ID: PMRREP35750| 198 Pages | 17 Oct 2025 | Format: PDF, Excel, PPT* | Industrial Automation

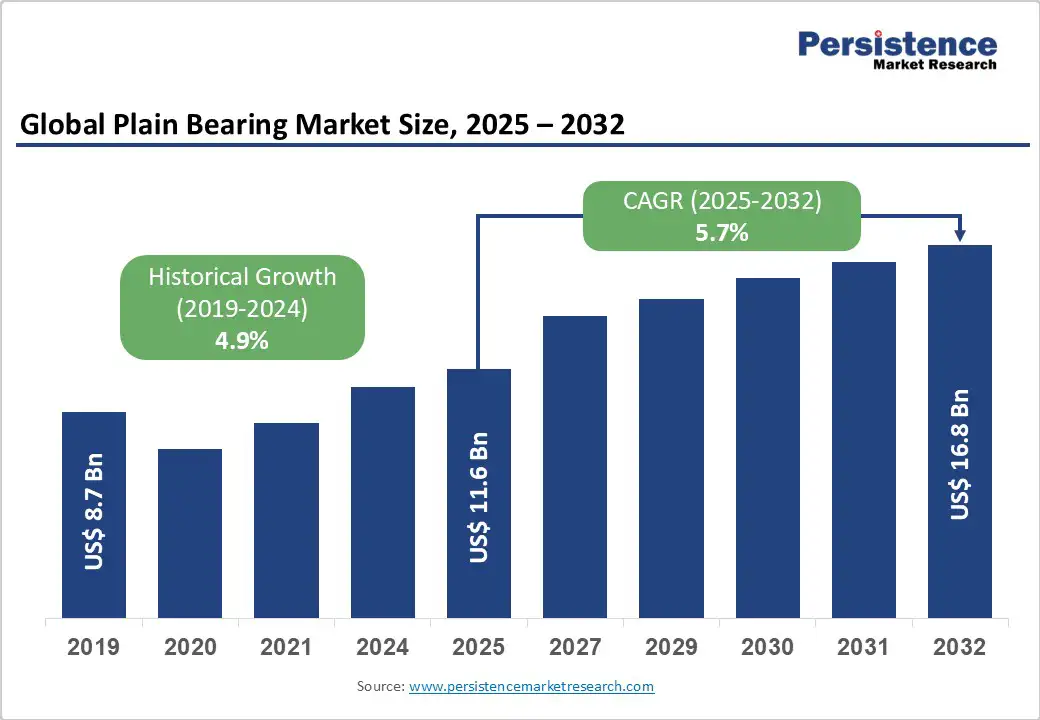

The global plain bearing market size is likely to be valued at US$11.6 billion in 2025. It is projected to reach US$16.8 billion by 2032, growing at a CAGR of 5.7% during the forecast period 2025 - 2032, powered by the increasing demand for bearing solutions from automotive, aerospace, and industrial machinery sectors.

This demand is driven by rapid industrialization in developing economies and the rising need for energy-efficient, durable bearing solutions in high-load applications. Plain bearings offer superior performance characteristics, including low maintenance requirements, exceptional load-bearing capacity, and reliable operation in demanding environments, making them indispensable components in a wide range of industrial applications.

| Key Insights | Details |

|---|---|

| Plain Bearing Market Size (2025E) | US$11.6 Bn |

| Market Value Forecast (2032F) | US$ 16.8 Bn |

| Projected Growth CAGR (2025 - 2032) | 5.7% |

| Historical Market Growth (2019-2024) | 4.9% |

The accelerating pace of industrialization across developing nations represents a fundamental driver for plain bearing market expansion. Countries including China, India, Brazil, and Mexico are experiencing unprecedented manufacturing growth, with government initiatives such as Make in India and China 2025 spurring domestic production capabilities.

According to the International Monetary Fund (IMF), the Asia Pacific region maintained 5.3% growth rates prior to recent global disruptions, with rising middle-class populations and urbanization creating substantial demand for industrial machinery, construction equipment, and automotive manufacturing.

Plain bearings are integral to heavy-duty machinery operations in steel production, mining equipment, and manufacturing systems, where their ability to handle extreme loads and operate reliably under demanding conditions makes them irreplaceable.

The Indonesian government's finalization of 190 National Strategic Projects worth US$ 95 million exemplifies the massive infrastructure investments driving plain bearing demand across construction machinery, earth-moving equipment, and industrial processing systems.

The plain bearing manufacturing industry faces significant challenges from fluctuating raw material costs, particularly steel, tin-based alloys, chrome steel, and engineering plastics that form the foundation of bearing production. Global commodity markets experience extreme price volatility due to geopolitical tensions, trade restrictions, and supply chain disruptions that directly impact bearing manufacturing costs.

