ID: PMRREP33330| 188 Pages | 26 Nov 2025 | Format: PDF, Excel, PPT* | Semiconductor Electronics

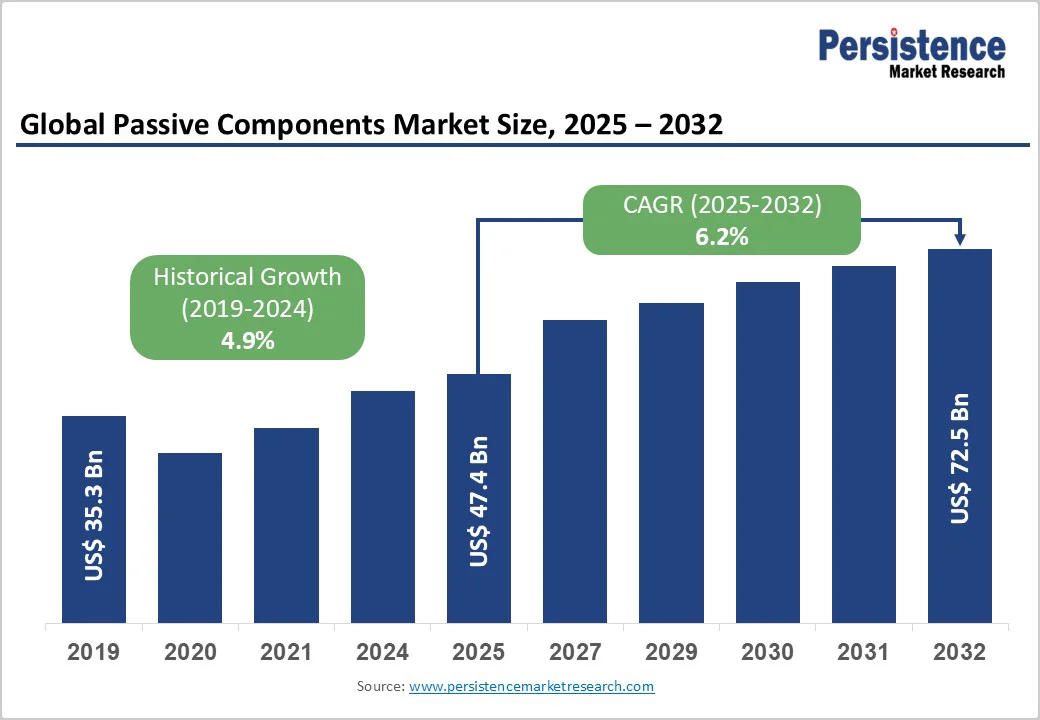

The global passive components market size is projected to rise from US$47.4 Bn in 2025 to US$72.5 Bn by 2032. It is anticipated to witness a CAGR of 6.2% during the forecast period from 2025 to 2032. This robust growth is driven by the increasing demand for smaller, more energy-efficient, and reliable electronic devices.

The rapid proliferation of IoT devices, the global rollout of 5G networks, and the electrification of vehicles, which require advanced electronic systems, further fuel market growth. Miniaturization and technological innovations in high-performance, durable components are creating new opportunities.

| Global Market Attribute | Key Insights |

|---|---|

| Passive Components Market Size (2025E) | US$47.4 Bn |

| Market Value Forecast (2032F) | US$72.5 Bn |

| Projected Growth (CAGR 2025 to 2032) | 6.2% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.9% |

IoT Device Proliferation and Miniaturization Demands

The exponential growth of Internet of Things applications drives sustained demand for passive components across the consumer, industrial, and healthcare sectors.

The global IoT market is rapidly expanding, with GSMA Intelligence forecasting over 38.7 billion IoT connections by 2030. Ericsson reporting ~3.9 billion cellular IoT connections and ~18.8 billion total IoT connections in 2024, projected to reach ~43 billion by 2030. IoT applications require ultra-small, low-power passive components with enhanced reliability for wearables, smart home devices, industrial sensors, and medical implants.

Miniaturization trends are exemplified by developments such as Murata's 006003-inch MLCC (0.16 mm x 0.08 mm), which represents approximately a 75% volume reduction compared to the previous smallest product, enabling manufacturers to pack greater functionality into increasingly compact form factors demanded by wearable technology, fitness trackers, and implantable biosensors.

