ID: PMRREP24472| 193 Pages | 15 Oct 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

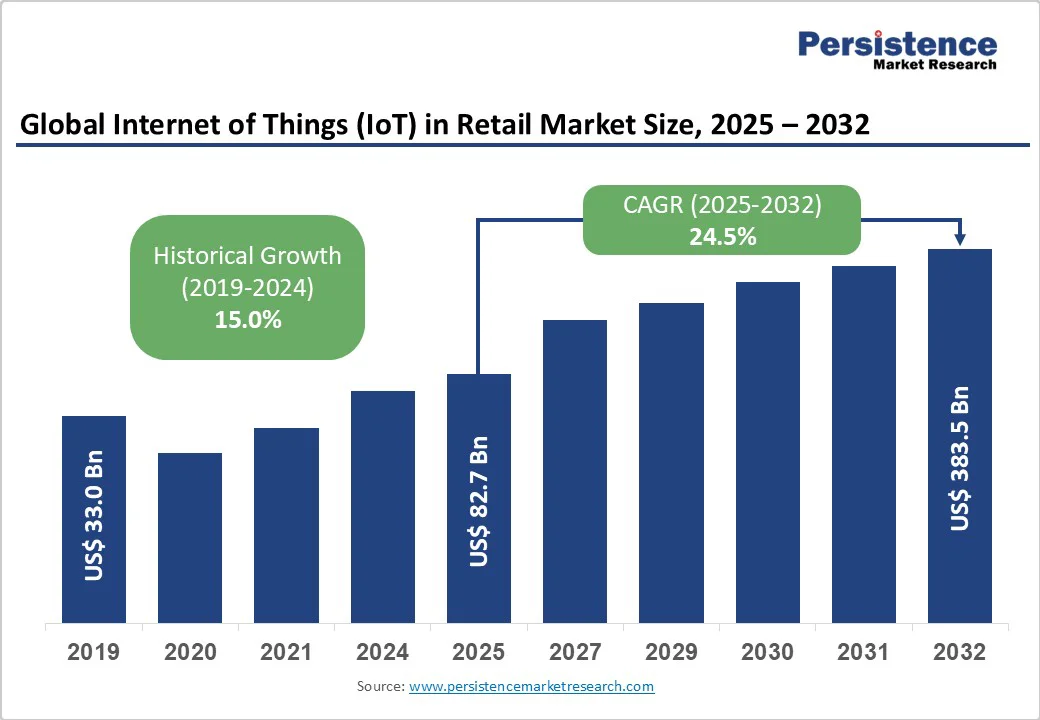

The global Internet of Things (IoT) in retail market size is likely to be valued at US$82.7 billion in 2025. It is estimated to reach US$383.5 billion by 2032, growing at a CAGR of 24.5% during the forecast period 2025 - 2032, driven by advancing sensor technologies and the increasing adoption of data analytics platforms.

High growth is driven by retailers’ focus on efficiency and customer experience through the use of IoT-enabled smart shelves, improved inventory management, and personalized marketing. Ongoing digital transformation and the adoption of edge computing further accelerate market expansion.

| Key Insights | Details |

|---|---|

| Internet of Things (IoT) in Retail Market Size (2025E) | US$82.7 Bn |

| Market Value Forecast (2032F) | US$383.5 Bn |

| Projected Growth (CAGR 2025 to 2032) | 24.5% |

| Historical Market Growth (CAGR 2019 to 2024) | 15.0% |

The ongoing innovation in sensor technologies, encompassing Radio Frequency Identification (RFID), Bluetooth Low Energy (BLE), computer vision, and specialized environmental sensors, is enabling real-time data capture that enhances inventory accuracy and provides valuable insights into customer behavior.

According to the RFID Journal and the U.S. Department of Commerce, the adoption of RFID in retail inventories has contributed to improving stock accuracy by up to 98% and reducing stock-taking times by nearly 96%. These quantifiable improvements increase retailer confidence in investing in IoT solutions that empower predictive inventory restocking, loss prevention, and dynamic customer engagement.

Industry bodies, such as GS1, project that the sensor technology segment will sustain double-digit growth, driven by exponential data generation and analysis requirements. This technological progression is translating into direct operational cost optimizations and enhanced sales performance, steering the IoT in the retail market toward rapid expansion.

Governmental initiatives promoting smart retail digitalization and infrastructure upgrades are accelerating the Internet of Things in retail market growth. For example, the U.S. National Institute of Standards and Technology (NIST) endorses standards that streamline IoT interoperability, thereby fostering broader deployment in the retail sector.

