ID: PMRREP35703| 190 Pages | 9 Oct 2025 | Format: PDF, Excel, PPT* | Consumer Goods

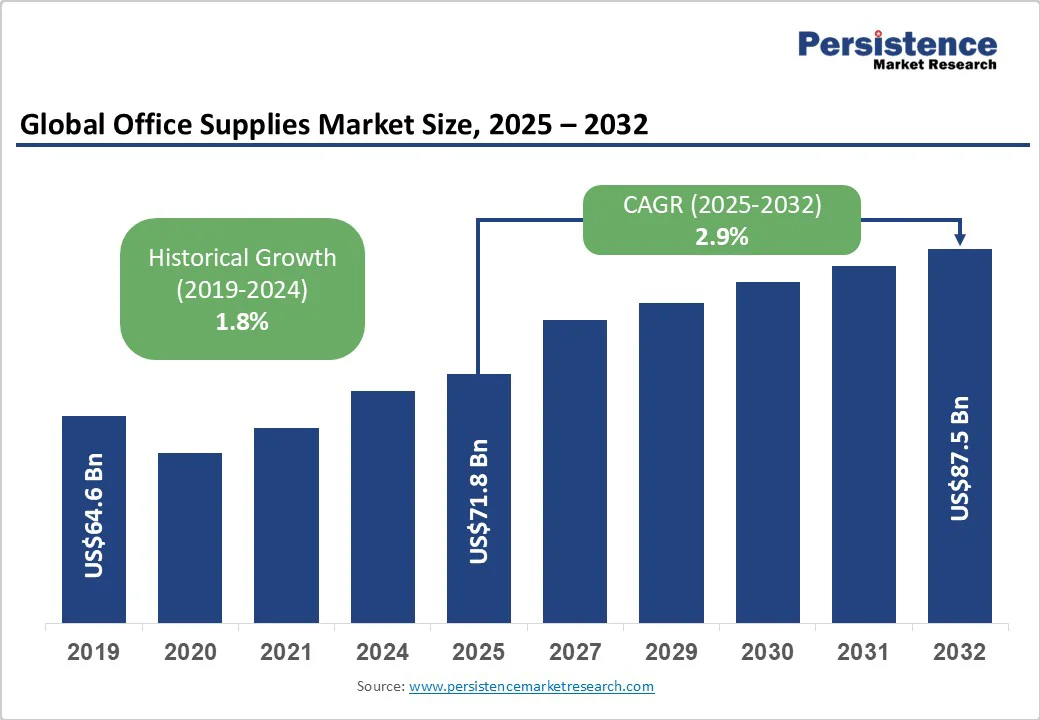

The global office supplies market size is likely to be valued at US$71.8 Billion in 2025 and is estimated to reach US$87.5 Billion in 2032, growing at a CAGR of 2.9% during the forecast period 2025-2032, driven by the evolution of modern workplaces, hybrid work trends, and the rising emphasis on productivity-improving tools. Increasing adoption of remote work setups has further spurred demand.

| Key Insights | Details |

|---|---|

|

Office Supplies Market Size (2025E) |

US$71.8 Bn |

|

Market Value Forecast (2032F) |

US$87.5 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

2.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

1.8% |

The continuous expansion of the education sector worldwide is one of the growth drivers for office supplies. Rising student enrollment, government-backed literacy programs, and increasing private investments in schools and universities are creating consistent demand for notebooks, pens, folders, and other classroom essentials.

In India, for instance, the National Education Policy (NEP) 2020 has triggered the establishment of new institutions and increased procurement of learning materials. Similarly, countries in Europe, such as Germany and France, have reported steady spending on academic stationery as in-person learning resumes fully after the pandemic.

As hybrid and full-time office setups regain momentum, companies are reordering essential stationery to support daily administrative tasks. The revival of on-site operations in sectors such as finance, consulting, and government has brought renewed demand for printing paper, pens, desk organizers, and filing accessories.

For example, the U.S. saw office occupancy rates cross 50% in 2024 according to Kastle Systems’ Back to Work Barometer, reflecting a gradual but clear shift to traditional office environments. Various companies are also redesigning their workplaces to improve employee engagement, prompting bulk purchases of branded stationery and eco-friendly office products.

