ID: PMRREP20971| 181 Pages | 10 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

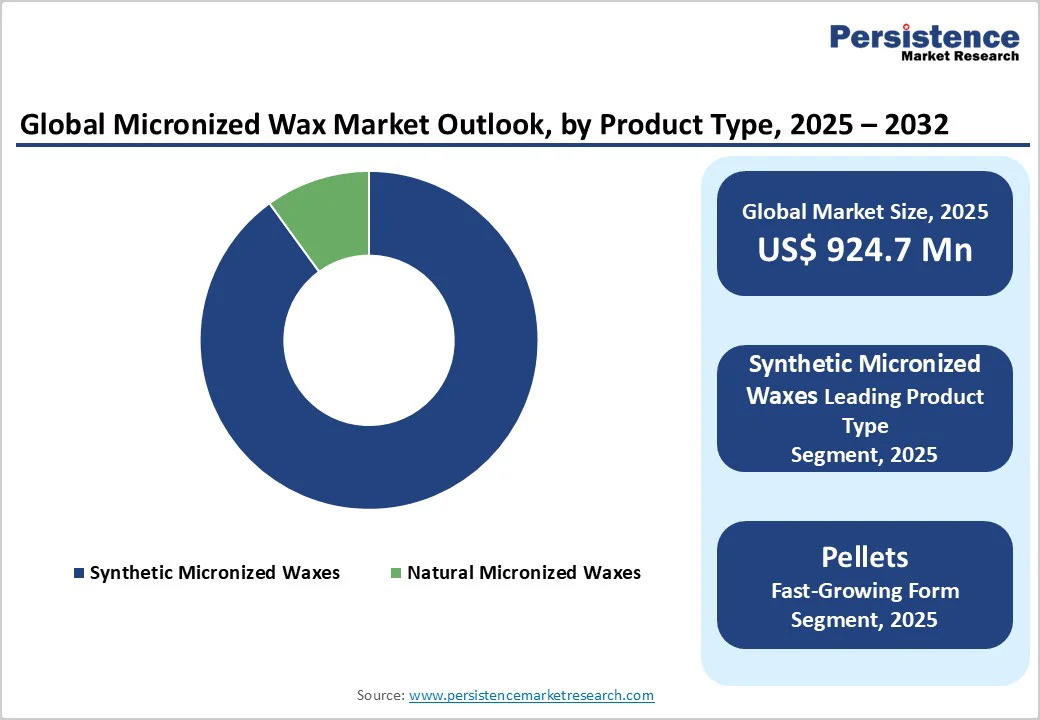

The global micronized wax market size is likely to value at US$ 924.7 million in 2025 and is projected to reach US$ 1,381.2 million, growing at a CAGR of 5.9 % between 2025 and 2032.

The robust expansion is driven by rising demand for high-performance coatings, inks, and plastics additives in automotive and packaging applications, where micronized wax powders enhance scratch resistance, surface finish, and barrier properties.

Technological advancements in micronization, such as jet smilling and spray-chilling, are enabling sub-5 µm particle production, unlocking new applications in electronics packaging and 3D printing resins. Additionally, regulatory emphasis on eco-friendly, bio-based wax additives is fueling growth in natural wax segments such as carnauba and rice bran powders.

| Key Insights | Details |

|---|---|

| Micronized Wax Powder Market Size (2025E) | US$ 924.7 million |

| Market Value Forecast (2032F) | US$ 1,381.2 million |

| Projected Growth CAGR (2025-2032) | 5.9% |

| Historical Market Growth (2019-2024) | 4.4% |

The automotive, construction, and packaging industries are propelling demand for micronized wax additives, which now account for nearly 50% of global usage in coatings and inks due to their ability to improve scratch resistance, surface finish, and anti-blocking properties.

Global automotive production grew by 6% in 2024, driving formulators to adopt synthetic micronized wax powders particularly PE and PP, within clearcoats and primers to meet stringent quality standards and durability requirements. These wax additives reduce coefficient of friction and enhance gloss retention, key prerequisites for automotive OEMs seeking to differentiate their vehicles in competitive markets.

Stringent environmental regulations in North America and Europe are accelerating the shift toward bio-based micronized wax solutions. Initiatives targeting a 30% reduction in VOC emissions by 2026 under various regional directives have compelled formulators to incorporate natural wax powders such as carnauba, beeswax, and rice bran that deliver water-repellency and anti-blocking performance without harmful solvents.

Government incentives and subsidies for green chemistry R&D have further encouraged specialty chemical manufacturers to expand bio-wax dispersion portfolios, aligning with sustainability goals and corporate ESG commitments.

Crude oil price fluctuations directly influence production costs for petroleum-based micronized waxes (PE, PP, FT), resulting in input cost variability of up to 20% year-on-year. Such volatility can pressure profit margins for wax manufacturers and lead to pricing instability for end-use formulators, who may face cost pass-through challenges.

