ID: PMRREP32528| 245 Pages | 30 Dec 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

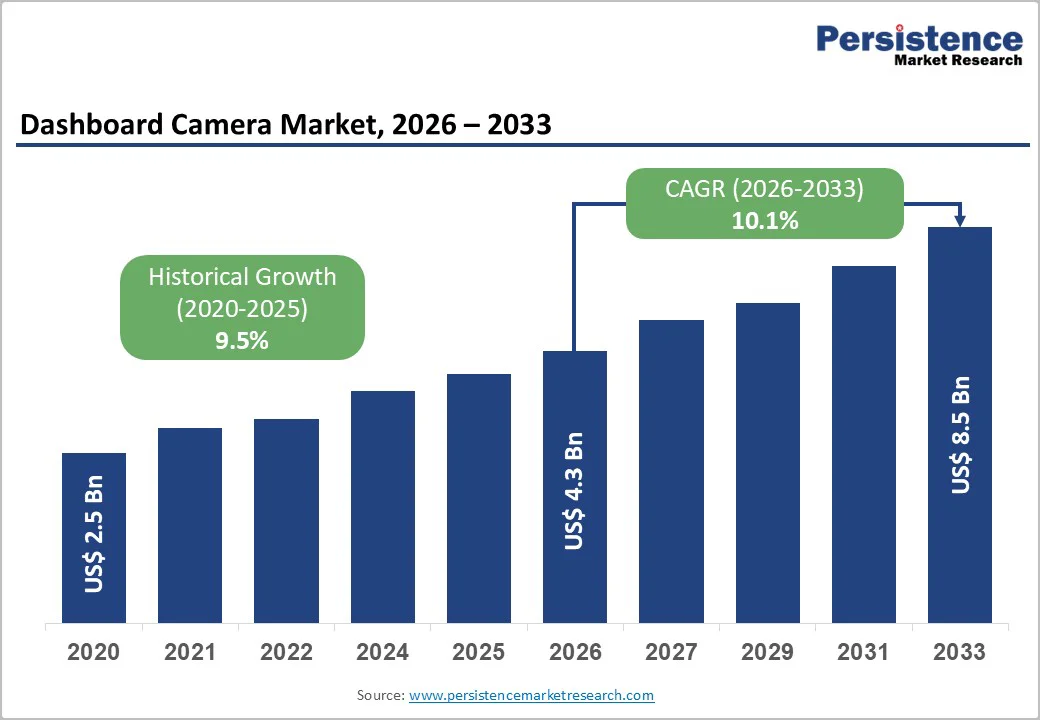

The global Dashboard Camera Market size is anticipated at US$4.3 billion in 2026 and is projected to reach US$8.5 billion by 2033, growing at a CAGR of 10.1% between 2026 and 2033.

Market expansion is driven by systematic road safety consciousness and accident prevention requirements, the insurance industry's adoption of dashboard camera footage, reducing fraudulent claims by 15% and disputed claims by 27%, and accelerating the integration of artificial intelligence and smart technology, enabling advanced safety features and telematics connectivity. North America benefits from strong fleet management mandates and commercial adoption, robust regulatory frameworks and a heightened focus on road safety anchor Europe. At the same time, Asia Pacific continues to gain momentum, driven by rapid vehicle proliferation in emerging markets and rising safety awareness.

| Key Insights | Details |

|---|---|

| Dashboard Camera Market Size (2026E) | US$ 4.3 billion |

| Market Value Forecast (2033F) | US$ 8.5 billion |

| Projected Growth CAGR (2026-2033) | 10.1% |

| Historical Market Growth (2020-2025) | 9.5% |

Road Safety Consciousness and Accident Prevention Supporting Consumer and Fleet Adoption

Road safety awareness and accident prevention requirements are systematically driving dashboard camera adoption, with the insurance industry reporting 15% reduction in fraudulent claims, unmasking 20% of fraudulent claims, and 27% decrease in disputed claims when dashcam footage is available, supporting sustained investment in advanced camera systems across commercial fleets and passenger vehicles. Commercial fleet insurance requirements mandating camera adoption. 77% of carriers plan rig upgrades with safety cameras (2025). Road accident documentation evidence collection. Liability protection for drivers and operators. Claims processing acceleration through video evidence. Consumer awareness from viral accident footage. Insurance premium incentives supporting adoption.

