ID: PMRREP33039| 200 Pages | 19 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

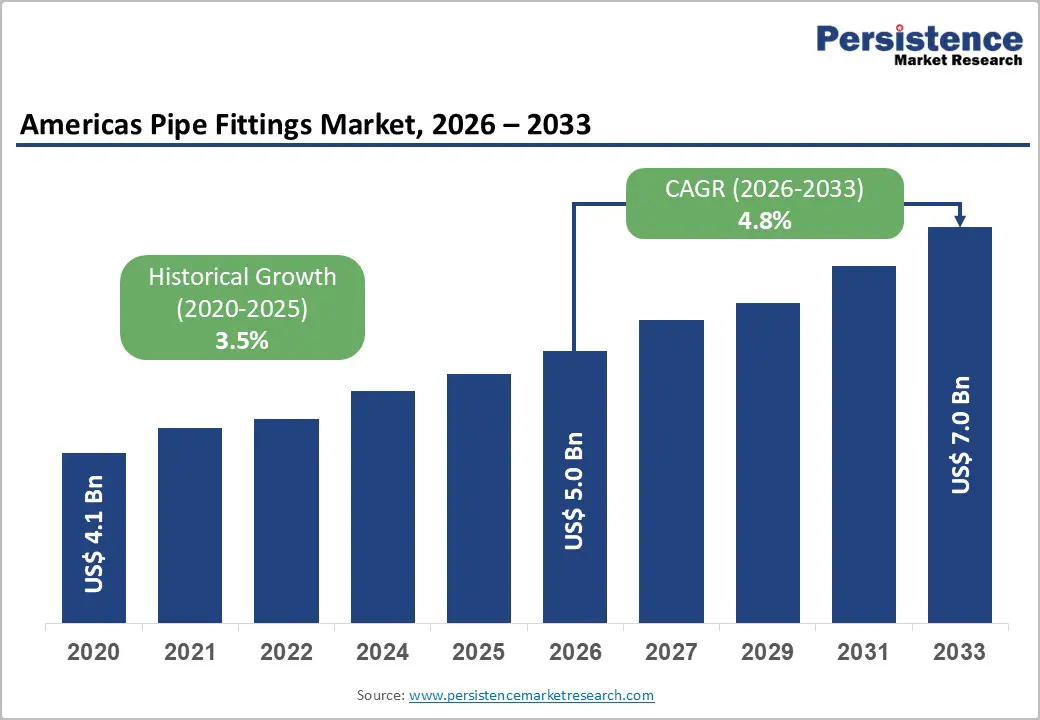

Americas pipe fittings market size is projected to reach US$ 5.0 billion in 2026 and US$ 7.0 billion by 2033, growing at a CAGR of 4.8% from 2026 to 2033.

