ID: PMRREP31937| 190 Pages | 19 Jan 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

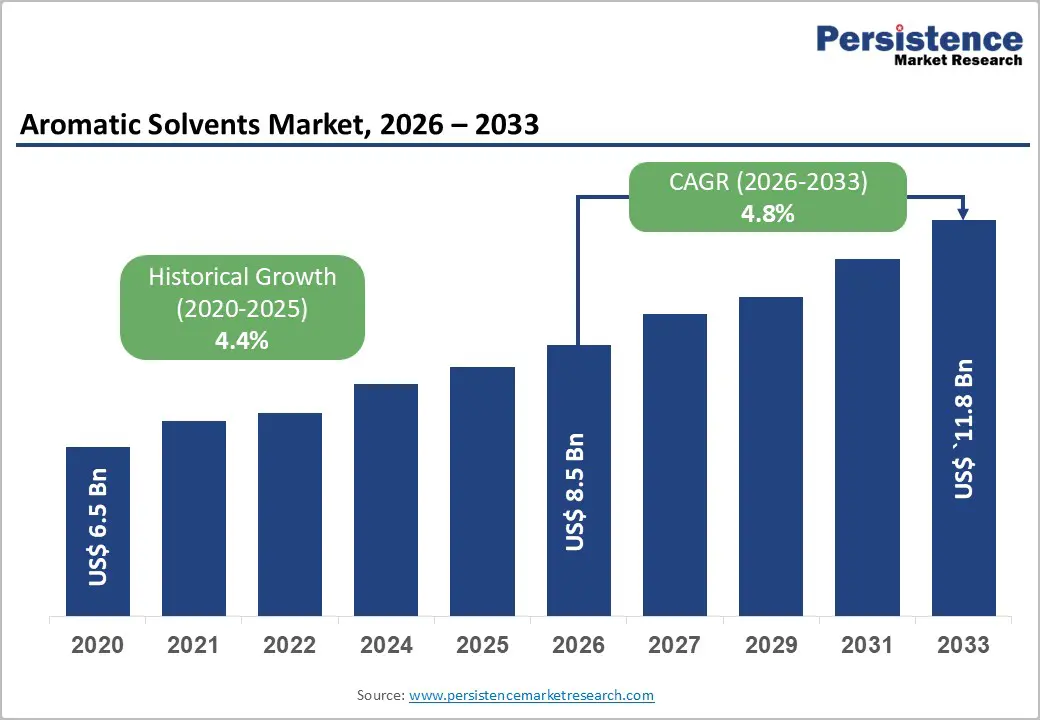

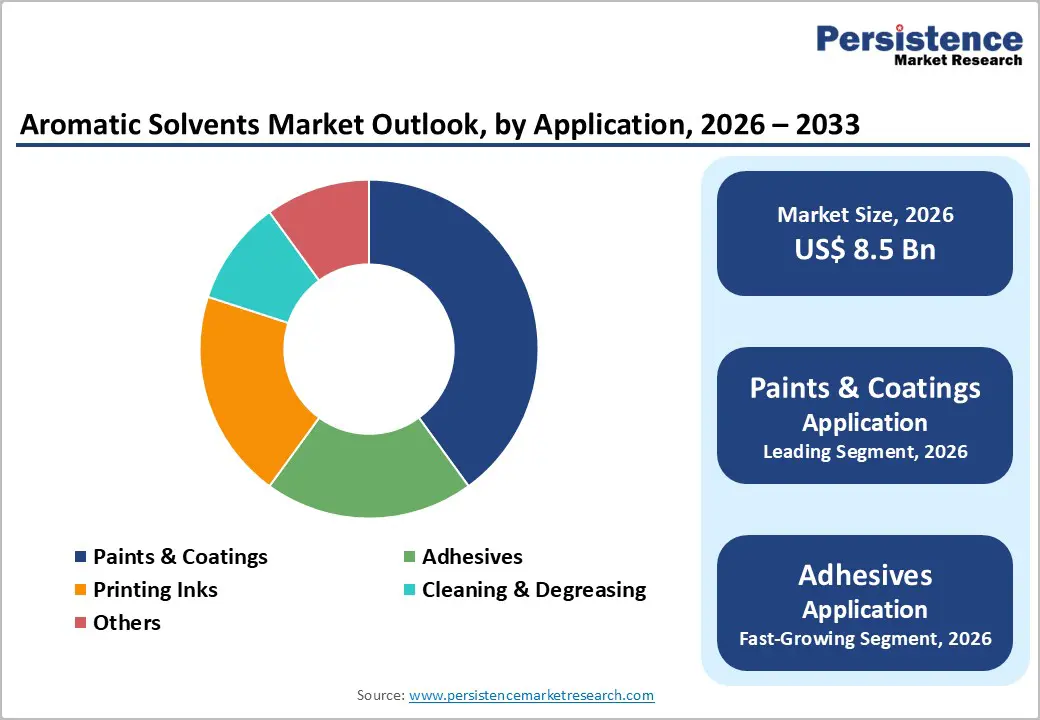

The global aromatic solvents market size is likely to be valued at US$8.5 billion in 2026, projected to reach US$11.8 billion by 2033, growing at a CAGR of 4.8% during the forecast period from 2026 to 2033, driven by the increasing demand for aromatic solvents in industries such as paints and coatings, adhesives, and chemical formulations.

The rising need for effective dissolving and thinning agents, especially in printing inks, has significantly fueled the use of aromatic solvents across various sectors. Advancements in toluene and xylene formulations, offering high-purity and versatile solutions, have further supported market expansion. The growing use of aromatic solvents in industrial cleaning processes, particularly in manufacturing, is also contributing to the market’s growth.

| Key Insights | Details |

|---|---|

| Aromatic Solvents Market Size (2026E) | US$8.5 Bn |

| Market Value Forecast (2033F) | US$11.8 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.8% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.4% |

The increasing prevalence of paints & coatings production globally is a primary driver of the aromatic solvents market. Global coatings output exceeds 50 million tons annually, with higher growth in Asia. This widespread manufacturing creates a substantial demand for thinning agents. Aromatic solvents offer superior solvency, typically dissolving resins 20-30% faster than alternatives, making them ideal for alkyd and polyurethane formulations. This is particularly critical for high-gloss finishes.

As infrastructure development accelerates across emerging economies, including large-scale residential and commercial construction in India, China, and Southeast Asia, the need for protective, decorative, and industrial coatings continues to expand. Paint manufacturers rely heavily on aromatic solvents owing to their superior solvency power, fast evaporation rate, and ability to dissolve resins, pigments, and binders efficiently, ensuring smooth application, strong adhesion, and high-quality film formation.

High development and environmental compliance costs represent a significant challenge across many industrial and manufacturing sectors, particularly those dealing with chemicals, construction materials, and advanced formulations. Developing new products or upgrading existing ones requires substantial investment in research, testing, and validation to meet performance, safety, and durability standards. These processes often involve extended development timelines, specialized equipment, and skilled technical personnel, all of which increase overall costs.

