ID: PMRREP35016| 199 Pages | 23 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

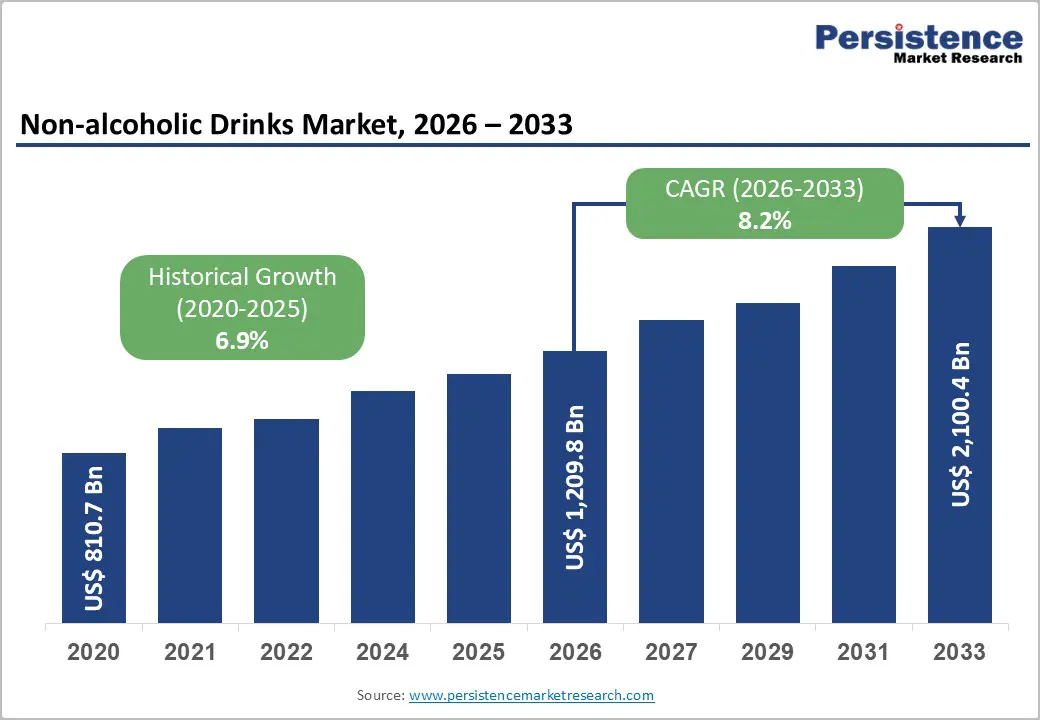

The global non-alcoholic drinks market size is likely to be valued at US$ 1,209.8 billion in 2026 to US$ 2,100.4 billion by 2033 growing at a CAGR of 8.2% during the forecast period from 2026 to 2033.

The global market is witnessing steady growth, supported by rising health awareness, rapid urbanization, and changing consumer lifestyles. Consumers are increasingly shifting away from alcoholic and high-sugar beverages toward low- and no-sugar, functional, and hydration-focused drink options. Beverage consumption continues to expand across both developed and emerging economies, driven by population growth and increasing household spending. Product innovation remains a key growth enabler, as manufacturers expand portfolios across low-calorie carbonates, fortified bottled water, plant-based beverages, and ready-to-drink tea and coffee. These developments are strengthening premiumization trends, particularly across modern retail formats and online distribution channels.

| Key Insights | Details |

|---|---|

| Non-alcoholic Drinks Market Size (2026E) | US$ 1,209.8 Bn |

| Market Value Forecast (2033F) | US$ 2,100.4 Bn |

| Projected Growth (CAGR 2026 to 2033) | 8.2% |

| Historical Market Growth (CAGR 2020 to 2025) | 6.9% |

Rising concern over obesity, diabetes, and cardiovascular disease is compelling consumers and regulators to reduce intake of sugar-sweetened beverages. OECD indicators show that in many member countries a significant share of adults and adolescents consume sugary soft drinks daily, prompting targeted public health campaigns and sugar taxes. In the United States, per-capita soft drink consumption has gradually declined to around 41.9 gallons in 2025, reflecting a move away from full-sugar sodas toward zero-sugar, flavored waters, and low-calorie options. In response, beverage majors such as The Coca-Cola Company and PepsiCo, Inc. have reformulated products, expanded zero-sugar lines, and introduced functional hydration and juice-based drinks. PepsiCo’s “pep+” strategy reports that about 62% of its beverage portfolio already meets reduced-sugar targets, underscoring a structural pivot to healthier non-alcoholic drinks that is expanding category value.