Artificial Intelligence Integration and Smart Safety Technology Advancement

The integration of artificial intelligence and smart safety technology is accelerating the adoption of advanced dashboard cameras, as AI-powered systems detect risky driving behaviors and reduce preventable accidents by up to 30% within the first year. Intelligent driver behavior monitoring identifies distraction and fatigue, while real-time safety alerts help prevent collisions and lane departures. Smart cameras support drowsiness detection, collision avoidance, and lane departure warnings, enhancing active safety. Cloud-based storage enables remote video access and data management, while telematics integration supports fleet analytics. Predictive maintenance connectivity and connected vehicle ecosystem compatibility position dashboard cameras as critical enablers for autonomous vehicle readiness worldwide market evolution.

High Initial Capital Investment and Installation Costs Limit Consumer Adoption

Dashboard camera market expansion is constrained by upfront capital investment requirements for advanced multi-channel systems, which range from USD 400 to 2000+, creating adoption barriers, particularly for price-sensitive consumers and small fleet operators, thereby limiting market penetration in cost-conscious segments. Professional installation costs for fleet vehicles. Subscription costs for cloud storage and telematics. Maintenance and hardware replacement requirements. System integration complexity with vehicle electronics. Data management and storage costs. Software licensing for advanced features. Financing and lease challenges. Depreciation concerns.

Data Privacy and Cybersecurity Concerns Affecting Consumer and Regulatory Acceptance

Dashboard camera market expansion is constrained by data privacy concerns with connected systems collecting personal driving data, video recordings, and location information, creating regulatory compliance complexity and consumer hesitation, limiting adoption, particularly in privacy-conscious markets and jurisdictions. Personal data protection regulations (GDPR, CCPA). Video recording consent requirements. Data storage location and security standards. Cybersecurity breach risks. Third-party data sharing concerns. Insurance data access and usage. Legal liability for privacy violations.

Electric Vehicle Integration and Autonomous Vehicle Support

Electric vehicle market expansion and autonomous vehicle development represent a significant emerging opportunity, as electric vehicles expand at 13.6% CAGR and accelerate the adoption of advanced safety electronics. Autonomous vehicle systems require comprehensive camera networks, driving demand for specialized dashboard camera platforms aligned with next-generation vehicle architectures. EV-specific safety requirements increase reliance on continuous video monitoring, while autonomous sensor networks integrate cameras with radar and LiDAR. Level 3–4 autonomy depends on 360-degree visibility, real-time data processing, and system redundancy. Dashboard cameras further support V2V communication, fleet analytics, and safety validation frameworks that are critical for regulatory approval and the scalable deployment of autonomous mobility globally.

Fleet Management Integration and Telematics Platform Convergence

Fleet management integration and telematics platform convergence represent a high-value opportunity, as AI-based in-cab video reduces risky driving by 30 percent, lowering insurance costs and legal liability. Integrated dashboard cameras enable revenue-sharing models for insurance partnerships, advanced fleet-optimization analytics, and data-driven operational insights. Continuous driver behavior monitoring supports targeted training programs, while vehicle behavior analysis enables predictive maintenance scheduling. Safety-driven route optimization improves efficiency and compliance across fleets. Real-time telematics data supports predictive insurance pricing, proactive risk scoring, and embedded risk management consulting services, positioning dashboard camera platforms as strategic intelligence hubs rather than standalone recording devices for modern fleets.

