ID: PMRREP35924| 193 Pages | 1 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

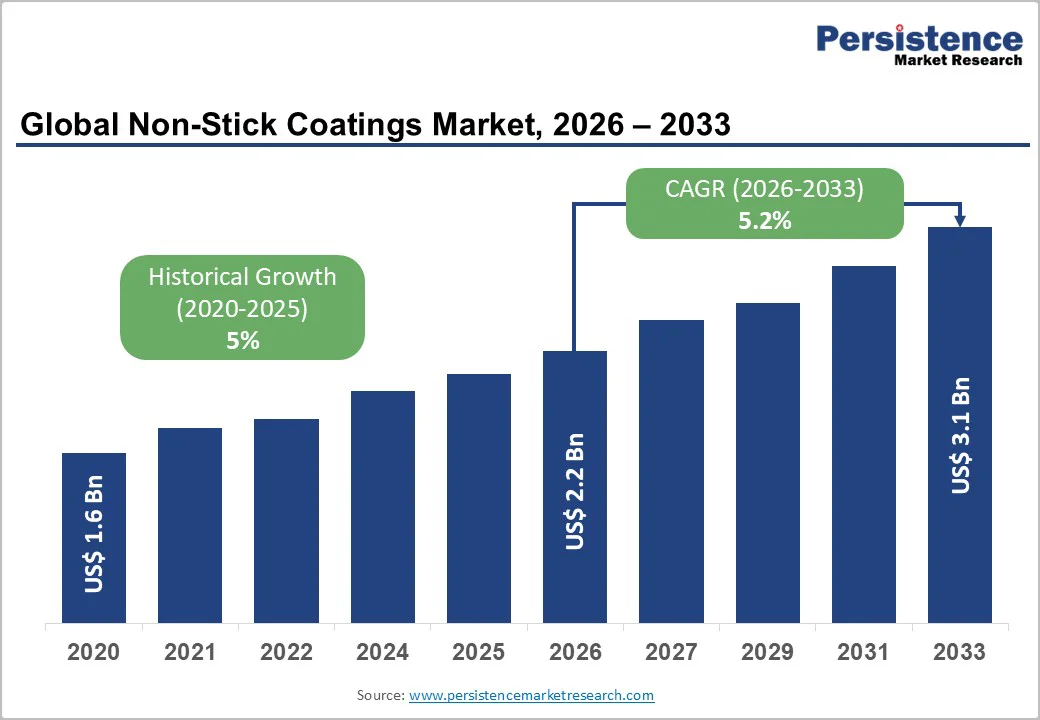

The global non-stick coatings market size is likely to be valued at US$2.2 Billion in 2026 and is expected to reach US$3.6 Billion by 2033, growing at a CAGR of approximately 4.8% during the forecast period from 2026 to 2033, driven by increasing consumer and regulatory demand for safe, PFOA-free and PFAS-free formulations and rapid adoption of non-stick surfaces in medical devices and electronics.

These trends, combined with sustained innovation in ceramic and hybrid coating systems, position the industry for stable, mid-single-digit expansion through the forecast period while transitioning toward more sustainable technologies.

| Key Insights | Details |

|---|---|

| Non-Stick Coatings Market Size (2026E) | US$2.2 Bn |

| Market Value Forecast (2033F) | US$3.1 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.2% |

| Historical Market Growth (CAGR 2020 to 2025) | 5% |

Health awareness and the desire for reduced-oil cooking continue to drive household adoption of non-stick cookware. Regulatory bodies and manufacturers have largely phased out PFOA, and consumer preference has shifted decisively toward certified safe products.

Urban households, especially dual-income families in developed and emerging markets, value convenience and easy cleanup. Rising disposable incomes in Asia Pacific further accelerate premium cookware purchases, creating a virtuous cycle of innovation in durable, scratch-resistant, eco-friendly coatings.

Non-stick coatings play a critical role in minimally invasive medical devices, diagnostic equipment, and semiconductor manufacturing. Hydrophobic and low-friction surfaces improve procedural outcomes, reduce contamination risk, and enhance production yields in electronics cleanrooms.

Aging populations and increasing healthcare spending worldwide amplify demand for coated surgical instruments and implantable devices, while the ongoing miniaturization of electronic components requires ever-more sophisticated release and protective layers.

Industry initiatives and the global shift toward electric vehicles create a steady need for heat-resistant, chemically inert coatings in food-processing equipment, conveyor systems, battery components, and powertrain components. These coatings lower maintenance costs, extend equipment life, and meet stringent hygiene and thermal-performance requirements in highly automated environments.

