ID: PMRREP33542| 220 Pages | 11 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

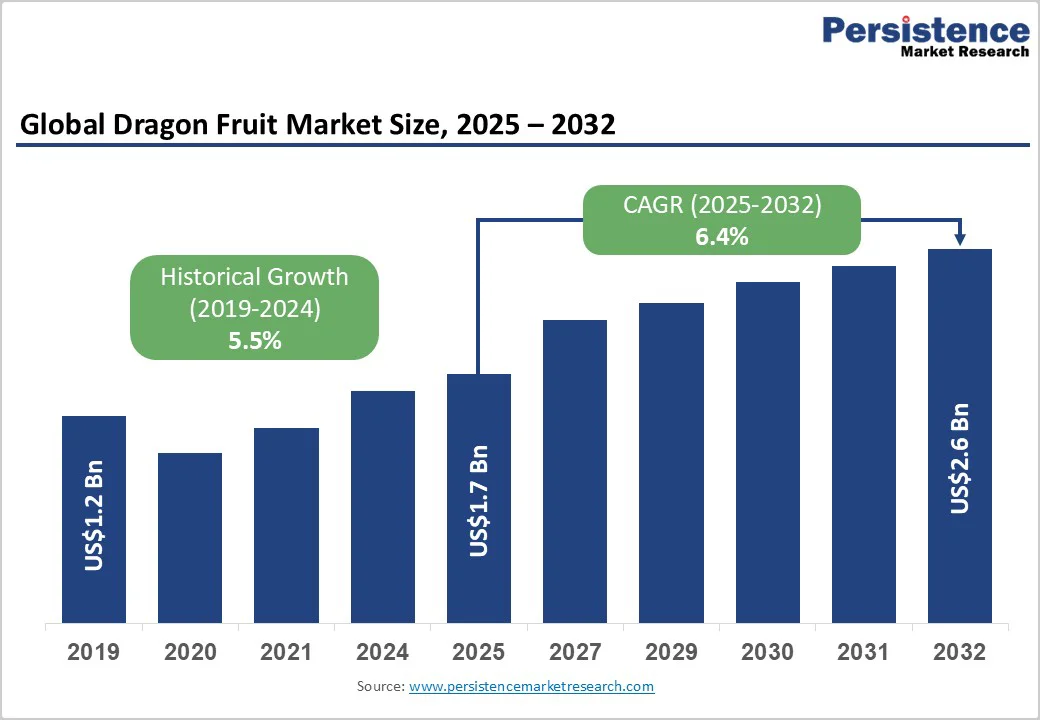

The global dragon fruit market size is likely to be valued at US$1.7 Billion in 2025 and is expected to reach US$2.6 Billion by 2032, growing at a CAGR of 6.4% during the forecast period from 2025 to 2032, driven by increasing consumer demand for nutrient-dense “superfruits,” the expansion of processing value chains (frozen pulp, puree, powder, and natural colorants), and the geographic scale-up of production in Southeast Asia and Latin America.

Rising retail penetration via supermarkets and e-commerce, along with expanding ingredient use across the food, beverage, and personal care sectors, is set to nearly double the market’s value between 2025 and 2032 amid sustained consumption and processing growth.

| Key Insights | Details |

|---|---|

| Dragon Fruit Market Size (2025E) | US$1.7 Bn |

| Market Value Forecast (2032F) | US$2.6 Bn |

| Projected Growth (CAGR 2025 to 2032) | 6.4% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.5% |

Global demand for dragon fruit is rising as consumers favor antioxidant- and fiber-rich diets. Processed forms such as purees and powders ensure a year-round supply, supporting their use in smoothies, nutraceuticals, and beverages. Rich in vitamin C, fiber, and pigments, dragon fruit is growing nearly 8% annually as a mainstream superfruit..

The Asia Pacific region, particularly Vietnam, continues to expand dragon fruit cultivation and output. Vietnam’s production stood at approximately 1.2 million metric tons in 2019 and has since increased steadily, supplying both export and domestic processing markets.