Furthermore, the European Union (EU)’s Digital Europe program allocates substantial funding to accelerate smart retail ecosystems, focusing on AI-driven analytics and IoT edge computing deployments.

These regulatory frameworks lower barriers and offer financial support mechanisms, encouraging retailers to integrate scalable IoT platforms. In parallel, increased global investments in 5G networks, projected to reach US$500 billion cumulatively by 2030, as per GSMA Intelligence, are significantly enhancing connectivity reliability and latency, critical for real-time IoT applications.

Despite the evident operational benefits, retail IoT solutions often involve substantial upfront investments in hardware, software integration, and employee training. According to research by the National Retail Federation, the average IoT system installation and customization cost ranges from US$500,000 to US$2 million, depending on scale and complexity, constituting a significant barrier for small to medium-sized retailers.

Integrating IoT platforms with existing legacy systems presents challenges associated with data standardization and cybersecurity compliance. These structural constraints introduce risk factors that may delay adoption timelines or impact return on investment, requiring strategic financing and phased implementation approaches from retailers and solution providers.

Global supply chain vulnerabilities, intensified by geopolitical tensions and pandemic-related disruptions, continue to impact the availability and pricing stability of critical IoT hardware components, including semiconductors, RFID tags, and sensors. Industry analytics by various studies have estimated that component shortages could increase IoT device costs by up to 20% in certain regions, impacting project budgets.

Delays in hardware deliveries can lead to postponed product launches and impact the competitive positioning of retailers. Supply chain resilience and diversified sourcing strategies remain essential for market players, while systemic disruptions constitute a substantial adoption risk over the forecast period.

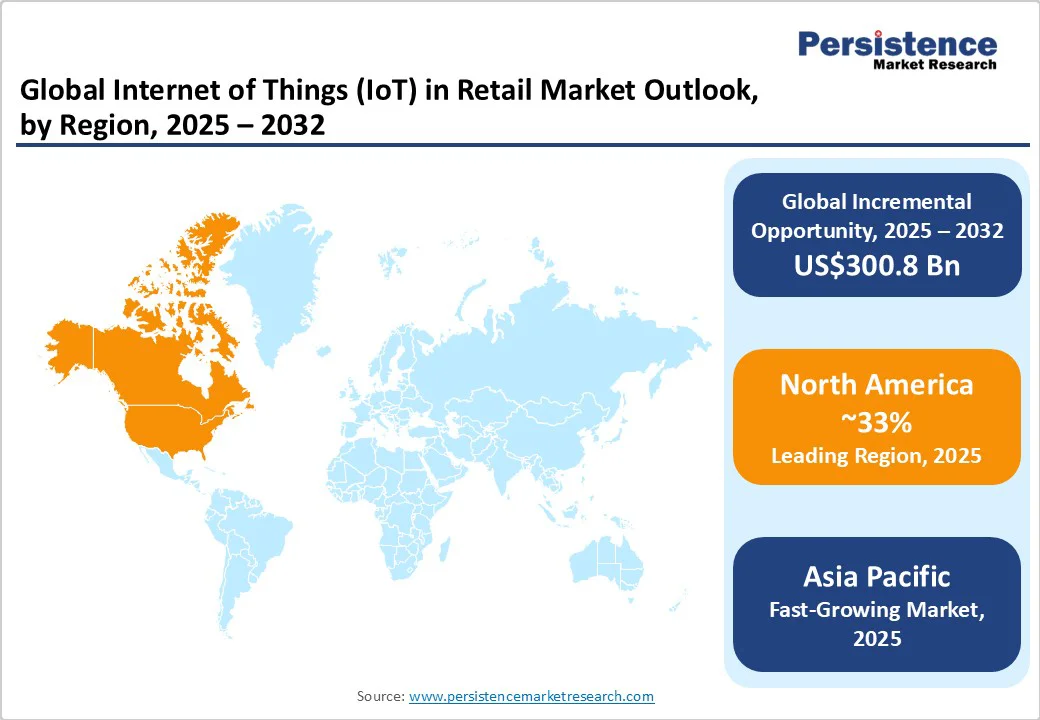

Emerging economies across the Asia Pacific, Latin America, and Africa are witnessing rapid retail modernization propelled by increased smartphone penetration and improving ROI on technological deployment. The IoT in the retail market in the Asia Pacific alone is projected to grow at a high CAGR, with China, India, and ASEAN countries leading digital infrastructure enhancements.

Government policies that facilitate smart city programs and retail digitization have further incentivized the adoption of Internet of Things (IoT) platforms across various sectors. This large untapped customer base presents scalable growth potential for solution providers, underscoring the need for market players to tailor their offerings to regional nuances and address unique infrastructural challenges.

