ID: PMRREP3036| 198 Pages | 24 Jun 2025 | Format: PDF, Excel, PPT* | Healthcare

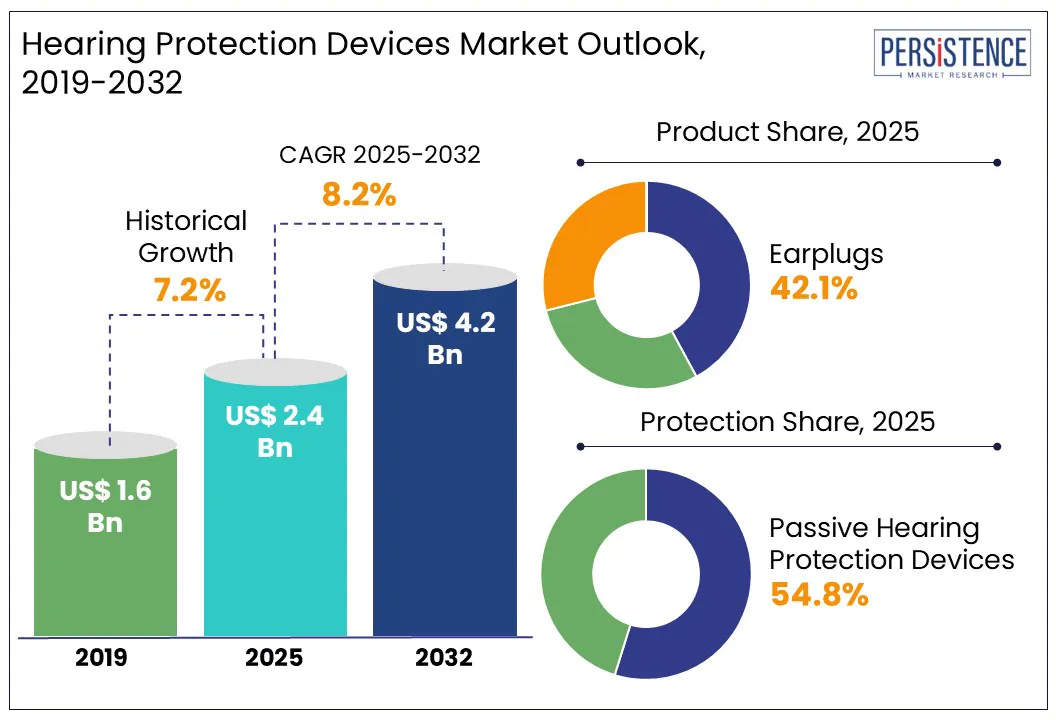

According to the Persistence Market Research, the global hearing protection devices market is likely to be valued at US$ 2.4 Bn in 2025 and is expected to reach US$ 4.2 Bn by 2032, growing at a CAGR of 8.2% during the forecast period from 2025 to 2032.

Hearing protectors are essential devices designed to prevent noise-induced hearing loss, especially when exposed to noise levels above 80 dB for extended periods. These devices are widely used in sectors such as the military, construction, and industrial settings.

According to the World Health Organization (WHO, 2025), by 2050, nearly 2.5 billion people are anticipated to experience some degree of hearing loss, with over 700 million requiring rehabilitation. Unaddressed hearing loss costs the global economy nearly US$ 1 trillion annually.

The 2024 report from the U.S. Centre for Disease Control and Prevention’s (CDC) NIOSH Hearing Loss Surveillance Program monitoring hearing health across U.S. industries, reveals that around 12% of workers have hearing difficulty, 8% suffer from tinnitus, and 53% of noise-exposed workers do not use hearing protection. These statistics highlight the urgent need for effective hearing protection devices and increased awareness to mitigate hearing loss worldwide.

Key Highlights:

|

Global Market Attribute |

Key Insights |

|

Hearing Protection Devices Market Size (2025E) |

US$ 2.4 Bn |

|

Market Value Forecast (2032F) |

US$ 4.2 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

8.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

7.2% |

Key factors such as rising industrialization and infrastructure development drives the global hearing protection devices market. As noise levels from machinery, equipment, and construction activities increase, so does the risk of noise-induced hearing loss (NIHL) among workers in sectors such as manufacturing, construction, mining, and transportation. Regulatory bodies have implemented strict occupational safety standards mandating the use of hearing protection devices in high-noise environments. This has led to an increased demand for effective solutions such as filtered and custom-made hearing protection devices.

Additionally, growing awareness of occupational safety, the health risks associated with prolonged noise exposure, and the need for ergonomic, comfortable protective equipment is prompting industries to invest in advanced hearing protection solutions. Supporting this trend, in May 2025, the University of Michigan, Apple, and WHO launched a collaborative study to examine the effects of sound exposure on hearing health, to shape future global public health policies. Such initiatives highlight the increasing global focus on hearing conservation and are expected to further accelerate the adoption of innovative hearing protection devices across industries.

