ID: PMRREP34376| 198 Pages | 2 Feb 2026 | Format: PDF, Excel, PPT* | Industrial Automation

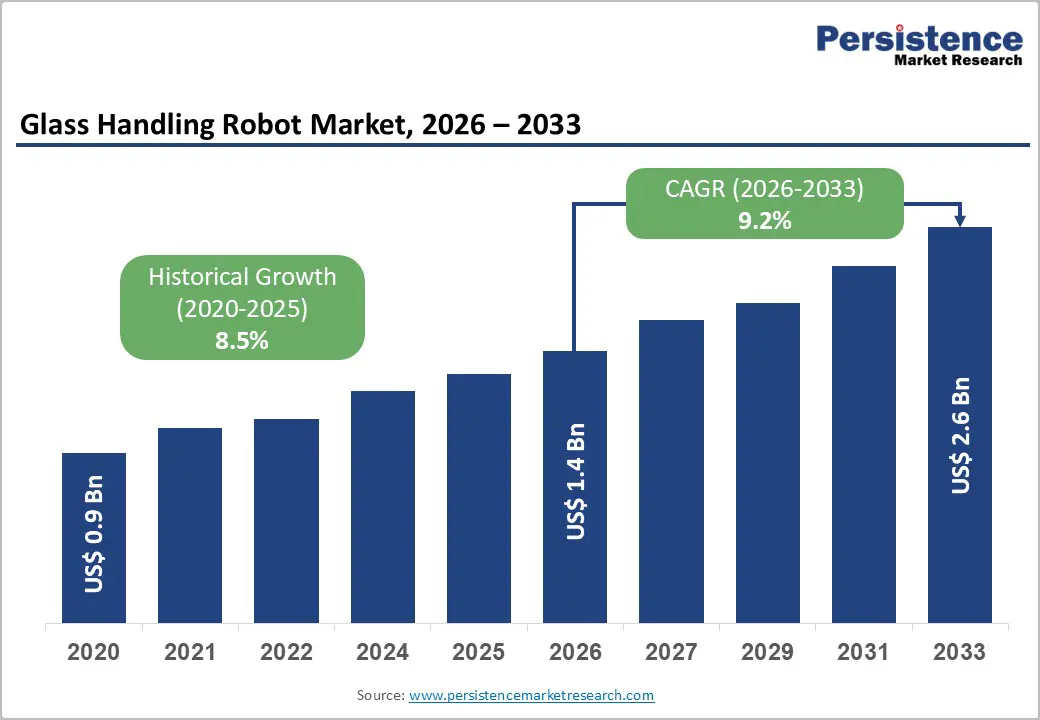

The global glass handling robot market size is likely to be valued at US$1.4 billion in 2026 and is expected to reach US$2.6 billion by 2033, growing at a CAGR of 9.2% during the forecast period from 2026 to 2033, driven by rising automation in automotive, construction, electronics, and packaging manufacturing, where handling large, fragile, and high-value glass components demands precision, consistency, and safety.

Escalating labor costs and skilled-labor shortages are prompting manufacturers to adopt robotic solutions that reduce manual intervention and operational risks. Technological advancements, including vision-guided robotics, AI-enabled motion control, collaborative robots, and advanced vacuum grippers, are significantly improving handling accuracy and throughput. These innovations have helped reduce glass breakage and defect rates, also improving production uptime and yield. Stringent workplace safety regulations, particularly in automotive and construction sectors, are accelerating the replacement of manual glass handling with automated robotic systems.

| Key Insights | Details |

|---|---|

| Glass Handling Robot Market Size (2026E) | US$1.4 Bn |

| Market Value Forecast (2033F) | US$2.6 Bn |

| Projected Growth (CAGR 2026 to 2033) | 9.2% |

| Historical Market Growth (CAGR 2020 to 2025) | 8.5% |

Glass handling is inherently delicate and hazardous, requiring consistent accuracy to minimize breakage and defects. Automated robotic systems offer repeatable, high-precision movements that significantly outperform manual handling, especially in high-volume production environments such as automotive, electronics, and glass manufacturing. As production lines become faster and more complex, manufacturers rely on robots to handle larger, thinner, and more fragile glass components without compromising quality. Automation also enables round-the-clock operations, reducing downtime and improving throughput, both critical to meeting growing demand. The integration of robotics aligns with industry initiatives, where connected systems, real-time monitoring, and data-driven decision-making enhance productivity and process control.