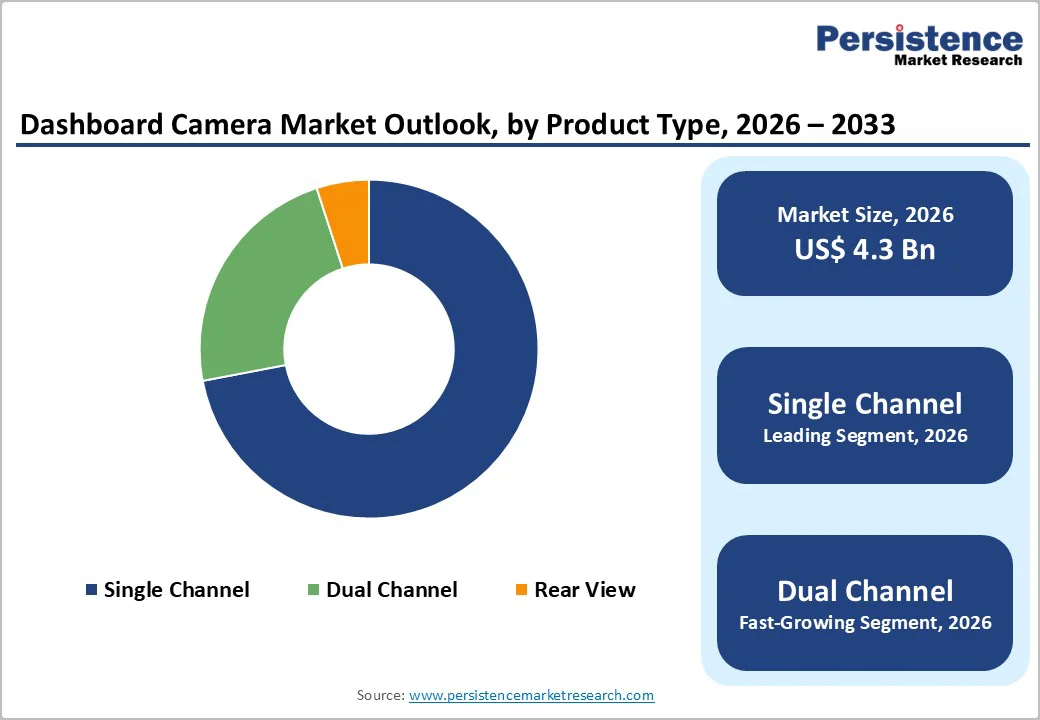

Single-channel cameras command 72% of market share, representing dominant product type reflecting cost-effectiveness and simplicity supporting broad consumer adoption across personal and small commercial vehicle segments. Front-facing recording as primary use case. Entry-level positioning supporting affordability. Space-efficient design for dashboard mounting. Straightforward operation and maintenance. Broad compatibility across vehicle types. Proven technology maturity. Service network availability.

Dual-channel cameras expand as the fastest-growing segment with 11.8% CAGR, driven by commercial fleet demand and increasing insurance requirements for comprehensive front and rear or interior monitoring, supporting the emerging high-margin segment serving commercial operators and safety-conscious consumers. Front and rear recording capabilities. Commercial fleet adoption acceleration. Insurance requirement satisfaction. Liability protection enhancement. Premium pricing support. Advanced feature integration. Emerging market differentiation.

Basic technology commands 58% of market share, representing an established standard for simple video recording without advanced features, supporting broad consumer adoption through affordability and simplicity across personal vehicle segments. Standard video recording capability. Basic storage options. Mechanical controls operation. Proven reliability and simplicity. Cost-effectiveness driving adoption. Service accessibility worldwide. Long-term maturity.

Smart technology expands as the fastest-growing segment by CAGR 13.1%, driven by AI integration, cloud connectivity, and advanced driver assistance capabilities, supporting the emerging premium segment serving tech-conscious consumers and commercial fleet operators with enhanced safety and operational benefits. AI-powered feature integration. Cloud-based storage and access. Connected vehicle ecosystem support. Advanced driver assistance features. Real-time alerts and notifications. Data analytics and insights. Future-ready architectures.

