ID: PMRREP35812| 197 Pages | 3 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

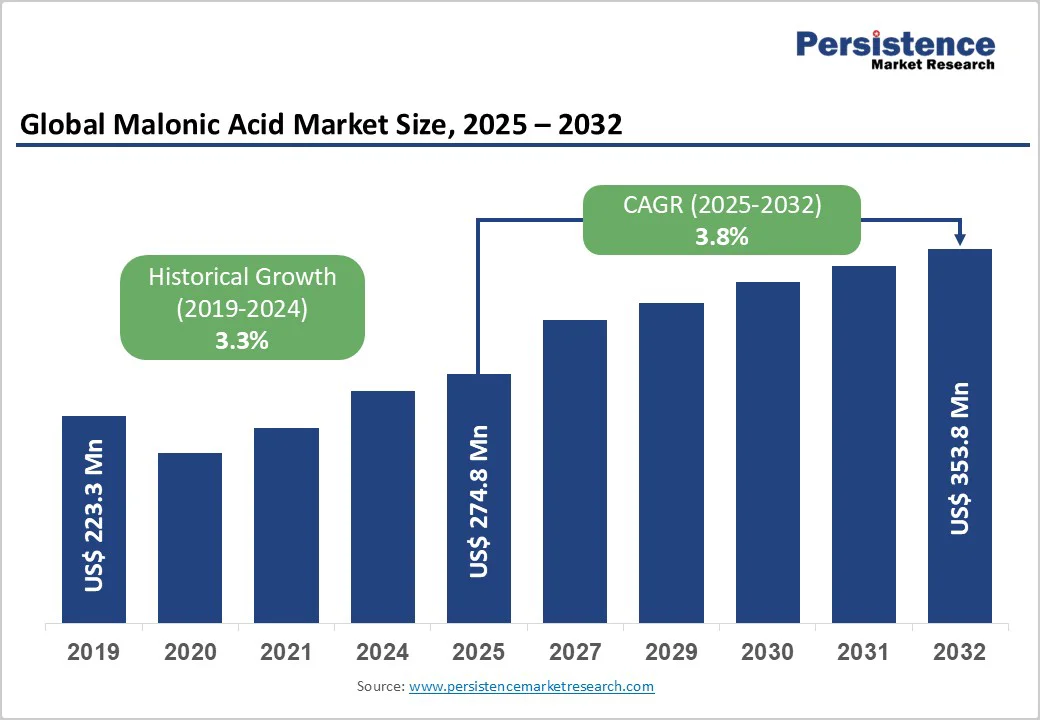

The global malonic acid market size is likely to reach US$274.8 million in 2025 and is projected to reach US$356.8 million by 2032, growing at a CAGR of 3.8% between 2025 and 2032.

The market expansion is primarily driven by increasing demand in pharmaceutical applications, where malonic acid serves as a critical intermediate in the synthesis of active pharmaceutical ingredients such as barbiturates, antibiotics, and cardiovascular medications.

The compound’s versatility in chemical synthesis, coupled with rising adoption in biodegradable polymer manufacturing and agrochemical formulations, positions it as an essential building block across multiple high-growth industries experiencing sustainability-driven transformations.

| Key Insights | Details |

|---|---|

| Malonic Acid Market Size (2025E) | US$274.8 Million |

| Market Value Forecast (2032F) | US$356.8 Million |

| Projected Growth CAGR (2025-2032) | 3.8% |

| Historical Market Growth (2019-2024) | 3.3% |

The pharmaceutical sector’s expansion is the dominant growth catalyst for malonic acid consumption, as the compound serves as an indispensable precursor in the synthesis of diverse therapeutic molecules. The global pharmaceutical intermediates market is projected to achieve US$ 55 billion by 2032, registering a CAGR of 4.9%, directly enhancing malonic acid derivatives demand.

