ID: PMRREP19117| 199 Pages | 13 Aug 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

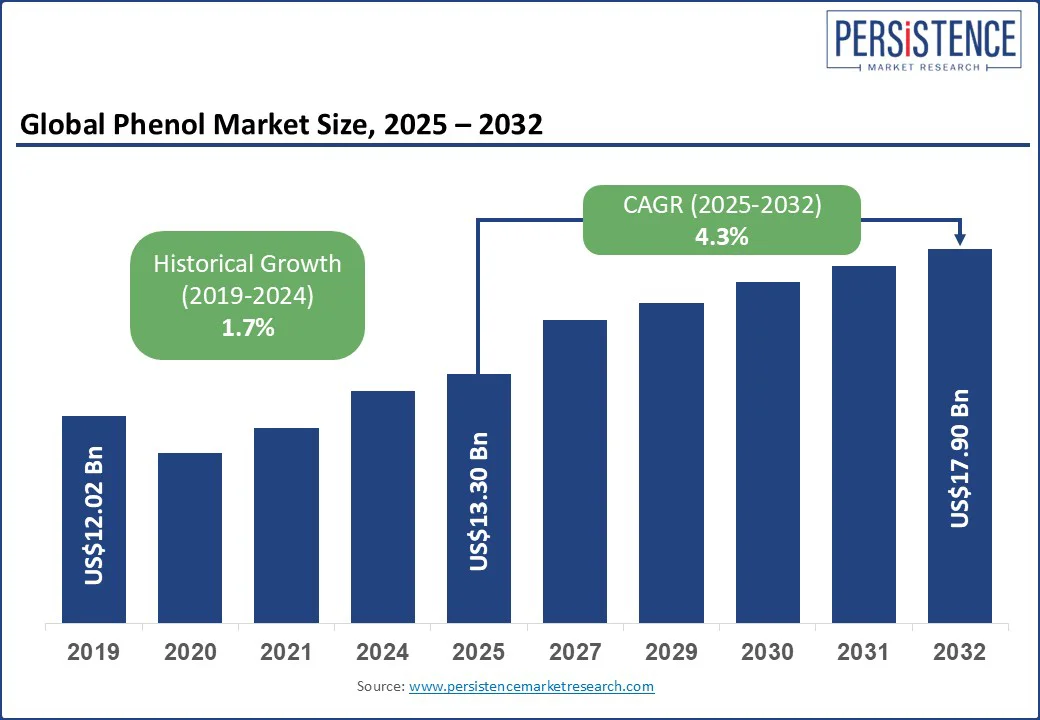

The global phenol market size is likely to value at US$13.3 Bn in 2025 and reach US$17.9 Bn, growing at a CAGR of 4.3% during the forecast period from 2025 to 2032.

The phenol market is experiencing steady growth, driven by rising demand across industries such as automotive, construction, and electronics. Phenol, a key raw material in the production of bisphenol A (BPA), phenolic resins, and Caprolactam, plays a crucial role in manufacturing plastics, laminates, and insulation materials.

Factors such as fluctuating crude oil prices, environmental regulations, and technological advancements in production processes influences market growth. Asia Pacific dominates the global scenario due to rapid industrialization and expanding end-use sectors. As sustainability becomes a priority, the global phenol industry is shifting toward bio-based alternatives and circular economy practices, reshaping the phenol production market dynamics worldwide.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Phenol Market Size (2025E) |

US$13.3 Bn |

|

Market Value Forecast (2032F) |

US$17.9 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

1.7% |

The growing demand for phenol in caprolactam and adipic acid production is one of the key drivers. Caprolactam is a monomer intermediate used to manufacture nylon 6 fibers, which are further utilized in the production of textile and industrial fibers, as well as carpets. Rapid growth of nylon fiber and polymer markets is anticipated to boost global caprolactam consumption by around 6 million tons in 2025.

