ID: PMRREP33395| 200 Pages | 8 Jan 2026 | Format: PDF, Excel, PPT* | Semiconductor Electronics

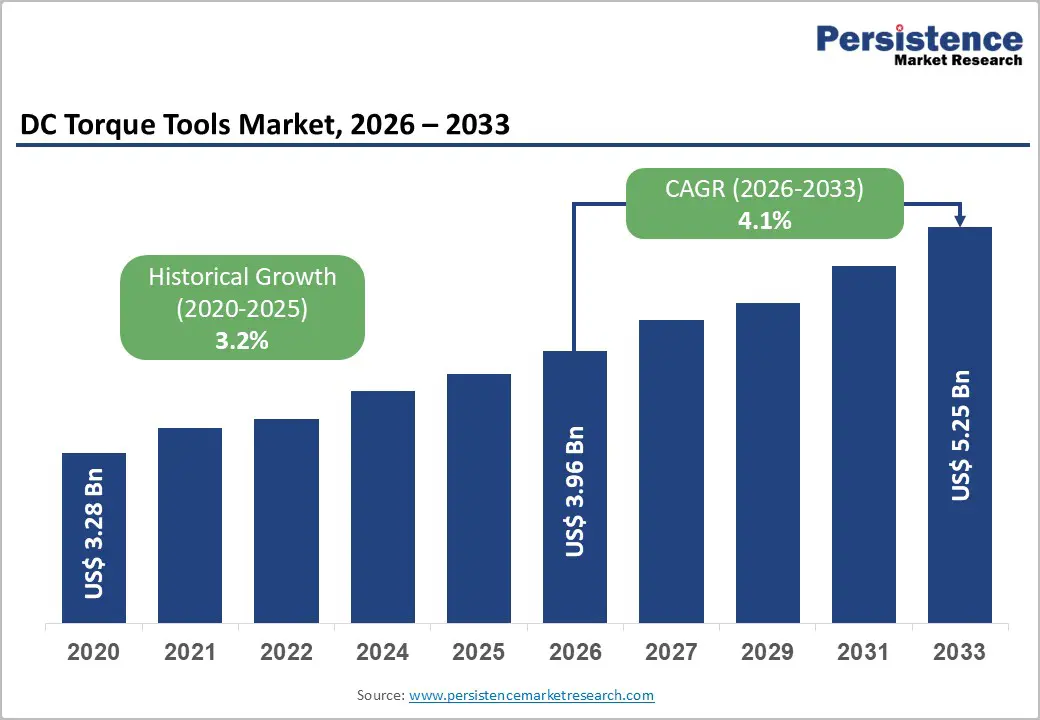

The global DC torque tool market size is supposed to be valued at US$ 3.96 billion in 2026 and is projected to reach US$ 5.25 billion by 2033, growing at a CAGR of 4.1% between 2026 and 2033.

This trajectory is primarily driven by increasing automation in manufacturing processes and the rising demand for precision assembly across multiple end-use industries. The automotive sector's transition to electric vehicles demands highly accurate torque control for battery pack assembly, while stringent safety regulations in aerospace and industrial manufacturing continue to mandate advanced torque control systems.

| Key Insights | Details |

|---|---|

| DC Torque Tool Market Size (2026E) | US$ 3.96 Bn |

| Market Value Forecast (2033F) | US$ 5.25 Bn |

| Projected Growth CAGR (2026 - 2033) | 4.1% |

| Historical Market Growth (2020 - 2025) | 3.2% |

The rapid growth of electric vehicle (EV) manufacturing has driven significant demand for DC torque tools to ensure precise torque control during battery pack assembly operations. Industry analysis indicates that proper torque application is vital for EV battery packs; only about 10% of the applied torque stretches the bolt to create the necessary preload, while the remaining 90% is lost to friction. This need for precision has prompted manufacturers to adopt automated fastening systems that can apply exact torque specifications and document each installation for quality assurance.

The global electric vehicle market is growing at approximately 60% annually, increasing production facilities and assembly requirements and creating ongoing demand for advanced torque tools. The safety-critical nature of high-voltage battery connections requires digital torque wrenches with real-time monitoring capabilities. These tools help prevent issues such as terminal damage caused by poor contact resistance, insulation failures, and residual torque, all of which can compromise battery performance and vehicle safety.

The global manufacturing sector's shift towards Industry 4.0 is driving an essential demand for connected and intelligent tooling. DC torque tools are leading this transformation because they act as edge devices that generate critical process data. In a "Smart Factory" environment, every tightening operation performed by a DC tool is recorded and timestamped for real-time analysis. This capability, known as traceability, enables manufacturers to verify that a specific bolt on a specific vehicle VIN or aircraft tail number was tightened to the required specifications.