Passenger vehicles command 62% of market share, representing a dominant segment reflecting personal vehicle ownership prevalence and insurance benefits driving consumer adoption across global markets. Personal vehicle protection. Accident documentation support. Insurance premium incentives. Consumer safety focus. Aftermarket installation. Broad distribution networks. Established market maturity.

Electric vehicles expand as the fastest-growing segment of around 13.6% CAGR, driven by higher technology adoption among EV owners and emerging vehicle integration requirements, supporting specialized dashboard camera platforms supporting electric vehicle architectures and autonomous capabilities. EV owner demographics supporting tech adoption. Vehicle integration during manufacturing. Advanced feature support. Autonomous vehicle preparation. Connected ecosystem advantages. Premium positioning opportunities. Future technology readiness.

In-store retail commands 58% of market share, representing a dominant channel reflecting consumer preference for hands-on evaluation, installation service availability, and established retail networks supporting broad market penetration. Physical store accessibility. Product demonstration and assessment. Professional installation services. Customer support availability. Warranty and service networks. Established brand presence. Traditional consumer preference.

E-commerce is the fastest-growing distribution channel, growing at a 12.3% CAGR, driven by convenience, pricing transparency, and digital-native consumer preferences, supporting emerging direct-to-consumer business models and market disintermediation, enabling manufacturer direct sales. Convenience and home delivery. Price comparison and openness. Broader product selection. Customer reviews and ratings. Direct manufacturer sales models. Subscription integration with e-commerce. Digital ecosystem convergence.

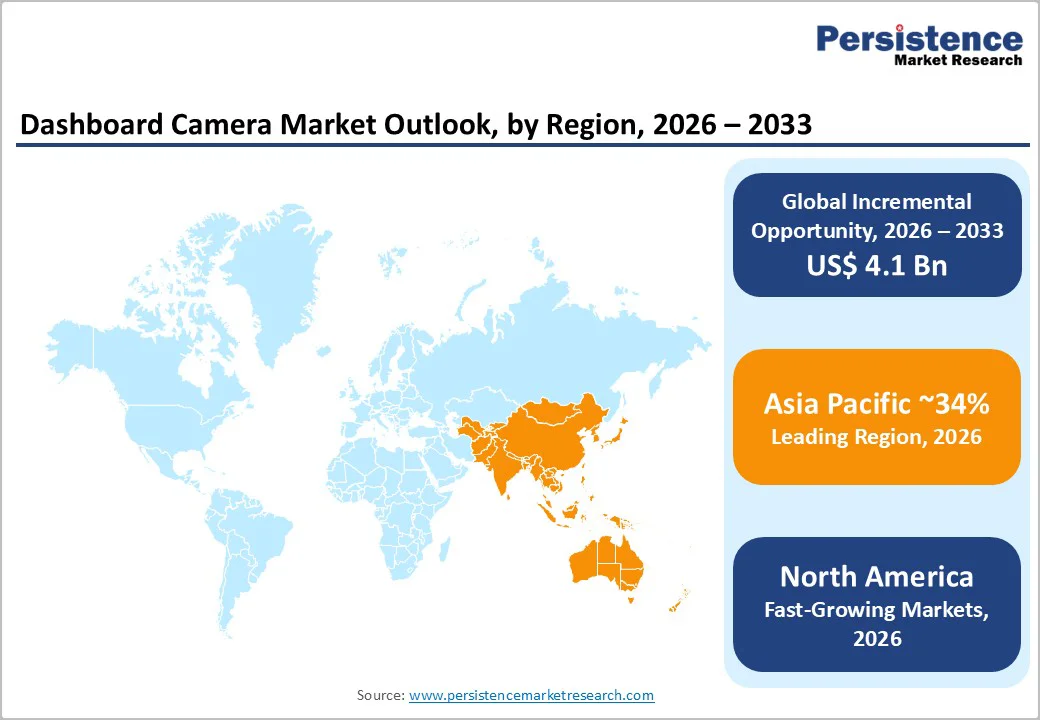

North America maintains a significant 25% market share, driven by fleet management mandates, insurance industry adoption, commercial vehicle concentration, and regulatory frameworks supporting market leadership in commercial applications. Commercial fleet adoption is driving demand. Insurance industry partnerships with manufacturers. Fleet insurance requirements. Technology innovation leadership. Government safety regulations. Established distribution networks. Advanced technology integration.

