ID: PMRREP26626| 192 Pages | 1 Aug 2025 | Format: PDF, Excel, PPT* | Food and Beverages

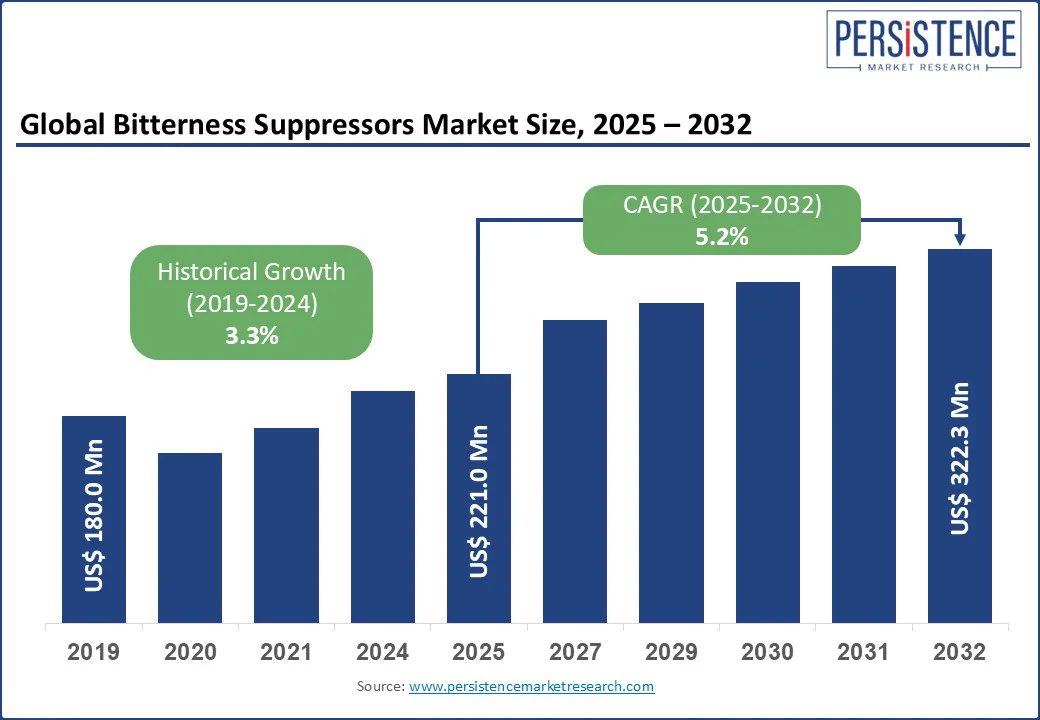

The global bitterness suppressors market size is likely to be valued at US$ 221.0 Mn in 2025 and is estimated to reach US$ 322.3 Mn in 2032, growing at a CAGR of 5.2% during the forecast period 2025 - 2032.

The bitterness suppressors market growth is driven by increasing demand for health-forward products, ranging from plant-based foods and dietary supplements to pediatric pharmaceuticals, alongside innovations in encapsulation and flavor delivery technologies. As consumers increasingly reject excessive sugar and artificial additives, manufacturers now turn to novel taste modulation technologies to address the sensory challenges posed by bitter active ingredients.

Taste modulators are emerging as a competitive differentiator in saturated markets. Backed by a surge in clean-label reformulations and functional innovations, taste modulators now enhance product success across food, beverage, and healthcare industries.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Bitterness Suppressors Market Size (2025E) |

US$ 221.0 Mn |

|

Market Value Forecast (2032F) |

US$ 322.3 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

5.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.3% |

Increasing popularity of cannabidiol (CBD)-based products is significantly driving the bitterness suppressors market growth owing to the inherent astringent and bitter taste profile of CBD extracts. As more food and beverage companies launch infused products, developing bitterness-masking solutions that preserve bioavailability has become a technical priority. CBD gummies, one of the most popular edible formats, are particularly sensitive to off-flavors. A 2023 online survey found that 45% of consumers cited unpleasant taste as a deterrent when trying CBD gummies for the first time.

To address this, several companies have started adopting multilayer flavor masking, combining encapsulated cannabinoids with fruit-derived bitterness blockers to appeal to first-time users. In the U.K., where CBD regulation is tightening under the Novel Foods Directive, firms are investing in bitterness suppressors that comply with clean-label requirements. In addition, the emergence of water-soluble CBD formats has introduced new taste-masking challenges. This has prompted companies to explore lipid-based masking systems and terpene-balancing techniques.

Regulatory challenges are hampering the adoption of bitterness suppressors, primarily due to the ambiguity around classification, labeling, and the natural status of masking agents. In the European Union (EU), bitterness suppressors that fall outside traditional flavoring definitions often require novel food approvals or fall under additive classifications. This often triggers lengthy safety assessments by the European Food Safety Authority (EFSA). These regulatory delays have slowed the rollout of some next-generation bitterness blockers derived from microbial fermentation or enzymatic processes.

