ID: PMRREP33041| 199 Pages | 14 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

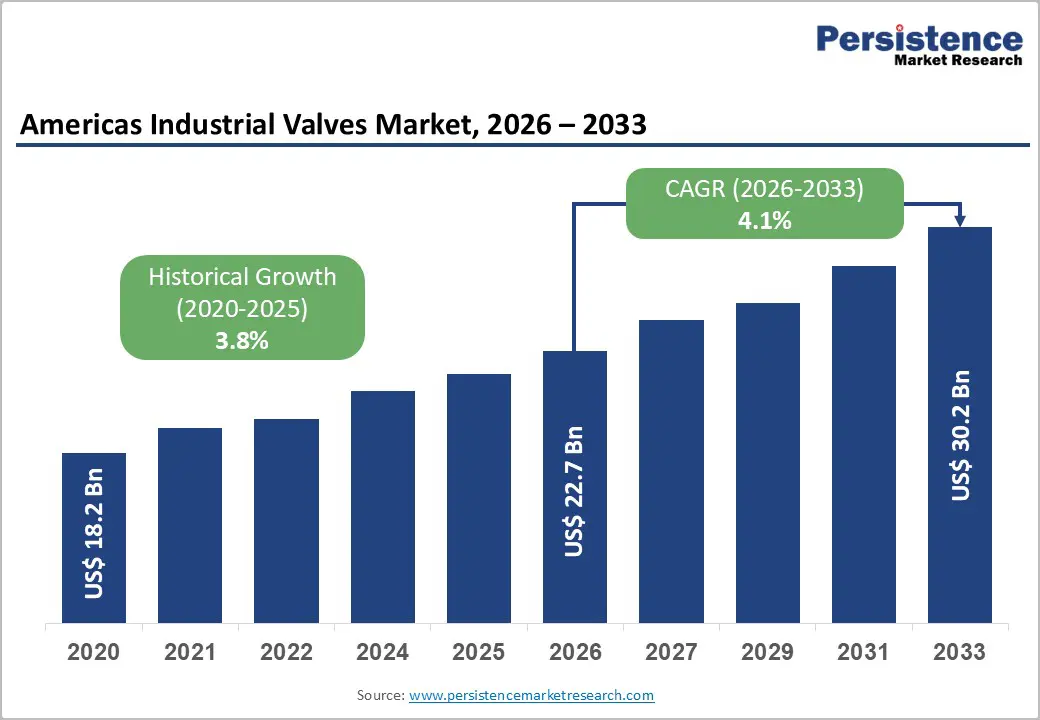

The Americas industrial valve market size is likely to be valued at US$ 22.7 billion in 2026 and is projected to reach US$ 30.2 billion by 2033, growing at a CAGR of 4.1% between 2026 and 2033. Market expansion is driven by oil and gas infrastructure investment supporting LNG development and pipeline modernization, water and wastewater treatment facilities meeting environmental compliance, and advancing automation with IoT, enabling predictive maintenance and optimization.