Adipic acid, derived from phenol through a series of chemical processes involving cyclohexanol and cyclohexanone, is used as a feedstock for producing nylon. Nylon is a versatile and widely used synthetic polymer with several applications in industries such as automotive, textile, electronics, and packaging. Global nylon polyamide (nylon) fiber production rose from 5.9 million tons in 2021 to 6.2 million tons in 2022, and it is projected to reach around 7 to 8 million tons by the end of 2025. Rapid growth in the aforementioned segments has led to a significant increase in the demand for adipic acid, which is likely to reach around 3 million tons by 2025.

The global phenol industry is currently challenged by stringent regulations and evolving business strategies focused on sustainability, which may result in structural changes and lower production capacity in developed regions. For example, in April 2024, Mitsui Chemicals announced the planned closure of its phenol plant at Ichihara Works by fiscal 2026, which has an annual production capacity of 190,000 tons.

With an emphasis on green chemicals, the strategy aligns with the Mitsui Chemicals Group's goal to transition its Basic & Green Materials Business Sector into competitive and sustainable derivatives. Although this decision indicates more commitment to sustainability, it also suggests that the supply of phenol may be reduced, which could cause supply-demand imbalances in the market, especially in Asia Pacific.

Regulatory changes are prompting shifts in downstream demand for phenol derivatives. In May 2023, AkzoNobel introduced a bisphenol-free internal coating for beverage cans, driven by increasing restrictions on bisphenol A (BPA). The European Food Safety Authority (EFSA) recently tightened its stance on BPA usage in metal packaging for food and beverages, creating a ripple effect across the phenol value chain. Phenol is a key raw material for BPA production, and these regulations are likely to reduce the demand for phenol in this application.

The global industrial chemical sector is undergoing a major transformation as manufacturers integrate sustainability, circular economy principles, and innovative technologies into their operations. This shift reflects the industry's rising commitment to reducing environmental impact and embracing eco-friendly solutions.

Companies are increasingly exploring alternative feedstocks, energy-efficient production processes, and waste-to-value strategies to align with global sustainability goals. One of the key opportunities in this evolving landscape lies in the adoption of recycled materials as feedstock, reducing dependence on fossil fuels. In November 2023, Cepsa achieved a milestone by using recycled plastic pyrolysis oil to produce essential chemical intermediates at its La Rábida Energy Park in Spain.

The recent breakthrough demonstrates a transformative approach to recycling, demonstrating how waste plastics can be converted into valuable raw materials for large-scale production. This trend not only addresses plastic waste concerns but also enhances sustainability credentials across the sector.

Another significant opportunity lies in the development of energy-efficient production technologies, which help reduce operational costs while enhancing environmental performance. In April 2024, SABIC Fujian Petrochemicals announced a new facility in collaboration with KBR, incorporating cutting-edge technology designed to reduce energy consumption and enhance production efficiency.

Growing emphasis on circular economy initiatives and resource recovery strategies presents a promising path for companies to gain a competitive edge while contributing to a more sustainable future.