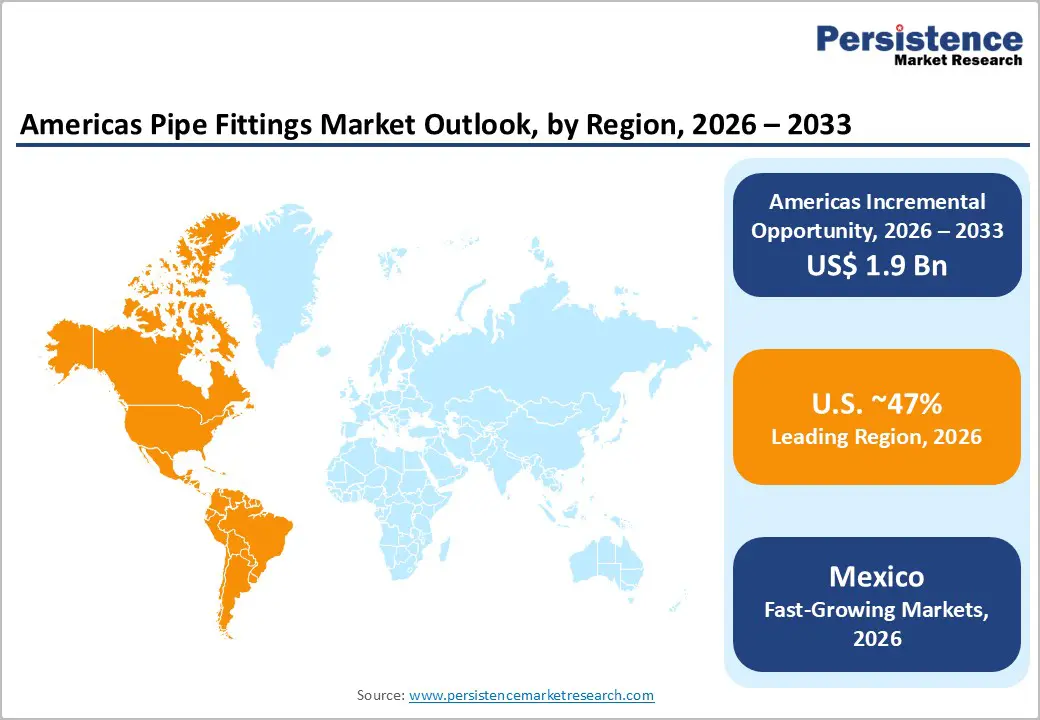

Market expansion is driven by systematic infrastructure modernization, addressing aging water and sewage systems, a rise in oil and gas sector capital expenditure supporting 523 planned North American projects through 2026, including 56% midstream expansion, and regulatory compliance mandates enforcing stricter environmental and safety standards, driving technology adoption. The United States dominates with 47% regional market share, leveraging mature infrastructure, robust construction activity, and advanced manufacturing capabilities, while Mexico demonstrates the fastest growth at 5.7% CAGR, supported by infrastructure expansion and manufacturing cost advantages.

| Key Insights | Details |

|---|---|

| Americas Pipe Fittings Market Size (2026E) | US$ 5.0 Billion |

| Market Value Forecast (2033F) | US$ 7.0 Billion |

| Projected Growth CAGR (2026 - 2033) | 4.8% |

| Historical Market Growth (2020 - 2025) | 3.5% |

Oil and gas sector capital investment across the Americas continues systematic expansion supporting upstream exploration, midstream pipeline development, and downstream processing facility modernization, with 523 planned North American oil and gas projects scheduled between 2022 and 2026, with 56% representing midstream infrastructure expansion, creating sustained demand for high-pressure, corrosion-resistant pipe fittings supporting critical operational infrastructure. LNG terminal development and liquefaction facility construction across the Gulf Coast and Canadian regions support specialized cryogenic fitting deployment for extreme-duty applications. Deepwater exploration and unconventional resource development require premium fitting technology supporting extreme pressure, temperature, and corrosion challenges. 120 petrochemical projects and 22 refinery projects planned across North America create substantial equipment procurement requirements supporting advanced fitting deployment. Pipeline modernization initiatives addressing regulatory compliance and operational efficiency improvements drive equipment replacement cycles. Geopolitical diversification supporting energy security objectives drives hemispheric supply chain development and infrastructure expansion investments.

Escalating environmental regulations, emissions reduction requirements, and water quality standards are systematically driving pipe fittings technology advancement and market adoption, with governmental agencies and organizational compliance requirements creating upgrade cycles supporting advanced material deployment. EPA water quality standards and Safe Drinking Water Act requirements mandate specific material specifications and testing protocols, favoring premium fitting solutions meeting stringent performance criteria. Fire safety regulations and building codes requiring CPVC fittings in commercial and institutional applications drive technology adoption across hospitality, healthcare, and laboratory sectors. U.S. PVC and CPVC pipe fittings market growing at 5.8% CAGR through 2033, demonstrating sustained demand driven by regulatory compliance and safety prioritization. Occupational safety regulations and worker protection standards drive the adoption of enclosed fitting designs, reducing exposure risks in industrial environments. International environmental protocols and corporate sustainability commitments drive organizational focus on material efficiency and waste reduction, supporting the adoption of advanced fitting technologies.