Automotive Electrification and Advanced Driver-Assistance Systems (ADAS)

The shift toward electric vehicles (EVs) and advanced driver-assistance systems (ADAS) is driving strong demand for passive components. Global EV sales surpassed 17 million units in 2024, accounting for over 20% of new car sales according to IEA. As vehicles electrify and integrate advanced electronics, the demand for passive electronic components has surged.

For instance, while some internal combustion engine (ICE) vehicles use around 3,000 MLCCs (multilayer ceramic capacitors), advanced battery electric vehicles use more than 10,000 MLCCs to support power electronics, battery management systems and ADAS modules. In Europe, new-car registrations grew modestly by 0.8 % to 10.6 million units in 2024, highlighting continued adoption of electrified and electronically sophisticated vehicles.

Raw Material Supply Chain Vulnerabilities and Price Volatility

Raw materials represent the highest variable cost in passive-component production, and supply-chain disruptions severely impact manufacturing. Critical inputs such as nickel used in MLCC terminations and electrode systems, as well as tantalum, palladium, ruthenium, and silver, experience significant price volatility due to geopolitical tensions, mining or refining issues, and environmental or regulatory constraints.

For instance, Ukraine supplied 45-54% of global semiconductor-grade neon gas before the 2022 conflict, demonstrating how regional disruptions affect production and pricing. Such instability increases production costs and limits the ability of manufacturers to meet demand.

Component Shortages and Manufacturing Capacity Constraints

Periodic component shortages and limited manufacturing capacities create major supply bottlenecks. The 2018 global shortage of multilayer ceramic capacitors (MLCCs), for example, extended lead times to over six months.

Rapid technological changes and volatile consumer demand lead to sudden spikes or drops in demand, exposing OEMs and EMS providers to excess inventory, production delays, and higher costs. These constraints particularly affect the automotive, consumer electronics, and telecommunications sectors, slowing production schedules and increasing component prices.

Renewable Energy Integration and Smart Grid Infrastructure

The global shift toward renewable energy and smart grid infrastructure offers significant growth opportunities for passive components manufacturers. Solar PV systems, wind turbines, energy storage solutions, and EV charging networks require advanced capacitors, inductors, and transformers for efficient energy conversion, voltage regulation, and power management.

Smart grids further demand robust components for sensors, automated switching, and electromagnetic interference suppression. According to IEA, with global renewable capacity additions projected to rise from ~666 GW in 2024 to ~935 GW by 2030, solar PV and wind accounting for ~95% and solar PV investment expected to exceed USD 500 billion in 2024, the demand for high-performance passive components is set to grow substantially.

Artificial Intelligence and High-Performance Computing Expansion

The rapid expansion of AI, data centers, and high-performance computing (HPC) is creating strong demand for specialized passive components. AI servers and HPC systems require high-capacitance, high-reliability MLCCs, inductors, and resistors that operate at elevated temperatures (~105 °C), support high-frequency workloads, and ensure stable power delivery with low noise.

Miniaturized, high-density components are essential to optimize space and efficiency, particularly for edge AI devices and AI-enabled IoT applications. Samsung Electro-Mechanics reports that state-of-the-art AI servers use over 10 times as many MLCCs as general-purpose servers, highlighting the significant growth potential in this segment.

Capacitors Enabling Energy Storage and Reliable Circuit Performance

Capacitors are expected to account for more than 45% of the market share in 2025 due to their critical role in stabilizing voltage, filtering noise, and storing energy in electronic circuits.

With the rapid growth of electric vehicles, renewable energy systems, and IoT devices, the demand for compact, high-capacity, and high-reliability capacitors has surged. They are essential for power management in AI servers, 5G infrastructure, and high-performance computing, where efficiency and stability are crucial.

Inductors are projected to grow rapidly, projected to exceed US$10.9 bn by 2032, due to the increasing need for efficient energy storage and filtering in compact electronic devices. They are essential in managing electromagnetic interference and ensuring stable current flow in high-frequency applications.

The expansion of advanced electronics and renewable energy systems drives the need for inductors with higher power density and thermal stability, supporting more reliable and efficient device performance. The introduction of diverse inductor geometries and advanced materials enhances performance characteristics, supporting specialized applications.