Pharmaceutical manufacturers, including Lonza Group, BASF, and Bayer, utilize high-purity malonic acid exceeding 99% purity thresholds for producing statins, antidiabetic medications, non-steroidal anti-inflammatory drugs, and anti-cancer therapeutics.

The increasing prevalence of chronic cardiovascular diseases, diabetes, and oncological conditions globally necessitates expanded active pharmaceutical ingredient production capacity, and malonic acid-based synthesis pathways offer cost-effective routes to complex molecular architectures.

Furthermore, the generic pharmaceuticals segment’s accelerated growth trajectory, particularly in emerging economies, intensifies demand for intermediates as patent expirations expand therapeutic access.

Environmental consciousness and regulatory mandates targeting single-use plastics are driving the adoption of malonic acid for biodegradable polymer synthesis, creating substantial market opportunities. The global biodegradable polymers market is anticipated to reach US$ 25 billion by 2032, demonstrating an exceptional CAGR of 22% during the forecast period.

Malonic acid-based polyesters exhibit desirable characteristics including thermal stability, mechanical strength, and complete biodegradability, making them suitable substitutes for petroleum-derived polymers in packaging, consumer goods, automotive components, and medical implants.

Governmental policies across Europe and North America impose increasingly stringent restrictions on conventional plastic materials, accelerating manufacturers’ transition toward renewable feedstock-based alternatives where malonic acid serves as a green chemistry platform chemical.

The compound’s compatibility with bio-based production methodologies via fermentation routes using renewable substrates, such as glucose, positions it advantageously within circular economy frameworks.

Malonic acid manufacturing typically involves multi-step synthetic routes beginning with chloroacetic acid and sodium cyanide as primary feedstocks, undergoing nucleophilic substitution to form cyanoacetic acid intermediates, which are then hydrolyzed to yield the final product.

This sophisticated production methodology incurs elevated capital expenditures for specialized reactor infrastructure and stringent safety protocols managing hazardous intermediates, consequently increasing manufacturing costs.

Price fluctuations affecting petrochemical-derived raw materials create margin pressures for producers, particularly when competing against lower-cost alternatives in price-sensitive application segments. Additionally, the limited production scale compared to commodity chemicals prevents manufacturers from fully realizing economies of scale, maintaining malonic acid as a specialty chemical commanding premium pricing that may restrict adoption in cost-constrained markets.

The handling and processing of malonic acid require adherence to comprehensive regulatory frameworks governing chemical manufacturing, particularly for pharmaceutical-grade material meeting FDA, EFSA, and pharmacopeial standards, including USP, EP, and JP specifications.

Malonic acid’s potential to cause irritation of the eyes, skin, and respiratory system necessitates robust occupational health measures and environmental controls during production and downstream processing.

Pharmaceutical and food-grade applications demand rigorous quality assurance protocols including certificate of analysis documentation, batch-level traceability, and validation of manufacturing processes under cGMP regulations, creating compliance burdens that elevate operational complexity.

These regulatory requirements pose particularly significant barriers for new market entrants lacking established quality systems and regulatory expertise, contributing to market concentration among established specialty chemical manufacturers.

The agricultural chemicals industry presents substantial growth prospects for malonic acid utilization in synthesizing plant growth regulators, herbicides, and fungicides aligned with sustainable farming methodologies.

The global plant growth regulators market is projected to reach US$ 15 billion by 2032, expanding at a remarkable CAGR of 12%. Malonic acid’s incorporation into agrochemical formulations supports green chemistry principles through reduced environmental persistence and enhanced biodegradability compared to conventional active ingredients.

The cytokinins segment, commanding 40% market share within plant growth regulators, and gibberellins experiencing fastest growth rates both represent application avenues where malonic acid derivatives contribute to agricultural productivity enhancement.

Rising global food security challenges, declining arable land availability, and increasing organic farming practices create sustained demand for eco-friendly crop protection and yield optimization solutions. The Asia Pacific region’s agricultural intensification, particularly across China, India, and ASEAN nations, offers significant geographic expansion opportunities for malonic acid-based agrochemical intermediates supporting precision agriculture technologies.

