ID: PMRREP31754| 191 Pages | 2 Sep 2025 | Format: PDF, Excel, PPT* | Industrial Automation

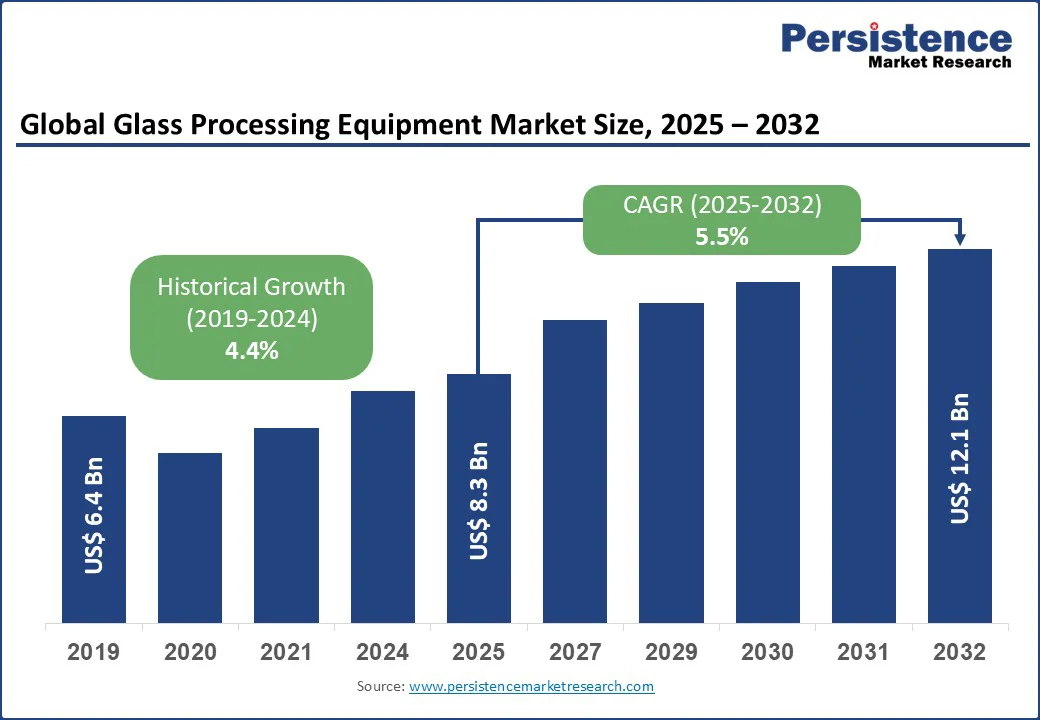

The global glass processing equipment market size is likely to be valued at US$8.3 Bn in 2025 and is expected to reach US$12.1 Bn by 2032, registering a CAGR of 5.5% during the forecast period from 2025 to 2032.

The glass processing equipment market has experienced steady growth, driven by increasing demand from the construction and automotive sectors, advancements in glass manufacturing technologies, and the rising adoption of energy-efficient and high-performance glass products.

The need for precision processing equipment to meet the growing requirements of modern architectural designs and automotive applications is further fueling market expansion across industrial, commercial, and specialized manufacturing settings.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Glass Processing Equipment Market Size (2025E) |

US$8.3 Bn |

|

Market Value Forecast (2032F) |

US$12.1 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.4% |

The global surge in construction activities significantly drives the industry. According to the United Nations, the urban population is projected to reach 68% by 2050, driving a boom in residential and commercial building projects that require advanced glass products, such as insulated, tempered, and low-emissivity glass. This increasing demand for energy-efficient and aesthetically appealing glass solutions fuels the need for high-precision processing equipment, including cutting, grinding, and drilling machines.

Technological advancements in glass processing, such as automated CNC systems and laser-assisted cutting, are key growth catalysts. For example, BENTELER International’s automated glass cutting systems deliver precision cuts with minimal material waste, significantly improving production efficiency compared to conventional methods, according to industry reports.