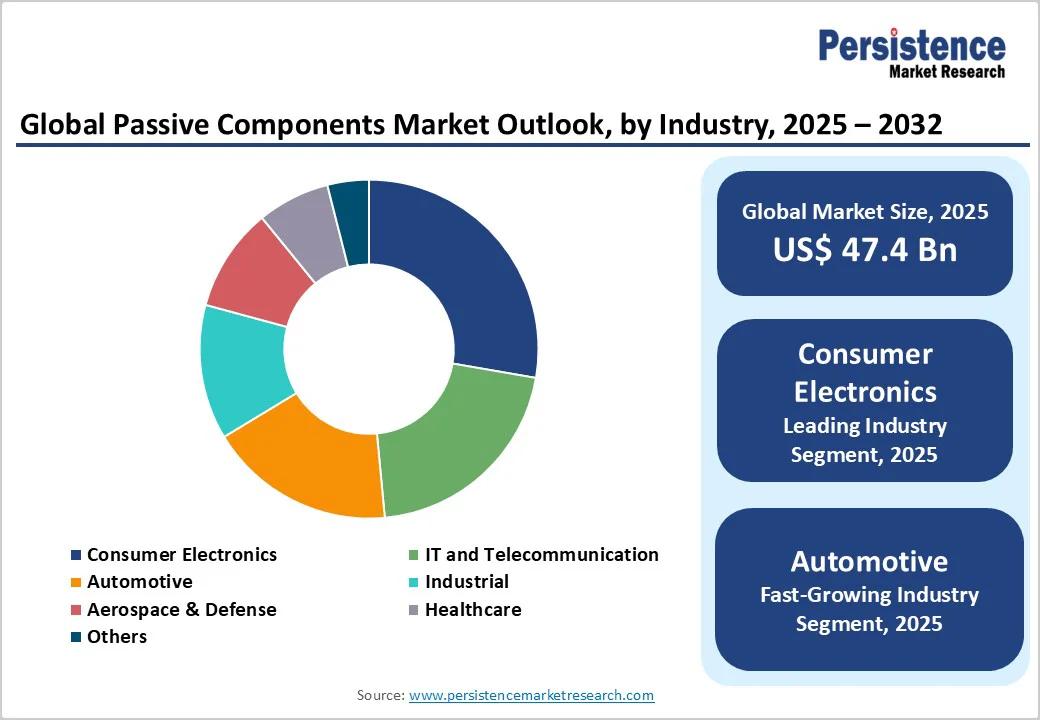

Consumer Electronics Driving Demand for High-Performance, Energy-Efficient Passive Components

Consumer electronics are expected to account for over 31% of the market, with their value exceeding US$14.7 bn by 2025, driven by growing demand for smaller, smarter, and more energy-efficient devices.

Modern smartphones, tablets, wearables, and smart home appliances require reliable passive components to ensure stable performance, efficient power management, and signal integrity. Rising disposable incomes globally enable consumers to upgrade devices more frequently, sustaining robust demand for high-performance passive components with enhanced efficiency, reliability, and compact form factors.

Automotive represents the fastest-growing industry segment with an impressive CAGR of 9.1%, reflecting the sector's fundamental transformation toward electrification and autonomous driving technologies.

The integration of advanced driver-assistance systems (ADAS), infotainment platforms, connectivity features, and electric powertrains drives exponential demand for passive components. Automotive-grade passive components are required to meet stringent reliability criteria, including high-ambient-temperature operation (up to ~125°C), elevated operating voltages, and harsh environments.

