ID: PMRREP35815| 210 Pages | 4 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

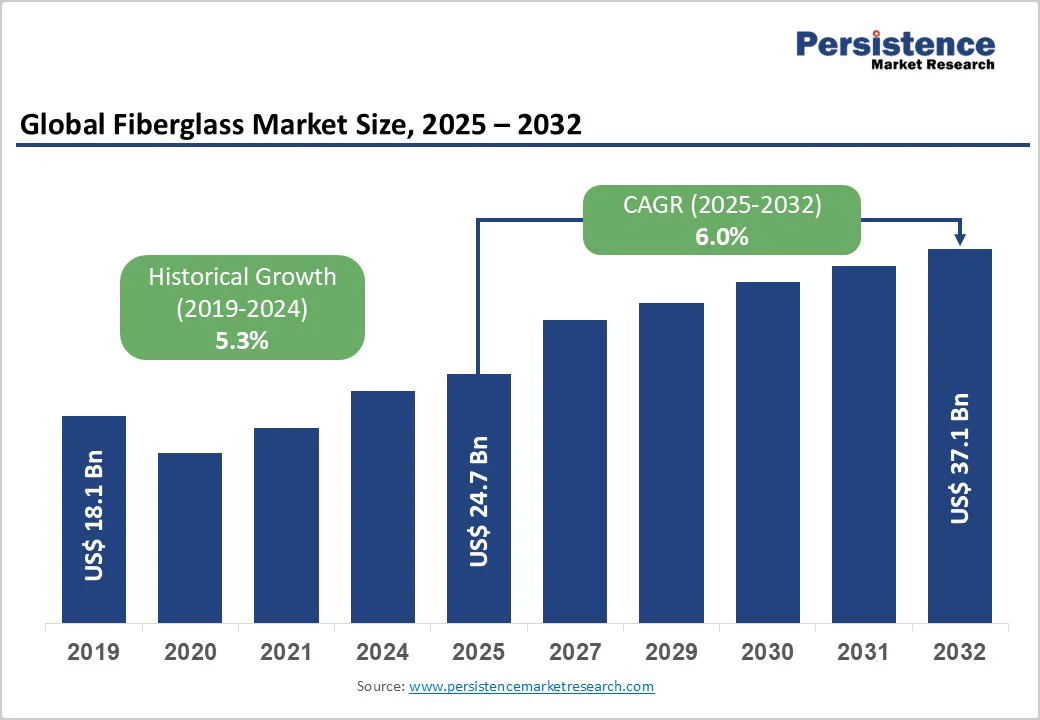

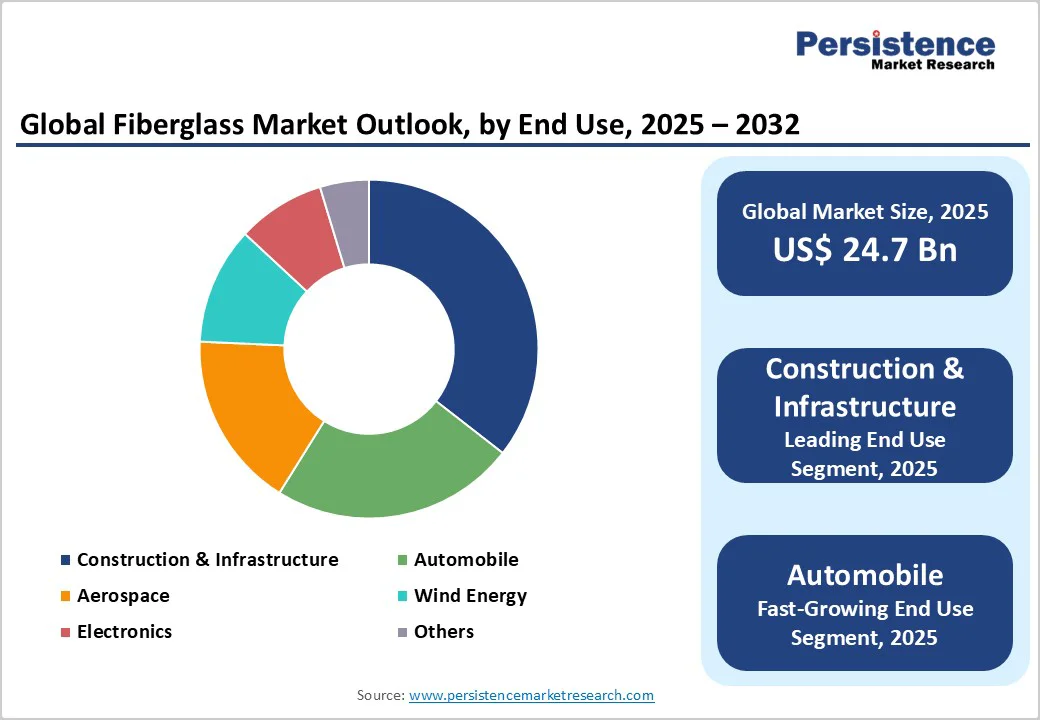

The global fiberglass market size is likely to reach US$24.7 billion in 2025 and is projected to reach US$37.1 billion by 2032, growing at a CAGR of 6.0% between 2025 and 2032.

The market expansion is driven by increasing demand for lightweight materials in the automotive and aerospace industries and rising construction activities focused on energy-efficient building solutions. Growing adoption of renewable energy technologies, particularly wind power installations, has created substantial demand for high-performance fiberglass composites.

| Key Insights | Details |

|---|---|

| Fiberglass Market Size (2025E) | US$24.7 Bn |

| Market Value Forecast (2032F) | US$37.1 Bn |

| Projected Growth CAGR (2025 - 2032) | 6.0% |

| Historical Market Growth (2019 - 2024) | 5.3% |

The global wind energy sector is a primary catalyst for fiberglass market growth, as wind turbine blade manufacturing requires specialized glass fiber reinforcements for structural integrity and performance optimization. The Global Wind Energy Council reported that global wind capacity reached 117 GW in 2024, with over 80% of rotor blades composed of fiberglass-reinforced composites.

Wind turbine manufacturers, including Vestas and Siemens Gamesa, use advanced fiberglass materials for blades exceeding 100 meters in length, driving demand for high-modulus glass fibers with superior strength-to-weight ratios. The International Energy Agency projects wind power capacity will triple by 2030, requiring approximately 2.79 billion specialized glass fibers for turbine blade construction.

Leading companies like Owens Corning and Jushi Group are developing enhanced glass fiber formulations specifically engineered for offshore and high-capacity turbine applications requiring exceptional durability in harsh marine environments.

