Herbicides Market Size and Forecast Analysis

Market Overview

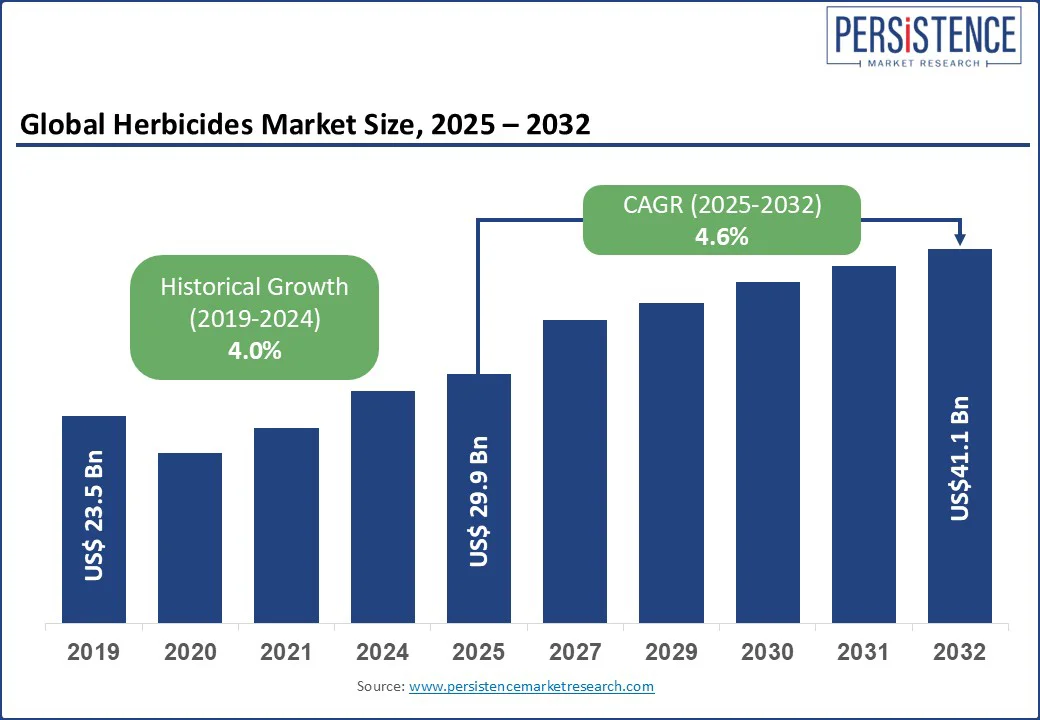

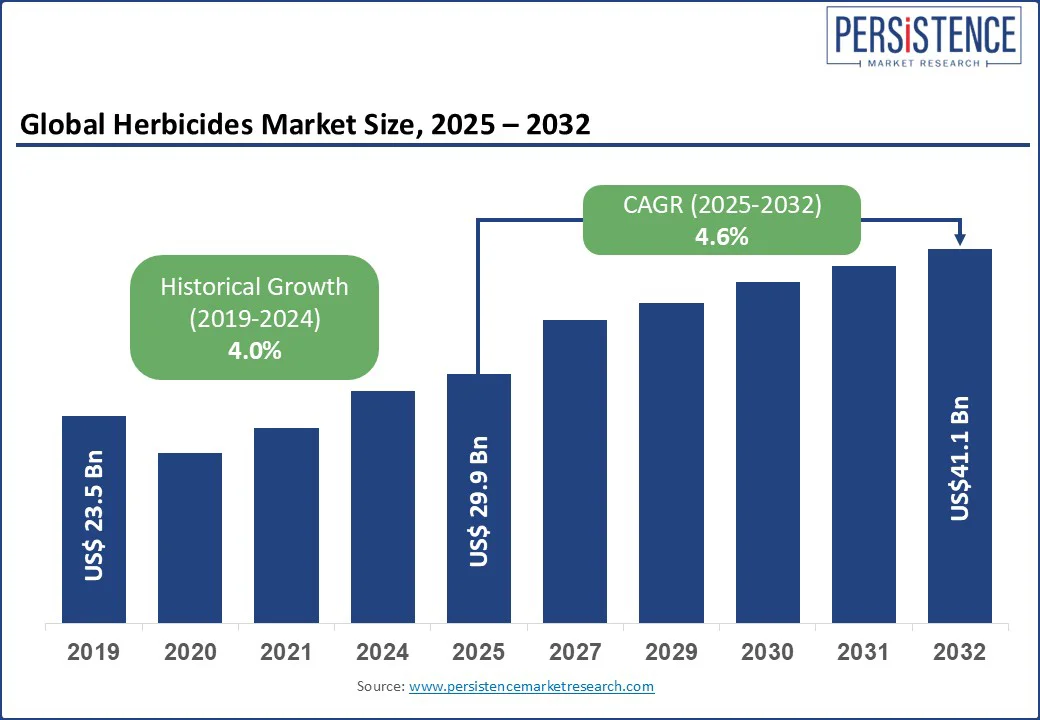

The global herbicides market size is likely to be valued at US$ 29.9 billion in 2025 and is expected to reach US$ 41.1 billion by 2032, growing at a CAGR of 4.6% from 2025 to 2032. The growth is fueled by increasing global food demand, rising cases of herbicide-resistant weeds, and the adoption of advanced farming practices such as precision agriculture and genetically modified crops. The global herbicides market is experiencing strong growth, driven by increasing global food demand, rising weed resistance, and the shift toward sustainable and bio-based herbicide formulations.

Herbicides are essential crop protection chemicals used to control weeds that threaten agricultural productivity across farmlands, aquatic environments, and residential landscapes. A major growth driver is the expansion of commercial farming in emerging economies, where the need for efficient weed management solutions is rapidly growing. Additionally, the widespread adoption of genetically modified (GM) crops and precision agriculture technologies is fueling demand for high-performance herbicides such as glyphosate and bio-herbicides. Industry leaders such as Nutrien, Bayer AG, BASF SE, DuPont, and Syngenta Group are investing heavily in eco-friendly weed control innovations and strategic market expansion to strengthen their global presence.

Market Dynamics

Drivers

- Rising Global Demand for Food Production: The global population is expected to reach 9.7 billion by 2050, increasing food demand by 50%, according to the Food and Agriculture Organization (FAO). To meet this demand, effective weed control solutions are critical, as weeds can reduce crop yields by up to 30%. For instance, according to the U.S. Department of Agriculture (USDA). This growing pressure on global food systems has driven the widespread use of herbicides to safeguard crop productivity.