In the U.S., while Generally Recognized As Safe (GRAS) status can expedite adoption, bitterness suppressors used in combination with dietary supplements or cannabis-infused products face strict scrutiny. The Food and Drug Administration (FDA) does not provide a specific regulatory framework for taste modulators, compelling manufacturers to navigate uncertain pathways. In the Asia Pacific region, traditional medicine regulations restrict the inclusion of synthetic or unapproved flavor modulators in herbal formulations. The lack of harmonization across regions further leads to reformulation burdens for global brands, increasing research and development costs.

Emerging innovative analytical tools, such as Least Squares Support Vector Machines (LS-SVM) and electronic tongues (e-tongues), are creating new market opportunities. Key players are accelerating bitterness suppressor development by using rapid, objective, and sensitive taste-profiling tools. LS-SVMs are being deployed to build predictive models that correlate chemical composition with sensory bitterness, significantly reducing formulation time.

Electronic tongue taste evaluations are becoming indispensable for screening the efficacy of bitterness blockers in complex food matrices. These sensor systems can detect and quantify bitterness levels even in the presence of masking agents. They enable formulators to fine-tune dosage and interaction effects. The combination of LS-SVM models with e-tongue outputs is also being used to train machine learning systems that simulate human sensory perception more accurately than traditional chemical assays.

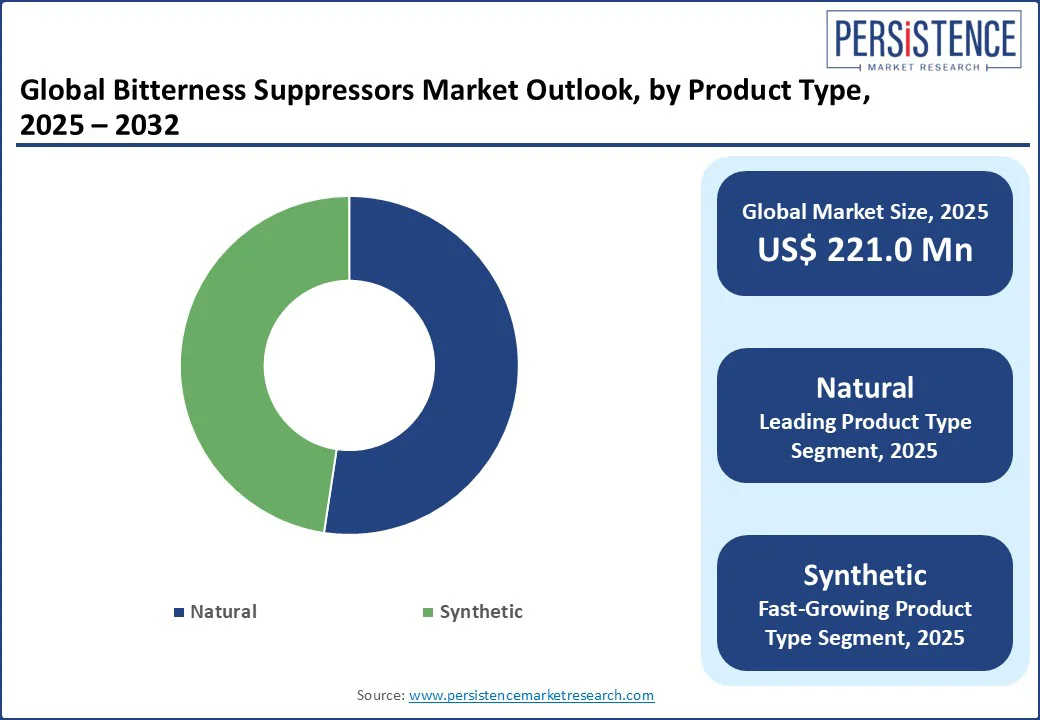

Based on product type, the market is bifurcated into natural and synthetic. Among these, natural bitterness suppressors are expected to hold approximately 52.4% of share in 2025 due to high demand in the U.S. and Europe where consumers are increasingly scrutinizing ingredient lists. Formulators are turning to botanical extracts, fruit-derived compounds, amino acids, and fermented ingredients that help enhance the health benefits of the final product. The shift is also being propelled by surging regulatory resistance to synthetic masking agents in dietary supplements and functional foods.

Synthetic bitterness suppressors are predicted to witness average growth through 2032 owing to increased clean-label pressures, tightening regulatory scrutiny, and high consumer resistance toward chemically derived additives. In developed markets, food and beverage manufacturers are shifting away from synthetic masking agents due to negative consumer perceptions and evolving label transparency requirements. The restricted usage of synthetic suppressors in sensitive sectors such as pediatric medicine and nutraceuticals is also slowing adoption.