Although PFOA has been eliminated, broader concerns around certain PFAS compounds continue to attract regulatory scrutiny and consumer caution. Stricter limits on PFAS usage can raise compliance costs and trigger reformulation expenses.

Key inputs remain subject to price swings and geographic concentration risks. Disruptions in fluorspar supply or geopolitical tensions affecting major producing countries can quickly translate into higher production costs and delivery delays.

The regulatory push away from forever chemicals, combined with genuine consumer preference for green products, opens a sizable window for ceramic, silicone-polyester, and sol-gel technologies that deliver comparable or superior performance without legacy environmental baggage.

China, India, and Southeast Asia continue to expand manufacturing capacity in automotive, food processing, and electronics. Local production incentives and rising labor costs in developed markets encourage investment in high-performance coatings tailored to regional needs.

Growth in outpatient procedures, wearable diagnostics, and disposable medical products creates ongoing demand for biocompatible, easy-to-sterilize non-stick surfaces.

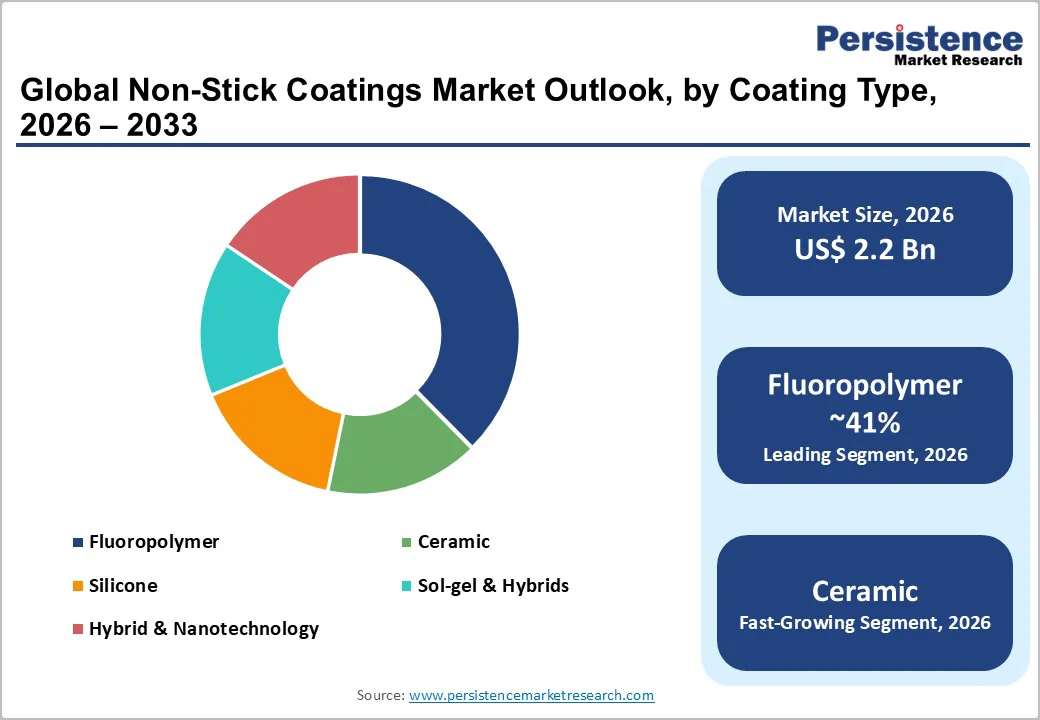

Fluoropolymer coatings (primarily PTFE, FEP, PFA, and modern ETFE, and their blends) is anticipated to be the leading segment, accounting for 41% in 2026. Their unique combination of extremely low surface energy, continuous heat resistance up to 260-315 °C, and outstanding chemical inertness continues to make them irreplaceable in high-performance applications.

Examples include Chemours Teflon on millions of frying pans worldwide, Daikin Polyflon on automotive fuel-system components, 3M Dyneon industrial dispersions for mold release, and Solvay Hyflon PFA in semiconductor fluid-handling lines. Even with modern, PFOA-free formulations, fluoropolymers maintain strong brand equity and entrenched supply-chain positions across cookware, food processing, and automotive.

Ceramic-based systems are expanding most rapidly, driven by the global push for PFAS-free alternatives that still deliver premium performance. These coatings offer superior hardness (7-9H), excellent scratch and abrasion resistance, and full compatibility with induction cooktops.

Leading examples include Whitford Eclipse and Fusion (used by GreenPan, Zwilling, and Tefal), ILAG CeramPro, Weilburger Greblon C3+, and Neoflon Ceramic from Daikin. They are now the preferred choice in mid-to-high-end consumer cookware and are quickly penetrating commercial bakeware and selected medical instruments where regulatory and consumer demand for “forever-chemical-free” solutions is strongest.