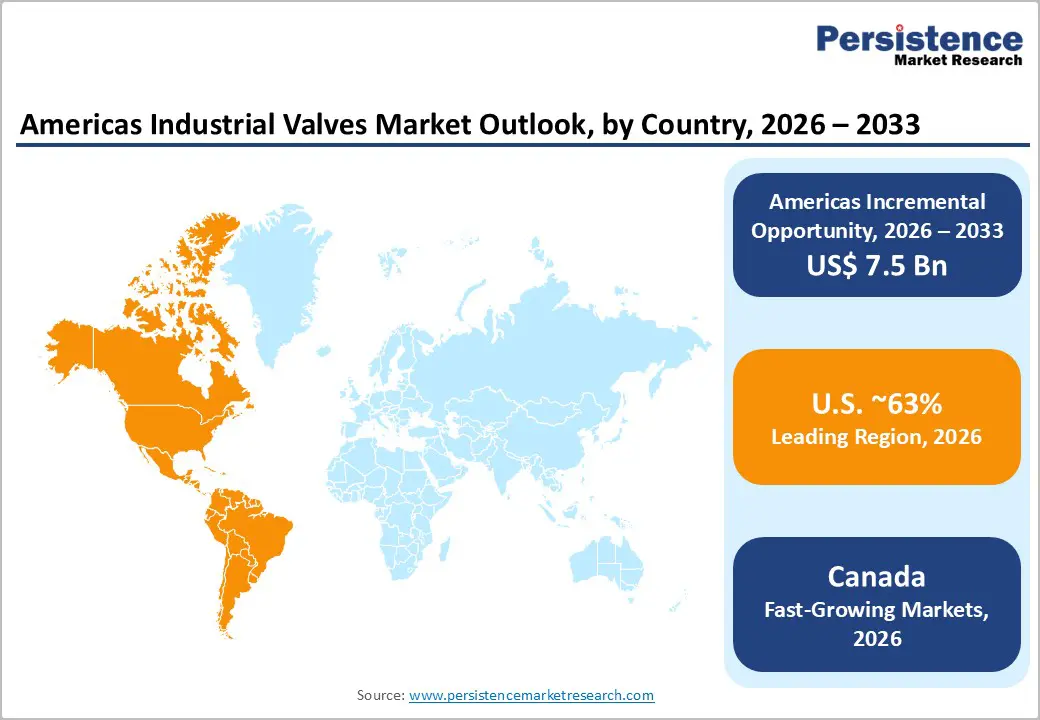

The United States leads with a 63% share, supported by energy infrastructure, regulation, and manufacturing, while Canada and Brazil show strong growth from energy modernization initiatives.

| Key Insights | Details |

|---|---|

| Americas Industrial Valves Market Size (2026E) | US$ 22.7 Billion |

| Market Value Forecast (2033F) | US$ 30.2 Billion |

| Projected Growth CAGR (2026 - 2033) | 4.1% |

| Historical Market Growth (2020 - 2025) | 3.8% |

Oil and gas capital expenditure across the Americas continues systematic expansion, supporting upstream exploration, midstream transportation infrastructure, and downstream refining modernization, generating sustained demand for industrial valves across extraction, processing, and distribution. U.S. liquefied natural gas exports are forecast at 12 billion cubic feet per day in 2024, rising to 15 bcf/day in 2025 and 16 bcf/day in 2026, per the U.S. Energy Information Administration, reinforcing the need for pipeline and infrastructure expansion. Shale gas accounted for 78% of U.S. dry natural gas production, totaling 37.87 trillion cubic feet in 2023, necessitating advanced valve solutions for high-pressure operations. Aging refineries require replacement equipment to meet tightening EPA emissions standards, making valve upgrades a significant cost focus. Gulf Coast LNG projects drive cryogenic valve deployment, while geopolitical energy security priorities sustain investment across the U.S., Canada, and Brazil over the medium term globally.

Escalating environmental regulations, emissions mandates, and water quality standards are driving the advancement and adoption of industrial valve technology, as government oversight and corporate sustainability commitments spur compliance-led modernization cycles. EPA rules targeting fugitive emissions reduction require advanced valve designs that minimize leaks, enhance sealing integrity, and support auditable compliance reporting. Expanding water reuse and recycling programs stimulates industrial water and wastewater treatment investments, increasing demand for specialized valves that enable precise flow control and process reliability. Climate commitments, including net-zero carbon pledges, are driving the deployment of energy-efficient valve technologies that improve operational efficiency and reduce lifecycle emissions. Wastewater treatment capacity expansions under the Clean Water Act and state regulations generate sustained demand for valves across treatment, isolation, and safety functions. Workplace safety regulations further promote enclosed designs and remote actuation to reduce hazardous exposure. International frameworks, including the Paris Agreement, apply.