The integration of Industry 4.0 technologies, including IoT-enabled monitoring and AI-driven process optimization, further enhances operational efficiency, making advanced systems highly suitable for large-scale manufacturing facilities. Recent studies from the International Glass Association highlight that modern equipment contributes to reducing energy consumption in glass processing, aligning with global sustainability trends.

Government initiatives and increased funding for infrastructure development also support market expansion. In India, the Smart Cities Mission has been instrumental in boosting demand for advanced glass processing equipment, particularly in architectural applications. Similarly, in North America, policies promoting green building standards, such as LEED certification, are incentivizing investments in sustainable and high-performance machinery, driving higher adoption across the construction sector.

High costs of glass processing equipment remain a major barrier to widespread adoption, particularly in emerging markets where affordability is a critical factor. Advanced machines equipped with CNC controls, laser systems, and high-precision tools often carry premium pricing, making them considerably more expensive than basic models.

For instance, a high-end glass cutting machine from Bottero is significantly costlier compared to traditional equipment, limiting its accessibility in regions such as rural India and parts of Latin America. Beyond initial purchase, ongoing expenses related to maintenance, skilled labor, and high-quality tooling further triggers operational costs, creating additional challenges for small and medium-sized enterprises (SMEs) that operate under tight budgets.

Market growth is also hindered by volatility in raw material prices, particularly for silicon and energy-intensive components, which directly impact production costs. Moreover, stringent environmental regulations, such as the EU’s REACH framework and EPA standards in North America, impose compliance requirements that increase expenses, delay product launches, and restrict adoption in cost-sensitive markets.

The development of automated and eco-friendly glass processing equipment is opening new growth opportunities, especially in high-demand industries such as construction and automotive. Automated systems, such as LiSEC’s advanced high-speed cutting lines, significantly boost throughput while reducing dependence on manual labor, making them highly attractive to large-scale manufacturers seeking efficiency and scalability.

At the same time, the rise of sustainable processing solutions, including energy-efficient grinding and tempering machines, supports global environmental objectives and strengthens demand in eco-conscious markets where green manufacturing is becoming a priority.

The increasing integration of smart manufacturing and Industry 4.0 technologies provides another strong growth avenue. For instance, Glaston’s IoT-enabled tempering furnaces enable real-time monitoring, predictive maintenance, and improved energy management, ultimately enhancing operational performance and reducing downtime. Additionally, the expansion of digital sales channels is reshaping accessibility.

Companies such as Biesse Group are pioneering e-commerce platforms and subscription-based models, making advanced equipment more attainable for small and medium-sized enterprises. This shift toward online engagement improves market reach, fosters innovation, and supports long-term growth across both developed and emerging regions.

The global glass processing equipment market is segmented into glass drilling machines, glass grinding machines, machinery for breaking glass, and machinery for cutting glass. Machinery for cutting glass dominates, holding approximately 31.7% share in 2025, due to its critical role in providing precise cuts for architectural, automotive, and consumer electronics applications. Advanced cutting systems, such as Bottero’s CNC-based machines, are widely adopted for their accuracy and efficiency in high-volume production.

Glass grinding machines are the fastest-growing segment, driven by increasing demand for smooth, polished edges in architectural and automotive glass applications. Innovation in high-precision grinding systems, such as those from CMS Glass Machinery, enhance surface quality and durability, boosting adoption in manufacturing facilities worldwide.

