ID: PMRREP18061| 188 Pages | 16 Jun 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

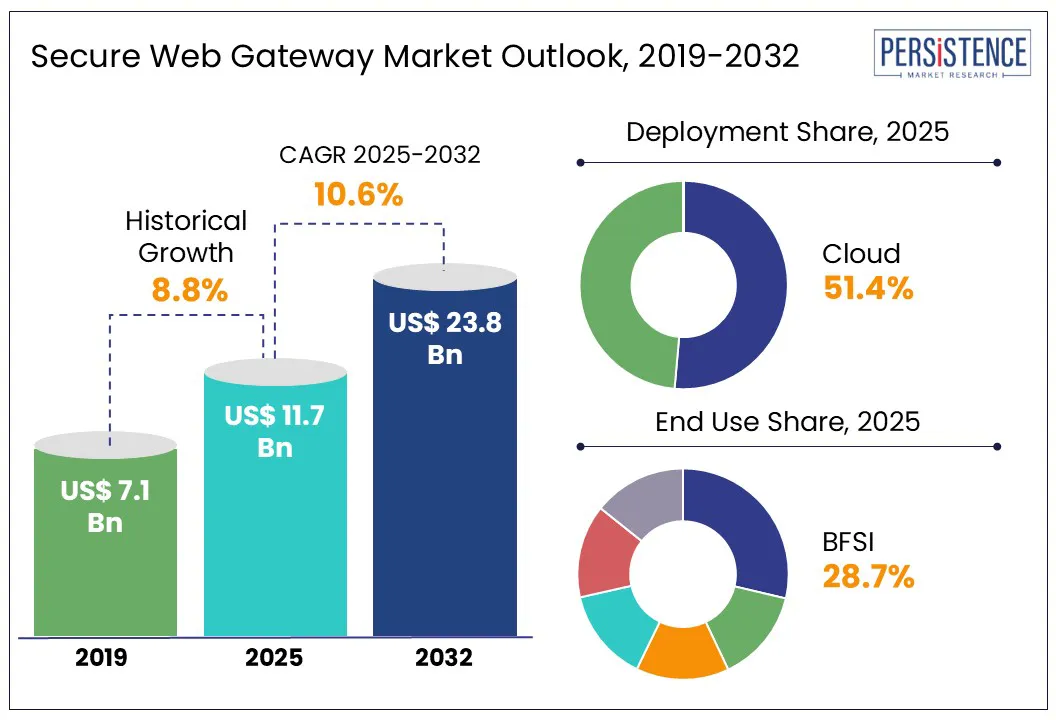

According to the Persistence Market Research report, the global secure web gateway market size is predicted to reach US$ 23.8 Bn in 2032 from US$ 11.7 Bn in 2025. It will likely witness a CAGR of around 10.6% in the forecast period between 2025 and 2032.

Secure Web Gateways (SWGs) have emerged as a significant frontline defense for modern enterprises navigating the digital shift. The rise of distributed endpoints accessing cloud apps, SaaS tools, and untrusted URLs has made the conventional network perimeter obsolete. Organizations are no longer just defending data centers; they are safeguarding thousands of micro-perimeters scattered across homes, mobile devices, and co-working spaces. As regulatory scrutiny intensifies and digital workforces expand, SWGs are evolving from simple content filters into intelligent enforcers of security and compliance in real time.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Secure Web Gateway Market Size (2025E) |

US$ 11.7 Bn |

|

Market Value Forecast (2032F) |

US$ 23.8 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

10.6% |

|

Historical Market Growth (CAGR 2019 to 2024) |

8.8% |

The surge in data breaches involving credential theft, phishing, and insider threats has made SWGs a significant component of enterprise security strategy. As per IBM’s Cost of a Data Breach Report 2024, the average cost of a breach reached US$ 4.45 Mn, with approximately 25% of breaches involving web-based vectors such as malicious URLs or cloud application misuse. This has compelled security teams to seek SWG solutions that deliver granular control over web traffic, enforce usage policies, and inspect encrypted traffic without impacting performance.

One of the key drivers for SWG demand is the shift from reactive security to proactive policy enforcement. Modern SWGs now go beyond simple URL filtering by integrating machine learning for behavior analytics, dynamic risk scoring, and real-time DLP. For instance, when Tesla experienced an internal data leak in mid-2023 due to employee mishandling of confidential files via personal cloud storage, it highlighted the requirement for tools capable of preventing policy violations through SaaS misuse. In response, several manufacturers and tech companies have tightened policy-based access using integrated SWG and CASB solutions.

The risk of overblocking legitimate content has emerged as a key barrier to the secure web gateway market growth. It is specifically evident in sectors that rely on dynamic or user-generated content for daily operations. Overly aggressive filtering algorithms or rigid URL categorization engines often misclassify benign websites. It results in strained IT support resources, low employee productivity, and workflow disruptions. These issues are high in industries such as research, education, and media, where access to diverse and constantly evolving web content is essential.

