ID: PMRREP32244| 176 Pages | 24 Sep 2025 | Format: PDF, Excel, PPT* | Industrial Automation

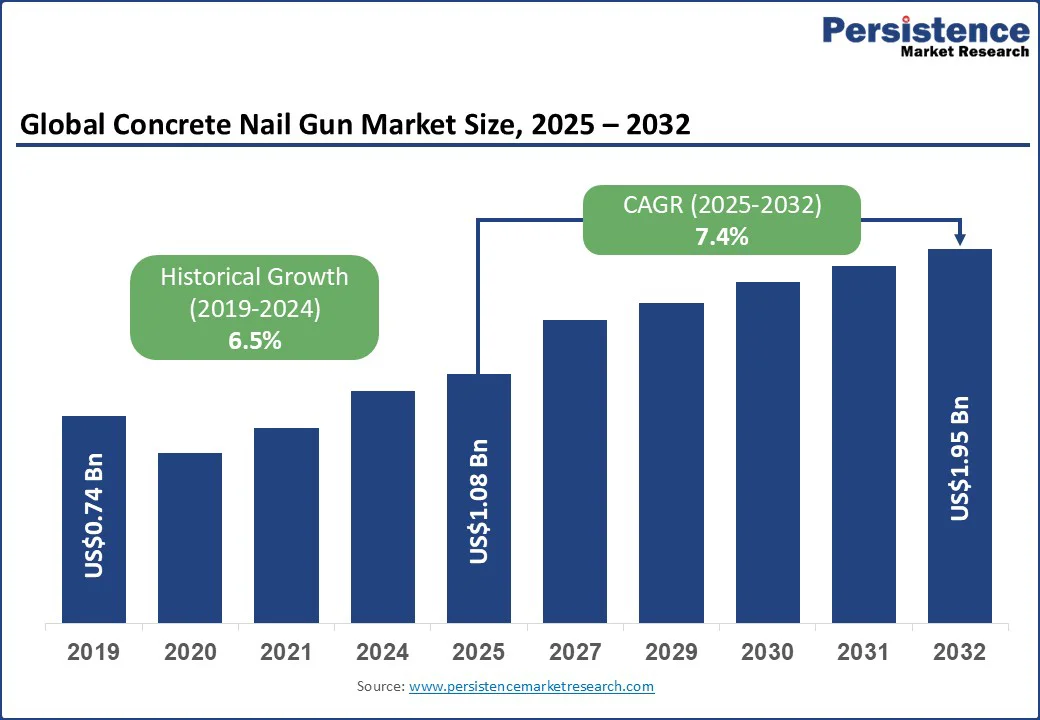

The global concrete nail gun market size is likely to be valued at US$1.08 Bn in 2025 and is expected to reach US$1.95 Bn by 2032, growing at a CAGR of 7.4% during the forecast period from 2025 to 2032, due to the expanding construction and infrastructure development sectors worldwide, accelerated urbanization in emerging economies, and technological advancements such as cordless nail gun innovations that improve user efficiency and safety.

Regulatory emphasis on workplace safety and ongoing governmental investments further support market expansion.

Key Industry Highlights

| Key Insights | Details |

|---|---|

| Concrete Nail Gun Market Size (2025E) | US$1.08 Bn |

| Market Value Forecast (2032F) | US$1.95Bn |

| Projected Growth (CAGR 2025 to 2032) | 7.4% |

| Historical Market Growth (CAGR 2019 to 2024) | 6.5% |

The global construction industry's expansion significantly propels demand for concrete nail guns. Construction spending in the U.S., exceeding US$1.8 trillion in recent years, drives demand for efficient fastening tools that help shorten project timelines and lower labor costs.

Fast-paced urbanization in Asia Pacific, specifically China and India, has spurred residential and commercial infrastructure projects, boosting demand for concrete nail guns. The construction sector's emphasis on productivity and quality directly increases the uptake of these specialized tools.

Innovations in concrete nail guns, including the rise of cordless designs, ergonomic builds, and enhanced battery life, catalyze market growth. Cordless nail guns provide improved mobility on worksites without dependency on power sources, aligning with modern construction's needs for efficiency and safety.

Features such as anti-dry fire mechanisms and sequential triggers minimize accidents, meeting stringent safety standards set by regulatory bodies globally. These innovations broaden market applicability across construction, manufacturing, and carpentry sectors.

Tightening safety standards and workplace regulations worldwide encourage the adoption of safer, high-quality tools such as concrete nail guns. Concurrently, government funding for infrastructure projects, including roads, bridges, and public buildings, especially in emerging markets, generates sustained demand. These policies not only ensure market growth but also stimulate manufacturers to continuously innovate and comply with evolving regulatory frameworks.

