ID: PMRREP33147| 210 Pages | 9 Jan 2026 | Format: PDF, Excel, PPT* | Semiconductor Electronics

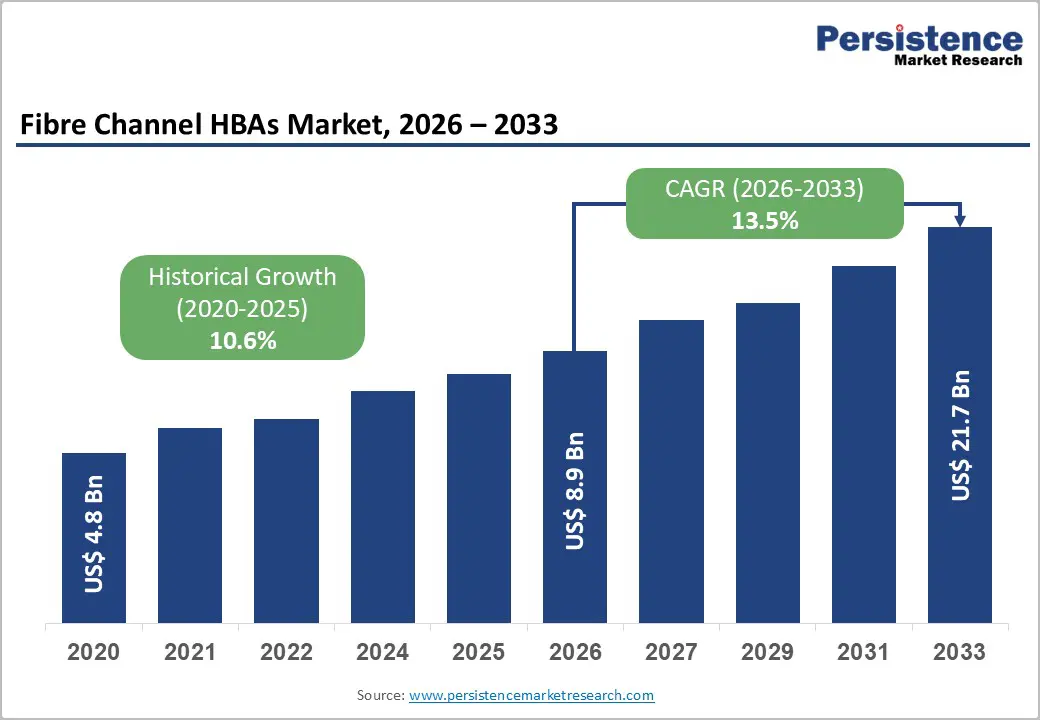

The global fibre channel HBAs market size is projected to rise from US$8.9 billion in 2026 to US$21.7 billion by 2033. It is anticipated to witness a CAGR of 13.5% during the forecast period from 2026 to 2033.

The proliferation of all-flash and NVMe-based storage systems, rising data volumes from IoT and analytics, and the need for secure, redundant, and high-throughput interconnects are driving the demand. Stringent data protection regulations and an enterprise focus on operational efficiency are further fueling market adoption.

| Key Insights | Details |

|---|---|

| Fibre Channel HBAs Market Size (2026E) | US$8.9 Bn |

| Market Value Forecast (2033F) | US$21.7 Bn |

| Projected Growth (CAGR 2026 to 2033) | 13.5% |

| Historical Market Growth (CAGR 2020 to 2025) | 10.6% |

Rising adoption of cloud computing, AI, and virtualization is driving demand for ultra-reliable, low-latency storage connectivity in data centers. Fibre channel HBAs enable high-throughput data transfer between servers and storage arrays, supporting all-flash and NVMe-based systems, while dual- and quad-port configurations ensure redundancy and load balancing. Global hyperscale and colocation data centers are expected to add ~10 GW in 2025, with ~7 GW already completed, reflecting a massive expansion of high-speed infrastructure. Nearly 6 billion people (~75% of the global population) were online in 2025, with 240 million more connected that year, fueling exponential growth in data consumption and real-time analytics workloads. This drives consistent investment in high-performance storage networking solutions, reinforcing strong market growth for Fibre Channel HBAs.

NVMe-oF adoption and the rapid shift toward virtualized and hybrid cloud storage are increasing demand for high-throughput storage connectivity in data centers. Fibre Channel HBAs enable lossless, deterministic performance and redundancy required to fully realize NVMe-oF benefits in AI, analytics, and real-time transaction workloads. As enterprises deploy all-flash arrays and software-defined storage, FC HBAs ensure consistent performance, data integrity, and high availability. With around 50% of global data expected to reside in cloud environments by 2025, data center operators are expanding FC HBA deployments to handle rising east-west storage traffic. This is further reinforced by regulatory requirements such as GDPR, which drive the modernization of secure, encrypted storage networks.

