ID: PMRREP33159| 199 Pages | 27 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

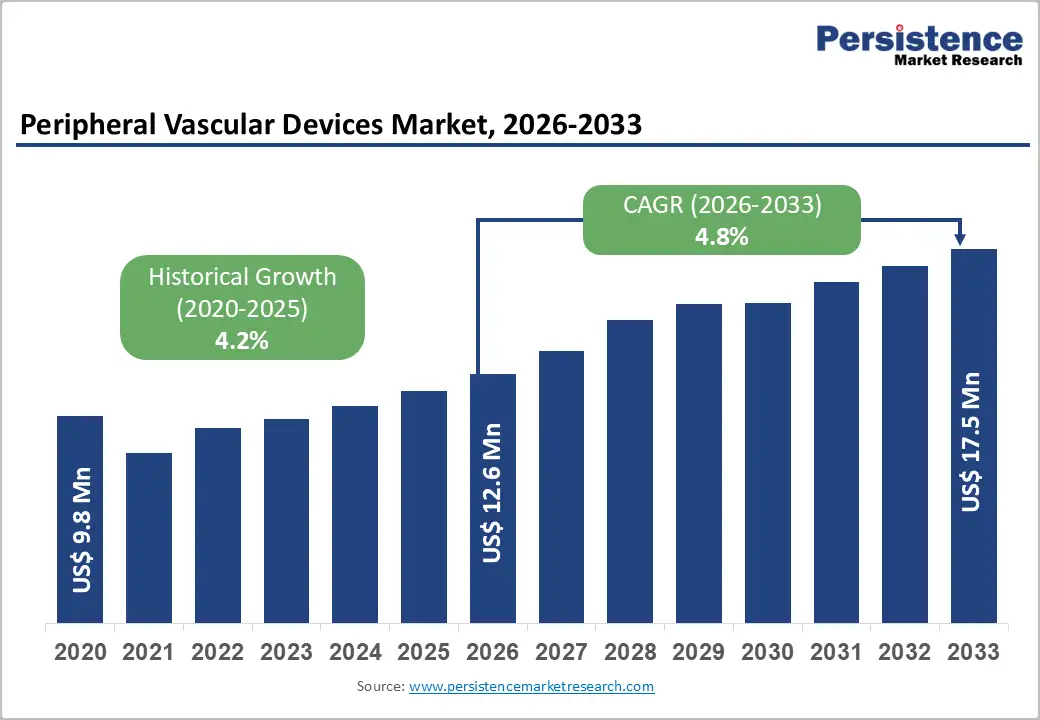

The global peripheral vascular devices market size is likely to be valued at US$12.6 billion in 2026 and is projected to reach US$17.5 billion by 2033, registering a CAGR of 4.8% during the forecast period 2026 - 2033.

A greater focus on the prevention & treatment of peripheral arterial disease in low & middle-income economies is expected to boost the global market for peripheral vascular devices. The rising prevalence of peripheral arterial disease fuels demand and focus on interventional cardiology. Patients suffering from long-term cardiovascular diseases undergo angioplasty as the first line of treatment intervention. The Centers for Disease Control and Prevention states that around 8.5 million Americans, including 12% to 20% of those over 60, have peripheral arterial disease (PAD). Factors such as the aging population, the prevalence of cardiovascular and peripheral vascular disease, and rising healthcare expenditure in lower-middle-income countries are projected to drive growth in the global peripheral vascular devices market.

| Key Insights | Details |

|---|---|

| Global Peripheral Vascular Devices Market Size (2026E) | US$12.6 Bn |

| Market Value Forecast (2033F) | US$17.5 Bn |

| Projected Growth CAGR(2026 - 2033) | 4.8% |

| Historical Market Growth (2020 - 2025) | 4.2% |

The global market for peripheral vascular devices is experiencing significant growth, driven primarily by the increasing prevalence of vascular diseases and the rising demand for minimally invasive treatments. Conditions such as peripheral artery disease (PAD) are becoming increasingly widespread, driven by factors like ageing populations, sedentary habits, diabetes, and hypertension. With these risk factors on the rise worldwide, the need for advanced therapeutic solutions, including stents, angioplasty balloons, catheters, and vascular grafts, is accelerating rapidly. According to the Global Burden of Disease Study, PAD affected around 200 million people worldwide in 2021, making it one of the most common cardiovascular diseases. Peripheral artery disease (PAD) was responsible for an estimated 74,000 deaths worldwide in 2021, underscoring its role as a major contributor to global cardiovascular mortality. While PAD itself is often underdiagnosed, its complications-such as critical limb ischemia, stroke, and myocardial infarction-drive mortality.