One of the key restraints hindering the growth of the hearing protection devices market is the persistent stigma associated with hearing impairment and the use of protective devices. Negative perceptions and stereotypes often portray hearing loss as a condition related to aging or disability, discouraging individuals particularly younger users from adopting hearing protection.

Many adults deny their hearing problems and avoid seeking proper diagnosis or treatment, reducing the potential user base for hearing protection devices. Additionally, the bulky or highly visible design of some devices deters users concerned with appearance or social judgment. Social challenges, such as difficulty in regulating voice levels due to impaired hearing, can further contribute to discomfort and reluctance in social settings.

Furthermore, some devices provide inadequate noise attenuation, particularly in environments with high-frequency noise, raising safety concerns in industrial workplaces. This uneven noise suppression can impair communication and situational awareness. Addressing these issues requires improved designs and public awareness campaigns.

Consumers prefer comfort, functionality, and smart features, making digital hearing protection devices more popular than traditional analog models. These advanced devices offer benefits such as Bluetooth connectivity, rechargeability, waterproof design, and customizable noise reduction levels, enhancing user experience and satisfaction.

The ability to filter harmful noise while preserving situational awareness makes these devices ideal for industrial workers, athletes, and recreational users. Moreover, rising awareness of hearing health and the link between hearing protection and quality of life is driving adoption. In May 2024, the Defense Health Agency launched a Virtual Education Center to improve service member health literacy supporting informed choices, including proper selection and use of hearing protector devices in military settings.

Additionally, companies are capitalizing on the growing demand for advanced hearing protection through continuous product innovation and strategic launches. For example, Loop introduced its Engage Kids range in August 2023 to provide comfortable hearing protection for children, while Sonova launched the SilentCloud™ app in February 2023, offering self-paced tinnitus management with therapies, education, and counseling. Most recently, in January 2025, AXIL unveiled its MX Series earmuffs, featuring passive, electronic, and Bluetooth-enabled models with customizable designs, tailored for outdoor enthusiasts and professionals seeking advanced hearing protection and enhancement. This innovation-driven environment presents significant opportunities for companies to meet diverse consumer needs and strengthen their market presence.

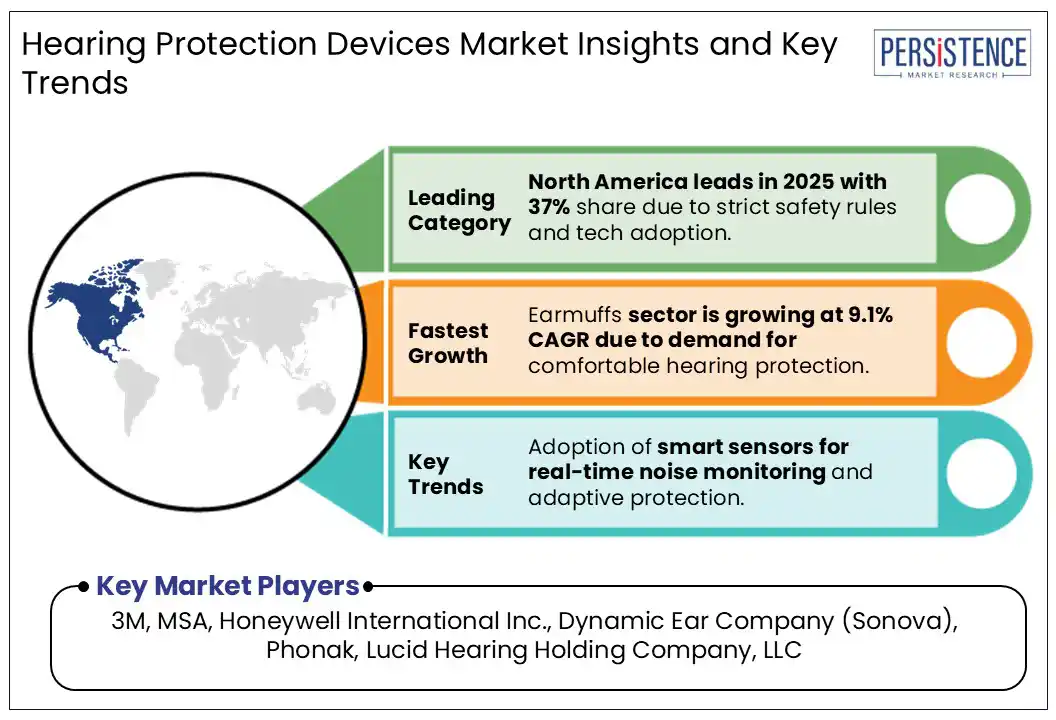

The earplugs segment is set to dominate the global market in 2025 with a revenue share of over 42%. primarily due to their affordability, compact-design, and widespread use across industries. Earplugs offer greater comfort for extended wear and are more widely adopted across industries such as construction, manufacturing or music. In comparison, metal-detectable hearing protection remains niche, mainly used in food and pharmaceutical sectors. Meanwhile, earmuffs are projected to register the notable CAGR of 9.1% through 2032, fuelled by increasing demand for reusable, comfortable, and technologically advanced solutions, including Bluetooth connectivity and noise-cancellation features, especially in high-noise industrial and military settings.