For instance, in 2024, global agricultural output was valued at US$ 4.3 trillion, with herbicides such as glyphosate and 2,4-D enhancing yields in key crops such as corn and soybeans. For instance, the USDA reports that 90% of U.S. soybeans are genetically modified varieties, significantly increasing herbicide demand for effective weed management using selective herbicides.

- Advancements in Sustainable Herbicide Formulations: Innovations in bio-based and low-toxicity herbicides are accelerating market growth by offering eco-friendly weed control. Leading agrochemical companies such as BASF SE and Syngenta Group are investing in the development of selective herbicides designed to target weeds while minimizing harm to crops, improving both yield and ecological safety.

For instance, in 2024, Bayer AG launched a bio-based herbicide that reduces environmental impact by 20%, aligning with the European Union’s Farm to Fork Strategy, which aims to cut chemical pesticide use by 50% by 2030. For instance, the U.S. Environmental Protection Agency (EPA) recognizes sustainable herbicides for their lower ecological footprint, contributing a 12% annual increase in bio-herbicide adoption.

Restraints

- Environmental and Health Concerns: Environmental and health concerns are key restraints in the herbicide market, particularly regarding widely used chemicals such as glyphosate. In 2015, the World Health Organization’s International Agency for Research on Cancer (IARC) classified glyphosate as a “probable carcinogen,” raising serious concerns about its safety.