The integration of IoT with AI, machine learning, and cloud-edge hybrid computing is unlocking novel retail experiences, including hyper-personalized marketing, real-time inventory optimization, and automated checkout systems. As omnichannel retail becomes the norm, IoT solutions facilitating seamless interaction between brick-and-mortar and e-commerce platforms are gaining traction.

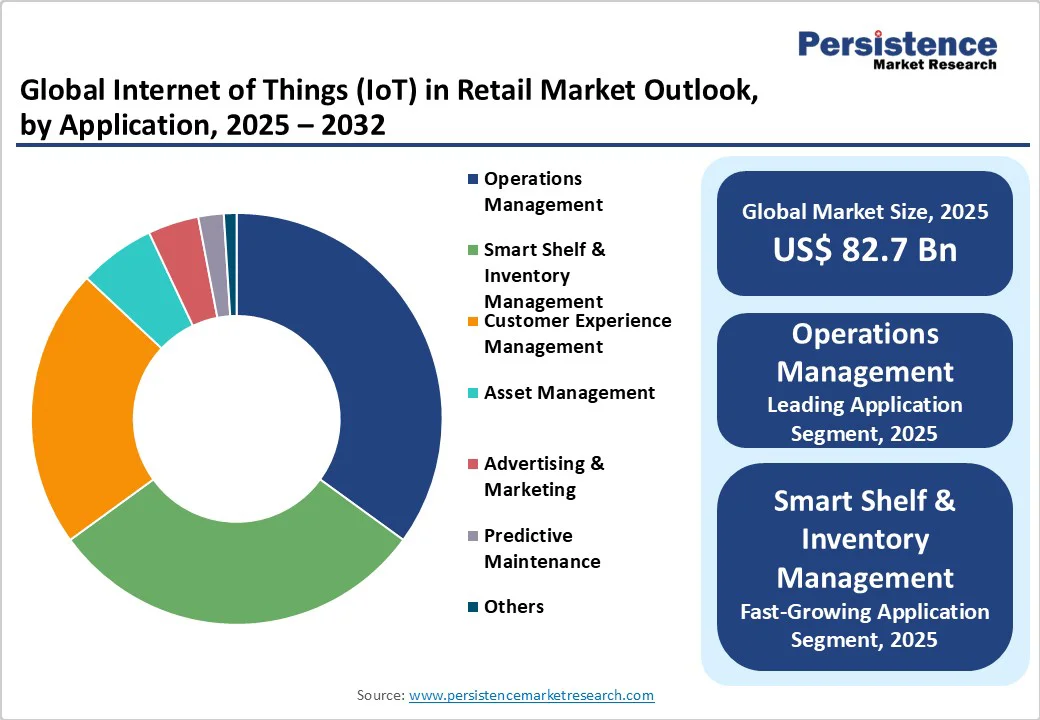

Market forecasts indicate that smart shelf and inventory management applications will collectively contribute over 40% to the IoT retail market size by 2032, with these applications growing at a CAGR exceeding 26%. Vendors focusing on converged solutions that address retail supply chain visibility and consumer personalization are positioned to capture significant market share.

The hardware component segment is forecasted to lead the market in 2025, with an anticipated share of approximately 47%, driven by consistent investments in RFID tags, smart shelves, sensors, and POS systems that underpin retail digitalization initiatives. This segment benefits from continuous technological improvements, lower device costs, and expanded applicability. Walmart and Zara utilize RFID tags to track inventory in real-time.

Software solutions that combine analytics and management platforms are expected to register the fastest CAGR from 2025 to 2032, driven by the increasing demand among retailers for advanced data-driven insights and the integration of AI capabilities into their operations.

The services sub-segment, including professional and managed services, remains critical for customization and ongoing support, contributing steadily to market growth. Oracle NetSuite and SAP Retail solutions are used for supply chain and inventory management.

Cloud-based deployment is currently the dominant mode, expected to hold an estimated 50% share of the retail IoT market in 2025, due to its scalability, cost-effectiveness, and ease of remote management. Retailers are prioritizing cloud solutions for flexibility in platform updates and cross-channel deployment capabilities.

Microsoft Azure IoT, used by Macy’s for inventory tracking and predictive analytics, is an example. Google Cloud Retail supports personalized marketing campaigns and customer behavior analytics in Target stores.

Edge computing is exhibiting the most robust growth trajectory, with a high CAGR through 2032, driven by the increasing demand for real-time data processing and ultra-low latency applications within retail environments. On-premises deployments, while still relevant for large retailers emphasizing data security and local process control, represent a smaller, more stable share.