Emerging biotechnological approaches for malonic acid biosynthesis from renewable feedstocks represent transformative opportunities addressing sustainability imperatives while potentially improving production economics.

Research developments demonstrate feasible artificial biosynthetic pathways converting oxaloacetate intermediates to malonic acid through enzymatic cascades involving α-keto decarboxylase and malonic semialdehyde dehydrogenase, achieving titers exceeding 42.5 mg/L in fungal production systems.

These biomanufacturing platforms leverage abundant renewable substrates including corn starch, sugarcane, and cellulosic biomass, reducing dependence on petroleum-derived precursors while minimizing carbon footprints.

The bio-based malonic acid segment presents differentiation opportunities for manufacturers targeting environmentally conscious pharmaceutical, polymer, and specialty chemical customers increasingly implementing green procurement policies.

Investment in metabolic engineering, fermentation optimization, and downstream purification technologies could establish cost-competitive bio-routes enabling market expansion into applications currently limited by conventional malonic acid pricing.

Companies developing proprietary biocatalytic processes may secure competitive advantages through intellectual property protection while aligning with circular bioeconomy trends, receiving governmental research funding and regulatory incentives across developed economies.

The Above 99% purity segment dominates the malonic acid market, capturing approximately 61% market share, attributable to stringent quality requirements across pharmaceutical and high-performance application domains.

Pharmaceutical synthesis requires exceptionally pure malonic acid that meets pharmacopeial monographs to prevent impurity-related complications in active pharmaceutical ingredient manufacturing. Leading suppliers like Lonza Group, Shanghai Nanxiang Reagent Co., Ltd., and Trace Zero LLC specialize in high-purity chemical blending tailored to customer specifications.

The FDA and international regulatory bodies mandate comprehensive impurity profiling and control for materials entering pharmaceutical supply chains, necessitating sophisticated purification technologies, including recrystallization, distillation, and chromatographic methods, to support quality-based pricing premiums.

Similarly, specialty applications in flavors, fragrances, and food-grade acidulants require elevated purity standards exceeding 99% to meet EFSA regulations and ensure consumer safety.

Conversely, the segment below 99% purity serves cost-sensitive industrial applications, including polymer synthesis, chemical intermediates, and certain agrochemical formulations, where moderate impurity levels remain acceptable, offering price-competitive alternatives for manufacturers prioritizing economic efficiency over ultrapure specifications.