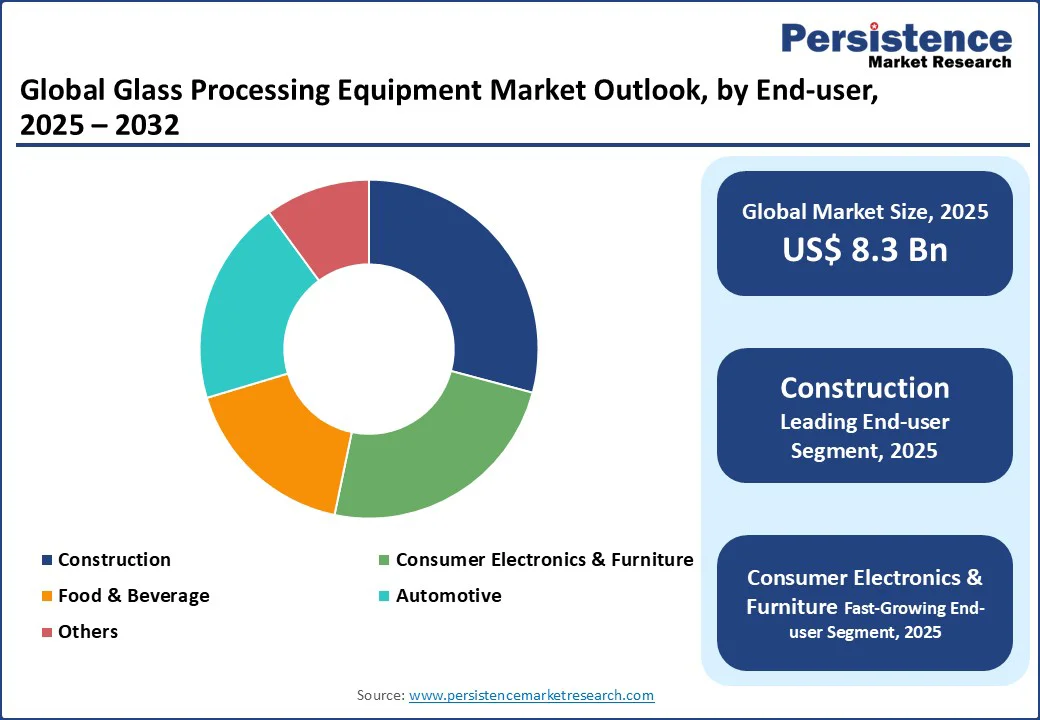

The industry is divided into consumer electronics & furniture, automotive, construction, food & beverage, and others. Construction leads with a 28.5% share in 2025, driven by high global demand for processed glass in building facades, windows, and interiors, with millions of square meters installed annually for commercial and residential projects.

Consumer electronics & furniture is the fastest-growing segment, fueled by rising demand for tempered and laminated glass in smartphones, displays, and modern furniture designs. The success of specialized processing for high-tech applications, such as those from Shenzhen Handong Glass Machinery, drives adoption in diverse consumer markets.