Fibre Channel HBAs face growing competitive pressure from alternative storage networking technologies such as iSCSI and high-speed Ethernet, which offer lower cost per port and simplified network convergence. Rapid adoption of 25/100/400 GbE and NVMe-oF, which delivers sub-10-microsecond latency over Ethernet, is reducing reliance on dedicated fibre channel infrastructure. The increasing maturity of software-defined storage and hyperconverged infrastructure enables enterprises to consolidate compute, storage, and networking on a unified Ethernet fabric. As organizations prioritize total cost of ownership, interoperability, and future-ready roadmaps, many reassess legacy Fibre Channel deployments, slowing incremental HBA adoption despite Fibre Channel’s continued reliability advantages in mission-critical workloads.

High initial capital investment remains a key restraint, particularly among SMEs with limited IT budgets. Individual fibre channel HBAs typically cost between US$ 500 and US$ 2,000, and when combined with fibre channel switches, optical cabling, and SAN management software, total deployment costs become prohibitive. Unlike Ethernet-based alternatives, Fibre Channel also requires specialized infrastructure and skilled personnel, increasing the total cost of ownership. These cost and complexity factors restrict adoption primarily to large enterprises and hyperscale data centers, limiting penetration in mid-market and emerging organizations.

Enterprises are modernizing data centers by replacing hybrid and disk-based storage with all-flash arrays to achieve sub-100-microsecond latency and multi-million IOPS performance. To fully utilize these capabilities, organizations are upgrading from legacy 16G/32G links to higher-bandwidth fibre channel HBAs, particularly 64G, which eliminate interconnect bottlenecks and deliver deterministic, lossless performance. This transition is especially critical for BFSI, cloud service providers, and data-intensive enterprises relying on deduplication, compression, and NVMe-based workloads. Fibre channel HBAs are increasingly viewed as essential infrastructure during enterprise-wide storage refresh and modernization cycles.

The rapid growth of AI, machine learning, and large language model training is creating strong demand for ultra-low-latency, high-throughput storage networking. AI-optimized servers require sustained, parallel access to petabyte-scale training datasets, where fibre channel HBAs combined with all-flash storage ensure predictable latency, lossless data transfer, and maximum GPU utilization. Compared to Ethernet-based alternatives, Fibre Channel offers superior reliability, security, and isolation, key requirements for regulated sectors such as BFSI, healthcare, and government. This wave of first-generation AI and HPC infrastructure investments represents a significant incremental growth opportunity for vendors.

Emerging regulatory mandates such as CNSA 2.0 (US), NIS 2, and DORA (EU) are compelling enterprises to deploy post-quantum cryptography across all data-in-transit paths, including storage networks, creating a new security-driven demand layer for fibre channel HBAs. Broadcom’s Emulex Secure Fibre Channel HBAs, which provide hardware-level, line-rate encryption between servers and storage, demonstrate how compliance can be achieved without performance degradation or full infrastructure replacement. As ransomware risks and quantum-enabled cryptanalysis intensify, enterprises are prioritizing secure, compliant storage interconnects, positioning encrypted fibre channel HBAs as a high-growth opportunity within next-generation data center security architectures.

Dual-port FC HBAs dominate the global market, capturing more than 54% of market share in 2026 with a market value exceeding US$ 4.8 Bn. These adapters provide redundancy and load-balancing, allowing organizations to distribute storage network traffic across multiple fabric connections and maintain continuous service availability during maintenance or infrastructure failures. Their ability to ensure reliable, high-performance connectivity makes them the preferred choice for mission-critical environments.

Quad-port FC HBAs are projected to grow at a CAGR of 19.3% due to increasing demand for high-performance, highly redundant storage networks. Organizations seek to consolidate storage IO requirements onto fewer physical cards, reducing infrastructure complexity while improving per-server bandwidth density. It is particularly attractive for high-density data center implementations, virtualized server environments with elevated storage requirements per physical host, and organizations pursuing infrastructure consolidation initiatives.

32 GBPs are expected to account for over 39% share, with value exceeding US$ 3.5 Bn in 2026, as enterprises and data centers need higher bandwidth and lower latency to support modern workloads such as all-flash storage, virtualization, and large database applications. It delivers significantly more throughput and I/O performance than earlier 16 Gbps systems, helping data-intensive operations scale without bottlenecks and improving server/storage efficiency. They also provide future-proofing and backward compatibility with existing fibre channel infrastructures, making upgrades attractive for long-term IT planning.