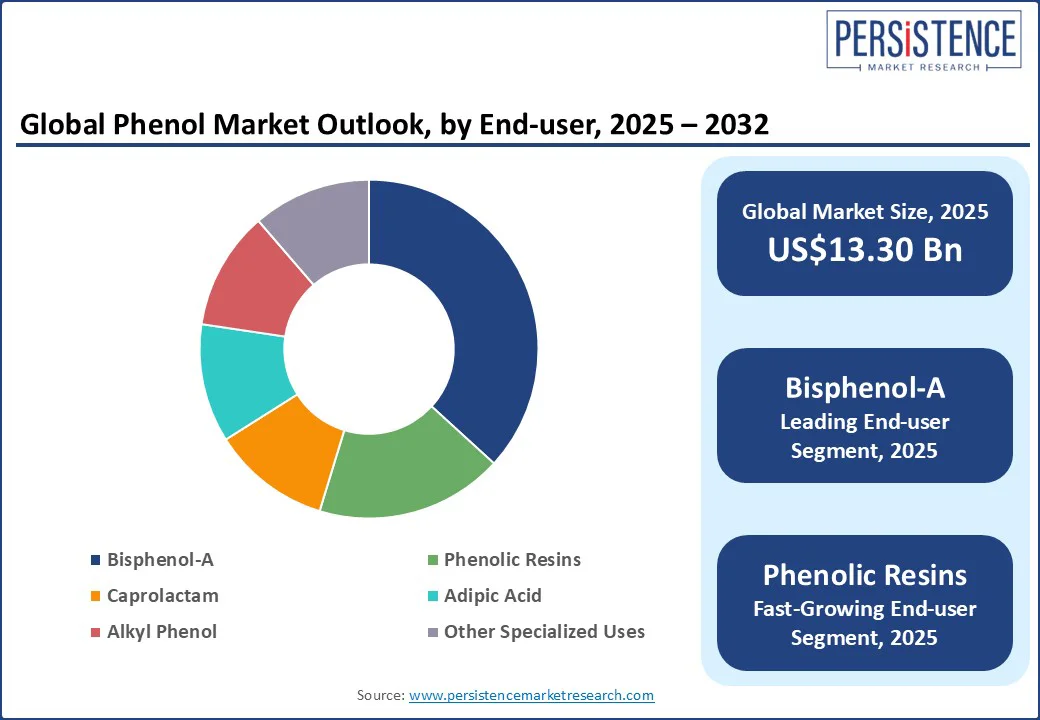

Bisphenol-A (BPA) remains the dominant end-use segment in the market, accounting for a 39.8% share in 2025. This dominance is primarily attributable to its wide use in polycarbonate plastics and epoxy resins, which have diverse applications in automotive components, construction materials, consumer electronics, and packaging. Rising demand for lightweight, durable plastics in the automotive and aerospace industries continues to fuel BPA consumption.

However, regulatory restrictions on BPA in food and beverage packaging, especially in Europe and North America, are prompting manufacturers to explore BPA-free alternatives and bio-based derivatives. Companies such as AkzoNobel have already introduced bisphenol-free coatings and circular phenol solutions. Despite these regulatory challenges, BPA’s demand will likely remain steady, particularly in Asia Pacific, where industrial expansion and infrastructure projects continue to support growth.

Phenolic resins, on the other hand, are projected to be the fastest-growing end-use segment. These resins are widely utilized in adhesives, coatings, insulation materials, and molded composites across various industries, such as construction, automotive, and electronics. Increasing adoption of phenolic resins for high-performance applications, such as fire-resistant materials and thermal insulation, is also driving the segment.

Rising need for bio-based and formaldehyde-free phenolic resins, along with global sustainability trends, is further accelerating market growth. In addition, the introduction of eco-friendly resins and developments in composite material technologies are set to boost demand, positioning phenolic resins as a key segment in the global market.