Furthermore, integrating these tools with Manufacturing Execution Systems (MES) allows for predictive maintenance and error-proofing (Poka-Yoke). This means the tool can automatically disable itself if the operator attempts to follow an incorrect sequence, significantly reducing scrap rates and warranty claims. According to the U.S. Bureau of Labor Statistics, the manufacturing sector is expected to grow by 3.2% annually through 2029, creating a favorable environment for the adoption of precision tools that enhance efficiency. The broader power tools market is also undergoing a similar technological transformation, with manufacturers emphasizing digitalization and smart connectivity features.

A major obstacle hindering the widespread adoption of DC torque tools, especially among cost-sensitive small and medium-sized enterprises (SMEs), is their high upfront cost. A complete DC tightening system, which includes the tool, a sophisticated controller, and necessary software and cabling, can be 5 to 10 times more expensive than a comparable pneumatic (air-powered) tool.

Although the Total Cost of Ownership (TCO) for DC tools is generally lower over time due to energy savings and reduced maintenance costs, the initial capital expenditure (CapEx) remains a substantial barrier. Many general industrial manufacturers in developing regions still use pneumatic tools because they are affordable, durable, and easy to repair. The financial burden of overhauling entire assembly lines to incorporate costly electronic systems slows down the transition, particularly in sectors where safety-critical fastening is not mandated by regulations.

As DC torque tools become more connected and software-dependent, they introduce operational complexity and risk. Integrating advanced controllers into legacy production IT systems can be challenging for facility managers without specialized IT/OT skills, leading to misconfigurations that cause production downtime or data loss.

Furthermore, the connectivity that enhances these tools also opens them up to cyberattacks. A compromised controller could alter torque specifications, resulting in product failures or safety hazards. This cybersecurity risk forces companies to invest in secure network architectures and regular software updates, adding to their operational burden. Consequently, manufacturers without robust IT support may prefer to stick with mechanical or standalone electronic tools rather than embrace fully connected ecosystems.

There is a growing and lucrative opportunity for manufacturers of DC torque tools in the Maintenance, Repair, and Operations (MRO) sector, particularly in emerging economies in the Asia Pacific and Latin America. As the number of wind turbines, heavy mining machinery, and commercial aircraft increases in these regions, the demand for precise and documented maintenance becomes critical. Unlike factory production lines that use automated tools, field maintenance often relies on manual torque wrenches, which depend on the operator's skill.

However, the introduction of durable, battery-powered cordless DC torque tools allows technicians to achieve factory-level precision in remote locations, such as offshore wind farms or mining excavation sites. Companies that can develop rugged, weather-resistant, and high-torque cordless tools specifically designed for field MRO applications stand to capture a significant untapped market segment that requires reliability and data logging capabilities outside of controlled factory environments.

The growing use of collaborative robots (cobots) in assembly operations presents significant opportunities for fixtured DC torque tool systems. As manufacturers face labor shortages and aim to automate repetitive tasks, they are increasingly adopting cobots with intelligent nutrunners and screwdrivers. These automation efforts require lightweight, compact DC tools that communicate seamlessly with robotic controllers. Toolmakers can partner with major robot manufacturers like Universal Robots and Fanuc to develop integrated "plug-and-play" fastening packages. Such automated systems boost throughput and ensure consistent quality, reducing human variability.

By creating specialized tool attachments and software interfaces, companies can tap into new sub-segments in electronics assembly and general industry that were once viewed as too complex or costly for full-scale automation.

Handheld tools lead the DC torque tool market, capturing about 67% of the market share due to their versatility and ergonomic benefits. Key products like electric nutrunners and torque wrenches are widely used in automotive and aerospace applications for precise torque control. The automotive industry has a strong demand for these tools, particularly for engine assembly, chassis construction, and electronics installation, as vehicle designs become more complex. Innovations such as Atlas Copco's TurboTight and TrueAngle technologies enhance electric screwdrivers with torque and angle control, improving ergonomics and accuracy while helping identify issues such as defective components.

Cordless power tools now make up about 58% of the DC torque tool market, reflecting a strong preference for mobility and operational flexibility. This shift is driven by advancements in lithium-ion battery technology, the removal of air-compressor requirements, and improved workplace safety by eliminating trip hazards posed by pneumatic hoses and cords. They are particularly advantageous in assembly operations for large structures, such as shipbuilding and aerospace manufacturing, where mobility is crucial. Although they come with higher initial costs, they offer a favorable total cost of ownership by reducing compressed air and maintenance expenses.

The professional-grade cordless segment benefits from battery standardization, enabling a single battery to power multiple tools, enhancing efficiency and simplifying inventory. Additionally, remote applications like wind turbine installation and railway maintenance increasingly prefer cordless solutions due to limited access to electrical power.