Industrial valve system deployment involves high capital intensity and complex integration, with advanced equipment, specialized installation, and technical training creating adoption barriers for cost-constrained and developing market participants. Smart valves, automated actuators, and IoT-enabled systems command a premium over conventional options, limiting uptake among smaller operators. Retrofitting existing facilities faces structural limitations, operational downtime, and system compatibility challenges, extending project timelines and raising total ownership costs. Installation and maintenance require skilled labor, often scarce in emerging regions, constraining execution. Supply chain disruptions and manufacturing capacity limits restrict availability during demand spikes, delaying deliveries, projects, and revenue realization cycles.

Global energy transition momentum and decarbonization mandates introduce uncertainty around long term fossil fuel capital expenditure, with potential delays impacting oil and gas equipment procurement and market growth. Climate-focused regulations restricting fossil fuel development threaten sustained investment in extraction and processing infrastructure, historically the core demand base for industrial valves. Financial-sector pressure on lending to hydrocarbon industries constrains capital availability for expansion and modernization projects. Rapid renewable energy deployment redirects organizational priorities toward alternative infrastructure, potentially reducing demand for conventional valves over longer horizons. Persistent policy ambiguity regarding future regulatory direction encourages cautious capital allocation and delays procurement decisions globally.

Water and wastewater treatment facility expansion represents a substantial market opportunity, with municipal infrastructure modernization, industrial water recycling initiatives, and regulatory compliance requirements supporting sustained valve technology deployment across treatment processes, supporting environmental protection and resource sustainability objectives. Municipal wastewater treatment facility expansion, supporting growing population centers and environmental compliance requirements drive specialized valve demand for treatment process flow control.

Industrial water recycling and reuse initiatives that support manufacturing efficiency improvement and environmental responsibility create opportunities for process valve deployment. Desalination facility development across water-scarce regions, including the southwestern U.S. and drought-prone areas, creates specialized valve demand for high-pressure seawater processing and membrane protection. Smart water management systems integrating IoT technology and remote monitoring capabilities drive the adoption of connected valve solutions, enabling comprehensive system optimization.

Smart valve technology platform development, integrating advanced sensors, cloud connectivity, and AI-driven analytics, represents a significant market opportunity. Flowserve's November 2024 sustainability initiative announced low-leakage, energy-efficient valve development aligned with International Energy Agency emissions reduction targets, demonstrating momentum in technology advancement. Predictive maintenance capabilities that enable an organizational transition from reactive to proactive maintenance strategies support operational efficiency improvements and cost reductions, creating value propositions that justify premium technology investment. IoT integration, enabling real-time performance monitoring and automated optimization, supports environmental compliance and energy efficiency objectives. Digital transformation initiatives within process industries drive the adoption of connected valve solutions, supporting comprehensive operational visibility and control.