The deployment mode mix is expected to evolve substantially, with hybrid cloud-edge architectures becoming a core market feature. For instance, Intel Edge solutions deployed by Walmart for instant smart shelf monitoring and dynamic pricing adjustments.

Operations management is projected to capture nearly 35% of the IoT in the retail market share in 2025, driven by its pivotal role in optimizing supply chains, coordinating workforces, and preventing losses, key to enhancing efficiency and controlling costs in retail.

Walmart utilizes IoT sensors in its distribution centers to track inventory in real-time, optimize stocking, and manage workforce allocation. Amazon’s smart warehouses are leveraging IoT-enabled robots and sensors to streamline supply chain logistics.

The smart shelf and inventory management application is the fastest-growing sub-segment, with a high CAGR through 2032, reflecting the market’s prioritization of automated replenishment and stock level optimization driven by real-time IoT sensor data.

Customer experience management, although slightly smaller in share at approximately 22% in 2025, is rapidly gaining prominence due to the growing emphasis on personalized marketing, interactive retail experiences, and customer journey analytics, which foster brand loyalty and drive sales growth. For instance, Hanshow Smart Shelf Solutions in FairPrice stores, Singapore, for automated price updates and inventory monitoring.

North America is poised to maintain its leadership position, with an estimated 33% Internet of Things (IoT) market share in retail by 2025, supported by early adoption of IoT technologies and a highly innovative retail ecosystem concentrated in the U.S. The U.S. regulatory landscape, including data privacy legislation and IoT standards set by the NIST, is fostering secure and standardized deployments.

Key drivers include robust investments in 5G infrastructure and extensive digital transformation initiatives by major retail chains. Competitive dynamics are characterized by a mix of tech giants and specialized IoT solution providers aggressively expanding their market footprints. Investment trends indicate rising venture capital inflows into smart retail startups and substantial mergers and acquisitions activity, contributing to ongoing market consolidation.

Europe is expected to capture an estimated 25% of the retail IoT market share in 2025, with Germany, the U.K., France, and Spain as the principal contributors. Harmonization of IoT regulations across the EU has facilitated standardized market practices, reducing integration complexities and promoting the adoption of cross-border technologies.

Regional market growth is further propelled by regulatory programs such as the Digital Europe Initiative and emphasis on sustainability through smart retail technologies. Retailers in Europe are increasingly focusing on omnichannel digital transformation, leveraging IoT-enabled analytics for personalized shopping experiences. The competitive landscape is moderately consolidated, with leading European telecommunications companies and technology firms actively investing in IoT innovation hubs and strategic partnerships.

Asia Pacific is projected to emerge as the fastest-growing regional IoT in the retail market. The dynamics of the market here are governed by rapid urbanization, rising middle-class consumers, and government-led smart city and digital infrastructure projects in China, India, and ASEAN nations.

Manufacturing advantages, coupled with the increasing rollout of 5G, accelerate IoT deployment in retail stores and warehouses. Regulatory environments are evolving progressively, with supportive policies that incentivize innovation and cross-industry collaboration. The competitive landscape is highly fragmented but is experiencing rapid consolidation as domestic and multinational players intensify investments and expand supply chain collaborations.

The global Internet of Things (IoT) in Retail Market demonstrates a moderately consolidated structure, with key players such as IBM, Cisco Systems, Microsoft, Amazon Web Services, and Zebra Technologies together accounting for approximately 40.0% of total market revenues.

The presence of several niche providers specializing in sensor technologies and software analytics contributes to fragmentation, enhancing competitive intensity. Market leaders utilize their strong technological capabilities, extensive customer bases, and global distribution channels to maintain a competitive edge. Differentiation through innovation, service quality, and integrated platform solutions drives market dynamics alongside venture capital investment fueling startup growth.

The Internet of Things (IoT) in retail market is projected to reach US$82.7 Billion in 2025.

Increasing emphasis of retailers on operational efficiency and enhanced customer experience through IoT-enabled smart shelves and personalized marketing solutions, and the unprecedented digital transformation of the retail sector are driving the market.

The Internet of Things (IoT) in retail market is poised to witness a CAGR of 24.5% from 2025 to 2032.

The convergence of advancing sensor technologies and the increasing adoption of data analytics platforms by retail chains are key market opportunities.

IBM Corporation, Cisco Systems, Inc., and Microsoft Corporation are some of the key players in the Internet of Things (IoT) in retail market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Component

By Deployment Mode

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author