The construction industry's focus on energy-efficient buildings drives substantial demand for fiberglass insulation, as the building insulation materials market demonstrates robust growth aligned with stringent energy codes and sustainability mandates. The U.S. Department of Energy estimates that buildings account for 40% of total energy consumption, creating significant opportunities for advanced insulation solutions, including glass wool and fiberglass panels.

The HVAC insulation market projects growth at a 5.2% CAGR through 2030, with fiberglass materials comprising approximately 45% of total insulation demand due to superior thermal performance and cost-effectiveness.

European Union energy efficiency directives require a 45% reduction in heat loss through building envelopes, driving the adoption of high-performance fiberglass insulation systems. Manufacturers are developing advanced glass wool formulations with enhanced thermal resistance and acoustic properties to meet evolving building codes and consumer preferences for sustainable construction materials.

The fiberglass industry faces significant cost pressures from fluctuating prices of key raw materials, including silica sand, soda ash, and limestone, which represent up to 60% of total production costs. The U.S. Geological Survey reported a 20% increase in silica sand prices in 2022 due to supply shortages and changes in mining regulations, directly impacting the economics of fiberglass manufacturing.

Global supply chain disruptions, particularly affecting glass fiber precursor materials, have created delivery delays averaging 8-12 weeks for standard specifications. Energy-intensive production processes, such as glass melting at temperatures exceeding 1,400°C, expose manufacturers to volatile energy costs that significantly impact profit margins and competitive positioning.

Fiberglass manufacturers face growing competition from alternative insulation materials, including spray foam, cellulose, and mineral wool, that offer comparable or superior performance at lower prices. Environmental concerns regarding fiberglass production energy intensity and disposal challenges create regulatory pressures for sustainable manufacturing practices.