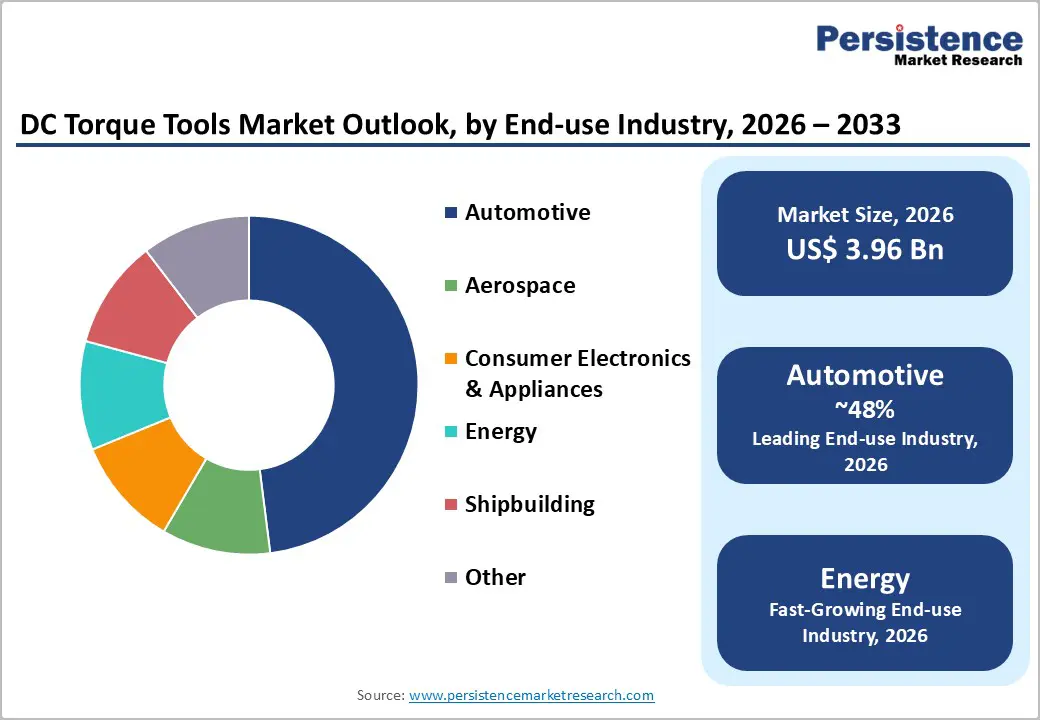

The automotive industry is the clear leader in the DC torque tool market, holding a market share of approximately 48%. This dominance is primarily due to the industry's high per-unit fastener volume and strict quality standards. A single passenger vehicle contains thousands of threaded fasteners, with hundreds classified as safety-critical.

The automotive sector was an early adopter of DC electric fastening technology to replace pneumatic tools, driven by the need for precise torque control and angle monitoring to ensure joint integrity. As the industry moves towards electric vehicle (EV) architectures, assembly complexity increases, necessitating more advanced programmable tools to accommodate diverse materials and meet higher quality standards. The ongoing investment in new model lines within the sector ensures a continued demand for high-quality tightening solutions.

