ID: PMRREP12316| 199 Pages | 22 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

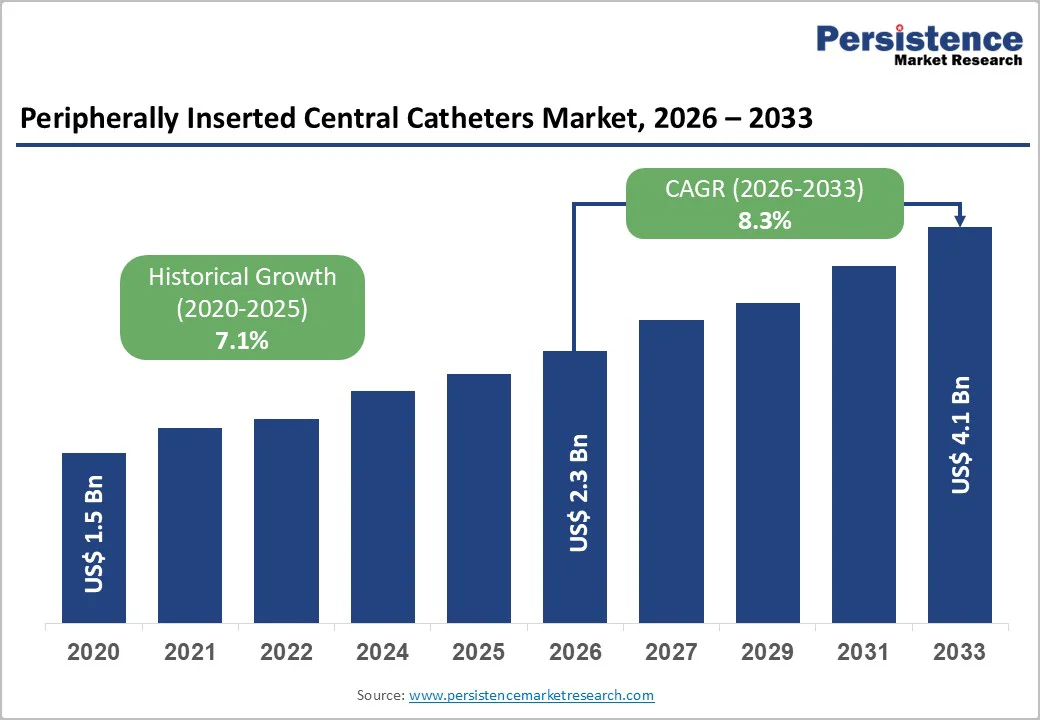

The global peripherally inserted central catheters market size is estimated to grow from US$ 2.3 billion in 2026 to US$ 4.1 billion by 2033. Growing at a CAGR of 8.3% during the forecast period from 2026 to 2033.