Rising labor costs and workforce shortages are accelerating the shift toward automated glass handling solutions. Many manufacturing regions face challenges sourcing skilled labor for physically demanding, high-risk tasks, making automation a cost-effective and sustainable alternative. Glass-handling robots help manufacturers reduce dependence on manual labor and improve workplace safety by minimizing human exposure to sharp edges, heavy panels, and repetitive strain injuries. Regulatory pressure to enhance occupational safety standards strengthens the case for automation, particularly in the automotive and construction industries. Advancements in robotic technologies, such as vision-guided systems, collaborative robots, and intelligent end-effectors, have lowered adoption barriers by improving ease of integration and flexibility across diverse production setups.

Automation reduces dependence on manual glass handling while increasing the need for technically skilled personnel capable of programming, monitoring, and maintaining robotic systems. Glass handling robots often require expertise in robotic programming, sensor calibration, vision systems, and preventive maintenance to ensure precision and minimize downtime. In many developing and mid-sized manufacturing regions, the availability of such skilled technicians is limited, slowing adoption despite strong demand for automation. Small and medium-sized enterprises (SMEs), in particular, face challenges in recruiting and retaining qualified staff, as skilled professionals are often attracted to larger manufacturers that offer better compensation and career growth.

The rapid evolution of robotic technologies intensifies the skills shortage, as existing workforce capabilities often lag behind technological advancements. Glass-handling robots increasingly incorporate AI-driven vision systems, collaborative capabilities, and digital connectivity, all of which require continuous upskilling for operators and engineers. Training programs and certification initiatives are still unevenly distributed across regions, creating disparities in adoption rates. Inadequate training can lead to suboptimal robot utilization, higher error rates, and unplanned downtime, reducing the expected return on investment. Manufacturers must allocate additional resources for training, which can be a deterrent, particularly for cost-sensitive industries.

Traditional industrial robots, cobots, are designed to operate alongside human workers without extensive safety fencing, making them ideal for glass handling environments where precision and adaptability are critical. In glass manufacturing and processing facilities, cobots are increasingly used for tasks such as loading and unloading glass sheets, assisting in inspection, and supporting assembly operations. Their compact design and ease of deployment enable manufacturers to automate specific production stages without major layout changes. This is especially beneficial for small and medium-sized enterprises that require scalable automation but lack the capital for fully automated lines.

Collaborative robots address key workforce and safety challenges prevalent in glass-intensive industries. Glass handling poses high risks due to sharp edges, heavy loads, and repetitive motions, increasing the likelihood of workplace injuries. Cobots reduce these risks by taking on hazardous tasks, allowing human workers to focus on supervision and quality control. Advances in force sensing, vision systems, and AI-based motion control have significantly improved cobot performance, enabling precise handling of fragile and irregularly shaped glass components. These technological improvements have lowered adoption barriers by simplifying programming and reducing integration costs.

Articulated robots are projected to dominate the glass-handling robot market, capturing approximately 35% of the revenue share by 2026. Their multi-axis flexibility enables precise and intricate handling of large, fragile, or irregularly shaped glass panels, making them ideal for complex tasks. In sectors such as automotive manufacturing, articulated robots are commonly used for windshield and side-panel assembly, where their ability to perform high-precision pick-and-place operations reduces breakage and boosts throughput. For instance, automotive OEMs such as BMW utilize articulated robots in their glass assembly lines to improve efficiency and ensure consistent quality. With their proven reliability and technological maturity, articulated robots are preferred by manufacturers for both large-scale and specialized production processes.