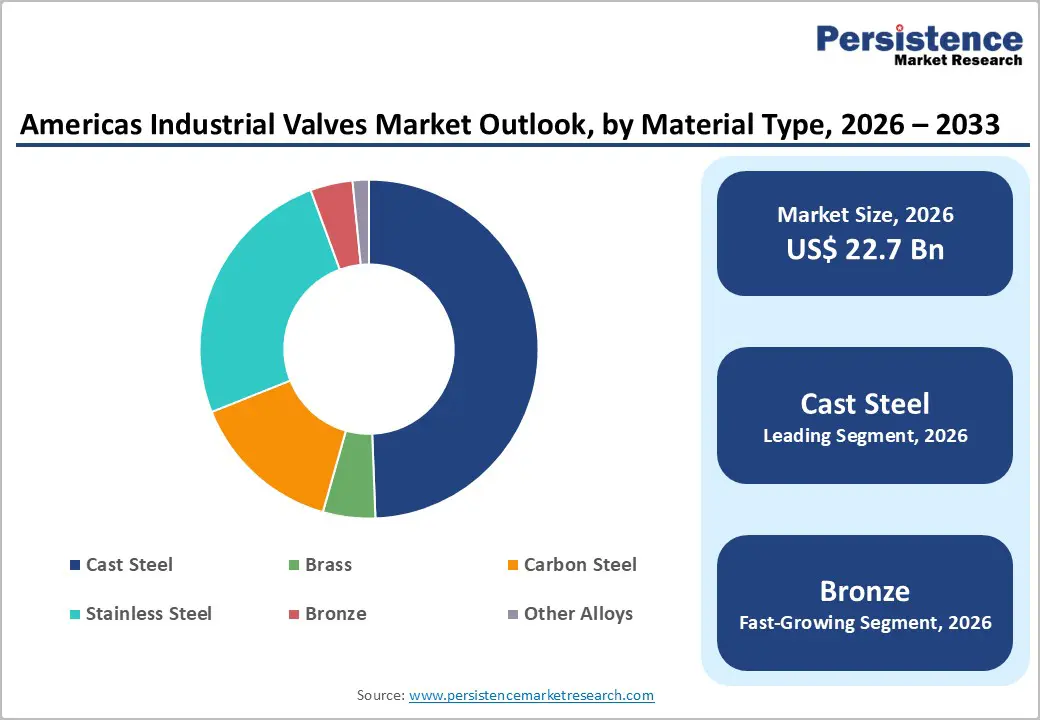

Cast steel valve construction commands approximately ~49% of America's industrial valve market share, representing the predominant material selection for high-pressure applications, extreme temperature environments, and demanding end-use contexts requiring robust material properties and superior stress tolerance characteristics. Cast steel provides cost-effective premium performance characteristics supporting broad applicability across oil and gas, chemical processing, and power generation sectors. Manufacturing flexibility supporting customized valve geometry and specialized pressure rating configurations drives sustained market preference among equipment designers and system integrators. Established manufacturing infrastructure and supplier relationships supporting cast steel valve production enable competitive pricing and reliable supply availability.

Bronze valve construction is the fastest-growing segment, recording a 5.1% CAGR, driven by superior corrosion resistance, marine suitability, and chemical compatibility supporting coastal industries and advanced processing. Extended service life justifies premium pricing, while recyclability and sustainability priorities increasingly favor the adoption of bronze materials across specialized industrial and infrastructure applications.

Manual valve operation maintains market dominance, with ~65% market share, reflecting established preferences for operator control, cost efficiency, and reliability across process industries, where manual intervention provides operational flexibility and safety assurance. Manual valve operation eliminates energy requirements and the need for complex automation infrastructure, supporting cost optimization for budget-conscious applications. Operator control capabilities that support adaptive responses to changing process conditions drive sustained preference across diverse industrial settings. Established maintenance infrastructure and operator familiarity support operational reliability and reduced training requirements.

Automatic valve operation systems expand at approximately 5.1% CAGR, driven by labor cost reduction, improved operational consistency, and integration with digital control architectures enabling Industry 4.0 adoption. Automation eliminates manual intervention in labor-constrained markets, while electronic controls and remote monitoring platforms enhance reliability, enable predictive maintenance, and improve facility optimization.

Ball valve technology commands ~25% of America's industrial valve market share, offering a versatile flow control solution across diverse pressure ranges, temperature conditions, and fluid characteristics, supporting widespread deployment across process industries. Ball valve reliability, compact design, and comprehensive product portfolio supporting standard and specialized applications drive sustained market dominance. Full-bore valve geometry, eliminating internal restrictions, minimizes pressure drop and enables efficient flow management. Bidirectional flow control capabilities and floating ball design variants support diverse application requirements across industrial sectors.

Globe valve technology is the fastest-growing valve category, posting a 4.6% CAGR, driven by precise flow control, superior throttling, and advanced variants such as angle and wye designs. Fine regulation and pressure reduction performance support adoption across sophisticated process control applications and diverse installation environments and operational requirements globally.

Oil and gas industry applications command approximately 37% of Americas industrial valve market share, driven by upstream extraction, midstream transportation, and downstream refining requirements supporting critical operational functions including pressure management, flow isolation, and safety protection. Upstream exploration and production operations require sophisticated valve infrastructure to support high-pressure extraction, gas processing, and transportation systems. Midstream pipeline infrastructure supporting energy distribution across continental networks represents a substantial valve deployment opportunity. Downstream refining facilities require a wide range of valve types to support processing operations, safety systems, and environmental compliance.

