ID: PMRREP35363| 180 Pages | 29 May 2025 | Format: PDF, Excel, PPT* | Food and Beverages

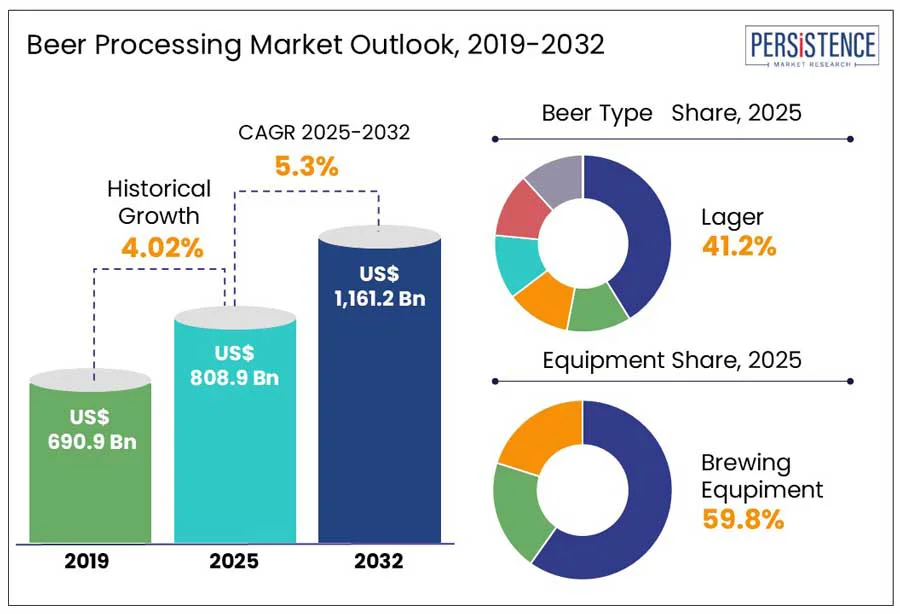

The global beer processing market size is expected to increase from US$ 808.9 billion in 2025 to US$ 1161.2 billion by 2032, with a projected CAGR of 5.3% during this period. According to the Persistence Market Research report, the industry is experiencing significant growth, driven by changing consumer preferences, technological advancements, and rising disposable incomes. This market includes various stages, such as malting, brewing, fermentation, maturation, and packaging, which are essential for producing high-quality beers that cater to diverse consumer demands.

The growing consumer interest in premium, craft, and health-conscious beers has led to innovations in brewing processes. Companies are increasingly adopting advanced techniques like automation, the Internet of Things (IoT), and sustainable practices.

Key Industry Highlights

|

Global Market Attributes |

Key Insights |

|

Beer Processing Market Size (2025E) |

US$ 808.9 Bn |

|

Market Value Forecast (2032F) |

US$ 1161.2 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.0% |

The beer processing market is significantly influenced by the growing prominence of urban nightlife and an evolving culture of social drinking. With rapid urbanization, metropolitan areas are transformed into social hubs where beer consumption is a norm. This shift in lifestyle has driven the demand for diverse beer varieties, prompting breweries to expand production capacities and refine processing techniques. In response to these trends, innovative platforms are introduced.

In 2025, the Heineken Studio was unveiled in Amsterdam as an experimental space designed to redefine the social drinking experience. At this venue, customizable draft systems are employed, allowing patrons to adjust characteristics such as bitterness and dryness, or even blend alcohol with non-alcoholic beer.

Through such initiatives, consumer engagement is enhanced, and product personalization is completely offered. As a result, beer processing practices are reshaped to meet the dynamic preferences of today’s social drinkers.

The growth of the global beer processing market is increasingly hindered by strict environmental regulations concerning water usage and wastewater discharge. Breweries face tighter controls on the amount of water they can use in production, as brewing is a water-intensive process. Many regions have imposed restrictions to limit water extraction and ensure the sustainable use of local water resources.

The wastewater produced during brewing, which often contains organic materials, cleaning agents, and other pollutants are treated according to more stringent environmental standards before released into the environment. As a result, the breweries are compelled to invest in advanced water treatment systems and sustainable processing technologies. These regulatory requirements impose operational constraints on large-scale and craft breweries reducing their flexibility and scalability. Consequently, efforts to expand operations and develop new facilities are often delayed or restructured to ensure full compliance with environmental regulations.