Minimally invasive procedures have become one of the strongest drivers of growth in the peripheral vascular devices market, fundamentally changing how vascular diseases are treated. Unlike traditional open surgeries, which require large incisions and longer recovery periods, minimally invasive techniques rely on catheters, guidewires, stents, and balloons inserted through small access points. This approach significantly reduces trauma to the body, leading to shorter hospital stays, faster recovery times, and fewer complications such as infections or bleeding. One of the most important enablers is image-guided technology, such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT), which allow physicians to visualize vessels in real time and deploy devices with greater precision. This reduces the risk of restenosis and improves long-term outcomes. Additionally, innovations such as drug-eluting stents and bioresorbable scaffolds are designed for minimally invasive use, further boosting adoption.

Advances in Imaging and Navigation Technologies

Technological advancements are playing a pivotal role in driving the growth of the peripheral vascular devices market. Innovations in device design and functionality have significantly improved treatment outcomes for patients with peripheral artery disease (PAD) and other vascular conditions. One of the most notable developments is the introduction of drug-eluting stents and balloons, which release medication directly at the site of blockage to reduce restenosis and improve long-term vessel patency. Similarly, bioresorbable scaffolds are gaining traction as they provide temporary support to vessels and then dissolve, minimizing long-term complications.

Modern imaging and navigation technologies such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT) have enhanced precision during interventions, allowing physicians to visualize vessels in real time and deploy devices more effectively. This has led to fewer complications and better patient outcomes. Additionally, catheter-based systems have become more sophisticated, enabling minimally invasive procedures that reduce hospital stays, recovery times, and overall healthcare costs. The integration of artificial intelligence (AI) and machine learning into device platforms is also emerging, offering predictive analytics and decision support for clinicians. Together, these innovations are not only improving patient care but also expanding adoption, thereby fuelling steady market growth.

The peripheral vascular devices market faces an increasing threat of product recalls, posing a significant challenge for manufacturers and healthcare providers. Recalls often occur due to device malfunctions, safety concerns, or regulatory non-compliance, and they can severely impact patient safety, company reputation, and market growth. Peripheral vascular devices such as stents, catheters, balloons, and grafts are highly complex and used in critical interventions, so even minor defects can lead to serious complications such as restenosis, thrombosis, or device failure.

The FDA, EMA, and regional authorities demand rigorous testing and post-market surveillance. Any deviation from quality standards can trigger immediate recall actions. Additionally, the growing use of advanced technologies, including drug-eluting stents and bioresorbable scaffolds, introduces new risks related to durability, drug release mechanisms, and long-term performance.

Innovative technologies to create a strong demand for peripheral vascular devices

The global peripheral vascular devices market is witnessing a strong opportunity in technological innovation, expanding minimally invasive procedures, and addressing the rising global burden of vascular diseases. Breakthroughs such as drug-eluting stents, bioresorbable scaffolds, drug-coated balloons, and advanced imaging systems are improving patient outcomes by reducing restenosis, enhancing durability, and enabling more precise interventions. These innovations are creating strong demand among physicians and patients seeking safer, more effective solutions. Endovascular procedures using stents, grafts, and catheters are increasingly preferred over open surgery. These procedures shorten recovery times, lower the risk of complications, and reduce hospital costs, making them attractive to both healthcare providers and patients.

Digital Integration enabling improved long-term care

Digital integration is rapidly transforming peripheral vascular care, creating new possibilities for patient management. Modern vascular devices now integrate AI-powered imaging, advanced sensors, and connected platforms, providing physicians with continuous data during and after procedures. AI tools can analyze intravascular ultrasound or angiography in real time, enabling quicker and more accurate clinical decisions. Remote monitoring extends care beyond the hospital, identifying early signs of restenosis or complications before they escalate. These connected systems also support personalized treatment plans, adapting interventions to individual patient trends. Over time, predictive analytics powered by machine learning shifts care toward proactive prevention, improving outcomes, reducing readmissions, and lowering healthcare costs.