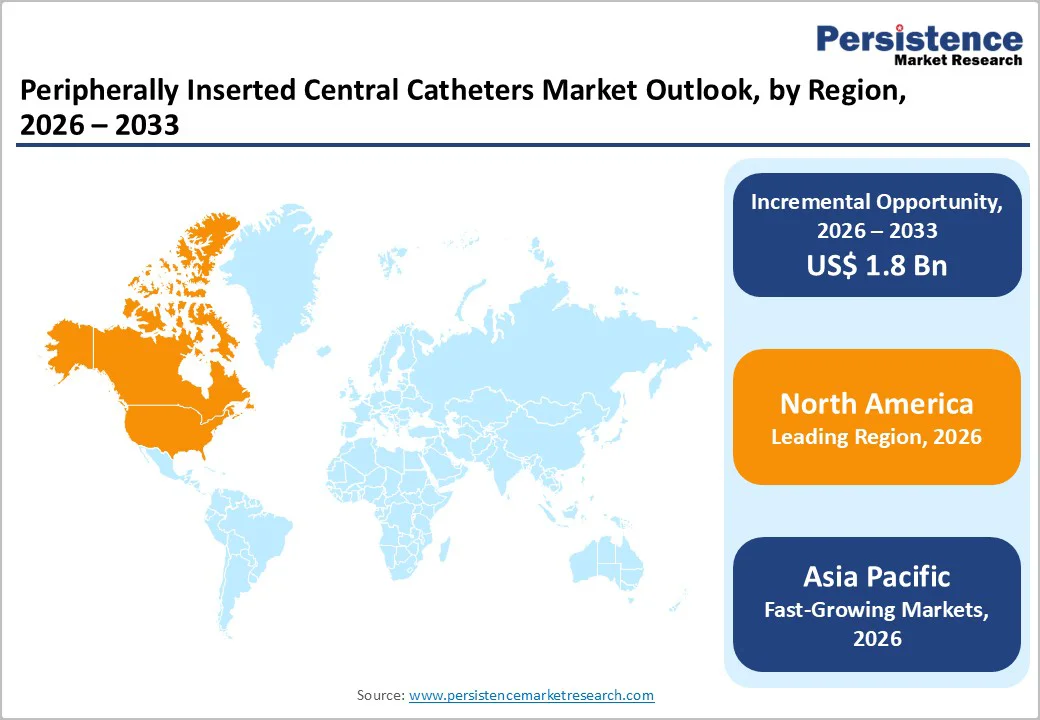

The market is poised to grow steadily, driven by rising chronic disease prevalence, increasing use of long-term IV therapies, and expanding oncology and critical care. North America leads due to advanced hospital infrastructure, a skilled workforce, and efficient reimbursement. At the same time, the Asia Pacific is expected to achieve the fastest growth, supported by expanding healthcare access, rising awareness, and growing local adoption of PICC devices.

| Key Insights | Details |

|---|---|

| Peripherally Inserted Central Catheters Market Size (2026E) | US$ 2.3 Bn |

| Market Value Forecast (2033F) | US$ 4.1 Bn |

| Projected Growth (CAGR 2026 to 2033) | 8.3% |

| Historical Market Growth (CAGR 2020 to 2025) | 7.1% |

The growing use of chemotherapy and parenteral nutrition (PN) is a major driver of the PICC market because both therapies require reliable, long-term venous access. Global cancer incidence continues to rise, with countries like India reporting over 1.4 million new cancer cases in 2022, contributing to a large population needing multi-cycle chemotherapy.

A clinical study evaluating long-term home PN in cancer patients reported more than 55,000 catheter-days of PICC use, with 71% of these patients receiving chemotherapy alongside nutritional support. The same study reported strong safety outcomes, including a catheter-related bloodstream infection rate of 0.05 per 1,000 catheter-days and symptomatic thrombosis in only about 1% of cases, demonstrating PICC reliability for prolonged home infusion therapy.

As chemotherapy protocols become more intensive and treatment-induced malnutrition increases PN demand, PICCs remain the preferred vascular access option, collectively boosting market growth through expanding oncology and nutritional support needs.

Complication risks such as deep vein thrombosis (DVT), catheter-related bloodstream infections, and occlusions significantly restrain PICC market growth because they affect patient safety and clinical preference. A large nine-year study reported that 28.1% of PICC insertions experienced some form of complication, equal to nearly 5 events per 1,000 catheter-days, with thrombosis accounting for about 10.9% and catheter-associated infections approximately 7.5%.

Broader clinical reviews show complication rates ranging from 9.5% to 38.6%, with venous thrombosis occurring in 2.3-5.9% of patients and catheter-related infections in 1.4-1.9%. In intensive care settings, symptomatic DVT rates have reached 4.6 per 1,000 catheter-days.

These events often require catheter removal, treatment interruption, additional imaging, anticoagulation therapy, or replacement with alternative vascular access devices. As hospitals and clinicians prioritize safety and lower complication profiles, concerns about thrombosis, infection, and occlusion reduce the preference for PICCs in certain patient groups, posing a significant restraint on market expansion.