64 Gbps is expected to grow significantly, driven by emerging requirements for ultra-high-bandwidth applications and next-generation server CPU capabilities. Organizations deploying AI-optimized infrastructure and high-performance computing environments are increasingly standardizing on 64 Gbps adapters to ensure storage network performance matches computational resource capabilities. Broadcom's first-to-market advantage with Emulex 64 Gbps products, combined with integrated security features, has positioned the company to capture disproportionate share growth within this segment.

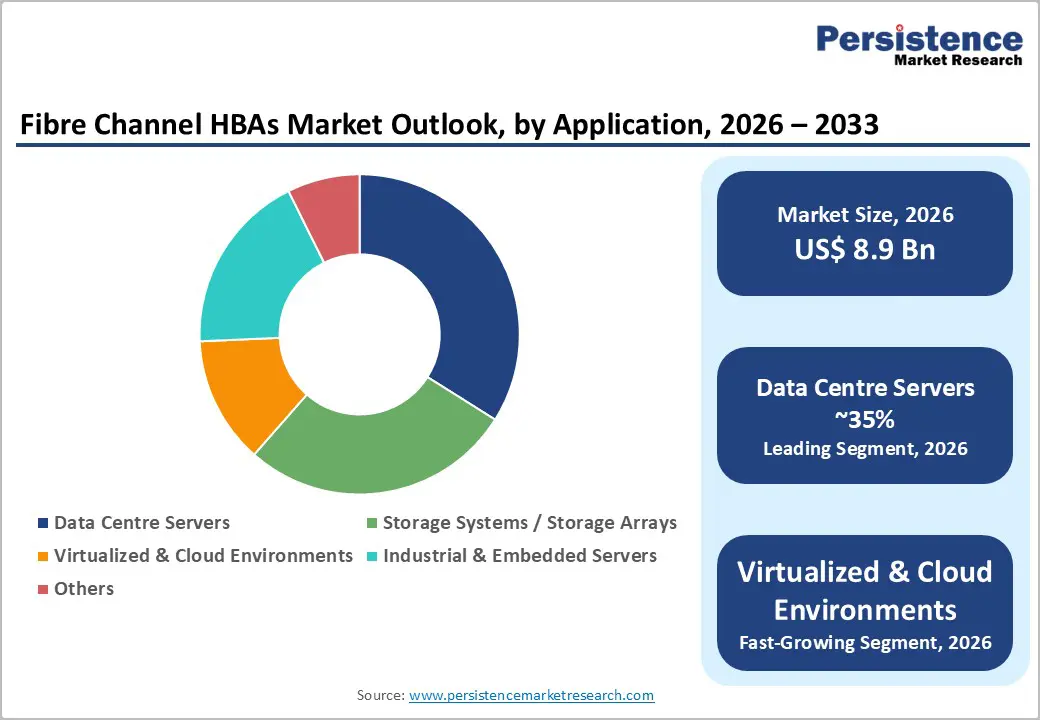

Data centre servers are expected to account for more than 35% share with value reaching more than US$ 3.1 Bn in 2026. They require high-speed, low-latency storage connectivity to support massive data processing and virtualization workloads. Enterprises rely on these servers to handle massive data traffic, ensuring uninterrupted access and data integrity. It meets the need for reliable, scalable, and high-performance storage networking, which is essential for data centres managing cloud services, AI workloads, and enterprise storage solutions.

Virtualized and cloud computing environments are expected to grow at a CAGR of 17.9%. Organizations worldwide are migrating workloads to virtualized infrastructure and cloud-native architectures, requiring storage connectivity solutions that maintain performance and reliability across multiple virtual machines and dynamic resource-allocation scenarios. Cloud service providers are expanding infrastructure deployments globally, creating substantial downstream demand within their data center networks.