Enhanced acreage, mechanized cultivation, and investment in post-harvest facilities have improved export capacity while lowering per-unit costs. These factors strengthen the export competitiveness of Southeast Asian producers and enable them to serve growing demand from China, Japan, and Western markets.

The development of the dragon fruit powder and puree industry is transforming the market’s economic profile. Powder and dried formats generate significantly higher margins than raw exports by extending shelf life and allowing use in a wide range of industrial applications-beverages, natural colorants, confectionery, and cosmetics. The value captured through processing has encouraged investments in drying, freeze-drying, and micronization facilities, allowing exporters to stabilize returns and expand into high-value ingredient markets.

Dragon fruit is highly perishable, and limited cold-chain infrastructure in some producing regions leads to considerable post-harvest losses. Exporters report potential quality losses ranging from 5% to over 10% when temperature controls are inadequate.

Volatile freight rates further impact landed costs for long-distance exports, constraining competitiveness in Europe and North America. These logistics challenges limit smallholder profitability and encourage producers to integrate into processing or cooperative models to mitigate risk.

Export access to major markets such as the U.S., the European Union, and China is subject to stringent phytosanitary standards and pesticide-residue limits. Shifts in import protocols, such as China’s tighter inspection rules during 2022 - 2024, caused notable export disruptions.

Compliance requires continuous investment in traceability, certification, and testing infrastructure, which can be cost-prohibitive for smaller exporters. These structural barriers slow market entry and lead to short-term trade volatility.

The scaling of dragon fruit powder, puree, and colorant processing presents one of the most lucrative market opportunities. Industry assessments indicate double-digit growth in powdered ingredients, particularly for use in beverages, dairy, and natural cosmetics.

Capturing even a modest share of the global fruit-ingredient market could translate to additional multimillion-dollar revenues for processors. Investments in organic certification, freeze-drying technologies, and non-GMO compliance enhance competitiveness and premium pricing potential.

Foodservice operators and retailers in North America and Europe are increasingly introducing dragon-fruit-based SKUs such as smoothie bowls and frozen purées. These premium products often command 20-40% higher margins than standard fruit SKUs.

Consumer appeal is supported by the fruit’s vibrant color and wellness positioning. For producers and exporters, forming co-branding or private-label partnerships with established foodservice and health-food chains offers a clear path to higher profitability and brand visibility.

