ID: PMRREP34984| 195 Pages | 2 Feb 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

The global field service management market size is projected to rise from US$5.6 billion in 2026 to US$12.7 billion by 2033. We anticipate a CAGR of 12.4% over the forecast period from 2026 to 2033, as organizations increasingly seek to optimize field operations, reduce service costs, and enhance customer satisfaction.

The growing need for real-time workforce management, predictive maintenance, and mobile-enabled service delivery is driving adoption across industries. Cloud-based deployments, AI-powered analytics, and mobile workforce solutions further accelerate market expansion. Rising customer expectations for faster, more reliable service are also fueling investments in FSM technologies, making it a critical component of modern field operations.

| Key Insights | Details |

|---|---|

| Field Service Management Market Size (2026E) | US$5.6 Bn |

| Market Value Forecast (2033F) | US$12.7 Bn |

| Projected Growth (CAGR 2026 to 2033) | 12.4% |

| Historical Market Growth (CAGR 2020 to 2025) | 9.5% |

Workforce shortages and rising service complexity are accelerating FSM adoption, as ageing technical workforces, especially in North American construction and skilled trades, where a large share of technicians is over 55, create widening skill gaps. In asset-intensive sectors such as manufacturing and utilities, where downtime across geographically dispersed infrastructure is costly, FSM-driven digital work instructions reduce errors and training time. As service portfolios expand and connected assets proliferate, enterprises increasingly rely on FSM to coordinate larger, more distributed workforces, sustaining long-term demand for software and services despite OECD labour force participation reaching ~74.1% in 2025, which masks persistent skill mismatches.

Regulatory requirements for workplace safety, equipment reliability, and compliance documentation continue to intensify across North America and Europe. Agencies such as OSHA and the EPA in the U.S., along with sector-specific regulators in energy, healthcare, aviation, and transportation, enforce strict maintenance schedules, inspections, and auditable service records, with high penalties for non-compliance. North America largely adheres to prescriptive, rule-based standards, whereas Europe emphasizes performance-based compliance under frameworks such as ISO 9001 and ISO 14001. As regulated industries modernize operations, these requirements continue to drive increased FSM adoption and spending.

Field service management adoption faces significant challenges beyond software costs, particularly due to complex integration with legacy and siloed enterprise systems. According to a study, more than 60% of field service professionals report difficulties integrating FSM platforms with existing infrastructure, particularly in organizations that use outdated technologies. More than 50% cite technician adoption and training as major concerns, as field staff often resist changes to long-established workflows. These organizational and human factors frequently outweigh technical issues, leading to prolonged deployment cycles and delayed or suboptimal realization of return on investment.

FSM implementation requires significant upfront investment beyond software licensing, including mobile hardware for technicians, system customization, legacy integration, and extensive training programs. These costs consume a substantial share of SME IT budgets, making adoption financially challenging. While large enterprises absorb FSM spending through established IT infrastructure budgets, mid-market firms often delay deployments due to competing capital priorities and difficulty in quantifying near-term ROI. This cost sensitivity continues to restrain FSM penetration in the strategically important SME and mid-enterprise segment.

AI and machine learning integration enable automated scheduling, intelligent dispatching, and shift from reactive to predictive maintenance. Organizations adopting AI-driven FSM solutions report estimated improvements of ~10-15% in service delivery speed and ~20-25% higher first-time fix rates, driven by optimized routing and decision support. Predictive maintenance powered by IoT sensor analytics is estimated to significantly reduce emergency breakdowns and extend equipment lifecycles by enabling condition-based service planning. According to a study, a substantial share of field service tasks potentially exceeding 40-50% will be supported by automation and AI tools, up sharply from under 10% in 2020. These underscore the growing value of AI in enhancing operational efficiency and customer experience in field service organizations.

Servitization and outcome-based business models are transforming the market by shifting the focus from product sales to the delivery of measurable results and value to customers. This approach encourages companies to offer predictive maintenance, uptime guarantees, and performance-based service contracts, boosting recurring revenue and customer loyalty. API marketplaces and multi-system orchestration further enhance FSM by enabling seamless integration of disparate enterprise systems, IoT devices, and field service platforms. This interoperability allows real-time data exchange, automated workflows, and improved decision-making in the field. These opportunities enable FSM providers to offer advanced, connected, and outcome-driven solutions, thereby expanding market demand across industries.