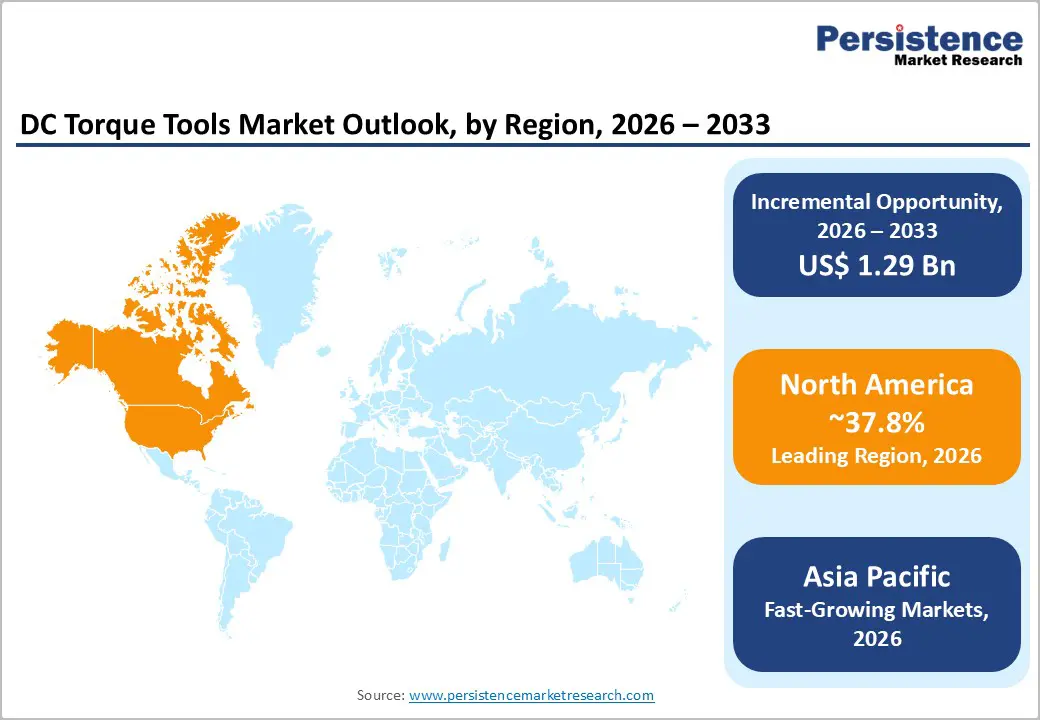

North America holds a strong position in the DC torque tool market, led by the U.S., which exhibits robust demand across the automotive, aerospace, and energy sectors. The region's innovation ecosystem fosters continuous advancements in torque tool technology. Prominent companies such as Stanley Black & Decker, Robert Bosch, and Snap-on are investing heavily in research and development, focusing on smart connectivity features, battery technology, and precision control systems.

In 2024, U.S. electric vehicle sales reached 1.56 million units, accounting for 10% of all light-duty vehicle sales. This surge is driving substantial demand for specialized torque tools intended for battery assembly and aftermarket service applications. The regulatory framework in North America emphasizes worker safety and product quality standards. As a result, manufacturers are compelled to implement torque verification systems equipped with documentation capabilities to ensure compliance.

Europe is a mature market for DC torque tools, with global manufacturers such as Robert Bosch GmbH, Hilti Corporation, and Gedore-Werkzeugfabrik GmbH. The demand for precision and quality fuels advanced torque control systems in sectors such as automotive, aerospace, and industrial machinery, with Germany, France, and the UK leading due to their strong manufacturing bases. European regulatory harmonization fosters standardized quality requirements, enhancing market access while ensuring safety standards.

The region exhibits robust adoption of Industry 4.0 principles, integrating torque tools into smart factory systems to enable real-time quality monitoring and predictive maintenance. Hilti and Bosch offer connected tool ecosystems that focus on data analytics and workflow optimization. Additionally, a commitment to sustainability emphasizes energy-efficient cordless tools made from recyclable materials. Strict aerospace regulations require detailed torque documentation for aircraft assembly and maintenance, driving demand for tools with integrated data-recording systems.

Asia Pacific is the fastest-growing market for DC torque tools, fueled by rapid manufacturing growth in China, India, Japan, and ASEAN countries. This area benefits from several manufacturing advantages, such as a skilled labor force, established industrial clusters, and government investment incentives. These factors attract global aerospace and automotive companies looking to expand their production capacity.

Airbus has forecast that the Asia-Pacific will need 19,560 new aircraft over the next 20 years, accounting for 46% of global aircraft demand. This presents significant opportunities for precision tool manufacturers that support aerospace assembly and maintenance operations. China and India are experiencing annual passenger traffic growth of 4.4%, surpassing the global average and driving increases in aircraft production, which in turn requires advanced torque tools for critical assembly applications.

The DC torque tool market is moderately consolidated, with key global manufacturers utilizing extensive distribution networks and strong brand recognition. These companies focus on technological innovation, particularly in Industry 4.0 connectivity, battery technology, and precision control, which help differentiate their premium products. Growth strategies involve targeting high-growth markets in the Asia Pacific and Latin America, driven by increased manufacturing demand. Market leaders leverage integrated software for data analytics, customizable torque settings, and strong after-sales support for calibration and maintenance.

The global market is projected to reach a valuation of US$ 5.25 billion by 2033, expanding from US$ 3.96 billion in 2026.

The surge in electric vehicle (EV) battery production and the Industry 4.0 shift toward smart, data-traceable manufacturing are the primary demand drivers.

The Handheld Tools segment, particularly electric nutrunners and screwdrivers, holds the dominant share due to their versatility and widespread application.

Asia Pacific is anticipated to be the fastest-growing region, supported by rapid industrialization and automotive manufacturing expansion in China and India.

A significant opportunity lies in developing ruggedized cordless tools for field Maintenance, Repair, and Operations (MRO) in the wind energy and mining sectors.

Key market players include Atlas Copco AB, Apex Tool Group, Makita Corporation, and Robert Bosch GmbH, among others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Tool Type

By Power Source

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author