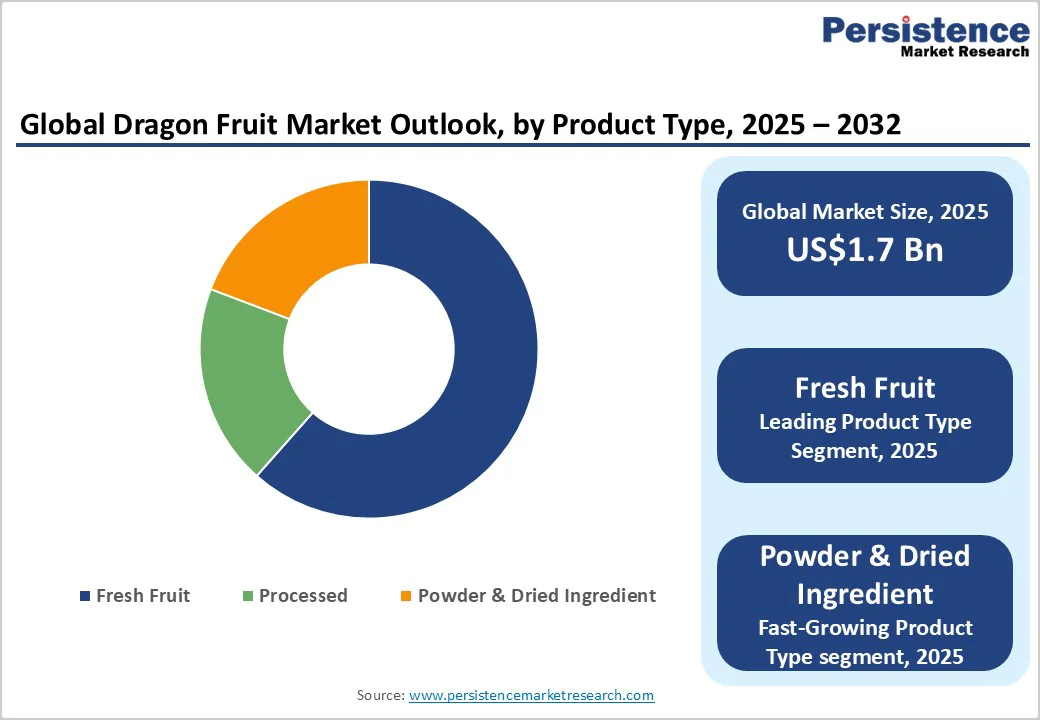

Fresh dragon fruit dominates the global market, representing over 64% of the total sales value in 2025 and serving as a key source of income for smallholder farmers and large plantations across Vietnam, Thailand, Colombia, and Nicaragua-the world’s leading exporters. Strong demand from China, the European Union, and the United States continues to drive exports, supported by consumer preference for low-calorie, high-fiber fruits.

Vietnam alone accounts for nearly 50% of global exports, leveraging specialized red- and white-flesh varieties such as Hylocereus undatus and Hylocereus costaricensis. Advances in cold-chain logistics, including vacuum-cooled containers and modified-atmosphere packaging, have extended shelf life by 25-30%, reducing losses and improving export margins.

The powdered and dried dragon fruit segment is experiencing rapid growth, fueled by rising global demand for superfood ingredients rich in natural colorants and antioxidants. Powder forms are increasingly used in functional beverages, protein blends, smoothies, bakery fillings, and skincare formulations, while dried slices and flakes cater to health-focused snacks and food-service markets.

Producers in Vietnam, Malaysia, and Thailand are investing in freeze- and spray-drying technologies to enhance nutrient retention and color stability. With organic and non-GMO certifications expanding access to premium markets, this segment stands as the most promising growth driver of the decade.

The food and beverage segment dominates the dragon fruit market, accounting for approximately 69% of total end-use consumption in 2025. Its appealing texture, mild sweetness, and high antioxidant content make it a favored ingredient in smoothies, juices, frozen desserts, dairy alternatives, and ready-to-drink wellness beverages.

Natural pigmentation and high betalain content have further driven its adoption as a clean-label food colorant, replacing synthetic dyes in confectionery and dairy products. Global brands such as PepsiCo’s Naked Juice, Tropicana, and Starbucks have launched limited-edition dragon-fruit beverages, leveraging both visual appeal and health benefits.

In Asia, companies such as F&N Foods (Singapore) and C2 Beverage (Vietnam) have introduced dragon-fruit juice variants targeting the functional drink segment. Its versatility extends to bakery applications, including bread, yogurts, and pastries, providing natural color and flavor enhancement.

Cosmetics and personal-care applications are emerging as a fast-growing, high-value vertical for dragon-fruit derivatives. Rich in antioxidants, vitamin C, betalains, and phenolic compounds, dragon fruit supports skin-brightening, anti-aging, and UV-protection formulations. Extracts from red-flesh varieties increasingly replace synthetic pigments and antioxidants in premium skincare and hair-care products.

Global brands such as L’Oréal, The Body Shop, and Innisfree incorporate dragon-fruit extracts to appeal to natural wellness and sustainability trends, while local companies in Thailand and South Korea develop organic serums, masks, and exfoliants for the expanding clean-beauty segment. Its natural color, mild aroma, and nutrient profile enhance product appeal and formulation versatility.