Solution dominates the global market, capturing more than 62% market share in 2026 with a value exceeding US$ 3.5 Bn, due to the growing need for comprehensive platforms that streamline field operations. Organizations increasingly require solutions that integrate scheduling, dispatch, inventory management, and real-time reporting to improve workforce efficiency and customer satisfaction. The demand for centralized, automated tools that reduce manual processes and operational costs further drives adoption. Rising digital transformation initiatives across industries have made solution-based FSM offerings more critical than standalone services. Services are growing at a 14.9% CAGR, driven by increasing demand for professional support in managing complex field operations. Businesses are seeking solutions that streamline scheduling, real-time monitoring, and maintenance tasks while ensuring high customer satisfaction. The need for predictive maintenance, remote troubleshooting, and workforce optimization is driving the adoption of FSM services. The shift toward subscription-based and cloud-managed service models enables faster deployment, scalability, and cost efficiency for enterprises across industries.

On-premises hold over 40% market share in 2026, with a value exceeding US$ 2.2 Bn as many organizations, especially in manufacturing, utilities, and critical infrastructure, require complete control over their data and workflows. These industries prioritize data security, regulatory compliance, and customization of FSM solutions to fit complex operational needs. It also offers greater integration with existing enterprise software and legacy systems, ensuring seamless operations. Organizations with stable IT infrastructure prefer predictable costs and direct management of software performance and updates.

Cloud-based solutions are expected to grow at the highest rate, with a 16.4% CAGR, driven by increasing demand for real-time data access, remote workforce management, and seamless collaboration across multiple locations. Organizations are seeking scalable, cost-effective solutions that reduce IT infrastructure burdens while enabling quick deployment of updates and integrations. The need for mobility, IoT-enabled service tracking, and advanced analytics is driving the adoption of cloud-based FSM platforms, especially among SMEs and geographically dispersed service teams.

Large enterprises are expected to account for more than 57% in 2026, with a value exceeding US$3.2 Bn, due to their complex service operations, extensive workforces, and high volumes of service requests that require streamlined management. They increasingly need to optimize efficiency and reduce operational costs. Regulatory compliance, customer experience expectations, and integration with enterprise IT systems drive their adoption of advanced FSM solutions. Their scale and budget allow them to invest in comprehensive platforms that smaller firms find cost-prohibitive.

Small and medium-sized enterprises (SMEs) are expected to grow at a CAGR of 16.7%, driven by their focus on improving operational efficiency and customer satisfaction despite limited resources. SMEs are adopting automation to automate scheduling, track field workforce performance, and reduce service delays, which helps optimize costs and improve service quality. The rising availability of affordable, cloud-based FSM platforms makes it easier for SMEs to implement advanced field service technologies without heavy upfront investment.