Environmental compliance further adds to the financial burden. Companies must adhere to stringent regulations related to emissions, waste management, raw material sourcing, and product safety. Meeting these requirements often necessitates the adoption of cleaner technologies, reformulation of products to reduce hazardous components, and implementation of monitoring and reporting systems. Regular audits, certifications, and regulatory approvals also contribute to recurring expenses. Compliance costs can rise due to regional differences in environmental laws, requiring firms to customize processes for different markets. Smaller and mid-sized players are particularly affected, as they may lack the financial flexibility to absorb these investments.

Advancements in bio-based and low-VOC (volatile organic compound) aromatic alternatives are gaining momentum as industries shift toward sustainable, safer, and regulation-compliant chemical solutions. Manufacturers are increasingly exploring biomass-derived feedstocks such as lignin, agricultural residues, and plant-based sugars to produce renewable aromatic compounds that can replace traditional petroleum-based solvents, plasticizers, and additives. These bio-aromatics offer comparable performance while significantly reducing environmental impact, especially in coatings, adhesives, packaging, and specialty chemicals.

Low-VOC alternatives are being prioritized due to tightening air-quality regulations across major markets, driving companies to redesign formulations that emit fewer pollutants during use and production. Innovations in catalytic conversion, biorefining, and fermentation technologies are enabling cost-effective pathways to produce high-purity aromatic molecules from renewable sources. The integration of green chemistry principles is encouraging the development of safer processing routes with reduced energy consumption and lower toxic byproducts. As consumer demand and regulatory pressures intensify, the push for eco-friendly aromatic solutions is creating new opportunities for chemical manufacturers, fostering collaborations among industry, academia, and technology providers to scale sustainable alternatives.

Xylene solvents are anticipated to lead the market, holding a 35% share in 2026, owing to their strong solvency, chemical stability, and wide compatibility with paint formulations. They effectively dissolve resins, enable smooth viscosity control, and support uniform coating application. These performance benefits make xylene the preferred choice for manufacturers of high-quality decorative and industrial paints. China Petroleum & Chemical Corporation (Sinopec), one of the world's largest producers of xylene solvents, manufactures both mixed xylene and para-xylene, which are key industrial solvents in paints, coatings, and related applications. Sinopec's xylene products are highly valued for their excellent solvency power and stability, ensuring even thinning and enhanced formulation quality in paints and coatings used in the construction, automotive, and industrial sectors.