The widespread use of disposable office supplies, including single-use plastic pens, markers, and excessive paper, continues to pose serious environmental concerns, thereby curbing market growth. These products significantly contribute to landfill accumulation and plastic pollution, as most are neither biodegradable nor recyclable.

According to the UN Environment Program, nearly 400 million tons of plastic waste are generated annually, with disposable stationery forming a small but persistent share of this total. In response, governments and consumers are pushing for green alternatives, prompting schools and corporations to limit purchases of single-use stationery.

The heavy reliance on non-recyclable packaging materials such as plastic film, bubble wrap, and Styrofoam for office supplies has emerged as a prominent restraint on the market. These materials generate substantial post-consumer waste and contribute to greenhouse gas emissions during production and disposal.

A 2024 report by the European Environment Agency revealed that packaging waste now accounts for over 40% of total plastic waste generated across the EU, with office and stationery products being notable contributors. Rising environmental regulations and extended producer responsibility (EPR) laws in Europe and Japan are prompting suppliers to reassess their packaging choices.

The rising preference for sustainable business practices is creating a superior opportunity for eco-friendly and recycled office supplies. Companies are adopting green procurement policies to reduce their carbon footprint, driving demand for biodegradable stationery, refillable pens, recycled paper, and office accessories made from bamboo.

Global corporations such as HP and Pilot have launched recycled printer cartridges and pens made from ocean-bound plastic, complying with Environmental, Social, and Governance (ESG) goals. The shift is also supported by government regulations and certifications such as the Forest Stewardship Council (FSC) and Blue Angel, which encourage responsible material sourcing.

The emergence of smart technology in everyday office tools presents a major opportunity for innovation and differentiation. Smart pens, notebooks, and digital sticky notes that instantly digitize handwritten content are gaining traction among professionals seeking efficiency and organization.

Products such as the Neo Smartpen and Rocketbook’s reusable smart notebooks allow smooth integration with cloud platforms, including Google Drive and Evernote, bridging the gap between traditional writing and digital storage. Also, AI-based scheduling tools, smart highlighters that scan text, and IoT-connected desk accessories are refining productivity in both corporate and remote workspaces.