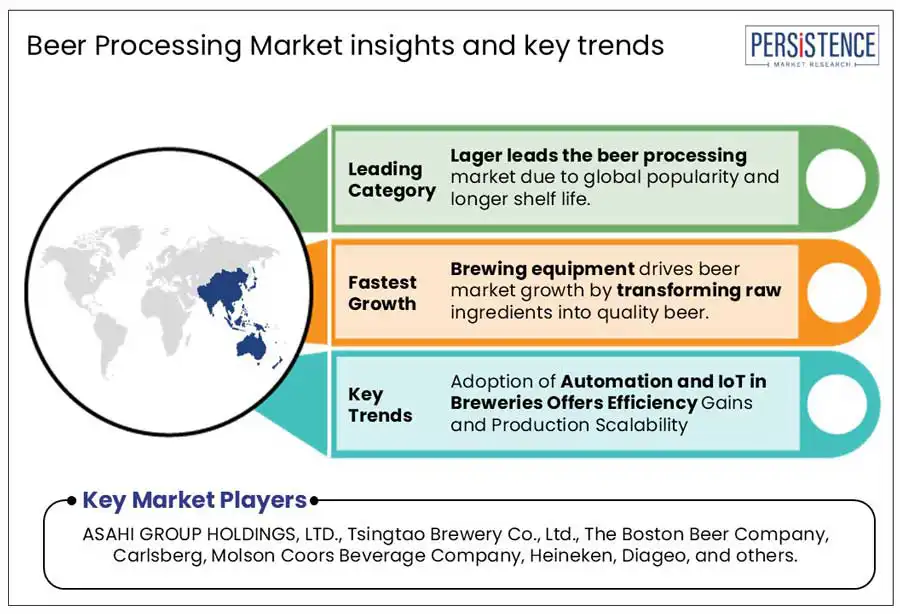

Advancements in the beer processing market are driven by the integration of automation and the Internet of Things (IoT) technologies. Brewing operations are increasingly optimized as real-time data collection, predictive maintenance and process control systems are adopted to enhance batch traceability, flavor consistency, and operational efficiency.

Heineken’s “Connected Brewery” initiative exemplifies this transformation, with 85 breweries retrofitted and over 4,100 machines connected to an IoT platform streaming 180 billion data points into the cloud. Through partnerships with firms such as Siemens, electrified heating and cooling systems powered by renewable energy are being implemented, aiming to reduce carbon emissions by 50% across facilities by 2025.

By enabling real-time monitoring, quality deviations and inefficiencies are being promptly addressed. As energy and resource consumption are better managed, sustainability goals are being supported, and competitive advantage is strengthened. The deployment of smart brewing systems is thus being recognized as vital in meeting rising global beer demand.

Lager has been recognized as the leading segment in the beer processing market, attributed to its global popularity and extended shelf life. Known for its crisp, refreshing taste, lager has been widely preferred by consumers across diverse regions. Its brewing process, characterized by low-temperature fermentation over a longer period, has enabled enhanced product stability and quality retention key attributes for large-scale distribution. Consequently, breweries have heavily prioritized lager production to align with market demand.

In 2025, Carlsberg reinforced its commitment by investing USD four billion in its Mysuru brewery in India. This investment was aimed at expanding production capacity to accommodate growing demand for its flagship lager offerings. The facility has been positioned as a strategic hub for Carlsberg, facilitating broader market penetration and supporting the sustained availability of its popular lager products. As a result, innovation in lager brewing continues to be driven by its central role in the global beer processing landscape.

Brewing equipment is essential in the beer industry, driving market growth by transforming raw ingredients into high-quality beer. Key components, such as mash tuns, kettles, and wort chillers, ensure efficiency and consistency in the brewing process, maintaining precise temperature control for an excellent final product. As the first step in production, this equipment is relied upon to deliver efficiency, consistency, and scalability, making it a critical investment for both large-scale breweries and craft producers.

In 2025, the significance of brewing equipment is highlighted by Sapporo-Stone Brewing’s US$20 million investment in expanding its Escondido, California, facility. Eight 30-foot, 400-barrel fermenter tanks were installed, allowing production capacity to be doubled to approximately 700,000 barrels annually across its U.S. operations.

Through this expansion, operational efficiency is enhanced and product quality is maintained, underscoring the essential role of advanced brewing equipment in driving growth within the beer processing industry.