A 2023 U.S. EPA review highlighted potential glyphosate residue risks in food, prompting stricter pesticide regulations and growing consumer backlash. These factors are pushing demand for safe herbicide alternatives and forcing manufacturers to reformulate products. Reformulation increases production costs and lengthens time-to-market, limiting profitability. Moreover, heightened awareness of the environmental impact of herbicides is driving policy changes worldwide, posing challenges to conventional herbicide use and negatively impacting overall herbicide market growth.

Opportunities

- Focus on Sustainable Formulations: The herbicides market is experiencing strong growth in bio-based herbicides, driven by increasing demand for eco-friendly and sustainable crop protection solutions. Companies such as FMC Corporation are projected to achieve a 10% market share increase by 2030, supported by innovations in low-impact herbicide formulations. This trend aligns with the EU’s Green Deal, which targets carbon neutrality by 2050, according to the European Commission. As environmental regulations tighten, leading herbicide manufacturers are investing in sustainable herbicide technologies to remain competitive and compliant.

- Precision Agriculture Trends: The herbicides market is benefiting from advances in precision agriculture technologies, including drone-based spraying and GPS-guided equipment, which improve application accuracy and reduce chemical waste. The global precision agriculture market was valued at US$ 10.5 billion in 2024.

Growth is driven by the rising adoption of smart farming technologies and data-based crop management (USDA). This rapid growth presents significant opportunities for targeted herbicide solutions, enabling higher efficiency, lower environmental impact, and greater adoption in both developed and emerging agricultural regions.

Category-wise Analysis

Product Type Insights

- Glyphosate dominates with a 42% market share in 2024, due to its broad-spectrum efficacy and use in GM crops such as soybeans and corn. Its affordability and accessibility drive adoption in large-scale agriculture, particularly in North America and Latin America, where GM crops cover 70% of arable land.

- Bio-based herbicides are experiencing the fastest growth between 2025 and 2032. Their eco-friendly properties and alignment with organic farming trends drive demand, particularly in home care and agricultural settings where sustainability is prioritized.

Application Type Insights

- Foliar application holds a 45% market share in 2024, driven by its rapid weed control and ease of use in cereals, oilseeds, and vegetables. Its effectiveness in large-scale farming supports its dominance.

- Soil application is expected to see the most rapid growth from 2025 to 2032, driven by advancements in controlled-release technologies that reduce environmental runoff and enhance weed control duration.

End-use Insights

- Agriculture dominates with a 40% market share in 2024, due to high demand for weed control to enhance crop yields in large-scale farming.

- Residential use is anticipated to expand rapidly between 2025 and 2032, supported by the growing demand for lawn and garden maintenance in urban areas. The U.S. home and garden pesticide market, valued at US$ 2.7 billion in 2024, grows at 6.2% annually, per the EPA.

Regional Insights

North America Herbicides Market Trends

The North American herbicides market continues to show strong growth, supported by advanced farming infrastructure, high GM crop adoption, and increasing demand for eco-friendly crop protection solutions.

- U.S.: With a 33% global market share in 2024, the U.S. dominates the herbicides market through widespread GM soybean usage (90%, USDA) and strong support for bio-based herbicides. EPA initiatives and precision agriculture reimbursement policies fuel the adoption of sustainable solutions.

- Canada: Holding a 5% regional share, Canada’s market is driven by extensive canola farming and growing emphasis on sustainable agriculture.

- Mexico: Emerging as a key player, Mexico is adopting modern herbicide technologies to support corn and sugarcane production, contributing to the regional herbicides market expansion.

Europe Herbicides Market Trends

The European herbicides market is expanding steadily, driven by regulatory reforms, demand for bio-based herbicides, and increased adoption of precision agriculture.

- Germany: Leading with a 25% regional market share in 2024, Germany’s US$ 95 billion agricultural sector fuels demand for selective herbicides such as atrazine (Federal Ministry of Food and Agriculture). The EU’s Farm to Fork Strategy supports a 10% annual rise in bio-based herbicide sales.