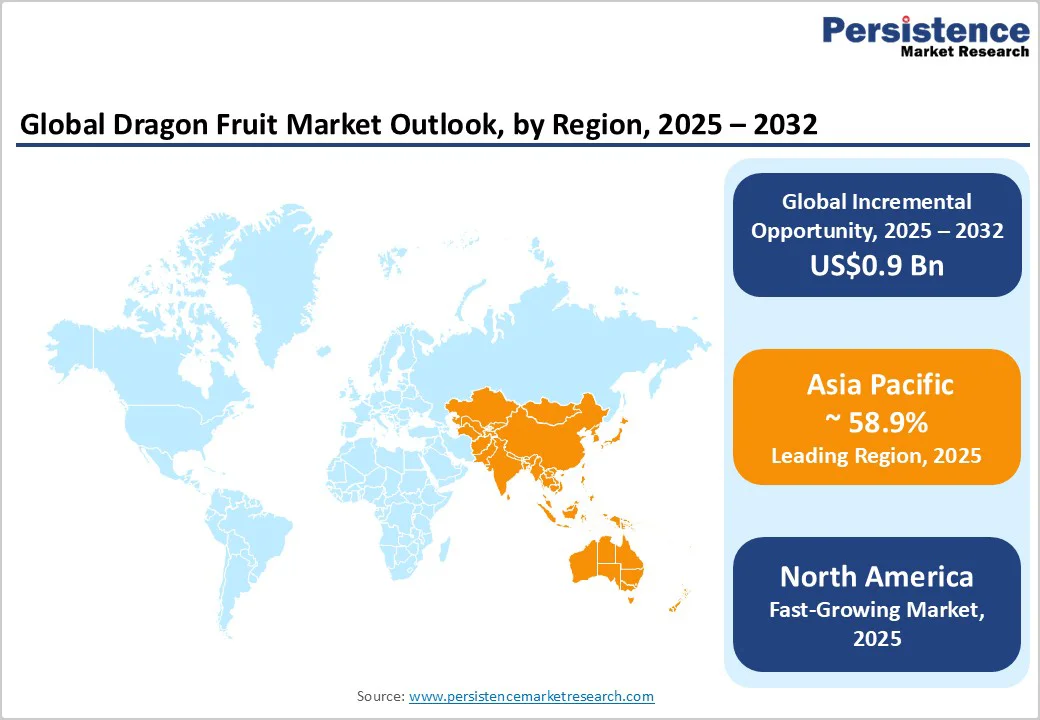

North America, led by the United States, is a significant value market for dragon-fruit consumption, despite limited domestic production. The region relies heavily on imports from Vietnam, Ecuador, and Nicaragua, with the U.S. market showing strong demand for frozen and purée formats used in smoothies, bakery fillings, and health-focused desserts.

In Canada, natural fruit powders are increasingly incorporated into packaged functional foods. Rising adoption of wellness cafés and plant-based dining has enhanced dragon fruit’s visibility as a clean-label, antioxidant-rich superfruit ingredient.

Key growth drivers include the expansion of smoothie bowls and cold-press beverages, a strong presence of branded frozen fruit companies offering ready-to-use products, and sustained consumer demand for naturally colored, nutrient-dense ingredients. Regulatory compliance under the FDA and USDA, including HACCP and BRC certifications, favors certified importers and processors capable of meeting stringent safety and labeling standards.

Notable developments include Dole Packaged Foods’ April 2024 launch of frozen dragon-fruit cubes across U.S. retail chains, addressing consumer demand for convenient superfruit options, and Pitaya Foods’ January 2025 introduction of ready-to-blend smoothie kits.

Mexico is emerging as a promising production hub, with investments in pitahaya cultivation in Jalisco and Yucatán aimed at reducing import dependence and boosting local processing capacity. These initiatives are expected to strengthen regional supply chains, improve year-round availability, and support growing consumer interest in functional and health-focused products.

Europe represents a significant consumption hub for both fresh dragon fruit and processed derivatives, with Germany, the U.K., France, and Spain serving as key markets. Demand is driven by the region’s preference for clean-label ingredients and natural food colorants.