Toluene solvents are the fastest-growing segment, driven by rising demand in adhesives and inks. Their rapid evaporation makes them ideal for printing applications. Innovations focusing on low-aromatic formulations are further boosting their adoption in Asia Pacific and Europe. TotalEnergies, a leading global energy and chemicals company, supplies toluene and low-aromatic solvent grades that are widely used in adhesives and printing ink formulations. Known for their fast evaporation rates and strong solvency, TotalEnergies' toluene products help adhesive manufacturers efficiently dissolve elastomers and tackifiers, creating pressure-sensitive and contact adhesives with consistent viscosity and quick setting times.

The paints & coatings segment is anticipated to lead the market, holding 40% of the share in 2026, due to their heavy reliance on solvents for resin dissolution, viscosity control, and smooth film formation. Their broad accessibility across decorative, industrial, and protective applications, combined with rising construction and manufacturing activity, continues to drive strong demand for aromatic solvents in this segment. AkzoNobel N.V., a leading global paints and coatings manufacturer (known for brands such as Dulux), formulates many solvent-borne architectural and industrial coatings that rely on aromatic solvents (such as toluene and xylene) to dissolve resins, control viscosity, and ensure smooth film formation in decorative and protective paints.

The adhesives segment is the fastest-growing segment, supported by rising demand for high-strength bonding solutions across automotive, construction, and packaging industries. Their ability to penetrate surfaces easily, enhance durability, and support lightweight manufacturing trends accelerates adoption. Expanding automotive production and the shift toward advanced structural adhesives further boost rapid market growth. Henkel AG & Co. KGaA, under its LOCTITE brand, is a recognized global leader in high-performance structural adhesives used extensively in the automotive industry to replace traditional mechanical fasteners and welding. Henkel’s adhesives (such as LOCTITE EA 9396 AERO and specialized epoxy/polyurethane systems) provide strong surface penetration, superior durability, and excellent resistance to heat and vibration, making them ideal for bonding body panels, lightweight materials, and EV components in modern vehicles.

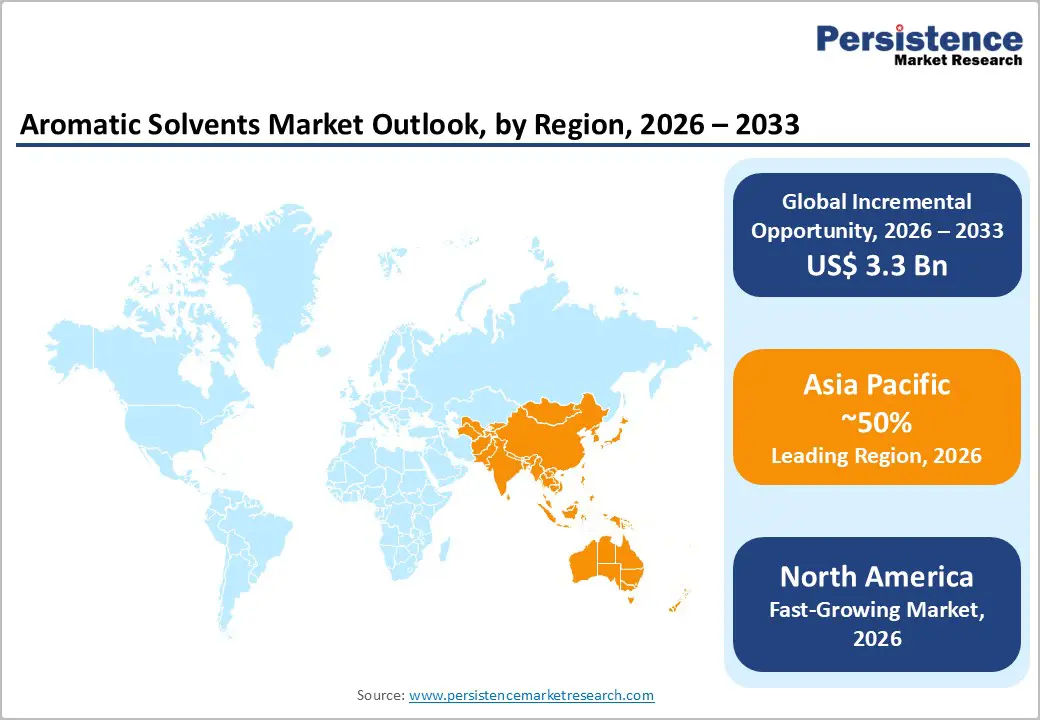

Growth in North America is shaped by strong industrial activity, stringent environmental regulations, and ongoing technological shifts. The region benefits from a mature manufacturing ecosystem, especially in paints & coatings, automotive, construction materials, and pharmaceuticals, driving a steady demand for solvents such as toluene, xylene, and ethylbenzene. The U.S. continues to dominate regional consumption due to its large chemical production capacity and well-established industrial clusters.