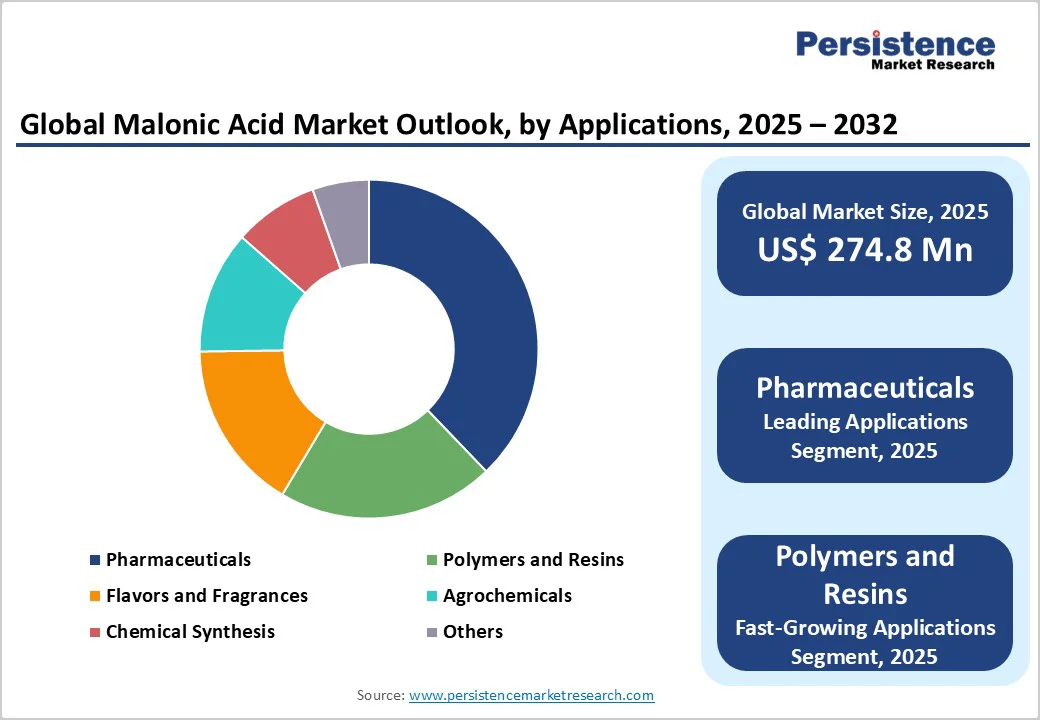

The pharmaceutical application segment maintains market leadership with approximately 42% share, driven by malonic acid’s irreplaceable role as a chemical synthesis precursor for diverse therapeutic categories. Pharmaceutical intermediates utilizing malonic acid achieved 30% market share in 2025, supporting the production of cardiovascular medications, including statins, antidiabetic compounds, antibiotics, and anti-inflammatory drugs.

The increasing global burden of chronic diseases, coupled with aging demographic trends across developed nations, sustains demand for pharmaceutical active ingredients, with Lonza Group, BASF, and specialty pharmaceutical manufacturers maintaining long-term malonic acid procurement relationships to ensure supply security.

The Polymers and Resins segment represents the fastest-growing application category, benefiting from sustainability-driven transitions toward biodegradable polyesters where malonic acid derivatives enable desirable material properties. Specialty polymers incorporating malonic acid exhibit enhanced thermal stability, flexibility, and biodegradability, making them suitable for packaging, automotive interiors, and medical devices and aligning with circular economy objectives.

The Agrochemicals application captures emerging opportunities in plant growth regulator synthesis, herbicide intermediates, and fungicide formulations, supporting sustainable agriculture practices. At the same time, Flavors and Fragrances and Chemical Synthesis segments provide diversified revenue streams across food additives, pH controllers, and fine chemical manufacturing.

