ID: PMRREP28057| 198 Pages | 23 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

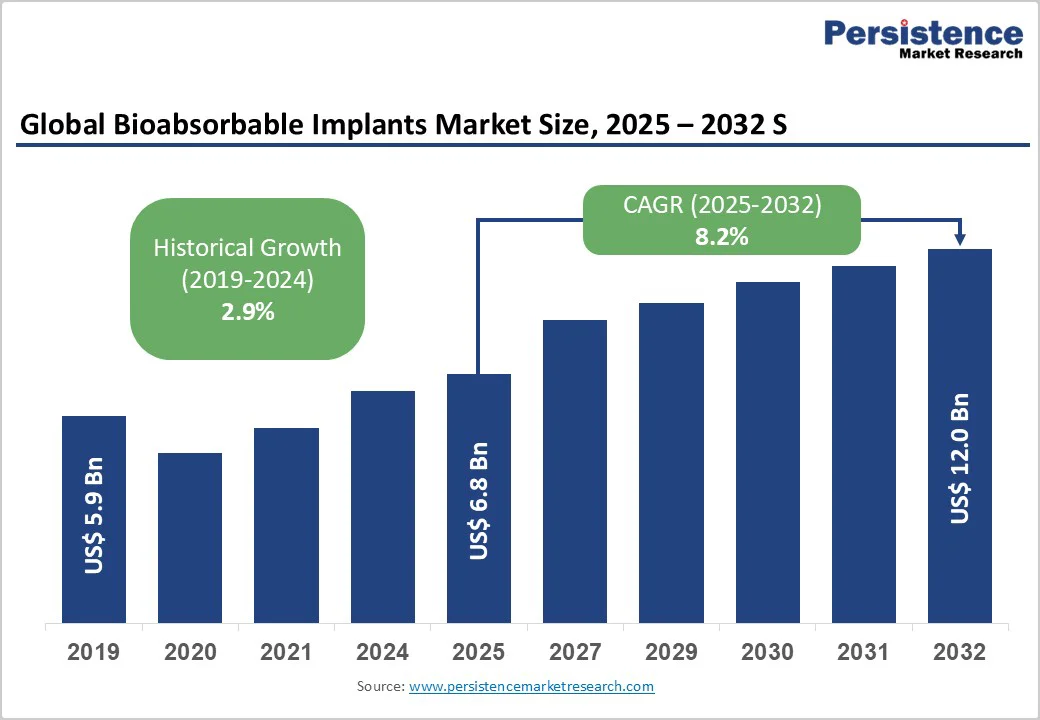

The global bioabsorbable implants market size is estimated to grow from US$ 6.9 billion in 2026 to US$ 11.3 billion by 2033. The market is projected to record a CAGR of 6.1% during the forecast period from 2026 to 2033. Global demand for bioabsorbable implants is rising rapidly, supported by increasing orthopedic, trauma, and sports-related procedures, growing awareness of the benefits of resorbable implants, and the shift toward minimally invasive surgical techniques.

The expansion of advanced surgical infrastructure, higher adoption of patient-specific and 3D-printed implants, and innovations in biodegradable polymers, metals, and ceramics are accelerating market momentum. Continuous improvements in mechanical strength, controlled degradation, and bioactive/drug-eluting properties are enhancing clinical outcomes and patient recovery. Additionally, favorable reimbursement policies, rising geriatric populations, and growing adoption in emerging markets further boost market growth.

| Key Insights | Details |

|---|---|

|

Bioabsorbable Implants Market Size (2026E) |

US$ 6.9 Bn |

|

Market Value Forecast (2033F) |

US$ 11.3 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

6.1% |

|

Historical Market Growth (CAGR 2020 to 2025) |

4.7% |

The global bioabsorbable implants market is being driven by the increasing number of orthopedic and trauma surgeries worldwide. Growing incidences of fractures, ligament injuries, sports-related trauma, and degenerative musculoskeletal conditions are fueling the demand for reliable fixation solutions that ensure effective healing and stability. Hospitals and specialty clinics are seeing higher surgical volumes, particularly in regions with aging populations and rising road-traffic accidents, creating a consistent need for advanced implant technologies.

Bioabsorbable implants offer significant clinical benefits. They eliminate the need for secondary removal surgeries, reduce long-term complications such as implant-related infections or tissue irritation, and promote faster patient recovery. These advantages make them a preferred choice for surgeons and patients alike, supporting wider adoption across orthopedic, cardiovascular, and other surgical applications.