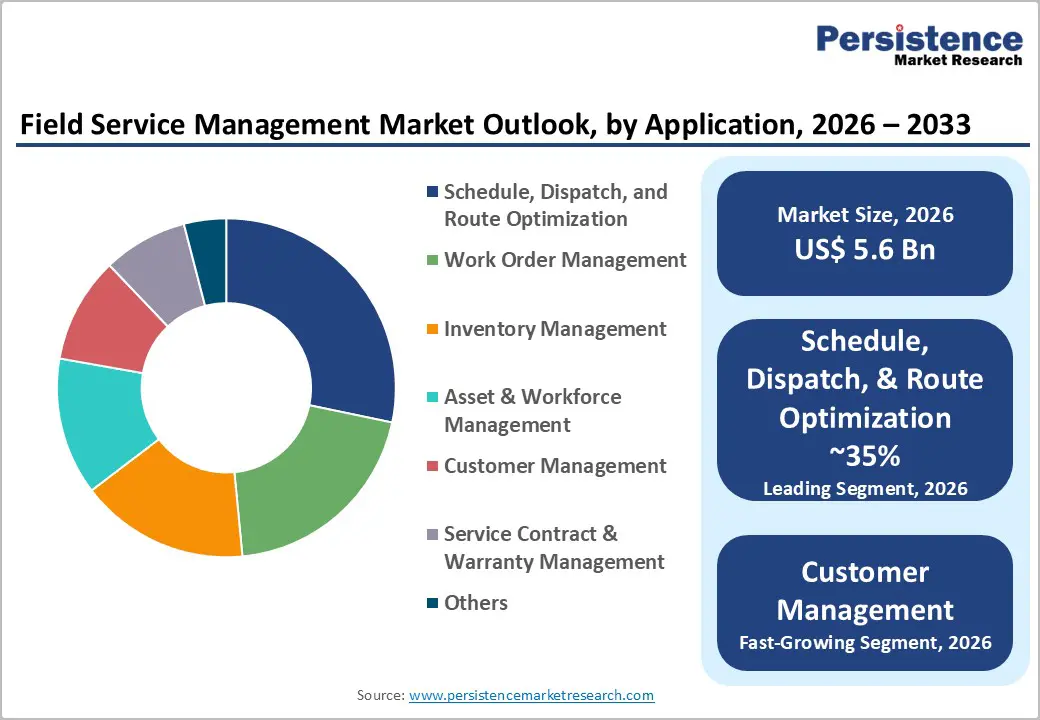

Schedule, dispatch, and route optimization command the largest market share at over 28% in 2026 with a value exceeding US$ 1.6 Bn, as businesses increasingly need to enhance operational efficiency and reduce service response times. These solutions help organizations assign the right technician to the right job, optimize travel routes, and minimize idle time, directly improving customer satisfaction. With rising customer expectations for faster and more reliable field services, companies are prioritizing tools that streamline workforce management, reduce fuel and labor costs, and ensure timely service delivery.

Customer management is expected to grow at a CAGR of 15.8%, driven by the increasing demand for personalized and seamless customer experiences. Businesses are focusing on improving service quality, real-time communication, and faster issue resolution to enhance customer satisfaction and loyalty. The rise of digital channels and mobile-first solutions enables field technicians to access customer histories, preferences, and service requirements on the go.

Manufacturing is expected to account for more than 22% in 2026, with a value exceeding US$1.2 Bn, driven by the critical need to maintain complex machinery, minimize unplanned downtime, and optimize production efficiency. With increasing adoption of IoT-enabled equipment and automated systems, manufacturers require real-time monitoring, predictive maintenance, and rapid service response. FSM solutions help streamline field operations, ensure timely repairs, and reduce operational costs, making them essential for sustaining productivity and meeting tight production schedules.

IT and Telecom are expected to grow at a CAGR of 16.2%, due to increasing demand for rapid deployment, maintenance, and upgrades of complex network infrastructure. Rising adoption of 5G, IoT, and cloud services requires real-time scheduling, remote monitoring, and efficient workforce management. Minimizing service downtime and ensuring high-quality customer support drives FSM solution adoption. The need to integrate AI-driven predictive maintenance and automation further accelerates growth in this segment.

