposable designs with IoT sensors and RFID technology, allowing caregivers to monitor wetness, manage skin health, and ensure comfort in real-time. These solutions cater to infants, toddlers, and the aging population, addressing adult incontinence and infant skin irritation. The adoption of skin-friendly fabrics, biodegradable absorbent materials, and low-cost disposable smart diapers increases accessibility while supporting caregivers in maintaining hygiene and patient dignity.

Key Industry Highlights:

|

Global Market Attribute |

Details |

|

Market Size (2024A) |

US$499.3 Mn |

|

Estimated Market Size (2025E) |

US$972.4 Mn |

|

Projected Market Value (2032F) |

US$2,359.4 Mn |

|

Value CAGR (2025 to 2032) |

13.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

11.4% |

The rising global infant population is driving a strong demand for hygiene-focused solutions that ensure skin health and comfort. Caregivers need timely and accurate information to prevent rashes and infections, which accelerates the adoption of real-time monitoring solutions. Over 2.2 billion children live worldwide, with India accounting for nearly 19% of the global child population, including 480 million under 18. The same technologies are adaptable for adult and elderly care, demonstrating scalability and versatility.

Institutional adoption in hospitals, neonatal units, and elderly care facilities, combined with technology-integrated smart diapers and eco-conscious designs, positions the market for sustained growth, catering to infant hygiene and geriatric care needs across regions. Innovations such as moisture-sensitive RFID tags embedded under conductive hydrogel layers enable low-cost, disposable smart diapers that send instant alerts to smartphones or monitoring systems within a one-meter range. These technologies improve response times, enhance caregiver efficiency, and maintain hygiene standards in homes, hospitals, and day-care facilities.

Advancements in sensor miniaturization and energy-efficient designs allow continuous monitoring without adding bulk or discomfort. Disposable RFID sensors costing less than US$0.02, combined with hydrogel-based moisture detection, reduce risks of skin irritation and urinary tract infections while providing automated alerts. Bluetooth-enabled and wireless connectivity enhance caregiver convenience, allowing seamless integration into hospital or home monitoring systems. Focus on infant hygiene, growing awareness of skin care, and the adoption of wearable monitoring devices collectively support market growth.

The high cost of smart diaper products limits affordability and accessibility across mainstream consumers, particularly in mass-market segments. The integration of Bluetooth sensors, RFID-based tracking, and printed or flexible chemical sensing technologies drives innovation but also increases production expenses.

Advanced features such as real-time health monitoring, incontinence detection, skin irritation alerts, and smartphone connectivity add value for caregivers and parents, yet contribute to premium pricing. Consumers seeking cost-effective options often find conventional diapers more attractive, restricting the adoption of technologically advanced solutions.

Manufacturing complexities and investment in research-driven materials, including biodegradable and eco-friendly substrates, further elevate costs. The development of alert-based diaper systems and zero-leakage designs requires precise sensor calibration and data transmission mechanisms, which impact supply-side economics. Market growth remains concentrated in segments that can absorb higher prices, and cost-sensitive consumers continue to delay the switch to connected, health-monitoring diapers.

The integration of smart diaper technology with mobile applications and caregiver alert systems offers a crucial opportunity in the adult and elderly care market. This solution allows caregivers to monitor incontinence management in real-time, ensuring timely diaper changes and improved patient comfort. IoT-enabled diapers paired with real-time monitoring apps optimize caregiving workflows, reduce unnecessary material use, and enhance the overall operational efficiency in hospitals and care facilities.

Advanced technologies, such as printed moisture sensors, LoRaWAN transmitters, and cloud-based data management platforms, enable seamless interaction between smart diapers and caregiver mobile notifications. Ontex’s Orizon system enables instant diaper change alerts, thereby improving workflow management and reducing waste. Investments by companies such as Henkel with Smartz AG strengthen IoT-enabled adult diaper solutions, combining printed electronics with digital health software for scalable adoption in medical and eldercare facilities.

This opportunity also supports eco-friendly and sustainable practices with reusable transmitters and disposable conductive print layers, certified for safe patient use. By leveraging digital health applications and smart diaper monitoring systems, caregivers can ensure higher patient dignity and comfort.