Despite rising demand, the upfront cost of advanced concrete nail guns, particularly cordless models with sophisticated battery technology, can be a barrier, especially for small-scale contractors and DIY users. Battery replacement and maintenance expenses also contribute to operational challenges. These cost factors may constrain market penetration in price-sensitive regions and segments.

The availability and cost fluctuations of essential raw materials and components, including specialized batteries and pneumatic parts, potentially disrupt manufacturing timelines. Global supply chain challenges, witnessed broadly across industries, can cause price volatility and delay new product launches, impacting competitive positioning and market growth predictability.

Rapid urbanization and infrastructure growth in Asia Pacific countries, notably China, India, and ASEAN members, present substantial market opportunities. Growing disposable incomes and increasing construction expenditures forecast a steady rise in concrete nail gun sales. Market penetration strategies combining product affordability and localized distribution can leverage this demand surge.

An increasing inclination toward DIY projects globally, fueled by rising homeowner awareness and the availability of user-friendly tools, opens new residential user segments for concrete nail guns. This trend supports growth, especially in North America and Europe, where consumers seek efficient, portable fastening solutions for home renovations.

Continuous innovation in cordless technology and safety features offers manufacturers the chance to develop diversified product portfolios tailored for specialized applications; for example, heavy-duty nails for industrial use and lightweight models for residential tasks. These diversifications cater to unmet user needs and can drive incremental revenue streams.

The leading technology segment is anticipated to be pneumatic nail guns with a market share of approximately 45% in 2025. These tools have dominated the professional construction industry due to their reliability, power, and efficiency. Pneumatic nail guns use compressed air to drive nails into hard surfaces such as concrete, making them ideal for large-scale construction projects where power and speed are critical.

Their popularity is especially strong among contractors working on framing, flooring, and other heavy-duty applications. Pneumatic nail guns remain the preferred choice on job sites that already have air compressors in operation. Their ability to perform consistently under demanding conditions, combined with their cost-effectiveness in high-volume use, has helped them maintain a dominant position in this segment.

The fastest-growing technology segment is electric concrete nail guns, particularly the cordless, battery-powered models. These tools are rapidly gaining popularity due to their portability, ease of use, and reduced setup time. Unlike pneumatic tools, electric nail guns do not require hoses or compressors, making them highly convenient for both professional and DIY users.

Advancements in battery technology, such as longer battery life, faster charging, and more compact designs, have significantly improved performance, making electric models a viable alternative to pneumatic tools for many applications. This shift is especially noticeable in residential construction and renovation work, where mobility and noise reduction are valued.