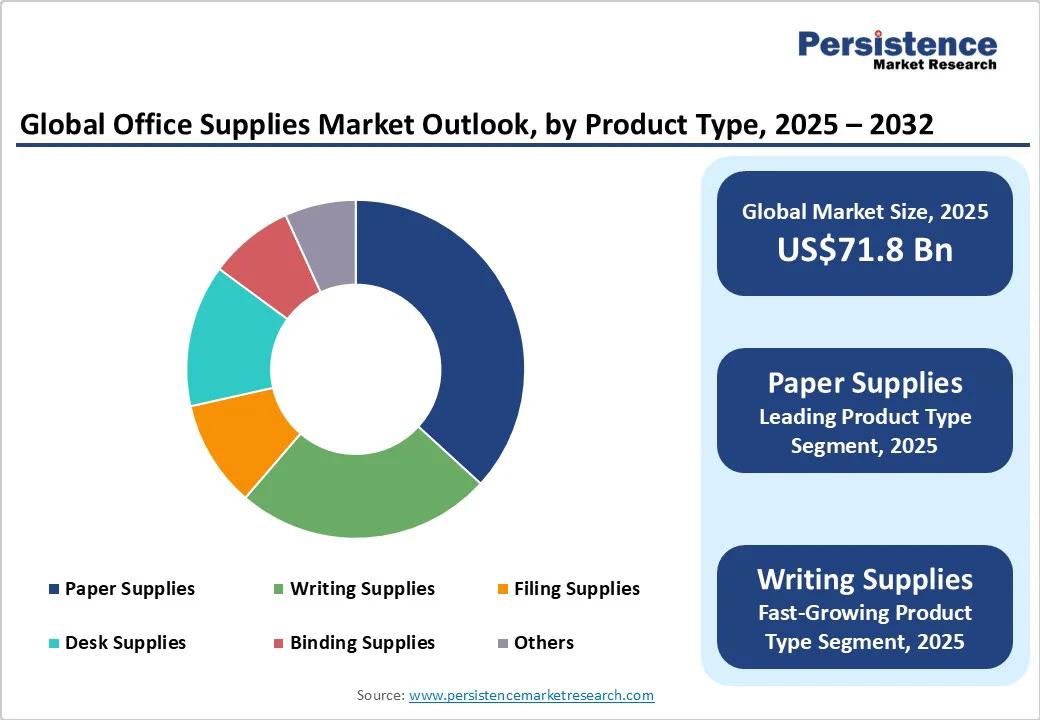

Paper supplies are expected to account for approximately 36.8% of the market share in 2025, owing to their reliability and versatility. Despite the rise of digital tools, paper remains indispensable for tasks such as documentation, legal records, and educational materials. For instance, in academic settings, students and educators often prefer handwritten notes for better retention and understanding, as digital devices can be distracting and may not provide the same cognitive benefits.

Writing supplies maintain a consistent demand due to their fundamental role in education, business, and personal activities. In educational institutions, items such as pens, pencils, and markers are essential for note-taking, assignments, and exams. The rise of remote learning and hybrid education models has further increased the demand for these supplies at home. Also, the surging popularity of creative hobbies such as journaling, calligraphy, and art has expanded the market for specialty writing instruments.

Educational institutions are expected to hold a market share of about 32.8% in 2025, owing to the essential role office supplies play in daily academic activities. Items such as notebooks, pens, binders, and paper are fundamental for students and teachers alike. The global expansion of education, particularly in developing regions, has pushed this demand, with governments investing heavily in education infrastructure.

Corporate offices are a major application area for office supplies due to the diverse requirements of businesses in daily operations. Essential items such as paper, writing tools, and organizational products are necessary for tasks, including documentation, communication, and record-keeping. The steady growth of administrative, corporate, and educational sectors has contributed to the increasing demand for these supplies, as handwritten tasks such as signing documents, note-taking, and making quick annotations remain important.

The offline channel is estimated to account for nearly 90.4% of the market share in 2025, as it delivers physical verification and instant access to products, which several consumers and institutional buyers still value. Businesses, schools, and government offices often rely on established local distributors or brick-and-mortar stores to source stationery, paper, and filing materials. This enables them to evaluate product quality before making a purchase and maintain consistent procurement relationships.

The online channel is expected to experience steady growth through 2032, as digital procurement becomes the norm among corporations and households. The expansion of e-commerce platforms such as Amazon Business, Staples, and Office Depot’s online portals has made it convenient for companies to automate recurring purchases, manage digital invoices, and access a wide range of SKUs. Hybrid working models have also augmented this trend as professionals now order supplies for home offices directly from online platforms.