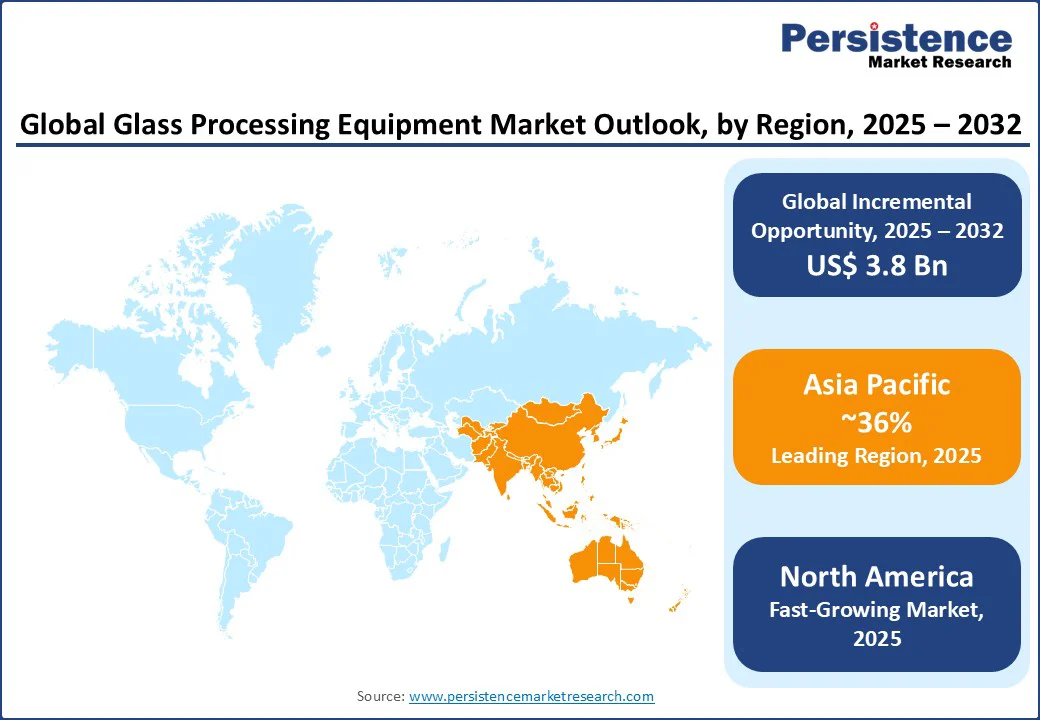

In North America, the U.S. has emerged as the fastest-growing market, expected to contribute significantly to regional expansion in the coming years. Growth is driven by rising investments in sustainable construction and automotive manufacturing, where demand for advanced glass cutting and grinding equipment is steadily increasing.

The adoption of green building standards, supported by initiatives such as LEED certification, further accelerates the shift toward environmentally responsible practices. Leading companies, including IGE Glass Technologies and LandGlass Technology, are responding by introducing automated systems designed specifically for the requirements of the construction and automotive sectors, ensuring higher precision and efficiency.

Market preferences are also evolving toward IoT-integrated and energy-efficient processing equipment, with firms such as Siemens advancing digital controls to minimize waste and optimize output. Sustainability continues to be a critical growth catalyst, reinforced by strict EPA regulations that encourage eco-friendly manufacturing. In addition, government-backed infrastructure initiatives are fostering higher adoption rates, creating a competitive, innovation-driven market landscape.

Europe’s industry is led by Germany, the U.K., and France, benefiting from robust regulatory frameworks and strong demand for sustainable glass solutions. Germany holds a significant share, with sales driven by brands such as Biesse Group and HEGLA, capitalizing on demand for high-precision cutting and grinding machines. The EU’s Green Deal and Circular Economy Action Plan support innovation and compliance, fostering the development of energy-efficient processing systems.

In the U.K., growth is fueled by the popularity of automated equipment, with products such as Glaston’s tempering furnaces appealing to manufacturers seeking efficiency and sustainability. France sees rising demand for automotive glass processing, with companies such as OCMI-OTG offering tailored solutions. Policies promoting sustainable manufacturing and energy efficiency strengthen market prospects, ensuring long-term growth and competitive diversification.

Asia Pacific dominates accounting for a 37% share in 2025, led by China, India, and Japan. In China, rapid construction expansion and industrial development, combined with the growing influence of a rising middle-class population, are fueling demand for advanced glass processing equipment. International manufacturers such as ZHONGSHAN DEWAY MACHINERY MANUFACTURE are adapting their product lines to cater to local architectural and automotive requirements, improving adoption and competitiveness.

In India, a surge in infrastructure projects and supportive government initiatives, including the Smart Cities Mission is creating strong demand for cost-effective glass cutting and grinding solutions. Local companies such as SK Glass Machines are meeting this need by providing affordable, high-precision technologies that appeal to a wide range of users, from small businesses to large-scale enterprises.

Japan, on the other hand is focused on precision-driven, high-tech systems that serve specialized applications in electronics and automotive manufacturing. Companies such as Conzzeta Management are gaining market share by delivering innovation in this space. Across Asia Pacific, the growth of e-commerce and digital platforms is further accelerating accessibility, supporting long-term market expansion.

The global glass processing equipment market is highly competitive, with global and regional players competing on innovation, pricing, and sustainability. The rise of automated and eco-friendly equipment intensifies competition, as companies strive to meet stringent environmental standards and consumer demands. Strategic partnerships, acquisitions, and regulatory compliance are key differentiators in this dynamic market.

The glass processing equipment market is projected to reach US$8.3 Bn in 2025.

Rising demand from the construction and automotive sectors, technological advancements, and government infrastructure initiatives are key drivers.

The glass processing equipment market is poised to witness a CAGR of 5.5% from 2025 to 2032.

Innovation in automated and sustainable processing equipment presents significant growth opportunities.

BENTELER International, Glaston, and Biesse Group are among the key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Process Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author