Pipe fittings market expansion is constrained by pronounced raw material price volatility across steel, copper, brass, aluminum, and specialty alloys, creating cost instability for manufacturers and buyers. Fluctuating steel and alloy prices directly pressure production economics, pricing strategies, and supplier margins, reducing competitiveness. Volatile copper and brass prices generate budgeting uncertainty for customers, limiting long-term purchasing commitments and inventory planning. Complex supply chains spanning sourcing, manufacturing, logistics, and distribution heighten exposure to disruption risks, affecting availability and delivery reliability. Capacity constraints during demand surges restrict order fulfillment capabilities, slowing growth momentum. Import tariffs and trade policies elevate costs and uncertainty.

Pipe fittings market competitiveness is intensified by significant competition from low-cost manufacturers, particularly in developing regions, with price-based competitive dynamics constraining profit margins for premium suppliers and limiting pricing power supporting premium positioning strategies. Chinese manufacturers are supplying commodity fittings at aggressive pricing pressure North American and Latin American suppliers creating margin compression and market share challenges. Consolidation among customers, including plumbing contractors and distributors, increases purchasing power, enabling demand for lower pricing and reducing supplier negotiating leverage. Some customers relocating production to low-cost countries reduce domestic demand, affecting North American manufacturers. Private label and distribution network brand competition limit differentiation and premium pricing opportunities. Currency volatility affecting emerging market competitiveness creates unpredictable competitive dynamics and pricing pressures.

Composite pipe fitting technology development and commercialization represent substantial market opportunity, with composite materials expanding at 6.5% CAGR driven by superior corrosion resistance, lightweight properties, and performance advantages supporting applications requiring extreme environmental conditions. Fiber-reinforced composite fittings addressing corrosion challenges in aggressive chemical and marine environments create premium product positioning. High-performance polymer fittings supporting weight reduction and installation efficiency improvements drive adoption in aerospace and transportation applications. Smart fittings with embedded sensors and IoT connectivity enabling real-time monitoring and predictive maintenance support emerging Industry 4.0 applications. Sustainable composite materials manufactured from recycled plastics address environmental consciousness supporting premium positioning. 3D printing and additive manufacturing technologies enabling rapid prototyping and customized fitting production create innovation opportunities.

Infrastructure modernization investments and public-private partnership proliferation represent significant market opportunity, with government commitment to facility upgrades, water system replacements, and transportation infrastructure development creating sustained equipment procurement demand supporting market expansion. U.S. government infrastructure initiative announced modernization projects including terminal and facility redevelopment supporting sustained investment pipeline. Municipal water network upgrades addressing aging infrastructure and regulatory compliance drive institutional procurement requirements. Private sector industrial modernization supporting manufacturing efficiency improvements and environmental compliance drive equipment investments. Mueller Water Products major contract win for municipal water network upgrade in January 2025 demonstrates substantial institutional market opportunity. Public-private partnerships enabling risk sharing and capital mobilization support project development and execution. Climate adaptation investments supporting resilience infrastructure development create emerging market opportunities.