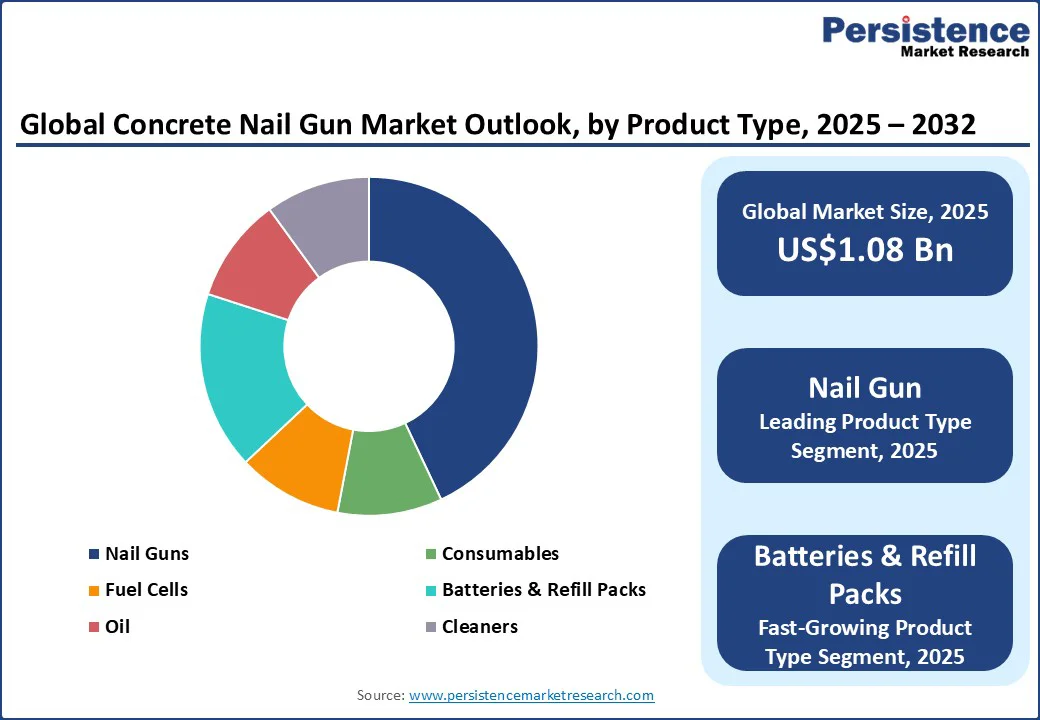

Within the product type category, the nail gun is projected to be the largest and most dominant segment, holding a market share of 42.6%. As the core piece of equipment, the sale of nail guns drives the initial investment in this market. Every new user, whether a construction company or an individual DIY, must purchase a nail gun before they can begin using consumables.

Due to their relatively high cost compared to accessories and consistent demand across both new construction and renovation projects, nail guns generate the highest revenue in this category. This is especially true in growing markets where urbanization and infrastructure development are increasing the need for efficient fastening tools. The consistent demand for new tools, along with regular model upgrades and technological improvements, helps this segment maintain its leadership position.

Meanwhile, the fastest-growing product segments are likely to be batteries and refill packs of nails. The surge in electric and cordless nail gun adoption directly fuels the growth in battery sales. Professionals often invest in multiple batteries to minimize downtime, while the increasing popularity of DIY home improvement further expands the customer base for rechargeable battery units. Similarly, refill packs, the consumable nails used with the tools, represent a high-growth area because they are recurring purchases.

Unlike the one-time investment in a tool, refill nails are consumed daily on active job sites. As more users adopt nail guns, especially in high-volume applications, the demand for refill nails grows in parallel. These consumables not only ensure continued tool operation but also represent a reliable and scalable revenue stream for manufacturers.

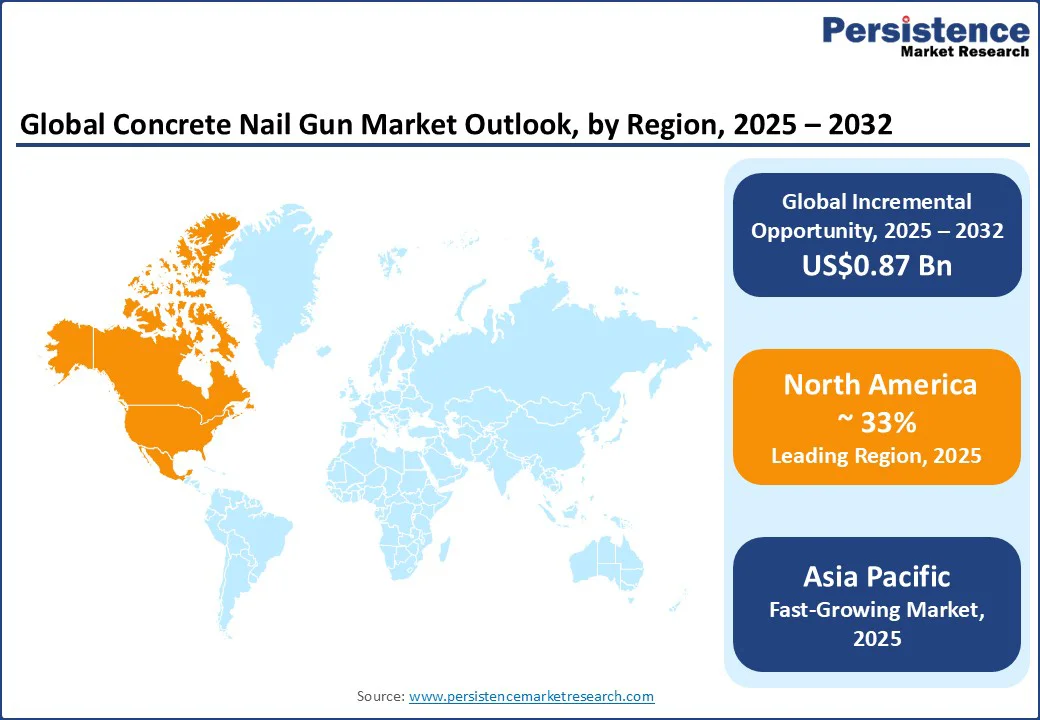

North America stands as a dominant market for concrete nail guns, capturing an estimated 33% share of the global market in 2025, led primarily by the U.S. The market size in this region is bolstered by robust construction expenditures approaching US$1.8 Tn annually, focused extensively on residential renovations, commercial infrastructure, and public projects.