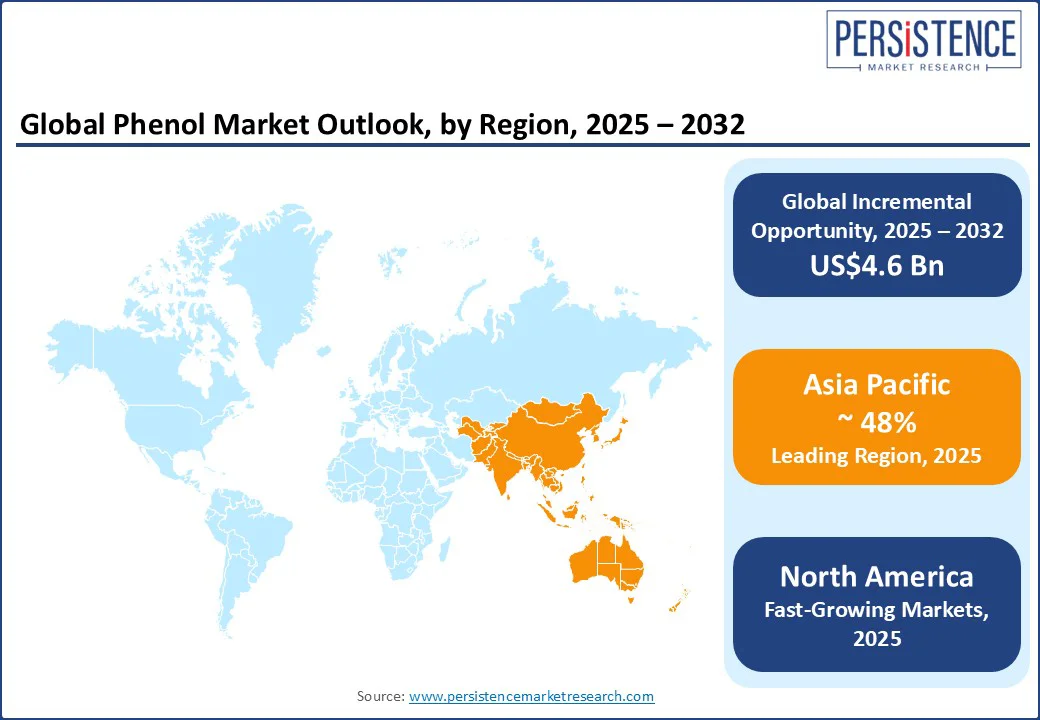

Asia Pacific dominates the global phenol industry, holding a 48.0% share in 2025. It is considered one of the largest consumers and producers of phenol globally. The region is set to maintain its leading position due to the ongoing development of petrochemical industries in China, Japan, South Korea, and India.

Recent capacity expansions, such as SABIC Fujian’s investment in a 250 KTA phenol plant in China scheduled for 2024, highlight the region’s increasing production capabilities. In Asia Pacific, East Asia is poised to remain the growth engine of the global market through 2032 due to the rising number of infrastructure projects and a strong manufacturing base.

North America holds a significant market share. The U.S. remains the leading country, supported by a strong chemical manufacturing infrastructure. However, BPA restrictions and environmental regulations are pushing companies toward sustainable phenol production.

Increasing investments in bio-based and recycled phenol alternatives indicate a gradual shift toward eco-friendly solutions. For instance, Ohio-based Hexion, Inc. is currently working on sustainable chemistry solutions and bio-based phenolic resins to lower environmental impact while complying with environmental norms. Similar strategies adopted by leading players across the U.S. are expected to unlock new growth opportunities through 2032.

Europe Phenol Market Trends - Increasing Use of Phenol in Automotive Coatings and Industrial Paints to Create New Opportunities in Europe

Europe is projected to experience stable growth over the forecast period. Key countries in the region include Germany, France, and the U.K., where phenol is widely used in coatings, automotive, and construction applications. For instance, Germany-based BASF utilizes phenol-derived resins in the production of industrial paints and automotive coatings, ensuring enhanced resistance and long-term durability.

Europe’s commitment to green chemistry, along with government incentives for sustainable production, is likely to drive the market forward. Significant investments in bio-based derivatives are also set to play a crucial role in bolstering future regional growth.

The global phenol market is competitive, with key players focusing on sustainability initiatives, capacity expansions, and supply chain modifications. Increasing concerns over waste management, carbon emissions, and BPA regulations are compelling manufacturers to invest in sustainable production methods. As a result, companies are investing in research and development to create bio-based phenol alternatives aimed at replacing fossil fuel-derived raw materials.

A few other companies are aiming to adopt vertical integration to control the entire supply chain. They are striving to establish fully integrated production models to ensure a steady supply of significant raw materials such as acetone and benzene for phenol production. These models are helping them to optimize cost structures and reduce supply chain disruptions.

In 2025, the global phenol market is expected to reach a value of US$13.3 Bn.

By 2032, the phenol market is projected to grow to approximately US$17.9 Bn.

Key trends in the market include rising demand from automotive, construction, pharmaceuticals, and chemicals, along with growing use of phenol-based composites in aerospace for their heat resistance and structural strength.

The bisphenol-A segment is the leading end-use category, expected to account for 39.8% of the market share in 2025.

The phenol market is projected to grow at a CAGR of 4.3% from 2025 to 2032.

Major players include INEOS Phenol, Haldia Petrochemicals Ltd. (HPL), Mitsui Chemicals, and Lummus Technology.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 to 2024 |

|

Forecast Period |

2025 to 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author