Sugar content limitations pose a significant challenge for the non-alcoholic beverages market. As consumers grow more health-conscious and seek lower-sugar options, manufacturers face pressure to reduce sugar levels. While this shift promotes better health, it often compromises taste, making it difficult to deliver the flavor and sweetness consumers expect from traditional drinks.

To compensate, many brands turn to artificial sweeteners or natural alternatives like stevia, but these often fail to recreate the authentic experience. Striking a balance between flavor and compliance with sugar regulations is crucial. As regulatory pressures around sugar content intensify, the market faces the challenge of delivering satisfying, flavorful beverages without compromising on health-conscious ingredients, which could limit consumer appeal.

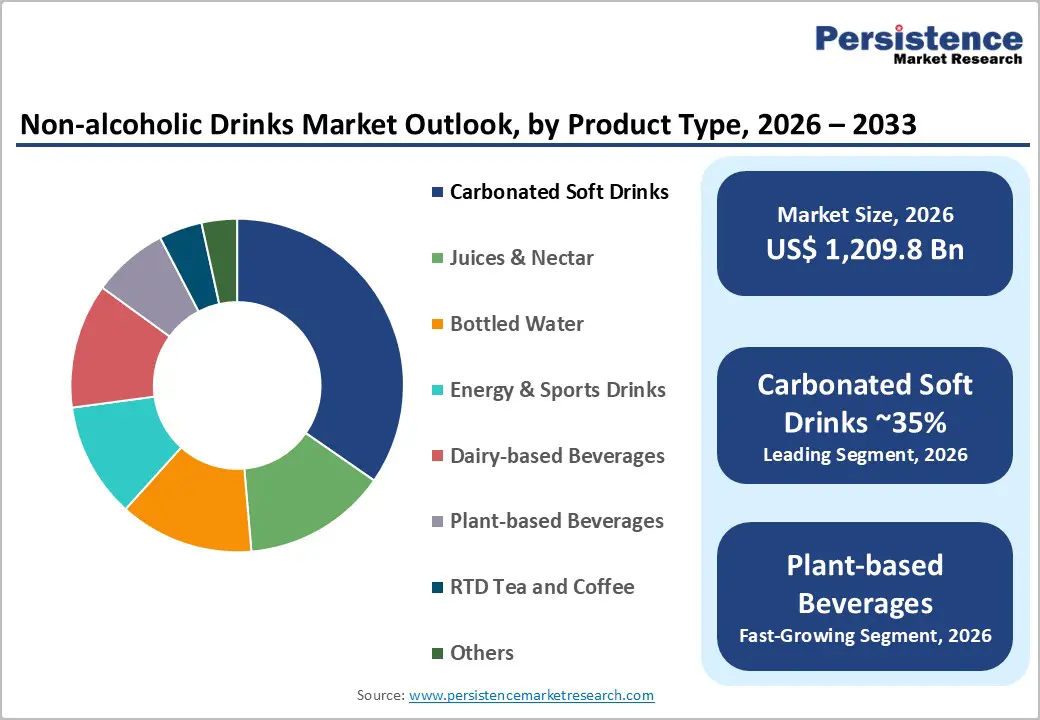

Functional beverages that deliver added health benefits such as immune support, gut health, mental focus, or sports recovery represent one of the most attractive opportunity areas in the non-alcoholic drinks market. Industry analyses show functional beverages holding a leading share of incremental growth, as consumers look for drinks with vitamins, electrolytes, probiotics, and botanical extracts. Plant-based beverages, including dairy alternatives made from oats, almonds, soy, and coconut, are expanding rapidly, aided by rising lactose intolerance diagnoses and vegan, flexitarian dietary trends. Companies like Danone S.A. and Nestlé S.A. have scaled plant-based portfolios, while local players such as SunOpta Inc. and Almarai invest in fortified juices and milk alternatives. These innovations enable premium pricing and support cross-category use in breakfast, snacking, and sports nutrition occasions.