Growing preference for low-alcohol and gluten-free beers is reshaping brewing practices in North America. To cater to health-conscious consumers, specialized brewing techniques are adopted. Enzymatic treatments and alternative grains such as sorghum, millet, and rice are being utilized to produce gluten-free options that comply with FDA standards of under 20 parts per million of gluten per serving. Low-alcohol beers are being developed through innovative fermentation processes that maintain flavor without requiring post-production alcohol removal.

Athletic Brewing Company has introduced a proprietary method that fully ferments beer to under 0.5% ABV, preserving flavor while eliminating the need for alcohol extraction. Advanced filtration systems are also being incorporated to enhance product quality. As a result, breweries are being driven to increase investment in research and development, with technological advancements in beer processing being prioritized to align with evolving consumer demands for healthier, inclusive beverage options.

In Europe, the revival of traditional beer processing techniques is being driven by rising consumer interest in heritage and locally brewed beers. Emphasis is being placed on preserving age-old brewing methods, such as open fermentation and the use of locally sourced ingredients, to cater to the demand for authentic, artisanal experiences. Craftsmanship and quality are prioritized over mass production, fostering a resurgence of sustainable practices and traditional brewing equipment. In 2025, Sierra Nevada Brewing Company’s collaboration with Brauerei Gutmann, a historic German brewery established in 1707. A Festbier was crafted using wheat malt, reflecting Gutmann’s classic Hefeweizen style and blending it with Sierra Nevada’s innovation.

Through such partnerships, centuries-old brewing traditions are being preserved while modern consumer tastes are accommodated, highlighting a broader industry movement toward authenticity, heritage preservation, and cultural storytelling through beer.

In Asia Pacific, a notable shift toward premium beer processing was observed in 2024, driven by rising disposable incomes and the increasing adoption of Western lifestyles. As consumer purchasing power grows, there is a greater preference for high-quality, craft, and imported beers. This evolving demand is being addressed by breweries through investments in advanced brewing technologies and the use of premium ingredients. The market's response has been reflected in performance metrics. United Breweries, the Indian arm of Heineken, reported a 13% increase in revenue and a 23% rise in profit, attributed to the growing demand for premium beers such as London Pilsner and Heineken Silver among urban consumers. These developments underscore the industry's response to evolving consumer preferences and the expanding market for premium beer products in Asia Pacific.

The competitive landscape of the global beer processing market is influenced by large multinational companies and smaller craft breweries with each striving for market share through product innovation, quality, and brand differentiation. Major players such as Anheuser-Busch InBev, Heineken, Carlsberg, and Molson Coors dominate the global market by leveraging extensive distribution networks and a wide range of beer products, including both premium and craft options. These companies invest significantly in research and development to improve brewing processes, enhance sustainability, and address emerging consumer trends such as low-alcohol, gluten-free, and organic beers.

Craft breweries and local companies are gaining ground, particularly in regions such as North America and Europe, by offering unique, high-quality beers that highlight artisanal brewing techniques. The technological adoption including automation and the Internet of Things (IoT) for improved brewing efficiency has become a critical component for maintaining a competitive advantage. Additionally, a strong focus on sustainability, such as reducing water usage and embracing eco-friendly practices, is increasingly important in this evolving market.

In January 2024, Carlsberg Marston's Brewery invested in a second-generation Innopack Kisters NMP packer, which will double the production capacity for Snap Pack multipacks. This investment is expected to reduce plastic usage by up to 76% and decrease water consumption by around 10% annually, in line with the company's sustainability goals.

The global beer processing market is projected to be valued at 808.9 bn in 2025.

The beer processing market is driven by the global rise in urban nightlife and social drinking culture is accelerating beer processing growth.

The beer processing market is poised to witness a CAGR of 5.8% from 2025 to 2032.

Adoption of automation and IoT in breweries offers efficiency gains, and production scalability is the key market opportunity.

Major players in the beer processing market include ASAHI GROUP HOLDINGS, LTD., Tsingtao Brewery Co., Ltd., The Boston Beer Company, Carlsberg, Molson Coors Beverage Company, Heineken, Diageo, and others.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 – 2024 |

|

Forecast Period |

2025 – 2032 |

|

Market Analysis Units |

Value: US$ Bn, Volume: Unit |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Process Type

By Beer Type

By Equipment

By Raw Material

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author