By application, the market is segregated into food, beverages, dietary supplements, and pharmaceuticals. Out of these, the food segment will likely hold about 41.6% of the bitterness suppressors market share in 2025, backed by increasing inclusion of naturally bitter ingredients in reformulated, functional, or clean-label food products. As brands push for sugar reduction and protein enrichment, they encounter bitter off-notes that can severely impact consumer acceptance. The commercial pressure to retain taste parity with conventional products has made bitterness suppression a formulation priority in food innovation.

Pharmaceuticals, on the other hand, are poised to showcase a steady growth rate in the foreseeable future due to the inherently unpleasant taste of multiple Active Pharmaceutical Ingredients (APIs). This significantly affects patient compliance, especially in pediatric, geriatric, and orally disintegrating formulations. Bitter APIs, including metronidazole, ciprofloxacin, and certain antiretrovirals, require precise taste-masking strategies to ensure consistent dosing and voluntary adherence.

North America will likely account for around 32.5% of share in 2025 owing to the mainstreaming of health-forward product categories that inherently contain bitter compounds, including low-sugar functional drinks and CBD edibles. The U.S. bitterness suppressors market is predicted to dominate as companies are actively collaborating with food tech start-ups to improve taste profiles without compromising clean-label positioning. The surge in ashwagandha, turmeric, and adaptogen-infused beverages has further skyrocketed the demand for efficient bitterness suppression.

According to data from SPINS (2024), sales of adaptogenic beverages in the U.S. grew by over 31% year-on-year, with most new product launches incorporating bitterness-masking technologies to appeal to broad consumer palates. This growth has encouraged companies such as Kerry and Sensient to introduce new North America-specific flavor modulators. In pharmaceuticals, companies are deploying novel polymer-based bitterness suppressors to improve compliance, especially in pediatric and geriatric formulations.

The market in Europe is evolving rapidly in response to the region’s strict clean-label regulations and surging consumer demand for plant-based, functional products. A significant development has been the increased use of bitterness masking in reformulated foods containing steviol glycosides and other natural sweeteners. The trend is driven by the EU’s sugar-reduction mandates. For example, Germany-based Symrise launched a new range of flavor modulators under its Taste Balancer portfolio. It was mainly designed to neutralize the bitter aftertaste of stevia in dairy and beverage applications.

Botanical-infused beverages and dietary supplements are gaining impetus in France and Italy. These markets are prompting companies to adopt layered bitterness suppression techniques, combining natural flavor blockers and pH adjustment methods. In addition, food and pharma sectors are increasingly adopting encapsulation-based solutions to meet bitterness challenges in pediatric medicines and functional gummies. Innovation is also emerging in niche areas, including insect protein, where start-ups are using bitterness suppression to improve consumer acceptance of cricket protein powders and snacks.

In Asia Pacific, the market is mainly augmented by rapid growth in fortified beverages, traditional herbal products, and the booming functional food segment. Japan and South Korea are leading in terms of innovation. Key players in these countries are integrating bitterness suppressors into conventional formulations such as ginseng tonics, green tea extracts, and amino acid supplements. China’s market is seeing large-scale adoption of bitterness suppressors in Traditional Chinese Medicine (TCM)-based products and pediatric syrups.

In India, the rise of ayurvedic nutraceuticals and vitamin-enriched gummies has created an increasing demand for effective aromatic bitters, mainly in ashwagandha, neem, and tulsi-based blends. Indonesia and Thailand are witnessing an increasing use of bitterness suppression in energy and electrolyte drinks that incorporate herbal extracts such as tongkat ali or bitter melon. Local brands are partnering with global flavor houses to adapt innovative masking technologies to tropical flavor bases.

The global bitterness suppressors market is characterized by a race among ingredient innovators to enhance palatability in functional foods, pharmaceuticals, and nutraceuticals. Companies are increasingly focusing on masking the bitterness of high-intensity sweeteners, plant-based proteins, and alkaloid-rich drugs without compromising the product’s sensory profile. Major manufacturers are also investing in proprietary taste modulation technologies that combine natural masking agents and enzymatic treatments. Start-ups and mid-tier firms are contributing to the fragmentation of the market by offering customized, application-specific solutions for segments such as pediatric syrups and fortified snacks.

The bitterness suppressors market is projected to reach US$ 221.0 Mn in 2025.

Shift toward clean-label suppressors and consumer intolerance for unpleasant flavors are the key market drivers.

The bitterness suppressors market is poised to witness a CAGR of 5.2% from 2025 to 2032.

Emergence of unique suppressors for pediatric drugs and development of application-specific suppressors are the key market opportunities.

Koninklijke DSM N.V., Kerry Group Plc., and Symrise AG are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Form

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author