Moreover, supply chain disruptions exacerbated by geopolitical tensions have occasionally caused raw material shortages, prompting companies to seek alternative feedstock and hedging strategies to mitigate risk.

Emerging competitors such as silica nanoparticles, polymeric flow modifiers, and fluoropolymer powders are gaining traction in coatings and printing ink applications. These alternatives offer comparable surface modification and rheology control at competitive price points, posing a threat to traditional micronized wax demand.

For instance, surface-modified silica is used to achieve anti-settling effects similar to wax powders, compelling wax producers to invest in innovation and product differentiation to maintain their market share.

Advancements in jet milling, spray-chilling, and cryogenic grinding are enabling the production of sub-5 µm wax particles with narrow size distributions. These nano-Micronized wax powders unlock novel applications in high-precision 3D printing resins, advanced electronics packaging, and microfluidic devices.

The global 3D printing materials market is expected to grow at 12% CAGR through 2032, presenting wax producers an opportunity to supply specialized additives that improve adhesion, flow, and surface quality in additive manufacturing processes.

The personal care & cosmetics sector is increasingly adopting PTFE, PA, and bio-wax microspheres to enhance texture, stability, and sensory profiles of creams, lotions, lipsticks, and mascaras. Forecasts indicate a 7% annual growth in specialty additives for cosmetics, driven by consumer demand for smooth, non-greasy formulations and “clean beauty” credentials.

Companies are developing Micronized wax dispersions that confer matte finishes, improved slip, and water-resistance, opening new revenue streams for wax suppliers partnering with majors in the personal care segment.

By Product Type, synthetic micronized waxes dominate, capturing approximately 90% of total market revenue. Polyethylene (PE) micronized wax leads with a 45% share of this synthetic segment, due to its versatile performance in coatings, plastics, and rubber applications as a slip and anti-blocking agent.

Fischer-Tropsch wax and polypropylene wax also register significant usage, particularly in hot-melt adhesives and ink formulations. Synthetic wax market growth is underpinned by continuous process optimization and cost-effective feedstock sourcing, enabling manufacturers to deliver consistent high-quality powders at scale.

Natural Micronized waxes including carnauba, beeswax, and candelilla, account for the remaining 10%, driven by sustainability mandates and consumer preferences. Carnauba wax, renowned for its hardness and gloss enhancement, is the leading bio-wax, especially in food-grade coatings and high-end cosmetics. Ongoing R&D aimed at reducing particle size and improving dispersion stability is expected to bolster the natural wax market over the forecast period.

By Form category, Powder form leads with roughly 70% of global consumption. Powders offer superior ease of handling and dispersion in solvent-based coatings, inks, and paints, delivering precise rheology control, enhanced surface finish, and consistent performance across diverse formulations. Powdered micronized wax additives are extensively used in automotive clearcoats, industrial coatings, and flexible packaging inks.

The pellets form comprising extruded wax granules accounts for 20% share, favored in hot-melt adhesives and masterbatch applications due to ease of metering and minimal dust generation. Liquid dispersions, representing the remaining 10%, are gaining traction in water-based and UV-cured formulations, enabling formulators to incorporate Micronized wax without dust concerns and aligning with eco-friendly solvent-free trends.

The rigid packaging & flexible packaging segment leads among end-use industries with 35% share, driven by rising demand for grease- and moisture-barrier coatings in food, pharmaceutical, and e-commerce packaging. Micronized wax dispersions enhance barrier performance and machinability of films, contributing to shelf-life extension and product protection. Growth in global e-commerce, which rose 20% in 2024, further propels the need for advanced packaging solutions incorporating wax additives.

The automotive sector follows closely, with around a 25% share, leveraging wax powders for scratch-resistant clearcoats, interior coatings, and plastic component lubricity. The personal care & cosmetics segment represents 10% of demand, growing swiftly due to “clean” formulation trends and consumer interest in bio-wax textures.