Health and safety considerations related to glass fiber handling require specialized protective equipment and disposal protocols, adding operational complexity and costs. The development of bio-based insulation materials and advanced polymer alternatives presents long-term competitive threats to traditional fiberglass applications in construction and automotive markets.

The Aerospace Composites Market offers significant growth opportunities for specialized fiberglass applications, as aircraft manufacturers increasingly adopt composite materials to reduce weight and improve fuel efficiency. Boeing and Airbus use fiberglass composites comprising up to 50% of the structure of newer aircraft, driving demand for high-performance E-glass and S-glass formulations.

The electric vehicle industry presents substantial opportunities for fiberglass materials in battery enclosures, underbody panels, and structural components that require lightweight thermal insulation. Tesla, BMW, and Toyota are incorporating fiberglass-reinforced plastics in vehicle platforms to achieve 30-40% weight reduction compared to traditional steel components while maintaining safety standards.

The global EV market, projected to grow at a 25% CAGR through 2030, creates sustained demand for specialized fiberglass composites engineered for automotive applications, including electromagnetic shielding and fire-resistant properties essential for battery systems.

The convergence of smart building technologies and advanced insulation systems creates opportunities for next-generation fiberglass products with integrated sensors and monitoring capabilities. The vacuum insulation panel market is projected to grow at a 16% CAGR, with fiberglass core materials accounting for 71% of total market demand due to their superior thermal performance and structural integrity.

Smart building initiatives requiring ultra-high-performance insulation solutions are driving innovation in nano-enhanced fiberglass formulations with thermal resistance properties exceeding those of conventional materials by 40-50%.

The integration of Internet of Things technology with building insulation systems creates opportunities for intelligent fiberglass panels that can monitor thermal performance in real time and enable predictive maintenance.

Manufacturers investing in advanced production technologies, including automated fiber placement and digital twin manufacturing processes, can capture premium pricing for customized high-performance applications in commercial and residential construction markets.

Glass Wool dominates the fiberglass market with approximately 42% market share, driven by its widespread use in building insulation and HVAC systems that require superior thermal and acoustic performance. The segment's leadership stems from cost-effective manufacturing processes and exceptional insulating properties, with thermal conductivity values as low as 0.032 W/mK, making it ideal for energy-efficient construction applications.

The HVAC Insulation Market is growing at a 5.2% CAGR, with glass wool insulation accounting for the majority of ductwork and equipment insulation installations due to its fire resistance and moisture management capabilities. Major manufacturers, including Owens Corning, Saint-Gobain, and Knauf Insulation have expanded production capacities to meet increasing demand from green building initiatives and stringent energy codes.

Glass wool's versatility enables applications ranging from residential wall insulation to industrial high-temperature environments, with density variations from 10 kg/m³ to 96 kg/m³, accommodating diverse performance requirements across construction and industrial sectors.

Insulation applications command approximately 46% of the fiberglass market share, reflecting the critical role of thermal and acoustic insulation across construction, industrial, and transportation sectors. This segment's dominance is supported by global energy-efficiency regulations and building codes that require enhanced thermal performance, with the Building Insulation Materials Market demonstrating sustained growth driven by sustainability mandates.

The International Energy Agency estimates that improvements in building insulation can reduce heating requirements by 50-75%, creating substantial market opportunities for advanced fiberglass insulation systems. Commercial and residential construction activities account for 70% of insulation demand, while industrial applications, including power generation, petrochemical, and manufacturing facilities, require specialized high-temperature fiberglass solutions.

The segment benefits from technological advancements in glass fiber manufacturing, enabling the production of ultra-fine fibers with enhanced thermal resistance and reduced installation complexity compared to traditional insulation materials.

E-Glass maintains market leadership with approximately 65% market share due to its versatile properties and cost-effective production characteristics suitable for diverse applications across construction, automotive, and general industrial uses.

E-glass formulations offer optimal balance of electrical insulation properties, mechanical strength, and chemical resistance, making them preferred choices for electrical and electronics applications requiring reliable performance. The electrical designation reflects E-glass's superior dielectric properties with low electrical conductivity values essential for electronic component manufacturing and electrical insulation systems.