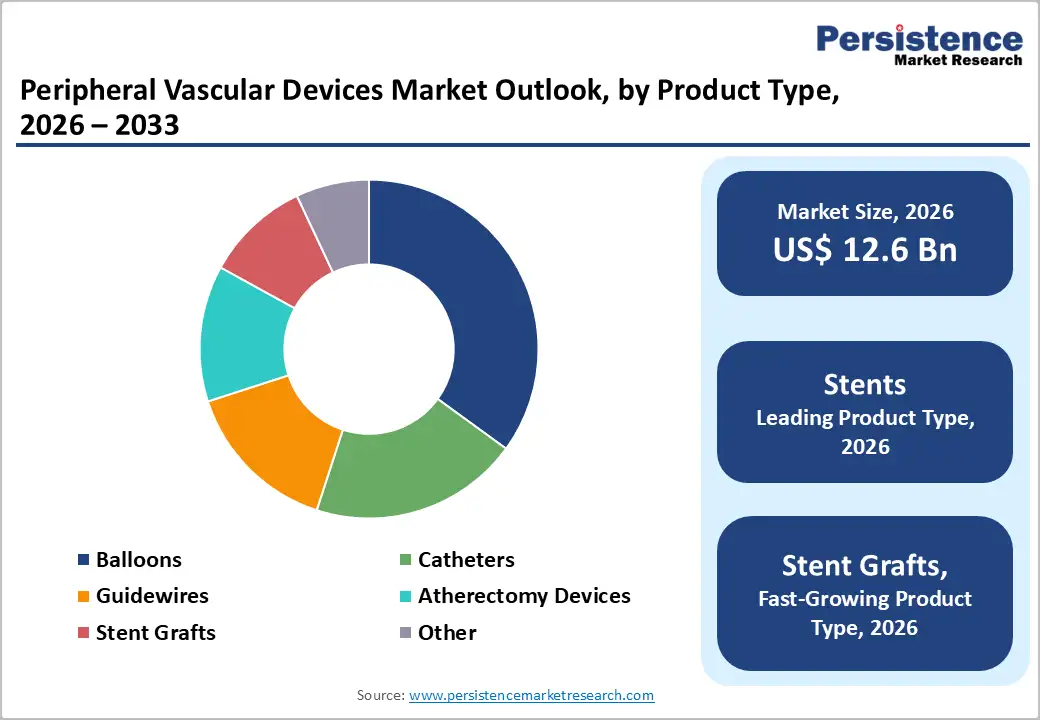

Peripheral vascular stents hold the largest share in the product type segment, accounting for approximately 30% of the global peripheral vascular devices market. Peripheral arterial stents remain the cornerstone of peripheral vascular procedures, largely because of their ability to deliver consistent and durable results across a wide range of clinical scenarios. Unlike balloon angioplasty alone, which often suffers from vessel recoil and restenosis, stents provide a mechanical scaffold that keeps arteries open, ensuring sustained blood flow. This reliability has made them the go-to option for physicians treating peripheral artery disease (PAD) and other vascular complications.

Stents perform reliably in short lesions, extended occlusions, and even heavily calcified vessels, situations where balloons or atherectomy devices often fall short in delivering durable results. Continuous improvements in design, materials, and drug-eluting technology have further strengthened their effectiveness, significantly lowered restenosis rates and better long-term patient outcomes. In-stent thrombosis and high device costs are two critical challenges that can restrict the widespread use of peripheral vascular stents, especially in emerging markets.

Peripheral artery disease remains the dominant application in the global peripheral vascular devices market, accounting for approximately 50% of the market. According to several Heart Associations, overall prevalence estimates indicate that 7 to 12 million individuals in the U.S. and 200 million worldwide are affected, with incidence rates varying significantly across countries due to differences in lifestyle, risk factors, and healthcare access. The worldwide increase in diabetes, obesity, and smoking has created a larger patient pool requiring vascular interventions. These conditions accelerate atherosclerosis, heightening the risk of arterial blockages that demand timely treatment.