Passive hearing protection devices are poised to capture a considerable share in the global market due to their cost-effectiveness, simplicity, and reliability in consistently reducing hazardous noise levels. These hearing devices work best for those who have lost high-frequency hearing. These devices can attenuate incoming acoustic pressure waves in a pre-described frequency range. They are comparatively cost-effective, require no additional power supply, and are also lightweight and compact.

Unlike active hearing protection, which relies on batteries and electronic components to filter or cancel noise, passive components use physical barriers such as foam or insulating materials, making them more durable and easier to maintain. These benefits lead to the higher adoption of passive devices, thus driving the segment’s dominance.

North America market is projected to dominate globally with over 37% value share in 2025. The region has stringent enforcement of safety regulations through the Occupational Safety and Health Administration (OSHA)and National Institute for Occupational Safety and Health (NIOSH), ensuring widespread compliance in workplaces.

The high prevalence of noise-induced hearing loss significantly drives demand for hearing protection devices. In the U.S., approximately 22 million workers are exposed to hazardous noise annually, with 58% of self-reported hearing difficulties linked to occupational noise exposure (WHO, 2025). Beyond hearing loss, noise exposure is also associated with tinnitus and other health issues such as depression and hypertension.

A recent analysis of the U.S. workers exposed to hazardous noise from 2007 to 2014 found that 53% did not use hearing protection devices (HPDs). The highest non-use was in the Accommodation and Food Services industry at 90%. Moreover, industries with low noise exposure such as Finance and Insurance (2%) and Healthcare (4%), still showed high HPD non-use rates of 80% and 83%, respectively. These findings highlight the urgent need to improve hearing protection awareness and compliance across all sectors to safeguard worker health.

Furthermore, leading players are investing significantly in safety technologies and research, fostering innovation in smart, AI-integrated, specialized hearing protection solutions, especially across industries such as aerospace and defense. These factors collectively contribute to driving the U.S. hearing protection devices market’s dominance and sustained growth through the forecast period.

Europe market is anticipated to hold a considerable share within this global market in 2025 due to the region’s proactive approach to workplace safety and health. European countries enforce comprehensive regulations focused on preventing noise-induced hearing loss (NIHL), supported by robust health and safety agencies.

A study in the International Journal of Occupational Medicine and Environmental Health found that 7% of the European population suffers from occupational NIHL, with 18% of overexposed workers affected highlighting the need for stronger hearing conservation efforts.

Public initiatives, such as EU-OSHA’s 2023–25 Healthy Workplaces campaign and the UK Hearing Conservation Association’s (UKHCA) industry collaborations, further promote hearing protection awareness. These coordinated efforts across policy, research, and advocacy are driving the growth of the hearing protection devices market in Europe.

Asia Pacific Market is projected to secure a CAGR of 9.1% in the forecast period from 2025 to 2032, driven by rapid industrialization and urbanization across countries such as China, India, and Southeast Asia.

Asia Pacific market faces unique challenges and opportunities with rapid industrial growth often outpacing enforcement of workplace safety standards. Many workers in informal or unregulated sectors lack access to proper hearing protection, creating an unmet demand. Urbanization is increasing noise pollution beyond industrial sites, raising awareness of hearing protection among the growing middle class.

Though occupational health investments are rising, especially in China and India, the market remains fragmented with varied needs across countries. Vocational training programs focused on safety are expanding, and as regulations strengthen, demand for higher-quality, affordable hearing protection devices is expected to grow significantly.

The global hearing protection devices market is becoming increasingly competitive, driven by rising health awareness, technological innovation, and lifestyle integration. Companies are focusing on style, functionality, and targeted solutions for diverse consumer needs. Collaborations across healthcare, tech, and entertainment sectors are broadening market reach and user adoption.

The global market is set to reach US$ 2.4 Bn in 2025.

The market is projected to record a CAGR of 8.2% during the forecast period from 2025 to 2032.

Demand for hearing protection devices are growing globally due to rising occupational noise hazards and increasingly stringent safety regulations, heightened awareness of hearing loss prevention, and the rising demand for smart, tech-integrated solutions.

3M, MSA, Honeywell International Inc., Dynamic Ear Company (Sonova), Phonak, and Lucid Hearing Holding Company, LLC are a few leading players.

North America is projected to dominate the global market in 2025.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn/Bn Volume : Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product

By Protection Type

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author