Carbonated soft drinks continue to lead the non-alcoholic beverages market, driven by consumer preference for their exciting fizz and refreshing mouthfeel. The sensory appeal of carbonation, characterized by its tingling and bubbly sensation that provides a unique drinking experience that other beverages often find difficult to replicate.

According to a survey by Persistence Market Research, 76% of U.S. consumers enjoy carbonated soft drinks at least once a week, with 46% citing fizziness as their main reason for consumption, highlighting carbonation's crucial role in building loyalty. This enduring preference supports high demand across various age groups and markets, making carbonated beverages a resilient and profitable segment. As brands innovate with clean-label ingredients and lower sugar options, maintaining that signature fizzy experience is essential for attracting and retaining customers in a competitive market.

Online retail is rapidly growing as consumers are increasingly drawn to attractive discounts and convenient subscription models that encourage repeat purchases. E-commerce platforms like Amazon's "Subscribe & Save" program offer up to 15% off and free shipping on recurring orders of non-alcoholic beverages, appealing to budget-conscious shoppers. Similarly, Alibaba.com enables bulk buying with tiered pricing, allowing buyers to enjoy significant savings. These models not only enhance affordability but also simplify the replenishment process. As online platforms continue to innovate and personalize their offerings, the convenience and cost-effectiveness of online retail are set to drive significant growth in the global non-alcoholic beverages market.

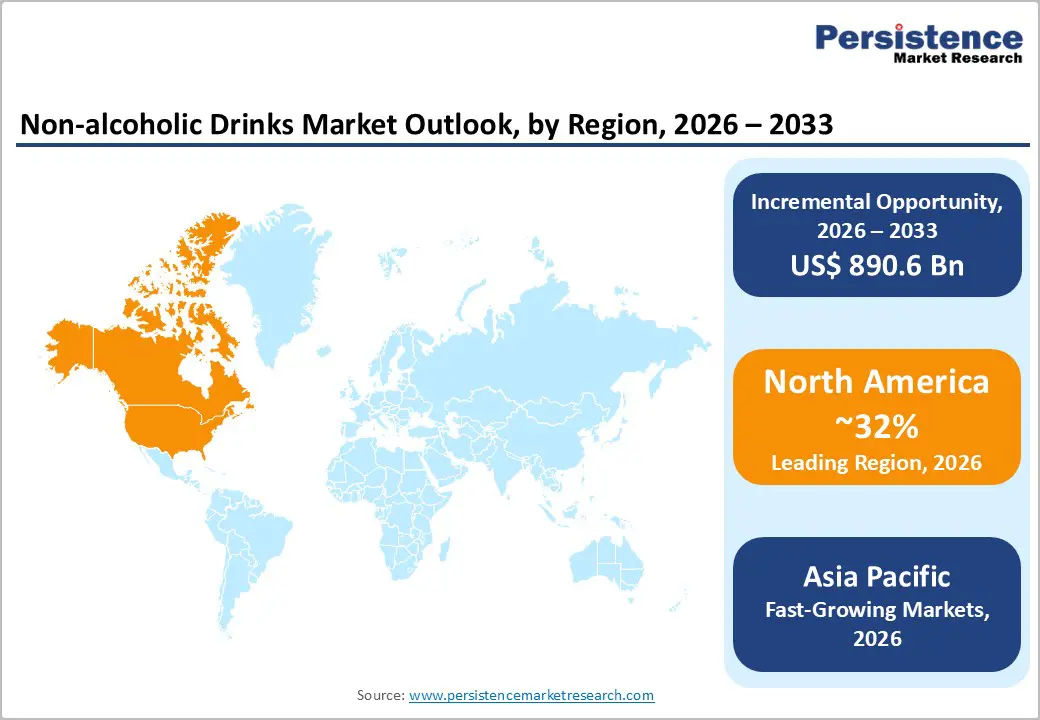

North America leads the global non-alcoholic beverages market with a significant 31.2% share, driven by evolving consumer preferences and a strong industry presence. As health consciousness grows, consumers are increasingly seeking cleaner, healthier options. In Canada, the demand for clean-label beverages made from natural ingredients is rising, reflecting a broader trend toward transparency and wellness.