The bioabsorbable implants market faces significant regulatory and approval hurdles, as devices must comply with stringent safety and efficacy standards before commercialization. Manufacturers are often required to conduct extensive preclinical and clinical studies to generate robust evidence, which can delay product launches and increase time-to-market. Variations in regulatory requirements across regions, particularly between North America, Europe, and emerging markets, further complicate approval processes and create barriers for smaller or new entrants.

In addition to regulatory challenges, bioabsorbable implants generally cost more than conventional metal or non-resorbable implants. The advanced biomaterials, precision manufacturing, and R&D investments required to develop these devices contribute to elevated prices, which may limit adoption in cost-sensitive healthcare settings or emerging markets. Hospitals and clinics must weigh these higher upfront costs against long-term clinical benefits, such as reduced secondary surgeries and fewer complications, when deciding on implant selection.

The bioabsorbable implants market growth is propelling due to the development of biodegradable metals, such as magnesium alloys, which offer superior mechanical strength and controlled degradation for load-bearing applications. For instance, in April 2023, researchers at the University of Central Florida (UCF) developed bioabsorbable implants designed to enhance bone healing. The team is creating screws, pins, rods, and other medical devices made from magnesium that naturally dissolve within the body, eliminating the need for surgical removal. These advanced materials address limitations of traditional polymers, enabling implants that support faster bone healing and reduce the risk of long-term complications.

Furthermore, the 3D-printed patient-specific bioabsorbable implants are gaining traction, allowing customization to individual anatomical needs and improving surgical precision. Additionally, drug-eluting and resorbable combination implants are emerging as promising solutions, delivering localized therapeutic agents while gradually degrading, reducing infection risk, and enhancing clinical outcomes. These technological advancements collectively create significant growth opportunities across orthopedic, cardiovascular, and reconstructive surgery applications.

The fixation devices segment is projected to dominate the global bioabsorbable implants market in 2026, accounting for 40.4% of the market's revenue. The segment’s strong performance is driven primarily by the widespread use of screws, pins, plates, and rods in orthopedic, trauma, and sports-injury surgeries, where stable fixation and gradual resorption are critical to effective healing. Bioabsorbable fixation devices eliminate the need for secondary removal surgeries, reduce long-term complications, and support faster patient recovery, making them highly preferred by surgeons. Advancements in biodegradable polymers and magnesium-based materials have enhanced mechanical strength, biocompatibility, and controlled degradation rates, further boosting adoption. Additionally, the growing trend toward minimally invasive procedures, rising orthopedic surgery volumes, and increasing patient awareness of the benefits of resorbable implants are driving market growth.