The North American market is characterized by a strong focus on commercial vehicles, with fleet operators increasingly mandating camera systems. Insurance partnerships are driving adoption and creating revenue opportunities. Regulatory clarity supporting equipment standardization. Advanced technology adoption enabling competitive differentiation.

Europe commands a significant 31% market share, with a strong growth pace, driven by strict safety regulations, manufacturer partnerships, and an emphasis on road safety, which supports advanced technology adoption and regulatory compliance. EU safety regulations driving adoption. Manufacturer expansion strategies. Road safety focus. Advanced technology integration. Partnership ecosystems supporting growth. Regulatory harmonization enabling consistency. Sustainability emphasis.

The European market is characterized by strict regulatory compliance and an advanced technology focus, with established brands including Nextbase and CameraMatics driving innovation. Manufacturer partnerships supporting market penetration. Strong emphasis on safety and evidence collection for liability defense. Technology leadership is attracting premium consumer segments.

Asia Pacific expands at a prominent 34% market share, driven by rapid vehicle proliferation, emerging market infrastructure development, manufacturing advantages, and growing safety consciousness supporting market growth exceeding developed market rates. Vehicle ownership expansion. Emerging market growth. Manufacturing cost advantages. Safety awareness growth. Government regulations development. Supply chain development. Technology localization.

Asia Pacific market characterized by rapid growth and emerging market opportunities with vehicle proliferation accelerating equipment adoption. Cost-conscious procurement supporting mid-range equipment adoption. Manufacturing presence enabling local production and cost reduction. Government safety initiatives supporting regulatory-driven adoption.

Market Structure

The dashboard camera market remains moderately fragmented, led by established players such as VIOFO, Nextbase, Garmin, and Thinkware, which leverage strong brand equity and continuous technology innovation. These leaders are complemented by specialists, including Kenwood, Radius Telematics, and CameraMatics, while emerging entrants from smartphone and automotive suppliers target niche opportunities through ecosystem integration and differentiated, technology-driven value propositions.

Strategic Developments (Post-2023)

Business Strategies

Market leaders employ technology differentiation through 4K video and AI integration, brand reputation and consumer trust, geographic expansion through retail and e-commerce channels, fleet partnership development for commercial segments, cloud storage and connectivity integration, professional installation service networks, and sustainability positioning through energy-efficient designs. Established manufacturers emphasizing proven reliability and warranty support. Emerging specialists targeting niche applications and premium positioning. E-commerce-native brands leveraging digital distribution. Partnerships with insurance companies enable data monetization and risk mitigation services.

The global dashboard camera market is valued at US$ 4.32 Bn in 2026 and is forecast to reach US$ 8.45 Bn by 2033, growing at a 10.06% CAGR, led by Asia Pacific (34%), Europe (31%), and North America (25%) amid rising road-safety adoption.

Market growth is driven by heightened road-safety awareness reducing insurance fraud by 15%, rapid AI-enabled safety feature integration, and strong uptake of dual-channel systems for comprehensive vehicle monitoring.

The market is projected to expand at a 10.1% CAGR between 2026 and 2033.

Key opportunities lie in emerging Asia-Pacific vehicle growth, EV and autonomous vehicle camera integration, and fleet telematics convergence enabling AI-based risk reduction and insurance optimization.

The market is led by VIOFO, Nextbase, Garmin, Thinkware, Kenwood, and Radius Telematics, all advancing AI-enabled, multi-channel, and fleet-focused dashcam solutions with continuous product innovation.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Technology

By Vehicle Type

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author