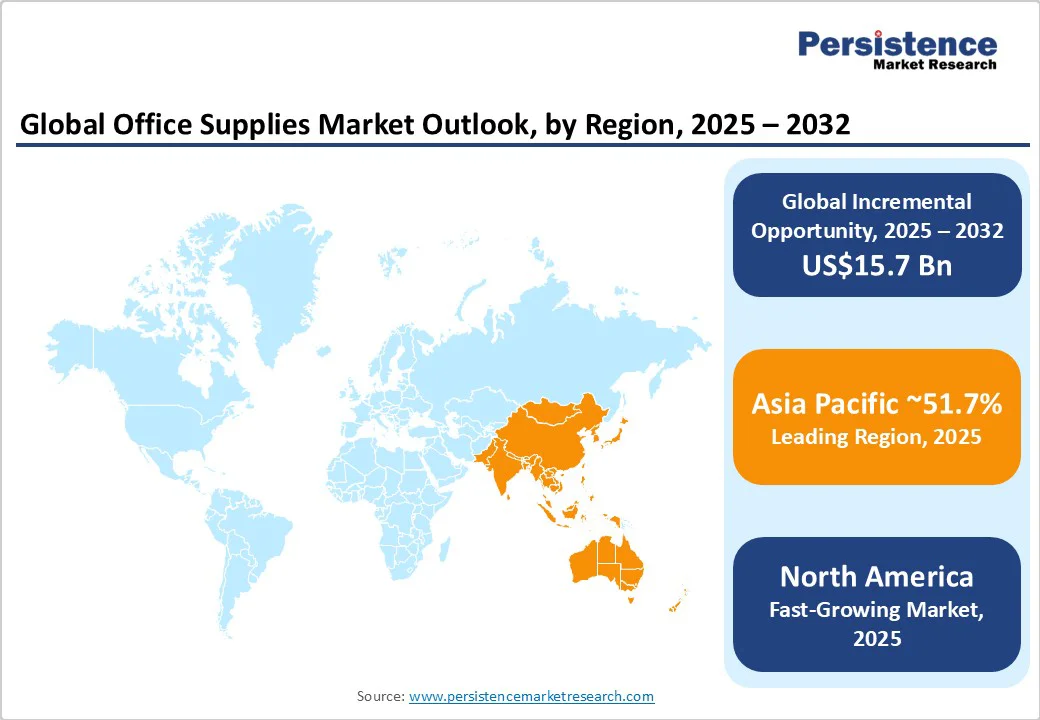

In 2025, Asia Pacific is predicted to account for approximately 51.7% of the market share, backed by the expansion of corporate offices and the increasing number of hotel establishments in the region. Every new office, whether a start-up, SME, or multinational branch, requires basic operational materials. This includes paper for printing and documentation, writing instruments for employees, filing supplies to organize documents, desk organizers, and binding products for reports and presentations.

For example, in India and China, rapid urbanization and the rise of business parks have created large clusters of office spaces, pushing bulk purchases of office stationery and recurring demand for consumables such as printer paper, sticky notes, and pens. The growth of hotel establishments in Singapore, Thailand, and Malaysia further propels demand for office and desk supplies in back-office operations, administrative departments, and conference facilities.

The increasing demand for home office setups due to hybrid and remote work trends is anticipated to boost growth in North America. In the U.S., paper supplies still form the backbone of demand, mainly from education, legal, and government institutions that continue to rely on printed materials for recordkeeping and compliance. While the paper segment has stabilized after years of digital disruption, products such as multi-purpose printing paper, notepads, and sticky notes remain resilient, augmented by hybrid workplaces balancing digital and physical documentation.

In Canada, paper supplies also account for the most prominent share of the office supplies segment, though the category faces slow growth due to the country’s superior digital adoption and sustainability policies. Public institutions are prioritizing paperless processes, but office paper, notebooks, and print accessories maintain steady demand from schools and SMEs. The government’s sustainable procurement initiatives have accelerated the use of recycled and FSC-certified paper products across corporate offices.

In Europe, the market is influenced by a blend of traditional and modern dynamics, with Germany, France, the U.K., and Italy playing key roles. Local players are adapting to changing demands by focusing on sustainability, digitalization, and customized solutions. Germany stands out as a prominent importer of office and school supplies, with imports valued at approximately US$116.28 Million, in 2020. The country's well-established industrial infrastructure and skilled workforce contribute to a steady demand for office supplies.

France is home to companies such as BIC and the Hamelin Group, which are renowned for their unique and sustainable office supply solutions. BIC, for instance, has introduced biodegradable pens and other writing instruments to cater to environmentally conscious consumers. The U.K. is being fueled by both local and international players. WH Smith PLC, for example, is focusing on expanding its online presence and delivering customized stationery solutions to meet the evolving requirements of businesses and educational institutions.

The global office supplies market has a dynamic competitive landscape influenced by evolving consumer behaviors, technological developments, and shifting workplace dynamics. Companies such as Staples and Office Depot are expanding their lines of sustainable office supplies, emphasizing their commitment to environmental responsibility. The market is also characterized by strategic mergers and acquisitions aimed at strengthening market positions. For instance, in September 2025, the ODP Corporation, parent company of Office Depot and OfficeMax, agreed to be acquired by Atlas Holdings for approximately US$1 Billion.

The office supplies market is projected to reach US$71.8 Billion in 2025.

Expanding corporate sector and return-to-office trends are the key market drivers.

The office supplies market is poised to witness a CAGR of 2.9% from 2025 to 2032.

Increasing preference for minimalist desk accessories and branding of stationery items are the key market opportunities.

Hamelin, The 3M Company, and Newell Brands are a few key market players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Application

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author