Collaborative robots (cobots) are expected to be the fastest-growing segment in 2026, driven by the rising demand for safe and flexible automation solutions in small and medium-sized manufacturing environments. Designed to work alongside human operators without requiring extensive safety barriers, cobots are well suited to glass-handling tasks that require both precision and manual supervision. For example, Epson Robots utilizes cobots in electronics glass assembly for smartphone screens, where human-robot collaboration improves handling accuracy and reduces defects. The growing emphasis on workplace safety regulations is further fueling the adoption of cobots, as these robots help minimize the risk of injuries related to handling sharp and heavy glass panels.

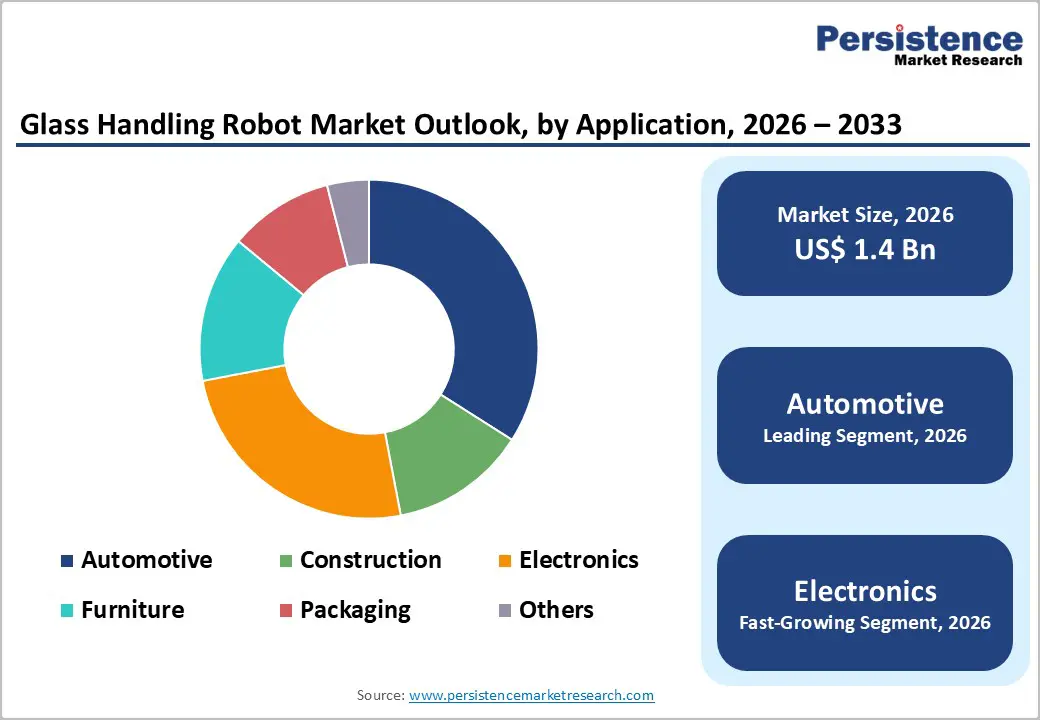

The automotive segment is projected to lead the market, accounting for approximately 30% of revenue in 2026, supported by high demand for precise handling of windshields, sunroofs, and side panels. Leading automotive manufacturers, such as Tesla, extensively use glass-handling robots on their production lines to automate assembly and reduce defects, thereby enhancing efficiency and quality. These robots are capable of managing large and fragile glass components that require accurate placement and minimal human intervention, which is critical for high-volume production and EV manufacturing. The segment benefits from technological integration, including AI-guided robotic arms that optimize cycle times and reduce material wastage. The automotive industry’s focus on lightweight, safety-compliant, and large-format glass panels supports continued investments in robotic solutions.

The electronics segment is likely to be the fastest-growing application in 2026, driven by the increasing need for precision in handling delicate display glass for smartphones, tablets, and wearable devices. For example, Samsung Electronics integrates glass-handling robots into its display panel lines to reduce manual errors, prevent scratches, and improve throughput in high-precision manufacturing. The rise of miniaturized devices, IoT integration, and high-resolution display requirements makes human handling inefficient, positioning robotics as essential for defect-free operations. The segment’s growth is also supported by robots' ability to adapt to varying screen sizes and complex layouts, a capability that traditional manufacturing methods cannot achieve. Electronics manufacturers benefit from automated inspection and alignment capabilities provided by modern robots, which enable faster production cycles and lower breakage rates.