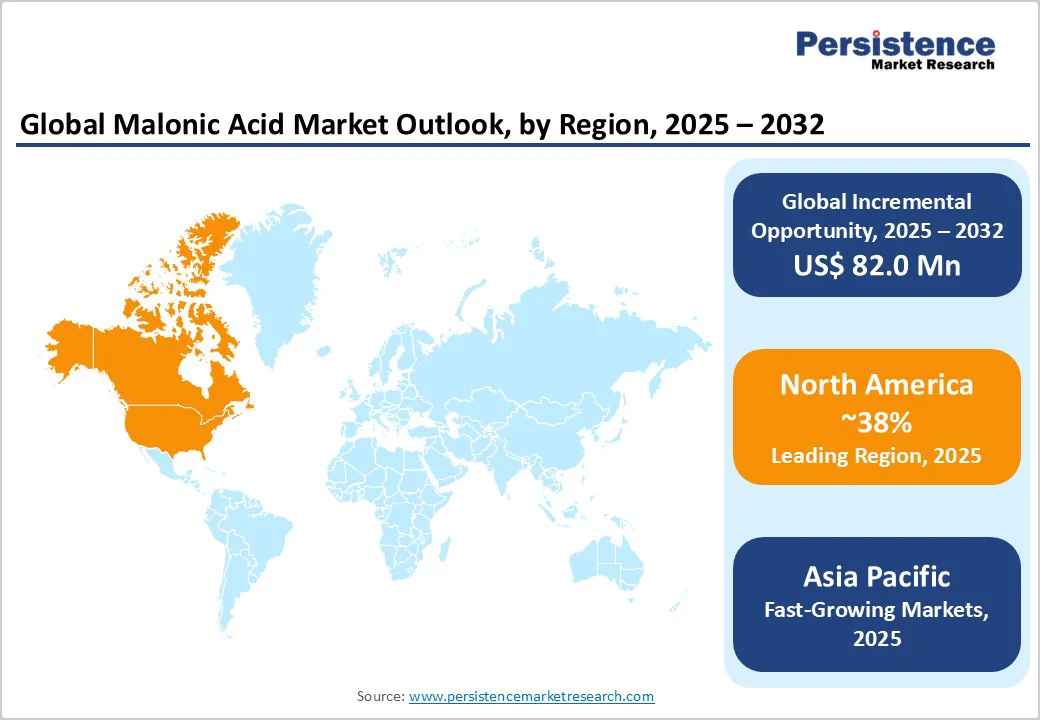

North America maintains a prominent position in the malonic acid market, characterized by advanced pharmaceutical manufacturing infrastructure and stringent regulatory frameworks ensuring high-quality standards.

The United States dominates regional consumption, hosting major pharmaceutical companies and contract development manufacturing organizations requiring pharmaceutical-grade malonic acid conforming to FDA Current Good Manufacturing Practice regulations.

The pharmaceutical intermediates market in the U.S. is projected to achieve US$ 15 billion by 2032, reflecting robust growth supporting malonic acid derivative demand. American pharmaceutical manufacturers increasingly emphasize supply chain diversification and quality assurance, with companies like Lonza Group establishing integrated early-intermediates supply initiatives leveraging ISO-certified production facilities to address regional sourcing concerns.

The region’s innovation ecosystem fosters continuous research into novel malonic acid applications, particularly within biodegradable polymer development and green chemistry initiatives receiving governmental research funding. North American regulatory harmonization efforts and industry collaboration through organizations, including pharmaceutical quality associations, promote best practice adoption in malonic acid handling, testing, and documentation.

The presence of specialty chemical distributors, including Columbus Chemical Industries, Inc. ensures reliable material availability supporting both large-scale pharmaceutical operations and emerging biotechnology ventures.

Environmental regulations targeting plastic waste reduction accelerate biodegradable polymer adoption across packaging and consumer goods sectors, creating additional malonic acid consumption avenues beyond traditional pharmaceutical applications.

Europe represents a significant malonic acid market, accounting for approximately 45% of the regional share, driven by established pharmaceutical industries, stringent environmental regulations, and leadership in sustainable chemical manufacturing.

Key markets, including Germany, the United Kingdom, France, and Spain, host major pharmaceutical manufacturers and specialty chemical producers emphasizing high-purity malonic acid for active pharmaceutical ingredient synthesis.

Germany’s position as Europe’s pharmaceutical and chemical industry hub concentrates substantial malonic acid consumption, with producers adhering to comprehensive European Pharmacopeia specifications and REACH regulatory compliance requirements governing chemical substance registration, evaluation, and authorization.

European leadership in the adoption of biodegradable polymers, supported by ambitious plastic reduction directives and circular economy policies, is creating expanding opportunities for malonic acid in sustainable materials manufacturing. The region dominated the biodegradable polymers market, with heightened environmental awareness driving consumer and industrial demand for eco-friendly alternatives.

The plant growth regulator market in Europe is expected to reach US$5 billion by 2032, driven by a 11.5% CAGR, supporting the utilization of malonic acid in agrochemical applications. Regulatory harmonization across the European Union facilitates cross-border chemical trade while maintaining stringent safety and environmental protection standards.

European research institutions and chemical manufacturers collaborate extensively on green chemistry innovations, biotechnological production routes, and advanced purification technologies, enhancing malonic acid quality and sustainability profiles.