The adoption of exotic fruits in premium grocery formats continues to grow, particularly across Western Europe, where dragon fruit features prominently in health-oriented beverages, yogurts, and ready-to-eat breakfast products.

The region’s growth momentum is supported by the integration of natural pigments in food manufacturing, the rise of health-focused foodservice outlets, and the increasing shelf presence of tropical fruit SKUs in high-end retail chains. Germany and the U.K. exhibit the highest per-capita expenditure on organic and functional foods, while Spain acts as a vital import and re-export hub within the EU.

The regulatory framework, governed by EFSA and reinforced by MRL and traceability requirements, has raised compliance costs but simultaneously enhanced brand credibility. Recent developments include Innocent Drinks’ 2024 launch of a dragon-fruit-based smoothie line across the U.K. and Germany and Alnatura’s 2023 pilot project for natural pigment use in yogurt formulations.

Among country-specific insights, the Netherlands has positioned itself as a central distribution and ripening hub for imported dragon fruit within Europe, leveraging its advanced cold-chain logistics and proximity to major ports such as Rotterdam.

Asia Pacific is the largest production hub and most dynamic export region for dragon fruit, with Vietnam, Thailand, Malaysia, and China accounting for over 80% of global exports. Vietnam leads production, exceeding 1.2 million metric tons in 2019, supported by mechanized farming and enhanced cold-chain infrastructure.

Key consumption markets include China and Japan, whose import regulations and seasonal preferences significantly influence global trade and pricing. India and ASEAN countries are emerging domestic markets, driven by urban dietary shifts and expanding processing capabilities.

Growth is fueled by export-oriented cultivation in Vietnam and Thailand, rising domestic demand in India and the Philippines, and investments in puree and drying facilities catering to global food and cosmetics industries. Regulatory frameworks, including China’s inspection standards and Japan’s import certifications, shape trade dynamics and quality compliance.

Recent developments highlight regional modernization and market expansion: Vietnam partnered with Charoen Pokphand Group in 2024 to upgrade post-harvest processing, while Thailand launched a 2023 initiative to establish a dragon-fruit export cluster targeting the Middle East and Australia.

In India, government-supported programs under the Mission for Integrated Development of Horticulture (MIDH) are promoting pitaya cultivation in Maharashtra and Karnataka, boosting farmer incomes and reducing import reliance. These strategies reinforce Asia Pacific’s dominance in production, exports, and supply-chain efficiency, while tapping growing domestic and international demand.

The global dragon fruit market is moderately fragmented, with numerous small-scale producers supplying fresh fruit and a smaller group of specialized processors and branded ingredient suppliers dominating higher-value segments.

The farming base remains largely decentralized, but concentration increases among exporters and processors who operate integrated supply chains. The market structure consists of three tiers: large-scale exporters and processors, branded frozen and powder companies, and smallholder cooperatives and contract farmers.

Prevailing strategies include vertical integration to control supply quality, product diversification from fresh to powdered and frozen formats, and the pursuit of organic and sustainability certifications. Leading firms also leverage brand partnerships and co-manufacturing arrangements to penetrate high-value retail markets.

The global dragon fruit market size is estimated at US$1.7 Billion in 2025.

By 2032, the dragon fruit market is expected to reach a value of US$2.6 Billion.

Key trends include rising demand for natural colorants and antioxidant-rich ingredients, the growth of freeze-dried and powdered formats for nutraceutical and cosmetic use, and the integration of dragon fruit into ready-to-drink functional beverages and clean-label snacks.

The fresh fruit segment remains dominant, accounting for nearly 64% of total market revenue in 2025. The segment benefits from established export channels in Vietnam, Thailand, and Colombia, serving major markets, including China, the U.S., and the EU.

The dragon fruit market is projected to grow at a CAGR of 6.4% from 2025 to 2032.

Major companies include Dole Packaged Foods, LLC, Pitaya Foods, Nam Viet Foods & Beverage Co., Ltd., Charoen Pokphand Group, and Tropical Pure Company.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author