A 2023 online survey found that 31% of organizations experienced operational slowdowns due to legitimate business resources being erroneously flagged or blocked by their SWG tools. In academic institutions, collaborative platforms, including Google Docs, Pastebin, and GitHub, are sometimes restricted because of outdated threat intelligence feeds or blanket policy enforcement. These often prompt IT teams to either bypass SWGs temporarily or weaken policy settings, both of which introduce security gaps.

The boom of remote and hybrid work has created a structural shift in how enterprises view network security, directly fueling demand for SWGs. With employees accessing cloud-based applications, corporate resources, and collaboration tools from home networks and personal devices, the attack surface has broadened significantly. According to a 2024 online report, nearly 74% of global enterprises have restructured their network security investments post-remote transition, with SWG adoption rising 38% year-on-year. It is mainly evident in the legal services and consulting sector, where sensitive data must be accessed remotely without compromising compliance or client confidentiality.

One of the key shifts is the requirement for end-point security. Organizations are now deploying agent-based SWGs or integrating browser isolation to enforce real-time web traffic control even when users operate outside VPN tunnels. In addition, the surge of Bring Your Own Device (BYOD) policies is boosting SWG relevance, as companies require browser-level visibility and control on unmanaged devices. Vendors are hence responding with containerized SWG solutions that deliver micro-segmentation and inline scanning without requiring full device management.

Based on deployment, the market is bifurcated into cloud and on-premises. Out of these, cloud is predicted to dominate with a share of nearly 51.4% in 2025 as organizations are rapidly shifting to distributed and remote work models that require scalable security. Cloud-native SWGs provide global reach with lower latency by leveraging distributed Points of Presence (PoPs). In 2024, for example, a report found that 68% of new SWG deployments were cloud-based. It was propelled by the requirement for agile policy enforcement and real-time threat detection at the user level.

On-premises deployment is estimated to showcase a steady adoption rate among organizations with strict data residency requirements or legacy infrastructure dependencies. This is particularly evident in critical sectors where full control over traffic inspection, log storage, and hardware-based policy enforcement remains a priority. From a performance standpoint, a few large enterprises also report better throughput and lower inspection delays with on-premise SWG hardware.

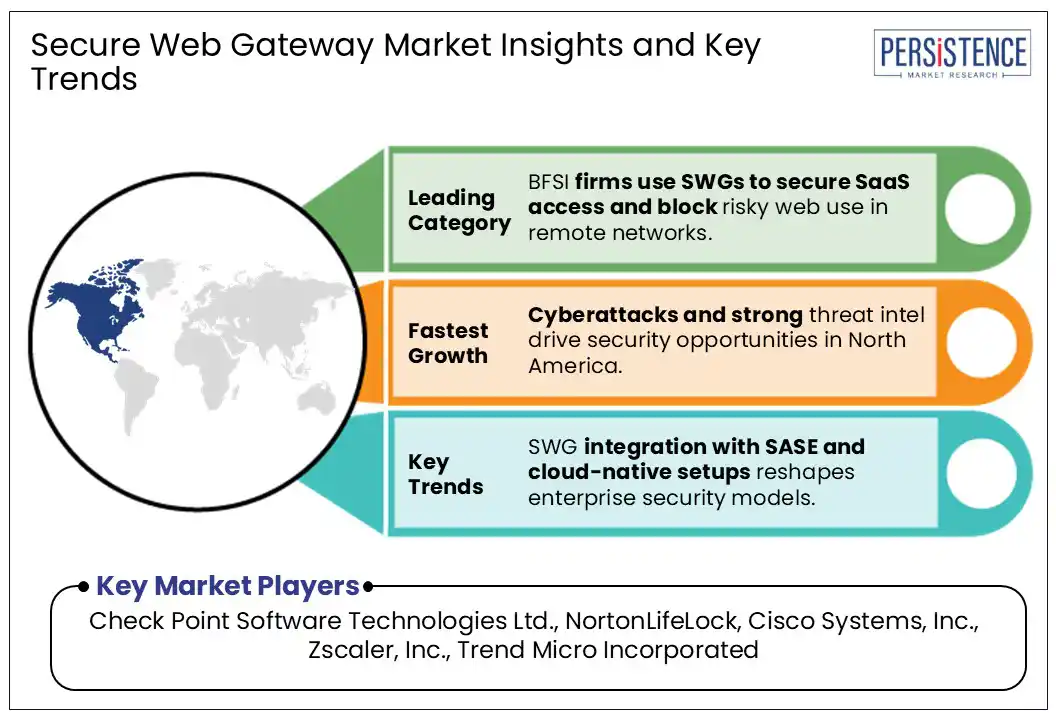

In terms of end-use, the market is segregated into BFSI, healthcare, manufacturing, government and defense, and IT and telecommunication. Among these, the BFSI segment is anticipated to hold nearly 28.7% of the secure web gateway market share in 2025 due to its high exposure to cyber threats and strict regulatory mandates around data privacy and transaction integrity. Financial institutions manage vast volumes of sensitive data, making them prime targets for phishing, web-based malware, and data exfiltration via unsanctioned cloud apps. Hence, it is seeing an urgent requirement for granular traffic inspection and dynamic web filtering, both core SWG functionalities.