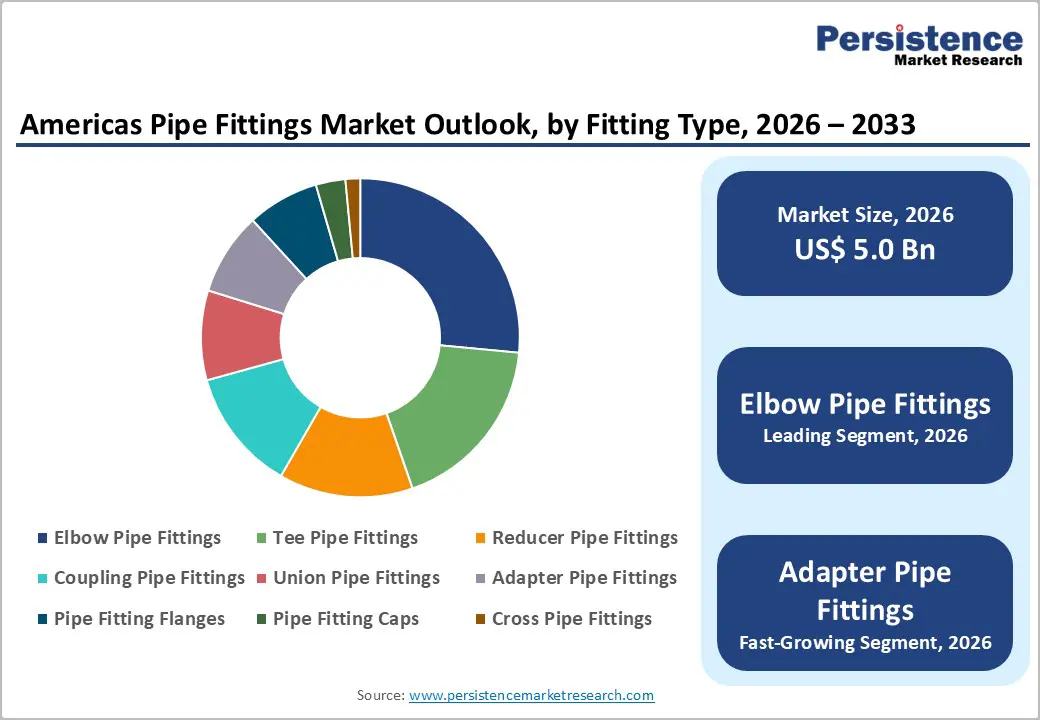

Elbow pipe fittings command approximately 27% of Americas pipe fittings market share, representing most utilized fitting type for directional changes in piping systems supporting standard installations across residential, commercial, and industrial applications. Elbow fittings market projected to grow at 4.8% CAGR, demonstrating sustained demand driven by fundamental piping system requirements. Diverse elbow variants including 45-degree, 90-degree, long-radius, and short-radius configurations support specialized installation requirements. CPVC and PVC elbows dominate residential plumbing applications. Steel and stainless steel elbows support industrial and high-pressure applications.

Adapter fittings are the fastest-growing segment, expanding at 5.6% CAGR, driven by system integration needs, mixed-material piping adoption, and specialized application requirements. Thread adapters connecting threaded and unthreaded components support commercial and industrial uses. Compression adapters enable retrofit installations without welding, while transition adapters accommodate material changes. Specialized adapters for PEX, PVC, and copper ensure compatibility across modern plumbing systems.

Steel and steel alloys command approximately 42% of Americas pipe fittings market share, representing dominant material selection for industrial, infrastructure, and high-pressure applications requiring robust mechanical properties and superior stress tolerance. Carbon steel fittings supporting cost-effective standard applications. Stainless steel fittings serving corrosion-critical environments including chemical processing and marine applications. Alloy steel fittings enabling extreme-temperature and high-pressure applications. Galvanized steel fittings providing corrosion protection for water and wastewater applications.

Composite pipe fittings expand at 6.5% CAGR, driven by superior corrosion resistance, lightweight properties, and environmental advantages supporting emerging application domains including chemical processing and marine environments. Fiber-reinforced polymer composites addressing corrosion immunity and weight reduction. High-strength polymer fittings supporting performance improvement and cost optimization. Sustainable composite materials manufactured from recycled content supporting environmental objectives.

Industrial applications command approximately 38% of pipe fittings market, driven by chemical processing, petrochemical operations, manufacturing facilities, and water treatment infrastructure requiring specialized fittings for pressure control, flow management, and safety applications. Chemical industry process piping requires corrosion-resistant fittings supporting aggressive chemical compatibility. Petrochemical facilities demand high-pressure, high-temperature fittings for processing operations. Mining and mineral processing utilize specialized fittings supporting slurry transport and chemical processing. Food processing and beverage production require sanitary fittings meeting hygiene standards.