Cookware and bakeware is expected to remain the largest single application, representing roughly 32% of the global non-stick coating consumption.

Everyday examples range from mass-market lines such as T-fal, Calphalon, and Circulon to premium and direct-to-consumer brands including Le Creuset, Scanpan, Made In, Caraway, and Our Place. Strong retail marketing, frequent product replacement cycles, and the explosive growth of e-commerce platforms continue to sustain robust volume demand for both traditional PTFE and newer ceramic-reinforced systems.

Medical applications are anticipated to grow significantly faster than any other segment. Non-stick coatings are essential on interventional devices such as guidewires, hypotubes, angioplasty catheters, endoscopic instruments, biopsy needles, and implant delivery systems.

Notable examples include 3M and DSM Biomedical silicone-ceramic coatings on cardiovascular catheters, Medtronic and Boston Scientific hydrophilic + non-stick combinations, and Teleflex PTFE-lined introducer sheaths. The ongoing shift toward minimally invasive and single-use procedures, combined with rising global healthcare spending, drives sustained high-single to low-double-digit annual growth in this precision-critical segment.

North America is anticipated to remain the most innovation-focused and highest-value market for non-stick coatings, led overwhelmingly by the U.S. The region combines world-class medical-device clusters in states such as Minnesota, California, and Massachusetts, strong intellectual-property protection, and a consumer base that willingly pays premiums for safety-certified, long-lasting products.

Strict FDA and EPA oversight eliminated PFOA years ago and is now driving the industry toward completely PFAS-free systems faster than most other parts of the world. The rapid scale-up of EV production and advanced food-processing automation is opening entirely new applications for heat-resistant, low-friction coatings in battery assemblies, thermal-management components, and high-speed production lines.

The U.S. dominates the region and sets global technical standards. It is home to the headquarters of Chemours, 3M, PPG, Whitford, and Axalta, as well as the majority of North American R&D investment.

Recent examples of this innovation leadership include Chemours’ early-2025 launch of the next-generation Teflon EcoElite ceramic-reinforced platform, now featured in premium cookware from All-Clad and Calphalon, and PPG’s ongoing multi-year expansion of its Illinois and North Carolina facilities to produce solvent-free ceramic systems for both medical guidewires and EV battery cooling plates.

These developments reinforce North America’s role as the primary proving ground and launchpad for premium, regulatory-compliant technologies before they are deployed globally.

Europe presents a sophisticated blend of mature Western consumer markets and highly specialized industrial demand, particularly in Germany, France, and the Nordic countries. What truly sets the region apart, however, is its aggressive sustainability leadership.

REACH restrictions, the European Green Deal, and upcoming national PFAS bans are forcing the fastest transition away from traditional fluoropolymers anywhere in the world. Companies able to deliver certified PFAS-free ceramic and sol-gel alternatives with proven durability and induction compatibility are winning major contracts from appliance manufacturers and automotive suppliers almost by default.

Germany stands at the center of Europe’s engineering-driven demand, supplying high-performance coatings for electric-vehicle thermal systems, commercial baking equipment, and precision medical instruments.

Recent activity includes Weilburger Coatings’ 2025 expansion of Greblon ceramic production near Frankfurt and AkzoNobel’s opening of a dedicated PFAS-free innovation center in partnership with a leading German appliance maker to develop next-generation induction-compatible coatings for brands such as Miele and Bosch.

Meanwhile, the U.K. benefits from post-Brexit agility, with Tefal and Le Creuset accelerating fully ceramic cookware lines tailored to British and Irish retailers. Across the continent, regulatory certainty combined with strong brand loyalty creates an attractive environment for premium, environmentally responsible non-stick solutions.