The tightening of environmental and air-quality regulations, especially those related to VOC emissions under frameworks such as the U.S. EPA’s Clean Air Act, is significantly influencing the market. This has prompted manufacturers to reformulate products, shift to lower-VOC blends, and invest in solvent-recovery and emission-control technologies. As a result, the market is slowly moving toward cleaner, more sustainable solvent alternatives. The growing demand for advanced coatings in industries such as automotive, aerospace, and infrastructure is driving the need for high-performance aromatic solvents. These solvents are essential for dissolving resins, improving spreadability, and ensuring the durability of coatings.

Growth in Europe is driven by strict environmental regulations, a mature chemical manufacturing base, and the region’s ongoing shift toward sustainable industrial practices. The European Union’s REACH framework and progressively tightening VOC directives strongly influence solvent formulation, pushing industries toward lower-emission, reformulated, or partially bio-based aromatic solvents. This regulatory environment encourages producers to innovate with cleaner processing technologies and controlled-emission manufacturing systems.

Demand remains stable across key sectors such as automotive coatings, industrial machinery, construction materials, adhesives, and specialty chemicals. Europe's advanced automotive and aerospace industries depend on high-performance coatings, where aromatic solvents play a crucial role in resin dissolution, enhancing flow properties, and ensuring fast evaporation for durable, uniform finishes. The rise in renovation projects, upgrades for energy-efficient buildings, and the use of protective coatings in infrastructure also drive continued solvent demand. The growing trend of high-value specialty formulations in countries such as Germany, Italy, and France highlights the focus on precision, purity, and compliance-friendly solvents by manufacturers.

Asia Pacific is projected to lead the market, capturing a 50% share by 2026, driven by rapid industrialization, growing manufacturing capacities, and increased construction activity in major economies such as China, India, South Korea, and Southeast Asia. The region’s dominance stems from its large-scale production of paints & coatings, adhesives, agrochemicals, and pharmaceuticals, all of which rely heavily on aromatic solvents such as toluene, xylene, and ethylbenzene for resin dissolution, formulation stability, and optimal application performance.

The expanding construction and infrastructure projects, especially in India and China, where residential, commercial, and industrial developments continue to surge, directly fuel demand for coatings and protective finishes, thus driving solvent consumption. Asia Pacific has also become a central hub for automotive manufacturing, electronics assembly, and flexible packaging, further increasing the need for high-purity solvents used in inks, adhesives, and specialty coatings.

The region is gradually shifting toward cleaner, low-VOC alternatives. While environmental regulations have been more lenient, countries such as Japan, South Korea, and China are tightening emission standards, pushing manufacturers to adopt more sustainable and efficient aromatic solvent formulations.

The global aromatic solvents market is highly competitive, characterized by a blend of large petrochemical corporations and regional specialty manufacturers. In mature markets such as North America and Europe, companies such as ExxonMobil Corporation and BASF SE maintain strong leadership through extensive R&D investments, integrated petrochemical operations, and well-established distribution networks. Their technological capabilities enable them to offer high-purity solvents, reformulated low-VOC blends, and customized solutions for coatings, adhesives, and chemical processing industries.

In the Asia Pacific region, China Petroleum & Chemical Corporation (Sinopec) plays a dominant role due to its massive production scale, cost-competitive feedstock availability, and ability to deliver localized formulations suited to regional industrial needs. Rapid industrial growth and the expansion of paints & coatings, automotive, and electronics sectors further strengthen the position of Asia Pacific players in the global competitive landscape. The pivot toward bio-based, low-aromatic, and low-VOC solvent technologies is driven by tightening environmental regulations and rising sustainability expectations. Players across regions are focusing on innovation in greener alternatives to differentiate themselves.

The global aromatic solvents market is projected to reach US$8.5 billion in 2026.

The rising prevalence of paints & coatings production and demand for effective solvents are the key drivers.

The aromatic solvents market is poised to witness a CAGR of 4.8% from 2026 to 2033.

Advancements in bio-based and low-VOC aromatic alternatives are the key opportunities.

ExxonMobil Corporation, China Petroleum & Chemical Corporation, BASF SE, Royal Dutch Shell PLC, and LyondellBasell Industries Holdings B.V. are the key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author