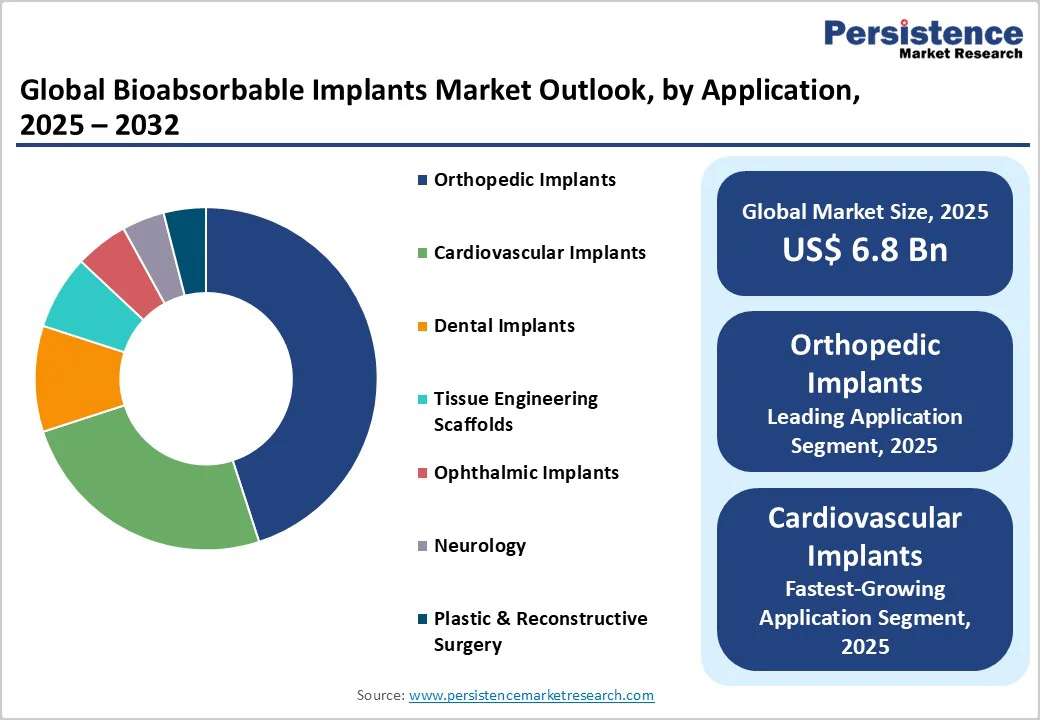

The orthopedic segment is projected to dominate the global Bioabsorbable Implants market in 2026, accounting for 48.8% of revenue. This is due to the increasing prevalence of musculoskeletal disorders, fractures, ligament injuries, and sports-related traumas that require surgical intervention with reliable fixation solutions. Bioabsorbable implants, including screws, pins, and plates, are widely preferred in orthopedic procedures as they provide mechanical stability while gradually degrading, eliminating the need for secondary removal surgeries. Advancements in biodegradable polymers and magnesium-based implants have further enhanced their mechanical strength, biocompatibility, and controlled degradation rates, making them ideal for load-bearing and non-load-bearing applications. The growing adoption of minimally invasive surgical techniques, coupled with favorable reimbursement policies and increased patient awareness of faster recovery and lower complication risks.

The hospitals segment is projected to dominate the global bioabsorbable implants market in 2026, accounting for a revenue share 54.8%. This is driven by the high volume of orthopedic, trauma, and sports-injury procedures performed in hospital settings, where access to advanced surgical equipment, specialized surgeons, and comprehensive post-operative care is readily available. Hospitals increasingly prefer bioabsorbable implants due to their clinical advantages, including reduced risk of long-term complications, elimination of secondary removal surgeries, and faster patient recovery. Additionally, hospitals often participate in clinical trials and early adopt innovative biomaterials, such as biodegradable polymers and magnesium-based implants. The presence of multidisciplinary surgical teams and robust reimbursement frameworks also facilitates the use of high-cost, technologically advanced implants.

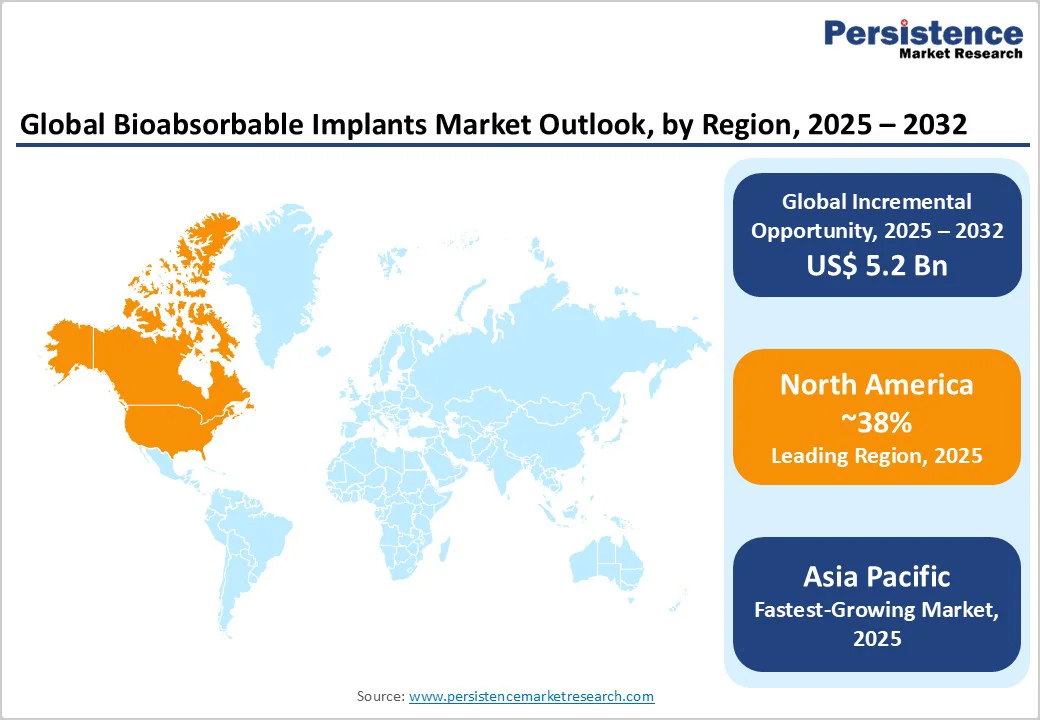

The North America market is expected to dominate globally with a value share of 43.7% in 2026, with the U.S. leading the region due to its advanced healthcare infrastructure, high procedural volumes, and faster adoption of next-generation orthopedic and sports-medicine technologies. The region benefits from strong clinical acceptance of bioabsorbable fixation systems, particularly in ACL reconstruction, rotator cuff repair, and fracture management, where reduced revision surgeries and long-term biocompatibility are key decision drivers.