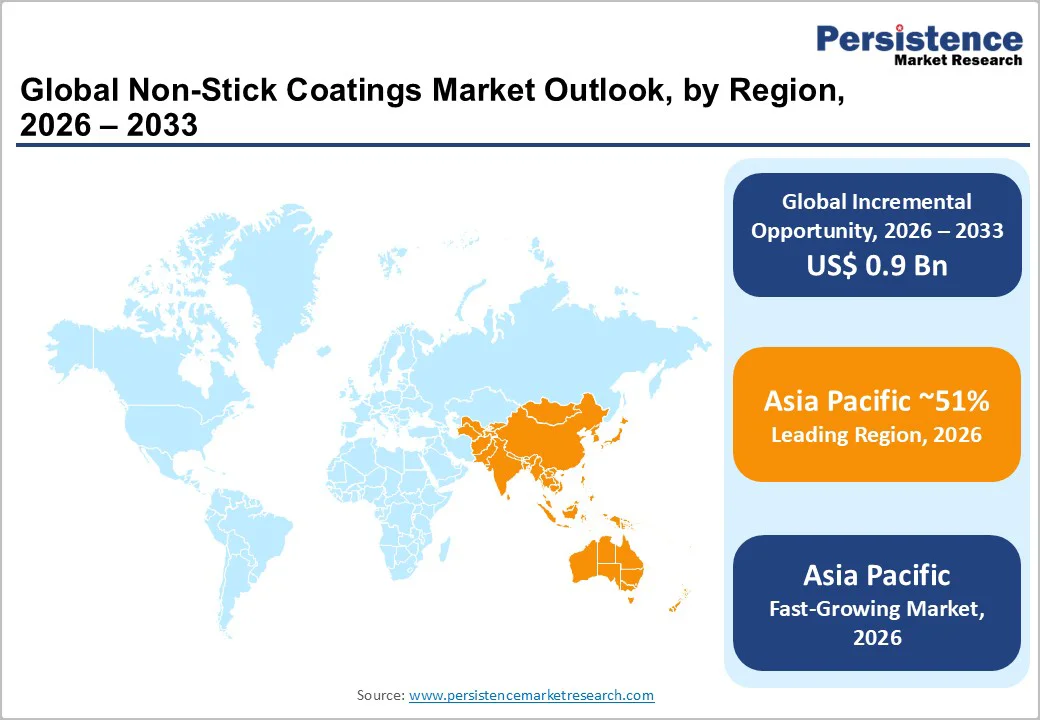

Asia Pacific is anticipated to be the largest and fastest-growing regional market, holding 51% of the global market share in 2026.

China remains the undisputed global manufacturing powerhouse for both traditional PTFE and newer ceramic systems, while Japan and South Korea continue to lead in ultra-high-performance grades used in electronics and medical devices. India is rapidly emerging as a major consumption market and an increasingly attractive production base, driven by rising disposable incomes and ambitious electric-vehicle programs.

China accounts for the majority of worldwide coating production capacity and is aggressively building sophisticated ceramic and hybrid facilities to serve both export markets and its massive domestic demand for cookware and EV components.

Notable recent moves include Daikin’s 2025 completion of a large-scale ceramic-coating plant in Changshu targeted at battery and semiconductor applications, and Supor, China’s leading cookware brand, shifting its entire premium range to PFAS-free ceramic systems to meet growing middle-class health preferences.

In India, local champions such as TTK Prestige and Hawkins, alongside multinational investments, have broken ground on several new ceramic-focused plants in Gujarat and Tamil Nadu to supply the country’s booming urban kitchenware and automotive sectors.

Japan maintains its edge in precision medical and semiconductor release coatings through innovators such as AGC and Resonac. Together, these dynamics ensure that Asia Pacific will remain the undisputed growth engine of the global non-stick coatings industry for the foreseeable future.

The global non-stick coatings market is moderately consolidated at the top tier. Five leading players collectively control well over half the global market, benefiting from scale, R&D budgets, and strong brand recognition (especially the Teflon trademark. Mid-sized specialists and regional manufacturers retain meaningful positions in ceramic systems and niche industrial applications.

3M introduced a completely PFAS-free ceramic coating platform for medical devices, achieving rapid regulatory clearance and early hospital-system adoption. PPG Industries strengthened its European sol-gel technology portfolio through a strategic minority investment, targeting automotive and industrial customers.

Daikin commissioned a new production facility in India focused on ceramic and hybrid coatings for electric-vehicle components, securing long-term local supply commitments. Leading companies emphasize innovation in sustainable formulations, backward integration of critical raw materials, geographic expansion into high-growth emerging markets, and close technical collaboration with key OEM customers in medical, automotive, and electronics sectors.

The global non-stick coatings market is estimated to be valued at US$2.2 Billion in 2026.

By 2033, the non-stick coatings market is projected to reach US$3.1 Billion.

Key trends include the rapid shift to PFAS-free and ceramic-based coatings for health and environmental compliance, growing adoption in medical and automotive applications for low-friction performance, and increasing demand for durable, eco-friendly options in cookware amid urbanization and health-conscious consumerism.

Fluoropolymer coatings (such as PTFE and PFA variants) remain the leading segment, holding approximately 42-45% of the market share due to their superior heat resistance, chemical inertness, and established use in high-performance applications like cookware and industrial machinery.

The non-stick coatings market is projected to grow at a CAGR of 5.2% from 2026 to 2033.

The key players in the non-stick coatings market include The Chemours Company, PPG Industries, Daikin Industries, 3M Company, and Whitford Corporation.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Coating Type

By Application

By Substrate

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author