The trend toward skin-friendly and biodegradable materials in disposable diapers reflects growing consumer demand for safe, sustainable, and eco-conscious products. Diapers with biodegradable layers and gentle materials minimize irritation and promote healthy skin, especially for babies and elderly users. Manufacturers focus on integrating bio-based superabsorbent polymers (bioSAP) to maintain high absorbency while reducing environmental impact.

Technological developments such as Ontex’s introduction of bioSAP in Moltex Pure and Nature-branded diapers highlight this shift. These eco-friendly diaper solutions replace conventional fossil-based SAP, supporting carbon footprint reduction and sustainable manufacturing practices. By combining skin-safe fabrics, biodegradable components, and high absorbent performance, the trend addresses both caregiver preferences and environmental responsibilities.

The focus on biodegradable and skin-friendly diapers strengthens product differentiation and aligns with global sustainability goals. This trend is expected to influence product development, packaging innovation, and consumer purchasing behavior across the smart diaper market.

The adults and elderly care is likely to be the fastest-growing segment in 2025, holding a market share of around 32.5% in 2025, driven by the growing geriatric population and increased adoption of technology-enabled eldercare solutions across Europe and India. According to the World Health Organization (WHO) and the United Nations (UN), global life expectancy reached 73.3 years in 2024, and the number of individuals aged 60 and older is projected to increase from 1.1 billion in 2023 to 1.4 billion by 2030, reaching 2.1 billion by 2050, reflecting a growing geriatric population requiring adult care solutions.

As of 2024, 21.6% of the EU population was aged 65 and older, with countries such as Italy, Portugal, and Bulgaria recording the highest proportions of older adults. Low fertility rates, declining birth numbers, and longer life expectancy are increasing the proportion of elderly individuals, creating a strong need for incontinence care and connected health products.

India also reflects a dual demographic scenario, with 153 million elderly individuals in 2023 projected to reach 347 million by 2050, highlighting the importance of policies such as the National Programme for Health Care of the Elderly (NPHCE) and the Silver Economy initiatives. Smart diapers with IoT-enabled monitoring, real-time alerts, and data-driven hygiene management provide efficient care, reduce caregiver workload, and align with integrated health and social care strategies.