- France: Market growth is reinforced by the national glyphosate ban and over 2 million hectares of organic farming, aligning with EU sustainability targets.

- U.K.: The country sees a 4% yearly increase in precision agriculture adoption, advancing the use of targeted herbicide application technologies.

Asia-Pacific Herbicides Market Trends

The Asia Pacific herbicides market is witnessing rapid growth, fueled by expanding agricultural sectors, rising herbicide demand, and increasing adoption of sustainable technologies.

- China: Dominating with a 60% regional share in 2024, China’s US$ 1.4 trillion agricultural industry (Absolute Reports) drives strong demand for both conventional and bio-based herbicides.

- India: Ongoing healthcare and agricultural reforms, combined with 8% annual agricultural growth (Indian Ministry of Agriculture), support the rising use of generic herbicides across diverse crop types.

- Japan: An aging farming population and a national focus on precision farming are accelerating the adoption of bio-based herbicides and smart application systems.

Competitive Landscape

The global herbicides market remains highly competitive, with leading companies focusing on advanced formulations and global expansion. Key players such as Bayer, BASF, and Syngenta invest in R&D to develop bio-based and selective herbicides, supporting sustainable agriculture. Strategic partnerships with agri-tech firms enhance innovation and precision application. Companies such as FMC and Nufarm are expanding in Asia Pacific and Latin America through localized manufacturing, meeting rising demand and adapting to region-specific regulatory and environmental requirements.

Key Developments

- 2024: Bayer AG launched a bio-based herbicide, reducing environmental impact by 20%.

- 2023: BASF SE invested US$ 600 million in selective herbicide R&D.

- 2024: Syngenta Group expanded production capacity in China, targeting a 10% market share increase.

Companies Covered in Herbicides Market

- Nutrien

- Bayer AG

- BASF SE

- DuPont

- ICL Group

- FMC Corporation

- Nufarm

- Syngenta Group

- Others

Frequently Asked Questions

Rising food demand, weed resistance, and sustainable formulations drive growth.

Glyphosate leads due to its use in GM crops.

Soil application is growing rapidly due to controlled-release technologies.

North America dominates with a 40% share in 2024.

Stringent EPA and EU regulations drive demand for eco-friendly herbicides.

Nutrien, Bayer AG, BASF SE, and Syngenta Group lead through innovation.

Global Herbicides Market Report Scope

|

Report Attribute

|

Details

|

|

Historical Data/Actuals

|

2019 - 2024

|

|

Forecast Period

|

2025 - 2032

|

|

Market Analysis

|

Value: US$ bn

|

|

2025 (E)

|

US$ 29.9 bn

|

|

2032 (F)

|

US$ 41.1 bn

|

|

Historical CAGR (2019 - 2024)

|

4.0%

|

|

Projected CAGR (2025 - 2032)

|

4.6%

|

|

Geographical Coverage

|

- North America

- Europe

- East Asia

- South Asia and Oceania

- Latin America

- Middle East and Africa

|

|

Segment Coverage

|

- By Product Type

- By Application Type

- By End-use

- By Region

|

|

Competitive Analysis

|

- Nutrien

- Bayer AG

- BASF SE

- DuPont

- ICL Group

- FMC Corporation

- Nufarm

- Syngenta Group

- Others

|

|

Report Highlights

|

- Market Forecast and Trends

- Competitive Intelligence & Share Analysis

- Growth Factors and Challenges

- Strategic Growth Initiatives

- Pricing Analysis

- Future Opportunities and Revenue Pockets

- Market Analysis Tools

|

|

Customization and Pricing

|

|

Market Segmentation

By Product Type

- Acetochlor

- Glyphosate

- 2,4-D

- Atrazine

By Application Type

By End-use

- Agriculture

- Aquatic Environment

- Residential

- Others

By Region

- North America

- Europe

- East Asia

- South Asia and Oceania

- Latin America

- Middle East and Africa