The growing burden of PAD has led to a steady increase in demand for endovascular procedures, particularly in hospitals and ambulatory surgical centers. These settings favour minimally invasive approaches such as stent placement, balloon angioplasty, and atherectomy, which offer faster recovery times and reduced complications compared to open surgery. Hospitals benefit from established infrastructure and physician expertise, while ambulatory centres provide cost-effective care and quicker turnaround, making them ideal for PAD interventions. Advancements in device technology, viz., drug-eluting stents and improved balloon catheters, have further reinforced PAD treatment as the primary application. These innovations deliver better long-term outcomes, reduce restenosis rates, and enhance patient quality of life. As cardiovascular risk factors continue to rise globally, PAD treatment will remain the dominant driver of peripheral vascular device adoption, ensuring sustained growth in both advanced and emerging healthcare markets.

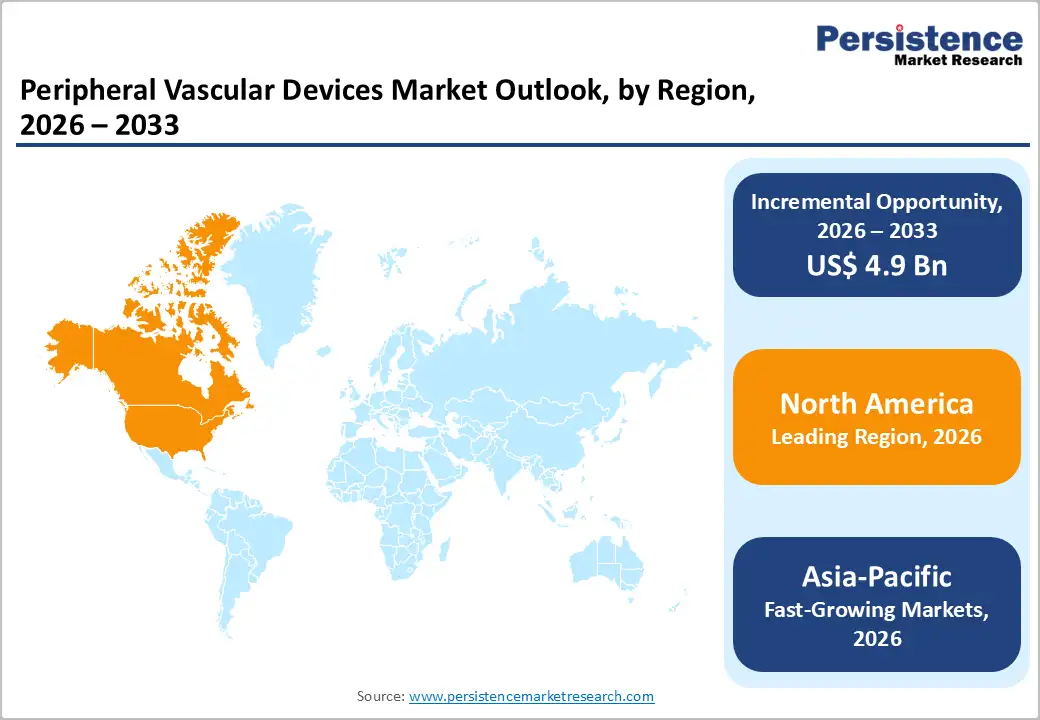

The United States dominates the North American peripheral vascular devices market, accounting for more than 70% share of the regional market value. Healthcare infrastructure in the U.S. also plays a major role, in addition to well-established reimbursement frameworks and strong adoption of new medical technologies. Hospitals and ambulatory surgical centers are equipped with skilled interventional radiologists and vascular surgeons, ensuring widespread use of these devices. The rapidly expanding elderly population in the U.S. and Canada has heightened vulnerability to conditions such as aneurysms, renal artery stenosis, and venous insufficiency. This demographic shift has significantly increased the number of patients requiring minimally invasive vascular treatments. At the same time, the growing prevalence of cardiovascular risk factors, including diabetes, hypertension, obesity, and smoking, further drives the incidence of peripheral vascular diseases, intensifying demand for advanced device-based interventions.

Europe exhibits a robust growth trajectory in the peripheral vascular devices market, with projections indicating a steady CAGR of 5.1% through 2033. Aging demographics, rising cardiovascular risks, technological advances, and supportive healthcare systems are driving the steady growth of peripheral vascular device use across Europe. Strong regulatory frameworks from the European Medicines Agency (EMA) and national health authorities provide confidence in device safety and efficacy, encouraging clinical uptake. Widespread screening programs and awareness campaigns for aneurysms and venous disorders further increase early diagnosis, expanding the number of patients eligible for intervention.