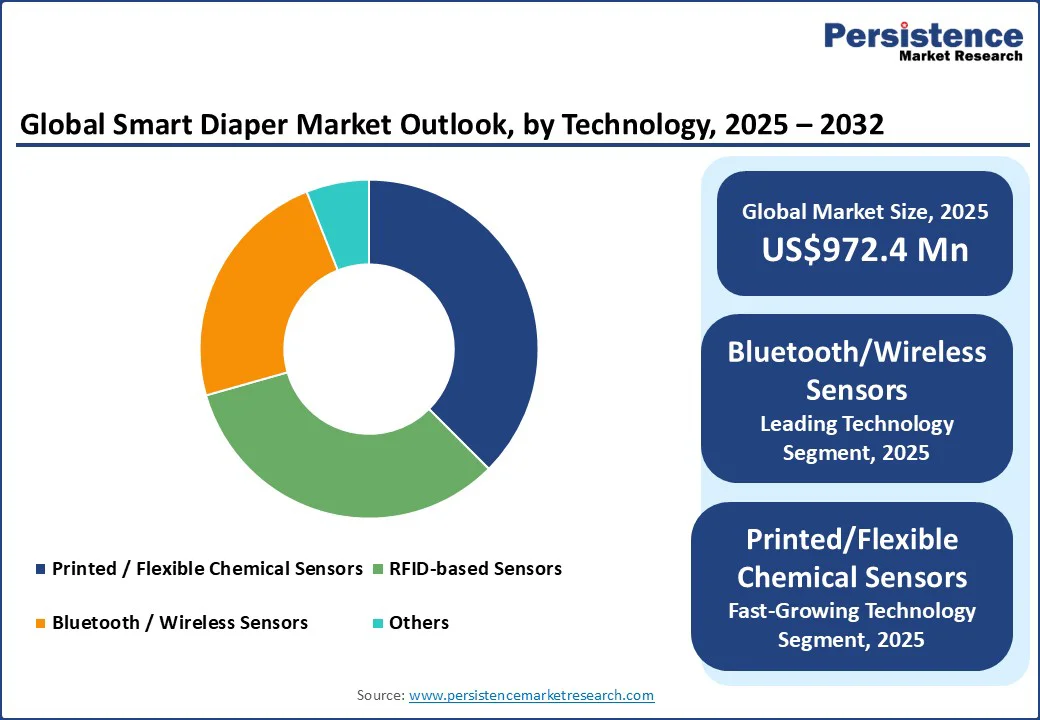

Bluetooth and wireless sensors are expected to hold nearly 35% of the smart hygiene market share, driven by their ability to provide real-time monitoring, remote alerts, and improved hygiene control. When paired with mobile apps, these sensors allow caregivers to track moisture and temperature, enhancing comfort and health outcomes for both infants and elderly individuals. Technological advancements, such as lightweight design, longer battery life, and greater data accuracy, have improved reliability, making smart hygiene products suitable for home, hospital, and long-term care environments. These solutions are particularly vital in aging societies such as Europe, where over 21% of the population is over 65. As wireless monitoring increasingly integrates with advanced absorbent materials, consumer trust and product usability are rising.

The RFID-based sensors segment is anticipated to be the fastest-growing segment, holding a market share of around 33% in 2025, driven by its ability to provide real-time monitoring, accurate saturation detection, and seamless caregiver notification. The technology leverages printed sensors and IoT-enabled transmitters that communicate with mobile and web applications, allowing healthcare providers and parents to monitor diaper usage efficiently. RFID-based smart diapers reduce leakage incidents, optimize caregiver workload, and support data-driven hygiene management, aligning with modern healthcare trends in both infant and elderly care.

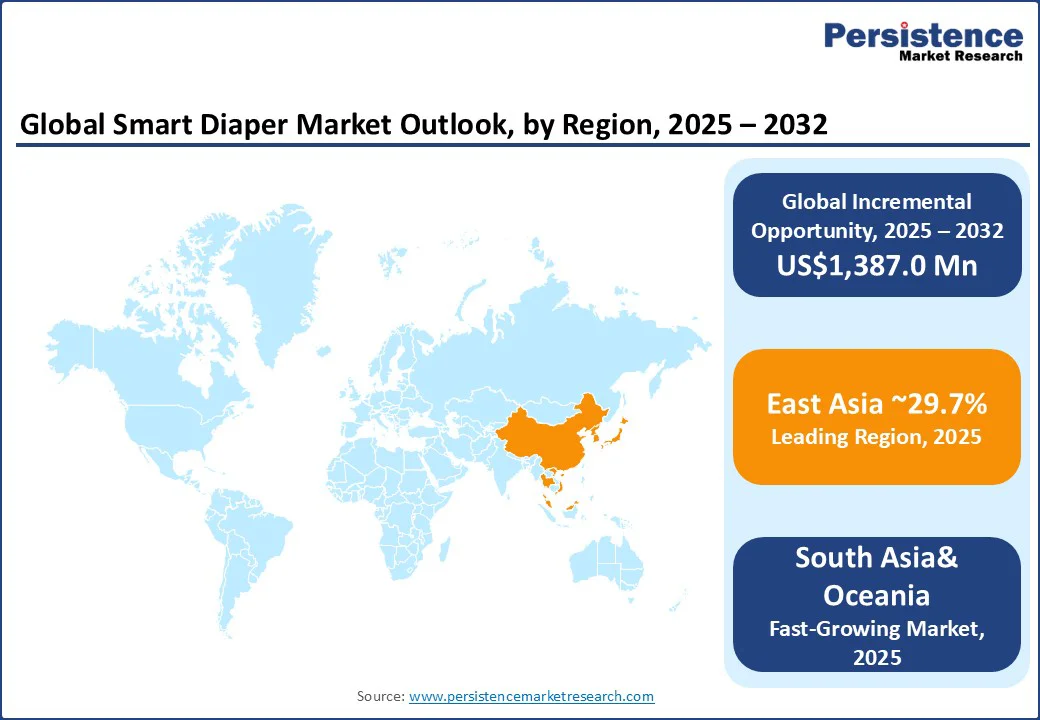

East Asia is anticipated to dominate, holding a market share of 29.7% in 2025, driven by rapid demographic transitions, growing geriatric populations, and increasing adoption of connected healthcare solutions.