Water and wastewater treatment is the fastest-growing end-user segment, registering a 4.7% CAGR, driven by municipal infrastructure upgrades, industrial water recycling, and regulatory compliance. Population growth fuels treatment expansion, while industrial wastewater management and process water reuse initiatives increase demand for reliable, high-performance process valve solutions globally.

The United States dominates the Americas' industrial valve market, holding a 63% regional share, driven by expansive oil and gas infrastructure, advanced water treatment systems, the chemical processing industry, and strong manufacturing capabilities that enable premium technology adoption. Shale-driven oil and gas production, representing 78% of U.S. natural gas output, sustains upstream, midstream, and downstream infrastructure demand. Extensive refinery assets supporting fuels and petrochemicals require continuous modernization, ensuring recurring valve replacement and upgrade cycles. Nationwide municipal water supply and wastewater treatment networks generate a steady baseline demand. Stringent regulatory and safety frameworks reinforce technology advancement. EPA emissions and water quality regulations accelerate investment in low-leakage, high-performance valve solutions. Major industrial hubs, including the Gulf Coast petrochemical corridor, California refining base, and diversified manufacturing clusters, underpin market scale. An innovation ecosystem advancing automation and IoT-enabled valves positions the United States as a growth engine.

Canada demonstrates robust growth momentum at 4.8% CAGR, supported by oil sands extraction infrastructure, natural gas production expansion, and sophisticated pipeline networks supporting energy transportation supporting North American supply diversification and regulatory compliance requirements. Oil sands development and extraction, supporting crude oil production, create specialized valve demand for high-pressure, high-temperature applications. Natural gas production and processing, supporting domestic consumption and export markets, drive infrastructure expansion. Pipeline infrastructure connecting energy production regions to processing and distribution facilities represents a substantial capital investment that supports sustained valve procurement. Government regulatory frameworks and environmental compliance requirements drive technology adoption, supporting operational reliability and environmental protection objectives. Established manufacturing infrastructure and supply chains support competitive positioning and reliable equipment availability.

Brazil demonstrates robust growth at a 4.5% CAGR, driven by offshore oil and gas development, petrochemical capacity expansion, and modernization initiatives strengthening energy sector competitiveness. Offshore production in presalt fields demands sophisticated valve systems capable of operating under extreme pressure, temperature, and deepwater conditions. Expanding petrochemical investments supporting polymers, intermediates, and specialty chemicals increase demand for precision process control valves. Broader industrial modernization programs encourage the adoption of automated, smart, and high-efficiency valve technologies. Infrastructure upgrades and technology investments improve operational reliability and safety standards. Economic recovery and manufacturing expansion across energy-intensive industries generate incremental process demand, reinforcing sustained valve market growth across upstream, midstream, downstream, and chemical processing applications nationally, while supporting industrial competitiveness and export-oriented growth momentum.

The Americas industrial valve market shows moderate consolidation, led by multinational manufacturers with broad portfolios, strong customer ties, and deep technical expertise across oil and gas, chemicals, water, and power. Players, including Flowserve, Crane Co., Emerson, Cameron, Velan, and specialists, face high entry barriers. Flowserve’s Velan and MOGAS acquisitions highlight accelerating consolidation, reshaping the regional competitive landscape materially going forward.

Americas Industrial Valve Market is valued at US$ 22.7 billion in 2026 and is projected to reach US$ 30.2 billion by 2033.

Market growth is driven by oil and gas infrastructure expansion, stringent environmental and regulatory compliance requirements, and increasing adoption of automation and Industry 4.0 technologies.

The market is projected to expand at a 4.1% CAGR between 2026 and 2033.

Key opportunities include water and wastewater infrastructure expansion, smart and energy-efficient valve technology adoption, and diversification into mining and emerging regional markets.

Key players include Flowserve, Crane Co., Emerson Electric, Cameron, and Velan, supported by regional specialists and ongoing consolidation through strategic acquisitions.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Valve Type

By Material Type

By Function

By End-user

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author