Leading manufacturers such as Stryker, Zimmer Biomet, and Smith+Nephew have deep market penetration supported by robust surgeon training programs, extensive distribution networks, and continuous R&D investments focused on polymer blends, magnesium-based implants, and bioactive resorbable materials. Favorable reimbursement for minimally invasive procedures, combined with rising sports injury rates and an expanding aging population, further boost market growth in the region.

The European market is expected to grow steadily, driven by the region’s strong orthopedic and sports-medicine ecosystem, well-established surgical infrastructure, and early clinical adoption of bioabsorbable fixation technologies. Countries such as Germany, the U.K., France, Italy, and the Nordics continue to perform a high volume of trauma and degenerative joint procedures, creating sustained demand for implants that minimize long-term complications and eliminate the need for removal surgeries. For instance, the Gelenk Klinik, a leading orthopedic hospital in Europe, treats over 24,000 orthopedic patients annually, underscoring the high procedural volumes that drive demand for advanced implant solutions. Robust regulatory emphasis on patient safety and biomaterial innovation is encouraging manufacturers to introduce devices with improved mechanical strength, controlled degradation rates, and enhanced biocompatibility.

Ongoing investments in R&D, particularly in biodegradable magnesium alloys, bioactive polymers, and drug-eluting implant platforms, are further supporting market expansion. Europe’s strong medical-device manufacturing base, combined with collaborative academic research, accelerates translational development and clinical validation. Favorable reimbursement structures for minimally invasive and regenerative procedures, along with rising awareness among surgeons and patients of the benefits of resorbable implants, are driving technology adoption.

The Asia Pacific market is expected to register a relatively higher CAGR of around 8.2% between 2026 and 2033, driven by a rapid rise in orthopedic, trauma, and sports-injury procedures across China, India, Japan, and Southeast Asia. Growing road-traffic accidents, aging populations, and increasing participation in competitive sports are accelerating the need for advanced fixation solutions that reduce revision surgeries. The region is also witnessing strong adoption of minimally invasive techniques, supported by improving surgical infrastructure and expanding access to specialty care.

Domestic manufacturers in China, India, and South Korea are investing heavily in bioabsorbable polymers, magnesium-based implants, and 3D-printed devices, offering cost-competitive alternatives and strengthening regional supply chains. Government-led initiatives to localize medical device production, coupled with rising healthcare expenditure and favorable reimbursement reforms, are further boosting market growth in the region.

The global bioabsorbable implants market is highly competitive, with leading players such as Medtronic, Stryker, Zimmer Biomet, B. Braun SE, Smith+Nephew, and W. L. Gore & Associates GmbH strengthening their positions through extensive surgical portfolios, strong distributor networks, and continuous biomaterial innovation.

Companies are advancing polymer- and magnesium-based technologies, improving mechanical strength, and enhancing controlled-degradation performance to differentiate products across orthopedic, sports medicine, and trauma applications. Manufacturers are also expanding into patient-specific, 3D-printed implant solutions, developing drug-eluting and hybrid bioactive implants, and increasing R&D investments to support faster healing and complication reduction.

The global bioabsorbable implants market is projected to be valued at US$ 6.9 Bn in 2026.

Growing orthopedic and trauma procedures, clinical advantages of resorbable materials, advancements in biodegradable polymers & metals, and rising demand for minimally invasive treatments are driving the global bioabsorbable implants market.

The global bioabsorbable implants market is poised to witness a CAGR of 6.1% between 2026 and 2033.

Personalized 3D-printed bioabsorbable devices, biodegradable metal implants, and drug-eluting resorbable technologies are creating opportunities in the market.

Medtronic, Stryker, Zimmer Biomet, B. Braun SE, Smith+Nephew, and W. L. Gore & Associates GmbH are some of the key players in the bioabsorbable implants market.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product

By Material

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author