Manufacturing efficiency advantages include standardized production processes and readily available raw materials, enabling cost-competitive pricing compared to specialty glass formulations. Major producers, including China Jushi, Nippon Electric Glass, and Taiwan Glass Industry Corporation, have established large-scale E-glass production facilities optimized for consistent quality and high-volume manufacturing requirements supporting global supply chains.

The Construction & Infrastructure sector accounts for approximately 38% of the fiberglass market, driven by expanding urbanization and infrastructure development that require lightweight, durable materials for structural and insulation applications. This segment benefits from global construction activity growth, with the United Nations estimating 68% of the global population residing in cities by 2050, creating sustained demand for energy-efficient building materials.

Smart city initiatives and green building certifications, including LEED and BREEAM, drive the adoption of high-performance fiberglass insulation systems and composite structural elements. The sector encompasses residential construction, commercial buildings, and infrastructure projects including bridges, tunnels, and transportation facilities requiring corrosion-resistant materials with extended service life.

Regional variations in building codes and energy efficiency standards create diverse market opportunities: European markets emphasize ultra-high thermal performance, while emerging economies focus on cost-effective insulation solutions for rapid urbanization projects.

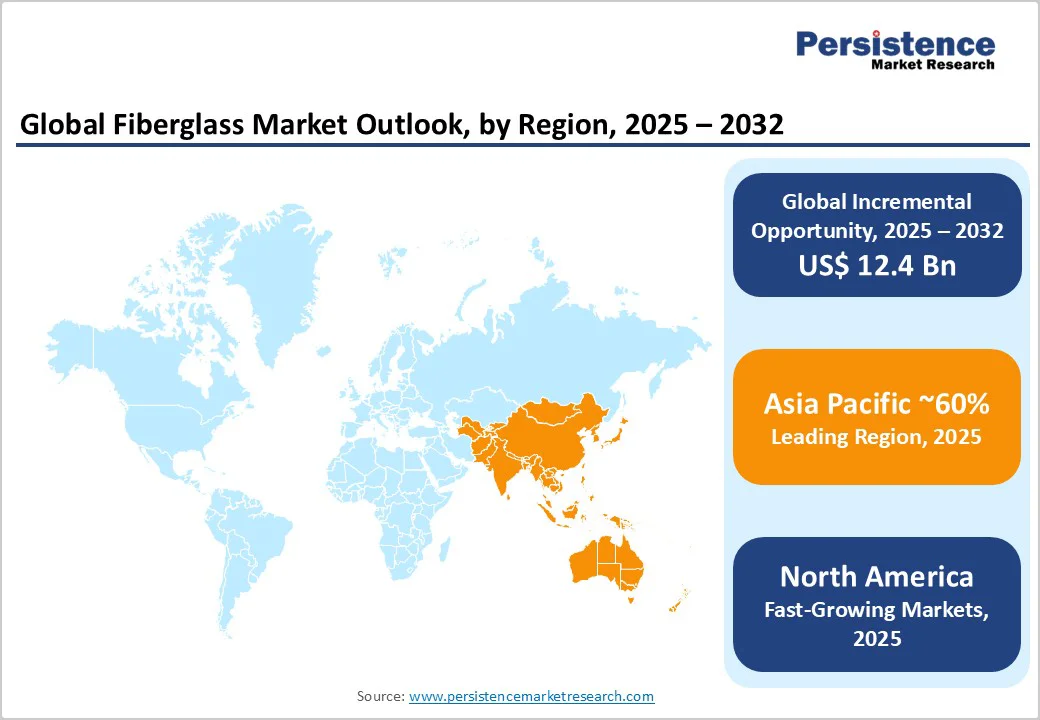

North America demonstrates stable market leadership through advanced manufacturing capabilities and stringent energy efficiency regulations driving high-performance fiberglass demand across construction and industrial applications.

The region benefits from established regulatory frameworks, including ASHRAE 90.1 energy standards and the International Energy Conservation Code, which mandate enhanced building thermal performance. Owens Corning, headquartered in Ohio, maintains technological leadership through continuous research and development investments in advanced composite materials and smart insulation technologies.