Meanwhile, the U.S. market continues to see robust demand for energy and sports drinks, as well as demographic-specific offerings tailored to millennials, Gen Z, and active lifestyles. The presence of key players such as PepsiCo and The Coca-Cola Company strengthens North America's leadership, as these corporations’ foster innovation in both functionality and flavor. The North American non-alcoholic beverage industry is likely to sustain its growing pace in the future years, because of flavor-forward innovations such exotic fruit infusions and functional blends combined with personalized marketing.

Europe non-alcoholic beverages market is evolving rapidly, driven by shifting consumer values and innovation. Studies from Persistence Market Research shows that vegan claims are the most preferred attribute in low and no-alcohol beverages, indicating a strong plant-based movement across the region. European consumers are also influenced by strict labeling regulations that promote transparency and encourage clean-label formulations. Fruit flavors, especially citrus and berry, remain highly popular due to their natural appeal. Innovation is accelerating in protein-infused ready-to-drink (RTD) coffee, which combines convenience with functional benefits.

Sustainable packaging is another critical trend, with eco-conscious consumers opting for brands that minimize environmental impact. Local sourcing and regional products are also major purchase drivers, as consumers seek authenticity and reduced carbon footprints. Leading players such as Coca-Cola Europacific Partners are aligning with this trend, targeting 100% recyclable primary packaging by 2025 to meet regulatory and consumer expectations.

Asia Pacific non-alcoholic beverages market is witnessing some dynamic trends shaped by local preferences and cultural shifts. In India, above-the-line (ATL) marketing remains the most popular strategy for carbonated beverage brands, often enhanced by celebrity endorsements that connect with the public. The country also has a significant dairy-based beverages market, being the leading producer and consumer of milk-based drinks.

In contrast, Chinese consumers are increasingly interested in functional beverages that incorporate traditional Chinese medicine (TCM) ingredients, reflecting a strong preference for wellness through ancient remedies. In Japan, our recent study revealed that 42% of respondents do not consume alcohol, indicating a notable shift towards sobriety particularly among younger generations. This “sober curious” movement is fueled by increasing health awareness, a trend amplified during the COVID-19 pandemic, opening doors for innovative non-alcoholic drink options.

The global non-alcoholic beverages market is highly competitive, featuring several global giants alongside an increasing number of regional brands and startups. This dynamic environment is being driven by growing foreign direct investment (FDI), strategic distribution partnerships, and increased investments in sustainability initiatives. Companies are actively innovating in eco-friendly packaging and developing cleaner, healthier formulations in response to consumer demand. Additionally, government regulations particularly those targeting sugar reduction are shaping product reformulation strategies. These evolving factors, combined with rapid innovation and shifting consumer preferences, are redefining the market's direction.

The global non-alcoholic drinks market is projected to be valued at US$ 1,209.8 Bn in 2026.

The growing popularity of sober curious lifestyles is positively influencing the demand for non-alcoholic beverages.

The global non-alcoholic drinks market is poised to witness a CAGR of 8.2% between 2026 and 2033.

Companies can tap into the growing preference for dairy-free, vegan-friendly nutritional beverages, is the key market opportunity for companies in the Global Non-Alcoholic Beverages market.

Key players in the Global Non-Alcoholic Beverages industry include The Coca-Cola Company, PepsiCo, Inc., Keurig Dr Pepper Inc., Nestlé S.A., Danone S.A., Monster Beverage Corporation, and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn and Volume (if Available) |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Packaging Type

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author