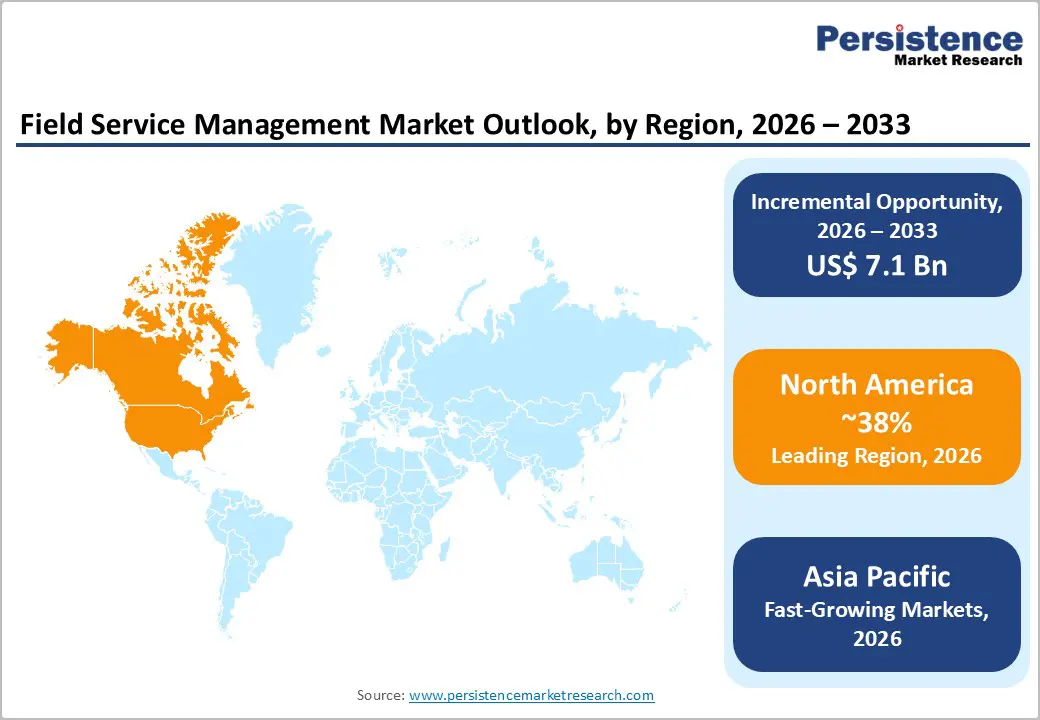

North America holds over 38% share by 2026, reaching a value of US$ 2.1 Bn, driven by its established digital infrastructure, high cloud adoption, and strong investments from technology leaders. The region leads in FSM innovation, with major vendors like Salesforce, Microsoft, Oracle, and ServiceNow fostering continuous technological advancements and competitive intensity. Strict regulatory frameworks and industry-specific compliance mandates have spurred robust security and compliance features in solutions. North America's prominence is further supported by the highest enterprise technology spending globally, over 40% of worldwide software spend and deep integration between FSM platforms and adjacent business systems.

Asia-Pacific is expected to grow at the highest rate, with a CAGR of 17.3%, driven by rapid industrialization, SME digital transformation, and the widespread adoption of mobile and cloud technologies. China, India, and ASEAN present significant opportunities due to expanding e-commerce, logistics, and government-backed digital initiatives, with India expected to grow at 21.4% CAGR through 2033. Lower labor costs, increasing demand for real-time service delivery, and high digital readiness, 71% of Indian employees showing advanced digital maturity, and 56% of urban adults using generative AI, further accelerate FSM adoption. ASEAN’s Digital Masterplan 2025, which emphasizes broadband expansion and digital services, supports the proliferation of cloud FSM.

Europe is expected to account for more than 25% of the market by 2026, led by Germany, the UK, France, and Spain, driven by digital transformation initiatives and stringent quality standards. Regulatory compliance, particularly the GDPR, shapes FSM solutions with respect to data protection, access controls, and auditing. Germany’s growth is driven by Industry 4.0 and manufacturing demand, whereas the UK benefits from digital mandates and telecommunications investments. Enterprises increasingly adopt cloud-based FSM for scalability, although on-premises solutions remain relevant in highly regulated sectors such as finance and healthcare. By 2025, 20% of EU enterprises with 10+ employees use AI, up 6.5% points from 2024, supporting intelligent FSM features such as predictive scheduling.

The field service management (FSM) market is largely fragmented, with numerous global and regional players vying for market share through technology innovation and service differentiation. Companies are focusing on offering cloud-based and AI-driven solutions to enhance scheduling, workforce optimization, and real-time reporting. Strategic partnerships, such as integrations with CRM and ERP platforms, are leveraged to provide end-to-end service management. Vendors emphasize customer-centric approaches by offering modular, scalable solutions tailored to industry-specific needs, while also investing in after-sales support and training to strengthen client retention and loyalty.

The global field service management market is projected to be valued at US$5.6 Bn in 2026.

Organizations require real-time visibility, mobile enablement, and data-driven automation to enhance customer experience while lowering operational costs is a key driver of the market.

The market is expected to witness a CAGR of 12.4% from 2026 to 2033.

AI-driven predictive maintenance, automated scheduling, and remote diagnostics that improve service efficiency and uptime are creating strong growth opportunities.

Salesforce, Inc., Oracle Corporation, Microsoft Corporation, SAP SE, ServiceNow, Inc., and IFS AB are among the leading key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Offering

By Deployment

By Enterprise Size

By Application

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author