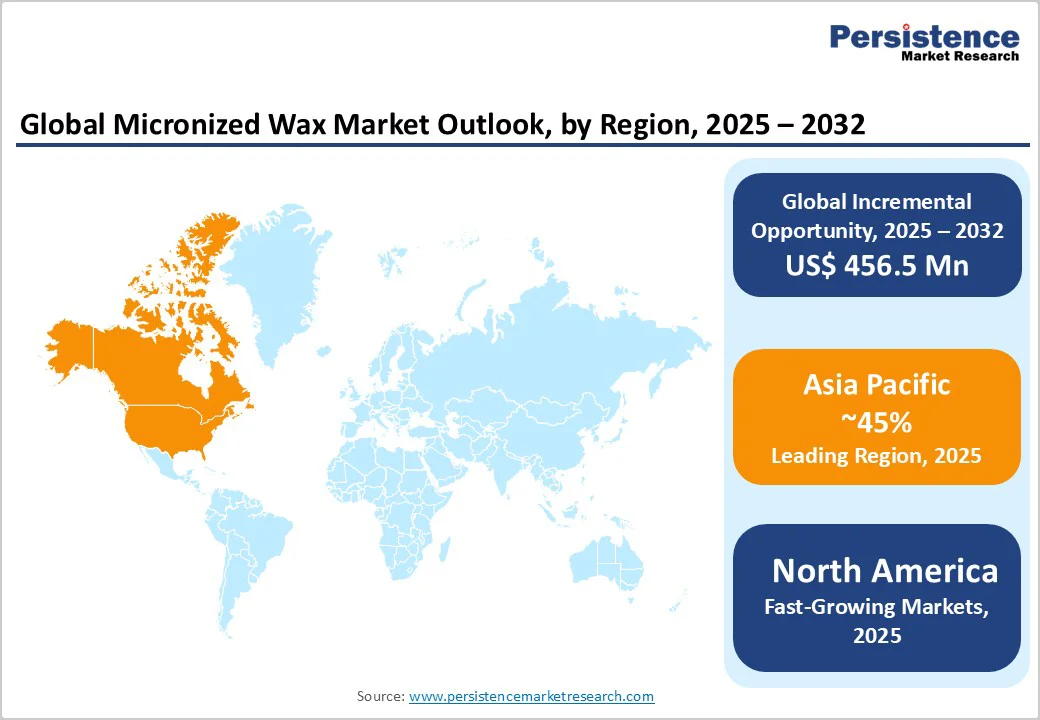

North America is expected to account for a 25% share in 2025, underpinned by the U.S.’s leadership in specialty chemicals R&D and Canada’s automotive OEM ecosystem. EPA’s tightened VOC regulations and TSCA revisions have incentivized formulators to adopt bio-based micronized wax dispersions, boosting growth in natural wax market applications. Partnerships between wax manufacturers and US automakers focus on developing low-VOC clearcoats incorporating micronized wax additives for electric vehicle exteriors, improving durability and aesthetic appeal.

Industry collaborations in Michigan and Ontario are advancing novel wax milling techniques and proprietary dispersion technologies, while government grant programs support pilot projects for sustainable wax production. The region’s strong logistics infrastructure facilitates the rapid delivery of wax powders to major paints and coatings hubs.

Europe commands a 20% share, driven by harmonized environmental frameworks (REACH, ECHA guidelines) that promote sustainable additive adoption. German automotive OEMs are integrating Micronized wax additives in corrosion-resistant and self-healing coatings, leveraging partnership projects with specialty wax producers. The U.K.’s cosmetics sector is innovating with carnauba dot polymer hybrid wax dispersions for eco-certified personal care products, reflecting consumer demand for natural ingredients.

France and Spain offer government incentives for green chemistry R&D, spurring development of bio-based wax dispersions and novel particle engineering. Collaborative research initiatives under the EU’s Horizon Europe program target low-energy micronization methods and circular economy integration, supporting regional leadership in sustainable wax technologies.

Asia Pacific’s leadership 45% share is anchored in China and India. China’s coating and packaging industries are rapidly incorporating PE Micronized wax powders to meet rising automotive output and flexible packaging demands. Government stimulus for manufacturing modernization and infrastructure projects has increased consumption of wax additives in construction-grade coatings.

India’s pharmaceutical cold-chain packaging sector is adopting wax dispersions for moisture and grease barriers, while 3D printing adoption in Japan and South Korea is driving demand for nano-Micronized wax powders in resin formulations. ASEAN markets Vietnam, Thailand, Indonesia are emerging production hubs for specialty wax micropowders, leveraging lower labor costs and favorable export policies to serve global formulators.

The global micronized wax market is fragmented, with the top ten players collectively accounting for 45% of global revenue. Leading companies focus on capacity expansions, strategic alliances, and targeted R&D in sustainable and high-performance wax technologies.

Differentiation strategies include proprietary micronization processes, customized particle size distributions, and application-specific formulations. Emerging business models involve toll milling services and co-development partnerships with end-use formulators, enabling smaller wax producers to access global distribution networks and specialized expertise.

The global Micronized Wax Market is forecast to reach US$ 1,381.2 million by 2032.

Rising demand for high-performance coatings and printing inks in automotive and construction sectors is the primary growth driver.

The Synthetic Micronized Waxes segment leads, accounting for approximately 90% of total revenue.

Asia Pacific dominates with a regional share of around 45%, driven by industrial growth in China and India.

Development and expansion of bio-based Micronized wax solutions in personal care and food packaging applications.

BASF SE, Sasol, and MÜNZING Corporation are among the top players based on revenue, portfolio strength, and innovation capabilities.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Mn/Bn; Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Form

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author