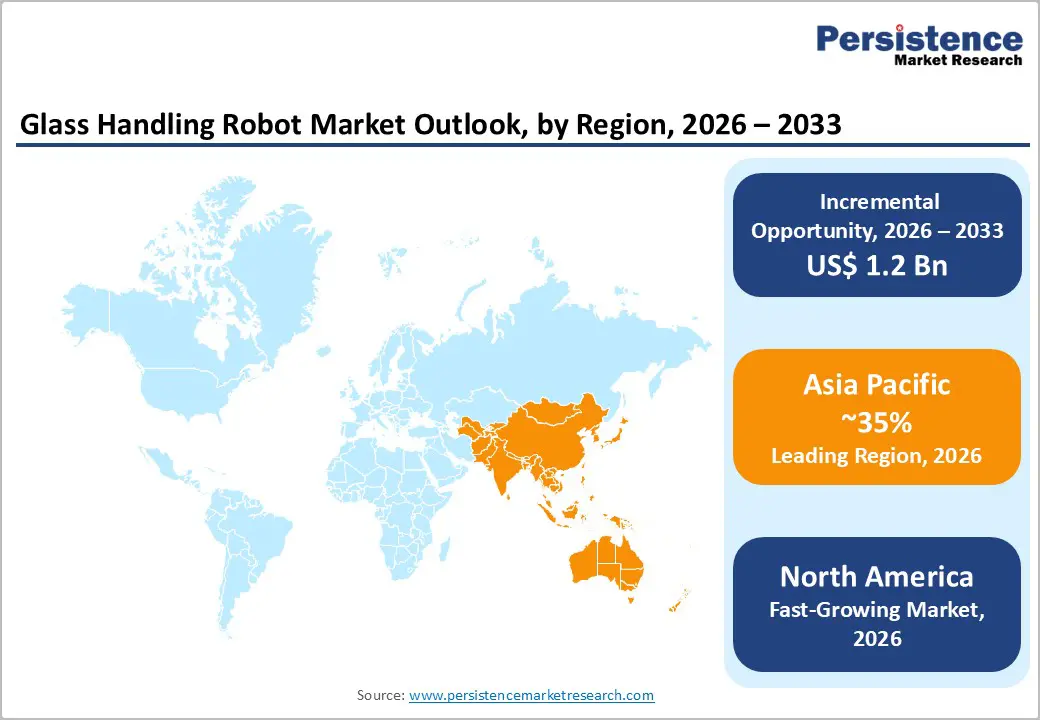

North America is likely to be the fastest-growing region in the glass handling robot market in 2026, driven by rapid automation adoption across key manufacturing sectors such as automotive, construction, and logistics. The region benefits from advanced industrial infrastructure, high labour costs, and stringent safety standards that incentivize the integration of robotics to enhance productivity and reduce workplace injuries. In the U.S., major automotive OEMs and glass component manufacturers are upgrading traditional handling systems with robotic solutions to improve precision and consistency, in response to increasing demand for complex glass products. For example, Yaskawa America has strengthened its presence by relocating engineering and support teams to strategic manufacturing hubs in Franklin and Wisconsin to better serve the region’s expanding glass automation needs, aligning with increased factory investments in robotics technology.

North America market trend increasingly emphasizes flexible and intelligent robotic solutions that can adapt to diverse production requirements and emerging manufacturing paradigms such as modular assembly and distributed production. There is growing interest in collaborative and semi-automated glass-handling robots that seamlessly support human workers in shared environments, particularly in settings with space constraints or variable workflows. In construction and prefab glass applications, compact robotic handlers are gaining traction as builders pursue safer and faster installation processes. Regional regulatory frameworks around machine safety and industrial automation are becoming more supportive of advanced robotics, helping to streamline certification and deployment processes.