The implementation of antidumping duties on Chinese tapered-roller imports by the U.S. Department of Commerce has reshaped sourcing patterns and encouraged domestic manufacturing capacity expansion, but also increased production costs for manufacturers relying on international supply chains.

These price fluctuations create uncertainty for both manufacturers and end-users, potentially delaying capital equipment investments and affecting overall market growth momentum, particularly in price-sensitive applications where cost competitiveness remains paramount.

Traditional plain bearings face increasing competition from advanced rolling bearing technologies that offer superior performance characteristics in specific applications. Modern hybrid ceramic bearings with ceramic rolling elements and steel raceways provide electrical insulation, reduced weight, and enhanced high-speed performance, particularly attractive for electric vehicle applications and precision machinery.

Smart bearing technologies incorporating sensors for condition monitoring and predictive maintenance capabilities offer operational advantages that plain bearings cannot match without additional external systems.

The development of sensor-enabled bearings by major manufacturers creates competitive pressure on plain bearing adoption, especially in applications where operational data collection and predictive maintenance capabilities justify higher initial investment costs.

The convergence of Industry 4.0 technologies with bearing systems presents substantial growth opportunities for plain bearing manufacturers willing to embrace digital transformation. Smart manufacturing initiatives are increasingly requiring components that can provide operational data for predictive maintenance, condition monitoring, and performance optimization.

Plain bearing manufacturers can capitalize on this trend by developing sensor-integrated solutions that combine the reliability of traditional plain bearings with modern data collection capabilities.

The rise of automated manufacturing systems, robotic applications, and Internet of Things (IoT) connectivity creates demand for bearings that can interface with digital monitoring systems while maintaining the fundamental advantages of plain bearing technology, including high load capacity and reliable operation in harsh environments.

The global transition toward renewable energy sources is expected to create significant opportunities for plain bearing applications, particularly in wind power generation systems. Wind turbines require specialized bearing solutions that can handle variable loads, extreme weather conditions, and extended operational periods with minimal maintenance requirements.

Plain bearings offer advantages in wind turbine applications due to their ability to accommodate misalignment, handle combined radial and axial loads, and operate reliably in harsh environmental conditions. According to industry data, wind power installations continue to expand globally, with major markets, including the United States, China, and the European Union (EU), investing heavily in renewable energy infrastructure.

The Philippines Department of Public Works and Highways' completion of infrastructure projects and Asia Pacific’s planned annual investment of over US$196 billion in transportation infrastructure development further demonstrate the expanding opportunities for plain bearing applications in renewable energy and infrastructure development projects.