The United States wind energy sector creates substantial demand for specialized fiberglass materials, with the Department of Energy projecting that wind power will generate 20% of electricity by 2030. Canada emerges as the fastest-growing market within the region, driven by green building initiatives and infrastructure modernization programs requiring advanced insulation solutions.

Innovation ecosystems centered around Research Triangle Park in North Carolina and Silicon Valley in California drive development of next-generation fiberglass applications including smart materials and nano-enhanced composites for aerospace and electronics applications.

European markets are experiencing strong growth driven by the European Green Deal and REPowerEU initiatives, which emphasize energy independence and sustainable building practices across member states.

Germany leads regional demand through robust automotive and renewable energy sectors, with major manufacturers such as BMW and Mercedes-Benz incorporating advanced fiberglass composites into electric vehicle platforms. The European Union's Energy Performance of Buildings Directive mandates near-zero-energy buildings by 2025, driving the adoption of ultra-high-performance insulation materials.

United Kingdom, France, and Spain demonstrate significant growth in offshore wind energy installations requiring specialized fiberglass materials for turbine blade manufacturing and marine applications.

Regulatory harmonization across EU member states has streamlined certification processes for building materials, facilitating market access for advanced fiberglass products meeting CE marking requirements. The region's focus on circular economy principles drives innovation in recyclable fiberglass formulations and sustainable manufacturing processes aligned with European Commission sustainability targets for 2030.

Asia Pacific represents the fastest-growing regional market with a leading CAGR projected through 2032, driven by rapid industrialization and massive infrastructure development across major economies. China dominates regional production through companies such as China Jushi and Taishan Fiberglass, which operate large-scale manufacturing facilities that supply both domestic and export markets.

The country's Belt and Road Initiative creates substantial demand for fiberglass materials in infrastructure projects across participating nations.

India emerges as a high-growth market driven by government initiatives, including Make in India and an expanding automotive manufacturing sector requiring lightweight materials for fuel efficiency improvements. The Indian fiberglass market is projected to reach US$ 2.2 billion by 2030, growing at a 6.9% CAGR with automobile applications leading demand growth.

Japan maintains technological leadership through companies like Nippon Electric Glass, which develops specialty glass formulations for electronics and advanced composite applications. ASEAN countries, including Thailand, Vietnam, and Indonesia, benefit from manufacturing cost advantages and from growing export-oriented industries that require fiberglass-reinforced materials.

The global fiberglass market is moderately consolidated, with leading players maintaining significant market share through technological expertise, production scale advantages, and comprehensive global distribution networks.

Market concentration remains notable, with the top five companies accounting for approximately 45-50% of global market share, reflecting the capital-intensive nature of fiberglass manufacturing and specialized technical requirements. Leading companies focus on vertical integration strategies, controlling raw material sourcing, glass fiber production, and finished product manufacturing to ensure consistent quality and cost optimization.

Research and development investments emphasize advanced glass formulations, automated manufacturing technologies, and sustainable production processes to maintain competitive differentiation. Emerging business models include circular-economy initiatives focused on recyclable fiberglass materials and digital-twin manufacturing technologies to optimize production efficiency and quality control.

The global fiberglass market is projected to reach US$ 37.1 billion by 2032, growing from US$ 24.7 billion in 2025 at a CAGR of 6.0% during the forecast period.

Market growth is driven by accelerating wind energy infrastructure development, expanding building insulation materials demand, lightweight material requirements in automotive and aerospace industries, and stringent energy efficiency regulations.

Glass Wool leads the market with approximately 42% share due to superior thermal insulation properties, cost-effectiveness, and widespread applications in building and HVAC systems.

Asia Pacific represents the fastest-growing regional market with 5.4% CAGR projected through 2030, driven by industrialization in China, India, and infrastructure development across ASEAN countries.

Smart building technologies and Vacuum Insulation Panel integration present the most significant opportunity, with 16% CAGR potential and premium pricing for advanced applications requiring ultra-high thermal performance.

Key market players include Owens Corning, Saint-Gobain, China Jushi Co., Ltd., Nippon Electric Glass, and Johns Manville, with established technological expertise and global manufacturing capabilities.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Glass Type

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author