The rise of home-infusion and outpatient care presents a major opportunity for the PICC market, driven by the global shift toward safer, cost-efficient alternatives to hospital-based therapy. In the U.S., more than 3.2 million patients receive home-infusion therapy each year, and PICC lines are used in nearly two-thirds of all vascular access devices placed in home-care settings.

This high utilization reflects PICC suitability for long-term antibiotics, chemotherapy, hydration, and parenteral nutrition outside the hospital. Health systems increasingly encourage outpatient IV therapy because it can reduce inpatient costs by 30-60% and lower hospital-acquired infection rates by moving patients out of high-risk environments.

Growing burdens of chronic infections, cancer, and gastrointestinal conditions also increase the need for long-duration infusions that can be safely managed at home. As more countries expand home-health programs and adopt outpatient IV protocols, demand for reliable central access devices, such as PICCs, continues to rise, creating a strong growth opportunity.

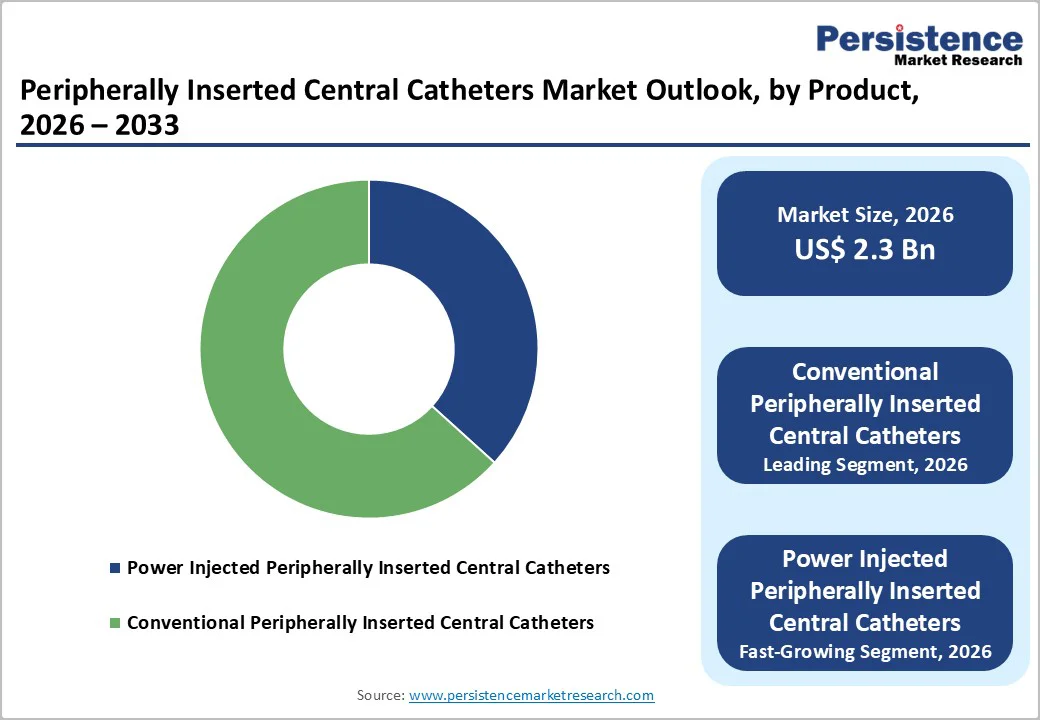

Conventional peripherally inserted central catheters occupy 63.3% of the global market in 2025 because they are simpler, more cost-effective, and suitable for most infusion therapies compared with power-injectable or multi-lumen catheters. Studies show that increasing the use of single-lumen PICCs can prevent about one deep-vein thrombosis and one catheter-related bloodstream infection per 1,000 catheters annually, highlighting their safety advantage.

Most home-infusion and non-critical care patients do not require high-pressure injection or multiple simultaneous infusions, making conventional PICCs sufficient for routine antibiotics, chemotherapy, or parenteral nutrition. Their lower cost, ease of maintenance, and reduced risk of complications make them the preferred choice for hospitals and outpatient settings.