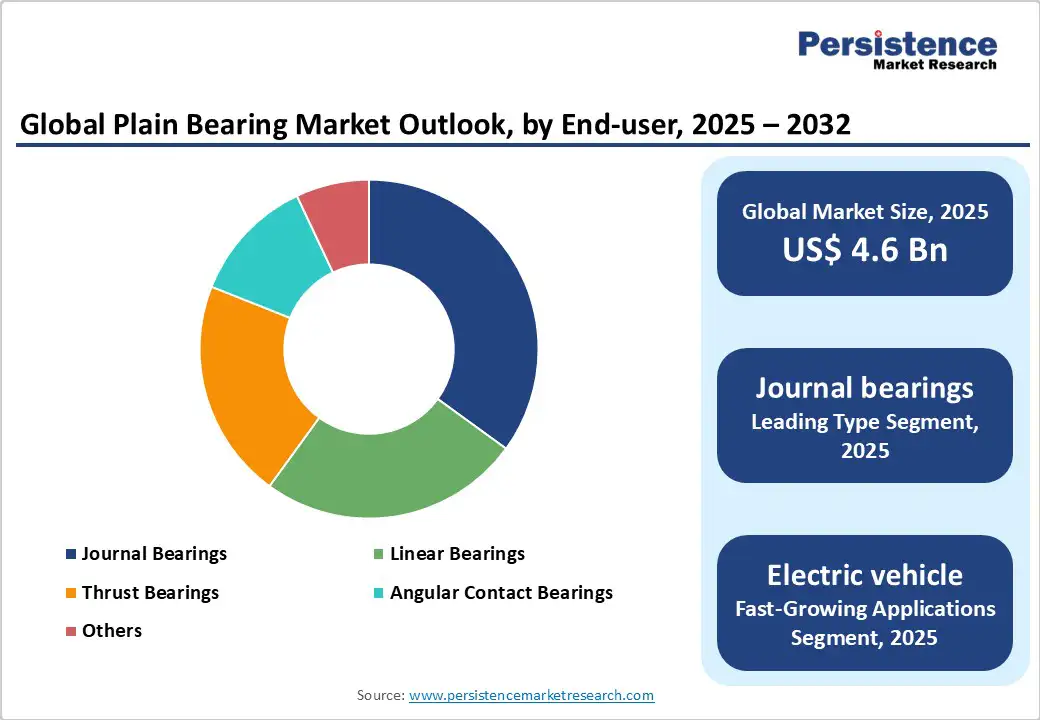

Journal bearings are expected to dominate the plain bearing market, with an approximately 35% share in 2025, reflecting their versatility and widespread application across industrial machinery, automotive systems, and heavy equipment. Journal bearings provide radial load support through hydrodynamic lubrication principles, where shaft rotation creates a lubricating film that separates moving surfaces and reduces friction.

Their popularity stems from their simple design, cost-effectiveness, and ability to handle high loads in applications such as steam turbines, large marine engines, internal combustion engines, and industrial pumps. The automotive industry represents the largest end-user segment for journal bearings, utilizing them in engine connecting rods, crankshaft supports, and transmission components where reliable operation under varying load conditions is essential.

Hydrodynamic bearings are poised to capture the leading market position, with an estimated 42% revenue share in 2025, due to their superior load-carrying capacity and self-generating lubrication characteristics. These bearings operate on the principle that shaft rotation draws lubricant into the clearance gap, creating pressure that lifts the shaft and eliminates direct metal-to-metal contact.

This design enables wear-free continuous operation and provides excellent damping characteristics, reducing vibration and noise in rotating machinery. Hydrodynamic bearings excel in applications requiring high load capacity, large bearing diameters, and high rotational speeds, making them ideal for power generation equipment, including wind turbines and hydroelectric power stations.

The automotive industry extensively utilizes hydrodynamic bearings in thermal management systems, while industrial applications include machine tools, pumps, and heavy machinery where reliable operation under demanding conditions is critical.

Metallic bearings are likely to maintain market leadership with approximately 65% share in 2025, primarily driven by their proven performance characteristics, cost-effectiveness, and established manufacturing infrastructure. Traditional metallic materials, including steel, bronze, brass, and Babbitt alloys, offer excellent load-bearing capacity, wear resistance, and compatibility with existing lubrication systems across diverse industrial applications.

Chrome steel bearings provide high hardness levels and quiet operation characteristics, making them suitable for vibrating motor systems, food processing machines, and linear motion components.

However, the market is witnessing growing interest in ceramic bearings made from zirconia (ZrO2), silicon nitride (Si3N4), and aluminum oxide (Al2O3) materials that offer magnetic insulation, corrosion resistance, high-temperature capability, and operation without lubrication requirements. Ceramic bearings find increasing adoption in aerospace, medical equipment, and high-performance applications where their unique properties justify premium pricing.