Europe is expected to be a key market for glass handling robots in 2026, driven by advanced manufacturing practices, strict safety standards, and sustainability-focused automation initiatives. The region has a strong legacy in precision engineering, particularly in Germany, France, and Italy, where glass-handling robots are widely used across the automotive, construction, and specialty manufacturing sectors. European manufacturers prioritize high-quality, energy-efficient production, aligning with the EU’s commitment to eco-design and regulatory compliance, which fosters automation upgrades and innovation in robotic solutions. For instance, Germany has integrated robotic systems extensively into architectural glass panel production and electric vehicle assembly lines, supported by government funding for smart glass factories that use high-payload robotic lifters with advanced sensors.

Another noteworthy trend in the European glass-handling robot market is the evolving competitive landscape, marked by partnerships and product innovation. Companies are investing in co-development efforts to enhance robotic capabilities for specific glass handling challenges. For example, KUKA AG, a German robotics manufacturer, has partnered with Schmalz to co-develop integrated vacuum-based glass handling cells optimized for flat and curved glass processing, addressing the complex needs of automotive and architectural glass lines. This collaboration reflects a broader movement in Europe where robotics providers team with component specialists to deliver tailored automation solutions that increase reliability and throughput.

Asia-Pacific is expected to be the leading region, accounting for 35% market share in 2026, driven by rapid industrialization, strong adoption of automation in automotive and electronics manufacturing, and government initiatives promoting smart factories and the integration of advanced robotics. Advanced sensor technologies, AI-enabled controls, and machine vision systems are being integrated into glass-handling robots to improve efficiency and reduce defects in high-volume production environments, thereby solidifying Asia-Pacific’s leadership in the market. Manufacturers emphasize higher throughput, reduced labor dependencies, and consistent product quality. The region continues to gain market momentum, supported by favorable policies and robust industrial growth.

The growing presence of regional robotics companies that are customizing solutions to address local manufacturing needs and cost considerations is becoming increasingly significant. For instance, Suzhou Inovance Technology Co., Ltd (Inovance) has emerged as a key player in China’s automation sector, expanding its industrial automation and robotics product offerings to serve a range of applications, including glass handling in automotive and electronics manufacturing. Inovance's focus on integrating advanced automation control products aligns with broader market trends toward localized innovation and self-sufficiency in robotics technology across the Asia Pacific region. These companies are complementing established players by providing competitive, region-specific alternatives that meet the unique demands for precision, cost efficiency, and system flexibility.

The global glass handling robot market is moderately fragmented, with several established multinational corporations and specialized regional and niche players competing for market share. Competition is driven by technological innovation, product customization, geographic reach, and service support, with established leaders focusing on advanced capabilities such as AI-enabled vision systems, vacuum-gripping technologies, and collaborative robotics tailored for glass-handling applications. This fragmentation allows both incumbents and smaller specialist firms to coexist, addressing diverse needs across automotive, construction, electronics, and packaging sectors.

With key leaders including KUKA AG, ABB Ltd., FANUC Corporation, and Yaskawa Electric Corporation, the market is defined by ongoing investments in R&D, strategic partnerships, and expansion into high-growth regions such as Asia Pacific and Latin America. These players compete by continuously enhancing their product portfolios, adopting cutting-edge technologies such as predictive maintenance and IoT connectivity, and expanding service networks to support customers throughout the automation lifecycle. Competitive differentiation increasingly centers on offering comprehensive automation ecosystems with robust after-sales support, flexible deployment models, and scalable solutions that meet the evolving demands of manufacturers seeking to optimize quality, efficiency, and safety.

The global glass handling robot market is projected to reach US$1.4 billion in 2026.

Rising automation demand in manufacturing sectors is driven by precision, efficiency, and workplace safety in handling fragile glass components.

The glass handling robot market is expected to grow at a CAGR of 9.2% from 2026 to 2033.

Growing demand for collaborative robots, AI-enabled automation, and expanding applications in automotive, electronics, construction, and renewable energy sectors.

ABB Robotics, KUKA Robotics, Yaskawa Electric Corporation, Midea Group (KUKA), and Fanuc Corporation are the leading players.

| Report Attribute | Details |

|---|---|

| Historical Data | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author