Infrastructure applications expand at 5.2% CAGR, driven by municipal water system modernization, wastewater treatment facility expansion, and transportation infrastructure development supporting environmental protection and public service objectives. Municipal water distribution system replacements create sustained demand for compliant fittings. Wastewater treatment facility expansion supporting environmental compliance drives institutional procurement. Public transportation infrastructure including transit systems and utilities require piping systems.

The United States dominates the Americas pipe fittings market, holding approximately 47% regional share, supported by extensive infrastructure networks, a mature industrial base, strong construction activity, advanced manufacturing capabilities, and stringent regulatory frameworks sustaining long-term demand. The market benefits from more than 500 planned oil and gas projects through 2026, supporting midstream infrastructure expansion and continuous equipment procurement. Aging water distribution systems drive recurring institutional replacement demand across municipal networks. Expanding residential and commercial construction further stimulates plumbing infrastructure requirements. Environmental regulations, including EPA standards, encourage adoption of premium, compliant products. A strong manufacturing innovation ecosystem enables advanced fitting development. Multinational manufacturers maintain significant U.S. operations, reinforcing technology leadership, large contract values, and system-wide enterprise deployments across diverse end-use sectors.

Brazil maintains a prominent market position holding approximately 14% of Americas market share, demonstrating robust growth driven by infrastructure modernization, urban development, industrial expansion, and manufacturing capabilities supporting regional market leadership and export positioning. Brazil plastic pipes market is growing prominently supporting substantial fitting demand. Urban population concentration in São Paulo, Rio de Janeiro, and Brasília creates substantial commercial infrastructure demand. Government infrastructure investment including BRL 30 billion allocation supports project pipeline. Industrial modernization and manufacturing facility expansion drive specialized fitting requirements. Brazil represents emerging manufacturing hub with competitive cost structure enabling regional export positioning. Supply chain integration within South America supports regional market penetration. Growing middle-class consumption and urbanization support infrastructure expansion momentum.

Mexico demonstrates the fastest growth in the Americas pipe fittings market, expanding at 5.7% CAGR, driven by construction recovery, industrial expansion, manufacturing cost advantages, and strategic geographic positioning supporting regional integration. Construction sector rebound following a 33% decline signals strong pent-up demand for piping infrastructure across residential, commercial, and infrastructure projects. Manufacturing and industrial facility expansion increase demand for specialized fittings across food processing, mining, and automotive industries. Nearshoring trends accelerate supply chain regionalization, attracting manufacturing investments and boosting local production capacity. Cost-competitive manufacturing enables exports to North American and Central American markets. Distribution network development and retail infrastructure expansion improve market penetration. Integration under the USMCA framework facilitates cross-border trade, investment flows, and deeper integration into regional manufacturing networks.

Americas pipe fittings market shows moderate consolidation, with multinational leaders balanced by specialized regional suppliers. Major players including Mueller Industries, Parker Hannifin, Swagelok, Victaulic, and Saint-Gobain leverage broad portfolios, strong distribution, and technical expertise. Entry barriers include scale, compliance, and relationships. Mueller Industries’ 2024 Elkhart acquisition signals consolidation momentum, while regional firms and private labels serve cost-sensitive segments.

The Americas pipe fittings market is valued at US$ 5.0 billion in 2026 and projected to reach US$ 7.0 billion by 2033.

Market growth is driven by aging infrastructure replacement, oil and gas expansion with 523 planned projects, and strict environmental and safety regulations accelerating demand for compliant, high-performance fitting solutions.

Americas pipe fittings market is forecast to grow at a 4.8% CAGR during the forecast period.

Key opportunities lie in composite material commercialization, municipal infrastructure modernization via PPPs, and Mexico-led manufacturing expansion, positioning the country as the fastest-growing country.

Market leadership is held by Mueller Industries, Parker Hannifin, Swagelok, Victaulic, and Saint-Gobain, supported by regional players Tupy, Tenaris, and Grupo Rotoplas, with recent acquisitions and partnerships validating ongoing consolidation and institutional demand strength.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Fittings Type

By Material Type

By End-user

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author