IT and telecommunication, on the other hand, is poised to witness a considerable CAGR from 2025 to 2032 amid its constant interaction with vast data environments, API-backed architecture, and globally distributed workforces. These companies often serve as infrastructure backbones for other industries, making them high-value targets for web-based attacks such as malicious redirects and watering hole attacks. Verizon’s 2024 Data Breach Investigations Report showcased a substantial rise in vulnerability exploitation, which nearly tripled. This highlighted the requirement for SWGs that offer deep traffic inspection, zero trust enforcement, and behavioral analysis across multi-cloud and multi-tenant environments.

North America will likely account for a share of approximately 37.4% in 2025, owing to a rapid shift toward cloud-based security architectures and widespread adoption of hybrid work. Companies are actively replacing conventional hardware-based SWGs with scalable, SaaS-delivered solutions that integrate with broad SASE frameworks. As per a 2024 online survey, more than 65% of enterprises in North America deploying SWGs have opted for cloud-based platforms. Palo Alto Networks Prisma Access, Cisco Umbrella, and Zscaler are considered the most adopted solutions.

The U.S. secure web gateway market is predicted to witness considerable growth through 2032 due to the ongoing consolidation of point solutions. Companies are looking for unified security platforms that include SWG, Zero Trust Network Access (ZTNA), and Data Loss Prevention (DLP) in one suite. This has resulted in increasing mergers and acquisitions, including Cisco’s US$ 28 Bn acquisition of Splunk in 2024. This helped in improving threat visibility and incident response across the company’s security portfolio, including web traffic monitoring.

In Europe, the market is seeing steady growth due to strict data privacy norms, specifically the General Data Protection Regulation (GDPR). It compels organizations to choose SWG solutions that offer strict data residency and policy enforcement controls. This regulatory landscape has resulted in a preference for regionally hosted, cloud-native SWG services or hybrid deployments that allow sensitive data to remain within specific jurisdictions. Domestic security vendors are gaining momentum among enterprises with strict compliance requirements, mainly in the government and healthcare sectors.

Local companies are further prioritizing SWG solutions with browser isolation and AI-backed threat protection, primarily in response to the rising wave of malicious scripts. The U.K.’s National Cyber Security Center (NCSC), for example, reported a 34% increase in web-based threats in 2024, prompting increased adoption of security analytics and sandboxing features in SWG tools. The surge of remote and hybrid work environments is also pushing demand for SWGs integrated into SASE frameworks across France and Germany.

The market is witnessing a decent growth due to the rising cybersecurity awareness among mid-sized enterprises, an increasing mobile-first workforce, and ongoing digital transformation. In India, for instance, the introduction of the Digital Personal Data Protection Act (DPDPA) 2023 has heightened the urgency for web traffic monitoring solutions that provide real-time policy enforcement and data loss prevention capabilities. Local organizations are seeking cost-effective SWG solutions with robust compliance reporting features. They are hence creating lucrative opportunities for regional vendors and lightweight, cloud-delivered platforms.

In South Korea and Japan, the focus is shifting toward AI-enhanced threat detection within SWG deployments. As Advanced Persistent Threats (APTs) are targeting critical infrastructure and defense contractors, organizations are investing in solutions that deliver dynamic content analysis. Japan-based NTT Communications, for example, recently collaborated with Palo Alto Networks to provide integrated SWG services as part of its zero-trust architecture for industrial clients. Similarly, South Korea’s Korea Internet & Security Agency (KISA) reported a 42% hike in malicious web traffic in the second half of 2024, leading to rising SWG deployment in telecom and e-commerce sectors.

The secure web gateway market is characterized by a shift toward cloud-native solutions, strategic acquisitions, and intense consolidation. Leading companies are providing SWG capabilities as part of broad Secure Access Service Edge (SASE) or Zero Trust architecture. They are focusing on deep integration with threat intelligence, lowering the relevance of standalone SWG vendors. Emerging companies are differentiating through browser isolation technologies, patented malware prevention techniques, and hybrid deployment models.

The market is projected to reach US$ 11.7 Bn in 2025.

Increasing adoption of cloud applications and rising data breach incidents are the key market drivers.

The market is poised to witness a CAGR of 10.6% from 2025 to 2032.

Emergence of AI-powered threat detection tools and surging demand for industry-specific compliance are the key market opportunities.

Check Point Software Technologies Ltd., NortonLifeLock, and Cisco Systems, Inc. are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Component

By Deployment

By Enterprise Size

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author