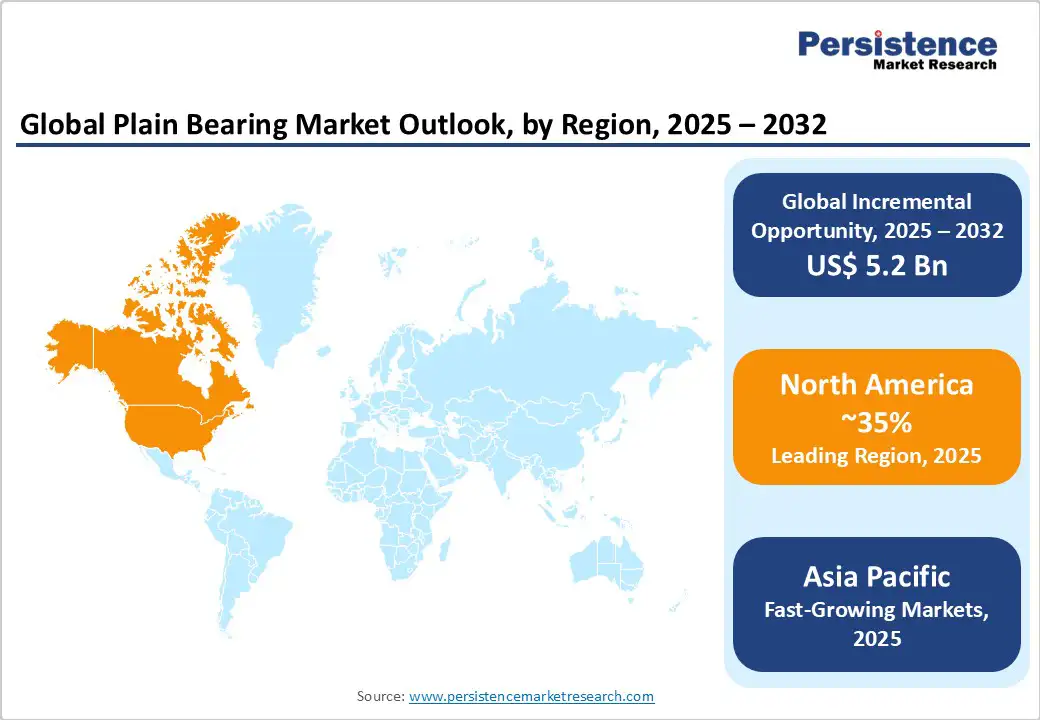

North America represents a mature plain bearing market characterized by advanced manufacturing capabilities, stringent quality standards, and a focus on technological innovation. The United States leads regional demand driven by robust automotive manufacturing, aerospace industry requirements, and extensive industrial infrastructure.

Auto giants such as Ford Motor Company, General Motors, and Chrysler have massive production facilities that require high-performance bearing solutions for manufacturing both traditional and electric vehicles, while aerospace majors such as Boeing and Lockheed Martin consistently demand precision bearings to meet strict performance and reliability specifications.

The regional market benefits from established manufacturing infrastructure with companies including The Timken Company, RBC Bearings Incorporated, and AST Bearings providing comprehensive bearing solutions and technical support.

Infrastructure investment initiatives, including the Bipartisan Infrastructure Law which provides over US$ 300 billion for roads and bridges, US$ 25 billion for airport improvements, and US$ 17 billion for port and waterway upgrades, create sustained demand for construction and material handling equipment incorporating plain bearing technology.

Europe offers strong opportunities for companies operating in the plain bearing space on the back of its advanced manufacturing capabilities, renewable energy investments, and automotive industry transformation. Germany leads regional demand with major automotive manufacturers, including Volkswagen, BMW, and Mercedes-Benz, requiring high-performance bearing solutions for both traditional and electric vehicle production.

The EU’s commitment to carbon neutrality by 2050 drives significant wind power and renewable energy infrastructure investments requiring specialized bearing solutions capable of operating in harsh environmental conditions.

Regulatory harmonization across EU member countries facilitates consistent quality standards and technical specifications, enabling efficient supply chain management and technology transfer. Major European bearing manufacturers, including SKF (Sweden), Schaeffler Group (Germany), and NTN-SNR (France) maintain extensive research and development capabilities focusing on advanced materials, smart bearing technologies, and energy-efficient solutions that position the region as a technology leader in the plain bearing market.

Asia Pacific represents the fastest-growing regional market for plain bearings, boosted by rapid industrialization, infrastructure development, and expanding manufacturing capabilities across major economies including China, Japan, India, and ASEAN countries.

China maintains dominant regional position as both consumer and producer of plain bearings, with extensive manufacturing capabilities supporting domestic demand and export markets. Chinese manufacturers, including LYC Bearing Corporation and Luoyang Huigong Bearings Technology Co., Ltd. have expanded production capacities and improved quality standards to serve global markets.

India demonstrates strong growth potential with government initiatives, including Make in India promoting domestic manufacturing capabilities and infrastructure investments. The Indian Railways revenue reached US$ 28.75 billion in 2024, with the government Union Budget allocation of US$ 29 billion for railway projects creating substantial demand for plain bearing applications.

Japan provides technology leadership through companies, including NSK Ltd., NTN Corporation, and JTEKT Corporation, that develop advanced bearing solutions and manufacturing technologies subsequently adopted throughout the region.

The global plain bearing market structure exhibits moderate consolidation with leading manufacturers holding approximately 55% collective market share, providing opportunities for specialized players to serve niche applications and regional markets.

Top companies including SKF, NSK Ltd., The Timken Company, Schaeffler Group, and NTN Corporation invest heavily in research and development, advanced manufacturing capabilities, and global distribution networks to maintain competitive positions.

Market leaders focus on product innovation including sensor-enabled bearings, cloud-linked diagnostics, and advanced coating technologies that extend bearing life and reduce maintenance requirements. Strategic initiatives include near-source manufacturing to mitigate trade risks, vertical integration into steel and component production, and additive manufacturing adoption to accelerate product development cycles and customization capabilities.

The global plain bearing market is projected to reach US$ 11.6 billion in 2025.

The increasing demand for bearing solutions from automotive, aerospace, and industrial machinery sectors and rapid industrialization in developing economies.

The market is poised to witness a CAGR of 5.7% from 2025 to 2032.

The convergence of Industry 4.0 technologies with bearing systems, aggressive implementation of smart manufacturing initiatives, and global transition towards renewable energy sources are key market opportunities.

NSK Ltd., Nachi-Fujikoshi Corp., and Myonic GmbH are some of the key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Design

By Material

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author