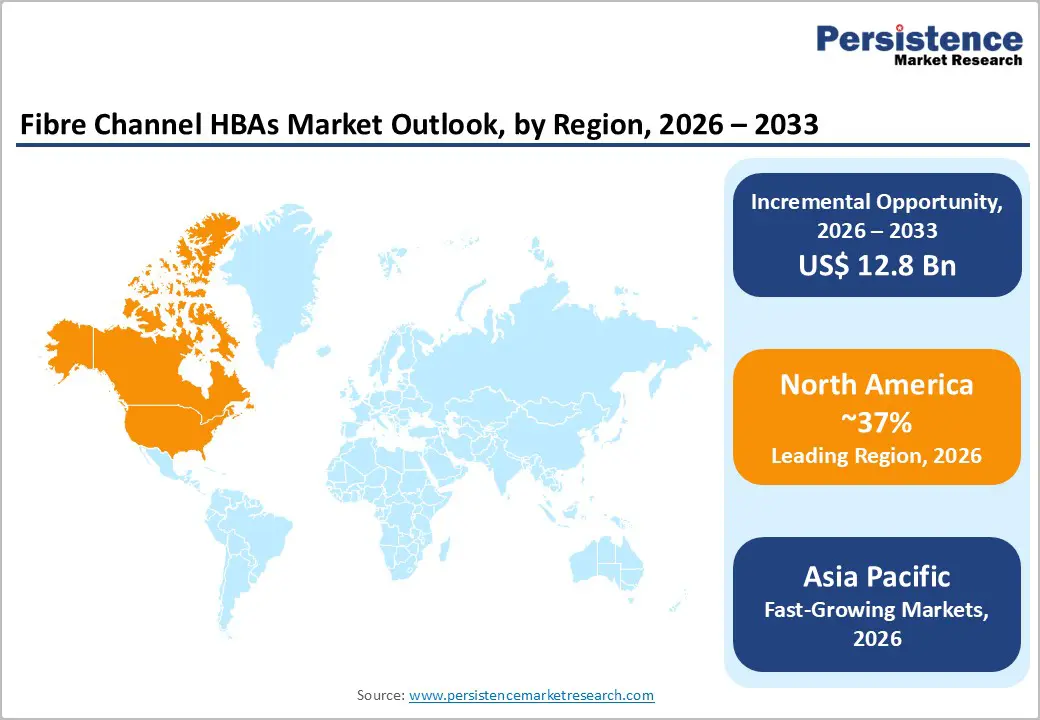

North America is expected to dominate the fibre channel HBAs market with over 37% share in 2026, valued at more than US$ 3.3 Bn, driven by a high concentration of enterprise data centers, cloud providers, and advanced IT infrastructure. The U.S. market alone is projected to exceed US$ 4.9 Bn by 2033, fueled by AI infrastructure investments, digital transformation, and hyperscale data center expansions requiring high-throughput, low-latency storage connectivity. Regulatory emphasis on data security and availability reinforces fibre channel adoption, while government reports highlight that computing loads already accounted for ~8% of commercial electricity consumption in 2024, reflecting rising SAN infrastructure investments to support cloud and AI workloads.

Asia Pacific is the fastest-growing market, projected to exceed US$ 8.7 Bn by 2033 at a CAGR of 18.4%, driven by China’s data center expansions, 5G investments, and energy-efficient refresh programs targeting PUE <1.5. India’s emerging technology sector, public-sector data center consolidation, and cloud-on-prem migrations are fueling strong demand with a CAGR of 21.8%. Japan emphasizes compliance with digital infrastructure guidance, low-power and AI-ready integrations, and long-term enterprise storage support. Southeast Asian countries, including Singapore, are encouraging hyperscaler and regional data center growth through initiatives like the Green Data Centre Roadmap, creating opportunities for value-oriented HBA solutions. China is expected to surpass US$ 1.0 Bn by 2026, while Japan is likely to hold over 18% of the regional share.

Europe’s fibre channel HBA market is growing at 14.1% CAGR, driven by regulatory focus on data sovereignty, cybersecurity, and sustainable ICT procurement. Germany, holding approximately 23% share, along with the UK and France, leads growth due to industrial demand, GDPR compliance, and substantial investments in data center infrastructure, with the UK hosting 1.6 GW of colocation IT power and the Netherlands’ data centers consuming 5,100 GWh. Enterprises across manufacturing, automotive, pharmaceutical, and finance sectors favor reliable, energy-efficient SAN fabrics, sustaining demand for Fibre Channel HBAs even as NVMe-oF adoption grows. Key vendors, including HPE, Broadcom, and IBM, benefit from a preference for established providers with local support and regulatory alignment, while phased upgrades in mixed-storage environments continue to drive HBA purchases.

The fibre channel HBA market is moderately consolidated, with a few global vendors holding a dominant share alongside smaller niche players. Companies are primarily competing through technology leadership, focusing on higher port speeds, low-latency performance, and enhanced reliability for mission-critical workloads. Strategic partnerships with server OEMs and storage vendors are used to strengthen ecosystem integration and secure long-term supply contracts. Vendors also emphasize firmware innovation, backward compatibility, and certification with enterprise operating systems.

The global fibre channel HBAs market is projected to be valued at US$8.9 Bn in 2026.

The need for high-speed, low-latency, and reliable storage connectivity to support data-intensive applications is a key driver of the market.

The market is expected to witness a CAGR of 13.5% from 2026 to 2033.

The growing artificial intelligence infrastructure development and high-performance computing adoption are creating strong growth opportunities.

Broadcom, IBM, Dell Inc., Hewlett Packard Enterprise Development LP, Microchip Technology Inc., NVIDIA, ATTO Technology, Inc. are among the leading key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Port Configuration

By Data Rate

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author