The U.S. construction industry’s demand for high-efficiency fastening tools is a major driver, supported by increasing adoption of cordless concrete nail guns that enhance operational mobility on complex job sites.

Key factors sustaining growth include stringent workplace safety regulations enforced by OSHA, mandating the use of safer, ergonomically designed tools, which fuel technological innovation among manufacturers. The region’s advanced distribution networks, strong presence of major players such as Stanley Black & Decker and Hilti, and a mature retail infrastructure (including specialized dealerships and online channels) strengthen market penetration.

North America is predicted to experience a steady CAGR of approximately 4.5% through 2032, aided by rising labor costs prompting contractors to favor time-saving equipment and by investments in green building projects that require reliable fastening tools compliant with environmental standards. Government incentives for infrastructure modernization, including road and bridge rehabilitation programs, provide further impetus for market growth.

Europe holds a significant portion of the concrete nail gun market, driven by several mature economies such as Germany, the U.K., France, and Spain. The market is characterized by heightened regulatory oversight on tool safety and environmental impacts, leading to widespread adoption of advanced concrete nail gun models equipped with anti-dry fire and safety sequential triggers.

Compliance with the European Union’s machinery and workplace safety directives compels suppliers to prioritize product innovation and reliability.

Construction sector growth, although moderate compared to Asia Pacific, is supported by urban renovation projects and energy-efficient building mandates. Germany leads the market with the most sizeable industrial base and infrastructure projects, followed by significant demand in the U.K. and France.

The competitive landscape in Europe is relatively consolidated, with manufacturers focusing on product durability and after-sales services. The region has seen increasing cross-border harmonization of construction standards, facilitating market expansion.

Europe is forecasted to grow at a moderate CAGR of 4.0% through 2032, fueled by steady private and public investments in commercial buildings and industrial facilities, balanced by cost pressures from supply chain uncertainties and raw material price volatility.

Asia Pacific represents the most dynamic and fastest-growing region for concrete nail guns, expected to achieve an accelerated CAGR of 7.2% from 2025 to 2032. Rapid urbanization, industrialization, and infrastructure development in countries such as China, India, Japan, and ASEAN nations underpin this robust expansion.

China and India stand as primary growth engines, driven by government-led programs investing hundreds of billions in transportation, housing, and commercial real estate. Rising disposable incomes and the growing construction workforce increase demand for portable, efficient fastening tools such as cordless concrete nail guns suited for diverse job sites.

The region benefits from being a major manufacturing hub due to comparatively lower labor and production costs, enabling local and global players to offer competitively priced products.

Technology adoption is gradually growing, with increased focus on ergonomic designs and battery-powered models. Regulatory frameworks are evolving to enhance construction safety and product quality, with emerging standards encouraging the adoption of high-performance tools. Investments in manufacturing capacity, technology partnerships, and localized distribution expand market reach while supporting export growth.

The global concrete nail gun market is moderately consolidated, led by major global players such as Hilti Corporation, Stanley Black & Decker, Makita, Hitachi, and Illinois Tool Works, which collectively hold a significant portion of the market share. These companies dominate by leveraging extensive distribution channels, strong brand equity, and continuous innovation. The market also contains numerous regional players competing on price and niche specialization.

Competitive dynamics focus heavily on product quality, technological advances, and geographic reach. Market leaders emphasize innovation through high-performance cordless products, cost leadership via efficient manufacturing, and geographic expansion into emerging markets.

Differentiation hinges on product safety, ergonomic design, and battery technology. Emerging trends include integrated tool connectivity and smart diagnostics to enhance user experience and operational efficiency.

The concrete nail gun market size is estimated at approximately US$1.08 Bn in 2025.

The concrete nail gun market is projected to grow to around US$1.95 Bn by 2032.

Key trends include increasing adoption of cordless nail guns due to enhanced portability and battery technology, rising infrastructure and construction activities globally, especially in Asia Pacific, and growing focus on safety and ergonomic design improvements.

By technology, the pneumatic nail guns segment leads the market, commanding about 45% market share, driven by technological advancements and ease of use across residential and commercial applications.

The concrete nail gun market is forecasted to grow at a CAGR of 7.4% from 2025 to 2032.

Leading companies include Hilti Corporation, Stanley Black & Decker, Inc., Makita Corporation, Milwaukee Corporation, and Robert Bosch GmbH.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Technology

By Product Type

By Shank Length

By End-user

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author