In the U.K., Germany, and France, peripheral vascular devices play a central role in treating both arterial disease and venous disorders, driven by demographic trends and rising cardiovascular risks. The aging populations in these countries have contributed to a higher prevalence of peripheral artery disease (PAD), affecting around 8-10% of adults over 60. At the same time, chronic venous insufficiency and varicose veins remain widespread, impacting an estimated 20-30% of adults. For arterial conditions, stents, balloon catheters, and endovascular grafts are the primary tools, while venous stents, ablation technologies, and filters are increasingly adopted for venous care. Robust healthcare systems and proactive screening initiatives further support widespread clinical use across Europe.

The Asia-Pacific region is witnessing rapid expansion in peripheral vascular therapies, fuelled by innovations such as drug-eluting stents, bioresorbable scaffolds, and next-generation angioplasty balloons that enhance vessel patency and lower restenosis rates. Advanced imaging technologies, including 4D intravascular ultrasound and intracardiac echocardiography catheters, are improving accuracy and precision during procedures. At the same time, digital integration and smart connectivity are elevating device performance and enabling better monitoring. With the growing burden of PAD and venous disorders, coupled with substantial healthcare investments, Asia is emerging as a leading hub for cutting-edge vascular solutions that deliver safer, more effective, and patient-centered outcomes. rephrase

In India, China, Japan, and Australia, peripheral vascular devices are increasingly vital for managing artery disease and venous disorders, driven by aging populations and rising cardiovascular risks. According to the regional health institutes in India and China, the burden of peripheral artery disease (PAD) is substantial, with tens of millions affected due to high rates of diabetes and smoking. Japan faces elevated PAD prevalence among its elderly, while according to the Australian Institute of Health and Welfare, Australia reports PAD in about 7-10% of adults over 60. Venous disorders, including chronic venous insufficiency and varicose veins, impact 20-30% of adults across these regions. Stents, balloon catheters, venous stents, and ablation systems dominate interventions, supported by advanced healthcare infrastructure.

The peripheral vascular devices market is highly competitive, with big global companies leading while smaller and regional firms work to differentiate themselves. The market is driven by advances in technology, regulatory clearances, and global expansion strategies. Leading players such as Medtronic, Boston Scientific, Abbott, and Cook Medical command substantial market share thanks to their extensive product lines, robust distribution capabilities, and strong clinical reputation. These companies compete vigorously across segments, including stents, balloon catheters, embolic protection devices, and atherectomy systems, frequently using their scale of operations to sustain competitive pricing and reinforce market dominance.

Furthermore, emerging companies such as Penumbra and Cardinal Health are establishing distinct positions in thrombectomy and embolism management. Penumbra concentrates on developing advanced aspiration-based thrombectomy systems, while Cardinal Health capitalizes on its strong distribution network to broaden access to innovative devices. Their flexibility enables them to address unmet needs swiftly, especially in minimally invasive clot-removal solutions. Integration of AI imaging and robotics is emerging, giving these firms an edge in precision interventions.

The Global Peripheral Vascular Devices market is projected to reach US$17.5 Bn by 2033, growing at a CAGR of 4.8% from 2026 to 2033.

The primary factors driving demand for Peripheral Vascular Devices include millions of patients worldwide suffering from blocked arteries due to diabetes, hypertension, smoking, and aging.

The peripheral vascular stents segment leads accounting for around 30% market share, owing to broad clinical applications, favourable reimbursement policies, and minimal invasive benefits.

The U.S. leads the Global Peripheral Vascular Devices market, holding the largest share, approximately 70% of the regional market value, because of its high disease burden, advanced healthcare infrastructure, strong reimbursement systems, and rapid adoption of innovative technologies.

Countries in Asia‑Pacific, Latin America, and the Middle East present vast growth potential due to large patient populations, rising rates of diabetes and hypertension, and expanding healthcare infrastructure. Device manufacturers can tap into these regions by offering cost‑effective solutions tailored to local needs.

Abbott Laboratories, Medtronic plc, Terumo Corporation, Boston Scientific Corporation and Cook Medical, Inc. are some of the leading players in the Global Peripheral Vascular Devices Market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn, Volume: Units (As applicable) |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Disease Indication

By End user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author