Consequently, conventional PICCs continue to account for the majority of PICC insertions, reinforcing their dominant position in the global market.

Multiple-lumen PICCs dominate the market because they allow simultaneous infusion of incompatible therapies without repeated venous access. Their design is particularly valuable for patients requiring complex treatments, such as chemotherapy, total parenteral nutrition, antibiotics, and blood transfusions.

Hospitals and clinicians prefer multi-lumen devices for intensive care, oncology, and long-term therapy because they reduce the need for multiple line insertions, improving patient comfort and workflow efficiency. The growing prevalence of chronic illnesses, cancer, and ICU admissions further drives demand. Despite slightly higher risks of infection and thrombosis compared to single-lumen PICCs, their versatility makes them the preferred choice in modern healthcare settings.

North America, especially the U.S., benefits from a mature, advanced healthcare system with thousands of hospitals and widespread adoption of minimally invasive treatments. Each year the U.S. alone performs over 2.7 million PICC insertions, reflecting high procedural volume and clinician comfort.

The region also has a substantial burden of chronic diseases, cancer, and a growing elderly population, driving demand for long-term IV access in oncology, intensive care and home infusion settings. Generous reimbursement policies, well-staffed vascular-access teams, and strong institutional infrastructure (hospital beds, outpatient infusion centers) further support broad adoption. That combination of infrastructure, disease burden and clinical preference keeps North America at the top globally.

Europe is a key region for the peripherally inserted central catheters market due to its ageing population, strong hospital infrastructure, and high demand for safe intravenous therapies. In 2024, over 21% of the European Union population was aged 65 or older, a group frequently requiring long-term or repeated IV treatments such as chemotherapy, antibiotics, nutrition, or hydration.

Many European hospitals report that 80-90% of inpatients receive IV therapy, highlighting the extensive need for reliable venous access. Strong regulatory standards, strict infection-control practices, and universal healthcare coverage further support PICC adoption over repeated peripheral cannulations. These demographic, clinical, and regulatory factors together make Europe an important and growing market for PICCs.

The Asia Pacific region is the fastest-growing market for peripherally inserted central catheters due to rapid demographic changes and rising healthcare needs. In 2024, the area had approximately 503 million people aged 65 and above, representing 10.5% of the population, projected to nearly double to 996 million, or 19.3%, by 2050.

This ageing population drives higher demand for long-term intravenous therapies, including chemotherapy, nutrition, antibiotics, and critical care treatments. Additionally, the Asia Pacific is witnessing significant expansion in healthcare infrastructure, with more hospital beds, infusion centers, and advanced medical facilities being developed.

Increasing healthcare spending, growing awareness of minimally invasive treatments, and rising prevalence of chronic and cancer-related conditions are further accelerating PICC adoption, making the Asia Pacific the fastest-growing regional market.

Leading companies in the peripherally inserted central catheters market focus on high-quality catheter design, multi-lumen innovations, and strict safety standards. They invest in research, training, and advanced materials, collaborating with hospitals and healthcare providers to improve efficacy, reduce complications, and expand adoption globally, supporting the growing demand for long-term intravenous therapies.

The global peripherally inserted central catheters market is projected to be valued at US$ 2.3 billion in 2026.

Rising chronic diseases, cancer cases, ageing population, ICU expansion, and preference for long-term, minimally invasive intravenous therapies drive the global PICC market.

The global peripherally inserted central catheters market is poised to witness a CAGR of 8.3% between 2026 and 2033.

Growing home healthcare, rising outpatient treatments, advanced multi-lumen catheters, emerging Asia Pacific demand, and increasing awareness of minimally invasive IV therapies.

AngioDynamic, Inc., B. Braun Melsungen AG, Becton, Dickinson and Company, C. R. Bard, Inc., Teleflex Incorporated, Argon Medical Devices, Inc.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product

By Design

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author