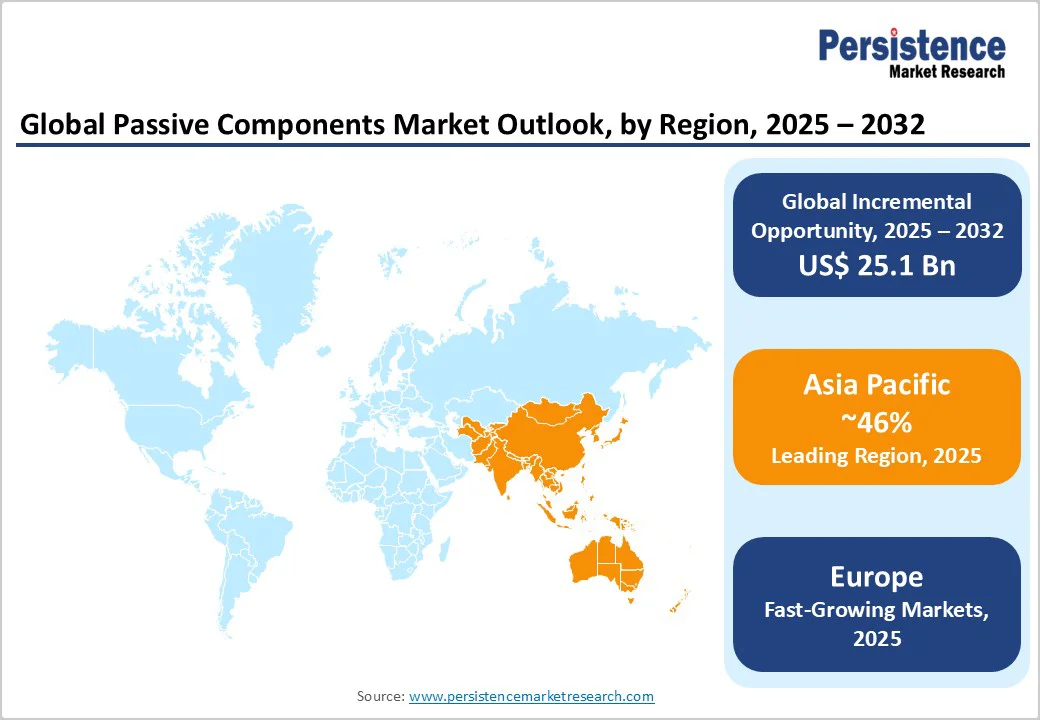

North America maintains strategic market importance, with the region expected to exceed US$18 Bn by 2032. The United States leads regional growth supported by electric vehicle adoption, 5G rollout, AI infrastructure, and data center investments. Local production of capacitors and inductors for automotive powertrains and charging, along with military-grade resistors and capacitors for defense modernization, strengthens regional supply chains.

Industry 4.0 practices and R&D centers drive technological innovation, while regional sourcing in the U.S. shortens lead times and boosts resilience. According to the U.S. Census Bureau, shipments of electrical equipment, appliances, and components reached $52.1 billion in unfilled orders in July 2025, reflecting sustained demand.

Asia Pacific is set to account for over 46% of the passive components market, expected to exceed US$21.8 bn by 2025, driven by dense semiconductor ecosystems in China, Japan, South Korea, and Taiwan supporting consumer electronics, automotive, and industrial sectors. China’s dominance, combined with India’s growing electronics manufacturing under the “Make in India” and PLI schemes totaling INR 22,919 crore, creates substantial opportunities.

The rollout of 5G networks and the rising adoption of electric vehicles are intensifying demand for compact, high-frequency components. Rapid industrialization, expanding electronics exports, for example, Japan’s passive component imports reached ¥17,330 million in July 2025, and strong sector growth, such as China’s electronic information manufacturing output rising 11.8% in 2024, reinforce the region’s leadership.

Europe is experiencing steady expansion, growing at a CAGR of 5.6%, driven by automotive electrification, Industry 4.0 adoption, and renewable energy investments, with Germany leading due to widespread automation and IoT integration. Electric vehicle growth is strong, with new battery-only EVs in the EU reaching ~1.45 million in 2024, up 32.4% year-on-year, increasing demand for capacitors, resistors, and inductors.

Regulatory frameworks such as RoHS and REACH, along with energy-efficiency mandates, are pushing manufacturers to adopt higher-spec components, such as halogen-free and high-efficiency film capacitors. Despite a 2.0% year-on-year decline in euro area industrial production in December 2024, sustained R&D in aerospace, defense, and industrial automation supports long-term market growth.

The passive components market is largely fragmented, with numerous global and regional players competing across product segments. Manufacturers focus on technological differentiation, offering high-reliability, miniaturized, and energy-efficient components to meet evolving industry standards.

Strategic partnerships with electronics OEMs and investments in advanced manufacturing facilities help to enhance production capacity and reduce lead times. Companies also leverage geographical expansion and localized supply chains to gain market share while maintaining cost competitiveness.

The global market is projected to be valued at US$47.4 Bn in 2025.

Growing demand for miniaturized, energy-efficient, and high-reliability devices that require stable power management, signal integrity, and thermal performance, is a key driver of the market.

The market is poised to witness a CAGR of 6.2% from 2025 to 2032.

The rapid adoption of electric vehicles, 5G networks, AI, and high-performance computing, which require advanced, high-reliability components, is creating strong growth opportunities.

KEMET Corp., KYOCERA AVX Components Corp, Murata Manufacturing Co. Ltd., Samsung Electro Mechanics Co. Ltd, Panasonic Corp are among the leading key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author