According to the WHO, China has one of the fastest-growing aging populations in the world, with the population aged 60 and above projected to reach 28% by 2040 due to longer life expectancy and declining fertility rates. This demographic shift presents challenges and opportunities for public health and socioeconomic development, particularly the need for integrated systems catering to the health and social needs of older adults with equal access to healthcare across regions.

South Korea, classified as a super-aged society with over 20% of residents aged 65 and older, also highlights the growing demand for technology-enabled elder care. Smart diapers with embedded IoT sensors, real-time mobile alerts, and data-driven monitoring help track saturation levels, prevent leakage, and reduce caregiver workload, supporting the WHO-aligned healthcare strategies.

According to the Economic and Social Commission for Asia and the Pacific (ESCAP), childcare needs also reinforce market growth, as China’s 0-14 population stood at 239.08 million in 2022, with 9.02 million newborns in 2023. Improved early-life survival, under-five mortality at seven per 1,000 live births, and infant mortality at five per 1,000 live births create opportunities for smart diapers that integrate health monitoring and hygiene management.

Government initiatives promoting age-friendly urban development, digital healthcare platforms, and integrated community care enhance the adoption of connected solutions. Combining elder and infant care needs with IoT-enabled sensor technologies positions East Asia as a leading market for innovative smart diaper products, bridging demographic challenges with efficient, WHO-aligned, data-driven care solutions.

North America is anticipated to grow at the fastest rate, accounting for the market share of 23.4% in 2025, driven by a combination of a growing geriatric population, advanced healthcare infrastructure, and increasing adoption of technology-driven care solutions. In the U.S., approximately 15% of the population is aged 65 and older, consuming nearly 40% of healthcare resources.

Smart diapers offer solutions for functional decline, chronic disease management, and hygiene maintenance, supporting caregivers while enhancing patient comfort. Technological advancements, including Bluetooth sensors, IoT-enabled monitoring, and mobile alert systems, are strengthening adoption among both infant care and adult incontinence segments.

The U.S. infant and toddler population also fuels demand, with around 19.5 million children under five in 2023, representing a diverse demographic including children of color and immigrant families. According to Statistics Canada, in Canada, 18% of the population was aged 65 and older in 2020, projected to reach 23.6% by 2040, with those aged 80 and above expected to grow from 4.4% in 2020 to 8.4% by 2040. These demographic shifts create opportunities for connected, technology-enabled smart diapers that monitor health, detect leakage, and optimize caregiver efficiency. By catering to both elder care and infant care requirements, North America continues to lead in the adoption of smart diaper solutions, combining comfort, hygiene, and real-time monitoring in technologically advanced products.

The global smart diaper market is moderately consolidated, led by top manufacturers such as Ontex, Essity, Procter & Gamble, Henkel, and Semtech Corporation. These companies focus on IoT-enabled sensors, mobile notifications, and real-time monitoring to enhance caregiver efficiency, hygiene, and user comfort across both infant and adult care segments.

Manufacturers prioritize technology-driven incontinence management, disposable low-cost sensors, and data-backed hygiene monitoring. The market outlook points to continued growth through digital health integration, eco-friendly solutions, and caregiver support technologies, ensuring competitive advantage in a fragmented yet innovation-focused market.

The smart diaper market is projected to be valued at US$972.4 Mn in 2025.

Infants and toddlers are expected to hold a 67.5% market share in 2025, driven by the rising infant population, increasing focus on hygiene, and the adoption of smart diaper technologies.

The market is poised to witness a CAGR of 13.5% from 2025 to 2032.

Smart diaper market growth is driven by a large infant population with a strong focus on hygiene and skin care, along with an aging population experiencing a high incidence of adult incontinence.

Key market opportunities include the adoption of low-cost, disposable smart diapers with RFID and printed sensor technologies, and integration with mobile applications and caregiver notification systems.

Key players in the smart diaper market include Ontex, Essity, Simavita – Smartz AG, Abena, Smardii Inc., and ElderSens.

|

Report Attribute |

Details |

|

Forecast Period |

2025 - 2032 |

|

Historical Data/Actuals |

2019 - 2024 |

|

Market Analysis |

US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available on Report |

By Technology

By End-user

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author