Asia Pacific is the fastest-growing regional market for malonic acid, driven by expanding pharmaceutical manufacturing capacity, agricultural intensification, and cost-competitive chemical production infrastructure.

China leads regional consumption and production, hosting major suppliers including Wuhan Kemi-Works Chemical Co., Ltd., Shanghai Nanxiang Reagent Co., Ltd., Medical Chem (Yancheng) Manuf.Co., Ltd., and Hefei TNJ Chemical Industry Co., Ltd., serving domestic and export markets.

China’s pharmaceutical industry expansion, supported by government initiatives promoting innovation and quality improvement, is driving rising demand for malonic acid for generic drug manufacturing and active pharmaceutical ingredient production.

India represents a high-growth market benefiting from its position as a global pharmaceutical manufacturing hub, with the pharmaceutical industry valued at US$60 billion in 2025 and projected to reach ~ US$130 billion by 2030.

The Indian active pharmaceutical ingredient market, with expectations of reaching US$20 billion by 2032 at an 8% CAGR, is driving substantial demand for malonic acid intermediates. Japan maintains advanced chemical synthesis capabilities with companies like TATEYAMA KASEI Co., Ltd. providing high-quality malonic acid for pharmaceutical and specialty chemical applications.

ASEAN nations, including Thailand, Vietnam, and Indonesia, develop pharmaceutical and agrochemical manufacturing sectors, creating expanding consumption opportunities.

The region’s manufacturing cost advantages, skilled workforce availability, and improving regulatory frameworks attract multinational pharmaceutical companies to establish production facilities, while agricultural development programs across South Asia and Southeast Asia stimulate the use of agrochemical malonic acid.

The malonic acid market exhibits a moderately consolidated structure, with specialized producers maintaining established positions through quality differentiation, technical expertise, and long-term customer relationships spanning the pharmaceutical, chemical, and agrochemical industries.

Leading manufacturers emphasize vertical integration strategies encompassing raw material procurement, multi-step synthesis capabilities, and rigorous quality control systems ensuring regulatory compliance across FDA, EFSA, and pharmacopeial standards. Companies differentiate through purity specifications exceeding 99%, customized synthesis services, and technical support for complex pharmaceutical intermediate development.

Strategic expansion initiatives include capacity additions at existing facilities, geographic diversification, particularly into Asia Pacific growth markets, and investment in sustainable production technologies, including bio-based synthesis routes and continuous flow chemistry platforms.

Research and development activities focus on process optimization, reducing manufacturing costs, developing novel derivatives, expanding application portfolios, and implementing green chemistry principles, improving environmental profiles.

Emerging business models emphasize integrated early-intermediate supply arrangements providing pharmaceutical customers with supply chain security and quality assurance, while contract manufacturing services address specialized production requirements for smaller-volume specialty applications.

The global malonic acid market is projected to reach US$ 356.8 million by 2032, growing from US$ 274.8 million in 2025 at a CAGR of 3.8%, driven by pharmaceutical intermediates demand and biodegradable polymer applications.

The malonic acid market expansion is primarily driven by escalating pharmaceutical industry demand for specialized intermediates in synthesizing active pharmaceutical ingredients, coupled with sustainability-driven shifts toward biodegradable polymer technologies.

The Pharmaceuticals application segment dominates with approximately 42% share, attributed to malonic acid’s critical role in synthesizing cardiovascular medications, antibiotics, antidiabetic drugs, and anti-inflammatory therapeutics.

Asia Pacific exhibits the fastest growth trajectory, propelled by expanding pharmaceutical manufacturing capacity in China and India, agricultural intensification across ASEAN nations, and cost-competitive production infrastructure.

Key opportunities include agrochemical sector expansion with plant growth regulators projected to reach US$ 14.74 billion by 2034, and bio-based production technologies offering sustainable routes from renewable feedstocks aligned with circular economy frameworks.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Purity

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author